Académique Documents

Professionnel Documents

Culture Documents

BDM of 06.16.2011 - Committees and Buyback

Transféré par

BVMF_RIDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BDM of 06.16.2011 - Committees and Buyback

Transféré par

BVMF_RIDroits d'auteur :

Formats disponibles

FREE TRANSLATION

BM&FBOVESPA S.A. BOLSA DE VALORES, MERCADORIAS E FUTUROS The Brazilian Securities, Commodities and Futures Exchange

Brazilian Federal Taxpayer CNPJ No.09.346.601/0001-25 State Registration NIRE No.35.300.351.452

MINUTES OF THE MEETING OF THE BOARD OF DIRECTORS HELD ON JUNE 16, 2011 1. Date, Time and Place: Meeting held on June 16, 2011, at 1:00 p.m., at the registered office of the Company, located in the City of So Paulo, State of So Paulo, at Praa Antonio Prado, 48, 7th floor, Downtown. 2. Attendance: Messrs. Arminio Fraga Neto Chairman of the Board, Claudio Luiz da Silva Haddad, Jos Roberto Mendona de Barros, Luis Stuhlberger, Pedro Pullen Parente, Renato Diniz Junqueira and Ren Marc Kern Directors. Pursuant to article 26, paragraph 4, of the Bylaws, Director Craig Steven Donohue attended the meeting by video conference. Justified absence of directors Candido Botelho Bracher, Julio de Siqueira Carvalho de Arajo and Marcelo Fernandez Trindade. 3. Presiding Officers: Mr. Arminio Fraga Neto Chairman; Mr. Henrique de Rezende Vergara Secretary. 4. Resolutions taken by unanimous vote, without qualification, based on supporting documents filed at the registered office of the Company, following a decision authorizing these minutes in summary form: 4.1. The directors appointed the members of the board advisory committees for a two-year term starting from todays date, as follows: 4.1.1. Nominations and Governance Committee: (a) independent director Jos Roberto Mendona de Barros, as Coordinator, (b) independent director Arminio Fraga Neto, and (c) Luis Stuhlberger; 4.1.2. Compensation Committee: (a) independent director Claudio Luiz da Silva Haddad, as Coordinator; (b) independent director Ren Marc Kern, and (c) Candido Botelho Bracher; 4.1.3. Audit Committee: (a) Nelson Carvalho, external independent member, as Coordinator; (b) Claudio Luiz da Silva Haddad, as independent director; and (c) Paulo Roberto Simes da Cunha, Srgio Darcy da Silva Alves and Tereza Cristina Grossi Togni, external independent members; and 4.1.4. Risk Committee: (a) Julio de Siqueira Carvalho de Arajo, as Coordinator; (b) Arminio Fraga Neto, and (c) Luis Stuhlberger, whereas the fourth member of the Risk Committee shall be elected timely, at which time the Committee will be constituted.

4.2. Given the nearing expiration of the term of our current Share Buyback Program, set to

occur on June 30, 2011, the directors decided to establish a new buyback program to maximize value generation for shareholders through efficient management of the capital structure. This approved terms and conditions of this new share buyback program are the following: Repurchases within the scope of the buyback program are authorized over a period of 184 days starting from July 1 and ending on December 31, 2011. It will be incumbent on the Executive Management to set the dates on which actual repurchases will be implemented; As defined under article 3, item III, of CVM Instruction No. 361 issued by the Brazilian Securities Commission on March 5, 2002, the free float of the Company is 1, 952,478,656 shares of common stock; The buyback program is authorized for repurchase of up to 30,000,000 shares of common stock, which represent 1.5% of the Companys total outstanding shares; Shares repurchased within the scope of the buyback program will be cancelled or used for fulfillment of options exercised within the scope of the Companys stock options plan; The repurchase price shall be the price at which the shares are trading on the stock exchange (BM&FBOVESPA) as of the relevant transaction date. The following institutions will intermediate the buyback process: (a) Credit Suisse Brasil S.A. CTVM, located at Avenida Brigadeiro Faria Lima 3,064, 13th floor, So Paulo, state of So Paulo; (b) Goldman Sachs do Brasil CTVM S.A., located at Av. Presidente Juscelino Kubitschek, 510, 6th floor, So Paulo, state of So Paulo, (c) Interfloat HZ CCTVM Ltda., located at Rua Boa Vista 63, 5th floor, So Paulo, state of So Paulo; (d) Ita CV S.A., located at Avenida Brigadeiro Faria Lima, 3.400, 10th floor, So Paulo, state of So Paulo; (e) JPMorgan CCVM S.A., located at Av. Brigadeiro Faria Lima, 3729, 13th floor, So Paulo, state of So Paulo; and (f) Morgan Stanley Corretora de Ttulos e Valores Mobilirios S.A., located at Avenida Brigadeiro Faria Lima 3,600, 6th floor, So Paulo, state of So Paulo. 5. Closing: There being no further business to transact, these minutes were drawn up, and subsequently read, found to conform, approved and signed by all directors in attendance. So Paulo, June 16, 2011. (sgd.) Arminio Fraga Neto Chairman of the Board; Claudio Luiz da Silva Haddad, Craig Steven Donohue, Jos Roberto Mendona de Barros, Luis Stuhlberger, Pedro Pullen Parente, Renato Diniz Junqueira and Ren Marc Kern, Directors. This is a true copy of the original drawn up in the proper register.

