Académique Documents

Professionnel Documents

Culture Documents

Annexure C Examples

Transféré par

Lee Ka FaiDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Annexure C Examples

Transféré par

Lee Ka FaiDroits d'auteur :

Formats disponibles

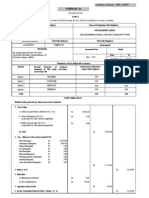

ANNEXURE 'C'

EXAMPLES .. SALARY

TAX YEAR: 2011

Note: For computation of tax liability, use tax calculator availabe at www.softax.com.pk Example 1 Mr. A is the employee of M/s ABC Ltd. Mr. A provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus House Rent Allowance Conveyance Allowance Utilities Allowance Medical Allowance Tax deducted by the employer u/s 149 including surcharge SOLUTION Mr. A M/s ABC Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic Salary Bonus House Rent Allowance Conveyance Allowance Utilities Allowance Medical Allowance Total Total Income Less: Zakat Taxable Income 300,000 20,000 150,000 12,000 30,000 36,000 18,805

Gross 300,000 20,000 150,000 12,000 30,000 36,000 548,000

Exempt 30,000 30,000

Taxable 300,000 20,000 150,000 12,000 30,000 6,000 518,000 518,000 518,000

Notes: 1. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable)

518,000 18,130 793 18,923 (18,805) 118

Example 2 Mr. B is the employee of M/s BCD Ltd. Mr. B provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Commission Furnished accommodation with annual value Utilities Allowance Medical Allowance Life insurance premium paid by the employer Tax deducted by the employer u/s 149 including surcharge SOLUTION Mr. B M/s BCD Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Commission Furnished accommodation Utilities allowance Medical allowance Life insurance premium paid by the employer Total Total Income Less: Zakat Taxable Income 300,000 20,000 125,000 150,000 30,000 36,000 12,000 36,285

Gross 300,000 20,000 125,000 150,000 30,000 36,000 12,000 673,000

Exempt 30,000 30,000

Taxable 300,000 20,000 125,000 150,000 30,000 6,000 12,000 643,000 643,000 643,000

Notes: 1. Annual value of accomodation is higher than 45% of Basic salary, so actual is taken. (Rule 4) 2. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) 3. Life insurance premium paid by the employer is taxable. COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable)

643,000 28,935 1,266 30,201 (36,285) (6,084)

Example 3 Mr. C is the employee of M/s CDE Ltd. Mr. C provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Commission Furnished accommodation with annual value Conveyance provided for personal use (Cost Rs. 400,000) Utilities Allowance Medical Allowance Tax deducted by the employer u/s 149 Tax paid on mobile phone u/s 236 Mr. C M/s CDE Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Commission Furnished accommodation Conveyance provided for personal use Utilities allowance Medical allowance Total Total Income Less: Zakat Taxable Income Gross 300,000 20,000 125,000 135,000 40,000 30,000 36,000 686,000 Exempt 30,000 30,000 Taxable 300,000 20,000 125,000 135,000 40,000 30,000 6,000 656,000 656,000 656,000 300,000 20,000 125,000 130,000 30,000 36,000 31,378 800

Notes: 1. Annual value of accomodation is less than 45% of Basic salary, so 45% of BS is taken. (Rule 4) 2. Vehicle provided for personal use, so 10% of the cost of vehicle is taken. [Rule 5(ii)] 3. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Less: Tax paid on mobile phone u/s 236 Net Tax payable / (refundable) 656,000 31,050 1,358 32,408 (31,378) (800) 230

Example 4 Mr. D is the employee of M/s DEF Ltd. Mr. D provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Un-furnished accommodation with annual value Conveyance provided for partial use (Cost Rs. 400,000) Conveyance Allowance Utilities Allowance Medical Allowance Leave Fare Assistance Recognized Provident Fund .. Employer's contribution Tax deducted by the employer u/s 149 Tax paid on mobile phone u/s 236 Tax paid with Motor vehicle tax SOLUTION Mr. D M/s DEF Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Unfurnished accommodation Conveyance provided for partial use Conveyance allowance Utilities allowance Medical allowance Leave Fare Assistance Provident Fund Employer's Contribution Total Total Income Less: Zakat Taxable Income Gross 400,000 30,000 180,000 20,000 36,000 45,000 45,000 20,000 40,000 816,000 Exempt 40,000 40,000 80,000 Taxable 400,000 30,000 180,000 20,000 36,000 45,000 5,000 20,000 736,000 736,000 736,000 400,000 30,000 160,000 36,000 45,000 45,000 20,000 40,000 42,960 1,200 1,000

Notes: 1. Annual value of accomodation is less than 45% of Basic salary, so 45% of Basic salary is taken. (Rule 4) 2. Vehicle provided for partial use, so 5% of the cost of vehicle is taken. [Rule 5(i)] 3. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) 4. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less. [Rule 3(a) Part I, 6th Schedule] COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Less: Tax paid on mobile phone u/s 236 Less: Tax paid with motor vehicle tax Net Tax payable / (refundable) 736,000 44,160 1,932 46,092 (42,960) (1,200) (1,000) 932

