Académique Documents

Professionnel Documents

Culture Documents

Microsoft Word - Remittances Versus FDI FII Hats Off To The Emigrant Worker

Transféré par

rvaidya2000Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Microsoft Word - Remittances Versus FDI FII Hats Off To The Emigrant Worker

Transféré par

rvaidya2000Droits d'auteur :

Formats disponibles

Remittances versus FDI/FII Hats off to the emigrant worker

Business Line, May 17, 2007 R. VAIDYANATHAN It is imperative that the country recognises the important role played by its workers, blue- and white-collared, on foreign shores in providing a phenomenal amount of foreign exchange that is stable and not volatile like portfolio and direct investments, says R. VAIDYANATHAN.

The size of Foreign Direct Investment flows has become a measure of the performance of the economy. Many an expert believes that FDI flows are the life-blood of the economy. Thus, it is suggested that we do not even sneeze else international funds will catch a cold. For most emerging markets one key source of funds flow are remittances by their workers toiling in the developed economies. Turks have been guest workers in Germany from the late 1950s as are Filipinos in Hong Kong. Indians West Asia, Mexicans in the US or Somalis and Algerians in France. It is estimated that up to 100 crore persons could be considered "migrants" by 2050 and they can change the global power equations. True globalization implies the ability of people to work and stay anywhere without the constraints of visa/passport. Just like capital, that moves anywhere in the world by the mere click of the mouse, so should human beings. Argument for FDI In today's context, the stress on FDI makes it an important component for investment in the economy. The need for FDI is explained as follows: The savings rate of the economy is around 30 per cent and if we have to grow at, say, an average of 10 per cent per annum and if incremental capital-output ratio is four then the required savings rate would be 40 per cent. So the 10 percentage point gap is to be filled by FDI, etc. Such an argument assumes that in every sector of the economy the capital-output ratio is similar. Actually the service sector constitutes nearly 60 per cent of the economy and that is one area where innovation and efficient use of capital are most visible.

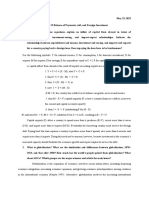

Experts are prone to using the capital-output ratio based on some manufacturing activities to estimate the general requirement. In the process we overestimate the need for capital. Table 1 provides the concentration of FDI flows to developing countries. China absorbs more than one third of the FDI and India one-tenth that of China's. Actually, the inflow into India is expected to rise, with some experts suggesting that it may touch $20 billion per annum. Table 2 provides the remittances across countries. India stands first in terms of remittances, constituting nearly one fifth of the global picture followed by countries such as Mexico and the Philippines. China has only 4 per cent of the global total and one-sixth of India's remittances. In 2006, India's cross-border remittances through formal channels were $27 billion, or slightly more than 3 per cent of GDP, and about one-eighth of global remittance flows. Remittances have many advantages. They are made by people from India to their relatives in this country whose sustenance is taken care of by the flows. They are less volatile than international fund flows as they are not looking just for short-term gains. The evidence is that private financial flows in the form of FDI /FII are more volatile compared to such receipts as grants and aid. The short-term flows are more volatile compared to the long-term ones. Increasingly, private flows are playing an important role compared to government receipts. In the 1960s the government flows used to be an important part of developmental assistance for developing countries. Remittances are less volatile and hence more preferred but less focused in terms of utilisation. India should focus on harnessing this flow as it is not volatile and shows a rising trend too. Of course, the government should facilitate swifter transfer of these funds to the far corners of the country at least cost. For this, the excellent postal system must be leveraged, by integrating it with global institutions for faster flow of remittances at low cost. More importantly, plans need to be formulated to channel these remittances into productive areas such as micro-credit. For that an existing financial institution can be converted into a channel organisation to enhance the returns from these remittances. Where is `Plan B'? Simultaneously, India must plan for difficult situations on the emigrant front. Just like Uganda decided to expel all Indians, it is not inconceivable that large sections of Indians may be compelled to quit West Asian or European nations due to some emerging political or economic situation. Does the country have a Plan B in such a situation? All countries having significant working populations in politically sensitive zones such as West Asia must be prepared with a Plan B. It is not just taking care of the emigrant workers and bringing them back to India; it is also the issue of dealing with the domestic communities depending on the money-order economy for their livelihood. In that context having a financial institution dealing with forex generated by remittances may be more appropriate than leaving it to the judgment of million of individual households. It is imperative that the country recognises the important role played by its workers, blue- and white-collared on foreign shores in providing the phenomenal amount of foreign exchange that is also stable and not volatile like FDI or FII.

