Académique Documents

Professionnel Documents

Culture Documents

A Case Study On Capital Budgeting - PKB

Transféré par

D M Shafiqul IslamDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Case Study On Capital Budgeting - PKB

Transféré par

D M Shafiqul IslamDroits d'auteur :

Formats disponibles

A Case Study on Capital Budgeting

Dr. Prashanta K. Banerjee, Md. Ruhul Amin, Faculty Member, BIBM

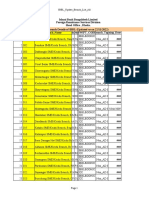

Cox's Bazar as the largest sea beach in the world earlier attracted thousands of tourists throughout the year. However, now-a-days this is not only a place for the tourists, but also a place for business delegates, cultural people, politicians, students and other classes of people. Gradually, the city is opening new windows for businesses and getting recognition as an important commercial hub in the South Asian region. There are a number of hotels and motels in the city of Cox's Bazar. However, the need still exists for more hotel services, in particular with the excellent service and because of the large number of visitors to the region. Especially so that currently as business delegates usually want to avoid Dhaka city and prefer to meet in a sea beach based city like Cox's Bazar. In the same way local business houses also prefer this city for their annual conference, meetings, etc. Cultural houses and sports houses also have special preference for this city. Last but not the least people from all over the country and all walks of life always favor Cox's Bazar city for their recreation. Mr. Rozario is the owner of a chain hotel named Paradise Bangladesh Ltd. and he decides to establish one more five star hotel in Cox's Bazar. His group has approached your bank for loan financing and submitted details relating to his upcoming project. The hotel will consist of 5 floors. The hotel will include 140 rooms and 2 suites, as well as a restaurant and a conference room cum a small wedding hall on the ground floor. A detailed picture of the hotel accommodation and its estimated occupancy rate including fare composition is given in the table: Types of Facility Numbers Occupancy Rate Normal Room 140 30% of 110 Days Suite 2 30% of 110 Days Conference Cum Wedding Hall 1 40 Days Average Rent Per Room TK. 5000 TK. 12,000 TK. 200,000

The estimated cost of land is of TK. 70.35 million and the construction cost is of TK. 180.375 million. The cost of furniture is of TK. 200, 000 for each room and TK. 400,000 for each suite. The cost of the furniture for the conference room cum wedding hall is of TK. 3,000,000 and restaurant is of Tk. 4,000,000. In addition, the cost is of TK. 22,500,000 for elevators and TK. 1,000,000 for air conditioning. The hotel will be built by the world renowned company named 'La Plata County Real Estate'. The builder estimated that building will survive for 20 years. It results in annual consumption of the building is at the rate of 5%. The required furniture will be supplied by the local reputed furniture company named Hatil Bangladesh Ltd. They ensured that furniture will go for 5 years very smoothly. This results in depreciation rate 20% per year. Hotel Manager Salary is amounting to Tk. 150,000 a month, a total of TK. 1,800,000 in the year. Treasurer salary is of TK. 120,000 a month, TK. 1,440,000 each year. Receptionist Salary is of TK. 60,000 per month (number 4) TK. 2,880,000 each year. Salary per worker is of TK. 8,000 per month (number 6) TK. 576,000 in the year. Water and electricity cost is of TK. 300,000 a month, Tk. 3,600,000 for the year and TK. 100,000 per month and Tk. 1,200,000 per annum is required for cleaning materials. The rate of depreciation for elevators and air conditioning is 20%, which is commonly followed for the electronics goods in Bangladesh. The current corporate tax rate of 37.5 % will also applied for the hotel. The estimated cost of capital by considering the structure of capital of the proposed hotel is fixed at 14%. The hotel authority is determined to provide the best and professional hotel services to the clients by offering training to the employees in home and abroad. They decided to spend Tk. 1,000,000 per year for the purpose of training of the employees. Calculate the following for making decision about the financing. 1. Total estimated annual income. 2. Total estimated recurring expenses. 3. Estimated Profit per year. 4. Yearly depreciation for building, furniture, elevators and air conditioning. 5. Variable expenses and fixed expenses. 6. Amount required for initial investment. 7. Cash inflow per year. 8. Pay Back Period 9. Net Present Value (NPV) 10. Internal Rate of Return (IRR) 11. Modified Internal Rate of Return (MIRR)

Vous aimerez peut-être aussi

- MBA 515 FinalDocument25 pagesMBA 515 FinalKazi Anisul IslamPas encore d'évaluation

