Académique Documents

Professionnel Documents

Culture Documents

Investing in Fixed Deposits & Their Tax Implications

Transféré par

sridharDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Investing in Fixed Deposits & Their Tax Implications

Transféré par

sridharDroits d'auteur :

Formats disponibles

Investing in Fixed Deposits & their tax implications - Moneycontrol.

com APPS Android Tab | iPhone | iPad | ENGLISH | HINDI

11/23/2012

Type Here

News

REGISTER

SIGN IN

FEEDBACK

News

Home

Markets

Business

Mutual Funds

General News

IPO

Commodities

Stocks

Wealth

Portfolio

Messages

My TV

Tax

Fixed Income

Lifestyle

Property

Politics

SME

Legal

CNBC-TV18

Market Trends

Fund News

Personal Finance

Corporate Strategy

Moneycontrol News Fixed Income - Bank Deposits

Enter Company

GET QUOTE

Mon, Jun 11, 2012 at 12:18

Investing in Fixed Deposits & their tax implications

With interest rates almost at the peak, FDs are offering good returns of up to 10 11%. Financial advisor Satkam Divya guides us about the pros and cons of fixed deposits and their tax implications. Sbi Home loan Rates Recurring Deposits

Com quotes fromtop 10 Banks Choose Lowest Rate pare &Max Eligibility www.deal4loans.com/sbicompare Invest Sm Save Huge - ICICI Bank large investm Just all ents a plan away! ICICIbank.com/Recurring-Deposit

Ads by Google

Jolla says no to official Sailfish OS port for Nokia N9

Mumbai: Bharti Walmart suspends CFO, others Bigg Boss: I have never won anything, says Karishma

Source: Moneycontrol.com

SHARE . EMAIL . PRINT . A+

ABOUT THE EXPERT

Satkam Divya

Business Head, Rupeetalk.com

s debt instruments like Fixed Deposit (FDs) schemes have become more lucrative after cyclic increase in the policy rates by Reserve Bank of India (RBI), the investment in bank and corporate fixed deposits make a lot of sense, especially at this time. They are not only safe havens to park your money but also offering good returns of up to 10-11 per cent for 1-2 years. The interest rates are almost at the peak and there is a little hope of further increases.

Thanks to the inflation which is making mandatory requirement to increase the key policy rates. A steep increase in the key policy rates dent the huge liquidity enjoyed by the banks and they have to increase the interest rates to collect the money from the public. The following table provides list of FD rates of banks:

Institution

State Bank Of Patiala (SBP) Oriental Bank Of Commerce (OBC) Punjab and Sind Bank (PSB) Corporation Bank Dena Bank UCO Bank Indian Overseas Bank (IOB) IDBI Bank Allahabad Bank

Duration Rate (%) Min. Deposit

555 days 1 - 2 years 500 days 1 year 1 year 1 - 2 years 1 - 2 years 500 days 1 - 2 years 9.75 9.75 9.75 9.65 9.60 9.50 9.50 9.50 9.50 9.50 Below Rs. 1 crore Below Rs. 1 crore Below Rs. 1 crore Below Rs. 15 lakh Below Rs. 1 crore Below Rs. 5 crore Below Rs. 1 crore Below Rs. 1 crore Below Rs. 1 crore * Senior citizens would Below Rs. 15 lakh fetch 0.25 ' 0.50%

Most Popular Top News

"Islamic banking is a myth; RBI is right to reject it"

State Bank Of Travancore (SBT) 500 days additional.

