Académique Documents

Professionnel Documents

Culture Documents

Cost Accounting (Short Notes) - Previous Year Questions

Transféré par

Jamal Hossain ShuvoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Cost Accounting (Short Notes) - Previous Year Questions

Transféré par

Jamal Hossain ShuvoDroits d'auteur :

Formats disponibles

Cost Accounting (short notes) - Previous Year Questions

Period cost: Costs incurred during a particular period of time. Expense that is not inventoriable; it is charged against sales revenue in the period in which the revenue is earned, also called period expense. Selling and general and administrative expenses are period costs. Zero base budgeting: A method of budgeting in which all expenses must be justified for each new period. Type of budgeting that assumes that there was no previous budget, and all expenditures need to be justified. Master budget: Master Budget is a summary of a company's plans in which specific targets are set for sales, production, distribution, and financing activities and that generally culminates in a cash budget, budgeted income statement, and budgeted balance sheet. Margin of safety: Margin of safety is used in break-even analysis to indicate the amount of sales that are above the breakeven point. In other words, the margin of safety indicates the amount by which a companys sales could decrease before the company will become unprofitable. C/M Ratio: The contribution margin ratio is the percentage of a firm's contribution margin to its sales. Contribution margin is a products price minus its variable costs, resulting in the incremental profit earned for each unit sold. Opportunity cost: The cost of best alternative that must be forgone in order to pursue a certain action. Limiting Factor: The success of an organism is limited by the presence or absence of the factors necessary for survival is called limiting factor. A Limiting factor is something that limits the growth, reproduction or distribution of organisms. Efficiency Variance: The difference between the actual quantity of input used (such as metres of materials) and the budgeted quantity of input that should have been used, multiplied by the budgeted price.

Split of point: The split-off point is the point in a production process where jointly manufactured products can be recognized as individual products. Full costing: Full costing is a costing method that includes all manufacturing costs - direct materials, direct labor, and both variable and fixed overhead - as part of the cost of a finished unit of product. Also know as Absorbing Costing. Relevance Range: The range of activity within which assumptions about variable and fixed cost behavior are valid. The relevant range refers to a specific activity level that is bounded by a minimum and maximum amount. Within that range of activities, certain revenue or cost levels can be expected to occur. Outside of that relevant range, revenues and expenses will likely differ from the expected amount.

Management By exception: Management by Exception is a "policy by which management devotes its time to investigating only those situations in which actual results differ significantly from planned results. Management by exception is the process of detecting problems and eliminating them so they do not occur again. Differential cost: Any cost that differs between alternatives in a decision-making situation. Feedback: Accounting and other reports that help managers monitor performance and focus on problems and/or opportunities that might otherwise go unnoticed.

Jamal Hossain shuvo

www.Quickincometips.com

Cost Accounting (short notes) - Previous Year Questions

Financial Budget: Financial budgets are financial plans that are structured to detail projections on incomes and expenses on both a long-term and a short-term basis. Out of pocket cost: Out of Pocket Cost is actual cash outlays for salaries, advertising, repairs, and similar costs. Out-ofpocket expenses are direct outlays of cash which may or may not be later reimbursed. Flexible budget: A budget that is adjusts for changes in sales volume and other cost-driver activities. Also called variable budget. Semi variable Cost: Semi-variable cost is an expense which contains both a fixed-cost component and a variable-cost component. The fixed cost element shall be a part of the cost that needs to be paid irrespective of the level of activity achieved by the entity. On the other hand the variable component of the cost is payable proportionate to the level of activity. Idle time variance: The difference between the number of hours budgeted for work and the number of paid hours not spent working (idle time). Standard costing: Standard costing means assigning the expected, budgeted costs to the goods manufactured, the goods in inventory, and the goods sold. In other words, the amounts assigned are the costs that should occur when manufacturing products. Standard Costing is a technique which uses standards for costs and revenues for the purpose of control through variance analysis. Cost driver: Cost driver is a factor, such as machine-hours, beds occupied, computer time, or flight-hours, that causes overhead costs. By product: A by-product is a secondary product derived from a manufacturing process or chemical reaction. It is not the primary product or service being produced. A by-product can be useful and marketable or it can be considered waste. Joint product: Two or more items that are produced from a common input are called joint products. Sunk cost: Sunk cost is any cost that has already been incurred and that cannot be changed by any decision made now or in the future. Under applied factory overhead: A debit balance in the Manufacturing Overhead account that arises when the amount of overhead cost actually incurred is greater than the amount of overhead cost applied to Work in Process during a period. Equivalent production unit: Number of units of an item that could have been produced with the given material and processing costs in an accounting period. This measure is used as a benchmark in allocating departmental costs. Prime cost: Prime costs are those costs which are prime importance for making any product, calculated as the total of direct material costs, direct labor costs, and direct expenses. Cost sheet: A document that reflects the cost of the items and services required by a particular project or department for the performance of its business purposes. Job order costing: A costing system used in situations where many different products, jobs, or services are produced each period.