- Chapter 11Document11 pagesChapter 11PeterGomesPas encore d'évaluation

- GEF Case 2Document6 pagesGEF Case 2gabrielaPas encore d'évaluation

- IBBL - BR - List - Updated - 22122022 - Branch - Sub Branch - AD BranchDocument38 pagesIBBL - BR - List - Updated - 22122022 - Branch - Sub Branch - AD BranchRomel Abdullh AlPas encore d'évaluation

- Protiviti PDFDocument3 pagesProtiviti PDFAnuradha SharmaPas encore d'évaluation

- Chapter - 8 Management of ReceivablesDocument6 pagesChapter - 8 Management of ReceivablesadhishcaPas encore d'évaluation

- Ground and Processed Spices and Cereals Project ReportDocument5 pagesGround and Processed Spices and Cereals Project ReportGirish DaryananiPas encore d'évaluation

- Chapter 20 Managing Credit RiskDocument11 pagesChapter 20 Managing Credit RiskJose Luis AlamillaPas encore d'évaluation

- ABC Wealth AdvisorsDocument5 pagesABC Wealth AdvisorsUjwalsagar Sagar33% (3)

- Oyo - PresentationDocument27 pagesOyo - PresentationNaveen AlluPas encore d'évaluation

- Lecture - 02 The Time Value of MoneyDocument41 pagesLecture - 02 The Time Value of Moneyanujgoyal31Pas encore d'évaluation

- Performance Management And: Reward System at Scottrade IncDocument13 pagesPerformance Management And: Reward System at Scottrade IncBarun SinghPas encore d'évaluation

- Module 2 ProblemsDocument48 pagesModule 2 ProblemsavivaindiaPas encore d'évaluation

- Break Even Practice Class QuestionsDocument7 pagesBreak Even Practice Class QuestionsÃhmed AliPas encore d'évaluation

- Case Study On Bajaj AvisekDocument9 pagesCase Study On Bajaj AvisekAvisek SarkarPas encore d'évaluation

- AMD - Note On PV Ratio-1Document4 pagesAMD - Note On PV Ratio-1Bharath s kashyapPas encore d'évaluation

- MBA LPP QuestionsDocument2 pagesMBA LPP QuestionsshabdPas encore d'évaluation

- Consumer Durables Industry in IndiaDocument11 pagesConsumer Durables Industry in IndiaSiba PrasadPas encore d'évaluation

- Animal HealthDocument3 pagesAnimal Healthkritigupta.may1999Pas encore d'évaluation

- Karur Vysya Bank Concept NoteDocument4 pagesKarur Vysya Bank Concept NotePankaj SinghPas encore d'évaluation

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalPas encore d'évaluation

- Nature of Ihrm & Strategic Ihrm: Jyoti Rekha Divya Ragendran Annie Thomas Nimmy Jose Priyanka G Shruthi S.PDocument82 pagesNature of Ihrm & Strategic Ihrm: Jyoti Rekha Divya Ragendran Annie Thomas Nimmy Jose Priyanka G Shruthi S.PPreethi KrishnanPas encore d'évaluation

- PSO & SHELL ComparisonDocument22 pagesPSO & SHELL ComparisonSabeen JavaidPas encore d'évaluation

- Cash Flow Statement Analysis Hul FinalDocument10 pagesCash Flow Statement Analysis Hul FinalGursimran SinghPas encore d'évaluation

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraPas encore d'évaluation

- 49615Document17 pages49615Deepak ChiripalPas encore d'évaluation

- Initiating Coverage - Indian Hume Pipe Co.Document38 pagesInitiating Coverage - Indian Hume Pipe Co.rroshhPas encore d'évaluation

- Maximum Permissible Bank Finance PDFDocument7 pagesMaximum Permissible Bank Finance PDFitrrustPas encore d'évaluation

- Assignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Document6 pagesAssignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Nihar KamblePas encore d'évaluation

- 2 - Time Value of MoneyDocument68 pages2 - Time Value of MoneyDharmesh GoyalPas encore d'évaluation

- Case StudyDocument3 pagesCase Studyjohnleh1733% (3)

- Class 11 Accountancy Top 55 Mcqs by DR Vinod Kumar Author of Ultimate Book of AccountancyDocument18 pagesClass 11 Accountancy Top 55 Mcqs by DR Vinod Kumar Author of Ultimate Book of AccountancyJasmine SainiPas encore d'évaluation

- A1 10BM60005Document13 pagesA1 10BM60005amit_dce100% (2)

