Académique Documents

Professionnel Documents

Culture Documents

MF0010 Set1

Transféré par

barthwalnishaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MF0010 Set1

Transféré par

barthwalnishaDroits d'auteur :

Formats disponibles

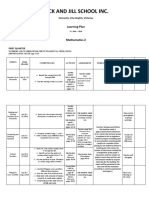

Master in Business Administration Semester 3 MF0010 Security Analysis and Portfolio Management - 4 Credits (Book ID: B1208) Assignment

t Set- 1 (60 Marks)

Note: Each question carries 10 Marks. Answer all the questions. Q.1 Frame the investment process for a person of your age group. Answer: It is rare to find investors investing their entire savings in a single security. Instead, they tend to invest in a group of securities. Such a group of securities is called a portfolio. Most financial experts stress that in order to minimize risk; an investor should hold a well-balanced investment portfolio. The investment process describes how an investor must go about making. Decisions with regard to what securities to invest in while constructing a portfolio, how extensive the investment should be, and when the investment should be made. This is a procedure involving the following five steps: Set investment policy Perform security analysis Construct a portfolio Revise the portfolio Evaluate the performance of portfolio 1. Setting Investment Policy This initial step determines the investors objectives and the amount of his investable wealth. Since there is a positive relationship between risk and return, the investment objectives should be stated in terms of both risk and return. This step concludes with the asset allocation decision: identification of the potential categories of financial assets for consideration in the portfolio that the investor is going to construct. Asset allocation involves dividing an investment portfolio among different asset categories, such as stocks, bonds and cash. The asset allocation that works best for an investor at any given point in his life depends largely on his time horizon and his ability to tolerate risk. Time Horizon The time horizon is the expected number of months, years, or decades that an investor will be investing his money to achieve a particular financial goal. An investor with a longer time horizon may feel more comfortable with a riskier or more volatile investment because he can ride out the slow economic cycles and the inevitable ups and downs of the markets. By contrast, an investor who is saving for his teen-aged

daughters college education would be less likely to take a large risk because he has a shorter time horizon. Risk Tolerance - Risk tolerance is an investors ability and willingness to lose some or all of his original investment in exchange for greater potential returns. An aggressive investor, or one with a high-risk tolerance, is more likely to risk losing money in order to get better results. A conservative investor, or one with a low-risk tolerance, tends to favour investments that will preserve his or her original investment. The conservative investors keep a "bird in the hand," while aggressive investors seek "two in the bush." While setting the investment policy, the investor also selects the portfolio management style (active vs. passive management). Active Management is the process of managing investment portfolios by attempting to time the market and/or select undervalued stocks to buy and overvalued stocks to sell, based upon research, investigation and analysis. Passive Management is the process of managing investment portfolios by trying to match the performance of an index (such as a stock market index) or asset class of securities as closely as possible, by holding all or a representative sample of the securities in the index or asset class. This portfolio management style does not use market timing or stock selection strategies. 2. Performing Security Analysis This step is the security selection decision: Within each asset type, identified in the asset allocation decision, how does an investor select which securities to purchase. Security analysis involves examining a number of individual securities within the broad categories of financial assets identified in the previous step. One purpose of this exercise is to identify those securities that currently appear to be mispriced. Security analysis is done either using Fundamental or Technical analysis (both have been discussed in subsequent units). Fundamental analysis is a method used to evaluate the worth of a security by studying the financial data of the issuer. It scrutinizes the issuer's income and expenses, assets and liabilities, management, and position in its industry. In other words, it focuses on the basics of the business. Technical analysis is a method used to evaluate the worth of a security by studying market statistics. Unlike fundamental analysis, technical analysis disregards an issuer's financial statements. Instead, it relies upon market trends to ascertain investor sentiment to predict how a security will perform. 3. Portfolio Construction This step identifies those specific assets in which to invest, as well as determining the proportion of the investors wealth to put into each one. Here selectivity, timing and diversification issues are addressed.

Selectivity refers to security analysis and focuses on price movements of individual securities. Timing involves forecasting of price movement of stocks relative to price movements of fixed income securities (such as bonds). Diversification aims at constructing a portfolio in such a way that the investors risk is minimized. The following table summarizes how the portfolio is constructed for an active and a passive investor.

