Académique Documents

Professionnel Documents

Culture Documents

Untitled

Transféré par

ಲೋಕೇಶ್ ಎಂ ಗೌಡDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Untitled

Transféré par

ಲೋಕೇಶ್ ಎಂ ಗೌಡDroits d'auteur :

Formats disponibles

Non-banking financial institutions OBJECTIVE OF THE PROJECT: To develop and understanding of the Non-Banking Financial Institutions (NBFIs) a nd their

business operations in India. To do a detailed research on SREI Equipment Finance Private Limited, its market share and the SWOT analysis. To thoroughly review SREI's credit appraisal and credit management process. To understand the risk management process of the company. To gain a detailed knowledge of the parameters that affects various risks. To determine weightages and scores for designing and developing risk assessment model based on market forces for assessing SREI's Customers. METHODOLOGY: In order to achieve the said objectives, will be to go through the entire NBFs h istory, thrust areas; growth opportunities, present scenario. This will be the o ngoing process and will be done using internet, news and books. To understand the functioning of SREI pertaining to credit risk management and a ppraisal process followed for financing large corporates (risk exposures more th an Rs.5 crores). Factual data, credit appraisal memorandum prepared by the compa ny and the credit risk policy of the company will be referred in this regard. Then comes the technical part of conducting Balance Sheet Analysis, Ratio Analys is and Cash Flow Analysis. To propose a statistical credit rating model, data have been collected from cred it officers and the relationship managers in the institution. Financial ratios w ere used to measure the strength of the customer. Score model for assessing risk to convert responses to scores. Weighted average method applied to assign appro priate importance to various parameters. LIMITATIONS OF THE STUDY: The study will only be focusing on the LARGE CORPORATES (risk exposure more than Rs.5 crores) not the retail and SME sectors of SREI. Study is on the basis of first-hand information collected from employees/head of the division of the company that might be incorrect or biased. Duration of the internship imparts the pressure of covering this vast spectrum i n a limit period of 14 weeks. The accuracy of the Risk Assessing Model depends on the accuracy of information provided by the customer. The risk rating model doesn't take into the consideration where in the company d oesn't follow the rules & norms strictly. The relationships with the customers a re given more importance. INDUSTRY ANALYSIS: Structure of India's Financial Services Industry: The RBI, the central banking and monetary authority of India, is the central reg ulatory and supervisory authority for theIndian financial system. SEBI and IRDA regulate the capital markets and insurance sector, respectively. A variety offin ancial intermediaries in the public and private sectors participate in India's f inancial sector, including the following: Commercial banks; NBFCs; Specialised financial institutions like NABARD, EXIM Bank, SIDBI and TFCI; Securities brokers; Investment banks; Insurance companies; Mutual funds; and Venture capital. NON-BANKING FINANCIALCOMPANIES: Non-banking financial companies (NBFCs) are fast emerging as an important segmen t of Indian financial system. It is an heterogeneous group of institutions (othe r than commercial and co-operative banks) performing financial intermediation in a variety of ways, like accepting deposits, making loans and advances, leasing, hire purchase, etc. They raise funds from the public, directly or indirectly, a nd lend them to ultimate spenders. They advance loans to the various wholesale a

nd retail traders, small-scale industries and self-employed persons. Thus, they have broadened and diversified the range of products and services offered by a f inancial sector. Gradually, they are being recognized as complementary to the ba nking sector due to their customer-oriented services; simplified procedures; att ractive rates of return on deposits; flexibility and timeliness in meeting the c redit needs of specified sectors; etc. The working and operations of NBFCs are regulated by the Reserve Bank of India ( RBI) within the framework of the Reserve Bank of India Act, 1934 (Chapter III B) and the directions issued by it under the Act. As per the RBI Act, a 'non-banki ng financial company' is defined as:- (i) a financial institution which is a com pany; (ii) a non-banking institution which is a company and which has as its pri ncipal business the receiving of deposits, under any scheme or arrangement or in any other manner, or lending in any manner; (iii) such other non-banking instit ution or class of such institutions, as the bank may, with the previous approval of the Central Government and by notification in the Official Gazette, specify. NBFCs VsBANKING SECTOR IN INDIA: Non-Banking Finance Companies (NBFCs) are an integral part of the country's fina ncial system complementing theservices of commercial banks. The main reason attr ibuted to the growth of NBFCs is the comprehensive regulation of thebanking syst em. Other factors include higher level of customer orientation, lesser pre/post sanction requirements andhigher rates of interest on deposits being offered by N BFCs. NBFCs have traditionally been extending credit across various parts of the count ry through their geographical presence,with NBFCs being a supplier of credit to segments such as equipment leasing, hire purchase, and consumer finance. Thesear e areas which warrant infusion of financing due to the existing demand-supply ga p. NBFCs have been a more flexiblesource of financing and have been able to disb urse funds to a gamut of client, from the local common man to a varietyof corpor ate client. NBFCs are also able to accelerate the pace of decision making to dis burse funds, customise andtailor their products according to the client needs an d take on excess risks on their portfolio. NBFCs can be divided intodeposit taki ng NBFCs, i.e., which accept deposits from public and non-deposit taking NBFCs b eing those which do notaccept deposits from public. The activities carried out by NBFCs in India can be grouped as under The types of NBFCs registered with the RBI are: Equipment leasing Company: is any financial institution whose principal business is that of leasing equipment or financing of such an activity. Hire-purchase Company:is any financial intermediary whose principal business rel ates to hire purchase transactions or financing of such transactions. Loan Company: means any financial institution whose principal business is that o f providing finance, whether by making loans or advances or otherwise for any ac tivity other than its own (excluding any equipment leasing or hire-purchase fina nce activity). Investment Company: is any financial intermediary whose principal business is th at of buying and selling of securities. Now, these NBFCs have been reclassified into three categories: Asset Finance Company (AFC) Investment Company (IC) and Loan Company (LC). Under this classification, 'AFC' is defined as a financial institution whose pri ncipal business is that of financing the physical assets which support various p roductive/economic activities in the country. GOVERNMENT ROLE IN PROMOTING INFRASTRUCTURE FINANCE: Infrastructure is expected to be a key area of growth in a developing country li ke India. The Government has been activelypromoting the country's infrastructure through a sustained focus on area like power, roads, ports and urbantransportat ion. Private sector participation through public private partnerships as well as privately funded projects isbeing encouraged in order to enable quick scale up of government's efforts and better management. As per PlanningCommission's estim ates the investments in infrastructure during the Tenth Plan aggregated to Rs. 4

