Académique Documents

Professionnel Documents

Culture Documents

Eurobonds: Euro Bonds

Transféré par

superjagdishDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Eurobonds: Euro Bonds

Transféré par

superjagdishDroits d'auteur :

Formats disponibles

EURO BONDS The process of lending money by investing in bonds originated during the 19th century when the

merchant bankers began their operations in the international markets. Issuance of Eurobonds became easier with no exchange controls and no government restrictions on the transfer of funds in international markets.

EUROBONDS All Eurobonds, through their features can appeal to any class of issuer or investor. The characteristics which make them unique and flexible are: a) No withholding of taxes of any kind on interests payments b) They are in bearer form with interest coupon attached c) They are listed on one or more stock exchanges but issues are generally traded in the over the counter market.

Typically, a Eurobond is issued outside the country of the currency in which it is denominated. It is like any other Euro instrument and through international syndication and underwriting, the paper is sold without any limit of geographical boundaries. Eurobonds are generally listed on the world's stock exchanges, usually on the Luxembourg Stock Exchange.

Anu Ppt Denominated in currency other than the currency of the country where bonds are issued. Underwritten by the underwriters of multi-nationality Tailored to the needs of multi-national of investors. Eurobonds are free from rules and regulations Advantages Obtaining financing by issuing Eurobonds is often cheaper than obtaining a foreign currency bank loan.

protection from large market shocks and erratic market discipline Provides a way for companies to obtain financing in an economy where financing is hard to obtain normally aimed at institutional investors and not the public

Disadvantages Issue costs to take into account Investing in a Eurobond is not a good idea for investors who may need a repayment of the investment at short notice

From pdf

Euro bonds are debt instruments denominated in a currency issued outside the country of that currency e.g. a Yen non-floated in Germany, a won bond issued in France. They are normally issued as unsecured obligations of the borrowers. The instrument floated by the Indian companies is Euro convertible bonds (ECBs). Euro convertible Bond is an equity-linked debt security which can be converted into shares or into Depository Receipts. It is a foreign currency debt instrument that an Indian Company Issues. The investor in the ECB has the option to convert it into equity usually in accordance with a predetermined formula and sometimes also at a predetermined exchange rate. This offers capital appreciation on sale. Investor has also option to retain it as a bond. Investors have an option to convert the bond if the market price of the stock goes up beyond a percentage of the share price at the time of issue at a predetermined premium. Some companies retain the right to convert compulsorily. The maturity of bond can range up to 10-12 years and if the option to convert equity is not exercised, the bond is redeemed. Mostly Euro Convertible Bond issues are listed at London or Luxembourg stock exchanges. Certain variations in Euro Convertible Bonds have evolved in the past few years. These are: 1. Straight debt bonds: These bonds resemble to debentures and have following special features that distinguish with other types of Eurobonds. (a) Fixed interest bearing securities; (b) Redeemable at face value (or par) by borrower on maturity with provision for early redemption on premium over the issue price by borrower.

(c) These bonds are unsecured. (d) Income on the bonds is exempt for withholding for tax at source but this does not exempt investors from reporting their income to their national authorities. (e) It makes possible tax evasion by illegal means and tax avoidance by legal means which is wide spread phenomenon. (f) Tax evasion become easier due to bearer nature of these bands. (g) Fluctuations in the secondary market prices of bonds produce capital gains and capital loses. (h) Yield is dependent upon short-term interest rates and that is the reason that London Inter Bank Offered Rate is the most convenient yardstick to measure Euro-bond yield. 2. Convertible bonds: These bonds are like the convertible debentures in the domestic market. This conversion can be done at the stipulated period. The conversion price is fixed at a premium above the market price of common stock on the date of the bond issue. On conversion, the borrowing company issue new stock for giving effect to conversion and would prefer to have capital gain rather than receiving fixed rate interest income. 3. Multiple tranche bond: The issuer initially issued only one-half or onethird bonds depending on the market conditions. Subsequent issues are at the option of the issuer. There is no obligation upon the issuer to issue any further bonds after initial issue particularly when borrower is not prepared to accept a lower rate of interest. 4. Currency option bonds: These bonds are issued in one currency but with the option for the investor to take payment of interest and principal in a second currency. It has been noted that in past such bonds were issued in Sterling and another currency usually the Deutsche mark or US dollar. UK Government prohibited outflow of Sterling under Exchange Central Act, 1947 and subsequently under Control of Borrowing Orders. The last Sterling issue for a wholly foreign borrower in London Market was made for Norway in 1952 and for New Zealand in 1971. 5. Floating rate notes (FRN): Floating rate notes are like Euro-dollar Bonds in denomination of $ 1,000 each with the difference that they carry a spread or margin above six months LIBOR (London Inter Bank Offered Rate) for Euro-dollar deposits. Floating rates notes have been used by both American and Non-American banks as main borrowers to obtain dollar without exhausting credit lines with other banks.

