Académique Documents

Professionnel Documents

Culture Documents

BRIEF HISTORICAL VIEW OF MODERN TAX ADMINISTRATION IN ALBANIA, 1994-2011 - AL-Tax

Transféré par

Eduart GjokutajTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BRIEF HISTORICAL VIEW OF MODERN TAX ADMINISTRATION IN ALBANIA, 1994-2011 - AL-Tax

Transféré par

Eduart GjokutajDroits d'auteur :

Formats disponibles

Law. Fiscal.

Accountability

www.al-tax.org altax@consultant.com

MODERN ALBANIAN TAX ADMINISTRATION

By AL-Tax

reflecting the administration as a service already provided on frameworks defined according to the principles of the new political system. In 1999 a more complete law structured in the context of contemporary laws passed in countries in political and economic transition was adopted. Law No.8560, date 22.12.1999 made a clear distinction in the administration model by clearly specifying the mission of tax administration, reflecting its structural changes covering the tasks that other institutions had, and strengthening the rights of taxpayers and services that they benefit. For the first time tax administration was divided between central and local administration. Drafting and approval of the current law on tax administration Nr. 9920; dated 19.05.2008 placed the tax administration in the position of a modern administration aligning it with the new geo-political changes in the country towards European integration. This law clearly reflects that tax administration passes through taxpayer service and a cooperative relationship with the institutions and all stakeholders who have interests in a growing stewardship. The law is based on the charter of the taxpayers rights and a complete clarity on universal principles of modern tax administration. Besides the tax authority, with decree Nr.7463 dated 31.01.1991 Financial Police was established as the armed executive body specialized for the control of fiscal legislation enforcement by private and public sector and by domestic or international physical and legal entities or based outside the territory of Albania and exercising economic activity in its territory.

The first years

The first approach about drafting and founding of the actually tax system in Albania begin since 1991 and with a group of tax laws they constitute the first fiscal package in the year 19921. Administration of taxes in the Republic of Albania, according to law Nr.7546, dated 06.01.1992 started to be made by tax authorities. Tax authorities under this law were the Tax Directorate in the Ministry of Finance and its branches in 36 district centers. The tax authorities were charged with the task of performing all acts related to the registration of subjects, maintenance of appropriate documentation, issuing tax acts according to the declaration and other data submitted by entities and determining the tax base and size. Tax Administration extended to include all categories of activities, without exception. Conventions and agreements signed between the Republic of Albania and other countries to avoid double taxation had priority in relation to tax legislation. The main taxes in 1992 included national and local taxes, tax on turnover, excise tax and profit taxi. Tax administration was strengthened with clearer rights and responsibilities as well as elements that were in line with administration development through Law Nr.7681, dated 04.03.1993. This law defined rights and duties of tax administration

Law. Fiscal. Accountability

www.al-tax.org altax@consultant.com

The financial police had the task to control the accuracy of financial statements, check the implementation of rules for weight, standards, prices, quality tariffs for goods, control illegal activities, control the enforcement of state monopoly and control the enforcement of provisions in the field of customs duties. In 1995, the Law Nr.7938, dated 24.05.1995, dissolved the financial police and served as the basis for the creation of two specialized bodies named: (a) Customs Police, under the Director General of Customs and (b) Tax Police under the Director of Taxes. The appointment and dismissal of the head of police for the two bodies was in the powers of the Minister of Finance. With the approval of the customs code and tax procedures law in 2008 these bodies were dissolved and integrated in other tasks of intelligence and field verification within the respective central administrations of customs and taxes. General Directors who run the tax administration in the years 1994-2011 exist since the first law of tax administration was adopted in 1992 together with the fiscal package. For the first time in 1995 the terms Director General of Taxes and General Tax Directorate were introduced in the law.

Tax Administration is the only authority that accepts tax declarations for national taxes and duties, including declarations for social and health insurance contributions; it assesses tax obligations, accuracy of the declarations and, on this basis, determines the additional tax liability of a taxpayer and the refund or return of overpaid taxes. Built on pillars of procedures and rules through functional organization, administration of tax liabilities in recent years has attempted to come closer to the principles of good administration and in response to taxpayers requests. Since the tax systems primary function is to generate revenue, the first administration goal is closely related to this function in order to operate effectively. In this regard the improvement of the administration has followed the function by adapting the organizational structure, method of tax collection, initially starting administration with the calculation of tax size in a legal manner and reaching as far as the assessment of tax calculated by taxpayers effectively and without harming the system. In this regard another administration goal was to increase the economic efficiency of the tax system. Over the years, the tax administration is less intrusive to business decision making regarding problems going beyond the constructed model. Businesses and individuals have developed activities independently and unprovoked by administrative decisions. Pursuing this goal, another goal which has strengthened over the years, has been the shifting of the tax burden through its distribution according to the place and subject where it is created. For this purpose by structuring tax administration both

Administration model

Tax policy and tax administration can be considered as a combination of two parts which complete the whole. The combination of a good tax and a good administration gives us a basis for evaluating the way taxes re oriented. After 19 years, the tax administration as a central institution is the only central tax authority in the Republic of Albania.

