Académique Documents

Professionnel Documents

Culture Documents

Stock Tracker 24.12

Transféré par

ran2013Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Stock Tracker 24.12

Transféré par

ran2013Droits d'auteur :

Formats disponibles

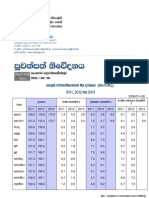

N D B Stockbrokers (Pvt) Ltd,

5th Floor,

# 40, NDB Building,

Nawam Mawatha,

Colombo 02.

Tel: +94 11 2314170

Fax: +9411 2314180

+9411 2314181

Q UARTERLY FINANCIALS

24-De c-12

Stock Tracker

Bank and Finance

mths Q TR Mkt. Price

Share s

2012

Ne t Asse ts

RO E

EPS

NP (mn)

1,286.86

6,105.70

6,105.70

1,212.62

114.33

3,894.68

3,894.68

700.17

3,533.12

46.73

1,706.91

1,169.96

126.45

7.18

7.18

614.83

23%

25%

25%

24%

-6%

26%

26%

23%

-64%

49%

20%

25%

-128%

504%

504%

-10%

(mn)

14,738.77

51,184.70

51,184.70

26,106.39

1,249.49

44,140.52

44,140.52

4,522.29

20,608.53

924.31

18,491.05

9,586.31

891.02

957.45

957.45

3,864.56

21%

19%

19%

12%

17%

15%

15%

38%

12%

15%

15%

20%

-8%

6%

6%

19%

30.16

11.61

11.61

11.33

2.12

16.88

16.88

24.90

5.31

2.79

16.57

8.42

(1.05)

0.03

0.03

2.49

CFIN

COMB*

COMB-x*

DFCC

CFVF

HNB

HNB-x

LFIN

LOLC

LVEN

NDB

NT B*

PMB

SEMB

SEMB-x

PABC

6

9

9

6

6

9

9

6

6

6

9

9

6

9

9

9

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

SAMP*

SEYB

SEYB-x

VFIN

HASU

UAL

CT CE

CINS

CINS-x

PLC

SDB

9

9

9

6

9

9

9

9

9

6

9

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

199.00

55.50

35.10

31.00

47.90

83.10

319.00

807.00

337.40

13.10

76.20

162.61

173.33

164.75

41.55

50.00

75.00

30.00

20.00

6.41

1,560.00

25.18

3,897.95

1,613.96

1,613.96

128.66

139.88

222.71

266.43

483.51

483.51

1,505.00

177.01

3,264.08

341.65

341.65

108.30

32.07

193.96

210.73

502.27

502.27

2,518.00

231.79

19%

372%

372%

19%

336%

15%

26%

-4%

-4%

-40%

-24%

24,121.81

19,241.57

19,241.57

773.45

1,647.45

2,919.28

3,498.81

11,249.72

11,249.72

19,128.00

3,105.05

20%

6%

5%

33%

11%

10%

10%

6%

6%

16%

8%

29.69

6.37

6.37

6.19

3.73

3.96

11.84

24.41

24.41

1.93

9.37

Be ve rage Food and Tobacco

BFL

6

Sep

147.00

CARG

6

Sep

153.00

CCS

6

Sep

120.20

CT C

9

Sep

800.10

COCO

6

Sep

35.90

COCO - x

6

Sep

28.20

DIST

6

Sep

162.00

KFP

6

Sep

72.90

NEST

9

Sep

1,450.10

T SML

6

Sep

42.50

LAMB

6

Sep

37.00

LION

6

Sep

270.10

LMF

6

Sep

96.00

16.00

224.00

95.04

187.32

21.60

1.80

300.00

25.50

53.73

30.00

31.40

80.00

40.00

68.54

326.86

430.30

6,192.00

126.63

126.63

3,078.41

22.73

2,044.12

54.54

43.46

627.95

125.47

133.68

545.31

310.06

4,619.00

69.87

69.87

2,850.27

33.92

2,027.69

(0.79)