(sgd.) Arminio Fraga Neto Chairman of the Board

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 67 Rich Dad and Robert Kiyosaki Quotes On Business and MoneyDocument14 pages67 Rich Dad and Robert Kiyosaki Quotes On Business and MoneyJunior KalonjiPas encore d'évaluation

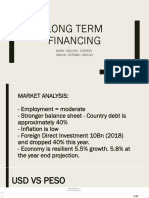

- LONG TERM FINANCING Finma FinalDocument36 pagesLONG TERM FINANCING Finma FinalJane Baylon100% (2)

- Business Law Unit - IVDocument9 pagesBusiness Law Unit - IVKaran Veer SinghPas encore d'évaluation

- Ichimoku Kinko HyoDocument48 pagesIchimoku Kinko HyoJanny23SD100% (2)

- Intraday Winning System by Paisa To BanegaDocument7 pagesIntraday Winning System by Paisa To BanegaSumeet Gupta40% (5)

- Sharekhan BBA ProjectDocument48 pagesSharekhan BBA ProjectAlok SharmaPas encore d'évaluation

- Extraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideDocument357 pagesExtraordinary Shareholders' Meetings - 06.14.2017 - Practical GuideBVMF_RIPas encore d'évaluation

- Material Fact - Merger of CETIP Into B3Document4 pagesMaterial Fact - Merger of CETIP Into B3BVMF_RIPas encore d'évaluation

- Extraordinary Shareholders' Meetings - 06.14.2017 - Call NoticeDocument2 pagesExtraordinary Shareholders' Meetings - 06.14.2017 - Call NoticeBVMF_RIPas encore d'évaluation

- Earnings PresentationDocument23 pagesEarnings PresentationBVMF_RIPas encore d'évaluation

- Material Fact - New Guidance For Expenses, Depreciation and Amortization and CAPEX BudgetsDocument2 pagesMaterial Fact - New Guidance For Expenses, Depreciation and Amortization and CAPEX BudgetsBVMF_RIPas encore d'évaluation

- 2016 Reference FormDocument178 pages2016 Reference FormBVMF_RIPas encore d'évaluation

- Earnings ReleaseDocument12 pagesEarnings ReleaseBVMF_RIPas encore d'évaluation

- BDM of 04.28.2017 - Nomination of The Chairman and Vice Chairman of The Board of DirectorsDocument1 pageBDM of 04.28.2017 - Nomination of The Chairman and Vice Chairman of The Board of DirectorsBVMF_RIPas encore d'évaluation

- Management Proposal Second Call AGE 10 5 2017 COMSOLIDADODocument169 pagesManagement Proposal Second Call AGE 10 5 2017 COMSOLIDADOBVMF_RIPas encore d'évaluation

- Ata AGOE 2017 Ingls VFDocument14 pagesAta AGOE 2017 Ingls VFBVMF_RIPas encore d'évaluation

- Extraordinary Shareholders' Meeting - 05.10.2017 - Call NoticeDocument4 pagesExtraordinary Shareholders' Meeting - 05.10.2017 - Call NoticeBVMF_RIPas encore d'évaluation

- Annual and Extraordinary Shareholders' Meetings - 04.28.2017 - Synthetic Map of The Remote Voting Procedure - Bookkeeping AgentDocument4 pagesAnnual and Extraordinary Shareholders' Meetings - 04.28.2017 - Synthetic Map of The Remote Voting Procedure - Bookkeeping AgentBVMF_RIPas encore d'évaluation