, 52,900 crores whichis expected to increase to Rs. 11, 25,000 crores in the Ele venth Plan. The chart below describes the anticipated andestimated investments u nder the two plans respectively. PROJECTED INVESTMENT IN INFRASTRUCTURE in the 11th FIVE YEAR PLAN: COMPANY PROFILE: A started operation in 1989, Srei is a leading infrastructure focused private se ctor Non-Banking Financial Company (NBFC) in India. It is currently the only ins titution in India offering holistic infrastructure solutions financing, advisory services & development. Milestones Achieved: 1989 - Started operations and identified the infrastructure sector as its core Business area. 1992 - Initial Public Offering with listing on all major stock exchanges. 1997 - IFC, FMO & DEG invested as strategic equity partners Promoters stake. 2002 - Conceived Quippo, India's first equipment bank. 2004 - All India presence, currently 63 offices. 2005 - First Indian NBFC to be listed on the London Stock Exchange. 2006 - Geographical expansion into Russia; equity partners EBRD, DEG, & FMO. 2007 - Joint venture with BNP Paribas Lease Group, 100% subsidiary of BNP Paribas. 2008 - Holistic Infrastructure Institution, financing, advisory services & Development. Services: Infrastructure Equipment Financing & Leasing Infrastructure Project: Financing, Advisory services and development Insurance Broking Venture Capital Capital market Sahaj e-village Quippo - Equipment Bank GROUP STRUCTURE: About Srei Equipment Finance Private Limited: Srei BNP Paribas (Registered name: Srei Equipment Finance Private Limited) is a 50:50 joint-venture between Srei Infrastructure Finance Limited, India's leading and only private sector Non-Banking Financial Institution in the infrastructure space and BNP Paribas Leasing Solutions(BPLS), a wholly owned subsidiary of BNP Paribas, France. Srei BNP Paribas started its operation from January 01, 2008 with the infrastruc ture and construction equipment financing and insurance businesses and has furth er plans to expand its business to new verticals. Industry leader in the infrastructure and construction equipment financing, Srei BNP Paribas is aptly benefitting from the Indian expertise and insight of Srei and global leasing insight in diverse product classes of BNP Paribas. Srei BNP Paribas has deep insight on diverse equipment used in the infrastructur e and construction sector and acts a valuable advisor to its customers. It has t ied up with all the leading equipment manufacturers. Over the years, Srei BNP Pa ribas has been innovating new marketing programs bringing together the manufactu rers and customers on a single platform, creating immense value and sharing this value with all the stake holders. "Paison Ki Nilami" and "Srei BNP Paribas Part nership Week" are two such prominent programs. Srei BNP Paribas has already started financing Technology Solutions (financing o f IT equipment, software and services) and has effectively partnered with leadin g global IT vendors for financing their customers. It has also forayed into fina ncing of new Equipment classes: Agriculture Equipment, Healthcare Equipment, Off ice Automation, and Equipment in Education sector etc. With its foray into new e quipment classes, Srei BNP Paribas has become probably the one and only Company to offer complete Equipment Solutions. With a customer base of over 20,000, Srei BNP Paribas has grown from strength to strength enjoying a strong national presence with a network of 86 offices acros

s India. VISION: To be the most inspiring global holistic infrastructure institution. MISSION: To be an Indian multinational company providing innovative integrated infrastruc ture solutions. CORE VALUES: Customer Partnership: At Srei, customer satisfaction is the benchmark for success. Srei delights its c ustomers through a comprehensive range of financial services that are personaliz ed, fast, reliable, convenient, quality driven, and yet cost - effective. Integrity: Business integrity is a way of life at Srei. The company strongly stands by inte grity in all its dealings and ensures strict adherence to the highest standards of business ethics. Passion for Excellence: Srei's passion for excellence is instrumental in positioning the company as the most innovative infrastructure solution provider in India. Respect for People: Srei acknowledges the fact that its people are its most valuable assets and acco rdingly provides the best possible work environment and treats them like family members. The company rewards excellence and initiative. Stakeholder Value enhancement: Srei is committed to earning the trust and confidence of all its stake holders. Its growth focus, the ability to constantly enlarge its product basket while con trolling risk and reducing the cost of its services have resulted in enhanced va lue for its stakeholders. Professional Entrepreneurship: Srei's in - depth knowledge of infrastructure financing business in India, coupl ed with its spirit of entrepreneurship, and helps the company to overcome the ob stacles and complexities with professional expertise. MANUFACTURING PARTNERS: MARKET SHARE OF SREI BNP PARIBAS: Source: Company. MAJOR COMPETITOR'S: 1. MAGMA FINCORP LIMITED: Magma Fincorp Ltd (Magma) is a Kolkata based asset financing company. The compan y is engaged in financingof commercial vehicles, cars, construction equipment, t ractors and utility vehicles.The company's target customers are mostly first tim e users and small entrepreneurs. The Company provides construction equipment finance across retail and strategic customer segments. In the retail segment, it focuses on first-time buyers and sm all customers. The Company has established contracts with large value vendors ad dressing multiple projects. It finances a range of construction equipment like e xcavators, backhoe loaders, compactors, compressors, cranes, tippers and driller s of prominent brands like JCB, Telcon, L&T, Ingersoll-Rand, Caterpillar, ECEL, Escorts and Atlas Copco etc. Magma provides unsecured EMI-based loans to SMEs for working capital, business e xpansion and business maintenance. It has developed proprietary financial analys is tools to make safe credit assessments. The share of this segment is increasin g in the total disbursements (5% in FY10). Going forward the company intends to maintain the proportion of these loans at 5% and would adopt a cautious approach while lending. In Commercial Vehicle Finance Segment, Magma provides loans on used commercial v ehicles and construction equipment. Magma refinanced popular models of Tata Moto rs and Ashok Leyland. Magma Fincorp predominantly was engaged in financing of construction equipment a nd passenger cars, utility vehicles and commercial vehicles (CVs). These busines s verticals accounted for 90% of the company's disbursements in FY10. Recently t he company has ventured into high-yield segments, viz; financing of used CVs, tr