37.81

544.33

171.24

-49%

-40%

39%

34%

81%

81%

8%

-33%

1%

7039%

15%

15%

-27%

1,608.00

7,666.23

7,334.06

4,534.00

1,447.22

1,447.22

40,156.62

1,473.05

2,825.39

657.48

673.52

5,493.16

2,136.10

9%

9%

12%

182%

17%

17%

15%

3%

96%

17%

13%

23%

12%

C he mical and Pharmace uticals

CIC

6

Sep

62.00

CIC-x

6

Sep

55.60

HAYC

6

Sep

170.00

72.90

21.87

29.71

23.55

23.55

239.78

384.35

384.35

169.47

-94%

-94%

41%

7,236.64

7,236.64

3,660.46

C onstruction and Engine e ring

DOCK

9

Sep

213.20

AEL

6

Sep

18.00

71.86

1,000.00

1,538.17

812.27

1,130.73

438.19

36%

85%

Dive rsifie d

CARS

HAYL

HHL

JKH*

RICH

SPEN

EXPO

432.00

292.00

26.60

217.80

7.70

119.80

6.80

196.39

75.00

515.29

851.07

1,938.83

406.00

1,954.92

1,337.90

591.56

705.06

4,070.45

1,015.07

1,371.98

583.06

4,746.89

2,048.16

486.44

2,753.09

1,248.69

894.29

574.88

Footwe ar and Te xtile s

MGT

6

Sep

11.40

152.34

He althcare

AMSL

6

LHCL

9

NHL

6

9.40

37.70

3.00

528.46

223.73

1,409.51

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

NP (mn)

1,581.57

7,622.80

7,622.80

1,501.52

107.13

4,917.30

4,917.30

862.11

1,262.06

69.72

2,040.92

1,459.73

(35.60)

43.36

43.36

551.57

Growth

21-Dec-12

160.00

103.00

90.10

111.00

11.70

143.00

110.70

149.00

52.50

32.80

137.10

53.50

15.00

1.00

0.40

19.00

6

6

6

6

6

6

6

(Mn)

104.88

779.10

53.47

265.10

101.25

311.22

77.15

69.26

475.20

50.00

164.20

230.61

67.50

1,191.77

614.07

295.04

2011

11.61

8.55

Annualise d

PER

5.31

8.87

7.76

9.80

5.53

8.47

6.56

5.98

9.88

11.76

8.27

6.35

(14.22)

