Académique Documents

Professionnel Documents

Culture Documents

Lafarge Surma Cement LTD

Transféré par

সামিউল ইসলাম রাজুTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lafarge Surma Cement LTD

Transféré par

সামিউল ইসলাম রাজুDroits d'auteur :

Formats disponibles

Aminul Haque, CFA

(880) 171 417 8460; amin@eplbangladesh.com Md. Ashfaque Alam (Research Associate) ashfaque@bracepl.com

Lafarge Surma Cement Ltd.

March 4, 2010

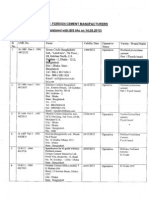

Company Summary 52-week Price Range (BDT) Current Price 12-month Target Price Total Return Number of Shares MM Market Cap BDT MM BDT MM Revenue Ops Income Net Income Margins Gross Margin Operating Margin Net Margin Growth Revenue Growth Net Income Growth Per Share EPS DPS Book Value/Share Cashflow BDT MM Operating Capex Dividend Valuation Forward P/E Forward P/B ROE ROA ROIC Misc BDT MM Total Debt MM Cash Debt/Equity Debt/Asset

700 600 400000 500

Rating: OUTPERFORM Target Price: BDT 575

Lafarge Surma Cement Ltd. (LSCL) is an integrated cement manufacturing company in Bangladesh. Lafarge Group of France, one of the world leaders in building materials is the majority shareholder of LSCL. Although LSCL competes with a large number of cement manufacturers in the country, it has a few unique advantages. While all other manufacturers import clinker, only LSCL has the capacity to manufacture clinker in-house using limestone from a owned quarry. This provides the company the benefit of significantly higher gross margins. Because of its affiliation with Lafarge worldwide, LSCL is considered a leading brand in a competitive market, and it enjoys price premium because of a perceived quality leadership. Lastly, Lafarge has one of the largest production plant in the industry (1.2MT, expandable to 1.5MT). In a fragmented industry where smaller producers are being gradually squeezed out of the market, LSCL has the advantage of scale. As and when consolidation starts in the market, LSCL stands prepared to benefit because of its staying power. LSCL recently experienced a setback in sourcing limestone from its quarry in the Indian state of Meghalaya. The Supreme Court of India ordered a suspension on mining at the quarry till a full hearing takes place on March 19, 2010. Till then LSCL has been operating with previously mined limestone, which would last for about two more months. Since the suspension was announced, LSCL shares prices fell significantly on the Dhaka Stock Exchange (DSE). Since early February when the suspension order was made public, stock prices retraced by over 30%. We do not have a view as to the outcome of the Indian Supreme Court hearing in March. However, we assessed the upside from a favorable verdict and the downside from a permanent ban on mining, and on balance we find LSCL is an attractive stock at this price. We initiate coverage of LSCL with an OUTPERFORM rating and a 12month target price of BDT 575. Our rating considers the upside from a favorable verdict by the Indian Supreme Court. We also took into account the sustainable advantages enjoyed by LSCL such as a price premium enjoyed by the company, LSCLs potential for achieving top and bottom line growth and an overall positive outlook for the consumption of cement in the country, especially in the backdrop of infrastructure investment. Our recommendation is based on a P/E of 20x an estimated 2011 EPS of BDT 30.23 and on a 4.5x estimated 2011 book value of BDT. 133.88. With no expectation for a dividend in the immediate future, this target price implies an estimated total return of 30%. Although on a balance we find Lafarge an attractive investment, we still draw attention to the considerable risk associated with this stock. In case of a permanent ban on mining, Lafarge would have to look for some costly alternatives, and it may take a number of years for the company to return to profitability. The company may be liable for restoration of forest land, and the cost for such reclamation may be higher than the company's estimate.

395 - 598 442 575 30% 58.1 25,651.8

2008A 6,211.9 2,183.5 176.5 2008A 40.2% 35.2% 2.8% 2008A 159% NM 2008A 3.04 0.00 59.00 2008A 1,229.5 409.2 .0 2008A 145.3x 7.5x 5% 1% 4%

2009E 7,618.9 2,552.3 1,133.9 2009E 40.0% 33.5% 14.9% 2009E 23% 542% 2009E 19.53 0.00 78.53 2009E 956.1 359.1 .0 2009E 22.6x 5.6x 25% 6% 9%

2010E 8,391.7 2,811.2 1,458.3 2010E 40.0% 33.5% 17.4% 2010E 10% 29% 2010E 25.11 0.00 103.64 2010E 2,409.5 356.9 .0 2010E 17.6x 4.3x 24% 8% 10%