actors and SME loans. Most of the loans disbursed are retail loans and have smal l ticket size except in the construction equipment segment. MFL has a concentrat ed focus on the under tapped semi urban and rural market to finance first time u sers, Small Road Transport operators, small contractors etc. 2. TATA CAPITAL: The Company was incorporated on March 8, 1991 and actively commenced business op erations since September, 2007. The Company is a wholly owned subsidiary of Tata Sons Limited, the apex holding company of the Tatas. Their fund based businesse s comprise Corporate Finance, Infrastructure Finance and Retail Finance & fee ba sed businesses comprise investment banking, broking and distribution, wealth man agement, private equity, treasury advisory, services relating to travel, forex a nd infrastructure. With the wide array of products and customized service, the commercial finance b usiness, helps small, medium and large corporates grow their business. The compa ny's team of handpicked professionals offers in-depth expertise to help customer s keep pace with the changing marketplace and offer them appropriate solutions t o meet their ever-growing financial needs. The company's management structure en ables them to leverage relationships across lines of our businesses. Their produ ct knowledge and multi-channel delivery model enhances the ability to cross-sell the company's services. TATA Capital is in the advanced stages of setting up in stitutional broking, insurance broking and rural finance businesses which would supplement the aforementioned lines of business. TATA Capital believes that the following are the key strengths: Unified financial services platform; Diversified and balanced mix of businesses; Experienced management team; Innovative solutions model; Respected brand; Controls, processes and risk management systems; and Access to capital. 3. L&T FINANCE LIMITED: L&T Finance Limited (LTF) is a subsidiary of Larsen and Toubro. It was incorpora ted as a Non-Banking Finance Company in November 1994. Through LTF, L&T aims at making a strong foray in the ever-expanding financial services sector.L&T Financ e understands the intricacies of your business. We at L&T Finance offer financin g for your Construction Equipment in the form of term loans, working capital loa n and operating lease facilities. In 1996, L&T Finance had made a foray in finan cing of commercial vehicles. L&T Finance offers financing Commercial Vehicles of all makes and sizes. We also undertake funding of the body for the Commercial V ehicles. L&T Finance has an extensive network from where you can easily avail fi nancing for your Commercial Vehicle. Advantages of partnering with L&T Finance Presence in more than 70 locations Flexible repayment option Competitive interest rates Finance for used vehicles available Faster loan approval and disbursement A brief Comparison between SREI EQUIPMENT FINSNCE & its Competitors: Magma Fincorp Ltd. TATA Capital L&T Finance SREI Product Profile Commercial Vehicle Finance,Construction Equipment Finance,Car and Utility Vehicl e Finance,Suvidha Loans (Refinance),Strategic Construction Equipment Finance,Tra ctor Finance,SME Loans,Insurance Fund based businesses: Corporate Finance, Infrastructure Finance and Retail Fina nce. Fee based Businesses:Investment banking, broking and distribution, wealth m anagement, private equity, treasury advisory, services relating to travel Commercial Vehicle Finance,Construction Equipment Finance, Rural finance, microf

inance, Working Capital Finance, Corporate Finance, Loan against Securities, Pro ject Finance, Insurance & Mutual Funds Fund based businesses:Equipment Financing, Project Financing. Fee based Business es:Project Advisory, Investment Banking, Venture Capital / Fund Management. Presence PAN India Presence PAN India Presence PAN India Presence PAN India Presence Focus Segment First Time Users & Small Entrepreneurs Retail finance, small and mediumEnterprise finance and construction equipment an d infrastructure finance. Strategic Retail Strategic & Retail Branch Network 172 100 200 86 Credit Ratings LAA+(ICRA) LAA+(ICRA) Date of Incorporation 1989 8th March, 1991 (commenced business operations since September,2007 November, 1994 1989 2008 - JV with BNP Paribas Leasing Solutions REASON FOR THE JOINT VENTURE WITH BNP PARIBAS LEGAL SOLUTIONS: Mr.HemantKanoria, Vice Chairman and Managing Director of SREI, termed this joint venture as a very significant step in the Indian Financial Services Market. We a re the largest player in the financing of infrastructure equipment and collabora ting with BPLG will help in increasing our market share further and also expandi ng the product line into financing of agriculture, information technology, medic al and other equipment. Speaking at the occasion Mr. Bertrand Gousset, member of the Executive Committee of BPLG, in charge of Corporate Development, said, We are delighted to be associ ated with the SREI group, who are the leaders in the financing of infrastructure equipment and provide a wide range of equipment finance products to large strat egic clients as well as to retail customers, with pan-India coverage. This joint venture is very significant for us and we look forward to a long and prosperous association with them. Mr. Sunil Kanoria said, This joint venture signifies the coming together of two c ompanies with the same shared values. Both SREI and BPLG are convinced that they are well positioned to build on the already strong platform established by SREI and that this will enable in reduction in cost of funds resulting in higher pro fitability. Mr.Amoudru, CEO of BNP Paribas India and Head of Territory, said "The acquisitio n of a 50% stake in this joint-venture with SREI - a highly recognised firm in e quipment and infrastructure financing - further evidences the willingness of the BNP Paribas Group to expand its presence in India in activities where it has a strong expertise. It represents another substantial capital commitment from the Group- the largest so far- in this country and testifies our confidence in the l ong term prospects of the Indian economy". SWOT ANALYSIS: LITERATURE REVIEW: FLOW OF THE PROCESS AT SREI: CREDIT APPRAISAL: Credit Appraisal is a process to ascertain the risks associated with the extensi

on of the credit facility. It is generally carried by the financial institutions which are involved in providing financial funding to its customers.These financ ial institutions appraise the technical feasibility, economic viability and bank ability including creditworthiness of the prospective borrower. Credit appraisal starts from the time a prospective borrower walks into the branch and culminate s in credit delivery and monitoring with the objective of ensuring and maintaini ng the quality of lending and managing credit risk within acceptable limits. Credit appraisal involves analysis of liquidity position/ financial soundness of the company. Although, the analysis also covers understanding growth trends in revenues and earnings, and profit margins, more emphasis is required to be place d on liquidity-both long term and short term. There are basically two types of proposals that are received by the companies fo r funds. The first types of proposals are financing against new and first hand a ssets to be purchased (EQUIK) and the other proposals are financing against pre owned assets (REQUIK). Asset finance is generally divided into three departments depending upon the ris k exposure*: Retail: Aggregate risk exposure not exceeding Rs.1 crore. SME (Small & Medium Enterprises): Aggregate risk exposure between Rs.1 - 5 crore s. Strategic: Aggregate exposure more than Rs.5 crores. *NOTE: Risk exposure to a client is determined by the summation of Net Finance A mount for the approval(s) being considered, together with all existing exposures to the client & all related concerns in aggregate and residual Net Finance Amou nts under all previous valid approvals for the Client pending part or full disbu rsement. SOME IMPORTANT TERMINOLOGIES: ASSET FINANCE: Asset Finance category includes secured business loan in which the borrower pled ges as collateral an asset used in the conduct of its business. Asset finance al so includes business in which a client takes an asset on lease for use in the co nduct of his business for a defined period with or without right of onward sub lease the asset. ASSET COST: In case of Equik, the invoice values of the Asset including all duties and taxes which are not refundable or adjustable under drawback or otherwise any scheme. Spares, consumables, accessories & auxiliaries, consultancy fees, installation a nd erection charges, etc. shall not be considered as part of asset cost. In case of Requik, Asset cost will be determined by the lowest of: Present Intrinsic Value of Asset as determined through a process by an expert ap proved by SREI. Actual purchase price to be paid by the consumer Current Insured Declared Value. MARGIN: Margin means the client's contribution on the Asset Cost payable upfront or any amount deposited with us as Security Deposit in relation to the transaction befo re the disbursement or release of facility. AIRR: Internal Rate of Return (IRR) by definition is the rate of return at which the N et Present Value of the stream of payments (repayment of installments and intere st by the customer vis--vis the actual disbursement made by the company) become e qual to zero. FIRR: Financial IRR (FIRR) shall mean the transaction IRR without factoring any benefi t available to Srei - BNPP in terms of normal MOU entered into by srei - BNPP wi th concerned manufacturer. Management fees/ RTE/ Commitment Charges collected up front, an extra credit period, subvention or other cash incentives extracted fro m the manufacturer over and above those available workings. YIELD: Yield means the rate of return to Srei-BNPP from the transaction, factoring all