Houseviews: 8 stocks that you must watch in today`s trade

Bank Deposits Vs Company Deposits

http://www.moneycontrol.com/news/fixed-income-bank-deposits/investingfixed-depositstheir-tax-implications_667363.html

Top 10 pending Bills to watch out for in winter session of Parliament

1/3

Investing in Fixed Deposits & their tax implications - Moneycontrol.com

11/23/2012

Here, as we about bank and corporate Fixed Deposit schemes , it becomes important for us to know the difference between the two so that we can take the right decision as far as investment in FDs are concerned. The prime difference between the two is that though corporate FDs offer 2-3 per cent higher interest rate per annum, they are not as safe as bank FDs. Bank deposits are generally safe investments because FDs up to Rs 1 lakh are insured under the Deposit Insurance & Credit Guarantee Scheme of India. Hence, it is important for us to ascertain the stability of the company, its track record of giving returns. To judge this, the simple way is to keep in mind the following points before investing in corporate FDs: What is the rating given to the company's fixed deposit scheme? These ratings given by credit rating agencies indicate the safety of the investments based on the number of criteria. Usually, AAA rating is considered safest. Company is issuing the fixed deposit to raise the money for its operations. Find out the liquidity of the company and its financial strength to repay at the time of maturity; otherwise, investors have issues on getting back their principal amount. Also, it is important to know that where you need to contact them to close the FD. Unlike banks, company FDs are not operated everywhere in the country. Read the complete terms and conditions of the FD and find out whether they allow the pre-close of the fixed deposit before the maturity. Company Fixed Deposits forms are available through various broking agencies or directly with the companies. The minimum investment in a Company Fixed deposit varies from company to company. Normally, the minimum investment is Rs.5,000. For individual investors, there is no upper limit. In case of recurring deposits, the minimum amount is normally Rs.100 per month.

Sudarshan Sukhani advises to go long; suggests stocks

Market may see new highs next year: Raamdeo Agrawal Hind Copper down 12% as stake sale at discount Mkt upmove was surprise; no recovery in near-term: Experts Hind Copper share sale price fixed at Rs 155/sh: Sources New pharma policy: How it impacts your wallet Share sale of Hind Copper, Blue Dart opens today

From DJ EU Officials Spain Aid Cap Of 100 Bn Euros 'should Be Enough'

Drawbacks

FDs are not 'liquid' investments. It means if you invest your money in FDs, you will not be able to withdraw it until it matures. Generally, if you need to remove your money before the maturity, you will be able to do so by either losing the interest that you were supposed to earn or paying charges on it. Besides this, a particular interest rate is decided at the time of investment. If the interest rate goes up while your money is invested, you will not be able to enjoy it on your investment. By investing in FD, you cannot beat inflation as the returns offered on bank FDs are still less than the rate of inflation and it may prove to be a futile investment exercise. The rate of return mentioned in FDs is pre-tax returns and tax amount has to be deducted from it.

The latest earning numbers FIRST on CNBC-TV18 Videos

Nov 23 2012, 15:23

Indian market attractive; bet on private banks: Amundi

- in FII View

Tax implications

When you open a fixed deposit account in the bank, the interest paid will be taxable income and the banker will deduct the tax at source and pay you the remaining income to your account. This process is called as Tax Deduction at Source (TDS). The interest income earned on any FD is taxable at the same tax slab as the customer is in. It will be added to his income in the year under the head 'Other Income'. However, if the interest earned on FD is more than Rs 10,000 annually, bank cut the TDS at the rate of 10 per cent. In this case, bank will also issue you a tax certificate, which you can show at the time of filing the income tax return. However, if you have not submitted the PAN number while opening the fixed deposit, 20% would be deducted as the TDS. On the other hand, if the total interest amount is up to Rs.10000, bank does not deduct tax on it. If the person is above 60, he/she can submit the Form 15H to avoid this TDS. For those, who are below the age of 60 have to file Form 15G. For example, Mrs. X earns Rs.25000 from the interest in a year. She doesn't have any other income and housewife. She is eligible to file the Form 15G and give it to the bank before March 31. In this case, the tax will not be deducted from the source. One important point is that, these forms have to be submitted in each financial year to avoid the tax deduction. It is advisable to submit in the beginning of the year. The NRI's, who earn interest on their NRO's account, are subject to 30% TDS.

