Académique Documents

Professionnel Documents

Culture Documents

The Global Economy - December 19, 2012

Transféré par

Swedbank AB (publ)Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Global Economy - December 19, 2012

Transféré par

Swedbank AB (publ)Droits d'auteur :

Formats disponibles

The Global Economy

Monthly letter from Swedbanks Economic Research Department by Cecilia Hermansson No. 9 December 19, 2012

The global economy closes the year on a down note major challenges await in 2013

Forecasters continue to revise their global growth projections downward. On the positive side, the US recovery has become more robust and a turnaround in China is more clearly evident. But in large parts of Europe, Japan and other emerging markets conditions have deteriorated. Among the most important events in 2012 has been the strengthening of the euro zones institutional framework. Concerns about a euro collapse and so-called Grexit have eased and a muddling-through scenario is still holding. While this means that the euro zones GDP will continue to shrink, interest rate spreads could still fall if the pace of reform is maintained. In 2013 parliamentary elections are scheduled in Italy and Germany, among other countries. The focus will be on balancing credit and budget austerity with reforms that lead to stronger growth. In the US (if the fiscal cliff is avoided), UK and even Germany confidence in the financial market will make it possible to avoid austerity, but the crisis countries have no alternative due to a lack of financing. Instead, they have to continue their reform work, while fiscal policies will have to include targeted measures to stimulate growth and support societys most vulnerable groups. Without social cohesion and a focus on democracy, there is a risk that the pessimists will be proven right about a euro collapse a fight that optimists have won to date.

Industrial production is still shrinking

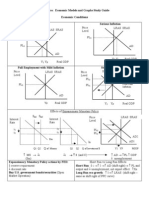

The global economy hasn't yet seen a turnaround, though conditions vary. We see a slightly brighter picture in the US and China, but a darker one in parts of Europe, Japan and other BRIC countries. In November the global purchasing managers index rose to 49.7, from 48.8 in October. While the US, Japan and Sweden noted declines, conditions have improved in China, the UK and India, as well as the euro zone. Only India and China (but just barely) have a PMI reading of over 50 i.e., even though the index has risen in other countries it is still signaling that industrial production is shrinking, but not by as much. Only China reported a higher index in November than in January of this year. Conditions have deteriorated most in Sweden, the US and Japan, while the euro zone, which is also weakening, already had a low reading of about 49 at the beginning of the year.

Manufacturing PMI globally and for individual countries and regions

Economic Research Department, Swedbank AB (publ), SE-105 34 Stockholm, tel +46-8-5859 7740 E-mail: ek.sekr@swedbank.se Internet: www.swedbank.com Responsible publisher: Cecilia Hermansson, +46-85859 7720, Magnus Alvesson, +46-8-5859 3341, Jrgen Kennemar, +46-8-5859 7730, ISSN 1103-4897

The Global Economy Monthly newsletter from Swedbanks Economic Research Department, continued No. 9 December 19, 2012

Global economy finishes the year weaker than it started

During the second half of the year the economy has weakened, not only in terms of industrial production but also in actual GDP in large parts of Europe and Asia. Global trade has, with few exceptions, stabilized at the 2011 level, or fallen significantly as in Japan's case. The recovery has strengthened mainly in the US. Why does the end of 2012 look worse than the beginning? Here are some reasons: In 2010 and 2011 the economy seemed to be strong in the wake of the recovery after the financial crisis and recession in 20082009. These catch-up effects disappeared in the latter part of 2011 and 2012. As we approached the first half of 2011 and 2012 the central banks increased liquidity, which strengthened confidence in the financial markets and to some extent the real economy. The impact subsided during the second half of 2011 and 2012 and activity slowed. Fiscal austerity and tighter credit in Europe have led to higher unemployment and weaker confidence among businesses and households. The euro zone hasnt been able to avoid a recession. The BRIC countries have launched a new stimulus phase through monetary and fiscal policy, but not of the same scope as in 2008-2009, since inflation has stayed fairly high and/or the bad loans in the financial system make it hard to repeat expansive economic policies. It also seems that the stimulus is not having the desired effect, especially in Brazil and India. Political uncertainty is higher than normal because activity in the US is affected by the fiscal cliff at the same time that concerns about new political crises in the euro zone have reduced the willingness to invest and consume. Another factor in Japan's case is its deteriorating relationship with China, which has contributed to a boycott of Japanese products and reduced auto exports to China. See our Asia Analysis no. 15, which was recently published.