2008A 2009E 2010E 12,788.1 12,570.5 10,080.1 69.5 373% 72% 449.0 276% 66% 11.1 167% 55%

500000 450000

350000

300000

400

250000

300

200000

200

150000

100000 100 50000

Volume

Close

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Business Lafarge Surma Cement Ltd. (LSCL) is a majority owned subsidiary of Lafarge Group of France. The Lafarge Group is a global market leader in construction materials. With Euro 5.4 Billion in revenue, it is one of the largest manufacturers of cement by shipped volume. Lafarge is the largest producer of cement and among the top three producers of aggregates, concrete and gypsum in the world. Lafarge operates in 79 countries and employs 84,000 people. Lafarge is traded on the Paris Stock Exchange and has a market cap of Euro 13.7 Billion. Through a wholly owned subsidiary, Surma Holding, Lafarge owns majority (59%) shares of LSCL. The other institutional shareholders are IFC, ADB, Sinha Fashions and Islam Cement. LSCL was incorporated in Bangladesh in 1997. The production facilities are located in Chattak in the Sunamganj district in Northeast Bangladesh bordering the Indian state of Meghalaya. The production facilities consist of a dry process cement plant with a 1.5 million metric ton (MMT) capacity and a clinker production line of about 1.2MMT capacity. LSCL also operates two subsidiaries in the Indian state of Meghalaya. Among these two, partially owned (75%) Lum Mawshun (LMMPL) holds the mining rights with two local partners, and wholly-owned Lafarge Umiam Mining (LUMPL) carries out the mining operations. Limestone and shale are mined at the quarry and transported across the international border by a 17 kilometer long conveyor belt. The project has a 30 MW captive power plant that ensures uninterrupted energy supply. Figure 1: LSCL Plant in Sunamganj LSCL markets its cement under the brand name of Supercrete. It produces a general purpose cement that can be used with different kinds aggregates for various purposes. This product passes all local quality standards. The company markets its product in 50KG bags. Because of a perception of higher quality of Lafarge products, a 50KG bag of cement receives a BDT. 15.00 BDT. 30.00 premium on average over cement produced by local competitors. The company started its operations in 2005 while ago and could achieve capacity utilization of a satisfactory level only in 2008 (62%). The company faced some challenges in mining at its quarry and transporting the limestone to Bangladesh.

Share Holding Structure

Shareholding Surma Holdings IFC ADB Sinha Fashions Ltd. Islam Cement Ltd. Other shareholders Number of shares 34,184,935 5,387,400 5,797,000 1,755,000 1,595,710 9,348,630 58,068,675 Percentage 59% 9% 10% 3% 3% 16% 100%

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Industry In terms of cement production, Bangladesh ranks about 40th in the world. Cement manufacturing is a highly fragmented business in Bangladesh. During the 1990s, many small cement companies entered the market as soon as the government started encouraging local production with favorable tariff differential. Currently 123 companies are listed as cement manufacturers in the country. Of them 63 have actual production capacity while about 30 do not have any production at all. The current installed capacity is 22.0 MMT. However, because of supply constraints for power and clinkers, the actual capacity is about 17.0 MMT. Bangladesh is one of the few sizable producers of cement that does not have its own supply of limestone and cannot produce clinkers domestically. Except for LSCL, all other cement manufacturers of Bangladesh are in essence grinders of clinkers. There is a strong tax-support for local cement manufacturers in Bangladesh. They receive a significant import tax advantage over finished cement (about 15% for raw-materials versus 100% for finished cement). This tariff differential helps most to operate profitably. A change in the tariff structure is not anticipated in the near future . Construction takes up an important role in the economy (about 10% of the GDP). Annual demand for cement in the country is about 10.0 MMT. Understandably the market has a capacity overhang. There is a small market for export of cement, mainly to the small northeastern states of India. However, the size of the export is quite small (about 200 KMT a year). There are four categories of cement consumers in the country. The largest with about 60% of the consumption are the individual homebuilders. This is also the most price sensitive segment. Real estate developers, especially in the countrys urban area constitute about 8% of the market. Construction contractors constitute another 3% of the market. Lastly, various government projects take up about 30% of the total cement construction. Demand for cement was particularly weak in 2007-08 for several reasons. First, the anti-corruption drive of the military-backed caretaker government subdued expenditure of undeclared funds. Most of these funds usually go to the construction sector. Second, a rapid climb of raw materials and shipping costs in the global market escalated the price in the local market for cement and other construction materials, further squeezing consumers out of the market. Third, government spending in construction under the annual development programs (ADP), which constitutes a large part of the cement market, was particularly slow in these years. Consequently, many of the smaller and some major cement manufacturers operated at less that 50% capacity and incurred large losses during these years.

Figure 2: Jamuna Bridge

The industry realized about 20% sales growth in 2009, mostly because of the latent demand from last years. On a secular basis, ongoing demand growth is expected to be about 8%, The outlook for the cement industry seems positive for a number of reasons. First, the government seems to be on a war footing to increase both the amount and the efficiency of spending in social and physical infrastructure under the Annual Development Programs (ADP). Second, the private sector is also energized because of certain tax advantages for undeclared funds if they are invested in real estate. Third, a number of large infrastructure construction projects (such as the Padma Bridge) are on the horizon. Both the government and the private sector are soliciting funds for such projects. If implemented, these projects would significantly improve demand for construction materials. The largest 10 cement manufacturers hold about 70% of the market share. While Heidelberg, Holcim and Lafarge are the leaders among multinational cement manufacturers; Shah, Akij and MI are the leading domestic manufacturers. Shah cement is the market leader with close to 12% of the market share, closely followed by Heidelberg with about 10% of the market share.