(The author is a Professor of Finance and Control at IIM-B and can be contacted at vaidya@iimb.ernet.in. The views are personal and do not reflect that of his organisation.) (This article was published in the Business Line print edition dated May 17, 2007)

Vous aimerez peut-être aussi

- 13 Chapter5Document9 pages13 Chapter5dambarudhara khodaPas encore d'évaluation

- Role of FDI in IndiaDocument3 pagesRole of FDI in Indiagurwinderdhillon0% (1)

- DiptiPatel FDI ResearchPaperDocument4 pagesDiptiPatel FDI ResearchPaperDrShailendra PatelPas encore d'évaluation

- Shaping Globalization: New Trends in Foreign Direct InvestmentD'EverandShaping Globalization: New Trends in Foreign Direct InvestmentPas encore d'évaluation

- International Migration, Remittances and Its Macroeconomic Impact On Indian EconomyDocument28 pagesInternational Migration, Remittances and Its Macroeconomic Impact On Indian EconomyMohd SihamPas encore d'évaluation

- Fdi in India: Determinants And: ITS Comparison With ChinaDocument5 pagesFdi in India: Determinants And: ITS Comparison With ChinaManoj Kumar SinghPas encore d'évaluation

- IBON FDI - 220327-Pn-Our-Destructive-Foreign-Investment-FetishDocument5 pagesIBON FDI - 220327-Pn-Our-Destructive-Foreign-Investment-FetishSonny AfricaPas encore d'évaluation

- Fdi in IndiaDocument15 pagesFdi in IndiaChandra ShekarPas encore d'évaluation

- Relation Between Inflow of FDI and The Development of India's EconomyDocument8 pagesRelation Between Inflow of FDI and The Development of India's EconomyIJTEMTPas encore d'évaluation

- Place Between The Citizens and Corporate of Different Country"Document10 pagesPlace Between The Citizens and Corporate of Different Country"Aswini K KrishnamurthiPas encore d'évaluation

- Foreign Direct InvestmentDocument36 pagesForeign Direct InvestmentSukumar Nandi100% (5)

- Determinants of Foreign Direct InvestmentDocument23 pagesDeterminants of Foreign Direct InvestmentAlex LeePas encore d'évaluation

- Trends and Patterns of Fdi in IndiaDocument10 pagesTrends and Patterns of Fdi in IndiaSakshi GuptaPas encore d'évaluation

- Impacts of FDI and Remittance Inflows in Developing Asia: A Comparative Dynamic Panel StudyDocument18 pagesImpacts of FDI and Remittance Inflows in Developing Asia: A Comparative Dynamic Panel StudyNgọc HânPas encore d'évaluation

- Foreign Direct Investments (FDI) - Pros and ConsDocument5 pagesForeign Direct Investments (FDI) - Pros and ConsPaih SauliPas encore d'évaluation

- Economic Development. CHAPTER 15Document8 pagesEconomic Development. CHAPTER 15Mica Joy GallardoPas encore d'évaluation

- Globalization & LiberalizationDocument12 pagesGlobalization & Liberalizationmitul-desai-8682Pas encore d'évaluation

- Does Urbanization Promote FDIDocument10 pagesDoes Urbanization Promote FDIsaraPas encore d'évaluation

- Assignment - Wealth of NationsDocument6 pagesAssignment - Wealth of Nationsadikt_whreckPas encore d'évaluation

- Economics Is Not About Things and Tangible Material Objects It Is About Men, Their Meanings and Actions. - Ludwig Von MisesDocument27 pagesEconomics Is Not About Things and Tangible Material Objects It Is About Men, Their Meanings and Actions. - Ludwig Von MisesSurya SudhakarPas encore d'évaluation