6. Floating Rate Certificates of Deposits (FRCDs): It is a certificate of deposit with a bank carrying floating rate of interest and is a negotiable bearer instrument which could pass title through delivery. This instrument carry coupon reflecting short term interest rate for six months. The prices of the FRCDs are close to par, the investors chance to lose the capital are rare. Other types of Eurobonds: Include the following: (a) Drop-lock bonds: It is a floating rate bond, which automatically get converted into fix rate bond at a pre-determined coupon rate. This automatic conversion takes place on reaching a predetermined specified rate of interest. As such, this issue of this kind of bond remains subjected to these conditions. (b) Floating rate bonds with variable interest rate: These are interest bearing bonds carrying fixed coupon rate for short-term which are converted into another bonds of the same nominal value, with longer maturity and/or a lower coupon. These bonds are issued when investor do not commit to long-term investment. (c) Detachable warrant bonds: Where investors are invested in acquiring shares and are guided by movement in share prices, rather than interest rate these bonds provide them money for purchasing equities. (d) Deferred purchases bonds: The bonds are issued with subscription money being deferred for future period recoverable in instalments after a part of the money at the time of issue of bonds. (e) Deep Discount and Zero Coupon Bonds: On these bonds, yield is worked out on coupon price of the bond on maturity to take advantage of future capital appreciation of the bond on maturity. (f) Short-term capital notes: This instrument is designed to help borrower to raise funds through banks credit on a floating rate basis for medium to long term maturities at a lower cost of borrowing.

Vous aimerez peut-être aussi

- International Finance ManagementDocument15 pagesInternational Finance ManagementGirish Harsha100% (2)

- H. Int. Financial MKTDocument18 pagesH. Int. Financial MKTsamy7541Pas encore d'évaluation

- What is a euro bondDocument5 pagesWhat is a euro bondpranoti_shinde8167Pas encore d'évaluation

- What Is An International BondDocument10 pagesWhat Is An International BondSudip BaruaPas encore d'évaluation

- CH 7 International Bond MarketDocument12 pagesCH 7 International Bond MarketManan SuchakPas encore d'évaluation

- Euro Currency Market Instruments ND Euro DepositsDocument35 pagesEuro Currency Market Instruments ND Euro DepositsVedant Jhunjhunwala100% (4)

- International BondDocument37 pagesInternational BondAli JumaniPas encore d'évaluation

- International Financial MarketsDocument13 pagesInternational Financial Marketsmanojpatel5150% (4)

- 5.1. Debt Market Instrument CharacteristicsDocument15 pages5.1. Debt Market Instrument CharacteristicsMavis LunaPas encore d'évaluation

- Euro Bonds are issued in offshore markets and not governed by any country rulesDocument5 pagesEuro Bonds are issued in offshore markets and not governed by any country rulesAnjali Angel ThakurPas encore d'évaluation

- International Financial MarketsDocument26 pagesInternational Financial MarketsMary LouisPas encore d'évaluation

- Chapter 7Document44 pagesChapter 7Junaid AhmedPas encore d'évaluation

- IF Unit 5 InstrumentsDocument10 pagesIF Unit 5 InstrumentsamritamonaPas encore d'évaluation

- Euro BondsDocument21 pagesEuro BondsKhan ZiaPas encore d'évaluation

- International Financial InstrumentsDocument25 pagesInternational Financial InstrumentsChintakunta Preethi100% (1)

- 04 Financial Markets 2 140-57-71Document15 pages04 Financial Markets 2 140-57-71Armando CarreñoPas encore d'évaluation

- EurobondDocument20 pagesEurobondmeenajibranPas encore d'évaluation

- International Financial Market InstrumentsDocument21 pagesInternational Financial Market InstrumentsJASVEER S86% (21)

- What is a EurobondDocument4 pagesWhat is a EurobondmissconfusedPas encore d'évaluation

- Chapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsDocument6 pagesChapter 12 International Bond Markets Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsMona AgarwallaPas encore d'évaluation

- IFS International Bond MarketDocument27 pagesIFS International Bond MarketVrinda GargPas encore d'évaluation