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Challenges On February 5, 2010, The Supreme Court of India ordered LSCL to stop mining operations at its quarry in Meghlaya. The order was the result of a lawsuit brought by Shella Action Committee, a civil rights group in Meghalaya. The lawsuit alleged that LSCL mortgaged the tribal land, on which the quarry is located, to foreign consortium lending to CSLM violating the countrys law. The Supreme Court asked the company to stop mining, continue shipping the already mined limestone (about 2-month supply) and set March 19 as the date for next hearing. CSML contends that the companys use of the land followed legal processes and consultation with the rightful authorities at every stage, including the state government and the union government. They also contend that use of the land was cleared with the Khasia Darbar, the rightful representative of the tribal interests whereas Shella is an obscure non-local civic organization with no formal authority to represent the Khasia community. Before the next court appearance, the company is trying to gain support from various interested parties including the Khasia Darbar, the state government and the union government. According to the company, LSCL is a result of an agreement between the governments of India and Bangladesh, and both the governments have a moral obligation to support the company. In an earlier event in April 2007, the Indian Union Ministry of Environment and Forestry ordered a stop of mining on the ground that the company misrepresented the condition of the land and hid the fact that it was a forest land. A special bench of the Supreme Court allowed continuation of mining on an interim basis, in November 2007, till a full verdict is given on forest clearing. Because of the special status of the land (forest land) and the people inhabiting it (the tribal Khasias), the quarry is subject to the attention and interest of many different parties. It appears that LSCLs acquisition of this vital asset came with its share of headaches. LSCL management is optimistic that the law favors its position. They also point out that the state government and the governments of India and Bangladesh are supportive of the project for economic and employment reasons. The Meghalaya government is currently negotiating with Lafarge for the company to build another cement factory in the state, which would solely cater to the local demands and generate employment in a backward state. In other words, the state government has every incentive to keep Lafarge in business in the state. Options available to LSCL Even in the worst case that the Court puts a permanent ban on mining, LSCL is not without options. However, under any of these scenarios, the profitability of the company would suffer. There are other quarries in the region whose product are traded in the open market. Transport of limestone by boat and trucks is already an established practice for Chattak Cement Factory, a government owned manufacturer in the same area. Although it would need substantial capacity building, LSCL can meet part of its limestone requirement from importing locally traded limestone. Import of clinkers like other cement manufacturers is also an option, although very costly for LSCL. In such a case, the company would have to import cement via Chittagong, transport it to current plants in Sunamganj for grinding, and then send it back to Dhaka and other distribution centers. This may involve relocation of its grinding plant. Acquiring other grinders may also be an option for LSCL, although that would require additional capital outlay. As the cement sector consolidates, the larger companies such as LSCL gains market shares at the cost of smaller manufacturers. It is expected that in the end only the ten or so manufacturers, who currently hold about 70% of the market share would survive. In such a case, Lafarge can shift its manufacturing from Sunamganj to Dhaka by acquiring the facilities of the marginal producers.

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Valuation Case 1: In the base case scenario, we have assumed that the company would be allowed by the Indian Supreme Court to resume mining of its quarry. We also made the following assumptions: 1. 2. 3. 4. 5. 6. The company maintains a 40% D/E ratio by repaying current long-term debt and assuming new debt. After paying off the debt from multilaterals, interest rates are slightly higher Companys Interest expenses are significantly reduced as most of its debt are at floating rates, With Rupee appreciating against Taka, there would be no translation loss or even may be a gain Gross margin is maintained at the current 40% level With an average of 8% growth each year, LSCL runs out of current capacity and goes for expansions in 2012 (to 1.5 MMT), in 2015 (to 1.8 MMT) and in in 2018 (to 2.0 MMT).

Under these assumptions, we conducted a comparative as well as a discounted cash flow (DCF) valuation using free cash flow to equity method (FCFE).

Lafarge valuation 2011 estimates Multiple Target price Average Target price 12-month target price Dividend yield Total return

Discounted FCF, MM Operating Cash Capital Expenditure Change in Debt 2009 2010

EPS 30.23 20.0x 604.64 564.02 575.00 0 30%

2011 2012

BVPS 133.88 4.5x 602.45

2013

2014

2015

2016

2017

2018

2019

2020 6,688.4 (407.4) .0 6,281.0 96,906.9 96,906.9 2,485.0

956.1 2,409.5 2,165.2 2,640.3 3,607.9 4,114.0 4,619.5 5,020.1 5,405.4 5,803.4 6,229.1 (359.1) (356.9) (354.8) (352.7) (876.4) (677.0) (458.1) (412.3) (411.0) (409.8) (408.6) (217.6) (2,490.4) (1,501.1) (2,153.1) (972.7) (1,252.8) (422.9) (422.9) 379.4 (437.8) 309.4 .0 .0 .0 134.5 1,758.9 2,184.2 3,738.5 4,185.0 4,994.4 5,393.6 5,820.5