- SEM IndonesiaDocument13 pagesSEM Indonesiaabhishek jainPas encore d'évaluation

- Foreign Direct Investment RevisedDocument6 pagesForeign Direct Investment RevisedFelix BossPas encore d'évaluation

- Impact of FdiDocument41 pagesImpact of FdiBarunPas encore d'évaluation

- Fdi in IndiaDocument8 pagesFdi in IndiamoniluckPas encore d'évaluation

- Globalization ProjectDocument10 pagesGlobalization ProjectSourab DebnathPas encore d'évaluation

- Term Paper-Business Environment Topic:Foreign Institution InvestmentDocument29 pagesTerm Paper-Business Environment Topic:Foreign Institution InvestmentRahul TargotraPas encore d'évaluation

- Naqib2 2Document15 pagesNaqib2 2Sayed Abdullah Shah SadaatPas encore d'évaluation

- Project On Foreign Direct Investment in Hotel and TourismDocument15 pagesProject On Foreign Direct Investment in Hotel and Tourismsweetsayliupale81085Pas encore d'évaluation

- Should Finmin Be Run by FM or FIIs and Foreign DalalsDocument4 pagesShould Finmin Be Run by FM or FIIs and Foreign Dalalsrvaidya2000Pas encore d'évaluation

- Write Up 2Document3 pagesWrite Up 2Raviraj PrajapatPas encore d'évaluation

- Impact of Capital Inflows On Economic Growth of Developing CountriesDocument15 pagesImpact of Capital Inflows On Economic Growth of Developing CountriesNurudeen Bamidele Faniyi (fbn)Pas encore d'évaluation

- 305-Int Fin-NotesDocument6 pages305-Int Fin-NotesRutik PatilPas encore d'évaluation

- Foreign Direct Investment Bharth Cohesion To EmploymentDocument24 pagesForeign Direct Investment Bharth Cohesion To EmploymentBharath GudiPas encore d'évaluation

- Negative and Positive Effects of Foreign Direct InvestmentDocument5 pagesNegative and Positive Effects of Foreign Direct Investmenttarunmishra123Pas encore d'évaluation

- Index: FDI (Foreign Direct Investement)Document73 pagesIndex: FDI (Foreign Direct Investement)Arvind Sanu MisraPas encore d'évaluation

- 19305c0003 RM Project SakibDocument11 pages19305c0003 RM Project SakibMohd sakib hasan qadriPas encore d'évaluation

- FDI and Trade BalanceDocument5 pagesFDI and Trade BalanceCharlyn Jewel OlaesPas encore d'évaluation

- History: Management Joint-Venture Transfer of Technology Expertise InvestmentDocument12 pagesHistory: Management Joint-Venture Transfer of Technology Expertise InvestmentMonika SharmaPas encore d'évaluation

- Meaning and Definition:: Capital FormationDocument17 pagesMeaning and Definition:: Capital FormationakmohideenPas encore d'évaluation

- Impact of FDI in IndiaDocument24 pagesImpact of FDI in IndiaBinoy JosePas encore d'évaluation

- FDI Versus FII: Sudhanshu RanadeDocument3 pagesFDI Versus FII: Sudhanshu RanadeSwati SobtiPas encore d'évaluation

- Role of Foreign Direct Investment (FDI) in The Growth of Indian Agricultural Sector: A Post Reform StudyDocument12 pagesRole of Foreign Direct Investment (FDI) in The Growth of Indian Agricultural Sector: A Post Reform StudyMandeep SinghPas encore d'évaluation

- Diaspora Direct Investment Policy Options For DevelopmentDocument34 pagesDiaspora Direct Investment Policy Options For DevelopmentTwisted MindsPas encore d'évaluation

- India's Growth Prospects Will Remain Strong, Even As World Economy Recovers Slowly, Says New World Bank ReportDocument14 pagesIndia's Growth Prospects Will Remain Strong, Even As World Economy Recovers Slowly, Says New World Bank ReportGaurav WilfredPas encore d'évaluation

- The Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaDocument21 pagesThe Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaTanay SoniPas encore d'évaluation