Jamal Hossain shuvo

www.Quickincometips.com

Vous aimerez peut-être aussi

- ABC: Activity-based costingDocument12 pagesABC: Activity-based costingDurga Tripathy DptPas encore d'évaluation

- CMA Viva Prep 190309Document5 pagesCMA Viva Prep 190309Md. Nazmul Huda ShantoPas encore d'évaluation

- Cost Accounting DefinationsDocument7 pagesCost Accounting DefinationsJâmâl HassanPas encore d'évaluation

- Cost Accounting ProjectDocument27 pagesCost Accounting ProjectKishan KudiaPas encore d'évaluation

- MGT Acctg Cost ConceptDocument30 pagesMGT Acctg Cost ConceptApril Pearl VenezuelaPas encore d'évaluation

- Managerial Accounting DefinitionsDocument15 pagesManagerial Accounting Definitionskamal sahabPas encore d'évaluation

- Cost Concepts Product Costs and Period CostsDocument10 pagesCost Concepts Product Costs and Period CostsRain AgrasihPas encore d'évaluation

- Absorption CostingDocument23 pagesAbsorption Costingarman_277276271Pas encore d'évaluation

- Karina-Managerial AccountingDocument13 pagesKarina-Managerial AccountingKarinaPas encore d'évaluation

- Acc 3200 MidtermDocument5 pagesAcc 3200 MidtermCici ZhouPas encore d'évaluation

- Cost Analysis Project ReportDocument6 pagesCost Analysis Project ReportNouman BaigPas encore d'évaluation

- Cost of AccountingDocument9 pagesCost of Accountingnadeemahad98Pas encore d'évaluation

- Cost Terminology and Classification ExplainedDocument8 pagesCost Terminology and Classification ExplainedKanbiro Orkaido100% (1)

- Cost & Management Accounting (ACT 301) : Department: BBA Group: 1Document7 pagesCost & Management Accounting (ACT 301) : Department: BBA Group: 1Mony MstPas encore d'évaluation

- Common Accounting Terminology Glossary Nov 08Document10 pagesCommon Accounting Terminology Glossary Nov 08mbilal1985Pas encore d'évaluation

- Cost Management Accounting April 2021Document10 pagesCost Management Accounting April 2021Nageshwar SinghPas encore d'évaluation

- Marginal Costing and Absorption CostingDocument9 pagesMarginal Costing and Absorption CostingKhushboo AgarwalPas encore d'évaluation

- Marginal Costing and Budgetary ControlDocument5 pagesMarginal Costing and Budgetary ControlThigilpandi07 YTPas encore d'évaluation

- Classification of CostDocument5 pagesClassification of CostCharlotte ChanPas encore d'évaluation

- CostingDocument32 pagesCostingnidhiPas encore d'évaluation

- Unit 1 Lesson 3Document4 pagesUnit 1 Lesson 3avan4052asPas encore d'évaluation

- Cost Accounting - Meaning and ScopeDocument27 pagesCost Accounting - Meaning and ScopemenakaPas encore d'évaluation

- Management Accounting GlossaryDocument10 pagesManagement Accounting GlossaryPooja GuptaPas encore d'évaluation

- Glossary: Absorption CostingDocument11 pagesGlossary: Absorption CostingHome UserPas encore d'évaluation

- MadmDocument9 pagesMadmRuchika SinghPas encore d'évaluation

- Management AccountingDocument87 pagesManagement AccountingYashveer MachraPas encore d'évaluation

- Managerial Accounting - Chapter3Document27 pagesManagerial Accounting - Chapter3Nazia AdeelPas encore d'évaluation

- Accounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)Document4 pagesAccounting 202 Exam 1 Study Guide: Chapter 1: Managerial Accounting and Cost Concepts (12 Questions)zoedmolePas encore d'évaluation