31.23

12.49

7.62

BV

PBV

DPS

DY

140.53

61.48

61.48

98.48

12.34

113.65

113.65

65.30

43.37

18.49

112.61

41.57

13.20

0.53

0.53

13.10

1.14

1.68

1.47

1.13

0.95

1.26

0.97

2.28

1.21

1.77

1.22

1.29

1.14

1.89

0.75

1.45

2.50

4.00

4.00

4.00

2.00

4.50

4.50

5.00

0.50

1.50

7.50

2.10

1.00

1.6%

3.9%

4.4%

3.6%

17.1%

3.1%

4.1%

3.4%

1.0%

4.6%

5.5% O ve rwe ight

3.9% O ve rwe ight

0.0%

0.0%

0.0%

5.3%

6.70

8.72

5.51

5.01

12.84

20.99

26.94

33.07

13.82

6.79

8.13

148.34

56.91

56.91

18.61

32.95

38.92

116.63

425.89

425.89

12.26

123.34

1.34

0.98

0.62

1.67

1.45

2.13

2.74

1.89

0.79

1.07

0.62

4.50

1.00

1.00

1.00

2.10

5.00

9.00

6.50

6.50

1.00

5.00

2.3%

1.8%

2.8%

3.2%

4.4%

6.0%

2.8%

0.8%

1.9%

7.6%

6.6%

8.57

2.92

9.06

44.07

10.82

10.82

20.52

1.78

50.73

3.64

2.77

15.70

6.27

17.12

17.16

52.43

13.27

18.15

3.32

2.61

7.89

40.90

28.58

11.69

13.37

17.21

15.30

100.50

34.22

77.17

24.20

61.85

61.85

133.86

57.77

52.59

21.92

21.45

68.66

53.41

1.46

4.47

1.56

33.06

0.58

0.46

1.21

1.26

27.57

1.94

1.72

3.93

1.80

4.00

2.00

4.00

31.14

1.00

1.00

3.00

2.00

47.50

1.00

4.00

1.00

2.7%

1.3%

3.3%

3.9%

2.8%

3.5%

1.9%

2.7%

3.3%

2.4%

0.0%

1.5%

1.0%

1%

1%

13%

0.50

0.50

16.14

10.53

124.75

111.87

10.53

76.36

76.36

123.20

0.81

0.73

1.38

3.20

3.20

5.50

5.2%

5.8%

3.2%

10,098.06

11,180.93

20%

15%

28.54

1.62

9.07

7.47

11.08

140.53

11.18

1.52

1.61

5.71

0.25

2.7%

1.4%

-72%

-71%

45%

48%

-19%

53%

1%

32,392.91

18,822.49

10,945.92

74,866.78

6,830.15

25,912.36

8,754.09

8%

6%

13%

15%

30%

11%

13%

6.81

15.78

2.74

13.54

1.05

6.76

0.60

14.85

63.41

18.51

9.72

16.09

7.35

17.73

11.40

164.94

250.97

21.24

87.97

3.52

63.82

4.48

2.62

1.16

1.25

2.48

2.19

1.88

1.52

2.00

4.00

0.50

3.50

0.70

1.40

0.12

0.5%

1.4%

1.9%

1.6%

9.1%

1.2%

1.8%

(85.11)

(357.62)

76%

1,906.02

-9%

(1.12)

(10.20)

(10.20)

12.51

0.91

0.0%

217.90

285.18

285.26

209.85

233.37

78.66

4%

22%

263%

3,925.94

3,516.88

3,421.14

11%

11%

17%

0.82

1.70

0.40

12.72

11.40

22.18

7.41

7.43

15.72

2.43

1.27

2.40

1.24

0.26

0.50

0.05

2.7%

1.3%

1.7%

O ve rwe ight

O ve rwe ight

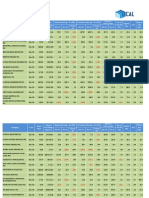

Hotels and Travels

mths Q TR Mkt. Price

21-Dec-12

AHPL**

6

Sep

73.00

AHUN**

6

Sep

72.30

HSIG**

6

Sep

80.00

KHL*

6

Sep

13.60

SHOT

6

Sep

23.60

SHOT-x

6

Sep

17.30

Shares

(Mn)

442.78

336.29

5.86

1,456.15

75.51

36.01

2012

NP (mn)

972.12

399.16

24.36

156.85

36.26

36.26

Investment Trust

GUAR

6

Sep

RHL

6

Sep

RHL - x

6

Sep

160.00

35.60

24.50

87.84

44.52

6.43

474.58

78.24

78.24

Land and Property

CLND

9

Sep

OSEA*

9

Sep

32.60

14.00

199.88

843.48

(15.51)

444.87

2011

Growth

NP (mn)

%

658.34

22%

188.10

112%

17.40

40%

121.22

29%

(10.78) 436%

(10.78) 436%

Net Assets

(mn)

13,020.92

11,344.18

223.61

13,556.70

1,571.45

1,571.45

17%

14%

24%

9%

5%

5%

5.10

4.80

9.30

0.85

0.65

0.65

14.33

Annualised

PER

14.31

15.06

8.60

16.00

36.30

26.61

RO E

EPS

BV

PBV

DPS

DY

29.41

33.73

38.17

9.31

14.09

14.09

2.48

2.14

2.10

1.46

1.67

1.23

4.00

0.70

5.00

0.30

-

5.5%

1.0%

6.3%

2.2% O verweight

0.0%

0.0%

2,077.87

155.25

155.25

-77%

-50%

-50%

13,867.85

2,160.18

2,160.18

7%

7%

7%

10.81

3.07

3.07

11.59

14.81

11.59

7.98

157.88

42.40

42.40

1.01

0.84

0.58

2.00

0.70

0.70

1.3%

2.0%

2.9%

13.40

382.49

-216%

16%

3,641.88

19,808.63

-1%

3%

(0.10)

0.64

21.88

(315.07)