Net Terminal Value Terminal Value Terminal liabilities FCFE Discount Rate Terminal Growth Rate NPV NPV/Share 15% 8% 28,162.1 484.98 379.4 (437.8) 309.4

134.5 1,758.9 2,184.2 3,738.5 4,185.0 4,994.4 5,393.6 5,820.5 103,187.9

Based on the valuation, our 12-month target price in BDT 575.00, which implies a price of 20x 2011 earning of BDT 30.23. This target also implies a 4.5x 2011 BVPS of BDT 133.88. This price target, if achieved, will provide a 12-month price-return of 30%.

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Valuation Case 2: In case that the Indian Supreme Court puts a permanent ban on mining from its quarries, LSCL would look for alternatives. We have made the following assumptions regarding this scenario: 1. 2. 3. 4. 5. The company gross margin reduces by about 10% LSCL slows down payment of debt; the company maintains a slightly higher debt levels (50% D/E ratio) Company initiates cost cutting measures, reducing SGA costs from 5% of sales to 4.5% The company will take at least two years and some capital outlay to adjust to the changed business model. We use 2012 results for our basis for valuation With a change in the companys profitability, valuation multiples are contracted. We use a P/E ratio of 18.0x, instead of the 20.0x in the base case scenario. Also, as a potential relocation may render many of the capital assets useless, we use a lower P/B ratio of 3.0x.

Based on the valuation based on these assumptions, our 12-month target price in BDT 350.00, which implies a price of 18.0x 2012 earning of BDT 18.81. This target also implies a 3.0x 2012 BVPS of BDT 128.89. This price target, if achieved, will provide a 12-month negative return of 21%.

Lafarge valuation 2012 estimates Multiple Target price Average Target price 12-month target price Dividend yield Total return

EPS 18.81 18.0x 338.56 362.62 350.00 0 -21%

BVPS 128.89 3.0x 386.68

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Income Statement

MM BDT Revenue COGS Gross profit/loss General and admin Selling and distribution Total expenses Other operating income Operating profit/loss Exchange gain/loss Finance expenses Interest income Other expenses/ (income) Worker's welfare fund Net profit/loss before tax Income tax PAT Number of shares MM EPS 2006 153.2 (111.3) 41.9 (164.7) (36.6) (201.4) .0 (159.5) (363.1) (163.7) .5 .3 .0 (685.4) (123.0) (808.4) 58.1 -13.92 2007 2,399.9 (2,532.4) (132.6) (263.9) (108.5) (372.4) 160.6 (344.4) 110.1 (1,138.3) .9 (6.2) .0 (1,377.8) 281.2 (1,096.5) 58.1 -18.88 2008 6,211.9 (3,712.6) 2,499.3 (362.0) (131.6) (493.6) 177.8 2,183.5 (331.8) (1,224.5) .6 (94.5) (49.5) 483.9 (307.3) 176.5 58.1 3.04 2009E 7,618.9 (4,571.3) 3,047.6 (380.9) (114.3) (495.2) .0 2,552.3 .0 (852.3) 5.2 .0 (85.3) 1,619.9 (486.0) 1,133.9 58.1 19.53 2010E 8,391.7 (5,035.0) 3,356.7 (419.6) (125.9) (545.5) .0 2,811.2 .0 (622.9) 4.6 .0 (109.6) 2,083.3 (625.0) 1,458.3 58.1 25.11 2011E 9,263.9 (5,512.0) 3,751.9 (463.2) (139.0) (602.2) .0 3,149.7 .0 (513.1) 3.3 .0 (132.0) 2,507.9 (752.4) 1,755.5 58.1 30.23

Cash Flow Statement

MM BDT Operating Cash Flow Net Income Add Back Non-cash Expense Change in Working Capital Cash Flow from Operations Investing Cash Flow Disposal of assets Capital Expenditure Cash Flow from Investing Financing Cash Flow Change in Debt Dividend Paid Cash Flow from Financing Effect of foreign currency translation Net Cash Beginning Balance Closing Balance Operating cash per share (2,268.4) .0 (1,064.1) 1,082.0 17.9 (16.28) (629.6) .8 11.8 17.9 29.6 (19.94) (272.5) (2.4) 39.9 29.6 69.5 21.17 (2,268.4) (629.6) (272.5) (945.6) (1,157.9) 1,229.5 2006 2007 2008 2009E 2010E 2011E

1,133.9 459.7 (637.5) 956.1

1,458.3 456.5 494.7 2,409.5

1,755.5 453.3 (43.6) 2,165.2

.0 (359.1) (359.1)

.0 (356.9) (356.9)

.0 (354.8) (354.8)