- Cost Classification and TerminologyDocument13 pagesCost Classification and TerminologyHussen AbdulkadirPas encore d'évaluation

- Cost AccountingDocument15 pagesCost Accountingesayas goysaPas encore d'évaluation

- 79 52 ET V1 S1 - Unit - 6 PDFDocument19 pages79 52 ET V1 S1 - Unit - 6 PDFTanmay JagetiaPas encore d'évaluation

- Assignment 1 BUSI 3008Document21 pagesAssignment 1 BUSI 3008Irena MatutePas encore d'évaluation

- Marginal and Absorption CostingDocument5 pagesMarginal and Absorption CostingHrutik DeshmukhPas encore d'évaluation

- Module 2 - Introduction To Cost ConceptsDocument51 pagesModule 2 - Introduction To Cost Conceptskaizen4apexPas encore d'évaluation

- Cost Capter FourDocument11 pagesCost Capter FourAbayineh MesenbetPas encore d'évaluation

- Nature and Scope of Cost & Management Accounting: Unit 1Document24 pagesNature and Scope of Cost & Management Accounting: Unit 1umang8808Pas encore d'évaluation

- Absorption CostingDocument76 pagesAbsorption CostingMustafa KamalPas encore d'évaluation

- 11th Sem - Cost ACT 1st NoteDocument5 pages11th Sem - Cost ACT 1st NoteRobin420420Pas encore d'évaluation

- Atp 106 LPM Accounting - Topic 6 - Costing and BudgetingDocument17 pagesAtp 106 LPM Accounting - Topic 6 - Costing and BudgetingTwain JonesPas encore d'évaluation

- Cost Classification and Procedures ReportDocument11 pagesCost Classification and Procedures Reportreyman rosalijosPas encore d'évaluation

- Marginal CostingDocument42 pagesMarginal CostingAbdifatah SaidPas encore d'évaluation

- CostDocument33 pagesCostversmajardoPas encore d'évaluation

- Management AccountingDocument11 pagesManagement AccountingVishnu SharmaPas encore d'évaluation

- cost management allDocument26 pagescost management allranveer78krPas encore d'évaluation

- Management InformationDocument2 pagesManagement InformationRup KothaPas encore d'évaluation

- LEC 02 COST CLASSIFICATION 16032023 115705amDocument19 pagesLEC 02 COST CLASSIFICATION 16032023 115705amZeeshan MajeedPas encore d'évaluation

- A. Detailed Organizational Structure of Finance DepartmentDocument22 pagesA. Detailed Organizational Structure of Finance Departmentk_harlalkaPas encore d'évaluation

- Elements of Cost: Management Accounting Costs Profitability GaapDocument8 pagesElements of Cost: Management Accounting Costs Profitability GaapstefdrocksPas encore d'évaluation

- Introduction To Food CostingDocument17 pagesIntroduction To Food CostingSunil YogiPas encore d'évaluation

- Definition of Cost AccountingDocument11 pagesDefinition of Cost Accountingkenshi ihsnekPas encore d'évaluation

- Costing ConceptsDocument16 pagesCosting ConceptskrimishaPas encore d'évaluation

- Cost ConceptDocument6 pagesCost ConceptDeepti KumariPas encore d'évaluation

- Introduction To Cost Accounting Final With PDFDocument19 pagesIntroduction To Cost Accounting Final With PDFLemon EnvoyPas encore d'évaluation

- Characteristics of Marginal CostingDocument2 pagesCharacteristics of Marginal CostingLJBernardoPas encore d'évaluation

- Marginal CostingDocument14 pagesMarginal CostingVijay DangwaniPas encore d'évaluation

- Cost Ch. IIDocument83 pagesCost Ch. IIMagarsaa AmaanPas encore d'évaluation

- Advanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Document62 pagesAdvanced Cost Accounting and Management Control System: Mekonnen Mengistie (PHD Candidate)Kalkidan ZerihunPas encore d'évaluation

- Intro To Managerial and Cost Accounting. CostsDocument19 pagesIntro To Managerial and Cost Accounting. Costsmehnaz kPas encore d'évaluation

- Fixed Cost (FC)Document3 pagesFixed Cost (FC)alcuinomarianessajeanPas encore d'évaluation