the benefits available to Srei-BNPP under normal MOU and otherwise from the manu facturers/vendors. ETR (Excellent Track Record): ETR means peak delay of not more than 30 days and average delay of not more than 15 days for payment of dues in all existing and past accounts of the proposed c ustomer. GTR (Good track Record): GTR means peak delay of not more than 45 days and average delay of not more than 30 days for payment of dues in all existing and past accounts of the proposed c ustomer. PTR (Poor track Record): PTR means peak delay more than 45 days and average delay of more than 30 days fo r payment of dues in all existing and past accounts of the proposed customer. ANALYSIS OF CREDIT APPRAISAL MEMORANDUM: Credit risk of each individual transaction is studied and managed from the five different perspectives: Customer credit worthiness Asset quality Asset deployment Collateral security Facility type Background of the proponent/ management: The identification of the borrower is done properly through scrutiny of his ante cedents, experience, competence, integrity, initiative etc. This may be done by obtaining status reports from previous bankers. In case of corporate, the manage ment structure, the background of the top management needs to be scrutinized. KY C guidelines as framed by RBI are adopted by the company. Commercial Appraisal: The nature of the product, demand for the same, the existing and perceived compe tition in the segment, ability of the proponents to withstand the same, governme nt policies governing the industry etc. need to be taken into consideration. Technical Appraisal: Technical appraisal of the project needs to be carried out for industrial activi ty proposals beyond the cut - off limits prescribed from time to time. Such appr aisal may be carried out in - house by technical officers. Financial Appraisal: Apart from ascertaining the need based character of the limits requested for, th e financial health of the proponents, ability to absorb unanticipated financial costs need to be looked into which would include scrutiny of the cost of the pro ject, means of financing, financial projections etc. important performance indic ators like profitability ratios, debt - equity ratio, operating profit margin et c. need to be within acceptable parameters for that industries/ activities. INTRODUCTION TO RISK: The interpretation of the word 'risk' will determine the approach to risk manage ment. The word 'risk' is interpreted in three distinct senses namely risk as haz ard, risk as opportunity and risk as uncertainty. Risk as hazard is the most commonly used meaning of risk and it means likely fin ancial losses arising from negative events such as control failures, bad publici ty and loss of reputation. Risk management in this context would mean eliminatin g possibilities of losses from such negative events by putting in place adequate control systems. Risk as an opportunity means, taking risks and earning adequate returns on them. This implies the trade-off between risk and return. Here risk management, becom es risk optimization meaning maximizing the upside potential and minimizing the downside. Here capacity and ability to manage risk is used to increase sharehold ers' value and achieve a competitive advantage. Risk, as uncertainty is basically a statistical concept, which assumes a normal distribution for future outcomes. Here risk management means narrowing the diffe rence between the expected outcomes and actual results. Banks and other similar financial institutions need to manage the risk inherent in the entire portfolio

as well as the risk in individual credits or transactions. The effective managem ent of risk is a critical component of a comprehensive approach to risk manageme nt and essential to the long-term success of any banking organization. In simple words, risk is the possibility of losses associated with decrease in t he credit quality of borrowers. In a financial institution, loss may stem from d efault due to inability or unwillingness of a customer to meet his commitments i n relation to lending, trading, settlement and other financial transactions. A d efault reduces the present value of the loan and consequently the value of the b ank's business. Thus, it is imperative that these institutions have a robust ris k management. MODEL BUILDING: Need for Study: A Risk Assessment Model (RAM) is necessary to avoid the limitations associated w ith a simplistic and broad classification of applicants into a "good" or "bad" c ategory The comapny currently uses a judgemental risk assessing model. Grading System for Standardization of Risk: The grades (symbols, numbers, alphabets, and descriptive terms) used in the inte rnal credit-risk grading system represent, without any ambiguity, the default ri sks associated with an exposure. The grading system will enable comparisons of r isks for purposes of analysis and top management decision-making. The grading sy stem is therefore, be flexible and should accommodate the refinements in risk ca tegorization. STEPS IN DEVELOPING OF MODEL: STEP- 1: Identification of all the key risk components in the principal business : The first step in the development of the model was the identification of the var ious parameters to be taken into consideration. For this purpose, the various ma nuals and documents pertaining to appraisal were carefully studied. More factors were added to the list to make it comprehensive, effective and statistical. Thi s was done through literature survey and scanning the company's appraisal system . The following was the result..Risk assessment can be done from 2 aspects: Quantitative aspect: Quantitative aspect refers to managing the credit risk by using the quantitative tools and techniques such as ratio analysis, and reaching a concrete number for every loan which would indicate the magnitude of risk and expected returns, on a case by case basis. Qualitative aspect: Qualitative aspect is taking a holistic view by a financial institute at its ove rall portfolio, deciding the lending limits to a sector, setting up the broad po licies and procedures, and so on. Both quantitative and qualitative aspects need to be taken into consideration wh ile computing the risk levels. In the case of corporate clients, post-mortem of the balance sheet is one of the main instruments. Ratio analysis helps us determ ine whether the loans have to be extended. But, past performance is not an ideal indicator of the future performance. This raises the necessity to consider othe r qualitative parameters such as technological status, reputation, repayment tra ck with others and so on. Classification of Risk: The risk faced by financial institutions extending commercial vehicles or constr uction equipment finance has been regrouped as follows: A. Liquidity Risk: Liquidity risk is the non-availability of cash to pay a liability that falls due . A company is deemed to be financially sound if it is in a position to carry on its business smoothly and meet all the obligations - both long term as well as short term - without strain. Assessment of the efficiency with which the funds a re put to use is very important for credit analysis. The study of efficiency of debt-service management becomes essential to banks as the ratios reveal:

