Académique Documents

Professionnel Documents

Culture Documents

United States Bankruptcy Court Eastern District of Michigan Southern Division

Transféré par

Chapter 11 DocketsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States Bankruptcy Court Eastern District of Michigan Southern Division

Transféré par

Chapter 11 DocketsDroits d'auteur :

Formats disponibles

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: COLLINS & AIKMAN CORPORATION, ) ) ) ) ) ) ) ) ) ) ) Chapter

11 Case No. 05-55927 (SWR) (Jointly Administered) Case No. 05-55932

COLLINS & AIKMAN PRODUCTS COMPANY, COLLINS & AIKMAN CANADA, INC., et al.,

Bankruptcy Judge Steven W. Rhodes

AMENDED REQUEST FOR ALLOWANCE OF ADMINISTRATIVE CLAIM Pursuant to the Notice of Effective Date of the First Amended Joint Plan of Collins & Aikman Corporation and Its Debtor Subsidiaries and Related Deadlines, Notice of Administrative Claims Bar date and Deadline for Final Fee Application dated October 12, 2007 and Section 365 and 503 of the United States Bankruptcy Code (the Bankruptcy Code), Relational, LLC, Relational Funding Corporation, Relational Technology Services, and Relational Funding Canada Corporation (collectively, Relational) hereby files this Amended Request for Allowance of Administrative Expense Claim against Collins & Aikman Corp., Collins & Aikman Products Company (CAPC), and Collins & Aikman Canada, Inc. (CACI) et al. In support hereof, Relational respectfully states as follows: 1. Prior to the filing of the above-captioned chapter 11 cases on May 17, 2005, the

(Petition Date), Relational entered into Master Equipment Lease Agreements and Schedules related thereto with CAPC and CACI (collectively, as amended from time to time, the PrePetition Leases.) Pursuant to the Pre-Petition Leases, Relational leased to CAPC and CACI certain computer and related equipment in exchange for regular lease payments.

0W[;'+,

0555927071112000000000066

bC

2.

After the Petition Date, Relational entered into additional lease agreements with

CAPC and CACI (the Post-Petition Leases, and, together with the Pre-Petition Leases, the Equipment Leases). 3. On August 29, 2007, the Debtors filed their Second Amended Exhibit F to First

Amended Joint Plan of Collins & Aikman Corporation and its Debtor Subsidiaries (Exhibit F). Exhibit F purports to identify those leases that the Debtors will reject as of the effective date (the Effective Date) of their First Amended Joint Plan (the Plan). The Effective Date was October 12, 2007. The deadline for filing administrative claims arising from the rejection of leases under the Plan is November 12, 2007. 4. Exhibit F purports to identify at least twenty-nine of Relationals Equipment

Leases. However, the information listed on Exhibit F is insufficient to allow Relational to identify which Equipment Leases the Debtors intend to reject. In particular, Exhibit F does not list the schedule number of the Equipment Leases, in some cases fails to identify the date the Equipments Leases were executed, and does not list which equipment is subject to rejection. Additionally, Exhibit F identifies certain leases by and between Relationals Canadian affiliates and CACI, which filed for bankruptcy in Ontario, Canada. 5. Relational has engaged in discussions with the Debtors and Debtors counsel in an

effort to identify which leases the Debtors intend to reject. Although the Debtors have been able to identify certain of the leases, the Debtors have been unable to provide sufficient information to allow Relational to determine which Equipment Leases the Debtors have rejected or intend to reject. 6. Moreover, the Debtors appear not to have returned to Relational all of the

equipment subject to the purportedly rejected Equipment Leases.

7.