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageD'EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- Powerpoint MCQ Bank PDFDocument21 pagesPowerpoint MCQ Bank PDFquickincometips0% (1)

- Operating Systems MCQ BankDocument21 pagesOperating Systems MCQ BankJamal Hossain Shuvo100% (1)

- CRM Slide Jamal50duDocument18 pagesCRM Slide Jamal50duJamal Hossain ShuvoPas encore d'évaluation

- Bear Call Spread Strategy ExplainedDocument2 pagesBear Call Spread Strategy ExplainedJamal Hossain ShuvoPas encore d'évaluation

- Comparative Short NotesDocument1 pageComparative Short NotesJamal Hossain ShuvoPas encore d'évaluation

- JSC composition suggestionsDocument3 pagesJSC composition suggestionsJamal Hossain ShuvoPas encore d'évaluation

- Main Body Part - CRGDocument24 pagesMain Body Part - CRGJamal Hossain ShuvoPas encore d'évaluation

- 1 Managing-ProjectsDocument9 pages1 Managing-ProjectsJamal Hossain ShuvoPas encore d'évaluation

- Interpersonal CommunicationDocument2 pagesInterpersonal CommunicationJamal Hossain ShuvoPas encore d'évaluation

- Arif's CVDocument3 pagesArif's CVJamal Hossain ShuvoPas encore d'évaluation

- Management Foundations Assessment 2 Business Report 2013Document7 pagesManagement Foundations Assessment 2 Business Report 2013Jamal Hossain ShuvoPas encore d'évaluation

- Bbbaa VivaDocument4 pagesBbbaa VivaJamal Hossain ShuvoPas encore d'évaluation

- Internship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshDocument67 pagesInternship Report - CRM (Credit Risk Management) Practice of BASIC Bank Limited, BangladeshJamal Hossain Shuvo100% (2)

- Ent MGT Assignment 1 Detailed GuidelineDocument2 pagesEnt MGT Assignment 1 Detailed GuidelineJamal Hossain ShuvoPas encore d'évaluation

- Essay Mid-Semester Exam - 6 August 2013Document2 pagesEssay Mid-Semester Exam - 6 August 2013Jamal Hossain ShuvoPas encore d'évaluation

- AuditDocument3 pagesAuditJamal Hossain ShuvoPas encore d'évaluation

- Islamic BankingDocument1 pageIslamic BankingJamal Hossain ShuvoPas encore d'évaluation

- Shantii Marketing AssignmentDocument4 pagesShantii Marketing AssignmentJamal Hossain ShuvoPas encore d'évaluation

- Assessment 2 International Marketing StrategyDocument4 pagesAssessment 2 International Marketing StrategyJamal Hossain ShuvoPas encore d'évaluation

- CV of Jamal HossainDocument2 pagesCV of Jamal HossainJamal Hossain ShuvoPas encore d'évaluation

- Statistics Term Paper FINALDocument60 pagesStatistics Term Paper FINALJamal Hossain ShuvoPas encore d'évaluation

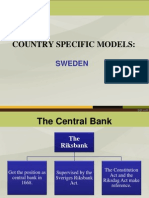

- SWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTDocument8 pagesSWEDEN'S CENTRAL BANK AND PARLIAMENTARY OVERSIGHTJamal Hossain ShuvoPas encore d'évaluation

- Ethics Case Study ADocument2 pagesEthics Case Study AJamal Hossain ShuvoPas encore d'évaluation

- Assessment 1 International Marketing StrategyDocument2 pagesAssessment 1 International Marketing StrategyJamal Hossain ShuvoPas encore d'évaluation

- AuditDocument3 pagesAuditJamal Hossain ShuvoPas encore d'évaluation

- Investment BankingDocument3 pagesInvestment BankingJamal Hossain ShuvoPas encore d'évaluation

- Step10 PlagiarismDocument15 pagesStep10 PlagiarismJamal Hossain Shuvo100% (1)

- Audit FinalDocument4 pagesAudit FinalJamal Hossain ShuvoPas encore d'évaluation

- HRMDocument5 pagesHRMJamal Hossain ShuvoPas encore d'évaluation

- De So 2 de Kiem Tra Giua Ki 2 Tieng Anh 8 Moi 1677641450Document4 pagesDe So 2 de Kiem Tra Giua Ki 2 Tieng Anh 8 Moi 1677641450phuong phamthihongPas encore d'évaluation

- Arpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionDocument4 pagesArpia Lovely Rose Quiz - Chapter 6 - Joint Arrangements - 2020 EditionLovely ArpiaPas encore d'évaluation

- Notes Socialism in Europe and RussianDocument11 pagesNotes Socialism in Europe and RussianAyaan ImamPas encore d'évaluation

- The Five Laws of Light - Suburban ArrowsDocument206 pagesThe Five Laws of Light - Suburban Arrowsjorge_calvo_20Pas encore d'évaluation

- Supply Chain AssignmentDocument29 pagesSupply Chain AssignmentHisham JackPas encore d'évaluation

- The Future of Indian Economy Past Reforms and Challenges AheadDocument281 pagesThe Future of Indian Economy Past Reforms and Challenges AheadANJALIPas encore d'évaluation

- AVK Butterfly Valves Centric 75 - TADocument1 pageAVK Butterfly Valves Centric 75 - TANam Nguyễn ĐứcPas encore d'évaluation

- ms3 Seq 01 Expressing Interests With Adverbs of FrequencyDocument3 pagesms3 Seq 01 Expressing Interests With Adverbs of Frequencyg27rimaPas encore d'évaluation

- P.E 4 Midterm Exam 2 9Document5 pagesP.E 4 Midterm Exam 2 9Xena IngalPas encore d'évaluation

- Arx Occasional Papers - Hospitaller Gunpowder MagazinesDocument76 pagesArx Occasional Papers - Hospitaller Gunpowder MagazinesJohn Spiteri GingellPas encore d'évaluation

- AVX EnglishDocument70 pagesAVX EnglishLeo TalisayPas encore d'évaluation

- Battery Genset Usage 06-08pelj0910Document4 pagesBattery Genset Usage 06-08pelj0910b400013Pas encore d'évaluation

- CP ON PUD (1) ADocument20 pagesCP ON PUD (1) ADeekshitha DanthuluriPas encore d'évaluation

- 11th AccountancyDocument13 pages11th AccountancyNarendar KumarPas encore d'évaluation

- 2010 Economics Syllabus For SHSDocument133 pages2010 Economics Syllabus For SHSfrimpongbenardghPas encore d'évaluation

- Introduction to History Part 1: Key ConceptsDocument32 pagesIntroduction to History Part 1: Key ConceptsMaryam14xPas encore d'évaluation

- Red Orchid - Best PracticesDocument80 pagesRed Orchid - Best PracticeslabiaernestoPas encore d'évaluation

- February / March 2010Document16 pagesFebruary / March 2010Instrulife OostkampPas encore d'évaluation

- Equity Valuation Concepts and Basic Tools (CFA) CH 10Document28 pagesEquity Valuation Concepts and Basic Tools (CFA) CH 10nadeem.aftab1177Pas encore d'évaluation

- Jesus' Death on the Cross Explored Through Theological ModelsDocument13 pagesJesus' Death on the Cross Explored Through Theological ModelsKhristian Joshua G. JuradoPas encore d'évaluation

- Classification of Boreal Forest Ecosystem Goods and Services in FinlandDocument197 pagesClassification of Boreal Forest Ecosystem Goods and Services in FinlandSivamani SelvarajuPas encore d'évaluation

- Codilla Vs MartinezDocument3 pagesCodilla Vs MartinezMaria Recheille Banac KinazoPas encore d'évaluation

- Speech Writing MarkedDocument3 pagesSpeech Writing MarkedAshley KyawPas encore d'évaluation

- Purposive Communication Module 1Document18 pagesPurposive Communication Module 1daphne pejo100% (4)

- Device Exp 2 Student ManualDocument4 pagesDevice Exp 2 Student Manualgg ezPas encore d'évaluation

- Activity 1 DIASSDocument3 pagesActivity 1 DIASSLJ FamatiganPas encore d'évaluation

- Full Discography List at Wrathem (Dot) ComDocument38 pagesFull Discography List at Wrathem (Dot) ComwrathemPas encore d'évaluation

- MW Scenario Handbook V 12 ADocument121 pagesMW Scenario Handbook V 12 AWilliam HamiltonPas encore d'évaluation

- Adic PDFDocument25 pagesAdic PDFDejan DeksPas encore d'évaluation

- Overlord Volume 1 - The Undead King Black EditionDocument291 pagesOverlord Volume 1 - The Undead King Black EditionSaadAmir100% (11)