4. Portfolio Revision This step is the repetition of the three previous steps, as objectives might change and previously held portfolio might not be the optimal one. 5. Portfolio performance evaluation This step involves determining periodically how the portfolio has performed over some time period (returns earned vs. risks incurred).

Q.2 From the website of BSE India, explain how the BSE Sensex is calculated. Answer: SENSEX: Sensex is the stock market index for BSE. It was first compiled in 1986. It is made of 30 stocks representing a sample of large, liquid and representative companies. The base year of SENSEX is 1978-79 and the base value is 100. The Bombay Stock Exchange SENSEX (acronym of Sensitive Index) more commonly referred to as SENSEX or BSE 30 is a free-float market capitalization-weighted index of 30 well-established and financially sound companies listed on Bombay Stock Exchange. The 30 component companies which are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since January 1, 1986, the SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX is taken as 100 on April 1, 1979, and its base year as 1978-79. On 25 July, 2001 BSE launched DOLLEX-30, a dollar-linked version of SENSEX. As of 21 April 2011, the market capitalisation of SENSEX was about 29,733 billion (US$660 billion) (42.34% of market capitalization of BSE), while its free-float market capitalization was 15,690 billion (US$348 billion).

The Bombay Stock Exchange (BSE) regularly reviews and modifies its composition to be sure it reflects current market conditions. The index is calculated based on a free float capitalization methoda variation of the market capitalisation method. Instead of using a company's outstanding shares it uses its float, or shares that are readily available for trading. The free-float method, therefore, does not include restricted stocks, such as those held by promoters, government and strategic investors. Initially, the index was calculated based on the full market capitalization method. However this was shifted to the free float method with effect from September 1, 2003. Globally, the free float market capitalization is regarded as the industry best practice. As per free float capitalization methodology, the level of index at any point of time reflects the free float market value of 30 component stocks relative to a base period. The market capitalization of a company is determined by multiplying the price of its stock by the number of shares issued by the company. This market capitalization is multiplied by a free float factor to determine the free float market capitalization. Free float factor is also referred as adjustment factor. Free float factor represent the percentage of shares that are readily available for trading. The calculation of SENSEX involves dividing the free float market capitalization of 30 companies in the index by a number called index divisor.The divisor is the only link to original base period value of the SENSEX. It keeps the index comparable over time and is the adjustment point for all index adjustments arising out of corporate actions, replacement of scrips, etc. The index has increased by over ten times from June 1990 to the present. Using information from April 1979 onwards, the long-run rate of return on the BSE SENSEX works out to be 18.6% per annum, which translates to roughly 9% per annum after compensating for inflation. Following is the list of the component companies of SENSEX as on Feb 26, 2010. Adj. Weight Code Name Sector Factor Index(%) 50041 ACC Housing Related 0.55 0.77 0 50010 BHEL Capital Goods 0.35 3.26 3 53245 Bharti Airtel Telecom 0.35 3 4 53286 DLF Universal Limited Housing related 0.25 1.02 8 50030 Grasim Industries Diversified 0.75 1.5 0 50001 HDFC Finance 0.90 5.21 0 50018 HDFC Bank Finance 0.85 5.03 in

0 50018 2 50044 0 50069 6 53217 4 50020 9 50087 5 53253 2 50051 0 50052 0 53250 0 53254 1 53255 5 50030 4 50031 2 53271 2 50032 5 50039 0 50011 2 50090 0 52471 5 53254 0 50057

Hero Honda Motors Ltd. Transport Equipments Hindalco Industries Ltd. Metal,Metal Mining Products &

0.50 0.7 0.50 1.00 0.85 0.70 0.55 0.90 0.75 0.50 0.15 0.15 0.15 0.20 0.35 0.50 0.65 0.45

1.43 1.75 2.08 7.86 10.26 4.99 1.25 6.85 1.71 1.71 2.03 2.03 2.03 3.87 0.92 12.94 1.19 4.57 2.39 1.03 3.61 1.66

Hindustan Lever Limited FMCG ICICI Bank Infosys ITC Limited Jaiprakash Associates Larsen & Toubro Mahindra Limited & Mahindra Finance Information Technology FMCG Housing Related Capital Goods Transport Equipments Transport Equipments Information Technology Power Information Technology Oil & Gas Telecom Oil & Gas Power Finance Metal, Metal and Mining Products,

Maruti Suzuki NIIT Technologies NTPC NIIT ONGC Reliance Communications Reliance Industries Reliance Infrastructure State Bank of India Sterlite Industries