Additionally, the Debtors have informed Relational that the list of leases on

Exhibit F is incorrect, both as to which Equipment Leases the Debtors intend to reject and the dates which any Equipment Leases will be rejected. The Debtors have also been unable to explain why leases involving CACI are listed on Exhibit F. 8. As a result of the acknowledged inaccuracy of Exhibit F, Relational cannot

determine which, if any, Equipment Leases the Debtors intend to reject. In particular, Relational cannot determine whether the Debtors have rejected, or will reject any of Equipment Leases. Nor can Relational determine when rejection of any Equipment Leases may occur. 9. Out of an abundance of caution, Relational has filed the instant Claim in an

unliquidated amount to account for administrative obligations that will continue to accrue for unreturned equipment and unrejected Equipment Leases. 10. Additionally, this Claim is intended to serve as a reservation of Relationals rights

to assert an administrative claim based on any other damages arising from the Post-Petition Leases. 11. Relational reserves the right to amend or supplement this Claim to include

rejection damages on Post-Petition Leases it is currently unable to assess based on the incomplete information provided by the Debtors. 12. Once the Debtors are in a position to provide an exact list of which Equipment

Leases they have under the Plan and the respective dates of rejection, Relational will amend or supplement this Claim to, among other things, provide a liquidated claim amount. Relational intends to work cooperatively with the Debtors to resolve the outstanding issues surrounding the Equipment Leases.

WHEREFORE, Relational respectfully requests that the Court enter an order allowing the Claim in an amount to be determined, and granting Relational such other and further relief as may be just and necessary. Dated: November 12, 2007 Respectfully submitted

BY:

/s/ Michael Terrien Ronald R. Peterson Michael Terrien JENNER & BLOCK LLP 330 N. Wabash Ave. Chicago, IL 60611 PH: 312-923-8316 FAX: 312-923-8416 Attorneys for Relational, LLC et al.

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION In re: COLLINS & AIKMAN CORPORATION, ) ) ) ) ) ) ) ) ) ) ) Chapter 11 Case No. 05-55927 (SWR) (Jointly Administered) Case No. 05-55932

COLLINS & AIKMAN PRODUCTS COMPANY, COLLINS & AIKMAN CANADA, INC., et al.,

Bankruptcy Judge Steven W. Rhodes

ORDER GRANTING AMENDED REQUEST FOR ALLOWANCE OF ADMINISTRATIVE CLAIM Upon the Amended Request for Allowance of Administrative Claim (the Motion)1 of Relational, LLC, Relational Funding Corporation, Relational Technology Services, and Relational Funding Canada Corporation (collectively, Relational); it appearing to the Court that notice of the hearing on the Motion was adequate, appropriate and in accordance with the Bankruptcy Code, 11 U.S.C. 101-1330 (the "Bankruptcy Code"), and the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules); the Court finding good cause to grant the relief sought in the; and the Court finding that (a) it has jurisdiction over this matter pursuant to 28 U.S.C. 157 and 1334, and (b) this is a core proceeding pursuant to 28 U.S.C. 157 (b)(2); IT IS HEREBY ORDERED that 1. 2. The Motion is granted; Relational is hereby allowed (a) an unliquidated administrative claim against

CAPC under sections 503(b) and 507(a)(2) of the Bankruptcy Code for any post-petition administrative obligations that will arise as a result of unreturned equipment, unrejected

1

Capitalized terms used but not defined herein shall have the meanings ascribed in the Motion.

1597011

Equipment Leases, or other damages arising from the Post-Petition Leases, and (b) an unliquidated administrative claim against CACI under sections 503(b) and 507(a)(2) of the Bankruptcy Code for any post-petition administrative obligations that will arise as a result of unreturned equipment, unrejected Equipment Leases, or other damages arising from the PostPetition Leases.