Whether the profit of the firm is enough to cover not only the interest payment, but also to provide a reasonable cushion against future uncertainty Whether the profit is sufficient to provide enough coverage for repayment bligat ions Whether the assets of the firm provide adequate security for loanssanctioned. In short, the coverage ratios show the relationship between the debt servicing c ommitments and the sources for meeting these burdens. Debt Equity Ratio: The ratio brings out the extent to which the firm is dependent on outsiders for its existence and indicates the proportion of the owners' stake in the business. A high ratio means that claims of creditors are greater than owner's funds. Exc essive liabilities tend to cause insolvency. This is the most unfavourable situa tion for a banker, as he may gain the position of just one among the many credit ors of the company. Current Ratio: The current ratio is an index of the concern's financial stability since it show s the extent of the working capital, which is the amount by which the current as sets exceed the current liabilities. A high current ratio indicates inadequate e mployment of funds while a poor current ratio is a danger signal to the manageme nt. It shows that business is trading beyond its resources. Interest Coverage Ratio: It tells the analysts the extent to which the firm's current earnings are able t o meet current interest payments. When this ratio is high it shows that the busi ness would earn sufficient profits to pay the interest charges periodically. A l ow interest coverage ratio may result in financial embarrassment. Funded Debt Ratio: The ratio of secured loans to turnover is known as Funded Debt Ratio. This ratio varies from sector to sector. A low Funded Debt Ratio is preferred. B. Operations Risk: In a competitive market, it is critical for any business unit to control its cos ts at all levels. To measure the operational efficiency, the turnover ratios and profitability ratios are used. They measure how efficiently the firm is employi ng the assets. They also represent the relationship between profit and sales, an d between profit and investment. Net profit margin: The final profit figure arrived at after charging all the expenses of the firm a gainst all its income is called net profit. A credit officer would look at the t rend of net profit over the years. A company, which has been consistently achiev ing positive growth rates, reflects a healthy industry position and the manageme nt's commitment to the business, effective steps taken by the management to prom ote their sales in the market. Fixed Assets Turnover Ratio: This ratio measures the sales per rupee of investment in fixed assets or the eff iciency with which fixed assets are employed. A high ratio indicates a high degr ee of efficiency in asset utilization and a low ratio reflects inefficient use o f assets. Total Assets Turnover Ratio: This takes the total view of the business as a producing unit. It determines the produce ability of the assets of the business, which also indicates the manager ial capacity of the entrepreneur in putting the assets to best use. Free Assets to Total Assets: This ratio is critical to firms employing commercial vehicles and construction e quipment as it determines the level of assets available to a banker in case of d efault. The higher the ratio more secured the funding would be. Construction Equipment / Vehicles Turnover Ratio: This ratio measures the sales per rupee of investment in construction equipment and vehicles. In simple terms it measures the fleet strength of the clients. Experience in the Industry: Experience in the industry also helps in determining the operation risk. Basical ly it helps in measuring the work orders and the cost involved in the same. If i

t is a well-established industry the risk to finance them will be low and vice v ersa C. Credit Risk: Credit risk is risk resulting from uncertainty in a counter party's willingness to meet his contractual obligations. The business character of a borrower rests on traits as trustworthiness and commitment. Repayment track with others: The repayment track of the borrower with others determines how well they have ca rried out their business in the past years. A business with prompt payment has l ess credit risks than those whose reputation is a question mark in the market. S rei has its own different categories based on the repayment track i.e. ETR, GTR & PTR. Percentage funding to total cost: This helps us measure the level of financial commitment of the borrower in the p roposal. Lower ratio means more contribution from the borrower and the risk on t he banker's end is low. Category of assets: At Srei, there are basically two types of assets: Standard assets & Non-Standard Assets. The approvals, interest charged, and risk assessment is done on the bas is of the category. Standard Assets are charged comparatively low interest rate with respect to Non-Standard Assets. D. Market Risk The factors influencing the relative competitive position of the customer are ex amined in detail. The result of these factors is reflected in the ability of the issuer to maintain or improve its market share. It may be mentioned that the cu stomers, whose market share is declining, generally do not get favourable long-t erm ratings. Net Worth to Net Sales: The net worth of a business provides that important cushion to withstand shocks from adverse changes in external (economic, financial and legal) and internal en vironments of the business. Net worth is thus referred to as the risk capital. W hen compared to the sales of the business, it shows the efficiency with which th e capital is rotated in the business. Technology Status Obsolescence is another problem that an industry faces. A firm's competitive pos ition is decided based on the technological competence it possesses. Advances in technology can dramatically alter a firm's landscape. The firm is at an advantageous position when it holds superior technology. The r isk is more among the players in the industry when the technological competence is inferior. The risk of not keeping up with the progress of changing technology may affect the growth. Hence a firm with a good technological background is mor e attractive. Competitions: The competitions prevailing in the market also determines the risk involved whil e financing a client. If there is less competition & the customer is the major p layer then there is less risk involved and vice versa. Geographical Factors Affecting the Industry: The geographical factors where the customers are established are also taken into consideration while assessing the risk. STEP - IV: ARRIVE AT THE RISK RATING ON THE RISK ASSESSMENT MODEL: Based on the information on weights which was collected from the credit team of the company, a standard and comprehensive model was developed. Each of the custo mers will be rated on each of the parameters based on the key provided. The fina l score of the customer decides the risk involved in operating with him. To aid the assessment process and to systematize the entire process, key for ass essment has been developed in consultation with people well versed in this field . The key will not only quicken the assessment, but also standardizes it. The pa rameters in each risk category should be analysed based on the key and must be g iven a score. The scores should be multiplied with the weights assigned, in prop ortion to the importance of the parameter, to arrive at an aggregate for each ri

sk category. Each risk category is measured separately and is also expressed as a percentage, which would help to measure the risk easily. After calculating the risks under each category, they must be summed up and the grand score will be o n 1000. To get a single point indicator of the risks, it is divided by 10 and ex pressed as a score on 100. Based on the final score the company is given a ratin g by referring to the scoring guide of the model. As mentioned earlier, the grades used in the internal risk grading system should represent, without any ambiguity, the default risks associated with an exposure . Here, we employ a numeric rating scale. A numeric scale developed is such that t he lower the risk, the lower is the rating on the scale. The rating scale consis ts of 6 levels, of which levels 0 to 2 represents various grades of acceptable c redit risk and levels 3 to 5 represents various grades of unacceptable credit ri sk associated with an exposure. The scale, starting from "0" (which would repres ent lowest level credit risk and highest level of safety) and ending at "5" (whi ch would represent the highest level of credit risk and lowest level of safety), is deployed to standardize, benchmark, compare and monitor credit risk associat ed with the bank's loans and give indicative guidelines for risk management acti vities. The model, the key for assessment and the scoring guide along with the interpret ation are illustrated below. # Parameters Weight Score Weighted score LIQUIDITY RISK 1 Debt Equity Ratio 8.5 2 Current Ratio 5 4 Interest Coverage Ratio 6 5 Debt Service Coverage Ratio 10 6 Secured Loans to Turnover Ratio 9 Sub Total OPERATIONS RISK 6 Net Profit Margin 9 7 OperatingProfit Margin 9 8 Fixed Assets Turnover Ratio 6 9 Return on Capital Employed 7.5 10 Free Assets to Total Assets 7 11