0.45 0.40 0.25 0.55

Sun Pharmaceutical Healthcare Industries Tata Consultancy Information Technology Services Tata Motors Transport Equipments

0 50040 Tata Power 0 50047 Tata Steel 0 50768 Wipro 5

Power

0.70

1.63 2.88 1.61

Metal, Metal Products & 0.70 Mining Information Technology 0.20

Q.3 Perform an economy analysis on Indian economy in the current situation. Answer: Economic analysis is done for two reasons: first, a companys growth prospects are, ultimately, dependent on the economy in which it operates; second, share price performance is generally tied to economic fundamentals, as most companies generally perform well when the economy is doing the same. 1 Factors to be considered in economy analysis The economic variables that are considered in economic analysis are gross domestic product (GDP) growth rate, exchange rates, the balance of payments (BOP), the current account deficit, government policy (fiscal and monetary policy), domestic legislation (laws and regulations), unemployment (the percent of the population that wants to work and is currently not working), public attitude (consumer confidence) inflation (a general increase in the price of goods and services), interest rates, productivity (output per worker), capacity utilization (output by the firm) etc . GDP is the total income earned by a country. GDP growth rate shows how fast the economy is growing. Investors know that strong economic growth is good for companies and recessions or full-blown depressions cause share prices to decline, all other things being equal. Inflation is important for investors, as excessive inflation undermines consumer spending power (prices increase) and so can cause economic Security Analysis and Portfolio Management stagnation. However, deflation (negative inflation) can also hurt the economy, as it encourages consumers to postpone spending (as they wait for cheaper prices). The exchange rate affects the broad economy and companies in a number of ways. First, changes in the exchange rate affect the exports and imports. If exchange rate strengthens, exports are hit; if the exchange rate weakens, imports are affected. The BOP affects the exchange rate through supply and demand for the foreign currency. BOP reflects a countrys international monetary transactions for a specific time period. It consists of the current account and the capital account. The current account is an account of the trade in goods and services. The capital account is an account of the cross-border transactions in financial assets. A current account deficit occurs when a country imports more goods and services than it exports.

A capital account deficit occurs when the investments made in the country by foreigners is less than the investment in foreign countries made by local players. The currency of a country appreciates when there is more foreign currency coming into the country than leaving it. Therefore, a surplus in the current or capital account causes the currency to strengthen; a deficit causes the currency to weaken. The levels of interest rates (the cost of borrowing money) in the economy and the money supply (amount of money circulating in the economy) also have a bearing on the performance of businesses. All other things being equal, an increase in money supply causes the interest rates to fall; a decrease causes the interest rates to rise. If interest rates are low, the cost of borrowing by businesses is not expensive, and companies can easily borrow to expand and develop their activities. On the other hand, when the cost of borrowing becomes too high (when the interest rates go up), borrowing may become too costly and plans for expansion are postponed. Interest rates also have a significant effect on the share markets. In very broad terms, share prices improve when interest rates fall and decline when interest rates increase. There are two reasons for that: the intrinsic value estimate will increase as interest rates (and the linked discount rate) fall and underlying company profitability will improve, if interest payments reduce. 2 Business cycle and leading coincidental and lagging indicators All economies experience recurrent periods of expansion and contraction. This recurring pattern of recession and recovery is called the business cycle. The business cycle consists of expansionary and recessionary periods. When business activity reaches a high point, it peaks; a low point on the cycle is a trough. Troughs represent the end of a recession and the beginning of an expansion. Peaks represent the end of an expansion and the beginning of a recession. In the expansion phase, business activity is growing, production and demand are increasing, and employment is expanding. Businesses and consumers normally borrow more money for investment and consumption purposes. As the cycle moves into the peak, demand for goods overtakes supply and prices rise. This creates inflation. During inflationary times, there is too much money chasing a limited amount of goods. Therefore, businesses are able to charge more for their items causing prices to rise. This, in turn, reduces the purchasing power of the consumer. As prices rise, demand slackens which causes economic activity to decrease. The cycle then enters the recessionary phase. As business activity contracts, employers lay off workers (unemployment increases) and demand further slackens. Usually, this causes prices to fall. The cycle enters the trough. Eventually, lower prices stimulate demand and the economy moves into the expansion phase. The performance of an investment is influenced by the business cycle. The direction in which an economy is heading has a significant impact on companies performance and ability to deliver earnings. If the economy is in a recession, it is likely that many business sectors will fail to generate profits. This is because the demand for most products decreases during economic declines, since people have less money with which to purchase goods and services (since high levels of unemployment are common