Nov 23 2012, 10:42

Crucial for Nifty to cross 5680: Anil Manghnani

- in Technicals

Conclusion

A fixed deposit is best suited for those investors who want to invest a lump sum of money at a low risk and are comfortable committing it for a fixed period of time, and earn a rate of interest on the same. - Satkam Divya The author is the Business Head ' Rupeetalk.com

http://www.moneycontrol.com/news/fixed-income-bank-deposits/investingfixed-depositstheir-tax-implications_667363.html 2/3

Investing in Fixed Deposits & their tax implications - Moneycontrol.com

11/23/2012

' Rupeetalk.com offers you to search, compare and apply for best deals on Home Loans , Personal Loans , Credit Cards , Demat Accounts and Car Loans from leading banks and NBFCs. Also read Expert Reviews , Case Studies , Articles , Guides and Tips on Personal Finance products.'

Buy Greaves Cotton; target of Rs 92: IIFL Trading cautious after Greek deal delay

4 BHK Apts in Noida Ext.

Luxurious Apartm @ 3250/sq.ft. Book the DreamHom for Your ents e Fam earthinfra.in/4-BHK-Apartments ily

SBl Best Pension Plan

Invest Rs 4.16K p.m get back 43 lacs. Get . Quote SBl.PolicyMagic.co.in

Ads by Google

Post Your Comments

With interest rates at the peak, will you invest in Fixed Deposit?

Type your message here

Follow moneycontrol.com Explore Moneycontrol

STOCKS A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | Others MUTUAL FUNDS A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

News | Markets | IPO | Technicals | Mutual Fund | Commodities | Best Portfolio Manager | Bse Sensex | Bombay Stock Exchange | Share Market Live | Commodities Price | Silver Price/Rate in India | Gold Price/Rate in India | Crude Oil | USD to INR | National Stock Exchange | Bank Fixed Deposits | Company Fixed Deposits | Small Savings Schemes | Bonds | Unit Linked Insurance Plans (ULIPs) | | Budget: 2008, 2009, 2010, 2011, 2012 | Intuit Money Manager | RBI Credit Policy | News Archive | BSE A Group Companies | BSE B Group Stocks | Financial Glossary | Message Board | Moneybhai | Latest Movie Songs | Sur Kshetra | Bigg Boss Season 6 | Business Yellow Pages | India's Premiere Technology Guide | History India | Latest News | IBNLive News | News in Hindi | Cricket News | Latest Videos | Business Technology News & Videos | Restaurants in Hyderabad | Ranbaxy Laboratories | Hindustan Copper | BSE Sensex | IKEA | Wal-Mart | Kolar Gold Fields | Suzlon Energy | Initial public offering | Securities and Exchange Board of India | HSBC

Site Map | About Us | Contact Us | Advertise | Bookmark | Disclaimer | Privacy Statement | Terms of Use | Careers

Copyright e-Eighteen.com Ltd. All rights reserved. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express written permission of moneycontrol.com is prohibited.

http://www.moneycontrol.com/news/fixed-income-bank-deposits/investingfixed-depositstheir-tax-implications_667363.html

3/3

Vous aimerez peut-être aussi

- Guidelines For Pre Submission Seminar-LPUDocument1 pageGuidelines For Pre Submission Seminar-LPUsridharPas encore d'évaluation

- IIITDM Yoga HandbookDocument24 pagesIIITDM Yoga HandbookBenoit HsuPas encore d'évaluation

- Lower Limb Evaluation Format Lower Limb Fracture Assesstment FormDocument12 pagesLower Limb Evaluation Format Lower Limb Fracture Assesstment FormsridharPas encore d'évaluation

- 01-13 2 End Diastolic Pneumatic Compression Boot As A Treatment of PVD or LymphedemaDocument4 pages01-13 2 End Diastolic Pneumatic Compression Boot As A Treatment of PVD or LymphedemasridharPas encore d'évaluation

