Académique Documents

Professionnel Documents

Culture Documents

Fuel Supply Agreement and Issues

Transféré par

naveen007_thummaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fuel Supply Agreement and Issues

Transféré par

naveen007_thummaDroits d'auteur :

Formats disponibles

Coal Indias fuel supply agreements - a solution to Indias power crisis?

Overview

Indias power sector has been witnessing challenges in recent times, with the countrys power deficit at around 8.5 percent. The demand for electricity is continuously growing, driven by high economic growth and increased rural electrification; however, supply is unable to keep pace with demand primarily due to a fuel shortage. Currently, more than 50 percent of Indias installed generation capacity is coal-based. Over the last five years, the demand for coal has been growing at an average rate of 89 percent annually as compared to a 56 percent increase in domestic production. This has widened the demandsupply gap, leading to growing dependence on imported coal. In 2011 12, the country imported around 100 million tons of coal (including thermal and coking coal) .

The shortage of coal is not only affecting operational plants but is also raising concerns around the viability the viability of future power projects. The lack of coal linkages is making it incrementally difficult for power-generation companies to raise capital for their proposed thermal plants. Further, as per recent reports, the Government of India is likely to lower the countrys power capacity addition target for the Twelfth Five Year Plan from 1,00,000 MW to 75,000 MW as a result of fuel shortage.

Fuel supply agreement: key terms and challenges associated with implementation

To ensure fuel security to coal-based power producers, the Indian Government issued a presidential directive to CIL in April 2012, asking it to sign fuel supply agreements (FSAs) with power companies. The following are the key characteristics of FSAs, proposed by the CIL:

Criteria: FSAs will be signed with power plants that have entered longterm power purchase agreements (PPAs) with distribution companies, commissioned between April 2009 and December 2011. In the next round, CIL will sign FSAs with those plants scheduled to be commissioned by 31 March 2015.

Duration: The FSAs will be signed for a period of 20 years and will be reviewed after every five years. Commitment and penalties: The FSAs will be signed with 80 percent of assured contracted quantity (ACQ) of the committed coal supply. In the event of supply falling short of 80 percent, CIL has to pay a penalty at 0.01 percent of the value of the shortfall quantity. Further, this penalty clause is said to be applicable only after three years of signing the contract; this means that for the first three years, CIL will not be obliged to supply the contracted quantity. Coal imports: If CIL cannot meet demand through domestic supplies, it can meet the shortfall through imported coal. If the buyer agrees to accept the imported coal, CIL will import coal for power companies and supply it at the unload port on a cost-plus basis, including service charges. Thus, CIL would not be responsible for the transportation of imported coal from the port to the project site. Additionally, if a customer does not accept imported coal, CIL would not be liable to pay any penalties. Force majeure clause: The new FSAs - along with existing force majeure events such as natural calamities, strikes and mine fires - includes additional force majeure circumstances to cover the risks arising from third parties. Additional conditions include the global shortage of imported coal, lack of response to enquiries, the breakdown of equipment, delays by contractors, power shortages, and obstruction in the transportation of coal, from pithead to sidings, by agitations/mob-violence/riots.

Power plants covered under the new FSA are expected to be at a disadvantage over plants that are supplied coal as per existing FSA. Many power-generation companies have raised concerns over the terms of the new FSA and are not willing to sign the contract with CIL. As on 18 June 2012, only 27 of all planned 48 thermal power units have entered the long-term fuel supply agreement. Power producers are opposing the new FSA due to the following reasons:

In the new FSA, the penalty rate is very low (0.01 percent as against 10 40 percent in the existing FSA). Therefore, it may be possible that CIL, instead of meeting demand requirements, prefers to pay penalty. In the case of partial supplies from CIL, power producers have to either operate at a relatively low plant load factor (PLF) or use expensive imported coal. At current international coal prices, the cost of power generation from imported coal (assuming a 70:30 mix between domestic and imported coal) is around 40 percent higher than a plant solely based on domestic coal.

The addition of new force majeure conditions would allow CIL easy exit options from the agreement.

Government intervention to resolve the issue between CIL and power companies

To strike a middle ground between CIL and power companies, the Prime Minister Office (PMO) has intervened and suggested a revision to CILs new FSA to address the concerns of all stakeholders.

Commitments: The Government concurs with CILs demand and agrees to lower fuel supply commitment of 65 percent for first three years as against 80 percent prescribed earlier. Further, in the fourth year, the supply has to increase to 72 percent followed by 80 percent in the fifth year of the agreements. Penalties: The Government also proposed an increase in penalty, from 0.01 percent to 20-40 percent, depending on the level of supply shortfall below the level agreed upon (65 percent). Other clauses: The PMO has also asked CIL to remove the three-year moratorium on penalty, review the force-majeure clauses, and modify clause terms that allow CIL to review and amend delivery levels every five years.