21.88

18.22

23.48

1.79

0.60

0.30

0.0%

2.1%

Manufacturing

ACL*

6

CERA

6

DIPD

6

GRAN**

9

GLAS*

6

LLUB*

9

KCAB

6

LWL

6

RCL

6

T YRE

6

T ILE

6

T KYO

6

T KYO-x

6

T JL *

6

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

Sep

65.00

61.00

110.00

54.50

5.90

204.00

69.90

59.00

95.00

34.30

60.50

27.50

18.80

8.70

59.89

30.00

59.86

60.00

950.09

120.00

21.80

54.60

110.79

80.40

53.05

202.50

101.25

655.00

199.32

270.70

630.70

361.76

414.07

1,716.26

118.03

135.28

681.14

211.30

213.02

155.58

155.58

328.67

215.08

281.89

1,579.63

300.68

383.72

1,439.18

128.04

198.24

887.36

85.63

142.10

573.19

573.19

222.09

-7%

-4%

-60%

20%

8%

19%

-8%

-32%

-23%

147%

50%

-73%

-73%

48%

5,229.80

2,524.78

5,715.69

2,924.84

3,267.10

4,154.41

2,027.59

4,098.01

7,715.73

1,523.61

2,818.46

6,269.15

6,269.15

5,602.52

8%

21%

22%

16%

25%

55%

12%

7%

18%

28%

15%

5%

5%

14%

6.82

18.05

21.07

6.63

0.93

19.75

10.83

4.96

12.30

5.26

8.03

1.02

1.02

1.22

7.13

7.89

3.38

5.22

8.22

6.34

10.33

6.46

11.91

7.73

6.53

7.53

26.85

18.35

7.13

87.32

84.16

95.48

48.75

3.44

34.62

93.01

75.06

69.64

18.95

53.13

20.64

20.64

8.55

0.74

0.72

1.15

1.12

1.72

5.89

0.75

0.79

1.36

1.81

1.14

1.33

0.91

1.02

1.00

1.10

6.00

1.00

0.36

11.00

2.50

4.00

2.00

1.45

4.00

1.30

1.30

0.48

1.5% O verweight

1.8%

5.5%

1.8%

6.1% O verweight

5.4%

3.6%

6.8%

2.1%

4.2%

6.6%

4.7%

6.9%

5.5% O verweight

Motors

DIMO

UML

6

6

Sep

Sep

590.10

96.00

8.88

67.27

465.59

1,339.56

1,557.40

954.06

-70%

40%

7,666.98

6,549.58

12%

41%

104.90

39.83

3.24

5.63

2.41

863.74

97.37

0.68

0.99

40.00

9.00

6.8%

9.4%

O il Palms

BUKI

6

Sep

670.00

102.00

1,824.19

4,717.14

-61%

29,143.35

13%

35.77

18.73

18.73

285.72

2.34

3.00

0.4%

Plantations

BALA

KGAL

KVAL

NAMU

MASK

T PL

WATA

Sep

Sep

Sep

Sep

Sep

Sep

Sep

38.40

102.20

77.20

82.50

12.10

24.20

11.70

23.64

25.00

34.00

23.75

26.98

23.75

236.67

128.96

278.28

386.98

175.69

55.73

68.60

343.56

75.22

71%

286.75

-3%

273.68

41%

163.92

7%

(521.70) 111%

(142.35) 148%

(36.96) 1030%

1,472.94

3,176.21

2,382.10

1,737.93

1,236.66

1,074.99

3,092.83

12%

18%

22%

20%

9%

9%

22%

7.27

22.26

15.18

14.79

4.13

3.85

2.90

5.13

5.28

4.59

5.09

5.58

2.93

6.28

4.03

62.32

127.05

70.06

73.18

45.84

45.26

13.07

0.62

0.80

1.10

1.13

0.26

0.53

0.90

2.00

7.50

5.00

4.50

2.50

0.35

5.2%

7.3%

6.5%

5.5%

0.0%

10.3%

3.0%

Power and Energy

HPWR

6

Sep

VPEL

6

Sep

VLL

6

Sep

LIOC

6

Sep

21.00

6.40

3.70

19.50

125.20

747.11

477.27

532.47

123.29

169.03

14.56

1,374.86

164.72

214.40

46.92

241.61

-25%

-21%

-69%

469%

2,780.83

1,987.74

1,086.02

11,492.03

9%

17%

3%

24%

1.97

0.45

0.06

5.16

5.10

10.66

14.14

60.65

3.78

22.21

2.66

2.28

21.58

0.95

2.41

1.63

0.90

2.00

0.25

0.20

-

9.5%

3.9%

5.4%

0.0%

Telecommunications

DIAL**

9

Sep

SLT L**

9

Sep

8.10

42.50

8,143.78

1,804.86

5,092.74

2,862.00

3,549.62

3,495.00

43%

-18%

36,252.86

54,952.00

19%

8%

0.85

2.38

12.72

9.53

17.86

4.45

30.45

1.82

1.40

0.25

0.85

3.1%

2.0%

120.70

76.90

97.00

70.88

35.99

125.21

952.95

182.69

839.15

-103%

-47%

0%

14,316.48

1,716.27

4,826.17

0%

11%

23%

(0.82)