Example 5 Mr. E is the employee of M/s EFG Ltd. Mr. E provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Un-furnished accommodation (provided within factory premises of the employer) Conveyance provided for business use (Cost Rs. 400,000) Conveyance Allowance Utilities Allowance Medical Allowance Qualification Pay Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 500,000 Tax deducted by the employer u/s 149 Tax paid on mobile phone u/s 236 Tax deducted on cash withdrawal from bank u/s 231A SOLUTION Mr. E M/s EFG Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Unfurnished accommodation Conveyance provided for business use Conveyance allowance Utilities allowance Medical allowance Qualification pay Provident Fund Employer's Contribution Provident Fund Employee's Contribution Provident Fund Interest Total Total Income Less: Zakat Taxable Income 400,000 30,000 36,000 45,000 45,000 60,000 45,000 45,000 75,000 44,144 1,000 1,500

Gross 400,000 30,000 180,000 36,000 45,000 45,000 60,000 45,000 75,000 916,000

Exempt 40,000 40,000 75,000 155,000

Taxable 400,000 30,000 180,000 36,000 45,000 5,000 60,000 5,000 761,000 761,000 761,000

Notes: 1. Annual value of accomodation is not given, so 45% of Basic salary is taken as minimum value. (Rule 4) 2. Vehicle provided only for business use, so nothing should be taken in the income of employee. 3. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) 4. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 5. Provident fund employee's contribution, no treatment.

6 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule] COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Less: Tax paid on mobile phone u/s 236 Less: Tax deducted on cash withdrawal from bank u/s 231A Net Tax payable / (refundable)

761,000 48,300 2,113 50,413 (44,144) (1,000) (1,500) 3,769

Example 6 Mr. F is the employee of M/s FGH Ltd. Mr. F provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Un-furnished accommodation (provided within factory premises of the employer) House Rent Allowance Conveyance provided for partial use (Cost Rs. 500,000) Conveyance Allowance Utilities Allowance Medical reimbursement according to the terms of employment Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 700,000 Zakat paid under Zakat & Ushr Ordinance, 1980 Tax deducted by the employer u/s 149 SOLUTION Mr. F M/s FGH Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Unfurnished accommodation House rent allowance Conveyance provided for partial use Conveyance allowance Utilities allowance Medical reimbursement Provident Fund Employer's Contribution Provident Fund Employee's Contribution Provident Fund Interest Total Total Income Less: Zakat Taxable Income Gross 500,000 50,000 225,000 250,000 25,000 42,000 50,000 145,000 52,000 115,000 1,454,000 Exempt 145,000 50,000 112,000 307,000 Taxable 500,000 50,000 225,000 250,000 25,000 42,000 50,000 2,000 3,000 1,147,000 1,147,000 (5,000) 1,142,000 500,000 50,000 250,000 42,000 50,000 145,000 52,000 52,000 5,000 115,068

Notes: 1. Annual value of accomodation is not given, so 45% of Basic salary is taken as minimum value. (Rule 4) 2. Vehicle provided for partial use, so 5% of the cost of vehicle is taken. [Rule 5(i)] 3. Medical reibursement according to the terms of employment is exempt. (Clause 139, Part I, 2nd Sch.) 4. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 5. Provident fund employee's contribution, no treatment. 6 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule]

7. Zakat paid under Zakat & Ushr Ordinance, 1980 is deductible allowance (Section 60), so directly deducted from total income of the taxpayer. COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable) 1,142,000 114,200 4,996 119,196 (115,068) 4,128

Example 7 Mr. G is the employee of M/s GHI Ltd. Mr. G provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Bonus Fee for professional services Accommodation provided with annual value Entertainment Allowance Conveyance provided for personal use (Cost Rs. 750,000) Children Education Allowance Utilities Allowance Medical reimbursement not in accordance with terms of employment Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 900,000 Interest free loan for daughter's marriage Rs. 300,000 Donation paid to recognized institution Tax deducted by the employer u/s 149 Tax deducted on cash withdrawal from bank u/s 231A SOLUTION Mr. G M/s GHI Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Bonus Fee for professional services Accommodation provided Entertainment allowance Conveyance provided for personal use Children Education allowance Utilities allowance Medical reimbursement not in TOE Provident Fund Employer's Contribution Provident Fund Employee's Contribution Provident Fund Interest Interest free loan (Bench mark rate 13%) Total Total Income Less: Zakat Taxable Income Gross 600,000 60,000 120,000 270,000 24,000 75,000 42,000 65,000 145,000 60,000 210,000 39,000 1,710,000 Exempt 60,000 144,000 204,000 Taxable 600,000 60,000 120,000 270,000 24,000 75,000 42,000 65,000 145,000 66,000 39,000 1,506,000 1,506,000 1,506,000 600,000 60,000 120,000 250,000 24,000 42,000 65,000 145,000 60,000 60,000 210,000 45,000 167,832 2,800

Notes: 1. Annual value of accomodation is less than 45% of Basic salary, so 45% of Basic salary is taken. (Rule 4) 2. Vehicle provided for personal use, so 10% of the cost of vehicle is taken. [Rule 5(ii)] 3. Medical reibursement not in accordance with the terms of employment is taxable (Clause 139, Part I, 2nd Schedule) 4. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 5. Provident fund employee's contribution, no treatment.