Optimists have defeated pessimists, so far

Only 43 of the 83 economists the Financial Times surveyed in January predicted that the euro would be intact at the end of the year. And that was at a point when institutions had begun to strengthen thanks to the introduction of the fiscal pact. Pessimism took over, especially among AngloSaxon analysts and journalists. Not until European Central Bank President Mario Draghi uttered the words, and believe me, it will be enough, did the financial markets confidence in the currency union grow. When the German constitutional court ratified the ESM bailout package and the ECB announced the details of the OMT, speculation about a euro collapse eased. During the early summer the focus was still on Greece, but after a new election there was optimism that the country would decide to reform. During the fall concerns returned, although fewer people are now anticipating a Grexit. Some are speculating that Greece will leave in a few years, but I find it hard to see why it would if the worst of the panic has died down and it continues to receive support from the euro zone. More debt write-offs will be needed, however, including public debts. The reason this isnt being done now is the risk it would hurt Spain and Italy's prospects of receiving support. Why would German taxpayers want to help Spain when they already know that tax money recently given to Greece has already been lost? For German Chancellor Angela Merkel it is a question of maintaining the will to reform within the euro zone and retaining power. The muddlingthrough scenario has survived, probably because of a lack of political alternatives for the 17 euro countries. The financial market is getting used to this and understands the political commitment involved in rescuing the euro zone and the EU. There are still overhanging risks of a dissolution, since you can never discount that political events could endanger the cooperation. This means that the pessimists may still be right, though the likelihood of that happening has fallen considerably. One of the most important things that have happened this year is the strengthening of institutions and confidence. Many puzzle pieces have to fall into place, however. The euro zone has to develop the Eurobond market, banking union and fiscal cooperation. Democratic aspects certainly have to be included, considering the democratic deficit in how decisions are made within the euro zone.

2 (3)

The Global Economy Monthly newsletter from Swedbanks Economic Research Department, continued No. 9 December 19, 2012

Major challenges ahead in 2013

Reforms are needed in 2013 to reduce uncertainty, which in turn would strengthen the economic outlook. This applies to the US (where avoiding the fiscal cliff remains first priority), Japan and Europe, as well as emerging markets. It would require stronger institutions, the introduction of new and removal of old regulations, and smaller imbalances. Reducing protectionism is also a key. At this point the global slowdown isnt as severe as in 2008-2009, when the financial sector collapsed and affected the real economy. On the other hand, there is reason to fear that this time it could be more long-lasting in a climate of debt and banking crisis, and that the recovery could have less impact than in 2010-2011. An important reason is that last time there were opportunities for a major stimulus through fiscal and monetary policy. Economic policies dont have the same muscle this time around. On the contrary, countries are tightening fiscal policy despite current conditions. More quantitative easing is in the monetary pipeline, but it is unclear whether it will have enough impact on the real economy or last long enough.