- Eun Resnick Chapter 6 STudy NotesDocument6 pagesEun Resnick Chapter 6 STudy NotesWai Man NgPas encore d'évaluation

- Lesson5&6 - Bonds PayableDocument27 pagesLesson5&6 - Bonds PayableCirelle Faye SilvaPas encore d'évaluation

- Chapter 12Document20 pagesChapter 12Cynthia AdiantiPas encore d'évaluation

- EurobondDocument11 pagesEurobondLiya JahanPas encore d'évaluation

- Foreign Bonds vs Euro Bonds: Key DifferencesDocument10 pagesForeign Bonds vs Euro Bonds: Key DifferencesRahul MoHananPas encore d'évaluation

- CHAPTER 3 - Questions - EditedDocument9 pagesCHAPTER 3 - Questions - EditedEsraa TarekPas encore d'évaluation

- Euro Bond Market & TypesDocument2 pagesEuro Bond Market & TypesVikram Kaintura100% (1)

- Bond in The UK) Is A Bond Issued in A Country's NationalDocument7 pagesBond in The UK) Is A Bond Issued in A Country's NationalpragatibahlPas encore d'évaluation

- International Financial Market InstrumentsDocument21 pagesInternational Financial Market InstrumentsSitaKumariPas encore d'évaluation

- IFMDocument18 pagesIFMJayana ModiPas encore d'évaluation

- International Capital Markets - AnkurDocument24 pagesInternational Capital Markets - AnkurRaj K GahlotPas encore d'évaluation

- Chapter 5 - Bonds Payable Other ConceptsDocument28 pagesChapter 5 - Bonds Payable Other ConceptsAngelica Joy ManaoisPas encore d'évaluation

- World's Bond Markets Statistical OverviewDocument31 pagesWorld's Bond Markets Statistical OverviewLyman BrahmaPas encore d'évaluation

- Financial Structure and International Debt: Group MembersDocument29 pagesFinancial Structure and International Debt: Group MembersDianna TenorioPas encore d'évaluation

- AC3650 Euro Bond MarketDocument9 pagesAC3650 Euro Bond MarketYuriy PodvysotskiyPas encore d'évaluation

- 16-F-324-Eurocurrency Markets & Syndicated Credits PDFDocument22 pages16-F-324-Eurocurrency Markets & Syndicated Credits PDFDhaval ShahPas encore d'évaluation

- EurobondDocument11 pagesEurobondMahirPas encore d'évaluation

- Chap 012Document7 pagesChap 012Jitendra PatelPas encore d'évaluation

- EuroDocument4 pagesEuroswami4ujPas encore d'évaluation

- Lec 14 Int'l Fin MarketsDocument19 pagesLec 14 Int'l Fin MarketsLaiba TufailPas encore d'évaluation

- Project Financing & Funding Through Foreign SourcesDocument22 pagesProject Financing & Funding Through Foreign Sourcesprateekagarwal_87Pas encore d'évaluation

- Debt MarketDocument2 pagesDebt MarketShafqat HossainPas encore d'évaluation

- International Financial Market Instruments 130522003719 Phpapp02Document21 pagesInternational Financial Market Instruments 130522003719 Phpapp02kadalarasanePas encore d'évaluation

- Characteristics of EuroDocument10 pagesCharacteristics of EuroSujith PSPas encore d'évaluation

- Debt Market Group 3Document57 pagesDebt Market Group 3Anne FernandezPas encore d'évaluation

- Raising CapitalDocument65 pagesRaising CapitalMerroDon ThomasPas encore d'évaluation

- Unit 3Document12 pagesUnit 3Davra NevilPas encore d'évaluation

- The Euromarkets1Document22 pagesThe Euromarkets1Shruti AshokPas encore d'évaluation

- Long Term LoanDocument2 pagesLong Term LoanMuhammadUmarNazirChishtiPas encore d'évaluation

- ReviewerDocument6 pagesReviewerChantelle IshiPas encore d'évaluation

- International Bond Markets-2Document57 pagesInternational Bond Markets-2najiath mzeePas encore d'évaluation

- Fixed Income Securities - SIGFi - Finance HandbookDocument15 pagesFixed Income Securities - SIGFi - Finance HandbookSneha TatiPas encore d'évaluation

- Understanding Types of Bonds Issued in Global MarketsDocument3 pagesUnderstanding Types of Bonds Issued in Global MarketsMithun MathewsPas encore d'évaluation