Dated __________, 2007

ENTER:

UNITED STATES BANKRUPTCY JUDGE

2

1597011

Vous aimerez peut-être aussi

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument45 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In Re:) : Debtors.)Document25 pagesIn Re:) : Debtors.)Chapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court For The District of DelawareDocument9 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- 10000005545Document49 pages10000005545Chapter 11 DocketsPas encore d'évaluation

- Et Al./: (LL) (Ill)Document32 pagesEt Al./: (LL) (Ill)Chapter 11 DocketsPas encore d'évaluation

- Answer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefDocument11 pagesAnswer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncChapter 11 DocketsPas encore d'évaluation

- Construction Supervision Services v. Branch Banking & Trust, 4th Cir. (2014)Document19 pagesConstruction Supervision Services v. Branch Banking & Trust, 4th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- Joint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantDocument39 pagesJoint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantChapter 11 DocketsPas encore d'évaluation

- 10000000452Document12 pages10000000452Chapter 11 DocketsPas encore d'évaluation

- Hearing Date: July 12, 2012 at 11:00 A.M. (EDT) Objection Deadline: June 29, 2012 at 4:00 P.M. (EDT)Document13 pagesHearing Date: July 12, 2012 at 11:00 A.M. (EDT) Objection Deadline: June 29, 2012 at 4:00 P.M. (EDT)Chapter 11 DocketsPas encore d'évaluation

- Declaration of Daniell. Fitchett in Support of Chapter 11Document21 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11Chapter 11 DocketsPas encore d'évaluation

- In Re:caribbean Petroleum Corp V., 3rd Cir. (2014)Document11 pagesIn Re:caribbean Petroleum Corp V., 3rd Cir. (2014)Scribd Government DocsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument17 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Et SeqDocument9 pagesEt SeqChapter 11 DocketsPas encore d'évaluation

- 10000025381Document124 pages10000025381Chapter 11 DocketsPas encore d'évaluation

- Notice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesDocument3 pagesNotice of Commencement of Chapter 11 Bankruptcy Case, Meeting of Creditors and Fixing of Certain DatesChapter 11 DocketsPas encore d'évaluation

- 05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Document7 pages05-55927-swr Doc 10184 Filed 11/07/08 Entered 11/07/08 18:13:21 Page 1 of 7Chapter 11 DocketsPas encore d'évaluation

- In Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Cf&i Steel Corporation Colorado & Wyoming Railway Company Unsecured Creditors Committee United Steelworkers of America Afl-Cio-Clc William J. Westmark, Trustee of the Colorado & Wyoming Railway Company, in Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Colorado & Wyoming Railway Company, 150 F.3d 1293, 10th Cir. (1998)Document13 pagesIn Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Cf&i Steel Corporation Colorado & Wyoming Railway Company Unsecured Creditors Committee United Steelworkers of America Afl-Cio-Clc William J. Westmark, Trustee of the Colorado & Wyoming Railway Company, in Re: Cf&i Fabricators of Utah, Inc., Reorganized Debtors. Pension Benefit Guaranty Corporation v. Cf&i Fabricators of Utah, Inc. Colorado & Utah Land Company Kansas Metals Company Albuquerque Metals Company Pueblo Metals Company Denver Metals Company Pueblo Railroad Service Company Cf&i Fabricators of Colorado, Inc. Colorado & Wyoming Railway Company, 150 F.3d 1293, 10th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- Et Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Document2 pagesEt Al.: Debtor (Other Names, If Any, Used by The Debtor in The Last 8 Years Appear in Brackets) Address Case No. Taxid#Chapter 11 Dockets100% (1)

- Hearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 7 and 43Document37 pagesHearing Date: July 27, 2012 at 1:00 P.M. (ET) Obj. Deadline: July 13, 2012 at 4:00 P.M. (ET) Docket Ref. Nos. 7 and 43Chapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument20 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationDocument19 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationChapter 11 DocketsPas encore d'évaluation

- (Ii) (Iii) (Iv)Document55 pages(Ii) (Iii) (Iv)Chapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCChapter 11 DocketsPas encore d'évaluation

- "Disclosure Statement" "Prior Disclosure Statement")Document23 pages"Disclosure Statement" "Prior Disclosure Statement")meischerPas encore d'évaluation

