Académique Documents

Professionnel Documents

Culture Documents

Dbcalc

Transféré par

Prasanna NarayananTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dbcalc

Transféré par

Prasanna NarayananDroits d'auteur :

Formats disponibles

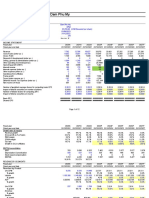

DBL Calc - Menu

Enter / Backup Data

Update Data

View / Print Reports

Year End

Help

Your Company Name

Profit & Loss

1

2

3

4

5

6

7

8

9

10

11

Operating Income

Cost of Sales

Gross Profit

Expenses

Employment Costs

Marketing & Selling Costs

Occupational Costs

Finance Costs

Depreciation

Other Costs

Operating Profit

Non Operating Expenses

Taxation

Dividend / Drawings

Retained Profit

YTD

Q4

2007

Q3

Q2

35,558.20

36,561.50

29,317.70

20,729.40

32,693.70

33,218.30

25,579.80

18,825.70

2,865

3,343

3,738

1,904

843.8

995.8

703.6

960

545.6

916

471.1

738.2

55.2

1,138.40

24.4

1,013.50

33.5

825

51

706.5

641

-809

614

404.6

389.2

28

1,013

-452

511

216.7

820.2

216.7

1,094.90

173.3

457.1

101.1

-1,537

-1,009

-255

-1,011

Balance Sheet

Q4

12

13

14

15

16

17

18

19

22

2007

Q3

Q4

Q2

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Q1

Bank & Cash

Debtors

Stock

Other Current Assets

Total Current Assets

Fixed & Other Assets

Total Assets

1,406.30

1,078.30

1,428.60

387.6

861.3

309.30

821.40

698.90

0

0

2,485

0

0

1,738

0

0

1,209

0

0

1,560

0

0

0

0

0

7,310.30

6,443.10

3,856.00

5,570.00

3,190.50

9,795

8,181

5,065

7,130

3,191

Creditors

Other Current Liabilities

Total Current Liabilities

Long Term Liabilities

Total Liabilities

144.5

6,119.00

144.5

4,331.00

144.5

3,788.40

144.5

3,631.60

6,264

0

6,264

4,476

0

4,476

3,933

0

3,933

3,776

0

3,776

0

0

0

0

0

3,531

3,706

1,132

3,354

3,191

Share Capital

Retained Earnings

Retained Profit

Owners Equity

0

0

-1,537

-1,537

0

0

-2,275

-2,275

0

0

-1,266

-1,266

0

0

-1,011

-1,011

0

0

0

0

Out of Balance

-5,068

-5,980

-2,398

-4,365

-3,191

Net Assets

20

21

Q1

Number of Employees

Your Company Name

For Period ending Quarter

0

2007

Financial Ratios

1

2

3

4

Profitability Ratios

Income Growth (%)

Gross Profit Margin (%)

Net Profit Margin (%)

Return on Owners Equity (%) per annum

5

6

7

8

9

Efficientcy Ratios

Asset Turnover per annum

Debtor (Days)

Stock (Days)

Creditor (Days)

Sales per Employee($) per annum

10

11

12

13

14

15

YTD

Q4

N/A

8.06%

-2.28%

#DIV/0!

Q3

Q2

Q1

24.71%

9.14%

0.08%

-4.87%

41.43%

12.75%

3.46%

-320.25%

N/A

9.18%

-2.18%

179.04%

N/A

0.00%

0.00%

0.00%

0.00

0.00

0.00

17.88

0.77

0.00

0.40

0

23.15

2.56

0.00

0.52

0

11.63

3.08

0.00

0.70

0

0.00

0.00

0.00

0.00

0

Financial Risk Ratios

Current Ratio (x:1)

Quick Ratio (x:1)

Ownership Ratio (%)

Interest Cover (times)

0.40

0.40

-15.69%

-13.66

0.39

0.39

-27.80%

2.14

0.31

0.31

-24.99%

31.24

0.41

0.41

-14.17%

-7.87

0.00

0.00

0.00%

0.00

$100 Sales Spread

Cost of Goods

Employment Costs

Marketing & Selling Costs

Occupational Costs

Finance Costs

Depreciation

Other Operating Costs

Non Operating Expenses

Taxation

Owners Share

Sales

$91.94

$2.37

$2.80

$0.00

$0.16

$3.20

$1.80

$0.00

$1.44

-$3.71

$100.00

$90.86

$1.92

$2.63

$0.00

$0.07

$2.77

$1.68

$0.00

$2.24

-$2.17

$100.00

$87.25

$1.86

$3.12

$0.00

$0.11

$2.81

$1.38

$0.00

$3.73

-$0.26

$100.00

$90.82

$2.27

$3.56

$0.00

$0.25

$3.41

$1.88

$0.00

$2.21

-$4.40

$100.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

#DIV/0!