- Globalization: An Indian PerspectiveDocument10 pagesGlobalization: An Indian Perspectivesaurabh dixitPas encore d'évaluation

- IBON - Cha-Cha and FDI 2301-26 - FinalDocument9 pagesIBON - Cha-Cha and FDI 2301-26 - FinalSonny AfricaPas encore d'évaluation

- Argumentative EssayDocument5 pagesArgumentative EssayJessica CortesPas encore d'évaluation

- Question 2Document3 pagesQuestion 2Prabhash singhPas encore d'évaluation

- Fdi in India Literature ReviewDocument5 pagesFdi in India Literature Reviewgvyns594100% (1)

- FDI in IndiaDocument7 pagesFDI in IndiaROHITH S 22MIB051Pas encore d'évaluation

- FDI - Driving The Future of IndiaDocument4 pagesFDI - Driving The Future of IndiaHusain AttariPas encore d'évaluation

- Migration and DevelopmentDocument5 pagesMigration and DevelopmentMarfa PepitoPas encore d'évaluation

- Indian Economy Post LiberalizationDocument5 pagesIndian Economy Post LiberalizationNishant NirupamPas encore d'évaluation

- What Does India Need - FDI or FIIDocument7 pagesWhat Does India Need - FDI or FIIVikas JhaPas encore d'évaluation

- The Economy of India: Looking at Tourism in IndiaDocument17 pagesThe Economy of India: Looking at Tourism in IndiaAmit RajPas encore d'évaluation

- Role of FIIDocument5 pagesRole of FIIkrishanPas encore d'évaluation

- Oecd Global Forum On International InvestmentDocument16 pagesOecd Global Forum On International InvestmentGajendra DeshmukhPas encore d'évaluation

- RESERVE BANK OF INDIA - : Investment in Credit Information CompaniesDocument1 pageRESERVE BANK OF INDIA - : Investment in Credit Information Companiesrvaidya2000Pas encore d'évaluation

- NGO's A Perspective 31-01-2015Document29 pagesNGO's A Perspective 31-01-2015rvaidya2000Pas encore d'évaluation

- Letter To PMDocument3 pagesLetter To PMrvaidya2000Pas encore d'évaluation

- SGFX FinancialsDocument33 pagesSGFX FinancialsPGurusPas encore d'évaluation

- National Herald NarrativeDocument2 pagesNational Herald Narrativervaidya2000Pas encore d'évaluation

- Shamelessness Is Paraded As ModernDocument2 pagesShamelessness Is Paraded As Modernrvaidya2000Pas encore d'évaluation

- Aranganin Pathaiyil ProfileDocument5 pagesAranganin Pathaiyil Profilervaidya2000Pas encore d'évaluation

- Brief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Document17 pagesBrief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Srini KalyanaramanPas encore d'évaluation

- Representation To PMDocument31 pagesRepresentation To PMIrani SaroshPas encore d'évaluation

- Humbug Over KashmirDocument4 pagesHumbug Over Kashmirrvaidya2000Pas encore d'évaluation

- Unsung HeroesDocument3 pagesUnsung Heroesrvaidya2000Pas encore d'évaluation

- Why A Full - Blooded Attack On Chaina During Olympics Is in India's FavourDocument3 pagesWhy A Full - Blooded Attack On Chaina During Olympics Is in India's Favourrvaidya2000Pas encore d'évaluation

- Why Sub-Prime Is Not A Crisis in IndiaDocument4 pagesWhy Sub-Prime Is Not A Crisis in Indiarvaidya2000Pas encore d'évaluation

- Why Reforms Fatigue Has Set inDocument5 pagesWhy Reforms Fatigue Has Set inrvaidya2000Pas encore d'évaluation

- Whoever Said The Govt Employees Were Ill - PaidDocument2 pagesWhoever Said The Govt Employees Were Ill - Paidrvaidya2000Pas encore d'évaluation

- Why Is Government Reluctant To Retrieve Funds Stashed AbroadDocument2 pagesWhy Is Government Reluctant To Retrieve Funds Stashed Abroadrvaidya2000Pas encore d'évaluation

- Understanding The Unorganised SectorDocument4 pagesUnderstanding The Unorganised Sectorrvaidya2000Pas encore d'évaluation