- Motion of The Debtors For Interim and Final Orders: (I) Prohibiting Utilities From Interrupting Service and (Ii) Determining That The Debtors Provided Adequate Assurance of PaymentDocument21 pagesMotion of The Debtors For Interim and Final Orders: (I) Prohibiting Utilities From Interrupting Service and (Ii) Determining That The Debtors Provided Adequate Assurance of PaymentChapter 11 DocketsPas encore d'évaluation

- In Re:) : Debtors.)Document15 pagesIn Re:) : Debtors.)Chapter 11 DocketsPas encore d'évaluation

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document7 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsPas encore d'évaluation

- Hearing Date: August 28, 2012 at II:00 Objection Deadline: July 17, 2012 at 4:00p.m. (EDT)Document31 pagesHearing Date: August 28, 2012 at II:00 Objection Deadline: July 17, 2012 at 4:00p.m. (EDT)Chapter 11 DocketsPas encore d'évaluation

- Re: Docket Nos. 5, 37Document25 pagesRe: Docket Nos. 5, 37Chapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Ref. Docket Nos. 922 and 1287Document3 pagesRef. Docket Nos. 922 and 1287Chapter 11 DocketsPas encore d'évaluation

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document5 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsPas encore d'évaluation

- Edward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Document7 pagesEdward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Scribd Government DocsPas encore d'évaluation

- Motion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsDocument16 pagesMotion For Authorzing The Retention and Compensation of Ordinary Course ProffessionalsJun MaPas encore d'évaluation

- Hearing Date: July 12, 2012 at 2:00 P.M. (EDT) Objection Deadline: July 6, 2012 at 4:00 P.M. (EDT)Document28 pagesHearing Date: July 12, 2012 at 2:00 P.M. (EDT) Objection Deadline: July 6, 2012 at 4:00 P.M. (EDT)Chapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court For The District of DelawareDocument12 pagesIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- Et Al./: These CasesDocument34 pagesEt Al./: These CasesChapter 11 DocketsPas encore d'évaluation

- 10000009535Document528 pages10000009535Chapter 11 Dockets67% (3)

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Southern District of New YorkDocument10 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument24 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Document10 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsPas encore d'évaluation

- Nunc Pro TuncDocument24 pagesNunc Pro TuncChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument14 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncDocument18 pagesDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Unique Fabricating, IncChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument41 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument21 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument22 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument125 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- Requirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)Document10 pagesRequirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)jarabboPas encore d'évaluation

- United States v. Fleet Bank, 288 F.3d 22, 1st Cir. (2002)Document30 pagesUnited States v. Fleet Bank, 288 F.3d 22, 1st Cir. (2002)Scribd Government DocsPas encore d'évaluation

- 10000022227Document99 pages10000022227Chapter 11 DocketsPas encore d'évaluation

- BAY:01512259 VLDocument15 pagesBAY:01512259 VLChapter 11 DocketsPas encore d'évaluation

- PNB V CADocument4 pagesPNB V CADenise Capacio LirioPas encore d'évaluation

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument27 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court For The District of DelawareDocument9 pagesUnited States Bankruptcy Court For The District of DelawareChapter 11 DocketsPas encore d'évaluation

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionD'EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionPas encore d'évaluation

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsPas encore d'évaluation

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsPas encore d'évaluation

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsPas encore d'évaluation

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsPas encore d'évaluation

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsPas encore d'évaluation

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsPas encore d'évaluation

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsPas encore d'évaluation

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsPas encore d'évaluation

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsPas encore d'évaluation

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsPas encore d'évaluation

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsPas encore d'évaluation

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsPas encore d'évaluation

- ECON 202 Optional Problem SetDocument3 pagesECON 202 Optional Problem SetAnthony SabarilloPas encore d'évaluation

- Crime Report Management SystemDocument49 pagesCrime Report Management SystemAbimbolaÀdésíréAdegbitePas encore d'évaluation