during economic crises). On the other hand, during times of economic prosperity, companies tend to expand their operations and in turn generate higher levels of earnings, as the demand for goods tends to grow. Security Analysis and Portfolio To some extent the business cycle can be predicted as it is cyclical in nature. The prediction can be done using economic indicators. Economic indicators are quantitative announcements (released as data), released at predetermined times according to a schedule, reflecting the financial, economical and social atmosphere of an economy. They are published by various agencies of the government or by the private sector. They are used to monitor the health and strength of an economy and they help to evaluate the direction of the business cycle. Economists use three types of indicators that provide data on the movement of the economy as the business cycle enters different phases. The three types are leading, coincident, and lagging indicators. Leading indicators tend to precede the upward and downward movements of the business cycle and can be used to predict the near term activity of the economy. Thus they can help anticipate rising corporate profits and possible stock market price increases. Examples of leading indicators are: Average weekly hours of production workers, money supply etc. Coincident indicators usually mirror the movements of the business cycle. They tend to change directly with the economy. Example includes industrial production, manufacturing and trade sales etc. Lagging Indicators are economic indicators that change after the economy has already begun to follow a particular pattern or trend. Lagging Indicators tend to follow (lag) economic performance. Examples: ratio of trade inventories to sales, ratio of consumer installment credit outstanding to personal income etc.

Q.4 Identify some technical indicators and explain how they can be used to decide purchase of a companys stock. Answer: A technical indicator is a series of data points that are derived by applying a formula to the price and/or volume data of a security. Price data can be any combination of the open, high, low or closing price over a period of time. Some indicators may use only the closing prices, while others incorporate volume and open interest into their formulae. The price data is entered into the formula and a data point is produced. For example, say the closing prices of a stock for 3 days are Rs. 41, Rs. 43 and Rs. 43. If a technical indicator is constructed using the average of the closing prices, then the average of the 3 closing prices is one data point ((41+43+43)/3=42.33). However, one data point does not offer much information. A series of data points over a period of time is required to enable analysis. Thus we can have a 3 period moving average as a

technical indicator, where we drop the earliest closing price and use the next closing price for calculations. By creating a time series of data points, a comparison can then be made between present and past levels. Technical indicators are usually shown in a graphical form above or below a securitys price chart for facilitating analysis. Once shown in graphical form, an indicator can then be compared with the corresponding price chart of the security. Sometimes indicators are plotted on top of the price plot for a more direct comparison. Technical indicators measure money flow, trends, volatility and momentum etc. They are used for two main purposes: to confirm price movement and the quality of chart patterns, and to form buy and sell signals. A technical indicator offers a different perspective from which to analyze the price action. Some, such as moving averages, are derived from simple formulae and they are relatively easy to understand. Others, like stochastics have complex formulae and require more effort to fully understand and appreciate. Technical indicators can provide unique perspective on the strength and direction of the underlying price action. Indicators filter price action with formulae. Therefore they are derivative measures and not direct reflections of the price action. This should be taken into account when analyzing the indicators. Any analysis of an indicator should be taken with the price action in mind. There are two main types of indicators: leading and lagging. A leading indicator precedes price movements; therefore they are used for prediction. A lagging indicator follows price movement and therefore is a confirmation. The main benefit of leading indicators is that they provide early signaling for entry and exit. Early signals can forewarn against a potential strength or weakness. Leading indicators can be used in trending markets. In a market that is trending up, the leading indicator helps identify oversold conditions for buying opportunities. In a market that is trending down, leading indicators can help identify overbought situations for selling opportunities. Some of the more popular leading indicators include Relative Strength Index (RSI) and Stochastic Oscillator. Lagging indicators follow the price action and are commonly referred to as trendfollowing indicators. Lagging indicators work best when the markets or securities develop strong trends. They are designed to get traders in and keep them in as long as the trend is intact. As such, these indicators are not effective in trading or sideways markets. Some popular trend-following indicators include moving averages and Moving Average Convergence Divergence (MACD). Technical indicators are constructed in two ways: those that fall in a bounded range and those that do not. The technical indicators that are bound within a range are called oscillators. Oscillators are used as an overbought / oversold indicator. A market is said to be overbought when prices have been trending higher in a relatively steep fashion for some time, to the extent that the number of market participants long of the market significantly outweighs those on the sidelines or holding short positions. This means that there are fewer participants to jump onto the back of the trend. The oversold condition is just the opposite. The market has been trending lower for some time and is running out of fuel for further price declines.