The proposed changes are acceptable to some power producers, and the NTPC has agreed to sign FSA with the revised terms. However, the Ministry of Power is not willing to accept the 65 percent commitment level and has said that banks are not accepting the 65 percent trigger level as against the earlier directive of 80 percent supply assurance. The CIL board is yet to take a final decision on the revised terms of the FSA.

Analysis

The presidential directive to CIL is a small step forward towards the resolution of the countrys fuel problem. However, this step alone cannot plug the gaps, as aggregate demand from all proposed FSAs and letter of assurance (LoAs) is likely to exceed the CILs current and near-future coal production. By 2015, CIL is

expected to see a shortfall of around 80 million tonnes, thus limiting CILs ability to meet growing demand. Further, to bridge this gap, the PMO has suggested that CIL reduces its e-auction quantity and divert e-auction coal to the power sector. While this measure will likely help increase coal supply to the power sector, it may be regressive step as it will adversely affect small coal consumers and CILs profitability.

The following measures could help resolve Indias coal shortage:

Build CILs coal import capability: CIL is primarily a producer and has little experience in importing large quantities of coal. Yet, given the growing dependence on imported coal, CIL need to build its import capabilities. Initially, CIL could import coal with the help of the MMTC and STC and gradually develop the capability and infrastructure (logistics) to import large volumes of coal. To increase imported coal acceptability, CIL could consider the pricepooling of imported coal with domestic coal and supply coal to power companies at an average price. This could help lower the cost disparity among power producers. However, for this mechanism to be efficient, the pooled price should be available to only those power plants that have coal linkages with CIL and are not based on imported coal.

Increase power tariffs to make imported coal affordable: There is a need to increase power tariffs for the end consumer to make imported coal-based power plants economically viable. Further, the government should address the issues of power plants that are stuck with low price PPAs and their fuel cost has increased considerably due to regulatory changes in coal exporting countries such as Indonesia and Australia. To protect these developers, the government could allow at least a partial pass-through' of fuel costs for projects awarded under tariff-based competitive bidding. This would increase end-consumer prices but help in avoiding stranded capacities and is necessary to retain private players interest in the power sector. Enhance domestic coal production: To increase productivity from existing fields, it is important to deploy the latest technology and professional assistance. Further, there is need to accelerate the process of land acquisition and environmental clearances, to increase the total area under exploration. Further, the government could adapt the NELP model (used for oil and gas blocks bidding) and allow global mining majors to participate instead of limiting the bidding to only end users (such as steel, cement and power plants).This route, along with much needed investment, can be expected to bring global technology and capabilities to the Indian mining sector.

Thus, to resolve the power crisis, the government should take a holistic approach - considering the interest of various stakeholders, eliminating roadblocks to increased domestic coal production and allowing generation companies to pass high-fuel costs on to end consumers.

Source: www.kpmg.com

Vous aimerez peut-être aussi

- ERC Resolution No.24 Series of 2013 Collection and Disbursement GuidelinesDocument33 pagesERC Resolution No.24 Series of 2013 Collection and Disbursement GuidelinesCarl ScottPas encore d'évaluation

- FPIP Vehicle Sticker Application FormDocument2 pagesFPIP Vehicle Sticker Application FormBryan Amerna100% (2)

- Debt Collection OfficerDocument2 pagesDebt Collection OfficerGregory Kagooha100% (1)

- Occupancy Permit Form (Complete Bundle) - OrganizedDocument12 pagesOccupancy Permit Form (Complete Bundle) - OrganizedJean TroncoPas encore d'évaluation

- List of Construction Supply in Aklan PDFDocument1 pageList of Construction Supply in Aklan PDFelaine perriePas encore d'évaluation

- TOP 500 Non Individual - Arranged - AlphabeticallyDocument12 pagesTOP 500 Non Individual - Arranged - AlphabeticallyjcalaqPas encore d'évaluation

- Fuel Supply Agreement - First DraftDocument104 pagesFuel Supply Agreement - First DraftMuhammad Asif ShabbirPas encore d'évaluation

- Letter To DILGDocument2 pagesLetter To DILGVeda MariaPas encore d'évaluation

- Bir Ruling Da 086 08Document5 pagesBir Ruling Da 086 08Orlando O. CalundanPas encore d'évaluation

- Drilling Agreement ExampleDocument6 pagesDrilling Agreement ExampleRitaPas encore d'évaluation

- Spa September 2015 PDFDocument1 pageSpa September 2015 PDFsilverwind0% (3)

