Académique Documents

Professionnel Documents

Culture Documents

Press 20121228e

Transféré par

ran2013Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Press 20121228e

Transféré par

ran2013Droits d'auteur :

Formats disponibles

Communications Department

30, Janadhipathi Mawatha, Colombo 01, Sri Lanka. Tel : 2477424, 2477423, 2477311 Fax: 2346257, 2477739 E-mail: dcommunications@cbsl.lk, communications@cbsl.lk Web: www.cbsl.gov.lk

Press Release

Issued By Date

Economic Research Department 28.12.2012

External Sector Performance November 2012 The declining trend in imports continued into November 2012, given the continued reduction in expenditure on imports of items such as gold, vehicles, and transport equipment, which have largely driven the decrease in import expenditure in recent months. Export earnings also recorded a further drop in November 2012, with However, reflecting seasonal

subdued global economic conditions persisting.

demand, earnings from exports of items such as garments, tea, gems and jewellery as well as leather, travel goods and footwear recorded positive growth for November 2012. Following these developments, the cumulative deficit in the trade account of the balance of payments recorded a year-on-year decline for the first eleven months of 2012, having steadily declined since April this year. Expenditure on imports declined across all major categories of imports. Expenditure on consumer goods declined in November 2012 as import expenditure in relation to both food and non-food items declined. Import expenditure on intermediate goods declined marginally by 0.3 per cent, year-on-year, in November 2012, despite an increase in expenditure on imports of fuel and textiles, which together usually

account for more than a third of the total import bill. Lower import expenditure in relation to gold and fertilizer mainly drove the decline in import expenditure in respect of intermediate goods. Meanwhile, lower expenditure on imports of

machinery and equipment as well as transport equipment resulted in the investment goods category recording a year-on-year decline in import expenditure in November 2012. With respect to exports, tea exports fetched favourable prices this year and therefore helped buoy export earnings. With earnings from exports of other categories of agricultural exports declining however, earnings from agricultural exports recorded a drop in November 2012, on a year-on-year basis. Industrial exports continued to record a decline on a year-on-year basis since March this year. However, with imports of textiles recording a growth in November, exports of garments are likely to record favourable performance in the ensuing months too, thus helping moderate the decline in export earnings observed in recent months.

With respect to the services account and current transfers in the BOP, earnings from tourism and workers remittances continued to grow at a healthy rate. Tourist arrivals in November 2012 increased by 20.1 per cent to 109,202, with arrivals during the first eleven months of 2012 totalling 883,353 reflecting a growth of 16.5 per cent. Earnings from tourism in November 2012 grew at a healthy rate of 30.1 per cent compared to the corresponding month of 2011, to US dollars 114.7 million. Earnings

from tourism during the first eleven months of 2012 increased by 23 per cent year-onyear to US dollars 905.3 million. With the record high earnings from tourism in

November 2012, and similar expectations for December 2012, earnings from tourism in 2012 are expected to be well above the level recorded for 2011, with tourist arrivals expected to be in the proximity of 1 million. Inflows on account of workers

remittances increased at a rate of more than 12.7 per cent, year-on-year, in November 2012. For the first eleven months of 2012, workers remittances recorded a growth of 17.1 per cent, year-on-year, and amounted to US dollars 5,432 million. Higher inflows in terms of tourism earnings and workers remittances are expected to increase foreign exchange liquidity in the market, thereby strengthening the external value of the rupee. Meanwhile, substantial foreign currency inflows have been recorded in the capital and financial account of the BOP during the first eleven months of 2012. Foreign investments at the Colombo Stock Exchange (CSE) increased to US dollars 280 million, on a net basis, by end November 2012, while there have been a significant increase in foreign investments in Government securities, with net inflows to Treasury bills and Treasury bonds during the first eleven months of 2012 amounting to US dollars 833 million. Meanwhile, long-term loans obtained by the government during the first ten months of 2012 amounted to US dollars 2,614 million. In

addition, long-term borrowings by commercial banks during January-November 2012 amounted to US dollars 973 million. Foreign Direct Investment (FDI), including foreign loans obtained by BOI companies, amounted to US dollars 615 million for the first nine months of 2012, and more inflows are expected to have materialised during the remainder of the year. Gross official reserves amounted to US dollars 6,490 million by end November 2012, while total international reserves, which include gross official reserves and foreign assets of commercial banks, amounted to US dollars 8,059 million. In terms of

months of imports, gross official reserves were equivalent to 4.1 months of imports by end November 2012, while total reserves were equivalent to 5 months of imports.