6 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule] 7. Loan is made by an employer to an employee without profit or the rate of profit is less than the benchmark rate (i.e. 13% for TY 2011), the amount of profit at benchmark rate or the difference between the amount of profit paid by the employee and the amount of profit computed at the benchmark rate as the case may be shall be included in the income of the employee. COMPUTATION OF TAX LIABILITY Taxable income Tax payable Less: Tax credit on donation Tax / Taxable income x Donation Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Less: Tax deducted on cash withdrawal from bank u/s 231A Net Tax payable / (refundable) Notes: 1. Donation paid to recognized charitable organization. Tax credit is available u/s 61. 1,506,000 181,900 (5,435) 176,465 7,720 184,185 (167,832) (2,800) 13,553

10

Example 8 Mr. H is the employee of M/s HIJ Ltd. Mr. H provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Leave pay Payment in lieu of leaves Overtime Sales commission Conveyance Allowance Cost of Living Allowance Subsistence allowance Travel allowance (Personal) House Rent Allowance Utilities Allowance Medical Allowance Reimbursement of Children Education expenses Vehicle transferred to employee on book value Rs. 200,000 (FMV: 275,000) Loan for construction of house Rs. 1,000,000 @ 5% pa Amount received against 5 years job agreement Tax deducted by the employer u/s 149 Tax paid on mobile phone u/s 236 Tax paid on residential telephone u/s 236 Tax deducted on cash withdrawal from bank u/s 231A SOLUTION Mr. H M/s HIJ Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Leave pay Payment in lieu of leaves Overtime Sales Commission Conveyance allowance Cost of living allowance Subsistance allowance Travel allowance (Personal) House rent allowance Utilities allowance Medical allowance Reimbursement of Children Education exp. Vehicle transferred on book value Profit of loan (Benchmark rate) (13% - 5%) Received against job agreement Total Total Income Less: Zakat Taxable Income 600,000 24,000 40,000 38,000 80,000 36,000 40,000 24,000 36,000 275,000 60,000 70,000 100,000 50,000 200,000 188,850 800 300 2,400

Gross 600,000 24,000 40,000 38,000 80,000 36,000 40,000 24,000 36,000 275,000 60,000 70,000 100,000 275,000 80,000 200,000 1,978,000

Exempt 60,000 200,000 260,000

Taxable 600,000 24,000 40,000 38,000 80,000 36,000 40,000 24,000 36,000 275,000 60,000 10,000 100,000 75,000 80,000 200,000 1,718,000 1,718,000 1,718,000

11

Notes: 1. Medical allowance is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) 2. Loan is made by an employer to an employee without profit or the rate of profit is less than the benchmark rate (i.e. 13% for TY 2011), the amount of profit at benchmark rate or the difference between the amount of profit paid by the employee and the amount of profit computed at the benchmark rate as the case may be shall be included in the income of the employee. 3 Amount received on job agreement is taxable in the hands of employee[Section 12(2)(e)(i)] 4 Vehicle transferred to employee on book value Rs. 200,000 but the FMV was Rs. 275,000, the difference of Rs. 75,000 will become taxable [Ref. Section 13(11)] COMPUTATION OF TAX LIABILITY Taxable income Tax payable Less: Tax credit on loan for construction of house Tax / Taxable income x total profit Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax including surcharge Less: Tax deducted by the employer u/s 149 Less: Tax paid on mobile phone u/s 236 Less: Tax paid on residential telephone u/s 236 Less: Tax deducted on cash withdrawal from bank u/s 231A Net Tax payable / (refundable)

1,718,000 219,700 (16,625) 203,075 8,885 211,960 (188,850) (800) (300) (2,400) 19,610

Notes: 1. Profit paid on loan for construction of house. Tax credit is available u/s 64. Total amount taken for credit (Actual Paid + added into the income of the employee on the basis of benchmark rate) (Actual paid Rs. 50,000 added due to benchmark rate Rs. 80,000 total Rs. 130,000 available for credit)

12

Example 9 Mr. I is the employee of M/s IJK Ltd (Unlisted company) and terminated on April 30,2009 under Golden Handshake sheme. Mr. I provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Leave pay Consideration for change in conditions of employment Golden handshake payment Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 2,000,000 Pension received from former employer Conveyance provided for personal use (10 months) Cost Rs. 1,000,000 Accommodation provided (Annual Value Rs. 400,000) Medical re-imbursement according to the terms of employment Medical allowance Utilities allowance Arrears for Tax Year 2009 received (Opted to add in current year's income) Driver provided by the employer with monthly salary Shares issued under Employee share scheme (FMV Rs. 90,000) Cost = 40,000 Received balance of provident fund Gratuity received under unapproved gratuity scheme Last three years average rate of tax Tax deducted by the employer u/s 149 Tax paid on mobile phone u/s 236 Tax paid on residential telephone u/s 236 Tax deducted on cash withdrawal from bank u/s 231A 1,000,000 60,000 150,000 2,000,000 100,000 100,000 340,000 240,000 80,000 100,000 100,000 60,000 6,000 2,340,000 800,000 14% 721,135 1,200 800 9,000

