Académique Documents

Professionnel Documents

Culture Documents

Monetary Experts Expect Lower Interest Rate

Transféré par

Ko Gree KyawTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Monetary Experts Expect Lower Interest Rate

Transféré par

Ko Gree KyawDroits d'auteur :

Formats disponibles

Saturday, 17 November 2012 12:41

Monetary experts expect lower interest rate

Category: Uncategorised Published on Saturday, 17 November 2012 19:28 Written by Kyaw Zeya Translated by Thida linn As the inflation rate in Myanmar has now decreased by less than three per cent, the banking experts are expecting a decline of lower interest rates. As the inflation rate in Myanmar has now decreased by less than three per cent, the banking experts are expecting a decline of lower interest rates. Dr Khin San Yi, deputy minister for the National Planning and Economic Development, told the Parliament on November 5 that the inflation rate in Myanmar is now 2.82 per cent in 2011-2012 fiscal year. The Central Bank of Myanmar has currently set the interest rate for bank loans at 10 per cent, but the minimum deposit rate is 8 per cent while the maximum loan rate is 13 per cent in the country. The former vice-president of the Central Bank of Myanmar in September said that it is impossible to decrease interest rate because of the countrys inflation rate is 5 per cent. In the 2010-2011 financial year, the inflation rate was over eight percent. Now, the inflation rate is around three percent so the bank loans should be lower. The current interest rate should be lower

again without exceeding the inflation rate. (The Central Bank) should reset the deposit rate to 6 percent and lending rate to 11 percent, said a member of the National Economic and Social Advisory Council, who requested not be named. Since the civilian government took office, it has lowered the bank interest rates in September, 2011 and January, 2012. Local industrialists are also suggesting that the interest rate should be reduced to be able to compete with foreign businesses in the country. Taking advantages on the gap of interest rate between Myanmar and their countries, businesspersons mostly from Singapore and Thailand take out loans from their countries and save the money in Myanmar banks. Foreign businesspersons are taking advantages on the gap of interest rates over 10 to 15 years as Myanmar has higher interest rate than neighbouring countries, said Than Lwin, Advisor(2) of Ministry of Finance and Revenue. The favourable conditions for the foreign businesspersons are the interest rate, long-term tax holiday which local businesspersons cannot enjoy, infrastructural and manufacturing sectors, and the qualities of their products which can penetrate into the international market. Some banking experts pointed out that these situations could damage the manufacturing sector of the country. Aye Aye Win, deputy director of Ministry of Industry, said that it is expected that the government will reduce the loan interest rate from 13 per cent to 8.5 per cent for the local entrepreneurs to compete their products with those of ASEAN countries.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- LivingScience CBSE CompanionDocument56 pagesLivingScience CBSE Companionnjlenovo95% (19)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Dirty Dozen List of Endocrine DisruptorsDocument4 pagesDirty Dozen List of Endocrine DisruptorsMariuszPas encore d'évaluation

- Amino AcidsDocument17 pagesAmino AcidsSiddharth Rohilla100% (2)

- Nammcesa 000008 PDFDocument197 pagesNammcesa 000008 PDFBasel Osama RaafatPas encore d'évaluation

- MediclaimDocument3 pagesMediclaimPrajwal ShettyPas encore d'évaluation

- Ems 01 Iso 14001 ManualDocument26 pagesEms 01 Iso 14001 ManualG BelcherPas encore d'évaluation

- ARS122 Engine Spare Part Catalogue PDFDocument134 pagesARS122 Engine Spare Part Catalogue PDFIrul Umam100% (1)

- Area 1 PROBLEM SET #2Document10 pagesArea 1 PROBLEM SET #2JC YabisPas encore d'évaluation

- Intuitive Biostatistics: Choosing A Statistical TestDocument5 pagesIntuitive Biostatistics: Choosing A Statistical TestKo Gree KyawPas encore d'évaluation

- Science Form 3 2020 (Notes, PBD, Exercise) : Chapter: 8 RadioactivityDocument19 pagesScience Form 3 2020 (Notes, PBD, Exercise) : Chapter: 8 Radioactivitysakinah100% (1)

