Académique Documents

Professionnel Documents

Culture Documents

Paterson Analysis For Cokal

Transféré par

Randy CavaleraTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Paterson Analysis For Cokal

Transféré par

Randy CavaleraDroits d'auteur :

Formats disponibles

36

Patersons Resources Review - May 2012

Cokal Limited CKA ($0.33)

Recommendation: BUY

Slow progress

OUR VIEW

Analyst: Andrew Harrington, Matthew Trivett

Information from Cokals (CKA) primary exploration project, Bumi Barito Mineral (BBM), in Central Kalimantan has been pretty slow since the maiden resource was dened in December 2011. This has been due to the consistent rain, which is normal for this time of the year, and only being able to use small manually portable drill rigs. The small rigs need to be used because CKA has not received the forestry exploration permit over BBM. Once the permit is granted tracks can be cleared and larger track mounted rigs can be used. Despite the slow drilling progress crews have been out completing surface exploration work on BBM as well as CKAs other Central Kalimantan tenements. CKA has also been expanding its footprint in Indonesia, acquiring 3 tenements in West Kalimantan and progressing infrastructure. Our CKA price target only reects BBM production of 2.4Mtpa and we believe that this has upside potential once feasibility studies on BBM and infrastructure in Murung Raya are completed and other projects are advanced. We have applied a country risk factor of 25% on the BBM project (0.75x NAV) and pushed our start date back one quarter to Q1 CY2014. This has reduced our price target to $0.65/share.

Investment Highlights

Investment Summary

Year End June 30 Reported NPAT ($m) Recurrent NPAT ($m) Recurrent EPS (cents) EPS Growth (%) PER (x) EBITDA ($m) EV/EBITDA (x) Capex ($m) Free Cashow FCFPS (cents) PFCF (x) DPS (cents) Yield (%) Franking (%) 2011A (2.6) (2.6) (0.7) na (47.9) (2.6) (41.5) 0.0 (25.7) (6.7) (4.9) 0.0 0.0 100.0 2012F (6.4) (6.4) (1.4) na (23.8) (6.3) (19.4) 0.0 (20.1) (4.4) (7.6) 0.0 0.0 100.0 2013F (8.2) (8.2) (1.8) na (18.7) (7.4) (23.3) 30.6 (48.4) (10.5) (3.1) 0.0 0.0 100.0 2014F (2.4) (2.4) (0.5) na (63.8) 6.4 37.6 59.8 (70.2) (15.2) (2.2) 0.0 0.0 100.0

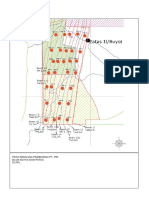

Bumi Barito Mineral (BBM). CKAs maiden resource was dened on BBM late last year. Since then it has been tough going for the drill crews, hampered by consistent rainfall throughout the wet season (January-March). CKA is also waiting for its forestry exploration permit. The introduction of the clean and clear requirement on permits has prolonged the process. Clean and clear status shows that the mining areas have complete documents and no overlapping areas. CKA believe that all requirements for this permit are now satised. Exploration ramp up. The exploration to date on BBM has been done by small manually transported drill rigs. This is difcult and time consuming. In addition to the drilling CKA have had exploration crews out mapping surface geology uncovering coal outcrops throughout the tenement. Once the forestry exploration permit is granted, exploration tracks can be cleared and larger track mounted rigs can be used. CKA has plant ready to be utilised once the permit is granted and we believe that better equipment, easier access and the greater understanding of the geology will result in an increase in the information ow of the coal contained in BBM and an increase to the JORC compliant resource. Infrastructure developments. CKA has progressed plans for coal export infrastructure for its Central Kalimantan tenements. MoUs have been signed with the regency of Murung Raya to develop two ports and two small scale coal red power stations. CKA is developing the infrastructure with the Regency Governments Development Corporation. This will benet the community and place CKA in an ideal place to supply infrastructure solutions to other mines to be developed in the area, including the BHP Adaro Juloi project. West Kalimantan. CKA completed the acquisition of 75.2% of PT Silangkop Nusa Raya (SNR), which holds three exploration licences in West Kalimantan near the Malaysian border. The SNR Licenses cover an area of approximately 13,000 hectares and while little work has been done recently, a review of the geological records of the area found that work done by a major Japanese coal company had identied coking coal bearing formations close to the western border of SNR. Analysis surfaces samples taken from weathered outcropping coal seams from areas surrounding SNR indicate the coal has metallurgical qualities and CKA believes that these outcropping seams continue into SNR.