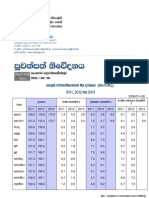

Table 1. A Summary of External Sector Performance November 2012 (a)

Category

November November Growth Jan. Nov. Jan. Nov. Growth 2011 2012 November 2011 2012 Jan. Nov. US$ mn US$ mn (%) US$ mn US$ mn (%) 885.8 206.7 125.2 676.1 347.7 75.8 27.6 2.4 1,986.4 330.9 137.5 193.5 1,179.0 489.6 193.2 470.2 255.4 124.2 90.2 827.6 190.2 126.0 632.8 363.9 75.5 31.0 3.7 1,820.5 235.5 98.2 137.3 1,175.3 581.3 204.0 409.1 230.1 55.8 122.9 -6.6 -8.0 0.6 -6.4 4.6 -0.4 12.0 58.3 -8.4 -28.8 -28.6 -29.0 -0.3 18.7 5.6 -13.0 -10.0 -55.0 36.2 9,625.4 2,316.6 1,357.9 7,271.8 3,809.1 804.3 316.5 31.0 18,393.0 3,328.3 1,434.5 1,893.9 11,114.9 4,306.1 2,118.8 3,904.4 1,943.9 969.6 987.4 8,991.4 2,114.1 1,273.6 6,727.5 3,633.3 782.7 263.2 52.0 17,574.3 2,755.0 1,192.3 1,562.7 10,701.6 4,672.5 2,072.6 4,090.9 2,037.3 933.9 1,115.7 -6.6 -8.7 -6.2 -7.5 -4.6 -2.7 -16.8 68.1 -4.5 -17.2 -16.9 -17.5 -3.7 8.5 -2.2 4.8 4.8 -3.7 13.0

Exports Of which Agricultural Products of which, Tea Industrial Products of which, Textiles and garments Rubber products Food, beverages and tobacco Mineral Products Imports Of which Consumer Goods of which, Food and beverages Other consumer goods Intermediate Goods of which, Petroleum Textile and textile articles Investment Goods of which, Machinery and equipment Transport equipment Building materials

-1,100.7 -992.9 -9.8 -8,767.6 -8,582.9 -2.1 Balance of Trade Workers Remittances 436.0 491.2 12.7 4,638.7 5,432.0 17.1 FDI (b) 679.3 614.7 -9.4 Portfolio Investments (Net) -3.4 11.8 -157.0 280.3 Commercial Banks Long-term Foreign Currency Borrowings 973.0 Earnings from Tourism 88.2 114.7 30.1 735.7 905.3 23.0 Inflows to the Government (c) 369.8 310.1 -16.1 3,761.7 4,834.9 28.5 of which, Treasury Bills and Bonds 48.2 143.2 197.4 914.7 2,097.6 129.3 Long term loans 281.4 153.5 -45.5 2,701.2 2,613.7 -3.2 (a) Provisional (b) FDI inflows, including foreign loans to BOI companies, recorded for the first nine months of each year (c) Inflows to the Government are recorded for October each year and include capital and current transfers to the government, inflows from sale of Treasury Bills and Treasury Bonds and long term loans of the Government

Vous aimerez peut-être aussi

- National Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResilienceD'EverandNational Strategies for Carbon Markets under the Paris Agreement: Current State, Vulnerabilities, and Building ResiliencePas encore d'évaluation

- Middle East and North Africa Quarterly Economic Brief, July 2013: Growth Slowdown Extends into 2013D'EverandMiddle East and North Africa Quarterly Economic Brief, July 2013: Growth Slowdown Extends into 2013Pas encore d'évaluation