- Aling MODEDocument29 pagesAling MODEBojan PetronijevicPas encore d'évaluation

- Writing White PapersDocument194 pagesWriting White PapersPrasannaYalamanchili80% (5)

- Taxicab Operators V BOTDocument2 pagesTaxicab Operators V BOTHazel P.Pas encore d'évaluation

- Remedial Law Syllabus 2013Document6 pagesRemedial Law Syllabus 2013Mirriam Ebreo100% (1)

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiPas encore d'évaluation

- Diesel Oil Matters 70 YrsDocument1 pageDiesel Oil Matters 70 YrsingsespinosaPas encore d'évaluation

- AloraDocument3 pagesAloraTatu AradiPas encore d'évaluation

- Ge Washing Machine ManualDocument52 pagesGe Washing Machine Manuallillith1723Pas encore d'évaluation

- 1 s2.0 S0959652618323667 MainDocument12 pages1 s2.0 S0959652618323667 MaintaliagcPas encore d'évaluation

- Diodat PDFDocument4 pagesDiodat PDFFatmir KelmendiPas encore d'évaluation

- Small Roller Granulator NPK Compound Fertilizer Production ProcessDocument3 pagesSmall Roller Granulator NPK Compound Fertilizer Production Processluna lePas encore d'évaluation

- T BeamDocument17 pagesT BeamManojPas encore d'évaluation

- CRM Short QuizDocument1 pageCRM Short QuizDaria Par-HughesPas encore d'évaluation

- Brigada EskwelaDocument4 pagesBrigada EskwelaJas Dela Serna SerniculaPas encore d'évaluation

- PepsiCo Strategic Plan Design PDFDocument71 pagesPepsiCo Strategic Plan Design PDFdemerePas encore d'évaluation

- Maintenance Repair Overhaul: Safely To New Horizons Ensuring Your Aircraft Is Ready Whenever Duty CallsDocument10 pagesMaintenance Repair Overhaul: Safely To New Horizons Ensuring Your Aircraft Is Ready Whenever Duty CallsSuryaPas encore d'évaluation

- Dahua Video Conferencing SolutionDocument16 pagesDahua Video Conferencing SolutionDennis DubePas encore d'évaluation

- IEC947-5-1 Contactor Relay Utilization CategoryDocument1 pageIEC947-5-1 Contactor Relay Utilization CategoryipitwowoPas encore d'évaluation

- Management Thoughts Pramod Batra PDFDocument5 pagesManagement Thoughts Pramod Batra PDFRam33% (3)

- National School Building Inventory (NSBI) Encoding For SY 2021-2022Document31 pagesNational School Building Inventory (NSBI) Encoding For SY 2021-2022Renato Rivera100% (1)

- Cash Management Bank of IndiaDocument52 pagesCash Management Bank of Indiaakalque shaikhPas encore d'évaluation

- CIVPRO - Case Compilation No. 2Document95 pagesCIVPRO - Case Compilation No. 2Darla GreyPas encore d'évaluation

- 24th SFCON Parallel Sessions Schedule (For Souvenir Program)Document1 page24th SFCON Parallel Sessions Schedule (For Souvenir Program)genesistorres286Pas encore d'évaluation

- Section 8 33KVDocument13 pagesSection 8 33KVMuna HamidPas encore d'évaluation

- Book of Abstracts: Philippine Projects To The Intel International Science and Engineering FairDocument84 pagesBook of Abstracts: Philippine Projects To The Intel International Science and Engineering FairJimarie BithaoPas encore d'évaluation

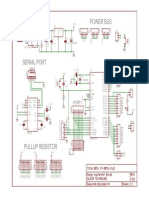

- 8051 Development Board Circuit DiagramDocument1 page8051 Development Board Circuit DiagramRohan DharmadhikariPas encore d'évaluation

- Lamaran NongyiDocument12 pagesLamaran NongyiTonoTonyPas encore d'évaluation

- Invoice-1Document2 pagesInvoice-1atipriya choudharyPas encore d'évaluation