Inflation measured by CPI in a number of countries/regions

upward. Its probably all the bad loans in the financial system that are restricting credit growth this time. Inflation is also higher in the euro zone than economic conditions warrant, but this can partly be explained by the fiscal austerity, which is leading to higher prices. Monetary policy in the more developed countries has already been expanded. Discount rates cant be cut much more, with the exception of the ECB, which could cut after the turn of the year if conditions remain weak. It had a slight opening when it made its last rate decision. In the US it is more a question of signaling that rate hikes arent in the offing and that the quantitative easing in the form of mortgage and government bond purchases will continue until unemployment has been reduced significantly, now to the Feds goal of 6.5 percent. The ECB is in position to expand its balance sheet by buying the bonds of crisis countries, but first they have to seek help from the bailout program, which they havent done yet. Although it has been said that the easing will be sterilized, there isnt always an opportunity to do so in practice. The most important economic challenges next year are to ensure a turnaround despite austerity and make sure that the recovery is strong enough to lower unemployment and increase confidence. The German and Italian elections will focus on these challenges. Reform work has to continue, partly because a stimulus isnt an option and partly because it will have a greater impact in the long term. Some countries that enjoy the financial markets confidence such as the US, Germany and UK could choose to avoid economic austerity. On the other hand, many crisis countries cannot finance their budget deficits, leaving them with few alternatives to consolidation and reform. In 2013 fiscal policy therefore has to focus more on structural reforms and targeted measures that stimulate growth and reduce the suffering of societys most vulnerable groups. Cecilia Hermansson

In BRIC countries such as India and Brazil inflation is stuck at high levels, probably due to weak competition and capacity shortages. In China inflation had declined, but has again begun to inch

Swedbank Economic Research Department

SE-105 34 Stockholm, Sweden Phone +46-8-5859 7740 ek.sekr@swedbank.se www.swedbank.se Legally responsible publisher Cecilia Hermansson, +46-88-5859 7720. Magnus Alvesson, +46-8-5859 3341 Jrgen Kennemar, +46-8-5859 7730

Swedbanks monthly The Global Economy newsletter is published as a service to our customers. We believe that we have used reliable sources and methods in the preparation of the analyses reported in this publication. However, we cannot guarantee the accuracy or completeness of the report and cannot be held responsible for any error or omission in the underlying material or its use. Readers are encouraged to base any (investment) decisions on other material as well. Neither Swedbank nor its employees may be held responsible for losses or damages, direct or indirect, owing to any errors or omissions in Swedbanks monthly The Global Economy newsletter.

3 (3)

Vous aimerez peut-être aussi

- 18 Econsouth Fourth Quarter 2012Document6 pages18 Econsouth Fourth Quarter 2012caitlynharveyPas encore d'évaluation

- The Forces Shaping The Economy Over 2012Document10 pagesThe Forces Shaping The Economy Over 2012economicdelusionPas encore d'évaluation

- World Economy Recovering or NotDocument3 pagesWorld Economy Recovering or NotCristina GheorghePas encore d'évaluation

- 2013 Global Powers of RetailingDocument0 page2013 Global Powers of RetailingConstanza Carcamo AsemPas encore d'évaluation

- World Economy: Hopes Turn To Fear and UncertaintyDocument8 pagesWorld Economy: Hopes Turn To Fear and UncertaintyQi LePas encore d'évaluation

- 3 Way Split ArticleDocument3 pages3 Way Split ArticlesumairjawedPas encore d'évaluation

- Return of The CrisisDocument15 pagesReturn of The CrisischarurastogiPas encore d'évaluation

- Executive Summary: The Global OutlookDocument34 pagesExecutive Summary: The Global OutlookmarrykhiPas encore d'évaluation

- Financial Institutions Stare Into The Abyss: World EconomyDocument6 pagesFinancial Institutions Stare Into The Abyss: World EconomyfrankhordenPas encore d'évaluation

- Economic and Market: A U.S. Recession?Document16 pagesEconomic and Market: A U.S. Recession?dpbasicPas encore d'évaluation

- Nvestment Ompass: Quarterly CommentaryDocument4 pagesNvestment Ompass: Quarterly CommentaryPacifica Partners Capital ManagementPas encore d'évaluation

- Is The New Year Too Happy?: The Global Economic and Financial Markets OutlookDocument35 pagesIs The New Year Too Happy?: The Global Economic and Financial Markets Outlookwbowen92888Pas encore d'évaluation