Construction Equipment / Vehicles Turnover Ratio 8 12 Experience in the Industry 9 Sub Total CREDIT RISK 18 %age Funding to Total Cost 7 19 Repayment Track with Others 10 22 Category of Assets 6.5 Sub Total MARKET RISK 100 23 Geographical factors affecting the Industry 7 24 Net Worth to Net Sales 6 25 Promoters stake in the Industry 8 26 Technology status 5 27 Competitions 6.5 Sub Total GRAND TOTAL SCORE (in %ge) The Risk Assessment Model Table showing the key for assessment # Parameters \ Scores Ratings Best Worst 5 4 3 2 1 1 Debt Equity Ratio 1 - 1.5 1.5 - 2 2 - 2.5 2.5 - 3 Above 3 2 Current Ratio Above 2.5 2 - 2.5 1.33 - 2 1 - 1.33

Below 1 Interest Cov-erage Ratio Above 4 2.5 - 4 1.5-2.5 1.5 - 1 Below 1 4 Debt Service Coverage Ratio Above 2.5 1.5 -2.5 1.25 -1.5 1 -1.25 Below 1 5 Funded Debt Ratio Very High High Moderate Low Very Low 6 Net profit Margin Increasing sharply Increasing Constant Inconsistent Decreasing 7 Operating Profit Margin Increasing sharply Increasing Constant Inconsistent Decreasing 8 Fixed assets turnover Ratio Above 3.5 3 - 3.5 2.5 - 3 2.5 - 3 2 - 2.5 9 Return on Capital Employed Very High High Moderate Low Very Low 10 Free Assets to Total Assets Very High High Moderate Low Very Low Construction Equipment/ Vehicles Turnover Ratio Very High

High Moderate Low Very Low 12 Experience in the Industry More than 20 years 10 - 20 years 5 - 10 years 2 - 5 years 0 - 2 years 13 %age funding to Total Cost Below 75 % 75 - 80% 80 - 85% 85 - 90% More than 90 % Repayment Track with Others ETR GTR PTR VPTR Category of Assets Standard Non Standard Geographical Factors Affecting the Industry Most favourable Favourable Moderate Less Favourable Very Less Favourable. Net Worth to sales Very High High Moderate Low Very Low Promoters Stake in the Industry 100% 80% 70% 60% Less than 60% 26 Technology Status Superior Updated Comfort -able Competitions No Competitio-n Very Less Competitio-n Less Competitio-n High Competito-n Very High Competition THE SCORING GUIDE RISK SCORE (%)

RISK CATEGORY EXPLANATION NATURE OF CASE 100 -81 0 Very low risk Excellent 80 - 71 1 Low risk Very good 70 - 61 2 Comfortable risk Good 60 - 51 3 Tolerable risk Fair 50 - 41 4 High risk Doubtful Below41 5 Undesirable risk Poor Interpretation: RISK CATEGORY 0 - Indicates fundamentally strong position. Risk factors are negl igible. There may be circumstances adversely affecting the degree of safety but even such circumstances are not likely to affect the timely payment of principal and interest as per terms. RISK CATEGORY 1 - The risk factors are more variable and greater in periods of e conomic stress. Any adverse change in circumstances may alter the fundamental st rength and affect the timely payment of principal and interest as per terms. RISK CATEGORY 2 - Considerable variability in risk factors. The protective facto rs are below average. Adverse changes in economic circumstances are likely to af fect the timely payment of principal and interest as per terms. RISK CATEGORY 3 - Risk factors indicate that obligations may not be met when due . The protective factors are narrow. Adverse changes in economic conditions coul d result in inability or unwillingness to service debts on time as per terms. RISK CATEGORY 4 - There are inherent elements of risk. Timely servicing of debts could be possible only in case of continued existence of favourable circumstanc es. RISK CATEGORY 5 - Extremely speculative. Either already in default in payment of interest and/or principal as per terms or expected to default. Recovery is like ly only on liquidation or re-organization. NOTE: The above proposed risk rating Model will not be applicable in following situati ons: When the financing is done on the basis of the SREI's Relationship with the clie nts. When the financing is done to a new or recently formed company. When financing is done to a Manufacturing Unit.

Vous aimerez peut-être aussi

- A Practical Approach to the Study of Indian Capital MarketsD'EverandA Practical Approach to the Study of Indian Capital MarketsPas encore d'évaluation

- Office Procedure ManualDocument145 pagesOffice Procedure ManualKarunamoorthy PeriasamyPas encore d'évaluation

- KSFE Chapter 1 IntroductionDocument52 pagesKSFE Chapter 1 IntroductionArcha PrasadPas encore d'évaluation

- Credit Appraisal System of Commercial Vehicle Loans.Document43 pagesCredit Appraisal System of Commercial Vehicle Loans.Pravin Kolpe92% (12)

- Project On NBFCDocument67 pagesProject On NBFCAnu Pandey77% (44)

- Project On NBFCDocument67 pagesProject On NBFCAnu Pandey77% (44)

- Growth of NBFC Sector in IndiaDocument40 pagesGrowth of NBFC Sector in IndiaNirmal Kumar Kushwah67% (3)

- NBFC ProjectDocument97 pagesNBFC Projectsanjaydesai173_8631850% (2)

- Credit Appraisal in MuthootDocument30 pagesCredit Appraisal in MuthootNISHI1994100% (1)

- MMU Internship Final Report (Strategic Communication)Document51 pagesMMU Internship Final Report (Strategic Communication)jaaynePas encore d'évaluation

- NBFC Final ProjectDocument56 pagesNBFC Final ProjectYogesh PatilPas encore d'évaluation

- A Project Report OnDocument109 pagesA Project Report Onpiyu211sarawagigmail50% (2)

- Project Report-Reliance Communications-Customer SatisfactionDocument57 pagesProject Report-Reliance Communications-Customer Satisfactionyash mittal82% (49)