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2D'EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2Pas encore d'évaluation

- In Search of Returns: Making Sense of the Financial MarketsD'EverandIn Search of Returns: Making Sense of the Financial MarketsPas encore d'évaluation

- Bonds Decoded: Unraveling the Mystery Behind Bond MarketsD'EverandBonds Decoded: Unraveling the Mystery Behind Bond MarketsPas encore d'évaluation

- Effect and AffectDocument1 pageEffect and AffectsuperjagdishPas encore d'évaluation

- DsaDocument17 pagesDsasuperjagdishPas encore d'évaluation

- Russia To Pitch Global CurrencyDocument4 pagesRussia To Pitch Global CurrencysuperjagdishPas encore d'évaluation

- Theta, BetaDocument12 pagesTheta, BetasuperjagdishPas encore d'évaluation

- Global Currency and World Government PlansDocument28 pagesGlobal Currency and World Government PlanssuperjagdishPas encore d'évaluation

- PURI-AHMEDABAD EXPRESSDocument1 pagePURI-AHMEDABAD EXPRESSsuperjagdishPas encore d'évaluation

- Global Currency and World Government PlansDocument28 pagesGlobal Currency and World Government PlanssuperjagdishPas encore d'évaluation

- Global Currency and World Government PlansDocument28 pagesGlobal Currency and World Government PlanssuperjagdishPas encore d'évaluation

- CDocument22 pagesCsuperjagdishPas encore d'évaluation

- PURI-AHMEDABAD EXPRESSDocument1 pagePURI-AHMEDABAD EXPRESSsuperjagdishPas encore d'évaluation

- SQDocument1 pageSQsuperjagdishPas encore d'évaluation

- Haorcore MeaningDocument1 pageHaorcore MeaningsuperjagdishPas encore d'évaluation

- Haorcore MeaningDocument1 pageHaorcore MeaningsuperjagdishPas encore d'évaluation

- Padma Vibhushan Awards 2012 - Current GK: Highest Civilian Award in IndiaDocument2 pagesPadma Vibhushan Awards 2012 - Current GK: Highest Civilian Award in IndiasuperjagdishPas encore d'évaluation

- Income-: 2010-11 2009-10Document6 pagesIncome-: 2010-11 2009-10superjagdishPas encore d'évaluation

- Bank Po EnglishDocument2 pagesBank Po EnglishsuperjagdishPas encore d'évaluation

- 12Document1 page12superjagdishPas encore d'évaluation

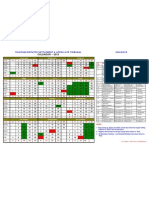

- TDSAT Holidays Calendar 2010Document1 pageTDSAT Holidays Calendar 2010superjagdishPas encore d'évaluation

- Bank Po EnglishDocument2 pagesBank Po EnglishsuperjagdishPas encore d'évaluation

- Current Gk1Document1 pageCurrent Gk1superjagdishPas encore d'évaluation

- TDSAT Holidays Calendar 2010Document1 pageTDSAT Holidays Calendar 2010superjagdishPas encore d'évaluation

- Nomination As Chairman - Haryana Biodiversity Board, Against VacancyDocument149 pagesNomination As Chairman - Haryana Biodiversity Board, Against VacancyNaresh KadyanPas encore d'évaluation

- Introduction:-: Mission & VisionDocument10 pagesIntroduction:-: Mission & Visionzalaks100% (5)

- THE - ARAB - SPRING - NEW - FORCES (The Legacy of The Arab SpringDocument93 pagesTHE - ARAB - SPRING - NEW - FORCES (The Legacy of The Arab SpringRuber DiazPas encore d'évaluation

- Impact of Ownership Pattern On Independence of MediaDocument3 pagesImpact of Ownership Pattern On Independence of MediaVishek MadanPas encore d'évaluation

- 2011 Veterans' Hall of Fame Award RecipientsDocument46 pages2011 Veterans' Hall of Fame Award RecipientsNew York SenatePas encore d'évaluation

- Module 2 - Part III - UpdatedDocument38 pagesModule 2 - Part III - UpdatedDhriti NayyarPas encore d'évaluation

- Chopin SongsDocument8 pagesChopin Songsgstewart_pianoPas encore d'évaluation

- Dua Mujeer - LinebylineDocument32 pagesDua Mujeer - LinebylineIsiakaPas encore d'évaluation