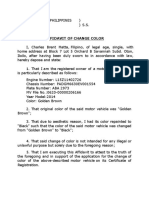

- Affidavit of Change ColorDocument2 pagesAffidavit of Change ColorKatherine B. AquinoPas encore d'évaluation

- Affidavit of AccidentDocument2 pagesAffidavit of AccidentFrances Anne GamboaPas encore d'évaluation

- Application For Securing Certificate of Compliance (Coc) : (As Indicated in DTI / SEC / CDA Registration)Document1 pageApplication For Securing Certificate of Compliance (Coc) : (As Indicated in DTI / SEC / CDA Registration)Muhammad Hasher Anjalin100% (1)

- DPWH Notice To ProceedDocument18 pagesDPWH Notice To ProceedAxiv The GreatPas encore d'évaluation

- Special Order No. 2022-073Document23 pagesSpecial Order No. 2022-073acelaerdenPas encore d'évaluation

- Corporatization PPPDocument9 pagesCorporatization PPPCharlotte Francis Marie AmbasPas encore d'évaluation

- Training Agreement TMODocument3 pagesTraining Agreement TMOSean Mendoza IIPas encore d'évaluation

- Trip Tiket FormDocument2 pagesTrip Tiket Formpablo gayodanPas encore d'évaluation

- Top Non-Individual by RankDocument12 pagesTop Non-Individual by RankGMA News OnlinePas encore d'évaluation

- Application For Airgun RegistrationDocument2 pagesApplication For Airgun RegistrationRolando Ison DangcaPas encore d'évaluation

- GPPB Resolution No 02 2020Document6 pagesGPPB Resolution No 02 2020Marisol RecuerdoPas encore d'évaluation

- Used Vehicle Purchase and Sale ContractDocument3 pagesUsed Vehicle Purchase and Sale ContractScribdTranslationsPas encore d'évaluation

- LTO and CPR ProcessingDocument2 pagesLTO and CPR Processingverkie100% (9)

- Letter of IntentDocument1 pageLetter of IntentInji Sammakieh Nsouli100% (1)

- Mgbform13 1Document2 pagesMgbform13 1ERC PERMITS AND LICENSINGPas encore d'évaluation

- Foreign Agency AgreementDocument2 pagesForeign Agency AgreementAnn Go100% (1)

- Affidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atDocument1 pageAffidavit of Loss: IN WITNESS WHEREOF, I Have Hereunto Set My Hands This 1st Day of July 2019 atJheyps VillarosaPas encore d'évaluation

- Certificate of EmploymentDocument1 pageCertificate of EmploymentJanine VeranoPas encore d'évaluation

- Sec Cert CorporationDocument2 pagesSec Cert CorporationNoe S. Elizaga Jr.Pas encore d'évaluation

- Affidavit of Desistance - MICHAEL BURAC CAÑADocument1 pageAffidavit of Desistance - MICHAEL BURAC CAÑAAnjo AlbaPas encore d'évaluation

- COC Form+1+ApplicationDocument4 pagesCOC Form+1+ApplicationJohn Raiel OlartePas encore d'évaluation

- FO07 - Final Form - Application For Refund of Fees (Under The PANDEMIC)Document1 pageFO07 - Final Form - Application For Refund of Fees (Under The PANDEMIC)Bangchan is my favorite side dishPas encore d'évaluation

- NCR Peso DirectoryDocument1 pageNCR Peso DirectoryRaj BautistaPas encore d'évaluation

- NGCP - National Grid Corporation of The PhilippinesDocument2 pagesNGCP - National Grid Corporation of The PhilippinesSheila BowenPas encore d'évaluation

- EFI Application Form SUPPLEMENTARY PDFDocument1 pageEFI Application Form SUPPLEMENTARY PDFJhoie GeeCeePas encore d'évaluation

- Mandaluyong City - CASH FINANCIAL ASSISTANCEDocument1 269 pagesMandaluyong City - CASH FINANCIAL ASSISTANCEPIO City Government of Mandaluyong100% (3)

- Fit-Coc 2022Document3 pagesFit-Coc 2022Janaisha Bai TitoPas encore d'évaluation

- People vs. David - Petition For Review - Court of Appeals - 09-04-2017 PDFDocument26 pagesPeople vs. David - Petition For Review - Court of Appeals - 09-04-2017 PDFLlamas TugononPas encore d'évaluation

- Daneco Letter of IntentDocument1 pageDaneco Letter of IntentGiovanni TandogPas encore d'évaluation

- Authorization Form For Querying FinalDocument1 pageAuthorization Form For Querying FinalApril NPas encore d'évaluation