- 2017 04 17 NM - Re-Filing Shareholders Meeting DocumentsDocument1 page2017 04 17 NM - Re-Filing Shareholders Meeting DocumentsBVMF_RIPas encore d'évaluation

- Sharekhan Morning Tiger (Pre Market Insight) 7 Nov 2022Document9 pagesSharekhan Morning Tiger (Pre Market Insight) 7 Nov 2022deepa gargPas encore d'évaluation

- Sahara India's Downturn A Study On Awareness and Customer's PerspectivesDocument5 pagesSahara India's Downturn A Study On Awareness and Customer's PerspectivesVishu RajPas encore d'évaluation

- Does Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyDocument9 pagesDoes Stock Market Development Cause Economic Growth? A Time Series Analysis For Bangladesh EconomyPushpa BaruaPas encore d'évaluation

- Banking & Financials - Writing On The WallDocument42 pagesBanking & Financials - Writing On The WallUnplugged12Pas encore d'évaluation

- Fs SP Us High Yield Corporate Bond Energy IndexDocument5 pagesFs SP Us High Yield Corporate Bond Energy IndexpabloPas encore d'évaluation

- Profit and Loss Analysis: © Dallas Brozik, Marshall UniversityDocument26 pagesProfit and Loss Analysis: © Dallas Brozik, Marshall UniversityrashmikupsadPas encore d'évaluation

- Veeva: Irrefutable Proof of TAM Overstatements, Pharma Rep Seat Saturation, Drastic Growth Deceleration, Opaque Disclosures, Nose Bleed Relative Valuation, and Highly Dubious Sell-Side CoverageDocument19 pagesVeeva: Irrefutable Proof of TAM Overstatements, Pharma Rep Seat Saturation, Drastic Growth Deceleration, Opaque Disclosures, Nose Bleed Relative Valuation, and Highly Dubious Sell-Side CoverageSuhailCapitalPas encore d'évaluation

- The Black-Scholes Option Pricing Model (BSOPM) This Teaching Note Supplements Textbook Chapter 16Document18 pagesThe Black-Scholes Option Pricing Model (BSOPM) This Teaching Note Supplements Textbook Chapter 16kenPas encore d'évaluation

- DMCSL Share PlanDocument3 pagesDMCSL Share PlanRayhan TanvirPas encore d'évaluation

- Securities Market StructureDocument69 pagesSecurities Market StructureGajjala Swetha Gajjala SwethaPas encore d'évaluation

- ACCA Paper F9 Mnemonics Revision (Sample Download)Document37 pagesACCA Paper F9 Mnemonics Revision (Sample Download)accountancylad100% (3)

- Order in The Matter of S.A.L. Steel Ltd.Document8 pagesOrder in The Matter of S.A.L. Steel Ltd.Shyam SunderPas encore d'évaluation

- 2010 OCBC Cycle Singapore To Follow Route of YOG Road Race, 15 Oct 2009, Business TimesDocument1 page2010 OCBC Cycle Singapore To Follow Route of YOG Road Race, 15 Oct 2009, Business TimesdbmcysPas encore d'évaluation

- Infinite Computer SolutionsDocument20 pagesInfinite Computer SolutionsVaibhav ChudasamaPas encore d'évaluation

- Capital Allocation Across RiskyDocument23 pagesCapital Allocation Across RiskyVaidyanathan RavichandranPas encore d'évaluation

- MoaDocument4 pagesMoaRaghvirPas encore d'évaluation

- Indian Accounting StandardsDocument7 pagesIndian Accounting StandardsVishal JoshiPas encore d'évaluation

- Tulipomania: Mutemwa MwitumwaDocument13 pagesTulipomania: Mutemwa MwitumwaRajeev ShanbhagPas encore d'évaluation

- First State China A Shares Fund USD B FV en HK IE00B3LV6Z90Document1 pageFirst State China A Shares Fund USD B FV en HK IE00B3LV6Z90Jannaki PvPas encore d'évaluation

- Summarize MCQs PDFDocument32 pagesSummarize MCQs PDFRam IyerPas encore d'évaluation

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeDocument26 pagesRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharPas encore d'évaluation

- Nelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, HarborviewDocument23 pagesNelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, Harborview83jjmackPas encore d'évaluation

- Tick Data Filtering White PaperDocument21 pagesTick Data Filtering White PapersmehdinPas encore d'évaluation