Académique Documents

Professionnel Documents

Culture Documents

BOB Cards To Bank's FD Customer

Transféré par

yuj7122Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BOB Cards To Bank's FD Customer

Transféré par

yuj7122Droits d'auteur :

Formats disponibles

BCC:BR:104/440 CIRCULAR TO ALL BRANCHES/ OFFICES IN INDIA

07.12.2012

Issued by Retail Banking Department

Dear Sir, Re: Issuance of BOBCARDS to Banks Fixed Deposit Customers We are happy to inform that Board of Directors in their meeting held on 27.09.2012 has approved scheme of issuing BOBCARD to Banks Fixed Deposit customers with details as under:1. If a customer does not have proof of Income (ITR return) or Income level of customer does not justify the issuance of a particular credit card with higher credit limit or if any existing BOBCARD customer desires to have higher limit for a specific period, same can be availed against lien on FDR. 2. The credit card may be offered to FD account holders with deposit amount of ` 25000 and above, without levying joining fee, against Banks lien on FDR for BOBCARD dues. 3. Branches are required to obtain Letter of Lien (Annexure-1), Letter of Authority (Annexure-2) from the BOBCARD applicants. BOBCARD application alongwith a copy of duly discharged FDR, copy of Letter of Lien (Annexure-1) and Letter of Authority (Annexure-2) should be forwarded to Bobcards Ltd. alongwith a covering letter (Annexure-3) from the branch confirming having marking of Lien in favour of Bobcards Ltd. and keeping the FD in safe custody and undertaking not to release the same without obtaining NOC from Bobcards Ltd. 4. The product type will be decided as per the qualifying amount of publicized credit limit without considering the income criteria attached to the product. 5. 50% waiver in Annual Fee is available even if the criteria of annual fee waiver (as per product design) is not met. 6. Service charges in these cases shall be 1.50% as against 2.50% applicable under normal circumstances. 7. The sanctioned credit limit shall not exceed 80% of the FD amount and cash limit not exceeding 80% of the credit limit. The said arrangement is proposed keeping in view that principal amount with accrued interest (of 180 days) will not exceed the FD amount in case of default by Cardholders and dues will be recovered by liquidating the FD in case of an account becoming NPA.

We are sure that this scheme shall help branches in mobilizing FD and Bobcards Ltd in expanding Credit Card base. Wishing you all the best in your business endeavours. Yours faithfully,

Kalyanarama alyanaraman) (S Kalyanaraman) General General Manager Banking, OL) (Retail Banking, Mktg & OL)

Annexure - 1

LETTER DEPOSITING FIXED/ SHORT DEPOSIT NOT TO BE STAMPED Place : _________________ Date : _________________ The Chief/Sr. Br./Br. Manager, Bank of Baroda ______________ branch Dear Sirs, I/We hereby apply for the facility of Bobcard with credit limit of Rs.__________ account with you at interest at the rate of 2.5 % p.m with monthly/ rests or at such rate or rates as the Bank may specify to me/us in writing in accordance with the Banks Prime Lending rate and my/our credit rating with the Bank from time to time. As security for the fluctuating balance from time to time of the Bobcard limit which you may grant to me/us, I/We, Mr./Mrs.____________________ will deposit with you the Fixed Deposit Receipt No. Dated favoring me/us, Mr./Mrs. ______________ _____________________________ for Rs. _______________ due from the Bobcard, so that you may hold the said fixed deposit receipt as security for such fluctuating balance. The said fixed deposit receipt is to be treated as a continuing security even if the Bobcard account runs into credit, is reduced or extinguished at any time or from time to time. If the Bobcard limit together with interest and banking charges payable by me/us is not paid before the due date of the fixed deposit receipt the proceeds of the fixed deposit may be credited to the Bobcard limit account and the balance if any may be paid to me/us, Mr./Mrs._____________. If the Bank recalls the Bobcard limit granted to _____________________ the Bank in that event shall be entitled to adjust the Bobcard limit account by payment of deposit receipt and in that case may allow such rate of interest as per the rules of the Bank in case of prepayment. If the said fixed deposit is renewed by me/us, Mr./Mrs._________ for a further period then until the Bobcard limit together with interest and banking charges is paid in full the renewed fixed deposit receipt will be endorsed and deposited with you so that you may hold the same and the proceeds thereof as security as aforesaid until the Bobcard limit together with interest and banking charges is paid by me/us in full. And I/We, Mr./Mrs.____ ____________________ hereby request the Bobcard limit grant the above facility to me/us and agree that the fixed deposit receipt No.________ dated__ ___ for Rs.__ ________ issued by Bank of Baroda to me/us and all renewals thereof and the proceeds thereof shall be held by the Bank as security for the Bobcard limit together with interest and banking charges as aforesaid. Yours faithfully

Annexure 2 LETTER OF AUTHORITY

The Manager, ., .., ..., , Dear Sir, I/We have been sanctioned Bobcard with credit limit of Rs. ... against my/our fixed deposit/short deposits, the details of which are given in the Letter depositing fixed/short deposits receipts dated .. Notwithstanding anything contained in our Letter depositing fixed/short deposits receipts dated .. I/We hereby irrevocably authorize Bank of Baroda to keep the various fixed deposits/short deposits ( referred to above) renewing until the Banks Bobcard dues ( including interest, penal interest, cost and charges, if any) are paid in full. I/We hereby declare and confirm the Bank shall continue to have lien on above referred deposits/ irrespective of the fact that receipts pertaining to above deposits remain undischarged. I/We hereby further irrevocably authrise the bank to appropriate the proceed of the said deposits to liquidate my/our Bobcard dues ( including interest, penal interest cost and charges, if any) even in the absence of discharge on the said deposits/ receipts by me/us as if the said deposits receipts have been duly discharged by me/us.