(217.6) .0 (359.1) .0 379.4 69.5 449.0 16.47

(2,490.4) .0 (356.9) .0 (437.8) 449.0 11.1 41.49

(1,501.1) .0 (354.8) .0 309.4 11.1 320.5 37.29

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Balance Sheet

MM BDT Current assets Inventories Trade receivables Advances, deposits & prepayments Derivative instruments-assets Cash and cash equivalents Total current assets Fixed assets Property plant and equipment Intangible assets Deferred income tax assets Total fixed assets Total assets Current liabilities Trade payables Other payables Derivative instruments-liabilities Current portion of long term debt Bank overdrafts Short-term debt Income tax payable Total current liabilities Long term liabilities Long term debt Lease obligation Deferred tax Total long term liabilities Equity Share capital Accumulated loss Foreign currency translation Share holder's equity; parent company Share money deposits Total equity Total liabilities and equity 2006 2007 2008 2009E 2010E 2011E

990.0 44.6 669.4 .0 17.9 1,721.7 15,378.0 17.9 .0 15,395.8 17,117.5

851.0 56.5 727.6 .0 29.6 1,664.7 15,446.3 225.6 393.8 16,065.6 17,730.3

1,092.2 640.6 701.6 2.0 69.5 2,506.0 14,961.8 217.3 81.8 15,260.9 17,766.9

2,057.1 761.9 687.6 2.0 449.0 3,957.5 14,872.0 206.5 81.8 15,160.2 19,117.8

1,678.3 839.2 687.6 2.0 11.1 3,218.2 14,782.8 196.2 81.8 15,060.7 18,278.9

1,852.8 926.4 687.6 2.0 320.5 3,789.3 14,694.1 186.3 81.8 14,962.2 18,751.4

579.4 304.8 .0 907.8 1,439.9 1.3 3,233.1 9,682.4 .0 121.7 9,804.1 5,806.9 (1,839.9) 112.9 4,079.9 .4 4,080.3 17,117.5

341.8 408.6 4.3 880.9 1,836.7 2,883.7 7.5 6,363.6 8,112.8 .0 .0 8,112.8 5,806.9 (2,708.4) 154.9 3,253.4 .5 3,253.9 17,730.3

843.4 626.7 79.7 1,717.6 1,628.0 3,037.6 2.6 7,935.7 6,404.9 .0 .0 6,404.9 5,806.9 (2,531.9) 150.9 3,425.9 .4 3,426.3 17,766.9

1,142.8 761.9 79.7 1,067.5 1,628.0 4,037.6 2.6 8,720.1 5,837.4 .0 .0 5,837.4 5,806.9 (1,398.0) 150.9 4,559.8 .4 4,560.2 19,117.8

1,258.8 839.2 79.7 1,117.5 407.0 3,835.7 2.6 7,540.4 4,720.0 .0 .0 4,720.0 5,806.9 60.3 150.9 6,018.1 .4 6,018.5 18,278.9

1,389.6 926.4 79.7 1,117.5 407.0 3,452.1 2.6 7,374.9 3,602.5 .0 .0 3,602.5 5,806.9 1,815.9 150.9 7,773.7 .4 7,774.1 18,751.4

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML)

Indicators

Indicators Grey cement Capacity '000 MT Sales '000 MT Capacity utilization Clinker Capacity '000 MT Sales '000 MT Capacity utilization Sales growth Earning growth Gross profit margin Operating margin Net margin Total debt Tk. MM Debt/Total equity Effective tax rate Per share figures Number of shares (MM) Earning per share (EPS) Dividend per share Payout ratio Return on equity Return on assets Book value per share 2007 1,500 335 22% 2008 1,200 748 62% 2009E 1,200 900 75% 2010E 1,200 990 83% 2011E 1,200 1,089 91% 2012E 1,200 1,198 100%