- Grade 11 - Life Science - November Paper 2-1 - MemoDocument8 pagesGrade 11 - Life Science - November Paper 2-1 - MemoJustinCase19910% (1)

- Sample Answer For Law of Contract Problem QuestionDocument1 pageSample Answer For Law of Contract Problem QuestionKo Gree KyawPas encore d'évaluation

- What Are The Various Punishments To Which Offenders Are Liable Under The Provisions of The Penal CodeDocument2 pagesWhat Are The Various Punishments To Which Offenders Are Liable Under The Provisions of The Penal CodeKo Gree KyawPas encore d'évaluation

- Assignment 7. State The Provisions of The Criminal Procedure Code Concerning Warrant TrialDocument2 pagesAssignment 7. State The Provisions of The Criminal Procedure Code Concerning Warrant TrialKo Gree KyawPas encore d'évaluation

- Assignment 5 What Are The Differences Between Contract and TortDocument1 pageAssignment 5 What Are The Differences Between Contract and TortKo Gree KyawPas encore d'évaluation

- Assignment 1. The DhammathatsDocument2 pagesAssignment 1. The DhammathatsKo Gree Kyaw100% (1)

- Assignment 5 DacoityDocument2 pagesAssignment 5 DacoityKo Gree KyawPas encore d'évaluation

- Assignement 6. What Are The Statements To The PoliceDocument2 pagesAssignement 6. What Are The Statements To The PoliceKo Gree KyawPas encore d'évaluation

- Paper I For TutorialDocument3 pagesPaper I For TutorialKo Gree KyawPas encore d'évaluation

- Ass 2 What Is An Unlawful AssenblyDocument2 pagesAss 2 What Is An Unlawful AssenblyKo Gree KyawPas encore d'évaluation

- DL-6101 KWO Assignment 1Document1 pageDL-6101 KWO Assignment 1Ko Gree KyawPas encore d'évaluation

- Emergency MRE Toolkit - Final HandbookDocument38 pagesEmergency MRE Toolkit - Final HandbookKo Gree KyawPas encore d'évaluation

- ShakeSpeare-MTL (On Air)Document213 pagesShakeSpeare-MTL (On Air)Ko Gree KyawPas encore d'évaluation

- DL-6101 KWO Assignment 1Document1 pageDL-6101 KWO Assignment 1Ko Gree KyawPas encore d'évaluation

- Measuring Performance of SCDocument18 pagesMeasuring Performance of SCKo Gree KyawPas encore d'évaluation

- Be Professional ATTDocument64 pagesBe Professional ATTKo Gree KyawPas encore d'évaluation

- Irrawaddy Literary FestivalDocument3 pagesIrrawaddy Literary FestivalKo Gree KyawPas encore d'évaluation

- TheEconomic Reform in Myanmar - The Long Road Ahead Long Road AheadDocument2 pagesTheEconomic Reform in Myanmar - The Long Road Ahead Long Road AheadKo Gree KyawPas encore d'évaluation

- TheEconomic Reform in Myanmar - The Long Road Ahead Long Road AheadDocument2 pagesTheEconomic Reform in Myanmar - The Long Road Ahead Long Road AheadKo Gree KyawPas encore d'évaluation

- Eng Spss BasicDocument35 pagesEng Spss BasicangelaskatsPas encore d'évaluation

- NGO Contact Addresses - Myanmar - CBIDocument7 pagesNGO Contact Addresses - Myanmar - CBIKo Gree KyawPas encore d'évaluation

- Myanmar - Golfing With The GeneralsDocument20 pagesMyanmar - Golfing With The GeneralsKo Gree KyawPas encore d'évaluation

- Socialism or Free MarketsDocument2 pagesSocialism or Free MarketsKo Gree KyawPas encore d'évaluation

- Nehru V. - Endowment C. - Myanmar's Five Economic Priorities - East Asia Forum - June2012Document5 pagesNehru V. - Endowment C. - Myanmar's Five Economic Priorities - East Asia Forum - June2012Ko Gree KyawPas encore d'évaluation

- Rakhine Thahaya - The Pros and Cons of SEZsDocument6 pagesRakhine Thahaya - The Pros and Cons of SEZsKo Gree Kyaw100% (1)