5.42

8.97

11.32

(146.88)

14.19

10.82

202.00

47.69

38.54

0.60

1.61

2.52

1.32

2.00

2

7.50

1.1%

2.6%

7.7%

Trading

BRWN

CWM

SINS

9

6

9

6

6

9

6

6

6

9

Sep

Sep

Sep

(29.12)

97.52

842.10

* Forecast EPS

** EPS adjusted for cyclicality

Annualised results are considered in all other cases

NTB

Profit growth has exceeded expectations in FY12Q3 mainly owing to an increase in net interest income (core operations of the bank). However the net interest

margin has slightly declined. The P/E and PBV valuations continue to be attractive compared to other banking sector shares. We expect medium term growth to

exceed the overall industry growth.

ACL

The recent increase in interest rates and rupee depreciation have affected earnings in FY12/13Q2 as we expected. However the earnings are below our

expectations in FY12/13H1 as the distribution costs also have gone up considerably indicating the growth is mainly from the low margin retail sector. The

valuation looks still attractive considering the growth expected over the next 2 years in the higher margin institutional sector.

KHL

Profit growth in FY12/13Q2 is only marginal as the Sri Lankan resorts have under-performed significantly. The resorts in Maldives have showed impressive

growth resulting in satisfactory earnings for the quarter. The growth for the year could be less than we anticipated although prospects look more attractive in

2013 and 2014.

SAMP

FY12Q3 earnings have got affected due to a marginal loss made in foreign exchange operations. However the net interest income (core operations) have showed a

growth of 21%. The cumulative earnings for the year is up 19%. The share is attractively priced considering the PBV below 1.5x, ROE of around 20%, P/E of below

10x and the high growth expectations due to the aggressive nature.

GLAS

The gross profit margins got affected in FY12/13Q2 due to the 51% increase in energy related costs. FY12/13H1 profitability was negatively affected by the

depreciation of the rupee as the rupee value of dollar loans increased resulting in an exceptional loss in the P&L. Therefore the achievement of a slight growth in

profits under the circumstances (through reductions in operating costs) is commendable. The P/E well under 10x is attractive considering the long term

expectations.

NDB

The earnings for FY12Q3 is a fraction lower compared to last year although the cumulative for the year is up 20%. The core operations (net interest income) has

recorded reasonable growth for the quarter. NDB is the bank trading closest to its book value (once the capital gain of its sale of the stake in the insurance

business is included). Has potential to appreciate significantly in the long term.

EXPO

The share has declined steeply since the IPO and offers significant upward potential in the long run. Depreciation of the rupee is likely to improve financials while

increased international trade in Sri Lanka in the medium term will benefit the company's revenue. Profit for FY12/13Q2 has been flat (as expected) due to the new

business ventures overseas are still at an early stage. In addition, increase in taxes in certain overseas operations have also affected profitability.

TJL

The profits have increased significantly in FY12/13Q2 with a reduction in operating costs and a reversal of provisions. The recent reduction in cotton prices as

well as the depreciation of the rupee has improved the gross profit margin as well. The share has declined sharply since the IPO and is attractively priced

currently.

This document is based on information obtained from sources believed to be reliable, but we do not make any representations as to its accuracy,

completeness or correctness. Opinions expressed are subject to change without notice. Any recommendation contained in this document does

not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is 3for

the information of addressees only and is not to be taken as substitution for the exercise of judgment by addressee. N D B Stockbrokers (Pvt)

Ltd and its associates, their directors, and/or employees may have positions in, and may effect transactions in securities mentioned herein and

may also perform or seek to perform broking, investment banking and other banking services for these companies.