- JK Bank Project ReportDocument74 pagesJK Bank Project ReportSurbhi Nargotra43% (7)

- Roadmap b1 Plus Teachers - Material Vocabulary - BankDocument10 pagesRoadmap b1 Plus Teachers - Material Vocabulary - BankHani oveissyPas encore d'évaluation

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- Privatising SecurityDocument184 pagesPrivatising Security...tho the name has changed..the pix remains the same.....Pas encore d'évaluation

- A Study On Financial Performance Analysis of The Sundaram Finance LTDDocument56 pagesA Study On Financial Performance Analysis of The Sundaram Finance LTDSindhuja Venkatapathy88% (8)

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsD'EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsPas encore d'évaluation

- Shriram Finace Sip ReportDocument64 pagesShriram Finace Sip Reportshiv khillari75% (4)

- A Study On Financial Performance Analysis of Sundaram Finance LimitedDocument56 pagesA Study On Financial Performance Analysis of Sundaram Finance LimitedAnonymous lOz8e6tl0Pas encore d'évaluation

- Yellow JournalismDocument14 pagesYellow Journalismtaasha26Pas encore d'évaluation

- Market Potential Study of MFS at MMFSL BangaloreDocument77 pagesMarket Potential Study of MFS at MMFSL BangaloreIMAM JAVOORPas encore d'évaluation

- About IndustryDocument36 pagesAbout IndustryHardik AgarwalPas encore d'évaluation

- Analysis of Loan Process and Competitors of Magma FincorpDocument39 pagesAnalysis of Loan Process and Competitors of Magma Fincorp983858nandini80% (5)

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardUbaid DarPas encore d'évaluation

- Mediating Effect of Service Quality on Non-Banking Financial InstitutionsDocument8 pagesMediating Effect of Service Quality on Non-Banking Financial InstitutionsGAYATHRIPas encore d'évaluation

- Non Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way ForwardDocument13 pagesNon Banking Financial Company (NBFC) Sector in India - Trends, Regulatory Issues and Way Forwardshubham moonPas encore d'évaluation

- Pandey FileDocument62 pagesPandey FileAkshat AgarwalPas encore d'évaluation

- NBFC Module 2 CompletedDocument27 pagesNBFC Module 2 CompletedAneesha AkhilPas encore d'évaluation

- Para Banking Services With Reference To HDFC BankDocument90 pagesPara Banking Services With Reference To HDFC Bankcharu100% (1)

- BBI FinalDocument25 pagesBBI FinalVarsha ParabPas encore d'évaluation

- International School of BusinessDocument37 pagesInternational School of BusinessTaseen MbPas encore d'évaluation

- Understanding Consumer Purchase of Durable Loans from NBFCsDocument37 pagesUnderstanding Consumer Purchase of Durable Loans from NBFCsTaseen MbPas encore d'évaluation

- Non-Banking Financial CompaniesDocument25 pagesNon-Banking Financial CompaniesbboysupremoPas encore d'évaluation

- Shraddha ProjectDocument70 pagesShraddha ProjectAkshay Harekar50% (2)

- Universal BankingDocument13 pagesUniversal BankingShrutikaKadamPas encore d'évaluation

- Pf-2-Term 5-BKFSDocument41 pagesPf-2-Term 5-BKFSAasif KhanPas encore d'évaluation

- Hinduja Leyland Finance LTDDocument28 pagesHinduja Leyland Finance LTDShekhar Landage100% (1)

- NBFC Edelweise Retail FinanceDocument14 pagesNBFC Edelweise Retail FinancesunitaPas encore d'évaluation

- Blackbook FinalDocument86 pagesBlackbook Finalgunesh somayaPas encore d'évaluation

- Report On Consumer Loan Services System of IDLCDocument51 pagesReport On Consumer Loan Services System of IDLCisraatPas encore d'évaluation

- Interim Report ModifiedDocument37 pagesInterim Report ModifiedsrikanthkgPas encore d'évaluation

- 43 Shweta SinghDocument5 pages43 Shweta Singhrohit sharmaPas encore d'évaluation

- Sundaram Finance LTD - Financial Analysis StudyDocument10 pagesSundaram Finance LTD - Financial Analysis StudyFinance Project ReportsPas encore d'évaluation

- NBFC FinalDocument100 pagesNBFC FinalDivyangi WaliaPas encore d'évaluation

- Environmental AnalysisDocument7 pagesEnvironmental Analysisprantik420Pas encore d'évaluation

- Trend Analysis FinanceDocument17 pagesTrend Analysis FinanceNarasimhaPrasadPas encore d'évaluation

- Final Project of Fin 433Document43 pagesFinal Project of Fin 433UpomaAhmedPas encore d'évaluation

- Understanding Non-Banking Financial Companies (NBFCsDocument19 pagesUnderstanding Non-Banking Financial Companies (NBFCsRohit AggarwalPas encore d'évaluation

- NBFC in IndaDocument26 pagesNBFC in Indajuvi_kPas encore d'évaluation

- Mahindra Finance Project PDFDocument60 pagesMahindra Finance Project PDFIMAM JAVOORPas encore d'évaluation

- Credit Appraisal of Corporate Borrowers Company:Ing Vysya BankDocument23 pagesCredit Appraisal of Corporate Borrowers Company:Ing Vysya BankGeetika ChouhanPas encore d'évaluation

- PPT of NBFC SDocument56 pagesPPT of NBFC Sfm949Pas encore d'évaluation

- SynopsisDocument6 pagesSynopsisksinghmohit1997Pas encore d'évaluation

- Loan RecoveryDocument62 pagesLoan RecoveryKaran Thakur100% (1)

- Non-Banking Financial InstitutionsDocument4 pagesNon-Banking Financial Institutionscool_vardahPas encore d'évaluation

- Capital First Limited ProjectDocument74 pagesCapital First Limited Projectbiranchi behera100% (1)

- Bnmit College ProjectDocument21 pagesBnmit College ProjectIMAM JAVOORPas encore d'évaluation

- 03 - IntroductionDocument50 pages03 - IntroductionVirendra JhaPas encore d'évaluation

- NBFCDocument21 pagesNBFCGuruPas encore d'évaluation

- Muthoot Finance Marketing StrategiesDocument10 pagesMuthoot Finance Marketing StrategiesNaveenPas encore d'évaluation

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)D'EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Pas encore d'évaluation

- Marketing of Consumer Financial Products: Insights From Service MarketingD'EverandMarketing of Consumer Financial Products: Insights From Service MarketingPas encore d'évaluation

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteD'EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NotePas encore d'évaluation

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesD'EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesPas encore d'évaluation