Company Statistics & Performance

Shares on issue (m) 411.0 Market Cap. ($m) 135.6 52 week range $0.34-$0.80 3mth ADT ($m) Debt est ($m) Cash est ($m) 0.37 0.0 28.7

1.00

3000 2500 2000 Volume ('000)

0.80 Share Price (A$)

0.60 1500 0.40 1000 0.20 500 0 12 Months

0.00

All information and advice is condential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of this rm or any member or employee thereof.

Patersons Resources Review - May 2012

Cokal Limited

Valuation Bumi Barito Mineral FX Hedging Corporate Unpaid Capital Cash Debt NAV Price Target (0.75x NAV) Summary of Assets A$m 399.4 0.0 (35.3) 6.6 28.7 0.0 399.5

37

$0.33

A$/sh 0.87 0.00 (0.08) 0.01 0.06 0.00 0.87 0.65 Commodity Assumptions 2011A

Year End June 30

2012F 1.04 303 228 233 123 49 2012F 2013F 1.03 211 153 158 98 50 2013F 2014F 1.00 176 123 128 88 51 2014F

US$/A$ 0.9869 Hard Coking Coal 248.75 Semi-soft Coking Coal 182.50 PCI 195.00 Export Thermal Coal 106.00 Domestic Thermal Coal (A$/t) 45.39 Production Summary 2011A

Attributable Saleable Coal Production Bumi Barito Mineral (kt) FOB costs (US$/t) Price Received (US$/t) All Mines (Kt) Cash costs (US$/t) Price Received (US$/t) Prot & Loss (A$m) Sales Revenue Other Income Operating Costs Exploration Exp. Corporate/Admin EBITDA Depn & Amort EBIT Interest Operating Prot Tax expense Abnormals + Minorities NPAT Normalised NPAT Cash Flow (A$m) Adjusted Net Prot + Interest/Tax/Expl Exp - Interest/Tax/Expl Inc + Depn/Amort +/- Other (Associates) Operating Cashow - Capex (+asset sales) - Working Capital Increase Free Cashow - Dividends (ords & pref) + Equity raised + Debt drawdown (repaid) Net Change in Cash Cash at End Period Net Cash/(Debt) Balance Sheet (A$m) Cash Total Assets Total Debt Total Liabilities Shareholders Funds Ratios Net Debt/Equity (%) Interest Cover (x) Return on Equity (%) 2011A 0.0 0.6 0.0 0.0 3.2 (2.6) 0.0 (2.6) 0.0 (2.6) 0.0 0.0 (2.6) (2.6) 2011A 2012F 0.0 1.1 0.0 1.8 5.6 (6.3) 0.1 (6.4) 0.0 (6.4) 0.0 0.0 (6.4) (6.4) 2012F 2013F 0.0 1.1 0.0 2.4 6.1 (7.4) 0.0 (7.4) 0.7 (8.2) 0.0 0.0 (8.2) (8.2) 2013F 264 89.05 149.25 264 89.05 149.25 2014F 39.6 0.2 23.6 3.5 6.2 6.4 0.9 5.6 8.0 (2.4) 0.0 0.0 (2.4) (2.4) 2014F

Bumi Barito Mineral 100%

Coal Production Summary

1,400 1,200 1,000

(kt)

200.00 160.00

(US$/t)

800 600 400 200 2012F 2013F 2014F 2015F 2016F 2017F 2018F 2019F 2020F 2021F 0

120.00 80.00 40.00 0.00

Cash costs (US$/t) Price Received (US$/t) All Mines (Kt)

Resources 100% Basis (Mt) Mine Bumi Barito Mineral Other Indonesian Assets Tanzania Mozambique Resources Directors Name Mr Peter Lynch Mr Pat Hanna Mr Jim Middleton Mr Domenic Martino Mr Duncan Cornish Mr Chris Turvey Signicant Shareholders Peter Lynch Domenic & Sandra Martino Blackrock Group Patrick Hanna Norges Bank Passport Capital Jim Middleton Position Executive Chairman Executive Director Managing Director Non Executive Director CFO & Company Secretary Exploration & Resource Manager Shares (m) 55.0 37.0 31.6 25.0 17.8 14.5 10.0 % 13.4 9.0 7.7 6.1 4.3 3.5 2.4 M&I Inferred 60 0 0 0 Total 60 0 0 0 60