Oscillator indicators move within a range, say between zero and 100, and signal periods where the security is overbought (near 100) or oversold (near zero). Oscillators are the most common type of technical indicators. The technical indicators that are not bound within a range also form buy and sell signals and display strength or weakness in the market, but they can vary in the way they do this. The two main ways that technical indicators are used to form buy and sell signals is through crossovers and divergence. Crossovers occur when either the price moves through the moving average, or when two different moving averages cross over each other. Divergence happens when the direction of the price trend and the direction of the indicator trend are moving in the opposite direction. This indicates that the direction of the price trend is weakening. Technical indicators provide an extremely useful source of additional information. These indicators help identify momentum, trends, volatility and various other aspects in a security to aid in the technical analysis of trends. While some traders just use a single indicator for buy and sell signals, it is best to use them along with price movement, chart patterns and other indicators. A number of technical indicators are in use. Some of the technical indicators are discussed below for the purpose of illustration of the concept: Moving average The moving average is a lagging indicator which is easy to construct and is one of the most widely used. A moving average, as the name suggests, represents an average of a certain series of data that moves through time. The most common way to calculate the moving average is to work from the last 10 days of closing prices. Each day, the most recent close (day 11) is added to the total and the oldest close (day 1) is subtracted. The new total is then divided by the total number of days (10) and the resultant average computed. The purpose of the moving average is to track the progress of a price trend. The moving average is a smoothing device. By averaging the data, a smoother line is produced, making it much easier to view the underlying trend. A moving average filters out random noise and offers a smoother perspective of the price action. Moving Average Convergence Divergence (MACD): MACD is a momentum indicator and it is made up of two exponential moving averages. The MACD plots the difference between a 26-day exponential moving average and a 12-day exponential moving average. A 9-day moving average is generally used as a trigger line. When the MACD crosses this trigger and goes down it is a bearish signal and when it crosses it to go above it, it's a bullish signal. This indicator measures shortterm momentum as compared to longer term momentum and signals the current direction of momentum. Traders use the MACD for indicating trend reversals. Relative Strength Index: The relative strength index (RSI) is another of the well-known momentum indicators. Momentum measures the rate of change of prices by continually taking price differences for a fixed time interval. RSI helps to signal overbought and oversold conditions in a

security. RSI is plotted in a range of 0-100. A reading above 70 suggests that a security is overbought, while a reading below 30 suggests that it is oversold. This indicator helps traders to identify whether a securitys price has been unreasonably pushed to its current levels and whether a reversal may be on the way. Stochastic Oscillator: The stochastic oscillator is one of the most recognized momentum indicators. This indicator provides information about the location of a current Security Analysis and Portfolio Management Unit 4 Sikkim Manipal University Page No. 64 closing price in relation to the period's high and low prices. The closer the closing price is to the period's high, the higher is the buying pressure, and the closer the closing price is to the period's low, the more is the selling pressure. The idea behind this indicator is that in an uptrend, the price should be closing near the highs of the trading range, signaling upward momentum in the security. In downtrends, the price should be closing near the lows of the trading range, signaling downward momentum. The stochastic oscillator is plotted within a range of zero and 100 and signals overbought conditions above 80 and oversold conditions below 20.

Q.5 Compare Arbitrage pricing theory with the Capital asset pricing model. Answer: Arbitrage Pricing Theory (APT) Arbitrage Pricing Theory (APT) are two of the most commonly used models for pricing all risky assets based on their relevant risks. Capital Asset Pricing Model (CAPM) calculates the required rate of return for any risky asset based on the securitys beta. Beta is a measure of the movement of the securitys return with the return on the market portfolio, which includes all the securities that are available in the world and where the proportion of each security in the portfolio is its market value as a percentage of total market value of all the securities. The problem with CAPM is that such a market portfolio is hypothetical and not observable and we have to use a market index like the S&P 500 or Sensex as a proxy for the market portfolio. However, indexes are imperfect proxies for overall market as no single index includes all capital assets, including stocks, bonds, real estate, collectibles, etc. Another criticism of the CAPM is that the various different proxies that are used for the market portfolio do not fully capture all of the relevant risk factors in the economy. An alternative pricing theory with fewer assumptions, the Arbitrage Pricing Theory (APT), has been developed by Stephen Ross. It can calculate expected return without taking recourse to the market portfolio. It is a multi-factor model for determining the required rate of return which means that it takes into account a number of economy wide factors that can affect the security prices. APT calculates relations among expected returns that will rule out arbitrage by investors. The APT requires three assumptions: 1) Returns can be described by a factor model.