- Press 20130402eDocument4 pagesPress 20130402eRandora LkPas encore d'évaluation

- Press 20130924eDocument7 pagesPress 20130924eRandora LkPas encore d'évaluation

- Press 20140325eDocument7 pagesPress 20140325eRandora LkPas encore d'évaluation

- Press 20130719eDocument6 pagesPress 20130719eRandora LkPas encore d'évaluation

- Press Release: External Sector Performance - July 2014Document7 pagesPress Release: External Sector Performance - July 2014Randora LkPas encore d'évaluation

- U.S. Census Bureau U.S. Bureau of Economic AnalysisDocument50 pagesU.S. Census Bureau U.S. Bureau of Economic AnalysiscrennydanePas encore d'évaluation

- Press 20150123 PDFDocument7 pagesPress 20150123 PDFRandora LkPas encore d'évaluation

- Press 20141007e PDFDocument7 pagesPress 20141007e PDFRandora LkPas encore d'évaluation

- Mustard Garment Industry: 1. Remittance 2. Inflation 3. Exchange Rate 4. GDP GrowthDocument9 pagesMustard Garment Industry: 1. Remittance 2. Inflation 3. Exchange Rate 4. GDP GrowthTanjeemPas encore d'évaluation

- 2013-June 2013", We Are Interested in The Scenario of The Overall Economy of The Country. ToDocument8 pages2013-June 2013", We Are Interested in The Scenario of The Overall Economy of The Country. ToMohammad AsaduzzamanPas encore d'évaluation

- Guide to Understanding Balance of Payments (BoPDocument9 pagesGuide to Understanding Balance of Payments (BoPAkshaya VenugopalPas encore d'évaluation

- 01 Indian Mineral Industry &national EconomyDocument22 pages01 Indian Mineral Industry &national Economymujib uddin siddiquiPas encore d'évaluation

- Global Trade PracticesDocument32 pagesGlobal Trade PracticesGleny SequiraPas encore d'évaluation

- Press 20140505eDocument7 pagesPress 20140505eRandora LkPas encore d'évaluation

- ELI suggests Moldovan economic stabilization in 2013Document6 pagesELI suggests Moldovan economic stabilization in 2013Iulia Sirghi-ZolotcoPas encore d'évaluation

- Echap-07 International TradeDocument24 pagesEchap-07 International TradeRabmeetPas encore d'évaluation

- Indian Exports Jumped 6.7 P..Document1 pageIndian Exports Jumped 6.7 P..nambisamPas encore d'évaluation

- NBIE IIP October 2013 13 December 2013Document3 pagesNBIE IIP October 2013 13 December 2013Rajesh KatarePas encore d'évaluation

- Iii. The External Sector: Gradual Recovery in World TradeDocument6 pagesIii. The External Sector: Gradual Recovery in World TradeSeilanAnbuPas encore d'évaluation

- Printed Study Material for IAS ExamsDocument26 pagesPrinted Study Material for IAS Examskrishan palPas encore d'évaluation

- Update On Indian Economy, March 2013Document12 pagesUpdate On Indian Economy, March 2013megaacePas encore d'évaluation

- Unit - 5 India's Foreign TradeDocument53 pagesUnit - 5 India's Foreign TradeAashik k XavierPas encore d'évaluation

- Russia Recorded A Trade Surplus of 17742 USD Million in January 2013Document12 pagesRussia Recorded A Trade Surplus of 17742 USD Million in January 2013Tamrika TyagiPas encore d'évaluation

- Prospects 2012Document7 pagesProspects 2012IPS Sri LankaPas encore d'évaluation

- International Business - Floriculture Industry in Sri Lanka and World MarketDocument57 pagesInternational Business - Floriculture Industry in Sri Lanka and World Marketveeshma100% (3)

- ER 2013-01-2012 Yearend ReportDocument12 pagesER 2013-01-2012 Yearend ReportLyn EscanoPas encore d'évaluation

- Economic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsDocument28 pagesEconomic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsmadddiuPas encore d'évaluation

- Trends in IndiaDocument19 pagesTrends in IndiaManish JangidPas encore d'évaluation