(2.6) (6.4) (8.2) (2.4) 0.0 1.8 3.2 11.5 14.7 15.2 12.9 20.4 0.0 0.1 0.0 0.9 (8.3) (0.4) 0.0 0.0 (25.7) (20.1) (17.8) (10.4) 0.0 0.0 30.6 59.8 0.0 0.0 0.0 0.0 (25.7) (20.1) (48.4) (70.2) 0.0 0.0 0.0 0.0 31.3 31.6 0.0 0.0 0.0 0.0 30.6 57.9 5.6 11.5 (17.8) (12.3) 17.2 28.7 10.9 (1.4) 17.2 28.7 (19.7) (90.0) 2011A 17.2 44.8 0.0 8.6 36.2 na na na 2012F 28.7 61.7 0.0 0.2 61.4 na na na 2013F 10.9 84.0 30.6 30.8 53.3 37.1 na na 2014F (1.4) 153.1 88.5 102.2 50.9 176.8 0.7 na

All information and advice is condential and for the private information of the person to whom it is provided and is provided without any responsibility or liability on any account whatsoever on the part of this rm or any member or employee thereof.

Vous aimerez peut-être aussi

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorD'EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorPas encore d'évaluation

- TAG Initiating Coverage - 20111003 CasimirDocument17 pagesTAG Initiating Coverage - 20111003 CasimirmpgervetPas encore d'évaluation

- Orca Financial ReportDocument8 pagesOrca Financial ReportLwaga KibonaPas encore d'évaluation

- AnnualReport 2011Document154 pagesAnnualReport 2011Anna FedoseevaPas encore d'évaluation

- Mining Industry PresentationsDocument38 pagesMining Industry Presentationspoitan2Pas encore d'évaluation

- Metals & Mining Result UpdatedDocument3 pagesMetals & Mining Result UpdatedAngel BrokingPas encore d'évaluation

- Technics Oil & Gas: Initiation of CoverageDocument15 pagesTechnics Oil & Gas: Initiation of Coveragecentaurus553587Pas encore d'évaluation

- PTTEP FinalDocument27 pagesPTTEP FinalBancha WongPas encore d'évaluation

- PTTEP - Analyst Meeting 1Q13Document31 pagesPTTEP - Analyst Meeting 1Q13spmzPas encore d'évaluation

- 20 Jewels 2020 PDFDocument54 pages20 Jewels 2020 PDFWan RuschdeyPas encore d'évaluation

- Technics Oil & Gas: 3QFY12 Results ReviewDocument4 pagesTechnics Oil & Gas: 3QFY12 Results ReviewtansillyPas encore d'évaluation

- Engineers India Annual Report 2009-10Document149 pagesEngineers India Annual Report 2009-10bhu_300Pas encore d'évaluation

- Tanjung Offshore: Turning Attractive Upgrade To BuyDocument4 pagesTanjung Offshore: Turning Attractive Upgrade To Buykhlis81Pas encore d'évaluation

- Plan - 2000 Ha Rubber Plantation Indonesia - PT NRDocument8 pagesPlan - 2000 Ha Rubber Plantation Indonesia - PT NRantoniussitanggang100% (1)

- Misc (Hold, Eps ) : HLIB ResearchDocument3 pagesMisc (Hold, Eps ) : HLIB ResearchJames WarrenPas encore d'évaluation

- Barings To Miami Pension PlanDocument25 pagesBarings To Miami Pension Planturnbj75Pas encore d'évaluation

- Rakon Announcement 14 Feb 08Document6 pagesRakon Announcement 14 Feb 08Peter CorbanPas encore d'évaluation

- Northern Star Resources LTD: More +KG/T Intercepts Into Voyager Lodes, PaulsensDocument6 pagesNorthern Star Resources LTD: More +KG/T Intercepts Into Voyager Lodes, Paulsenschrisb700Pas encore d'évaluation

- Middle Fly District Development Authority: Fly River Provincial GovernmentDocument4 pagesMiddle Fly District Development Authority: Fly River Provincial GovernmentJeremiah TerryPas encore d'évaluation

- Peb 16augDocument24 pagesPeb 16augFahmy ArdhiansyahPas encore d'évaluation

- Krakatau Steel (B) CaseDocument6 pagesKrakatau Steel (B) CaseWidyawan Widarto 闘志Pas encore d'évaluation