Vous aimerez peut-être aussi

- Stock Tracker 29.04.2013Document3 pagesStock Tracker 29.04.2013Randora LkPas encore d'évaluation

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkPas encore d'évaluation

- Karnataka State Financial CorporationDocument16 pagesKarnataka State Financial CorporationVishwas NayakPas encore d'évaluation

- Annual Report 2018 Min - FINALDocument152 pagesAnnual Report 2018 Min - FINALraghavPas encore d'évaluation

- Daily Stock Market Insight 01.04.2014Document7 pagesDaily Stock Market Insight 01.04.2014Ahmed BashirPas encore d'évaluation

- Portfolio Assignment 1Document16 pagesPortfolio Assignment 1Iqra RaniPas encore d'évaluation

- Trend Analysis of TCLDocument1 pageTrend Analysis of TCLRaviShankarSharmaPas encore d'évaluation

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocument6 pagesUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkPas encore d'évaluation

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDocument18 pagesHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221Pas encore d'évaluation

- Daily Note: Market UpdateDocument3 pagesDaily Note: Market UpdateAyush JainPas encore d'évaluation

- Daily Trade Journal - 27.05.2013Document6 pagesDaily Trade Journal - 27.05.2013Randora LkPas encore d'évaluation

- Audited Financial Results March 2009Document40 pagesAudited Financial Results March 2009Ashwin SwamiPas encore d'évaluation

- Preference Shares BangladeshDocument5 pagesPreference Shares BangladeshBangladesh Foreign Investment PolicyPas encore d'évaluation

- SPFocus 220811Document2 pagesSPFocus 220811maxicoolPas encore d'évaluation

- Bajaj AutoDocument7 pagesBajaj AutoAatish J ShroffPas encore d'évaluation

- CompanyDocument19 pagesCompanyMark GrayPas encore d'évaluation

- Idea Cellular: Previous YearsDocument8 pagesIdea Cellular: Previous YearsParvez AnsariPas encore d'évaluation

- Metabical - Group 6 - Div EDocument10 pagesMetabical - Group 6 - Div EAniket PallavPas encore d'évaluation

- Audited Financial Results: For The Year Ended 31st March 2008Document34 pagesAudited Financial Results: For The Year Ended 31st March 2008bharat1010Pas encore d'évaluation

- Manila Standard Today - Business Daily Stocks Review (October 30, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 30, 2013)Manila Standard TodayPas encore d'évaluation

- DerivativekitDocument766 pagesDerivativekitbiswal83Pas encore d'évaluation

- Weekly Apr 08 - Apr 12 12Document9 pagesWeekly Apr 08 - Apr 12 12Safwan SaadPas encore d'évaluation

- Daily Trade Journal - 28.01.2014Document6 pagesDaily Trade Journal - 28.01.2014Randora LkPas encore d'évaluation

- Markets Tracker: Rs (In Crores)Document1 pageMarkets Tracker: Rs (In Crores)sannu91Pas encore d'évaluation

- Chettinadu Cment - FinancialsDocument10 pagesChettinadu Cment - FinancialsvmktptPas encore d'évaluation

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Analysis 2Document1 pageAnalysis 2Mohammed BilalPas encore d'évaluation

- AnalysisDocument1 pageAnalysisMohammed BilalPas encore d'évaluation

- Analysis IDocument1 pageAnalysis IMohammed BilalPas encore d'évaluation

- NTPCDocument7 pagesNTPCDivyesh GandhiPas encore d'évaluation

- Exhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsDocument6 pagesExhibit TN1 Google' Ratio Analysis and Forecast of Free Cash FlowsAnkush WinniethePooh AnsalPas encore d'évaluation

- Ogdcl PDFDocument2 pagesOgdcl PDFnomi9818Pas encore d'évaluation

- Priyanka Matrial 2Document198 pagesPriyanka Matrial 2riddhiPas encore d'évaluation

- Reliance Equity Opportunities FundDocument1 pageReliance Equity Opportunities FundSandeep BorsePas encore d'évaluation

- Kamco Kse Dec-2014Document7 pagesKamco Kse Dec-2014Waleed EhsanPas encore d'évaluation

- SR DM 05Document42 pagesSR DM 05Sumit SumanPas encore d'évaluation

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Trailing Best Case Worst Casemukeshkumar91Pas encore d'évaluation

- HAL Annual ReportDocument103 pagesHAL Annual ReportAnirudh A Damani0% (1)