- Trends in IMF PDFDocument8 pagesTrends in IMF PDFrajul836227Pas encore d'évaluation

- 0613 Travel and Tourism TextDocument9 pages0613 Travel and Tourism TextZoran H. VukchichPas encore d'évaluation

- IndiaDocument4 pagesIndiagenuineamitPas encore d'évaluation

- Trends in IndiaDocument2 pagesTrends in IndiaSamarthPas encore d'évaluation

- Economic Analysis of IndiaDocument120 pagesEconomic Analysis of Indiamonish147852Pas encore d'évaluation

- Monthly Economic Review February 2012Document35 pagesMonthly Economic Review February 2012mbirimifaraiPas encore d'évaluation

- Romania-EU 09 01 13 PDFDocument5 pagesRomania-EU 09 01 13 PDFviorikalunguPas encore d'évaluation

- Press Information Bureau: Only For Upscportal Premium MembersDocument5 pagesPress Information Bureau: Only For Upscportal Premium Members123F38262Pas encore d'évaluation

- Bangladesh's Balance of Payment SituationDocument13 pagesBangladesh's Balance of Payment SituationAtiqul Islam33% (3)

- Direction of Exports Imports in IndiaDocument12 pagesDirection of Exports Imports in IndiaVårúñ Fêêl D LúvPas encore d'évaluation

- Analysis On Export and Import Performance of India and Its Key DeterminantsDocument45 pagesAnalysis On Export and Import Performance of India and Its Key DeterminantsAbhishek M. APas encore d'évaluation

- CVD Hurts Nepali Garment Exports To India: January 10, 2012 (Nepal)Document13 pagesCVD Hurts Nepali Garment Exports To India: January 10, 2012 (Nepal)Ridhima PangotraPas encore d'évaluation

- Adb2014 Sri LankaDocument5 pagesAdb2014 Sri LankaRandora LkPas encore d'évaluation

- Economic and Fiscal Outlook 2014-USDocument40 pagesEconomic and Fiscal Outlook 2014-USMaggie HartonoPas encore d'évaluation

- Flash Comment: Latvia - March 11, 2013Document1 pageFlash Comment: Latvia - March 11, 2013Swedbank AB (publ)Pas encore d'évaluation

- Balance of Payments Report: Central Bank of The Republic of TurkeyDocument28 pagesBalance of Payments Report: Central Bank of The Republic of TurkeyKonna DiPas encore d'évaluation

- Matrade 2007Document14 pagesMatrade 2007Mohammad Hyder AliPas encore d'évaluation

- India's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayDocument6 pagesIndia's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayBikash Ranjan SatapathyPas encore d'évaluation

- Macro CIA3Document8 pagesMacro CIA3Srestha DasPas encore d'évaluation

- Vietnam: Key Facts and Economic IndicatorsDocument2 pagesVietnam: Key Facts and Economic IndicatorschensbhakarPas encore d'évaluation

- Iii. The External Sector: Global Trade Remains SubduedDocument7 pagesIii. The External Sector: Global Trade Remains Subduedanjan_debnathPas encore d'évaluation

- Country Strategy 2011-2014 MoldovaDocument21 pagesCountry Strategy 2011-2014 MoldovaBeeHoofPas encore d'évaluation

- India Foreign TradeDocument10 pagesIndia Foreign TradeJatin NarulaPas encore d'évaluation

- Trade Deficit, Exports, Imports and Foreign Investments DiscussedDocument4 pagesTrade Deficit, Exports, Imports and Foreign Investments DiscussedManthan Ketan ShahPas encore d'évaluation

- RBI Releases Preliminary BoP Data for Q3 FY2012-13Document6 pagesRBI Releases Preliminary BoP Data for Q3 FY2012-13mainu30Pas encore d'évaluation

- Balance of Payments and Comparative Analysis Between India and BhutanDocument30 pagesBalance of Payments and Comparative Analysis Between India and BhutanKshitij ShahPas encore d'évaluation

- Economic Impact of TT 2013 Annual Update - SummaryDocument4 pagesEconomic Impact of TT 2013 Annual Update - SummaryMaties LucianPas encore d'évaluation