Law. Fiscal. Accountability

www.al-tax.org altax@consultant.com

horizontally and vertically, it was possible through decentralization to have a fairer separation of powers involved in administration by strengthening the interaction between them and adjusting tax levels according to geographic and economic areas. The introduction of individual income declaration in 2011 came as a result of increased administrative capacities capable of managing this administration development process. Tax policies pursued by a growing administration, as will be illustrated with statistical information in this document will serve to further maintain the level of administration according to the principles of good management.

In the same comparison format revenue collected by tax administration towards total budget revenue one can observe a difference of 2.6 higher for revenue collected by tax administration. The share of revenue from taxes and customs for the last 5-years had a weight increase towards GDP by 2.2 percentage points compared to the previous 5-years reaching 18.2% of GDP. If you look at the respective 5year ratios (or more) of revenues collected from tax administrations, customs, local government, social and health contributions fund and grants towards total budget revenues, we see that over 2/3 of total budget revenues are composed of revenue from the two central administrations, tax administration and Custom. 2012

Tax ratios

If compared public expenditures between 1994 and 2011 and revenues between 2011 and 1994 there is in a revenue increase of 1.2 times higher in relation to costs, which is indicative of a positive budgetary performance. In this regard the weight of each category of income in relation to public spending reflects a consistency index of income growth, whether we can distinguish the share of revenues collected by Albanian tax administration in 2011 (not including social insurances contributions) with 30.7 percent coverage level of total public expenditure. The weight of other revenue If compared the GDP for 2011 with 1994 in the same projection for revenue collected by tax administration you can see a 3 times higher level for tax revenue to GDP. Tax administration to GDP used to be 9.1% and it is 13% in 2011 with a positive difference of 3.9% of continuous weight increase for revenue collected by tax administration.

Law No.7543, date 24.12.1991 On Turnover Tax, issued by Decree No.106, date 06.01.1992 Law Nr.7544, date 06.01.1992 On Profit Tax. Law No.7545, date 06.01.1992 On income tax on physical persons in private sectors of commerce, artifacts, and other services Law No.7546, date 06.01.1992 On administration of taxes in the Republic of Albania. Law No.7547, date 06.01.1992 On excise tax in the Republic of Albania. Law No.7585, date 14.07.1992 On personal income taxes.

Vous aimerez peut-être aussi

- Fiscal Policy of PakistanDocument26 pagesFiscal Policy of PakistanMuhammad Muavia Siddiqy60% (5)

- CHAPTER 1-8 Noli Me TangereDocument36 pagesCHAPTER 1-8 Noli Me TangereRianne AguilarPas encore d'évaluation

- Motion To Compel Responses To Defendant's DiscoveryDocument4 pagesMotion To Compel Responses To Defendant's DiscoveryMarciaQuarle100% (2)

- Critical Review Paper On Tax - LucarezaDocument4 pagesCritical Review Paper On Tax - LucarezaAngel LucarezaPas encore d'évaluation

- A Research Proposal OnDocument21 pagesA Research Proposal Onsamuel kebede100% (1)

- Sarmiento vs. Zaratan (Digest)Document12 pagesSarmiento vs. Zaratan (Digest)Sittie Norhanie Hamdag LaoPas encore d'évaluation

- Revision ChecklistDocument24 pagesRevision Checklistaditya agarwalPas encore d'évaluation

- A Comparative Analysis on Tax Administration in Asia and the PacificD'EverandA Comparative Analysis on Tax Administration in Asia and the PacificPas encore d'évaluation

- CIS-Client Information Sheet - TEMPLATEDocument15 pagesCIS-Client Information Sheet - TEMPLATEPolat Muhasebe100% (1)

- What Is TRAIN Law and Its PurposeDocument6 pagesWhat Is TRAIN Law and Its PurposeNica BastiPas encore d'évaluation