- Time To Shake Down The Swiss BanksDocument4 pagesTime To Shake Down The Swiss Banksrvaidya2000Pas encore d'évaluation

- The Future of The RMB - Special Focus - Euromoney MagazineDocument24 pagesThe Future of The RMB - Special Focus - Euromoney MagazineALPas encore d'évaluation

- L&T Mindtree Project PresentationDocument8 pagesL&T Mindtree Project PresentationPuneet Agarwal100% (2)

- A Study On Technical Analysis As An Indicator For Investment Decision-MakingDocument69 pagesA Study On Technical Analysis As An Indicator For Investment Decision-MakingSantosh....Pas encore d'évaluation

- Itendra Irahyas: Presented byDocument83 pagesItendra Irahyas: Presented byJitendra VirahyasPas encore d'évaluation

- A Project Report On Derivatives (Futures & Options)Document98 pagesA Project Report On Derivatives (Futures & Options)Sagar Paul'gPas encore d'évaluation

- EPRA NAREIT Developed Europe FactsheetDocument2 pagesEPRA NAREIT Developed Europe FactsheetRoberto PerezPas encore d'évaluation

- Third Point - Third Quarter Letter (2010)Document8 pagesThird Point - Third Quarter Letter (2010)thebigpicturecoilPas encore d'évaluation

- Information Classification: GeneralDocument14 pagesInformation Classification: GeneralAnton De la GarzaPas encore d'évaluation

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Document4 pagesRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 4Suppy PPas encore d'évaluation

- Chartered Wealth ManagerDocument4 pagesChartered Wealth ManagerKeith Parker100% (1)

- Price Action TradingDocument17 pagesPrice Action TradingST Martin100% (2)

- CHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionDocument49 pagesCHAPTER 1-Semester 2-Capital Market. Investment & ConsumptionYohana Ray100% (10)

- AFCABLDocument95 pagesAFCABLsoyeb60Pas encore d'évaluation

- Sharma2015 PDFDocument20 pagesSharma2015 PDFCitra MurtiPas encore d'évaluation

- Yinguangxia Events: - China'S Enron EventsDocument11 pagesYinguangxia Events: - China'S Enron EventsMohammed I. AzamPas encore d'évaluation

- Module 1 - Overview of SukukDocument36 pagesModule 1 - Overview of SukukArun Kumar MurugasuPas encore d'évaluation

- SAP Available CoursesDocument20 pagesSAP Available Coursessumandua0% (1)

- Fame Export 1Document16 pagesFame Export 1Seine LaPas encore d'évaluation

- 137.COSV: Council of Orthodox Synagogues of Victoria LTD: Current & Historical Company ExtractDocument9 pages137.COSV: Council of Orthodox Synagogues of Victoria LTD: Current & Historical Company ExtractFlinders TrusteesPas encore d'évaluation

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateVikinguddin AhmedPas encore d'évaluation

- Pre TestDocument5 pagesPre TestJason Saberon Quiño0% (1)

- Wyckoff e BookDocument43 pagesWyckoff e BookIan Moncrieffe95% (22)

- Chapter 11, Modern Advanced Accounting-Review Q & ExrDocument12 pagesChapter 11, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- M and A Engagement Letters Power PointDocument79 pagesM and A Engagement Letters Power PointjonnyrevPas encore d'évaluation

- IGate Patni M&a DealDocument56 pagesIGate Patni M&a Dealmaheswara448Pas encore d'évaluation

- Example of An Engagement LetterDocument3 pagesExample of An Engagement LettermaryxtelPas encore d'évaluation

- Lamp IrancDocument1 pageLamp IrancaaaaPas encore d'évaluation

- "A Study On Customer Satisfaction": IciciDocument68 pages"A Study On Customer Satisfaction": IciciSagar Paul'gPas encore d'évaluation

- Valueresearch NewsletterDocument64 pagesValueresearch Newsletterdrsachin_uc7552100% (2)

- Credit Risk Interview QuestionsDocument2 pagesCredit Risk Interview QuestionsSahid WahabPas encore d'évaluation