Borrower/s

ANNEXURE 3 The Sr. Vice President ____ / 20____ Credit Card Business BOBCARDS Ltd Corporate Office Jogeshwari (W) Mumbai 400102 Dear Sir, Re : Issuance of Credit Card to Mr. / Ms. ____________________________ against lien on FDR We hereby enclose credit card application of Mr. / Ms. ___________________________________ under FD Scheme. We write to confirm that: 1. We have noted lien for Rs. _______________ on his/ her fixed deposit bearing no. _____________ and A/c No. __________________________ (copy enclosed) for Rs. ________________________ 2. We have obtained letter of lien and letter of Authority as per prescribed format and the same are enclosed. 3. The aforesaid FD is duly discharged on the reverse with our endorsement. 4. We confirm having retained the original FDR copy in our safe custody and shall not release the same without obtaining No Objection Certificate (NOC) from Bobcards Ltd. Date : ____ /

Yours faithfully,

Signature with Signature No: Name : Designation : EC No. : Name of the branch :

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Detailed Study of BOI Car Loan SchemeDocument99 pagesDetailed Study of BOI Car Loan SchemeAnkit Vardhan68% (37)

- Types of Bank DepositsDocument55 pagesTypes of Bank DepositsrocksonPas encore d'évaluation

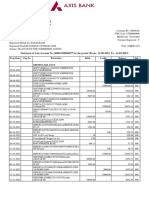

- Acct Statement - XX4077 - 14022023 PDFDocument3 pagesAcct Statement - XX4077 - 14022023 PDFDebashis SurPas encore d'évaluation

- Account Opening Form BOIDocument4 pagesAccount Opening Form BOIhrocking1Pas encore d'évaluation

- Project Report of Oriental Bank of Commerce.Document58 pagesProject Report of Oriental Bank of Commerce.Chandrakant80% (15)

- Commercial Banking in IndiaDocument71 pagesCommercial Banking in IndiaSharath Unnikrishnan Jyothi NairPas encore d'évaluation

- Ifb PDFDocument45 pagesIfb PDFSushmitha ChithanuruPas encore d'évaluation

- Bac310 Lecture MaterialsDocument120 pagesBac310 Lecture MaterialsNdung'u Wa MumbiPas encore d'évaluation

- July-Dec 2022 Top 300 Marathon NotesDocument879 pagesJuly-Dec 2022 Top 300 Marathon NotesBaba FakruddinPas encore d'évaluation

- Banking Law and Practice Units-2Document52 pagesBanking Law and Practice Units-2പേരില്ലോക്കെ എന്തിരിക്കുന്നുPas encore d'évaluation

- Banking Theory and Practice Chapter TwoDocument40 pagesBanking Theory and Practice Chapter Twomubarek oumerPas encore d'évaluation

- This Line Is Only For CommerceDocument23 pagesThis Line Is Only For CommerceSourav SsinghPas encore d'évaluation

- Reliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment PlanDocument24 pagesReliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment Planpuneetk20Pas encore d'évaluation

- Banking Industry OverviewDocument56 pagesBanking Industry OverviewMd Khaled NoorPas encore d'évaluation

- FORM B-2 - RunwadDocument48 pagesFORM B-2 - Runwadsat palPas encore d'évaluation

- Taxation ProjectDocument15 pagesTaxation ProjectTanya SinglaPas encore d'évaluation

- Executive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersDocument43 pagesExecutive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersTabassum Iffat TanniePas encore d'évaluation

- DEPOSIT AND LOAN MANAGEMENT OF IFIC BANKDocument48 pagesDEPOSIT AND LOAN MANAGEMENT OF IFIC BANKJahid Hassan0% (1)

- Resolutions Yes BankDocument24 pagesResolutions Yes Bankapi-3835069Pas encore d'évaluation

- Outdoor Training Program For Retail Banking - ReportDocument18 pagesOutdoor Training Program For Retail Banking - ReportBibek ShresthaPas encore d'évaluation

- Banking Law Report - Cases ReviewDocument8 pagesBanking Law Report - Cases ReviewNuraini ShapariahPas encore d'évaluation

- NIT03 WAR Museurm PDFDocument78 pagesNIT03 WAR Museurm PDFDeepak SinghPas encore d'évaluation

- Chapters Index Page No1111-1Document58 pagesChapters Index Page No1111-1Sangeeta S SoppimathPas encore d'évaluation

- CPWD invites bids for Tamil institute construction projectDocument107 pagesCPWD invites bids for Tamil institute construction projectThilak BalakrishnanPas encore d'évaluation

- TermsAndConditions 9687 04112023153427Document3 pagesTermsAndConditions 9687 04112023153427Jeetu WadhwaniPas encore d'évaluation

- BcaDocument15 pagesBcapoonam_careerPas encore d'évaluation

- HSBC Branchless BankingDocument5 pagesHSBC Branchless BankingSKSAIDINESHPas encore d'évaluation

- Assignment On Income From House PropertyDocument17 pagesAssignment On Income From House PropertySandeep ChawdaPas encore d'évaluation

- Comparative Analysis of Investment Avenues 161102084109Document71 pagesComparative Analysis of Investment Avenues 161102084109Yogesh TardePas encore d'évaluation

- All About Interest Rates in IndiaDocument27 pagesAll About Interest Rates in IndiaNitinAggarwalPas encore d'évaluation