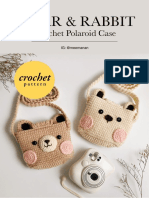

- Crochet Polaroid Case: Bear & RabbitDocument8 pagesCrochet Polaroid Case: Bear & RabbitSusi Susi100% (1)

- 3-Value Added Tax Its Impact in The Philippine EconomyDocument23 pages3-Value Added Tax Its Impact in The Philippine Economymis_administrator100% (8)

- Importance and Role of TaxationDocument7 pagesImportance and Role of TaxationZale Crud100% (2)

- Q2 2017 ColliersQuarterly JakartaDocument46 pagesQ2 2017 ColliersQuarterly JakartadetrutamiPas encore d'évaluation

- 305 1185 1 PB PDFDocument8 pages305 1185 1 PB PDFEkha MukaramPas encore d'évaluation

- LAW 323-Tax Law-Asim Zulfiqar-Akhtar AliDocument7 pagesLAW 323-Tax Law-Asim Zulfiqar-Akhtar AliWajahat GhafoorPas encore d'évaluation

- Tax Gap in Kosovo and Albania 2014Document29 pagesTax Gap in Kosovo and Albania 2014Eduart GjokutajPas encore d'évaluation

- Demirew Getachew - Tax Reform in Eth and Progress To DateDocument23 pagesDemirew Getachew - Tax Reform in Eth and Progress To Datewondimg100% (5)

- Informe de TributacionDocument9 pagesInforme de TributacionJULIANA GIANELLA NINATANTA VASQUEZPas encore d'évaluation

- Chapter 9Document19 pagesChapter 9Nigussie BerhanuPas encore d'évaluation

- Final Project of Taxation: Arsalan Haider Afzal Ahmed Shahid Iqbal Amir Shahzad M.TayyabDocument26 pagesFinal Project of Taxation: Arsalan Haider Afzal Ahmed Shahid Iqbal Amir Shahzad M.TayyabGul ShairPas encore d'évaluation

- Lesson 1 Taxes and Taxation of RK BasicsDocument4 pagesLesson 1 Taxes and Taxation of RK BasicsAssylbekPas encore d'évaluation

- Introduction To FBRDocument19 pagesIntroduction To FBRMuhammad Nadeem Mughal0% (1)

- Revenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeDocument18 pagesRevenue Productivity of The Tax System in Lesotho Nthabiseng J. Koatsa and Mamello A. NchakeTseneza RaselimoPas encore d'évaluation

- MeleseDocument40 pagesMeleseዳግማዊ ጌታነህ ግዛው ባይህPas encore d'évaluation

- Lesotho Tax System (w1)Document3 pagesLesotho Tax System (w1)Limpho Teddy PhatePas encore d'évaluation

- Tax Education Balance Between Direct and Indirect Taxation. Establishment of The OECD and Examination of Its Application To The Tax Rates of GreeceDocument5 pagesTax Education Balance Between Direct and Indirect Taxation. Establishment of The OECD and Examination of Its Application To The Tax Rates of GreeceKOPSIDAS ODYSSEASPas encore d'évaluation

- Advanced Taxation and STR NotesDocument63 pagesAdvanced Taxation and STR Noteskarelmengue3Pas encore d'évaluation

- Taxation I Lesson 1 and 2 Introduction TDocument13 pagesTaxation I Lesson 1 and 2 Introduction TApex LionheartPas encore d'évaluation

- Module On Tax and Revenue Management - 1665451458Document20 pagesModule On Tax and Revenue Management - 1665451458jeff sulitasPas encore d'évaluation

- Next Generation Tax Reform in The PhilippinesDocument18 pagesNext Generation Tax Reform in The PhilippinesJonas MedinaPas encore d'évaluation

- Name: Yathartha Kumar ROLL NO.: 1305016654Document2 pagesName: Yathartha Kumar ROLL NO.: 1305016654MeenuJangidPas encore d'évaluation

- Part A: Taxation 1. Concept of TaxationDocument49 pagesPart A: Taxation 1. Concept of TaxationAbhishekShresthaPas encore d'évaluation

- Iota Paper - Elena Petrova - North MacedoniaDocument7 pagesIota Paper - Elena Petrova - North MacedoniaBanon KekePas encore d'évaluation

- M222994Document5 pagesM222994Carlos Takudzwa MudzengererePas encore d'évaluation

- Tax AssignmentDocument6 pagesTax AssignmentCarlos Takudzwa MudzengererePas encore d'évaluation