- Action Notes: Trican Well Service LTDDocument4 pagesAction Notes: Trican Well Service LTDkanith0Pas encore d'évaluation

- Implementation Completion and Results ReportDocument46 pagesImplementation Completion and Results ReportNebojsa RedzicPas encore d'évaluation

- NFL Annual Report 2011-2012Document108 pagesNFL Annual Report 2011-2012prabhjotbhangalPas encore d'évaluation

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkPas encore d'évaluation

- Mercator Lines (Singapore) LTD.: Stock Code: EE6Document31 pagesMercator Lines (Singapore) LTD.: Stock Code: EE6tsrayPas encore d'évaluation

- "Working Capital": A Project Report On GNFCDocument13 pages"Working Capital": A Project Report On GNFCEr Priti SinhaPas encore d'évaluation

- 8990 Initiation Cimb Format PDFDocument33 pages8990 Initiation Cimb Format PDFrtfirefly168Pas encore d'évaluation

- Weekly Foreign Holding & Block Trade - Update - 13 02 2014Document4 pagesWeekly Foreign Holding & Block Trade - Update - 13 02 2014Randora LkPas encore d'évaluation

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforPas encore d'évaluation

- Analyst Meet 2013Document44 pagesAnalyst Meet 2013anon_481361080Pas encore d'évaluation

- Fibria Corporate Presentation Mar 2011Document21 pagesFibria Corporate Presentation Mar 2011FibriaRIPas encore d'évaluation

- Tata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Document46 pagesTata Moters" 2011-2013 A Project Report On Financial Analysis of "Tata Motors"Arpkin_lovePas encore d'évaluation

- Profitability Ratio (2007)Document25 pagesProfitability Ratio (2007)zonayetgaziPas encore d'évaluation

- KKR Investor UpdateDocument8 pagesKKR Investor Updatepucci23Pas encore d'évaluation

- Analyst Meet Presentation Jan 08Document37 pagesAnalyst Meet Presentation Jan 08Varun KumarPas encore d'évaluation

- Hynix Semiconductor: Initiate With A 1-OW: Re-Armed and ReadyDocument45 pagesHynix Semiconductor: Initiate With A 1-OW: Re-Armed and Readymanastir_2000Pas encore d'évaluation

- Sarin Technologies: SingaporeDocument8 pagesSarin Technologies: SingaporephuawlPas encore d'évaluation

- Daily Trade Journal - 04.10.2013Document6 pagesDaily Trade Journal - 04.10.2013Randora LkPas encore d'évaluation

- IRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Document2 pagesIRIS Corporation Berhad - Rimbunan Kaseh To Come in Next Quarter - 120827Amir AsrafPas encore d'évaluation

- Sub: Accounting and Financial Management IVRCL and Infrastructure PVT LTD Submitted To: Dr. D.R.Patel By: Shaikh Adnan Cp1812Document15 pagesSub: Accounting and Financial Management IVRCL and Infrastructure PVT LTD Submitted To: Dr. D.R.Patel By: Shaikh Adnan Cp1812Adnan ShaikhPas encore d'évaluation

- Corporate Presentation: February, 2011Document21 pagesCorporate Presentation: February, 2011FibriaRIPas encore d'évaluation

- Daily Trade Journal - 26.12.2013Document6 pagesDaily Trade Journal - 26.12.2013Randora LkPas encore d'évaluation

- India Cements: Performance HighlightsDocument12 pagesIndia Cements: Performance HighlightsAngel BrokingPas encore d'évaluation

- Accenture and Lockheed Martin A Financial Management PortfolioDocument20 pagesAccenture and Lockheed Martin A Financial Management PortfolioMark SamrajPas encore d'évaluation

- Ezra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysDocument13 pagesEzra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysTheng RogerPas encore d'évaluation

- Krakatau Steel (A)Document12 pagesKrakatau Steel (A)Fez Research Laboratory100% (4)

- Emas Kiara Industries Berhad: 1QFY12/10 Net Profit Grows 23% YoY - 31/5/2010Document7 pagesEmas Kiara Industries Berhad: 1QFY12/10 Net Profit Grows 23% YoY - 31/5/2010Rhb InvestPas encore d'évaluation

- ICRA Credit Rating Rationale - KaruturiDocument7 pagesICRA Credit Rating Rationale - KaruturiTj BlogsPas encore d'évaluation