13

SOLUTION Mr. I M/s IJK Ltd. Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Gross Basic salary 1,000,000 Leave pay 60,000 Change in conditions of employment 150,000 Golden handshake payment (as separate block of income) Provident Fund Employer's contribution 100,000 Provident Fund Employee's contribution Interest on provident fund 340,000 Pension 240,000 Conveyance provided for personal use 83,333 Accommodation provided 450,000 Medical reimbursement 80,000 Medical allowance 100,000 Utilities allowance 100,000 Arrears for TY 2009 60,000 Driver's salary 60,000 Shares under Employee share scheme 50,000 Provident Fund Balance received 2,340,000 Gratuity received (as separate block of income) Total 5,213,333 Total Income Less: Zakat Taxable Income

Exempt 100,000 320,000 240,000 80,000 2,340,000 3,080,000

Taxable 1,000,000 60,000 150,000 20,000 83,333 450,000 100,000 100,000 60,000 60,000 50,000 2,133,333 2,133,333 2,133,333

Notes: 1. Consideration paid for any change in conditions of employment is taxable u/s 12(2)(e)(ii). 2. Golden handshake payment - option is avaialable with taxpayer to add in the current year income or to be taxed at an average rate of tax for preceeding three years. Section 12(6) 3. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 4. Provident fund employee's contribution, no treatment. 5 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule] 6. Pension received from former employer is exempt from tax under clause 8, Part I of second schedule. 7. Vehicle provided for personal use, so 10% of the cost of vehicle is taken for 10 months, because he worked for 10 months. [Rule 5(ii)] 8. Annual value of accomodation is less than 45% of Basic salary, so 45% of Basic salary is taken. (Rule 4) Basic salary is for 10 months so the value of accomodation is not apportioned to number of months occupied. 9. Medical reibursement in accordance with the terms of employment is exempt from tax. (Clause 139, Part I, 2nd Schedule) 10. Facility of medical actual reimbursement is provided in accordance with terms of employment, therefore medical allowance is taxable.

14

11. Arrear received by a taxpayer .. Option is available to the taxpayer to add in the current year's income or add in the relevant year for which arrears are paid, it depends on the tax liability. Section 12(7) 12. Driver or any other servant provided by the employer, the salary of the servant should be added to the income of the employee. Section 13(5) 13. Shares issued under Employee Share Scheme, Section 14. The difference between Fair Market Value of the share and the cost borne by the employee should be added to the income of the employee. 14. Balance amount received from Recognized provident fund is exempt. (Rule 4, Part I, 6th schedule) 15. Gratuity received from unapproved gratuity scheme is exempt upto Rs. 75,000 or 50% of the amount of gratuity, whichever is less. Remaining should be taxed at an average rate of tax for the preceeding three years or added in the current year's income. Option is with the taxpayer. (Clause 13, Part I, 2nd Schedule) COMPUTATION OF TAX LIABILITY Taxable income Tax payable on current year's salary Tax on Golden handshake payment (Amount x 3 years' average rate) Tax on Gratuity payment [(Amount-75000) x 3 years' average rate) Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax payable Less: Tax deducted by the employer u/s 149 Less: Tax paid on mobile phone u/s 236 Less: Tax paid on residential telephone u/s 236 Less: Tax deducted on cash withdrawal from bank u/s 231A Net Tax payable / (refundable)

2,133,333 320,000 280,000 101,500 701,500 30,691 732,191 (721,135) (1,200) (800) (9,000) 56

Notes: 1. Tax on Golden handshake payment is computed on the basis of preceding three years average rate i.e. 14% as given in the question, if this amount is added in the current year's income then applicable tax rate will be 22.08%. Section 12(6) 2. Tax on Gratuity payment from unapproved gratuity scheme is computed on the basis of preceding three years average rate i.e. 14% as given in the question, if this amount is added in the current year's income alongwith golden handshake payment then applicable tax rate will be 16.1%. (Circular # 17 of 1959, Circular # 16 of 1967, C. # 4(23)-IT-3/77, 30/10/77)

15

Example 10 Mr. J is the employee of FBR under pay scale 25,000-3,000-35,000 Mr. J provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Statutory Provident Fund .. Employer's contribution Statutory Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 600,000 Car provided for personal use Cost Rs. 500,000, Running & Maintenance cost borne by the employer Accommodation provided (Annual Value Rs. 150,000) Medical re-imbursement according to the terms of employment Medical allowance Utilities provided Driver provided by the employer with monthly salary Saving out of TA/DA Special additional allowance Special allowance for official duties Tax deducted by the employer u/s 149 SOLUTION Mr. J Central Board of Revenue Salaried Individual Tax Year: 2011 Pay scale: 25,000 - 3,000 - 35,000 COMPUTATION OF TAXABLE INCOME Description Basic salary Provident Fund Employer's contribution Provident Fund Employee's contribution Interest on provident fund Conveyance provided for personal use Accommodation provided Medical reimbursement Medical allowance Utilities provided Driver's salary TA/DA (Saving) Special additional allowance Special allowance for official duties Total Total Income Less: Zakat Taxable Income 372,000 40,000 40,000 108,000 30,000 80,000 40,000 48,000 4,500 40,000 20,000 50,000 46,954

