Académique Documents

Professionnel Documents

Culture Documents

Financial Accounting

Transféré par

Neil GriggCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Accounting

Transféré par

Neil GriggDroits d'auteur :

Formats disponibles

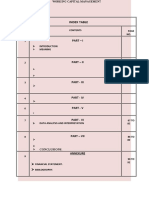

Chapter 13 Statement of Cash Flows (SCF)

A required financial statement Reconciles beginning cash to ending cash (shows cash inflows and cash outflows) Converts accrual accounting income statement to cash basis Statement of Cash Flows

Why Report the Causes of the Changes in Cash?

Back out accruals

Accruals may be relevant, but they also introduce uncertainty into financial statements. Accruals often involve estimates that can be manipulated by management to achieve earnings targets.

Detail sources and uses of cash Highlight possible future cash flow and credit problems

Why is the SCF Important?

How much cash is generated by operations? Is enough cash generated to fund operations and replace plant and equipment? Can debt be paid? Are sources of financing changing?

Categories of Cash Flows

The SCF must include the following sections: 1. Cash Flows from Operating Activities

Direct Method (preferred but rarely used) Indirect Method (used by 99% of companies)

2. Cash Flows from Investing Activities 3. Cash Flows from Financing Activities Also, disclose noncash investing and financing activities

Cash Flows from Operating Activities

The cash effects of transactions that create revenues and expenses and enter into determination of net income -- current assets and

liabilities (except investments & short term borrowings) Inflows include:

Cash receipts from customers Dividends and Interest on Investments

Outflows include:

Payments to suppliers Interest paid on liabilities Salary and wages paid to employees Cash paid for income taxes

Cash Flows from Investing Activities

Cash inflows and outflows that are related to the purchase and sale of productive assets -- Long-term Assets (and short-term investments) Inflows include proceeds from:

Sales of PP&E Sales of Investments in securities Cash received from collection of loan (principal only)

Outflows include payments for:

The purchase of PP&E The purchase of long-term investments

Cash Flows from Financing Activities

Cash inflows and outflows that are related to how cash was obtained to finance the enterprise -- Long-term Liabilities (and short-term borrowings) and Stockholders Equity Inflows include:

Proceeds from the sale of stock Proceeds from the sale of bonds Proceeds from borrowings (loans)

Outflows include:

Payments to purchase Treasury Stock Principal payments to creditors (not interest) Dividends paid to stockholders

Operating Activities - Clarification

Some cash flows that seem to relate to investing or financing activities are classified as operating activities Receipts of investment revenue (interest and dividends) Payments of interest to lenders are classified as operating activities because these items are reported in the income statement.

Significant Noncash Activities

Investing and financing activities that do not involve cash, such as . . .

Retirement of bonds by issuing stock Settlement of debt by transferring assets Issuance of debt to purchase assets

must be disclosed in a separate schedule at the bottom of the SCF or in a separate footnote or supplementary schedule to the financial statements.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- MT-760 Deut81326542195Document3 pagesMT-760 Deut81326542195reza younesy100% (3)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Investment Banking Interview GuideDocument228 pagesInvestment Banking Interview GuideNeil Grigg100% (2)

- Icu 58 297 PDFDocument2 pagesIcu 58 297 PDFNeil GriggPas encore d'évaluation

- Demon of Our Own DesignDocument3 pagesDemon of Our Own DesignNeil GriggPas encore d'évaluation

- Polis - City-State (Pl. Poleis) : TH NDDocument8 pagesPolis - City-State (Pl. Poleis) : TH NDNeil GriggPas encore d'évaluation

- Reply To E.A. Rakha Et Al: Lajos PusztaiDocument2 pagesReply To E.A. Rakha Et Al: Lajos PusztaiNeil GriggPas encore d'évaluation

- British History Notes 26 January 2015Document21 pagesBritish History Notes 26 January 2015Neil GriggPas encore d'évaluation

- David Wessels - Corporate Strategy and ValuationDocument26 pagesDavid Wessels - Corporate Strategy and Valuationesjacobsen100% (1)

- Financial AccountingDocument41 pagesFinancial AccountingNeil Grigg100% (1)

- Investment Banking Interview PrepDocument18 pagesInvestment Banking Interview PrepNeil GriggPas encore d'évaluation

- Financial AccountingDocument46 pagesFinancial AccountingNeil GriggPas encore d'évaluation

- Investment Banking Prep Interview QuestionsDocument8 pagesInvestment Banking Prep Interview QuestionsNeil GriggPas encore d'évaluation