- Liver Enzymes (AST-ALT)Document3 pagesLiver Enzymes (AST-ALT)sridharPas encore d'évaluation

- PNFDocument39 pagesPNFsridhar100% (1)

- Hepatitis B VirusDocument47 pagesHepatitis B VirusDiah Puspita RiniPas encore d'évaluation

- Patterns of PNFDocument39 pagesPatterns of PNFsridhar100% (1)

- Brachial Plexus InjuryDocument43 pagesBrachial Plexus InjurysridharPas encore d'évaluation

- Inflammatory My Opa ThiesDocument10 pagesInflammatory My Opa ThiessridharPas encore d'évaluation

- Nerve Conduction Velocity StudiesDocument12 pagesNerve Conduction Velocity StudiessridharPas encore d'évaluation

- 10-11 Gbs General Neuro 2nd YearDocument29 pages10-11 Gbs General Neuro 2nd YearsridharPas encore d'évaluation

- Brachial Plexus InjuryDocument43 pagesBrachial Plexus InjurysridharPas encore d'évaluation

- Adverse Reaction To DrugsDocument22 pagesAdverse Reaction To DrugssridharPas encore d'évaluation

- Ankle MobilizationDocument16 pagesAnkle MobilizationsridharPas encore d'évaluation

- Brachial Plexus InjuryDocument43 pagesBrachial Plexus InjurysridharPas encore d'évaluation

- College of NursingDocument1 pageCollege of NursingsridharPas encore d'évaluation

- Vinayagar Agaval - Avvaiyar PDFDocument17 pagesVinayagar Agaval - Avvaiyar PDFkckejaman100% (1)

- Imaging Findings and Clinical Correlation: Cerebral Herniation SyndromesDocument64 pagesImaging Findings and Clinical Correlation: Cerebral Herniation SyndromessridharPas encore d'évaluation

- Sudden Infant Death SyndromeDocument20 pagesSudden Infant Death SyndromesridharPas encore d'évaluation

- Clavicle FractureDocument9 pagesClavicle FracturesridharPas encore d'évaluation

- Thoracic Spine AnatomyDocument5 pagesThoracic Spine AnatomysridharPas encore d'évaluation

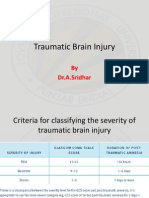

- Traumatic Brain InjuryDocument26 pagesTraumatic Brain InjurysridharPas encore d'évaluation

- Imaging Findings and Clinical Correlation: Cerebral Herniation SyndromesDocument64 pagesImaging Findings and Clinical Correlation: Cerebral Herniation SyndromessridharPas encore d'évaluation

- Tardieu ScaleDocument2 pagesTardieu ScalesridharPas encore d'évaluation

- Application FormatDocument2 pagesApplication FormatsridharPas encore d'évaluation

- Skanda Shasti KavachamDocument6 pagesSkanda Shasti KavachamsriramanaPas encore d'évaluation

- Clavicle FractureDocument4 pagesClavicle FracturesridharPas encore d'évaluation

- Windlass Effect Ankle JointDocument35 pagesWindlass Effect Ankle JointsridharPas encore d'évaluation

- Infra RedDocument7 pagesInfra RedsridharPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Turnaround Management An Overview For MBADocument36 pagesTurnaround Management An Overview For MBAlnpillai75% (4)

- Skull and Bones Prescott Bush Stole Geronimos RemainsDocument34 pagesSkull and Bones Prescott Bush Stole Geronimos RemainsGuy RazerPas encore d'évaluation

- Central Bank Vs Citytrust Banking CorpDocument8 pagesCentral Bank Vs Citytrust Banking CorpMorphuesPas encore d'évaluation

- Himalayan Bank Limited Internship ReportDocument152 pagesHimalayan Bank Limited Internship ReportAbhisheshBamPas encore d'évaluation