Gross 372,000 40,000 108,000 50,000 150,000 80,000 40,000 48,000 54,000 40,000 20,000 50,000 1,052,000

Exempt 40,000 108,000 80,000 40,000 50,000 318,000

Taxable 372,000 50,000 150,000 40,000 48,000 54,000 20,000 734,000 734,000 734,000

Notes: 1. This is Statutory Provident Fund for Government Departments. Amount received from this fund is exempt from tax under clause 22 of Part I of 2nd schedule. Therefore, no treatment is required during the year on contribution and credit of interest. 2. Vehicle provided for personal use, so 10% of the cost of vehicle is taken. As well as running and maintenance expenses are concerned no treatment is available in the rules, therefore not taken into account.

16

3. Accomodation provided - 45% of Basic salary is Rs. 167,400, but MTS is given so, 45% of MTS will be taken and 45% of MTS i.e Rs. 135,000 is less than the actual value. So, actual value is taken. 4. Medical reibursement in accordance with the terms of employment is exempt from tax. (Clause 139, Part I, 2nd Schedule) 5. Facility of medical actual reimbursement is provided in accordance with terms of employment, therefore medical allowance is taxable. 6. Driver or any othe servant provided by the employer, the salary of the servant should be added to the income of the employee. Section 13(5) 7. TA/DA is exempt from tax, because it is paid for official duties. Reference Circular # 12 of 1980. 8. Special allowance for official duties is exempt from tax under clause 39, Part I of 2nd schedule. COMPUTATION OF TAX LIABILITY Taxable income Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax payable Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable)

734,000 44,040 1,927 45,967 (46,954) (987)

17

Example 11 Mr. K is a full time teacher working with KLM College, a recognized educational institution Mr. K provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Payment in lieu of leave Fee Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 600,000 Pension received from former employer Conveyance allowance Accommodation provided within College premises Medical re-imbursement not in accordance with the terms of employment Utilities provided by the employer Home servant provided by the employer Tax deducted by the employer u/s 149 SOLUTION Mr. K KLM College Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Payment in lieu of leaves Fee Provident Fund Employer's contribution Provident Fund Employee's contribution Interest on Provident Fund Pension Conveyance allowance Accomodation provided Medical reimbursement Utilities provided Home servant salary Total Total Income Less: Zakat Taxable Income 800,000 30,000 124,000 100,000 100,000 90,000 240,000 60,000 90,000 60,000 60,000 47,225

Gross 800,000 30,000 124,000 100,000 90,000 240,000 60,000 360,000 90,000 60,000 60,000 2,014,000

Exempt 80,000 90,000 240,000 410,000

Taxable 800,000 30,000 124,000 20,000 60,000 360,000 90,000 60,000 60,000 1,604,000 1,604,000 1,604,000

Notes: 1. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 2. Provident fund employee's contribution, no treatment. 3 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule] 4. Pension received from former employer is exempt from tax under clause 8, Part I of second schedule.

18

5. Annual value of accomodation is not given, so 45% of Basic salary is taken as minimum value. (Rule 4) 6. Medical reibursement not in accordance with the terms of employment is exempt upto 10% of Basic Salary. (Clause 139, Part I, 2nd Schedule) 7. Home servant provided by the employer, the salary of the servant should be added to the income of the employee. Section 13(5) COMPUTATION OF TAX LIABILITY Taxable income Tax on salary Less: Tax rebate (75%) Full time teacher [Clause (2) Part III, 2nd Schedule] Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax payable Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable)

1,604,000 200,500 (150,375) 50,125 2,193 52,318 (47,225) 5,093

Notes: 1. 75% tax rebate is available to full time teachers and researchers. Clause 2, Part III, 2nd schedule.

19

Example 12 Mr. L (Age 68 years) is a full time teacher working with LMN University, a recognized government owned educational institution. Mr. L provided following particulars. Compute his taxable income and tax liability for the Tax Year 2011 Basic salary Fee Recognized Provident Fund .. Employer's contribution Recognized Provident Fund .. Employee's contribution Interest credit on Provident Fund Account Balance Rs. 300,000 Conveyance allowance Medical re-imbursement in accordance with the terms of employment Utilities allowance Tax deducted by the employer u/s 149 SOLUTION Mr. L LMN University Salaried Individual Tax Year: 2011 COMPUTATION OF TAXABLE INCOME Description Basic salary Fee Provident Fund Employer's contribution Provident Fund Employee's contribution Interest on Provident Fund Conveyance allowance Medical reimbursement Utilities allowance Total Total Income Less: Zakat Taxable Income 250,000 40,000 30,000 30,000 48,000 24,000 68,000 20,000 1,255