- The Impact of Dubai Exports on Export Growth 2008-2011Document20 pagesThe Impact of Dubai Exports on Export Growth 2008-2011MuhammadJeffreyPas encore d'évaluation

- Prepared For: Dr. Zaid Bakht, Professor, MBA Program North South UniversityDocument11 pagesPrepared For: Dr. Zaid Bakht, Professor, MBA Program North South UniversityTanjeemPas encore d'évaluation

- India Foreign TradeDocument10 pagesIndia Foreign TradeJatin NarulaPas encore d'évaluation

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013Pas encore d'évaluation

- Daily Trade Journal - 27.02Document12 pagesDaily Trade Journal - 27.02ran2013Pas encore d'évaluation

- Daily Trade Journal - 06.03Document7 pagesDaily Trade Journal - 06.03ran2013Pas encore d'évaluation

- Current T Bill Press Release 25-03-2013Document1 pageCurrent T Bill Press Release 25-03-2013Randora LkPas encore d'évaluation

- Daily Trade Journal - 26.02Document13 pagesDaily Trade Journal - 26.02ran2013Pas encore d'évaluation

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013Pas encore d'évaluation

- Daily Trade Journal - 04.03Document7 pagesDaily Trade Journal - 04.03ran2013Pas encore d'évaluation

- Daily Exchange Rates-CommiDocument1 pageDaily Exchange Rates-Commiran2013Pas encore d'évaluation

- Daily Trade Journal - 05.03Document7 pagesDaily Trade Journal - 05.03ran2013Pas encore d'évaluation

- Daily Trade Journal - 28.02Document13 pagesDaily Trade Journal - 28.02ran2013Pas encore d'évaluation

- Legal OpinionDocument63 pagesLegal Opinionran2013Pas encore d'évaluation

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayPas encore d'évaluation

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013Pas encore d'évaluation

- Daily Trade Journal - 01.03Document7 pagesDaily Trade Journal - 01.03ran2013Pas encore d'évaluation

- CCPI Feb 2013Document2 pagesCCPI Feb 2013ran2013Pas encore d'évaluation

- NBF Sector - February 2013Document27 pagesNBF Sector - February 2013ran2013Pas encore d'évaluation

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayPas encore d'évaluation

- Daily Exchange Rates-Commi 28Document1 pageDaily Exchange Rates-Commi 28ran2013Pas encore d'évaluation

- Daily Trade Journal - 20.02Document12 pagesDaily Trade Journal - 20.02ran2013Pas encore d'évaluation

- DIAL-Earnings Note 2012-Faster and Cheaper Data-BUYDocument6 pagesDIAL-Earnings Note 2012-Faster and Cheaper Data-BUYran2013Pas encore d'évaluation

- Daily Trade Journal - 21.02Document12 pagesDaily Trade Journal - 21.02ran2013Pas encore d'évaluation

- Daily Trade Journal - 22.02Document12 pagesDaily Trade Journal - 22.02ran2013Pas encore d'évaluation

- CAL UPI Introduction - 20 Feb 2013Document8 pagesCAL UPI Introduction - 20 Feb 2013ran2013Pas encore d'évaluation

- Current T Bill Press Release 25-03-2013Document1 pageCurrent T Bill Press Release 25-03-2013Randora LkPas encore d'évaluation

- Results Update - Dec 2012 20.02Document15 pagesResults Update - Dec 2012 20.02ran2013Pas encore d'évaluation

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayPas encore d'évaluation

- Plantations Sector 19.02Document3 pagesPlantations Sector 19.02ran2013Pas encore d'évaluation

- Daily Trade Journal - 19.02Document13 pagesDaily Trade Journal - 19.02ran2013Pas encore d'évaluation

- Results Update - Dec 2012 19.02Document14 pagesResults Update - Dec 2012 19.02ran2013Pas encore d'évaluation

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayPas encore d'évaluation

- CSS Enlish Comprehension72 - 2012Document21 pagesCSS Enlish Comprehension72 - 2012jawadPas encore d'évaluation