1,150 927 81% NM NM NM NM NM 13,714.1 421% 20%

1,150 651 57% 159% NM 40% 35% 3% 12,788.1 373% 64%

1,150 550 90% 23% 542% 40% 34% 15% 12,570.5 276% 30%

1,150 490 98% 10% 29% 40% 34% 17% 10,080.1 167% 30%

1,150 424 98% 10% 20% 41% 34% 19% 8,579.1 110% 30%

1,150 351 98% 11% 17% 41% 34% 20% 6,426.0 65% 30%

58.1 -18.88x 0.00x 0% -34% -6% 56.04

58.1 3.04x 0.00x 0% 5% 1% 59.00

58.1 19.53x 0.00x 0% 25% 6% 78.53

58.1 25.11x 0.00x 0% 24% 8% 103.64

58.1 30.23x 0.00x 0% 23% 9% 133.88

58.1 35.27x 0.00x 0% 21% 11% 169.15

Lafarge Surma Cement Ltd. (DSE, CSE: LAFSURCEML) IMPORTANT DISCLOSURES

Analyst Certification: Each research analyst and research associate who authored this document and whose name appears herein certifies that the recommendations and opinions expressed in the research report accurately reflect their personal views about any and all of the securities or issuers discussed therein that are within the coverage universe. Disclaimer: Estimates and projections herein are our own and are based on assumptions that we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any security. As it acts for public companies from time to time, BRAC-EPL may have a relationship with the above mentioned company(s). This report is intended for distribution in only those jurisdictions in which BRAC-EPL is registered and any distribution outside those jurisdictions is strictly prohibited. Compensation of Analysts: The compensation of research analysts is intended to reflect the value of the services they provide to the clients of BRAC-EPL. As with most other employees, the compensation of research analysts is impacted by the overall profitability of the firm, which may include revenues from corporate finance activities of the firm's Corporate Finance department. However, Research analysts' compensation is not directly related to specific corporate finance transaction. General Risk Factors: BRAC-EPL will conduct a comprehensive risk assessment for each company under coverage at the time of initiating research coverage and also revisit this assessment when subsequent update reports are published or material company events occur. Following are some general risks that can impact future operational and financial performance: (1) Industry fundamentals with respect to customer demand or product / service pricing could change expected revenues and earnings; (2) Issues relating to major competitors or market shares or new product expectations could change investor attitudes; (3) Unforeseen developments with respect to the management, financial condition or accounting policies alter the prospective valuation; or (4) Interest rates, currency or major segments of the economy could alter investor confidence and investment prospects. BRAC EPL Investments Capital Markets Group

Aminul Haque Md. Monirul Islam Parvez Morshed Chowdhury Ali Imam Asif Khan Md. Ashfaque Alam Khandakar Safwan Saad BRAC EPL Research www.bracepl.com WW Tower (8th Floor) 68 Motijheel C/A, Dhaka-1000 Tel: +88 02 9514731-40 Fax: +88 02 7116418 E-Mail: research@bracepl.com Head of Capital Markets Research Analyst Research Analyst Investment Analyst Investment Analyst Research Associate Research Associate amin@bracepl.com monirul@bracepl.com parvez@bracepl.com imam@bracepl.com asif@bracepl.com ashfaque@bracepl.com safwan@bracepl.com 01730317802 01730357150 01730357154 01730357153 01730357158 01671020956 01911420549

Vous aimerez peut-être aussi

- Decision Model Using ExcelDocument236 pagesDecision Model Using Excelসামিউল ইসলাম রাজু100% (3)

- Judge Kaplan's Ruling in Lehman Brothers LitigationDocument110 pagesJudge Kaplan's Ruling in Lehman Brothers LitigationDealBookPas encore d'évaluation

- EduCBA - Equity Research TrainingDocument90 pagesEduCBA - Equity Research TrainingJatin PathakPas encore d'évaluation

- Lafarge Cement MainDocument88 pagesLafarge Cement MainAnonymous okVyZFmqqX100% (1)

- Key Attributes of The World-Class Information Technology OrganizationDocument7 pagesKey Attributes of The World-Class Information Technology OrganizationMichael Esposito100% (1)

- Cement Industry in BDDocument26 pagesCement Industry in BDMahbubur Rahman75% (4)

- Supply Chain Management in The Cement IndustryDocument8 pagesSupply Chain Management in The Cement IndustryRamakrishna Reddy100% (1)

- Amtrak Dining RFPDocument54 pagesAmtrak Dining RFPdgabbard2Pas encore d'évaluation

- Masing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Document2 pagesMasing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Atty. Providencio AbraganPas encore d'évaluation

- Mrs Fields CookiesDocument12 pagesMrs Fields CookiesAditya Maheshwari100% (2)

- Shree CementDocument30 pagesShree Cementsushant_vjti17Pas encore d'évaluation

- Capital Structure Analysis of Cement Industry in BangladeshDocument19 pagesCapital Structure Analysis of Cement Industry in Bangladeshamanur rahmanPas encore d'évaluation

- Market Structure in Indian Cement IndustryDocument7 pagesMarket Structure in Indian Cement IndustryrajyalakshmiPas encore d'évaluation

- 2.SK EO SK Inventory SK Pob. Zone 3Document3 pages2.SK EO SK Inventory SK Pob. Zone 3Barangay BotongonPas encore d'évaluation

- Acc CementDocument60 pagesAcc Cementsahib21Pas encore d'évaluation

- Maha Cements - Pon Pure Logistics by VenkatDocument27 pagesMaha Cements - Pon Pure Logistics by VenkatVenkata SubramanianPas encore d'évaluation

- Project Final - India CementsDocument73 pagesProject Final - India Cementsabhisekparija86% (7)

- Ultratech Cement AnalysisDocument11 pagesUltratech Cement AnalysisANAND KHISMATRAO100% (1)

- ACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFDocument41 pagesACCA - AA Audit and Assurance - CBEs - 18-19 - AA - CBE Mock - 1.BPP PDFCami50% (2)

- Project Work Cash Flow StatementDocument8 pagesProject Work Cash Flow StatementSiva RohithPas encore d'évaluation

- Devops Case StudiesDocument46 pagesDevops Case StudiesAlok Shankar100% (1)