- 2012, Challenging Times Ahead: 2012. Can't Be Worse Than 2011, Can It?Document18 pages2012, Challenging Times Ahead: 2012. Can't Be Worse Than 2011, Can It?vladvPas encore d'évaluation

- Monthly: La Reforma Del Sector Servicios OUTLOOK 2012Document76 pagesMonthly: La Reforma Del Sector Servicios OUTLOOK 2012Anonymous OY8hR2NPas encore d'évaluation

- Bahrain Economic Quarterly: Second Quarter 2012Document54 pagesBahrain Economic Quarterly: Second Quarter 2012GeorgePas encore d'évaluation

- Essay On Economic Impacts of Euromarkets and Other Offshore Markets On Global Financial MarketDocument4 pagesEssay On Economic Impacts of Euromarkets and Other Offshore Markets On Global Financial MarketKimkhorn LongPas encore d'évaluation

- Full Report GlobalPowersOfConsumerProducts2013 - 031913Document0 pageFull Report GlobalPowersOfConsumerProducts2013 - 031913doannamphuocPas encore d'évaluation

- Plan C - Shaping Up To Slow GrowthDocument11 pagesPlan C - Shaping Up To Slow GrowthThe RSAPas encore d'évaluation

- Bahrain Economy 2012Document54 pagesBahrain Economy 2012Usman MoonPas encore d'évaluation

- Lane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastDocument18 pagesLane Asset Management 2012 Stock Market Commentary and 2013 Fearless ForecastEdward C LanePas encore d'évaluation

- Greece Crisis and The Consequences For IndiaDocument4 pagesGreece Crisis and The Consequences For IndiaAditya KharkiaPas encore d'évaluation

- Highlights: Economy and Strategy GroupDocument33 pagesHighlights: Economy and Strategy GroupvladvPas encore d'évaluation

- Eurozone Autumn 2011 Main ReportDocument52 pagesEurozone Autumn 2011 Main ReportMukesh KumarPas encore d'évaluation

- Spex Issue 24Document11 pagesSpex Issue 24SMU Political-Economics Exchange (SPEX)Pas encore d'évaluation

- Global Financial Crisis and Sri LankaDocument5 pagesGlobal Financial Crisis and Sri LankaRuwan_SuPas encore d'évaluation

- The Centrality of The g20 To Australian Foreign PolicyDocument15 pagesThe Centrality of The g20 To Australian Foreign PolicyLatika M BourkePas encore d'évaluation

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846Pas encore d'évaluation

- G R o U P o F T W e N T Y: M G - 2 0 D J 1 9 - 2 0, 2 0 1 2 M CDocument20 pagesG R o U P o F T W e N T Y: M G - 2 0 D J 1 9 - 2 0, 2 0 1 2 M CLuke Campbell-SmithPas encore d'évaluation

- 2010-12-29 Yearly Review: World Economy in 2010: People in The KnowDocument5 pages2010-12-29 Yearly Review: World Economy in 2010: People in The KnowJohn Raymond Salamat PerezPas encore d'évaluation

- Global Economic RecoveryDocument13 pagesGlobal Economic Recoveryd4debojit100% (2)

- Strategic Analysis: Is The Recovery Sustainable?Document16 pagesStrategic Analysis: Is The Recovery Sustainable?varj_fePas encore d'évaluation

- The Europea Debt: Why We Should Care?Document4 pagesThe Europea Debt: Why We Should Care?Qraen UchenPas encore d'évaluation

- Global Financial Crisis II: The Challenges For IndiaDocument9 pagesGlobal Financial Crisis II: The Challenges For IndiaKritika_Gupta_3748Pas encore d'évaluation

- IMF's Bold Recipe For Recovery: TagsDocument5 pagesIMF's Bold Recipe For Recovery: TagsKrishna SumanthPas encore d'évaluation

- The European Debt Crisis: HistoryDocument7 pagesThe European Debt Crisis: Historyaquash16scribdPas encore d'évaluation