Gross 250,000 40,000 30,000 48,000 24,000 68,000 20,000 480,000

Exempt 25,000 48,000 68,000 141,000

Taxable 250,000 40,000 5,000 24,000 20,000 339,000 339,000 339,000

Notes: 1. Employer's contribution in Recognized provident fund is exempt upto 10% of Salary (excluding perquisites & allowances) or Rs. 100,000 whichever is less [Rule 3(a) Part I, 6th Schedule] 2. Provident fund employee's contribution, no treatment. 3 Interest on recognized provident fund contribution. "Interest credit on the balance is exempt upto 1/3rd of the salary or is allowed at the rate fixed by Federal Government in this behalf (i.e. 16%). If interest credited exceed 1/3rd of the Salary or is allowed at a higher rate, the amount exceeding the salary of the said rate shall be taxable". [Rule 3(b), Part I, 6th Schedule] 4. Medical reibursement in accordance with the terms of employment is exempt from tax. (Clause 139, Part I, 2nd Schedule)

20

COMPUTATION OF TAX LIABILITY Taxable income Tax on salary Less: Tax rebate (50%) Senior Citizen [Clause (1A), Part III, 2nd Schedule] Tax after 1st rebate Less: Tax rebate (75%) Full time teacher [Clause (2) Part III, 2nd Schedule] Tax payable Surcharge u/s 4A 15% for 3.5 months (Tax / 12 x 3.5 x 15%) Total tax payable Less: Tax deducted by the employer u/s 149 Net Tax payable / (refundable)

339,000 2,543 (1,272) 1,272 (954) 318 14 332 (1,255) (923)

Notes: 1. 50% tax rebate is available to Senior Citizen age 60 years or more. Clause 1A, Part III, 2nd schedule. 2. 75% tax rebate is available to full time teachers and researchers. Clause 2, Part III, 2nd schedule.

21

Vous aimerez peut-être aussi

- Examples Salary 2015Document44 pagesExamples Salary 2015Farhan JanPas encore d'évaluation

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleJags NagwekarPas encore d'évaluation

- IPCE May 2013 Taxation Suggested AnswerDocument13 pagesIPCE May 2013 Taxation Suggested AnswerParasuram IyerPas encore d'évaluation

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedPas encore d'évaluation

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebePas encore d'évaluation

- Tanzania Tax Guide 2016/2017Document22 pagesTanzania Tax Guide 2016/2017Timothy Rogatus67% (3)

- Hussainkhawaja 1177 3641 2 LECTURE-10Document51 pagesHussainkhawaja 1177 3641 2 LECTURE-10Hasnain BhuttoPas encore d'évaluation

- Taxation of De Minimis Benefits and Fringe BenefitsDocument5 pagesTaxation of De Minimis Benefits and Fringe BenefitsNereus Sanaani CAñeda Jr.Pas encore d'évaluation

- SalaryDocument66 pagesSalaryFurqan AhmedPas encore d'évaluation

- Tax UpdateDocument149 pagesTax UpdateJamz LopezPas encore d'évaluation

- Train Law & Tax UpdatesDocument211 pagesTrain Law & Tax UpdatesAlicia FelicianoPas encore d'évaluation

- Exemptions: Status of The PersonDocument13 pagesExemptions: Status of The PersonThulani NdlovuPas encore d'évaluation

- Employment Income: Presented By: Kennedy OkiroDocument21 pagesEmployment Income: Presented By: Kennedy OkiroLeah Wambui MachariaPas encore d'évaluation

- Taxation of IndividualsDocument18 pagesTaxation of IndividualsŁÖVË GÄMËPas encore d'évaluation

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYPas encore d'évaluation

- What Is Annualized Withholding TaxDocument7 pagesWhat Is Annualized Withholding TaxMarietta Fragata RamiterrePas encore d'évaluation

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespiePas encore d'évaluation

- Employment Income TaxDocument20 pagesEmployment Income TaxBizu AtnafuPas encore d'évaluation

- Filing Requirements for PAYE ReturnsDocument164 pagesFiling Requirements for PAYE Returnsmulabbi brianPas encore d'évaluation

- Identify and Discuss Direct TaxDocument7 pagesIdentify and Discuss Direct Taxsamuel asefaPas encore d'évaluation

- Addendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForDocument19 pagesAddendum: TO Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation Method ForKhoo Kah JinPas encore d'évaluation

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarPas encore d'évaluation

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedPas encore d'évaluation

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvPas encore d'évaluation

- S Reg PayslpDocument3 pagesS Reg Payslpjaggu_gram0% (1)

- Adv. Accountancy Paper-3Document22 pagesAdv. Accountancy Paper-3Avadhut PaymallePas encore d'évaluation

- Importance of Withholding Tax SystemDocument14 pagesImportance of Withholding Tax SystemAcademic Stuff100% (1)

- Personal TaxDocument7 pagesPersonal TaxNika JikaiiPas encore d'évaluation

- Unit 4 - Inclusions & Exclusions To Gross Comp IncomeDocument8 pagesUnit 4 - Inclusions & Exclusions To Gross Comp IncomeJoseph Anthony RomeroPas encore d'évaluation

- Quick Tax Guide-2012Document9 pagesQuick Tax Guide-2012Paul MaposaPas encore d'évaluation

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluPas encore d'évaluation

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaPas encore d'évaluation

- Business Reporting July 2010 Marks PlanDocument24 pagesBusiness Reporting July 2010 Marks PlanMohammed HammadPas encore d'évaluation