- RBSA Indian Cement Industry AnalysisDocument18 pagesRBSA Indian Cement Industry AnalysisPuneet Mathur100% (1)

- SAP LE Warehouse Management Transaction CodesDocument12 pagesSAP LE Warehouse Management Transaction CodesGopi Krishna MurthyPas encore d'évaluation

- 162-Cement Industry in IndiaDocument33 pages162-Cement Industry in Indiapiyushbhatia10_28338100% (2)

- Erp Vendor Directory v4 0Document118 pagesErp Vendor Directory v4 0Melina MelinaPas encore d'évaluation

- Binani Cement Research ReportDocument11 pagesBinani Cement Research ReportRinkesh25Pas encore d'évaluation

- Report On Cement Industry in India By: Shobhit ChandaDocument13 pagesReport On Cement Industry in India By: Shobhit ChandaPrasanta DebnathPas encore d'évaluation

- Cement Industry in IndiaDocument19 pagesCement Industry in IndiaShobhit Chandak100% (14)

- Cement IndustryDocument18 pagesCement Industryvasanthamsri100% (1)

- HeidelbergDocument11 pagesHeidelbergTaqsim E RabbaniPas encore d'évaluation

- A Report On Swot Analysis and Pest Analysis of Birla GroupDocument5 pagesA Report On Swot Analysis and Pest Analysis of Birla Groupjustinlanger4100% (5)

- CC CC CC C !""#$ %&' (!""!) (CC '&&+ '&!&) (Document4 pagesCC CC CC C !""#$ %&' (!""!) (CC '&&+ '&!&) (Rahat Ul AminPas encore d'évaluation

- Cement Industry in BangladeshDocument6 pagesCement Industry in BangladeshNaim Hasan100% (2)

- Case Study - Valuation of Ultra Tech CementDocument26 pagesCase Study - Valuation of Ultra Tech CementKoushik BiswasPas encore d'évaluation

- "Managerial Economics" Ambuja Cements: 2005-2010financial AnalysisDocument23 pages"Managerial Economics" Ambuja Cements: 2005-2010financial Analysisnamankapoor27Pas encore d'évaluation

- Cement Industry of BangladeshDocument22 pagesCement Industry of BangladeshAfrin Tonni33% (3)

- Planning Comision SummaryDocument11 pagesPlanning Comision Summarykumud_nishadPas encore d'évaluation

- Demerge To Merge: The Case of Grasim: January 2010Document16 pagesDemerge To Merge: The Case of Grasim: January 2010Ashu KhandelwalPas encore d'évaluation

- Kafle Report 1Document71 pagesKafle Report 1arjun kaflePas encore d'évaluation

- Grasim & L&TDocument41 pagesGrasim & L&TSuchi Patel0% (1)

- Assignment On Fundamental Analysis Acc CompanyDocument5 pagesAssignment On Fundamental Analysis Acc CompanyDevika SuvarnaPas encore d'évaluation

- An Environmental Scanning Report On Cement IndustryDocument20 pagesAn Environmental Scanning Report On Cement IndustrySatyajeet SumanPas encore d'évaluation

- ACC LTD.: Investment RationaleDocument0 pageACC LTD.: Investment Rationalespatel1972Pas encore d'évaluation

- Industry Background and Current ScenarioDocument2 pagesIndustry Background and Current ScenarioShristy SinghPas encore d'évaluation

- UltraTech Cement LTD Financial AnalysisDocument26 pagesUltraTech Cement LTD Financial AnalysisSayon DasPas encore d'évaluation

- Ambuja Cements: Report by V Niraj AdityaDocument5 pagesAmbuja Cements: Report by V Niraj AdityaBell BottlePas encore d'évaluation

- LNT Vs Grasim Full DossierDocument108 pagesLNT Vs Grasim Full Dossierbiswajit0% (1)

- Ambuja Main FileDocument60 pagesAmbuja Main Filemicropoint2524Pas encore d'évaluation

- Cement Industry in India PDFDocument19 pagesCement Industry in India PDFVrushabh ShelkarPas encore d'évaluation

- Analysis of The Indian Cement IndustryDocument19 pagesAnalysis of The Indian Cement Industryashish sawantPas encore d'évaluation

- Lafarge Cement MainDocument88 pagesLafarge Cement MainSagor AhmedPas encore d'évaluation

- Semester ProjectDocument6 pagesSemester Projectmuhammad mubashirPas encore d'évaluation

- Roll No 8 (PGDM - Comm) - Value Chain Analysis - Ultra Tech CementsDocument8 pagesRoll No 8 (PGDM - Comm) - Value Chain Analysis - Ultra Tech CementsanuragmahendraPas encore d'évaluation

- Equity Valuation of ACC LTDDocument12 pagesEquity Valuation of ACC LTDAbhishek GuptaPas encore d'évaluation

- Cement IndustryDocument57 pagesCement Industryruchir_srivastava_26Pas encore d'évaluation