#DIV/0!

0.002812291

0.002735118

0.003410909

0.004824066

Cash Flow Statement

Net Earnings

Depreciation

Decrease / (Increase) Debtors

Decrease / (Increase) Stock

Decrease / (Increase) C/Assets

Increase / (Decrease) Creditors

Increase / (Decrease) C/Liabilities

Cash In/(Out) Flow from Operations

(1,537)

2,545

(309)

0

0

145

4,331

5,174

(1,009)

1,014

512

0

0

0

543

1,059

(255)

825

(123)

0

0

0

157

604

(1,011)

707

(699)

0

0

145

3,632

2,773

0

0

0

0

0

0

0

0

Decrease / (Increase) Non C/Assets

Cash In/(Out) Flow from Investments

(5,798)

(5,798)

(3,601)

(3,601)

889

889

(3,086)

(3,086)

0

0

Increase / (Decrease) Non C/Liabilities

Increase / (Decrease) S/Holders Funds

Cash In/(Out)/ Flow from Financing

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

(623)

0

(623)

(2,542)

1,181

(1,361)

1,493

-313

1,181

(313)

0

(313)

0

0

0

Net Cash In/(Out) Flow

Opening Cash Balance

Closing Cash Balance

Vous aimerez peut-être aussi

- Pacific Spice CompanyDocument15 pagesPacific Spice CompanySubhajit MukherjeePas encore d'évaluation

- Case AnalysisDocument29 pagesCase AnalysisLiza NabiPas encore d'évaluation

- Games Strategies and Decision Making 2nd Edition Harrington Solutions Manual DownloadDocument18 pagesGames Strategies and Decision Making 2nd Edition Harrington Solutions Manual DownloadAmyBrightdqjm100% (31)

- NHDC SolutionDocument5 pagesNHDC SolutionShivam Goyal71% (24)

- 22 22 YHOO Merger Model Transaction Summary AfterDocument101 pages22 22 YHOO Merger Model Transaction Summary Aftercfang_2005Pas encore d'évaluation

- Elasticity of DemandDocument62 pagesElasticity of DemandVikku AgarwalPas encore d'évaluation

- Scaling Operations Worksheet2Document56 pagesScaling Operations Worksheet2olusegun0% (2)

- New Heritage Doll CompanyDocument12 pagesNew Heritage Doll CompanyRafael Bosch60% (5)

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueD'EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueÉvaluation : 1 sur 5 étoiles1/5 (1)

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodPas encore d'évaluation

- Growth Rates (%) % To Net Sales % To Net SalesDocument21 pagesGrowth Rates (%) % To Net Sales % To Net Salesavinashtiwari201745Pas encore d'évaluation

- Excel Bex PharmaDocument44 pagesExcel Bex PharmaMidul KhanPas encore d'évaluation

- Honda Motor Co., Ltd.Document6 pagesHonda Motor Co., Ltd.zakihafifiPas encore d'évaluation

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Document11 pagesProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniPas encore d'évaluation

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarPas encore d'évaluation

- Income StatementDocument3 pagesIncome StatementUsman NasirPas encore d'évaluation

- Sony Corporation Financial StatementDocument4 pagesSony Corporation Financial StatementSaleh RehmanPas encore d'évaluation

- Ib Case MercuryDocument9 pagesIb Case MercuryGovind Saboo100% (2)

- Annual Performance 2012Document3 pagesAnnual Performance 2012Anil ChandaliaPas encore d'évaluation

- MCB - Standlaone Accounts 2007Document83 pagesMCB - Standlaone Accounts 2007usmankhan9Pas encore d'évaluation

- DiviđenDocument12 pagesDiviđenPhan GiápPas encore d'évaluation

- First Resources: Singapore Company FocusDocument7 pagesFirst Resources: Singapore Company FocusphuawlPas encore d'évaluation

- Financial AnalysisDocument2 pagesFinancial AnalysisOmar abdulla AlkhanPas encore d'évaluation

- Wyeth ValuationDocument54 pagesWyeth ValuationSaurav GoyalPas encore d'évaluation