- 3.1 Employment Income Tax Edited March 2021Document22 pages3.1 Employment Income Tax Edited March 2021Bimmer MemerPas encore d'évaluation

- White Paper: Ministry of Finance, Trade and Economic PlanningDocument16 pagesWhite Paper: Ministry of Finance, Trade and Economic PlanningBonar StepanusPas encore d'évaluation

- Income From SalaryDocument21 pagesIncome From SalaryAditya Avasare60% (10)

- Salary Taxation and Related Concepts: Malik Faisal Mehmood, ACADocument25 pagesSalary Taxation and Related Concepts: Malik Faisal Mehmood, ACAMalik FaisalPas encore d'évaluation

- S Reg Payslp MarDocument3 pagesS Reg Payslp Marjaggu_gramPas encore d'évaluation

- Instruction NotesDocument148 pagesInstruction NotesMusiime AlvinPas encore d'évaluation

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionPas encore d'évaluation

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalPas encore d'évaluation

- Form 16 Salary CertificateDocument5 pagesForm 16 Salary CertificateAshok PuttaparthyPas encore d'évaluation

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinPas encore d'évaluation

- Salary SimplifiedDocument16 pagesSalary SimplifiedaruunstalinPas encore d'évaluation

- Introduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesDocument31 pagesIntroduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesArham SheikhPas encore d'évaluation

- Tool Kit Salary 2015Document11 pagesTool Kit Salary 2015Farhan JanPas encore d'évaluation

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaPas encore d'évaluation

- PFT Chapter 4Document27 pagesPFT Chapter 4DanisaraPas encore d'évaluation

- Reales Tax Rev Computation ExerciseDocument4 pagesReales Tax Rev Computation ExerciseJethroret RealesPas encore d'évaluation

- Fifth PartDocument17 pagesFifth PartMahsinur RahmanPas encore d'évaluation

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879Pas encore d'évaluation

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralPas encore d'évaluation

- Income Tax Deduction from Salaries CircularDocument70 pagesIncome Tax Deduction from Salaries CircularrhldxmPas encore d'évaluation

- GeneralPrinciples Incometax Tabag 51 224Document28 pagesGeneralPrinciples Incometax Tabag 51 224John Carlo Dela CruzPas encore d'évaluation

- Codal Reference and Related IssuancesDocument17 pagesCodal Reference and Related IssuancesBernardino PacificAcePas encore d'évaluation

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross SalaryDeyzan HusainPas encore d'évaluation

- CBDT Circular outlines income tax deductions for FY 2010-2011Document59 pagesCBDT Circular outlines income tax deductions for FY 2010-2011Pragnesh ShahPas encore d'évaluation

- Section 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09Document32 pagesSection 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09api-19795300Pas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Auditing Case StudiesDocument2 pagesAuditing Case StudiesLee Ka FaiPas encore d'évaluation

- Analysis and Uses of Financial StatementsDocument144 pagesAnalysis and Uses of Financial StatementsPepe ArriagaPas encore d'évaluation

- No 8 AuditorDocument3 pagesNo 8 AuditorLee Ka FaiPas encore d'évaluation

- LAW6Document6 pagesLAW6Lee Ka FaiPas encore d'évaluation

- LAW3Document6 pagesLAW3Lee Ka FaiPas encore d'évaluation

- Chowtaifook AR13Document166 pagesChowtaifook AR13P_A_SINGHANIAPas encore d'évaluation

- LAW10Document5 pagesLAW10Lee Ka FaiPas encore d'évaluation

- LAW7Document5 pagesLAW7Lee Ka FaiPas encore d'évaluation

- LAW9Document5 pagesLAW9Lee Ka FaiPas encore d'évaluation

- Approval Required for Certain Company NamesDocument5 pagesApproval Required for Certain Company NamesLee Ka FaiPas encore d'évaluation

- LAW4Document6 pagesLAW4Lee Ka FaiPas encore d'évaluation

- LAW5Document6 pagesLAW5Lee Ka FaiPas encore d'évaluation

- HK Company Law Meeting OperationDocument5 pagesHK Company Law Meeting OperationLee Ka FaiPas encore d'évaluation

- EB Scott FATheory3e BWDocument520 pagesEB Scott FATheory3e BWLee Ka FaiPas encore d'évaluation

- LAW2Document6 pagesLAW2Lee Ka FaiPas encore d'évaluation

- GlobalizationDocument1 pageGlobalizationLee Ka FaiPas encore d'évaluation

- LAW1Document6 pagesLAW1Lee Ka FaiPas encore d'évaluation

- Consider Tai OnDocument1 pageConsider Tai OnLee Ka FaiPas encore d'évaluation

- GlobalizationDocument1 pageGlobalizationLee Ka FaiPas encore d'évaluation

- Charter 2 Share CapitalDocument7 pagesCharter 2 Share CapitalLee Ka FaiPas encore d'évaluation

- Chacter 7 Not Include 5 and 6Document6 pagesChacter 7 Not Include 5 and 6Lee Ka FaiPas encore d'évaluation

- Charter 3 Officer of The CompanyDocument5 pagesCharter 3 Officer of The CompanyLee Ka FaiPas encore d'évaluation