- Daily Trade Journal - 15.10.2013Document6 pagesDaily Trade Journal - 15.10.2013Randora LkPas encore d'évaluation

- Minmetals Land (230 HK) : Making The Right Moves But Doubts LingerDocument4 pagesMinmetals Land (230 HK) : Making The Right Moves But Doubts LingerChee Siang LimPas encore d'évaluation

- Still A Long Way To Go: Otto MarineDocument6 pagesStill A Long Way To Go: Otto MarineckyeakPas encore d'évaluation

- Kiribati Road Rehabilitation ProjectDocument53 pagesKiribati Road Rehabilitation Projecthaquet_prif100% (1)

- EDB Annual Report 2010 2011 EnglishDocument24 pagesEDB Annual Report 2010 2011 EnglishKarthik ManoharanPas encore d'évaluation

- Daily Trade Journal - 29.07.2013Document6 pagesDaily Trade Journal - 29.07.2013Randora LkPas encore d'évaluation

- Daily Trade Journal - 28.01.2014Document6 pagesDaily Trade Journal - 28.01.2014Randora LkPas encore d'évaluation

- PTT 2010 AnalystMeetingDocument43 pagesPTT 2010 AnalystMeetingspmzPas encore d'évaluation

- Thermal Power ProjectDocument40 pagesThermal Power ProjectHinal GangarPas encore d'évaluation

- Daiwa June InitiatingDocument73 pagesDaiwa June InitiatingvaruntalukdarPas encore d'évaluation

- Creating Value MiningDocument53 pagesCreating Value MiningRandy CavaleraPas encore d'évaluation

- Case Crown CompanyDocument24 pagesCase Crown CompanyRandy CavaleraPas encore d'évaluation

- Peta Rencana Pemboran Pt. Pir Blok Buyoi Dan Patas Di Apl: BB-14 BB-15 HP-3 HP-4Document1 pagePeta Rencana Pemboran Pt. Pir Blok Buyoi Dan Patas Di Apl: BB-14 BB-15 HP-3 HP-4Randy CavaleraPas encore d'évaluation

- Chapter 3: Quality Management 1Document92 pagesChapter 3: Quality Management 1Randy CavaleraPas encore d'évaluation

- Ausimm Register Members 102012Document287 pagesAusimm Register Members 102012Randy CavaleraPas encore d'évaluation

- General: PT. Kertawira Sera Lestari Executive Summary 1Document9 pagesGeneral: PT. Kertawira Sera Lestari Executive Summary 1Randy CavaleraPas encore d'évaluation

- Infomercial EffectivenessDocument13 pagesInfomercial EffectivenessRandy CavaleraPas encore d'évaluation

- Decision AnalysisDocument5 pagesDecision AnalysisRandy CavaleraPas encore d'évaluation

- Free Magic ShowDocument2 pagesFree Magic ShowRandy CavaleraPas encore d'évaluation

- SAP PM Training Course Catalog Distribution Version 1Document8 pagesSAP PM Training Course Catalog Distribution Version 1Randy CavaleraPas encore d'évaluation

- Theory of ConstraintsDocument25 pagesTheory of ConstraintsRandy CavaleraPas encore d'évaluation

- Management Accounting and Control Systems: Assessing Performance Over The Value ChainDocument51 pagesManagement Accounting and Control Systems: Assessing Performance Over The Value ChainRandy CavaleraPas encore d'évaluation

- Mattel Product RecallDocument19 pagesMattel Product RecallRandy Cavalera100% (1)

- Output Kasus DD UAS-QMDocument3 pagesOutput Kasus DD UAS-QMRandy CavaleraPas encore d'évaluation

- Chapter 2: Cost Terms, Concepts, and Classifications: Canadian Edition by Garrison, Noreen, Et AlDocument2 pagesChapter 2: Cost Terms, Concepts, and Classifications: Canadian Edition by Garrison, Noreen, Et AlRandy CavaleraPas encore d'évaluation

- Mo2013 39MMDocument144 pagesMo2013 39MMRandy CavaleraPas encore d'évaluation

- Babbie Basics 5e PPT CH 14Document47 pagesBabbie Basics 5e PPT CH 14Randy CavaleraPas encore d'évaluation

- Lecture4 Inv f06 604-InventoryDocument63 pagesLecture4 Inv f06 604-InventoryRandy CavaleraPas encore d'évaluation

- Pan Asia ReviewDocument8 pagesPan Asia ReviewRandy CavaleraPas encore d'évaluation