- Fear Returns: World EconomyDocument6 pagesFear Returns: World EconomymuradgwaduriPas encore d'évaluation

- The Spectre of Eurozone DeflationDocument2 pagesThe Spectre of Eurozone DeflationsignalhucksterPas encore d'évaluation

- Euro Crisis and IndiaDocument18 pagesEuro Crisis and Indiaडॉ. शुभेंदु शेखर शुक्लाPas encore d'évaluation

- Levy Economics Institute of Bard College Strategic Analysis December 2011 Is The Recovery Sustainable?Document20 pagesLevy Economics Institute of Bard College Strategic Analysis December 2011 Is The Recovery Sustainable?mrwonkishPas encore d'évaluation

- World Economy: Confidence Takes Welcome TurnDocument6 pagesWorld Economy: Confidence Takes Welcome Turnapi-210904824Pas encore d'évaluation

- Latin Manharlal Commodities Pvt. LTD.: Light at The EndDocument25 pagesLatin Manharlal Commodities Pvt. LTD.: Light at The EndTushar PunjaniPas encore d'évaluation

- Capital Economics European Economics Focus Euro Zone Break Up 11282011Document13 pagesCapital Economics European Economics Focus Euro Zone Break Up 11282011Jose BescosPas encore d'évaluation

- Stimulating DebateDocument2 pagesStimulating DebatetbwsmPas encore d'évaluation

- Weekly Market Commentary 1/22/2013Document4 pagesWeekly Market Commentary 1/22/2013monarchadvisorygroupPas encore d'évaluation

- Key Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures VideoDocument23 pagesKey Rates: Home Business Markets World Politics Tech Opinion Breakingviews Money Life Pictures Videosujeet1077Pas encore d'évaluation

- What Is The European DebtDocument32 pagesWhat Is The European DebtVaibhav JainPas encore d'évaluation

- Safiullah Sir AssDocument6 pagesSafiullah Sir AssAvijit SahaPas encore d'évaluation

- Market BulletinDocument1 pageMarket BulletinMoneyspritePas encore d'évaluation

- Burch Wealth Mangement 20 06 11Document2 pagesBurch Wealth Mangement 20 06 11admin866Pas encore d'évaluation

- Bus Tim May 2709 Glob Fix PublDocument3 pagesBus Tim May 2709 Glob Fix Publchorpharn4269Pas encore d'évaluation

- Global Insurance+ Review 2012 and Outlook 2013 14Document36 pagesGlobal Insurance+ Review 2012 and Outlook 2013 14Harry CerqueiraPas encore d'évaluation

- DM House ViewDocument2 pagesDM House ViewBolajoko OlusanyaPas encore d'évaluation

- Atwel - Global Macro 6/2011Document15 pagesAtwel - Global Macro 6/2011Jan KaskaPas encore d'évaluation

- Global Credit CrisisDocument8 pagesGlobal Credit CrisisNLD1888Pas encore d'évaluation

- Euro Crisis (India + The End)Document5 pagesEuro Crisis (India + The End)BEEXTCAPas encore d'évaluation

- Euro Briefing: Crisis Resolution Enters New PhaseDocument24 pagesEuro Briefing: Crisis Resolution Enters New PhaseJavier EscribaPas encore d'évaluation

- Lessons From The Global Financial Crisis: What Has Happened?Document11 pagesLessons From The Global Financial Crisis: What Has Happened?palashndcPas encore d'évaluation

- S&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31Document6 pagesS&P Credit Research - Europe's Growth As Good As It Gets 2010 08 31thebigpicturecoilPas encore d'évaluation

- The Reform of Europe: A Political Guide to the FutureD'EverandThe Reform of Europe: A Political Guide to the FutureÉvaluation : 2 sur 5 étoiles2/5 (1)

- PMI Services March 2016Document8 pagesPMI Services March 2016Swedbank AB (publ)Pas encore d'évaluation

- PMI - February 2016Document8 pagesPMI - February 2016Swedbank AB (publ)Pas encore d'évaluation