- The Ethics of International Transfer Pricing: Messaoud MehafdiDocument17 pagesThe Ethics of International Transfer Pricing: Messaoud MehafdiFir BhiPas encore d'évaluation

- 09 - Chapter 1Document32 pages09 - Chapter 1city9848835243 cyberPas encore d'évaluation

- Turkey-Africa Relations 2016Document5 pagesTurkey-Africa Relations 2016David ShinnPas encore d'évaluation

- Unit 4 Economic EnvironmentDocument10 pagesUnit 4 Economic EnvironmentlaxmisunitaPas encore d'évaluation

- Retail Environment Notes 4Document8 pagesRetail Environment Notes 4MercyPas encore d'évaluation

- 2018 Global Cities Report EDITABLE PDFDocument16 pages2018 Global Cities Report EDITABLE PDFHarlika DawnPas encore d'évaluation

- MBFM4002Document4 pagesMBFM4002dinu dineshPas encore d'évaluation

- The Two-Gap Model of Economic Growth in Nigeria: Vector Autoregression (Var) ApproachDocument27 pagesThe Two-Gap Model of Economic Growth in Nigeria: Vector Autoregression (Var) ApproachyaredPas encore d'évaluation

- Telecommunications Investment Companies InsuranceDocument5 pagesTelecommunications Investment Companies InsuranceWalid Mohamed AnwarPas encore d'évaluation

- International Journal of Research in Management & Social Science Volume 2, Issue 3 (II) - July To September 2014 ISSN: 2322-0899Document185 pagesInternational Journal of Research in Management & Social Science Volume 2, Issue 3 (II) - July To September 2014 ISSN: 2322-0899empyrealPas encore d'évaluation

- M&A in KoreaDocument67 pagesM&A in Koreamtl71% (7)

- FDI PPT IBDocument11 pagesFDI PPT IBsonal jainPas encore d'évaluation

- A Study in Last Decade (2000-2010)Document25 pagesA Study in Last Decade (2000-2010)Ruchi Singh100% (2)

- Impact of Foreign Aid on Savings in NigeriaDocument80 pagesImpact of Foreign Aid on Savings in NigeriaTreasured PrincePas encore d'évaluation

- Service Operations Management Final NotesDocument49 pagesService Operations Management Final Notessanan inamdarPas encore d'évaluation

- Retail IndiaDocument25 pagesRetail Indiamahiroy100% (1)

- Assignment For LicensingDocument6 pagesAssignment For Licensingm tvlPas encore d'évaluation

- Retail Industry OverviewDocument30 pagesRetail Industry OverviewDivya PrabhuPas encore d'évaluation

- India's sustainable economic growth scenarioDocument44 pagesIndia's sustainable economic growth scenariojatt ManderPas encore d'évaluation

- 5e66f4870c370vol 36 No 2 April 2015Document96 pages5e66f4870c370vol 36 No 2 April 2015syed_sazidPas encore d'évaluation

- Training and Management in OrganizationDocument24 pagesTraining and Management in OrganizationZeeshanPas encore d'évaluation

- 2018 Bitc Annual Report PDFDocument126 pages2018 Bitc Annual Report PDFkago khachanaPas encore d'évaluation

- Eune Pakistan Was Established in 1994 by Industry TrendsettersDocument9 pagesEune Pakistan Was Established in 1994 by Industry TrendsettersMahmood SadiqPas encore d'évaluation

- Fdi FDocument40 pagesFdi Fdr_ashishvermaPas encore d'évaluation

- Chapter 5. Tax Policy: Policy Framework For Investment User'S ToolkitDocument40 pagesChapter 5. Tax Policy: Policy Framework For Investment User'S ToolkitRediet UttePas encore d'évaluation

- Business ManagementDocument19 pagesBusiness ManagementMiano MuturiPas encore d'évaluation

- Foreign Direct Investment in KoreaDocument168 pagesForeign Direct Investment in Koreamtl100% (4)

- Factors Attracting Mncs in IndiaDocument17 pagesFactors Attracting Mncs in Indiarishi100% (1)

- Africa China SEZs FinalDocument93 pagesAfrica China SEZs FinalMike WrightPas encore d'évaluation