- Rem 2 NotesDocument1 655 pagesRem 2 NotesCerado AviertoPas encore d'évaluation

- Smart Mobs Blog Archive Habermas Blows Off Question About The Internet and The Public SphereDocument3 pagesSmart Mobs Blog Archive Habermas Blows Off Question About The Internet and The Public SpheremaikonchaiderPas encore d'évaluation

- (1959) 1 Q.B. 11Document18 pages(1959) 1 Q.B. 11Lim Yi YingPas encore d'évaluation

- Trilogy Monthly Income Trust PDS 22 July 2015 WEBDocument56 pagesTrilogy Monthly Income Trust PDS 22 July 2015 WEBRoger AllanPas encore d'évaluation

- Punishment For Offences Against The StateDocument3 pagesPunishment For Offences Against The StateMOUSOM ROYPas encore d'évaluation

- 18 - Carvana Is A Bad BoyDocument6 pages18 - Carvana Is A Bad BoyAsishPas encore d'évaluation

- War in The Tibet of Old On A Number of Occasions Meant The Military Intervention of Various Mongolian Tribes Into The Internal Affairs of The CountryDocument44 pagesWar in The Tibet of Old On A Number of Occasions Meant The Military Intervention of Various Mongolian Tribes Into The Internal Affairs of The CountryTikkun OlamPas encore d'évaluation

- 26 VANGUARDIA, Cedric F. - COVID Essay PDFDocument1 page26 VANGUARDIA, Cedric F. - COVID Essay PDFEstrell VanguardiaPas encore d'évaluation

- Oliver Wyman Insurance Insights Edition 15 EnglishDocument7 pagesOliver Wyman Insurance Insights Edition 15 EnglishChiara CambriaPas encore d'évaluation

- Pappu Kumar Yadaw's CAT Exam Admit CardDocument2 pagesPappu Kumar Yadaw's CAT Exam Admit Cardrajivr227Pas encore d'évaluation

- Hacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Document8 pagesHacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Martin SPas encore d'évaluation

- Philippine Citizenship Denied Due to Absence After Filing PetitionDocument6 pagesPhilippine Citizenship Denied Due to Absence After Filing Petitionalyssa bianca orbisoPas encore d'évaluation

- Manifesto: Manifesto of The Awami National PartyDocument13 pagesManifesto: Manifesto of The Awami National PartyonepakistancomPas encore d'évaluation

- How to Make a Fortune with Other People's Junk_ An Insider's Secrets to Finding and Reselling Hidden Treasures at Garage Sales, Auctions, Estate Sales, Flea Markets, Yard Sales, Antique Shows and eBay ( PDFDrive )Document258 pagesHow to Make a Fortune with Other People's Junk_ An Insider's Secrets to Finding and Reselling Hidden Treasures at Garage Sales, Auctions, Estate Sales, Flea Markets, Yard Sales, Antique Shows and eBay ( PDFDrive )Blink SPas encore d'évaluation

- Your Electronic Ticket-EMD ReceiptDocument2 pagesYour Electronic Ticket-EMD Receiptazeaq100% (1)

- Napoleon Edwards Amended Complaint - RedactedDocument13 pagesNapoleon Edwards Amended Complaint - Redactedthe kingfishPas encore d'évaluation

- Traffic Science TSC1125NDocument9 pagesTraffic Science TSC1125NNhlanhla MsomiPas encore d'évaluation

- Fillet Weld Moment of Inertia Equations - Engineers EdgeDocument2 pagesFillet Weld Moment of Inertia Equations - Engineers EdgeSunil GurubaxaniPas encore d'évaluation

- The Berenstain Bears Blessed Are The PeacemakersDocument10 pagesThe Berenstain Bears Blessed Are The PeacemakersZondervan45% (20)

- Quiz Week 3 AnswersDocument5 pagesQuiz Week 3 AnswersDaniel WelschmeyerPas encore d'évaluation

- G. M. Wagh - Property Law - Indian Trusts Act, 1882 (2021)Document54 pagesG. M. Wagh - Property Law - Indian Trusts Act, 1882 (2021)Akshata SawantPas encore d'évaluation

- # 17,, New Delhi 110021, India Payment File: RBI-DEL/id1033/13 Payment Amount: IN INDIA RUPEES 500,000.00GBP Reserve Bank of India Official Payment NotificationDocument2 pages# 17,, New Delhi 110021, India Payment File: RBI-DEL/id1033/13 Payment Amount: IN INDIA RUPEES 500,000.00GBP Reserve Bank of India Official Payment Notificationgajendrabanshiwal8905Pas encore d'évaluation