- Meraih Kinerja Pengelolaan Hutan Lestari Kelas Dunia: Achieving World Class Performance in Sustainable Forest ManagementDocument32 pagesMeraih Kinerja Pengelolaan Hutan Lestari Kelas Dunia: Achieving World Class Performance in Sustainable Forest ManagementDody Heriawan PriatmokoPas encore d'évaluation

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadPas encore d'évaluation

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43Pas encore d'évaluation

- TescoDocument2 pagesTescoChitra RamasamyPas encore d'évaluation

- Tata JLR MergeDocument15 pagesTata JLR MergeSiddharth SharmaPas encore d'évaluation

- EVA ExampleDocument14 pagesEVA ExampleKhouseyn IslamovPas encore d'évaluation

- Gemini Electronics Template and Raw DataDocument9 pagesGemini Electronics Template and Raw Datapierre balentinePas encore d'évaluation

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789Pas encore d'évaluation

- Pepsi Co - Calculations - FinalDocument46 pagesPepsi Co - Calculations - FinalMelissa HarringtonPas encore d'évaluation

- Gas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Document3 pagesGas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Kazmi Qaim Ali ShahPas encore d'évaluation

- % of Revenue Iphone Ipad Mac Itunes Icar? Video Games? Reality TV?Document15 pages% of Revenue Iphone Ipad Mac Itunes Icar? Video Games? Reality TV?Nguyen D. NguyenPas encore d'évaluation

- FS2007 08Document3 pagesFS2007 08Shahnawaz SaqibPas encore d'évaluation

- Profit and Loss AccountsDocument1 pageProfit and Loss AccountsHumayun AzizPas encore d'évaluation

- Nissan Motors, Inc Financial StatementDocument4 pagesNissan Motors, Inc Financial StatementSaleh RehmanPas encore d'évaluation

- The Discounted Free Cash Flow Model For A Complete BusinessDocument6 pagesThe Discounted Free Cash Flow Model For A Complete BusinessarijitroyPas encore d'évaluation

- CTC - Corporate Update - 10.02.2014Document6 pagesCTC - Corporate Update - 10.02.2014Randora LkPas encore d'évaluation

- Sandisk Corporation Financial StatementDocument4 pagesSandisk Corporation Financial StatementSaleh RehmanPas encore d'évaluation

- NestleDocument25 pagesNestleShafali PrabhakarPas encore d'évaluation

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarPas encore d'évaluation

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonPas encore d'évaluation

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanPas encore d'évaluation

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadPas encore d'évaluation

- Blaine Kitchenware: Case Exhibit 1Document5 pagesBlaine Kitchenware: Case Exhibit 1Niroshani MannaperumaPas encore d'évaluation

- Afs Assignment Profitability RatiosDocument9 pagesAfs Assignment Profitability RatiosMohsin AzizPas encore d'évaluation

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RIPas encore d'évaluation

- Midterm Exam R45D Coke. Co. TemplateDocument20 pagesMidterm Exam R45D Coke. Co. TemplateAchmad BaehakiPas encore d'évaluation

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadPas encore d'évaluation

- EVA ExampleDocument27 pagesEVA Examplewelcome2junglePas encore d'évaluation

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhPas encore d'évaluation

- Air Thread Excel FileDocument7 pagesAir Thread Excel FileAlex Wilson0% (1)

- 6 - Zee Entertainment Enterprises 2QF15Document7 pages6 - Zee Entertainment Enterprises 2QF15girishrajsPas encore d'évaluation

- Income Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Document2 pagesIncome Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Salman RahiPas encore d'évaluation

- Puma Energy Results Report q3 2016 v3Document8 pagesPuma Energy Results Report q3 2016 v3KA-11 Єфіменко ІванPas encore d'évaluation

- Business Service Center Revenues World Summary: Market Values & Financials by CountryD'EverandBusiness Service Center Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Temporary Shelters Revenues World Summary: Market Values & Financials by CountryD'EverandTemporary Shelters Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Elasticity Supply and Demand 3Document26 pagesElasticity Supply and Demand 3Vicky KumarPas encore d'évaluation

- Activity Number 5 Elasticity of Demand & SupplyDocument5 pagesActivity Number 5 Elasticity of Demand & SupplyLovely Madrid0% (1)

- Consumer OptimisationDocument23 pagesConsumer OptimisationSuraj SukraPas encore d'évaluation

- Game Theory Problem Set 3 AnswersDocument2 pagesGame Theory Problem Set 3 AnswersAsrafuzzaman RobinPas encore d'évaluation