- Income Tax Self Assessment Scheme Effectiveness andDocument4 pagesIncome Tax Self Assessment Scheme Effectiveness andIrfan AbbasiPas encore d'évaluation

- Performance Determinants of Business Income Tax CollectionDocument12 pagesPerformance Determinants of Business Income Tax CollectionZed AlemayehuPas encore d'évaluation

- Indirect Taxes: Income TaxDocument9 pagesIndirect Taxes: Income TaxDanial ShadPas encore d'évaluation

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalPas encore d'évaluation

- Topic 2 - History of The Jamaican Tax Systems and Tax Administration of JamaicaDocument35 pagesTopic 2 - History of The Jamaican Tax Systems and Tax Administration of JamaicaaplacetokeepmynotesPas encore d'évaluation

- Presentasi Topik ArtikelDocument30 pagesPresentasi Topik ArtikelputriPas encore d'évaluation

- Train Law: Rodrigo DuterteDocument5 pagesTrain Law: Rodrigo DuterteSheila Mae AramanPas encore d'évaluation

- TRA Obligations-WPS OfficeDocument4 pagesTRA Obligations-WPS Officesteve lubaPas encore d'évaluation

- Direct Taxation Code2Document8 pagesDirect Taxation Code2MahekPas encore d'évaluation

- Slide C1-C4Document229 pagesSlide C1-C4Lê Hồng ThuỷPas encore d'évaluation

- PopDocument17 pagesPopcleophacerevivalPas encore d'évaluation

- Tax ReformsDocument9 pagesTax ReformsAmreen kousarPas encore d'évaluation

- RP - Ta2019Document2 pagesRP - Ta2019Alaine DoblePas encore d'évaluation

- Lecture 2 - Tax Administration 1-1Document64 pagesLecture 2 - Tax Administration 1-1Ekua Baduwaa KyeraaPas encore d'évaluation

- Determinants of Value Added Tax Collection Performance in West Shoa Zone, Oromia Regional State, EthiopiaDocument19 pagesDeterminants of Value Added Tax Collection Performance in West Shoa Zone, Oromia Regional State, EthiopiaAyana GemechuPas encore d'évaluation

- The Philippine Tax System and Double TaxationDocument2 pagesThe Philippine Tax System and Double TaxationArnee Pantajo100% (3)

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaD'EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaPas encore d'évaluation

- Topic 2 Value Added TaxDocument22 pagesTopic 2 Value Added TaxSam ClassicPas encore d'évaluation

- Differences Between Public Goods and Private GoodsDocument16 pagesDifferences Between Public Goods and Private GoodsGetu WeyessaPas encore d'évaluation

- The Compliance of Paying Taxes in Tiyingtali VillageDocument10 pagesThe Compliance of Paying Taxes in Tiyingtali VillageArdian AndriawanPas encore d'évaluation

- I. Definition and History of Value-Added Tax Laws in Vietnam 1. DefinitionDocument5 pagesI. Definition and History of Value-Added Tax Laws in Vietnam 1. DefinitionBim BimPas encore d'évaluation

- Short Thought Over Tax IssuesDocument3 pagesShort Thought Over Tax IssuesDavid IoanaPas encore d'évaluation

- Value Added Tax Act, 1991 Vs Value Added Tax and Supplementary Duty Act, 2012: A Comparison Dr. Md. Abdur RoufDocument6 pagesValue Added Tax Act, 1991 Vs Value Added Tax and Supplementary Duty Act, 2012: A Comparison Dr. Md. Abdur RoufMD Saiful IslamPas encore d'évaluation

- Determinant Factors of Exist Gaps Between The Tax Payers and Tax Authority in Ethiopia, Amhara Region The Case of North Gondar ZoneDocument6 pagesDeterminant Factors of Exist Gaps Between The Tax Payers and Tax Authority in Ethiopia, Amhara Region The Case of North Gondar ZonearcherselevatorsPas encore d'évaluation

- The Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)Document14 pagesThe Assessment of Taxation Impact On Economic Development. A Case Study of Romania (1995-2014)RashidAliPas encore d'évaluation

- E-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiDocument20 pagesE-Commerce As The Tax Potential Revenue in Indonesia: Nufransa Wira SaktiadhystyPas encore d'évaluation

- The Core of Future Tax ReformDocument4 pagesThe Core of Future Tax ReformAnonymous Q8c4ljfZOCPas encore d'évaluation