- PMI Services January 2016Document8 pagesPMI Services January 2016Swedbank AB (publ)Pas encore d'évaluation

- PMI Services - February 2016Document8 pagesPMI Services - February 2016Swedbank AB (publ)Pas encore d'évaluation

- Swedbank Interim Report Q1 2016Document55 pagesSwedbank Interim Report Q1 2016Swedbank AB (publ)Pas encore d'évaluation

- Swedbank's Year-End Report 2015Document58 pagesSwedbank's Year-End Report 2015Swedbank AB (publ)Pas encore d'évaluation

- Swedbank Economic Outlook January 2016Document35 pagesSwedbank Economic Outlook January 2016Swedbank AB (publ)Pas encore d'évaluation

- PMI November 2015Document8 pagesPMI November 2015Swedbank AB (publ)Pas encore d'évaluation

- Baltic Sea Report 2015Document31 pagesBaltic Sea Report 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI December 2015Document8 pagesPMI December 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI Services July 2015Document8 pagesPMI Services July 2015Swedbank AB (publ)Pas encore d'évaluation

- BrexitDocument8 pagesBrexitSwedbank AB (publ)Pas encore d'évaluation

- PMI Services December 2015Document9 pagesPMI Services December 2015Swedbank AB (publ)Pas encore d'évaluation

- ECB QE in The Baltics 2015-11-25Document4 pagesECB QE in The Baltics 2015-11-25Swedbank AB (publ)Pas encore d'évaluation

- PMI Services - December 2015Document8 pagesPMI Services - December 2015Swedbank AB (publ)Pas encore d'évaluation

- Purchasing Managers' Index - Services: Services PMI Fell To 52.4 in August: Slowdown On Broad BasisDocument8 pagesPurchasing Managers' Index - Services: Services PMI Fell To 52.4 in August: Slowdown On Broad BasisSwedbank AB (publ)Pas encore d'évaluation

- PMI-Services, September 2015Document8 pagesPMI-Services, September 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI-Services November 2015Document8 pagesPMI-Services November 2015Swedbank AB (publ)Pas encore d'évaluation

- Swedbank Economic Outlook Update, November 2015Document17 pagesSwedbank Economic Outlook Update, November 2015Swedbank AB (publ)Pas encore d'évaluation

- Commodities and Energy SepDocument6 pagesCommodities and Energy SepSwedbank AB (publ)Pas encore d'évaluation

- Pmi - Aug 2015Document8 pagesPmi - Aug 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI October 2015Document8 pagesPMI October 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI - Services April 2015Document8 pagesPMI - Services April 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI-Services, June 2015Document8 pagesPMI-Services, June 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI July 2015Document8 pagesPMI July 2015Swedbank AB (publ)Pas encore d'évaluation

- Commodities and EnergyDocument5 pagesCommodities and EnergySwedbank AB (publ)Pas encore d'évaluation

- PMI - April 2015Document8 pagesPMI - April 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI - May 2015Document8 pagesPMI - May 2015Swedbank AB (publ)Pas encore d'évaluation

- PMI Services - May 2015Document8 pagesPMI Services - May 2015Swedbank AB (publ)Pas encore d'évaluation

- Economic Survey Report 1H23 FINALDocument103 pagesEconomic Survey Report 1H23 FINALCCV CCVPas encore d'évaluation

- MAC 1E Study Guide CompleteDocument225 pagesMAC 1E Study Guide Completealicia1990Pas encore d'évaluation

- BLO3405 - s4681214 - Assignment 2, Part ADocument6 pagesBLO3405 - s4681214 - Assignment 2, Part Amajmmallikarachchi.mallikarachchiPas encore d'évaluation

- Monetary PoliciesDocument10 pagesMonetary PoliciesVishwarat SinghPas encore d'évaluation

- Tutorial 5 Chapter 4&5Document3 pagesTutorial 5 Chapter 4&5Renee WongPas encore d'évaluation