- Ricardian Theory of RentDocument3 pagesRicardian Theory of Rentshabbirmia570Pas encore d'évaluation

- Test Bank For Microeconomics Principles Applications and Tools 8 e 8th Edition Arthur Osullivan Steven Sheffrin Stephen PerezDocument60 pagesTest Bank For Microeconomics Principles Applications and Tools 8 e 8th Edition Arthur Osullivan Steven Sheffrin Stephen PerezMaryJohnsonafrz100% (34)

- Demand, Supply, and Market EquilibriumDocument38 pagesDemand, Supply, and Market EquilibriumNestor Liwagon BalansagPas encore d'évaluation

- FACON BURGOS Assignment 3 RevisedDocument7 pagesFACON BURGOS Assignment 3 RevisedLip SyncersPas encore d'évaluation

- Chapter Two: Theory of Consumer BehaviorDocument58 pagesChapter Two: Theory of Consumer BehaviorOromay EliasPas encore d'évaluation

- Advantages and Disadvantages of Cardinal ApproachDocument2 pagesAdvantages and Disadvantages of Cardinal ApproachGift MoyoPas encore d'évaluation

- Q-Microeconomics Assignment 1 - HSS-01Document2 pagesQ-Microeconomics Assignment 1 - HSS-01GajananPas encore d'évaluation

- Exercises Chapter 3Document21 pagesExercises Chapter 3Katia Ibrahim100% (1)

- Abhinay Muthoo Bargaining Theory With APDocument5 pagesAbhinay Muthoo Bargaining Theory With AP姚望Pas encore d'évaluation

- Indifference Curves Are Negatively Sloped:: Properties/Characteristics of Indifference CurveDocument5 pagesIndifference Curves Are Negatively Sloped:: Properties/Characteristics of Indifference CurveSrujan ReddyPas encore d'évaluation

- ECO 101 QuizDocument8 pagesECO 101 QuizMd. Thasin Hassan Shifat 2031495630Pas encore d'évaluation

- Student: Choo Wei Sheng Instructor: Riayati Ahmad Date: 2/3/21 Course: Eppd1013 Microeconomics 1 Set 2 - Book: Perloff: Microeconomics, 8e, Global Edition Time: 7:45 PMDocument1 pageStudent: Choo Wei Sheng Instructor: Riayati Ahmad Date: 2/3/21 Course: Eppd1013 Microeconomics 1 Set 2 - Book: Perloff: Microeconomics, 8e, Global Edition Time: 7:45 PMChoo Wei shengPas encore d'évaluation

- Game TheoryDocument155 pagesGame TheoryAnand Kr100% (1)

- Economics Basics-Demand & SupplyDocument8 pagesEconomics Basics-Demand & SupplyNahiyan Islam ApuPas encore d'évaluation

- Elasticity and Its ApplicationDocument57 pagesElasticity and Its ApplicationLionel MessiPas encore d'évaluation

- Microeconomics Chapter 2 Exercises - The MarketDocument3 pagesMicroeconomics Chapter 2 Exercises - The MarketPearl Jade YecyecPas encore d'évaluation

- (Scanned) Administrative Law - Text and Cases by de LeonDocument24 pages(Scanned) Administrative Law - Text and Cases by de LeonArnel CRuZ NoTsErp0% (3)

- Welfare & Marshallian & Alternative DistributionDocument4 pagesWelfare & Marshallian & Alternative DistributionShilpita ChakravortyPas encore d'évaluation

- Class Xi (Economics) Cw-7)Document20 pagesClass Xi (Economics) Cw-7)Mythreyi VasudevanPas encore d'évaluation

- Indifference Curve Analysis Concept Assumptions and PropertiesDocument6 pagesIndifference Curve Analysis Concept Assumptions and PropertieskanishkPas encore d'évaluation

- Class 3 Unit 4-Strategy, Altruism and CooperationDocument6 pagesClass 3 Unit 4-Strategy, Altruism and CooperationSara Martin VelaPas encore d'évaluation

- Krishna Kanta Handiqui State Open University: (Only For The January 2021 Batch and in Lieu of MCQ Tests)Document4 pagesKrishna Kanta Handiqui State Open University: (Only For The January 2021 Batch and in Lieu of MCQ Tests)avatar sudarsanPas encore d'évaluation

- 04) Consumer BehaviourDocument141 pages04) Consumer BehaviourgunjannisarPas encore d'évaluation

- Tutorial 3 Worksheet PDFDocument4 pagesTutorial 3 Worksheet PDFTapiwaNicholasPas encore d'évaluation