- Bài TTDocument3 pagesBài TTPhạm Như HuỳnhPas encore d'évaluation

- XEROXDocument25 pagesXEROXSALONY METHIPas encore d'évaluation

- Advance Accounting Installment Sales Manual MillanDocument14 pagesAdvance Accounting Installment Sales Manual MillanHades AcheronPas encore d'évaluation

- Microsoft Assignment FRA Group 7Document5 pagesMicrosoft Assignment FRA Group 7Payal AgrawalPas encore d'évaluation

- Project Planning and FinanceDocument79 pagesProject Planning and FinanceajayghangarePas encore d'évaluation

- Revenue Memorandum Circular No. 09-06: January 25, 2006Document5 pagesRevenue Memorandum Circular No. 09-06: January 25, 2006dom0202Pas encore d'évaluation

- Focus On Japan Risk Specialist Issue 7Document4 pagesFocus On Japan Risk Specialist Issue 7Megha JhanjiPas encore d'évaluation

- Investment Arbitration and Country Risk 1711783556Document28 pagesInvestment Arbitration and Country Risk 17117835568nqcpq9tq9Pas encore d'évaluation

- UMKC Econ431 Fall 2012 SyllabusDocument25 pagesUMKC Econ431 Fall 2012 SyllabusMitch GreenPas encore d'évaluation

- Psak 72 10 Minutes PDFDocument2 pagesPsak 72 10 Minutes PDFMentari AndiniPas encore d'évaluation

- Full Download Corporate Financial Accounting 13th Edition Warren Solutions ManualDocument35 pagesFull Download Corporate Financial Accounting 13th Edition Warren Solutions Manualmasonh7dswebb100% (37)

- Sector Strategy Outlook2019Document66 pagesSector Strategy Outlook2019Encis Kacang BuncisPas encore d'évaluation

- Topic2 Part1Document16 pagesTopic2 Part1Abdul MoezPas encore d'évaluation

- Subject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Document4 pagesSubject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Rimpa SenapatiPas encore d'évaluation

- Accpd9629e 2023Document5 pagesAccpd9629e 2023wordsinditePas encore d'évaluation

- MhaDocument35 pagesMhaDhananjay SainiPas encore d'évaluation

- MRK - Fall 2019 - HRM630 - 1 - MC180203268Document2 pagesMRK - Fall 2019 - HRM630 - 1 - MC180203268Z SulemanPas encore d'évaluation

- Security Analysis and Portfolio Management Mba Project Report PDFDocument31 pagesSecurity Analysis and Portfolio Management Mba Project Report PDFvishnupriya0% (1)

- A Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachDocument8 pagesA Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachJedd Virgo100% (2)

- FICA Configuration Step by Step - SAP Expertise Consulting PDFDocument35 pagesFICA Configuration Step by Step - SAP Expertise Consulting PDFsrinivaspanchakarla50% (6)

- KPMG - IFRS vs. US GAAP - RD CostsDocument8 pagesKPMG - IFRS vs. US GAAP - RD CoststomasslrsPas encore d'évaluation

- Moa SK FundDocument2 pagesMoa SK FundMelvyn Casuga100% (2)

- Function and Importance of Capital MarketDocument1 pageFunction and Importance of Capital MarketKhurram KhanPas encore d'évaluation

- Proposal 2017Document29 pagesProposal 2017Faysal100% (1)

- 1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?Document163 pages1.what Is SAP Finance? What Business Requirement Is Fulfilled in This Module?sudhakarPas encore d'évaluation

- Exercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1Document30 pagesExercise 7.1 Cash Journals - Stan's Car Wash: © Simmons & Hardy Cambridge University Press, 2019 1JefferyPas encore d'évaluation

- 2015 Pru Life UK Annual Report PDFDocument61 pages2015 Pru Life UK Annual Report PDFMichael S LeysonPas encore d'évaluation

- Technical Analysis of MahindraDocument3 pagesTechnical Analysis of MahindraRipunjoy SonowalPas encore d'évaluation

- TAX317 Topic ITADocument11 pagesTAX317 Topic ITAchukanchukanchukanPas encore d'évaluation

- QSRSAI Q1 2023 - DARPO Davao OrientalDocument33 pagesQSRSAI Q1 2023 - DARPO Davao OrientalLouie Mark lligan (COA - Louie Mark Iligan)Pas encore d'évaluation