- Provision of Food, Accommodation, and Meal Allowance To PHWsDocument6 pagesProvision of Food, Accommodation, and Meal Allowance To PHWsNoel Ephraim AntiguaPas encore d'évaluation

- Complaint Affidavit Phase Two City HallDocument6 pagesComplaint Affidavit Phase Two City HallManuel MejoradaPas encore d'évaluation

- BOT LawDocument42 pagesBOT LawCalypsoPas encore d'évaluation

- Moa Solar ProjectDocument2 pagesMoa Solar ProjectcarlomaderazoPas encore d'évaluation

- Housing and Land Use Regulatory BoardDocument1 pageHousing and Land Use Regulatory BoardDolly Llantero-De LeonPas encore d'évaluation

- Demand To Explain AsaytonaDocument1 pageDemand To Explain AsaytonaMarceliano Monato IIIPas encore d'évaluation

- Affidavit of Loss: CAINTA RIZAL 1990 After Being Duly Sworn To in Accordance With Law, Depose and 516323143Document1 pageAffidavit of Loss: CAINTA RIZAL 1990 After Being Duly Sworn To in Accordance With Law, Depose and 516323143Irene MutyaPas encore d'évaluation

- Memo On Sticker System 2020Document1 pageMemo On Sticker System 2020Anonymous yisZNKXPas encore d'évaluation

- Philippine Health Insurance Corporation Regional Office: LetterheadDocument1 pagePhilippine Health Insurance Corporation Regional Office: LetterheadMarilyn CidroPas encore d'évaluation

- Flexible Work Agreement: Last Updated 4 July 2019Document4 pagesFlexible Work Agreement: Last Updated 4 July 2019Muso OnleePas encore d'évaluation

- Board Resolution No 7 2023Document5 pagesBoard Resolution No 7 2023jordan lacopiaPas encore d'évaluation

- Mayor's Permit QC 2 - 2Document2 pagesMayor's Permit QC 2 - 2Zachary YapPas encore d'évaluation

- Code of ConductDocument15 pagesCode of ConductPun'z SalgadoPas encore d'évaluation

- Contract of Lease For Construction EquipmentDocument3 pagesContract of Lease For Construction EquipmentTheresa C FrondaPas encore d'évaluation

- NTP Irr - SignedDocument24 pagesNTP Irr - SignedPalanas A. VincePas encore d'évaluation

- Waiver On Request For Temporary Power Interruption (R T P I) / RestorationDocument1 pageWaiver On Request For Temporary Power Interruption (R T P I) / RestorationJang MolinaPas encore d'évaluation

- Uncertainties Take Spark Out of Power SectorDocument4 pagesUncertainties Take Spark Out of Power Sectorlaloo01Pas encore d'évaluation

- Fuel Supply Risks Loom Over New Coal-Based Thermal Power ProjectsDocument6 pagesFuel Supply Risks Loom Over New Coal-Based Thermal Power ProjectsMeenakshi SinhaPas encore d'évaluation

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesD'EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesPas encore d'évaluation

- Reading ComprehensionsDocument13 pagesReading Comprehensionsrahul vanamaPas encore d'évaluation

- Mahila Kisan Sashaktikaran PariyojanaDocument2 pagesMahila Kisan Sashaktikaran Pariyojanarahul vanamaPas encore d'évaluation

- IT Enabled TransparencyDocument1 pageIT Enabled Transparencyrahul vanamaPas encore d'évaluation

- History of The Basel Committee and Its Membership (August 2009)Document8 pagesHistory of The Basel Committee and Its Membership (August 2009)Lakshay BhatiaPas encore d'évaluation

- IsotopesDocument6 pagesIsotopesrahul vanamaPas encore d'évaluation

- FDI in Multi Brand RetailDocument5 pagesFDI in Multi Brand Retailrahul vanamaPas encore d'évaluation

- FTADocument7 pagesFTArahul vanamaPas encore d'évaluation

- Hierarchy of Courts and Court ProceduresDocument10 pagesHierarchy of Courts and Court Proceduresrahul vanama100% (1)

- Financial InclusionDocument5 pagesFinancial Inclusionrahul vanamaPas encore d'évaluation

- Eco Tourism in IndiaDocument8 pagesEco Tourism in IndiaNoble VarghesePas encore d'évaluation

- Bill Summary NIMHANS Bill, 2010Document1 pageBill Summary NIMHANS Bill, 2010rahul vanamaPas encore d'évaluation

- BiodiversityDocument24 pagesBiodiversityrahul vanamaPas encore d'évaluation

- Biodiversity and Indian LawDocument15 pagesBiodiversity and Indian Lawrahul vanamaPas encore d'évaluation