- My School Name Is R.N.S. Vidyniketan.: I Am Seven Years OldDocument1 pageMy School Name Is R.N.S. Vidyniketan.: I Am Seven Years Oldಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Advanced Financial ManagementDocument17 pagesAdvanced Financial Managementಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- VismDocument1 pageVismಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- My School Name Is R.N.S. Vidyniketan.: I Am Seven Years OldDocument1 pageMy School Name Is R.N.S. Vidyniketan.: I Am Seven Years Oldಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- AfmDocument10 pagesAfmಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Vtu Mba Final Summer Project On Hyundai Part ADocument31 pagesVtu Mba Final Summer Project On Hyundai Part Avikash_thakur2363% (8)

- Consumer SatisfactionDocument23 pagesConsumer SatisfactionAnupam KrisPas encore d'évaluation

- VismDocument1 pageVismಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- My School Name Is R.N.S. Vidyniketan.: I Am Seven Years OldDocument1 pageMy School Name Is R.N.S. Vidyniketan.: I Am Seven Years Oldಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- AdnmjDocument17 pagesAdnmjಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- AfmDocument10 pagesAfmಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- A Study On Inventory Management 1. Industry Profile:: East West Institution of Technology BangaloreDocument83 pagesA Study On Inventory Management 1. Industry Profile:: East West Institution of Technology Bangaloreಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Advanced Financial ManagementDocument17 pagesAdvanced Financial Managementಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Karnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008Document6 pagesKarnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008ಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Biz Resources Book-6Document23 pagesBiz Resources Book-6Khairol AlejandroPas encore d'évaluation

- 3 1 FinancingSlidesDocument23 pages3 1 FinancingSlidesಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- AfmDocument10 pagesAfmಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- New Microsoft Office Word DocumentDocument83 pagesNew Microsoft Office Word Documentಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Project Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument69 pagesProject Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofBramharoutu Kaushik100% (2)

- TRG ProjectreportDocument5 pagesTRG ProjectreportRavi SinghPas encore d'évaluation

- TitelsDocument15 pagesTitelsಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Executive SummaryDocument1 pageExecutive Summaryಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- TitelsDocument15 pagesTitelsಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Ratio AnalysisDocument85 pagesRatio AnalysisSuramalla PratapPas encore d'évaluation

- Hyundai Industrial Trident Co Environmental Policy LeaderDocument2 pagesHyundai Industrial Trident Co Environmental Policy Leaderಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- GREEN MKTG TITLES UNDER 40 CHARSDocument11 pagesGREEN MKTG TITLES UNDER 40 CHARSಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Chervolet Part A N BDocument35 pagesChervolet Part A N Bಲೋಕೇಶ್ ಎಂ ಗೌಡPas encore d'évaluation

- Contrast1 Unit2Document28 pagesContrast1 Unit2Ignacio Joaquin García SosaPas encore d'évaluation

- 1989 Tiananmen Square - Student Massacre - Was A HoaxDocument33 pages1989 Tiananmen Square - Student Massacre - Was A HoaxTimPas encore d'évaluation

- Coca Cola (KO) Financial RatiosDocument4 pagesCoca Cola (KO) Financial RatiosKhmao SrosPas encore d'évaluation

- Application - Module2 - Zuasula, Jannila G.-Se12Document7 pagesApplication - Module2 - Zuasula, Jannila G.-Se12Jannila ZuasulaPas encore d'évaluation

- Learn French Fast with Top AppsDocument4 pagesLearn French Fast with Top AppsTeacher SabrinaPas encore d'évaluation

- ACSVAW 2008-2010 Biennial ReportDocument72 pagesACSVAW 2008-2010 Biennial ReportAssociation Concerning Sexual Violence Against WomenPas encore d'évaluation

- G10PP Economics Winter Holiday Research Report analyzes market monopolyDocument5 pagesG10PP Economics Winter Holiday Research Report analyzes market monopolyWinnie LeePas encore d'évaluation

- Oral Communication q1 LP 6Document7 pagesOral Communication q1 LP 6MICHAEL MORILLOPas encore d'évaluation

- Admissibility of Complaints Before The African CourtDocument80 pagesAdmissibility of Complaints Before The African CourtPress FidhPas encore d'évaluation

- OPT B1plus Diagnostic TestDocument6 pagesOPT B1plus Diagnostic TestUla GłPas encore d'évaluation

- DocumentDocument6 pagesDocumentKervie Jay LachaonaPas encore d'évaluation

- American Dissident Prince Judge MatthewDocument25 pagesAmerican Dissident Prince Judge MatthewIgnita Veritas University Law CentrePas encore d'évaluation

- Reviglass 2nd TermDocument7 pagesReviglass 2nd TermIñigo MuñagorriPas encore d'évaluation

- Writing Feature Articles PDFDocument26 pagesWriting Feature Articles PDFAdama MarcPas encore d'évaluation

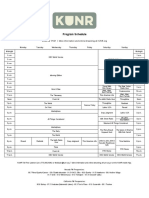

- KUNR Schedule July 1, 2021Document1 pageKUNR Schedule July 1, 2021KUNR Reno Public Radio100% (1)

- Srimathi Sundaravalli Memorial School Chennai 2021-2022: EnglishDocument4 pagesSrimathi Sundaravalli Memorial School Chennai 2021-2022: EnglishJitheshPas encore d'évaluation

- News BulletinDocument2 pagesNews BulletinUtkarsh bajajPas encore d'évaluation

- Media Outlets Audience Reach Personal Preference: NewspaperDocument4 pagesMedia Outlets Audience Reach Personal Preference: Newspapertherese BPas encore d'évaluation

- LA Sheriff Deputy Ryan Clinkunbroomer Shot, Killed While Sitting in Patrol CarDocument4 pagesLA Sheriff Deputy Ryan Clinkunbroomer Shot, Killed While Sitting in Patrol CarRamonita GarciaPas encore d'évaluation

- Print Edition: February 10, 2014Document21 pagesPrint Edition: February 10, 2014Dhaka TribunePas encore d'évaluation

- Informative EssayDocument8 pagesInformative EssayMaria Resper LagasPas encore d'évaluation

- Media Prima ANNUAL REPORT 2011Document248 pagesMedia Prima ANNUAL REPORT 2011Mohd Firdaus Abd LatifPas encore d'évaluation

- Minshall Taylor Analysis3Document7 pagesMinshall Taylor Analysis3api-293751345Pas encore d'évaluation

- SolarEdge - A World Leader in Smart EnergyDocument3 pagesSolarEdge - A World Leader in Smart EnergyAgusPas encore d'évaluation

- 2ND Quarter Periodical ExamDocument3 pages2ND Quarter Periodical ExamErica DeocampoPas encore d'évaluation