- The Effects of The Environment On Mcdonald'S: The External, Internal and Competitive Environment: External EnvironmentDocument28 pagesThe Effects of The Environment On Mcdonald'S: The External, Internal and Competitive Environment: External EnvironmentJamilah MuminPas encore d'évaluation

- Economic Crisis and Its Impact On Economic Development Special Reference To SrilankaDocument7 pagesEconomic Crisis and Its Impact On Economic Development Special Reference To SrilankaCPas encore d'évaluation

- BFN 102 Practice Questions 2023Document10 pagesBFN 102 Practice Questions 2023anatomy grandgerPas encore d'évaluation

- FIP Assignment # 2Document11 pagesFIP Assignment # 2talhashafqaatPas encore d'évaluation

- Dollar IzationDocument352 pagesDollar IzationJamesPas encore d'évaluation

- FULL Download Ebook PDF International Business The Challenges of Globalization 11th Global Edition PDF EbookDocument42 pagesFULL Download Ebook PDF International Business The Challenges of Globalization 11th Global Edition PDF Ebookscott.ramirez644100% (34)

- Assessing The Impact of Financial Inclusion On Inflation Rate in Developing CountriesDocument28 pagesAssessing The Impact of Financial Inclusion On Inflation Rate in Developing CountriesJuan Manuel Báez CanoPas encore d'évaluation

- 86806-RBI Comm PolicyDocument5 pages86806-RBI Comm PolicyrbrPas encore d'évaluation

- Did Hayek and Robbins Deepen The Great Depression 2008Document19 pagesDid Hayek and Robbins Deepen The Great Depression 2008profkaplanPas encore d'évaluation

- Sbi (Clerk) 23-08-14 CLERCKDocument23 pagesSbi (Clerk) 23-08-14 CLERCKpikumarPas encore d'évaluation

- Scientific Macroeconomics & The Quantity Theory of CreditDocument67 pagesScientific Macroeconomics & The Quantity Theory of CreditRonitSingPas encore d'évaluation

- Overview of International RelationsDocument47 pagesOverview of International RelationsuyPas encore d'évaluation

- All HL P1 Essays (Micro Macro Split and Tagged) 90s To NOV2019Document17 pagesAll HL P1 Essays (Micro Macro Split and Tagged) 90s To NOV2019Darryn FlettPas encore d'évaluation

- BLO3405 LFIS Assessment 2 Part ADocument10 pagesBLO3405 LFIS Assessment 2 Part A李姈潓Pas encore d'évaluation

- Impact of Monetary Policy.Document90 pagesImpact of Monetary Policy.PiyushPas encore d'évaluation

- Pid 14 MT23 160412Document20 pagesPid 14 MT23 160412Amol ChavanPas encore d'évaluation

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (21)

- IAS Economics - Aggregate Demand (AD)Document8 pagesIAS Economics - Aggregate Demand (AD)Jonathan JeevaratnamPas encore d'évaluation

- Pest Analysis PoliticalDocument4 pagesPest Analysis PoliticalAHMAD ALIPas encore d'évaluation

- Ukraine Aid For Trade Needs AssessmentDocument128 pagesUkraine Aid For Trade Needs AssessmentUNDP in Europe and Central AsiaPas encore d'évaluation

- Banking and Finance AnswersDocument6 pagesBanking and Finance AnswersStan leePas encore d'évaluation

- f1 Acca Lesson10Document11 pagesf1 Acca Lesson10Patricia DoucePas encore d'évaluation

- Monetary Policy of Nepal 2070-71Document2 pagesMonetary Policy of Nepal 2070-71GracieAndMePas encore d'évaluation

- Macroeconomics ProjectDocument29 pagesMacroeconomics ProjectHarsh VagalPas encore d'évaluation

- UBL Standalone Financial Statements 2021 With DR ReportDocument122 pagesUBL Standalone Financial Statements 2021 With DR ReportAftab JamilPas encore d'évaluation