- Investment Banking Interview PrepDocument8 pagesInvestment Banking Interview PrepNeil GriggPas encore d'évaluation

- Investment Banking Interview PrepDocument56 pagesInvestment Banking Interview PrepNeil Grigg100% (3)

- Banker Blueprint PDFDocument37 pagesBanker Blueprint PDFSangwoo Kim100% (1)

- Investment Banking PrepDocument6 pagesInvestment Banking PrepNeil GriggPas encore d'évaluation

- Steve SaporitoDocument22 pagesSteve SaporitorajasekharboPas encore d'évaluation

- Section 8 Business FinanceDocument11 pagesSection 8 Business FinanceLeeana MaharajPas encore d'évaluation

- ACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDDocument38 pagesACFrOgDZ7Mb1kEnd0SWTabZ8VTNHoE2URvhT8DhCJGcSZcROTUArMhbEM93WzGm2kI1BwFxq0 x1Pf-HKvzBDZ5dplRt2Zs - hEPqbAFI0Fc3z2m0dtyYdxz8KJGo8dJYsrypTjAUs2oYzuZ - TDTwish BarriosPas encore d'évaluation

- Balance Sheet GodrejDocument2 pagesBalance Sheet GodrejDhruvi PatelPas encore d'évaluation

- Chapter-01 An Overview of Corporate Finance NotesDocument19 pagesChapter-01 An Overview of Corporate Finance NotesShuvo ExceptionPas encore d'évaluation

- Board Resolution ModelDocument3 pagesBoard Resolution ModelRajula Gurva ReddyPas encore d'évaluation

- IFRS 11 Joint ArrangementsDocument6 pagesIFRS 11 Joint Arrangementsmcastillo3313Pas encore d'évaluation

- Finman Midterm ReviewerDocument12 pagesFinman Midterm ReviewerNoneh EardPas encore d'évaluation

- PAN FormDocument3 pagesPAN FormStephen GreenPas encore d'évaluation

- DrillsDocument4 pagesDrillsKRISTINA DENISSE SAN JOSEPas encore d'évaluation

- FinalDocument1 200 pagesFinalRahulPas encore d'évaluation

- Abhinav Choudhary (1) .Doc 97 03Document3 pagesAbhinav Choudhary (1) .Doc 97 03Rituraj SinghPas encore d'évaluation

- Chapter 1 SubmittedDocument23 pagesChapter 1 SubmittedChu ChuPas encore d'évaluation

- GE 9 Cell MatrixDocument10 pagesGE 9 Cell MatrixMr. M. Sandeep Kumar0% (1)

- Chapter 5 Basics of Analysis Multiple CHDocument7 pagesChapter 5 Basics of Analysis Multiple CHEslam AwadPas encore d'évaluation

- ICB Member Resource IndexDocument7 pagesICB Member Resource IndexKopi BrisbanePas encore d'évaluation

- Philippine Competition Act and IRR MatrixDocument64 pagesPhilippine Competition Act and IRR MatrixBinkee Villarama100% (1)

- EY Optimize Network Opex and CapexDocument12 pagesEY Optimize Network Opex and Capexjhgkuugs100% (1)

- Ambani Vs AmbaniDocument9 pagesAmbani Vs AmbaniAashima Sharma BhasinPas encore d'évaluation

- How To Calculate Present ValuesDocument16 pagesHow To Calculate Present ValuesAishwarya PotdarPas encore d'évaluation

- Capital StructureDocument39 pagesCapital StructureSneha DasPas encore d'évaluation

- An Economic Analysis of Dhaka - Chittagon PDFDocument24 pagesAn Economic Analysis of Dhaka - Chittagon PDFshivu khatriPas encore d'évaluation

- ECG BoilerDocument1 pageECG BoilerImaya ElavarasanPas encore d'évaluation

- Chapter 3 Comp. ProblemsDocument9 pagesChapter 3 Comp. ProblemsIrish Gracielle Dela CruzPas encore d'évaluation

- Case Study On National BankDocument12 pagesCase Study On National BankMasuk HasanPas encore d'évaluation

- Working Capital ManagementDocument80 pagesWorking Capital ManagementVijeshPas encore d'évaluation

- Summary Chapter 8Document6 pagesSummary Chapter 8Zahidul AlamPas encore d'évaluation

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument6 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesprachiPas encore d'évaluation

- Bindura Nickel Corporation Limited PDFDocument1 pageBindura Nickel Corporation Limited PDFBusiness Daily ZimbabwePas encore d'évaluation