- Market Data (As On 20 Dec 2010) Price P/E EPS (RS) MKT - Cap. (CR) BV (RS) Face Value (RS) BetaDocument5 pagesMarket Data (As On 20 Dec 2010) Price P/E EPS (RS) MKT - Cap. (CR) BV (RS) Face Value (RS) BetaKalyan SrinivasaPas encore d'évaluation

- Daily Trade Journal - 11.06.2013Document7 pagesDaily Trade Journal - 11.06.2013Randora LkPas encore d'évaluation

- QUA06194 SalarySlipwithTaxDetails21 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails21 PDFUtsabPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- 455 QD 2024 - SignedDocument9 pages455 QD 2024 - SigneddulichsinhthaiPas encore d'évaluation

- Invoice: Metamorf Interiors and Designers PVT LTDDocument1 pageInvoice: Metamorf Interiors and Designers PVT LTDJana VinayaPas encore d'évaluation

- DairyDocument17 pagesDairySriKanthPas encore d'évaluation

- Jabatan Pelajaran Negeri SabahDocument33 pagesJabatan Pelajaran Negeri SabahAmir TumiranPas encore d'évaluation

- Previous Years: Tata Motor S - in Rs. Cr.Document28 pagesPrevious Years: Tata Motor S - in Rs. Cr.priya4112Pas encore d'évaluation

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaPas encore d'évaluation

- Quarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianDocument44 pagesQuarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianAmreen KhanPas encore d'évaluation

- Balan Ce Sheet of Tata Steel: - in Rs. Cr.Document18 pagesBalan Ce Sheet of Tata Steel: - in Rs. Cr.Mukesh PandeyPas encore d'évaluation

- Karishma WorkDocument14 pagesKarishma WorkApoorva MathurPas encore d'évaluation

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngPas encore d'évaluation

- QUA06706 - SalarySlipwithTaxDetails Nov PDFDocument1 pageQUA06706 - SalarySlipwithTaxDetails Nov PDFmrugeshkatePas encore d'évaluation

- QUA06706 SalarySlipwithTax MaiDocument1 pageQUA06706 SalarySlipwithTax MaimrugeshkatePas encore d'évaluation

- EIH DataSheetDocument13 pagesEIH DataSheetTanmay AbhijeetPas encore d'évaluation

- 7.1 KSE 100 & General Index of All Shares: Sector NameDocument5 pages7.1 KSE 100 & General Index of All Shares: Sector NameZahid RehmanPas encore d'évaluation

- ECM Lampiran 1 DataDocument12 pagesECM Lampiran 1 DataDevi SantikasariPas encore d'évaluation

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013Pas encore d'évaluation

- CCPI Feb 2013Document2 pagesCCPI Feb 2013ran2013Pas encore d'évaluation

- Daily Trade Journal - 04.03Document7 pagesDaily Trade Journal - 04.03ran2013Pas encore d'évaluation

- Daily Trade Journal - 21.02Document12 pagesDaily Trade Journal - 21.02ran2013Pas encore d'évaluation

- Daily Trade Journal - 22.02Document12 pagesDaily Trade Journal - 22.02ran2013Pas encore d'évaluation

- Daily Market Update 18.02Document1 pageDaily Market Update 18.02ran2013Pas encore d'évaluation

- Results Update - Dec 2012 20.02Document15 pagesResults Update - Dec 2012 20.02ran2013Pas encore d'évaluation

- Weekly Plus - 2013 Issue 07 (15.02.2013)Document14 pagesWeekly Plus - 2013 Issue 07 (15.02.2013)ran2013Pas encore d'évaluation

- Results Update - Dec 2012 15.02Document10 pagesResults Update - Dec 2012 15.02ran2013Pas encore d'évaluation

- Dialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. ColomboDocument3 pagesDialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. Colomboran2013Pas encore d'évaluation

- CBWeeklyReport 13.02Document1 pageCBWeeklyReport 13.02ran2013Pas encore d'évaluation

- Press Release - EnglishDocument1 pagePress Release - Englishran2013Pas encore d'évaluation

- UN Report On Sri LankaDocument18 pagesUN Report On Sri LankaSri Lanka GuardianPas encore d'évaluation

- 2nd Semester Income Taxation Module 10 CPAR Gross Income - Exclusion and InclusionsDocument21 pages2nd Semester Income Taxation Module 10 CPAR Gross Income - Exclusion and Inclusionsnicole tolaybaPas encore d'évaluation