2) There are no arbitrage opportunities. 3) There are large numbers of securities that permit the formation of portfolios that diversify the firm-specific risk of individual stocks. The Capital Asset Pricing Model (CAPM) is a model to explain why capital assets are priced the way they are. William Sharpe, Treynor and Lintner contributed to the development of this model. An important consequence of the modern portfolio theory as introduced by Markowitz was that the only meaningful aspect of total risk to consider for any individual asset is its contribution to the total risk of a portfolio. CAPM extended Harry Markowitzs portfolio theory to introduce the notions of systematic and unsystematic (or unique) risk. Arbitrage Pricing Theory vs. the Capital Asset Pricing Model The Arbitrage Pricing Theory (APT) and the Capital Asset Pricing Model are the two most influential theories on stock and asset pricing today. The APT model is different from the CAPM in that it is far less restrictive in its assumptions. APT allows the individual investor to develop their model that explains the expected return for a particular asset. Intuitively, the APT makes a lot of sense because it removes the CAPM restrictions and basically states that the expected return on an asset is a function of many factors and the sensitivity of the stock to these factors. As these factors move, so does the expected return on the stock - and therefore its value to the investor. However, the potentially large number of factors means that more factor sensitivities have to be calculated. There is also no guarantee that all the relevant factors have been identified. This added complexity is the reason arbitrage pricing theory is far less widely used than CAPM. In the CAPM theory, the expected return on a stock can be described by the movement of that stock relative to the rest of the stock market. The CAPM theory is really just a simplified version of the APT, where the only factor considered is the risk of a particular stock relative to the rest of the stock market - as described by the stock's beta. From a practical standpoint, CAPM remains the dominant pricing model used today. When compared to the Arbitrage Pricing Theory, the Capital Asset Pricing Model is both elegant and relatively simple to calculate.

Q.6 Discuss the different forms of market efficiency. Nov 2010 Answer: Forms of Market Efficiency A financial market displays informational efficiency when market prices reflect all available information about value. This definition of efficient market requires answers to two questions: what is all available information? & what does it mean to reflect all

available information? Different answers to these questions give rise to different versions of market efficiency. What information are we talking about? Information can be information about past prices, information that is public information and information that is private information. Information about past prices refers to the weak form version of market efficiency, information that consists of past prices and all public information refers to the semistrong version of market efficiency and all information (past prices, all public information and all private information) refers to the strong form version of market efficiency. Prices reflect all available information means that all financial transactions which are carried out at market prices, using the available information, are zero NPV activities. The weak form of EMH states that all past prices, volumes and other market statistics (generally referred to as technical analysis) cannot provide any information that would prove useful in predicting future stock price movements. The current prices fully reflect all security-market information, including the historical sequence of prices, rates of return, trading volume data, and other market-generated information. This implies that past rates of return and other market data should have no relationship with future rates of return. It would mean that if the weak form of EMH is correct, then technical analysis is fruitless in generating excess returns. The semi-strong form suggests that stock prices fully reflect all publicly available information and all expectations about the future. Old information then is already discounted and cannot be used to predict stock price fluctuations. In sum, the semistrong form suggests that fundamental analysis is also fruitless; knowing what a company generated in terms of earnings and revenues in the past will not help you determine what the stock price will do in the future. This implies that decisions made on new information after it is public should not lead to above-average risk-adjusted profits from those transactions. Lastly, the strong form of EMH suggests that stock prices reflect all information, whether it be public (say in SEBI filings) or private (in the minds of the CEO and other insiders). So even with material non-public information, EMH asserts that stock prices cannot be predicted with any accuracy.