- 1340 4106 1 SMDocument7 pages1340 4106 1 SMgr3atPas encore d'évaluation

- Chapter 1. OverviewDocument38 pagesChapter 1. OverviewKhuất Thanh HuếPas encore d'évaluation

- Tax Administration and Risk ManagemDocument12 pagesTax Administration and Risk ManagemTsogt-Ochir NarankhuuPas encore d'évaluation

- Taxation in Sri LankaDocument11 pagesTaxation in Sri LankaThiluneluPas encore d'évaluation

- Iota Paper - Lithuania Assessing A Case of Dividend Tax Avoidance As Good Practice by Martynas EndrijaitisDocument5 pagesIota Paper - Lithuania Assessing A Case of Dividend Tax Avoidance As Good Practice by Martynas EndrijaitisEduart GjokutajPas encore d'évaluation

- Would Flat Tax Work Again in Albania?Document4 pagesWould Flat Tax Work Again in Albania?Eduart GjokutajPas encore d'évaluation

- The Legal Procedure For The Liquidation of An Albanian Company - Altax - AlDocument6 pagesThe Legal Procedure For The Liquidation of An Albanian Company - Altax - AlEduart GjokutajPas encore d'évaluation

- Tax Notes For Construction Industry in AlbaniaDocument117 pagesTax Notes For Construction Industry in AlbaniaEduart GjokutajPas encore d'évaluation

- Rosales Balm105 1Document4 pagesRosales Balm105 1Allyssa Melan RosalesPas encore d'évaluation

- The Kartilya of The KatipunanDocument2 pagesThe Kartilya of The Katipunanapi-512554181Pas encore d'évaluation

- Country Research Repor111 PDFDocument130 pagesCountry Research Repor111 PDFalankrita singhPas encore d'évaluation

- United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, Local 1-1937 v. Taan Forest Limited Partnership, 2018 BCCA 322Document33 pagesUnited Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Workers International Union, Local 1-1937 v. Taan Forest Limited Partnership, 2018 BCCA 322Andrew HudsonPas encore d'évaluation

- Terms of ServiceDocument8 pagesTerms of ServiceGabriel Lima BallardPas encore d'évaluation

- Conroy InformationDocument25 pagesConroy InformationAsbury Park PressPas encore d'évaluation

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDocument12 pagesPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraPas encore d'évaluation

- Hearing Transcript - April 8 2010Document252 pagesHearing Transcript - April 8 2010kady_omalley5260Pas encore d'évaluation

- Inc 2Document19 pagesInc 2MathiPas encore d'évaluation

- STHBDocument4 pagesSTHBketanrana2Pas encore d'évaluation

- Petron Vs CaberteDocument2 pagesPetron Vs CabertejohneurickPas encore d'évaluation

- 1963-Nucleate Boiling Characteristics and The Critical Heat Flux Occurrence in Subcooled Axial-Flow Water Systems PDFDocument36 pages1963-Nucleate Boiling Characteristics and The Critical Heat Flux Occurrence in Subcooled Axial-Flow Water Systems PDFTahok24Pas encore d'évaluation

- GR 199539 2023Document28 pagesGR 199539 2023Gela TemporalPas encore d'évaluation

- Quasi-Contracts: By: Val F. PiedadDocument33 pagesQuasi-Contracts: By: Val F. PiedadMingPas encore d'évaluation

- GOOD MORAL CertDocument19 pagesGOOD MORAL CertUno Gime PorcallaPas encore d'évaluation

- Czech Republic: Jump To Navigation Jump To SearchDocument5 pagesCzech Republic: Jump To Navigation Jump To SearchRadhika PrasadPas encore d'évaluation

- Lease Contract SampleDocument3 pagesLease Contract SamplecowokePas encore d'évaluation

- Arrieta Vs Llosa DigestDocument2 pagesArrieta Vs Llosa DigestMichael Parreño VillagraciaPas encore d'évaluation

- Corruption and Indonesian CultureDocument6 pagesCorruption and Indonesian CultureRopi KomalaPas encore d'évaluation

- IDirect Brokerage SectorUpdate Mar23Document10 pagesIDirect Brokerage SectorUpdate Mar23akshaybendal6343Pas encore d'évaluation

- Life in Australia BookletDocument46 pagesLife in Australia BookletAmber Patterson100% (1)

- Legislative IssuesDocument323 pagesLegislative IssuesOur CompassPas encore d'évaluation

- Afi36 2803Document74 pagesAfi36 2803cerberus0813Pas encore d'évaluation