- Blue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlDocument4 pagesBlue Bill Corp Module 6 Assignment-1cxlc8byxz6r5 - 1euusngisn9vlKimberley WrightPas encore d'évaluation

- L1, Accounting EquationDocument16 pagesL1, Accounting EquationYelzhan ShaikhiyevPas encore d'évaluation

- BUSINESS PROPOSAL GRP 1Document3 pagesBUSINESS PROPOSAL GRP 1Mariko Sapitula MatsumotoPas encore d'évaluation

- Jawaban Quiz 2Document2 pagesJawaban Quiz 2Muhammad IrvanPas encore d'évaluation

- Grade 7 Term 3 Learner - S WorkbookDocument21 pagesGrade 7 Term 3 Learner - S WorkbookBotle MakotanyanePas encore d'évaluation

- Unit 1 Agricultural IncomeDocument25 pagesUnit 1 Agricultural IncomeSresth VermaPas encore d'évaluation

- E-Portfolio (PAS 1)Document6 pagesE-Portfolio (PAS 1)Kaye NaranjoPas encore d'évaluation

- Accounting Cycle Exercise AnswerDocument9 pagesAccounting Cycle Exercise AnswerRaziel Jangas100% (1)

- Accounting Principles: Second Canadian EditionDocument38 pagesAccounting Principles: Second Canadian EditionErik Lorenz PalomaresPas encore d'évaluation

- SOAL Test Magang OnlineDocument6 pagesSOAL Test Magang OnlineFajar SaputraPas encore d'évaluation

- Macro Economics KLE Law College NotesDocument193 pagesMacro Economics KLE Law College Noteslakshmipriyats1532Pas encore d'évaluation

- 2017 Vol 3 CH 9 AnsDocument3 pages2017 Vol 3 CH 9 AnsDiola QuilingPas encore d'évaluation

- Chapter 2 Opportunity Seeking, Screening and SeizingDocument73 pagesChapter 2 Opportunity Seeking, Screening and SeizingMjhane Herrera BattungPas encore d'évaluation

- DCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021Document7 pagesDCB Bank Announces First Quarter Results FY 2021 22 Mumbai August 0 2021anandPas encore d'évaluation

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearVivek SinghPas encore d'évaluation

- Chapter 14 Ia2Document18 pagesChapter 14 Ia2JM Valonda Villena, CPA, MBA67% (3)

- Income Tax ReviewerDocument19 pagesIncome Tax ReviewerRaxelle MalubagPas encore d'évaluation

- Chapter 2 - Applied EconomicsDocument4 pagesChapter 2 - Applied EconomicsMaleeha AhmadPas encore d'évaluation

- Perusahaan ManufakturDocument26 pagesPerusahaan ManufakturMuhammad Mahesa PutraPas encore d'évaluation

- CSAT Class VDocument4 pagesCSAT Class VShubham NaikPas encore d'évaluation

- BFS Du Point Analysis BR6 Axis BankDocument27 pagesBFS Du Point Analysis BR6 Axis BankMadhusudhanan RameshkumarPas encore d'évaluation

- 2nd Quarter Module Business MathematicsDocument49 pages2nd Quarter Module Business MathematicsNiejay Arcullo Llagas88% (16)

- Chapter - 2: FinancialDocument21 pagesChapter - 2: FinancialYasir Saeed AfridiPas encore d'évaluation

- CFR Tax Booklet - Eng 2022Document48 pagesCFR Tax Booklet - Eng 2022Justin CamilleriPas encore d'évaluation

- Batik Malaysia Gallery Budgeted Income StatementDocument6 pagesBatik Malaysia Gallery Budgeted Income StatementkiwiweePas encore d'évaluation

- ECONOMICS 2014 Past PapersDocument7 pagesECONOMICS 2014 Past PapersHenry OkoyePas encore d'évaluation

- Mock Test 7 - Paper 1 - EngDocument12 pagesMock Test 7 - Paper 1 - Enghiu chingPas encore d'évaluation

- Post Office Surjit PDFDocument7 pagesPost Office Surjit PDFPawan SharmaPas encore d'évaluation

- Bank NII and NIM Scenarios Case StudyDocument8 pagesBank NII and NIM Scenarios Case Studynedhul50Pas encore d'évaluation