*******

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 2009 GCSE PE SpecificationsDocument225 pages2009 GCSE PE SpecificationsAdstasticPas encore d'évaluation

- MATH6113 - PPT5 - W5 - R0 - Applications of IntegralsDocument58 pagesMATH6113 - PPT5 - W5 - R0 - Applications of IntegralsYudho KusumoPas encore d'évaluation

- Argenti, P. Corporate Communication. Cap. 8-9Document28 pagesArgenti, P. Corporate Communication. Cap. 8-9juan100% (1)

- Balzac and the Little Chinese Seamstress: A Journey During the Cultural RevolutionDocument4 pagesBalzac and the Little Chinese Seamstress: A Journey During the Cultural RevolutionRogona 123Pas encore d'évaluation

- 8483724Document24 pages8483724ejkiranPas encore d'évaluation

- Appraisal Sample PDFDocument22 pagesAppraisal Sample PDFkiruthikaPas encore d'évaluation

- Pahang JUJ 2012 SPM ChemistryDocument285 pagesPahang JUJ 2012 SPM ChemistryJeyShida100% (1)

- How To Use Hyper-V Snapshot Revert, Apply, and Delete OptionsDocument15 pagesHow To Use Hyper-V Snapshot Revert, Apply, and Delete OptionsKaran MishraPas encore d'évaluation

- Community Development A Critical Approach PDFDocument2 pagesCommunity Development A Critical Approach PDFNatasha50% (2)

- Math 2 Curriculum GuideDocument19 pagesMath 2 Curriculum GuideMichelle Villanueva Jalando-onPas encore d'évaluation

- Description MicroscopeDocument4 pagesDescription MicroscopeRanma SaotomePas encore d'évaluation

- Chicago TemplateDocument4 pagesChicago TemplateJt MetcalfPas encore d'évaluation

- Mega Goal 4Document52 pagesMega Goal 4mahgoubkamel0% (1)

- British and American Culture Marking RubricDocument5 pagesBritish and American Culture Marking RubricAn Ho LongPas encore d'évaluation

- Auerbach Slideshow How To Write A ParagraphDocument22 pagesAuerbach Slideshow How To Write A ParagraphFreakmaggotPas encore d'évaluation

- Chime Primary School Brochure TemplateDocument1 pageChime Primary School Brochure TemplateNita HanifahPas encore d'évaluation

- Cat IQ TestDocument3 pagesCat IQ TestBrendan Bowen100% (1)

- Pump IntakeDocument6 pagesPump IntakeAnonymous CMS3dL1T100% (1)

- Safety Data Sheet for Instant AdhesiveDocument6 pagesSafety Data Sheet for Instant AdhesiveDiego S. FreitasPas encore d'évaluation

- As 2710-1984 Screw Gauges - VerificationDocument7 pagesAs 2710-1984 Screw Gauges - VerificationSAI Global - APACPas encore d'évaluation

- My ResumeDocument4 pagesMy Resumeapi-216740002Pas encore d'évaluation

- Transistor Amplifier Operating ParametersDocument21 pagesTransistor Amplifier Operating ParametersReddyvari VenugopalPas encore d'évaluation

- PoiconverterDocument2 pagesPoiconvertertaco6541Pas encore d'évaluation

- Pengkondisian Kesiapan Belajar Untuk Pencapaian Hasil Belajar Dengan Gerakan Senam OtakDocument9 pagesPengkondisian Kesiapan Belajar Untuk Pencapaian Hasil Belajar Dengan Gerakan Senam OtakSaadah HasbyPas encore d'évaluation

- Adjutant-Introuvable BASIC VERSIONDocument7 pagesAdjutant-Introuvable BASIC VERSIONfurrypdfPas encore d'évaluation

- Key Elements of Participation and Conflict Resolution in a DemocracyDocument6 pagesKey Elements of Participation and Conflict Resolution in a DemocracyAbhinayPas encore d'évaluation

- System Software Module 3: Machine-Dependent Assembler FeaturesDocument28 pagesSystem Software Module 3: Machine-Dependent Assembler Featuresvidhya_bineeshPas encore d'évaluation

- 4WE10 New Series Directional Valves NG10Document9 pages4WE10 New Series Directional Valves NG10Paulo ArrudaPas encore d'évaluation

- BC Planning EvenDocument5 pagesBC Planning EvenRuth KeziaPas encore d'évaluation

- Mohammad R. Mestarihi: About Me ObjectiveDocument1 pageMohammad R. Mestarihi: About Me ObjectiveMhmd MsttPas encore d'évaluation