- AgreementDocument3 pagesAgreementLee Ka FaiPas encore d'évaluation

- Annexure C ExamplesDocument21 pagesAnnexure C ExamplesLee Ka FaiPas encore d'évaluation

- Hong Kong Comnpny Law NotesDocument10 pagesHong Kong Comnpny Law NotesLee Ka FaiPas encore d'évaluation

- Swot AnalysisDocument1 pageSwot AnalysisLee Ka FaiPas encore d'évaluation

- Annexure C ExamplesDocument21 pagesAnnexure C ExamplesLee Ka FaiPas encore d'évaluation

- Official Game GuideDocument30 pagesOfficial Game GuideHhfugPas encore d'évaluation

- Final Draft - Banana ChipsDocument34 pagesFinal Draft - Banana ChipsAubrey Delgado74% (35)

- 2.9&10 Synthesis Adn Stereoisomerism Exam Qs - 4Document4 pages2.9&10 Synthesis Adn Stereoisomerism Exam Qs - 4sureshthevanPas encore d'évaluation

- 04 Refrigerated CargoDocument33 pages04 Refrigerated Cargosaurabh1906100% (1)

- Air Regulations CPL Level QuestionsDocument56 pagesAir Regulations CPL Level QuestionsRahul100% (3)

- Reduced Renal Sodium Excretion: Forced Through A Narrow LumenDocument5 pagesReduced Renal Sodium Excretion: Forced Through A Narrow LumenFlowerPas encore d'évaluation

- Final National HCF WASH Guideline ETHIOPIADocument97 pagesFinal National HCF WASH Guideline ETHIOPIAEfrem TsegabuPas encore d'évaluation

- B25 Pompe de Peinture PDFDocument98 pagesB25 Pompe de Peinture PDFchahinePas encore d'évaluation

- Pre Mocks Y11 2023Document14 pagesPre Mocks Y11 2023Ahsan AhmedPas encore d'évaluation

- ClindamycinDocument1 pageClindamycinTanalie Dulawan100% (3)

- Higuey, Dom Rep Mdpc/Puj: .Eff.23.MayDocument5 pagesHiguey, Dom Rep Mdpc/Puj: .Eff.23.MayVanessa Yumayusa0% (1)

- Brand Mgt. StarbucksDocument3 pagesBrand Mgt. StarbucksPrashansa SumanPas encore d'évaluation

- LESSON 1 PREPARE VEGETABLE DISHES OverviDocument12 pagesLESSON 1 PREPARE VEGETABLE DISHES OverviKeym Garcia Galvez IIIPas encore d'évaluation

- Postnatal Care, Complaints & AbnormalitiesDocument38 pagesPostnatal Care, Complaints & AbnormalitiesBernice GyapongPas encore d'évaluation

- Litreature On Automatic Dipper Circuit For Vehicle-2Document10 pagesLitreature On Automatic Dipper Circuit For Vehicle-2Rushikesh TajnePas encore d'évaluation

- Low Back Pain Anatomy of Thoracolumbar SpineDocument10 pagesLow Back Pain Anatomy of Thoracolumbar SpineMPas encore d'évaluation

- Research Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesDocument9 pagesResearch Paper - Perceptions of Grade 11 STEM Students Towards ContraceptivesKyle BinuyaPas encore d'évaluation

- ECD KEBVF5 Installation ManualDocument32 pagesECD KEBVF5 Installation Manualashish gautamPas encore d'évaluation

- Home Study Report of Resident Indian Parent: Name of The Social WorkerDocument4 pagesHome Study Report of Resident Indian Parent: Name of The Social WorkerVmksPas encore d'évaluation

- Deutz-Fahr Workshop Manual for AGROTRON MK3 ModelsDocument50 pagesDeutz-Fahr Workshop Manual for AGROTRON MK3 Modelstukasai100% (1)

- E IA Diagnostic Atmos Cube 2012-07-04Document32 pagesE IA Diagnostic Atmos Cube 2012-07-04RogerPas encore d'évaluation

- Lesson Plan The Food: TH THDocument8 pagesLesson Plan The Food: TH THFeraru FlorinPas encore d'évaluation

- Piling Procedure - IoclDocument8 pagesPiling Procedure - IocltpgggkPas encore d'évaluation

- PositionsDocument4 pagesPositionsMixsz LlhAdyPas encore d'évaluation

- Data SheetDocument15 pagesData SheetLucian Sorin BortosuPas encore d'évaluation

- 16-Bit UUID Numbers DocumentDocument28 pages16-Bit UUID Numbers DocumentJuan M Iñiguez RPas encore d'évaluation

- Full Test 14 (Key) PDFDocument4 pagesFull Test 14 (Key) PDFhoang lichPas encore d'évaluation

- Butterfly Valve ConcentricDocument6 pagesButterfly Valve ConcentricpramodtryPas encore d'évaluation

- Kovach 1987Document10 pagesKovach 1987Quyen ta thi nhaPas encore d'évaluation

- Msae Msae2018-Arwm012 Full Dronespraying 2Document4 pagesMsae Msae2018-Arwm012 Full Dronespraying 2Muhammad Huzaifah Mohd RoslimPas encore d'évaluation