- ADB - Burma's Predicted Growth Rate IncreasedDocument2 pagesADB - Burma's Predicted Growth Rate IncreasedKo Gree KyawPas encore d'évaluation

- IMF - Statement at The Conclusion of An IMF Staff Mission To Myanmar - Nov2012Document1 pageIMF - Statement at The Conclusion of An IMF Staff Mission To Myanmar - Nov2012Ko Gree KyawPas encore d'évaluation

- U Myint - Myanmar Exchange Rate IssueDocument7 pagesU Myint - Myanmar Exchange Rate IssueYe PhonePas encore d'évaluation

- Myanmar Administrative StructureDocument1 pageMyanmar Administrative StructureKo Gree Kyaw100% (1)

- UNIT 3 Polymer and Fuel ChemistryDocument10 pagesUNIT 3 Polymer and Fuel Chemistryld6225166Pas encore d'évaluation

- Uric Acid Mono SL: Clinical SignificanceDocument2 pagesUric Acid Mono SL: Clinical SignificancexlkoPas encore d'évaluation

- Drug Abuse - A Threat To Society, Essay SampleDocument3 pagesDrug Abuse - A Threat To Society, Essay SampleAnonymous o9FXBtQ6H50% (2)

- Secondary 1 Express English Paper 1 & 2Document15 pagesSecondary 1 Express English Paper 1 & 2Menon HariPas encore d'évaluation

- Damasco - Cpi - Activity No. 10Document18 pagesDamasco - Cpi - Activity No. 10LDCU - Damasco, Erge Iris M.Pas encore d'évaluation

- Air Compressors: Instruction, Use and Maintenance ManualDocument66 pagesAir Compressors: Instruction, Use and Maintenance ManualYebrail Mojica RuizPas encore d'évaluation

- 3M Window Film PR SeriesDocument3 pages3M Window Film PR SeriesPhan CrisPas encore d'évaluation

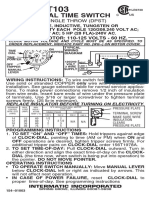

- T103 InstructionsDocument1 pageT103 Instructionsjtcool74Pas encore d'évaluation

- IS 11255 - 7 - 2005 - Reff2022 Methods For Measurement of Emission From Stationary Sources Part 7 Oxides of NitrogenDocument10 pagesIS 11255 - 7 - 2005 - Reff2022 Methods For Measurement of Emission From Stationary Sources Part 7 Oxides of NitrogenPawan SharmaPas encore d'évaluation

- Windows Perfectpath: Promise Multipath DriverDocument3 pagesWindows Perfectpath: Promise Multipath Driverpd904526Pas encore d'évaluation

- Red Winemaking in Cool Climates: Belinda Kemp Karine PedneaultDocument10 pagesRed Winemaking in Cool Climates: Belinda Kemp Karine Pedneaultgjm126Pas encore d'évaluation

- Minimum Number of Thermocouples-Local PWHTDocument5 pagesMinimum Number of Thermocouples-Local PWHTPradip Goswami100% (1)

- Summative Test SolutionsDocument1 pageSummative Test SolutionsMarian Anion-GauranoPas encore d'évaluation

- Ctaa040 - Ctaf080 - Test 4 Solution - 2023Document7 pagesCtaa040 - Ctaf080 - Test 4 Solution - 2023Given RefilwePas encore d'évaluation

- NFPA 220 Seminar OutlineDocument2 pagesNFPA 220 Seminar Outlineveron_xiiiPas encore d'évaluation

- WP DeltaV Software Update Deployment PDFDocument8 pagesWP DeltaV Software Update Deployment PDFevbaruPas encore d'évaluation

- So 2nd Ed Adv Read Extra U4Document2 pagesSo 2nd Ed Adv Read Extra U4hector1817Pas encore d'évaluation

- 2nd Term Biology Ss3Document20 pages2nd Term Biology Ss3Wisdom Lawal (Wizywise)Pas encore d'évaluation

- Electrolux EKF7700 Coffee MachineDocument76 pagesElectrolux EKF7700 Coffee MachineTudor Sergiu AndreiPas encore d'évaluation

- Diarrhoea in PediatricsDocument89 pagesDiarrhoea in PediatricsKimbek BuangkePas encore d'évaluation