- Group01 - End Term ProjectDocument35 pagesGroup01 - End Term ProjectSiddharth GuptaPas encore d'évaluation

- Indian Cement IndustryDocument2 pagesIndian Cement Industryamitrajalwar5022Pas encore d'évaluation

- Accenture 2016 Shareholder Letter10 K006Document6 pagesAccenture 2016 Shareholder Letter10 K006ziaa senPas encore d'évaluation

- India Symposium IBEF Sectoral Reports CementDocument32 pagesIndia Symposium IBEF Sectoral Reports CementRitesh TayalPas encore d'évaluation

- Cement Industry AmbujaDocument21 pagesCement Industry Ambujaakhil janjirala100% (1)

- AssignmentDocument12 pagesAssignmenthafeez azizPas encore d'évaluation

- A Project Report Submitted To: Market Survey of Consumer Perception About Cement IndustryDocument36 pagesA Project Report Submitted To: Market Survey of Consumer Perception About Cement Industryriteshgautam77Pas encore d'évaluation

- Overview of Indian Cement Industry 2010Document17 pagesOverview of Indian Cement Industry 2010shubhav1988100% (2)

- Edited Project Fulll - Docx - 1524468476442 PDFDocument70 pagesEdited Project Fulll - Docx - 1524468476442 PDFsai suvasPas encore d'évaluation

- Cement World Summary: Market Values & Financials by CountryD'EverandCement World Summary: Market Values & Financials by CountryÉvaluation : 5 sur 5 étoiles5/5 (1)

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryD'EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Rubber Products for Mechanical Use World Summary: Market Values & Financials by CountryD'EverandRubber Products for Mechanical Use World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryD'EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesD'EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesPas encore d'évaluation

- A Strategic Analysis of the Construction Industry in the United Arab Emirates: Opportunities and Threats in the Construction BusinessD'EverandA Strategic Analysis of the Construction Industry in the United Arab Emirates: Opportunities and Threats in the Construction BusinessPas encore d'évaluation

- Quarterly Economic Update: June 2005Document26 pagesQuarterly Economic Update: June 2005সামিউল ইসলাম রাজুPas encore d'évaluation

- Cement Market Report On Southeast AsiaDocument3 pagesCement Market Report On Southeast Asiaসামিউল ইসলাম রাজুPas encore d'évaluation

- Data of Cement ProductionDocument7 pagesData of Cement Productionসামিউল ইসলাম রাজুPas encore d'évaluation

- The Demand Curve Facing A Competitive Firm The ...Document3 pagesThe Demand Curve Facing A Competitive Firm The ...BLESSEDPas encore d'évaluation

- LllllllolllDocument24 pagesLllllllolllAgustiar ZhengPas encore d'évaluation

- HSRPHR3Document1 pageHSRPHR3ѕᴀcнιn ѕᴀιnιPas encore d'évaluation

- Ghorahi Cement Industry Ltd.Document71 pagesGhorahi Cement Industry Ltd.सुबास अधिकारीPas encore d'évaluation

- Banking InformationDocument14 pagesBanking InformationIshaan KamalPas encore d'évaluation

- GB917 2 - Release 2 5 - V2 5Document218 pagesGB917 2 - Release 2 5 - V2 5Artur KiełbowiczPas encore d'évaluation

- RetailfDocument2 pagesRetailfAbhishek ReddyPas encore d'évaluation

- Intdiff Ltot Ldisrat Lusdisrat Lusprod LrexrDocument4 pagesIntdiff Ltot Ldisrat Lusdisrat Lusprod LrexrsrieconomistPas encore d'évaluation

- Vaya Group Organizational Culture White PaperDocument10 pagesVaya Group Organizational Culture White Paperapye1836Pas encore d'évaluation

- Grievance 1Document10 pagesGrievance 1usham deepika100% (1)

- Airline Alliance PDFDocument2 pagesAirline Alliance PDFSimran VermaPas encore d'évaluation

- National IP Policy Final 1EDocument11 pagesNational IP Policy Final 1EsandeepPas encore d'évaluation

- hrm4111 Recruitment and Selection Assignment Five Employment Contract Christina RanasinghebandaraDocument3 pageshrm4111 Recruitment and Selection Assignment Five Employment Contract Christina Ranasinghebandaraapi-3245028090% (1)

- The Ideal Essay ST Vs PLTDocument1 pageThe Ideal Essay ST Vs PLTAlisha HoseinPas encore d'évaluation

- Supernova Muhammad AliDocument19 pagesSupernova Muhammad AliZafar NawazPas encore d'évaluation

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 3Document5 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 3LaVida LocaPas encore d'évaluation

- Reference Form 2011Document473 pagesReference Form 2011LightRIPas encore d'évaluation

- Management Concepts - The Four Functions of ManagementDocument13 pagesManagement Concepts - The Four Functions of ManagementsanketPas encore d'évaluation

- Certif I CteDocument13 pagesCertif I CteJoielyn Dy DimaanoPas encore d'évaluation