- Various Investment Avenues in IndiaDocument74 pagesVarious Investment Avenues in IndiaRakeshPas encore d'évaluation

- Basel3 QIS 202004 PDFDocument198 pagesBasel3 QIS 202004 PDFsh_chandraPas encore d'évaluation

- Quicksheet FRM Part IIDocument7 pagesQuicksheet FRM Part IITheodoros NikolaidisPas encore d'évaluation

- CBN 2013 Annual ReportDocument475 pagesCBN 2013 Annual ReportDzmitry HalubnichyPas encore d'évaluation

- Small Finance BankDocument9 pagesSmall Finance BankRohit SinghPas encore d'évaluation

- Brief History of Canara BankDocument35 pagesBrief History of Canara BankSambathkumar Madanagopal0% (1)

- Recto & Maceda LawDocument2 pagesRecto & Maceda LawJacqueline SyPas encore d'évaluation

- 61b8ba8bf3b4a552dd630e83 All UPSTOX SIGNEDDocument22 pages61b8ba8bf3b4a552dd630e83 All UPSTOX SIGNEDAtib InamdarPas encore d'évaluation

- Nameofwholesale AgentsnewDocument98 pagesNameofwholesale AgentsnewdeepakdeekshujmsPas encore d'évaluation

- NO Answer: FAQ For Unifi Mobile PostpaidDocument15 pagesNO Answer: FAQ For Unifi Mobile PostpaidSaufiPas encore d'évaluation

- FAC1502+Discussion+Class+Slides+2012+ +First+SemesterDocument97 pagesFAC1502+Discussion+Class+Slides+2012+ +First+SemestergizzarPas encore d'évaluation

- Preparation of Nso AmmendedDocument19 pagesPreparation of Nso AmmendedahmadPas encore d'évaluation

- Currency Swaps ExplainedDocument15 pagesCurrency Swaps ExplainedKiran NayakPas encore d'évaluation

- Liquidity Management Techniques: Pooling and Cash ConcentrationDocument30 pagesLiquidity Management Techniques: Pooling and Cash Concentrationdarshanzamwar0% (1)

- Details of Functional Heads at Corporate LevelDocument3 pagesDetails of Functional Heads at Corporate LevelSingh AnupPas encore d'évaluation

- A Plain English Guide To Financial TermsDocument42 pagesA Plain English Guide To Financial TermssyedmanPas encore d'évaluation

- A Report by Shivani SinghDocument8 pagesA Report by Shivani Singh1820 GAURAV MISHRAPas encore d'évaluation

- Capital Market Instruments and FDIDocument47 pagesCapital Market Instruments and FDIakash deepPas encore d'évaluation

- Annuity, Simple and Compuond InterestDocument61 pagesAnnuity, Simple and Compuond Interestmarites abanadorPas encore d'évaluation

- Eurocity Corporate Structure 2Document6 pagesEurocity Corporate Structure 2simon1608Pas encore d'évaluation

- Zangi TestDocument20 pagesZangi TestEng Hinji RudgePas encore d'évaluation

- Guide to Living in Stavanger, NorwayDocument35 pagesGuide to Living in Stavanger, NorwayM Mohsin Chowdhury100% (1)

- World Bank: Selection OF ConsultantDocument30 pagesWorld Bank: Selection OF ConsultantRadhai senthil kumaranPas encore d'évaluation

- Vat Act-1991 (English Version)Document39 pagesVat Act-1991 (English Version)enamul100% (2)

- AR Pre-License Fearless Math Ebook PDFDocument155 pagesAR Pre-License Fearless Math Ebook PDFErika MacLeodPas encore d'évaluation

- "Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local BankDocument3 pages"Foreign Currency Deposit Unit" or "FCDU" Shall Refer To That Unit of A Local Bankalimoya13Pas encore d'évaluation