- Interview Materials ICICI BankDocument3 pagesInterview Materials ICICI BankBiswajit BeheraPas encore d'évaluation

- ResumeDocument2 pagesResumeViswanath TurlapatiPas encore d'évaluation

- BPSM Case StudyDocument17 pagesBPSM Case Studyybbvvprasada rao100% (1)

- Learnovate Task No. - 02Document5 pagesLearnovate Task No. - 02Nikita DakiPas encore d'évaluation

- The Impact of Government Policy and Regulation On BankingDocument15 pagesThe Impact of Government Policy and Regulation On BankingAmna Nasser100% (1)

- Accounting Techniques For Decision MakingDocument24 pagesAccounting Techniques For Decision MakingRima PrajapatiPas encore d'évaluation

- Top Seven Changes in India's Business EnvironmentDocument12 pagesTop Seven Changes in India's Business Environmentamitsingla19Pas encore d'évaluation

- BRM Questionnaire Design 8Document35 pagesBRM Questionnaire Design 8jitender KUMARPas encore d'évaluation

- Case Study - VCDocument5 pagesCase Study - VCapi-3865133Pas encore d'évaluation

- Economic Survey of Nepal 2015-16 - EnglishDocument412 pagesEconomic Survey of Nepal 2015-16 - EnglishLok Bijaya Pokharel0% (1)

- Leadership Style of BanglalinkDocument13 pagesLeadership Style of Banglalinkshariar MasudPas encore d'évaluation

- Managerial EconomicsDocument2 pagesManagerial EconomicsAbdul Hakeem0% (1)

- Foreign Portfolio Investment in IndiaDocument27 pagesForeign Portfolio Investment in IndiaSiddharth ShindePas encore d'évaluation

- Analysis On The Basis of 7 Ps and SwotDocument28 pagesAnalysis On The Basis of 7 Ps and Swotvedanshjain100% (3)

- Presented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulDocument13 pagesPresented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulBhanu NirwanPas encore d'évaluation

- Corporate Finance Paper MidDocument2 pagesCorporate Finance Paper MidAjmal KhanPas encore d'évaluation

- Presentation - Silk BankDocument22 pagesPresentation - Silk BankNona ChilliPas encore d'évaluation

- The Essence and Importance of Financial ManagementDocument4 pagesThe Essence and Importance of Financial Managementatwhvs sysbvePas encore d'évaluation

- CRM ProcessDocument17 pagesCRM ProcessSaurabh Rinku86% (7)

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Document23 pagesDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiPas encore d'évaluation

- Z-Chart & Loss FunctionDocument1 pageZ-Chart & Loss FunctionVipul SharmaPas encore d'évaluation

- Semester Iii / Bangalore University Mba Presidency College, Bangalore 24Document13 pagesSemester Iii / Bangalore University Mba Presidency College, Bangalore 24Aarya PatelPas encore d'évaluation

- SRM Cases - 34rd BatchDocument17 pagesSRM Cases - 34rd Batchishrat mirzaPas encore d'évaluation

- TRB MCQDocument6 pagesTRB MCQDurai ManiPas encore d'évaluation

- 3 Star Hotel - BaalbeckDocument19 pages3 Star Hotel - BaalbeckAkm EngidaPas encore d'évaluation

- Phuket Beach HotelDocument4 pagesPhuket Beach HotelIda Lubelle Urian93% (14)

- Addis Ababa Science and Technology UniversityDocument15 pagesAddis Ababa Science and Technology UniversityYabsra kasahunPas encore d'évaluation

- Exam Schdule For Level 1Document2 pagesExam Schdule For Level 1D M Shafiqul IslamPas encore d'évaluation

- BD0010990 Co Code: LC NO: 154013010272Document2 pagesBD0010990 Co Code: LC NO: 154013010272D M Shafiqul IslamPas encore d'évaluation

- Present & Permanent Address:sanmar Santino', Flat # A/4, Road # 02, Dev Pahar, College Road, ChittagongDocument1 pagePresent & Permanent Address:sanmar Santino', Flat # A/4, Road # 02, Dev Pahar, College Road, ChittagongD M Shafiqul IslamPas encore d'évaluation

- Particulars 2007 2008 2009 2010Document7 pagesParticulars 2007 2008 2009 2010D M Shafiqul IslamPas encore d'évaluation

- Revised Class Routine - Jan-June, 2014Document7 pagesRevised Class Routine - Jan-June, 2014D M Shafiqul IslamPas encore d'évaluation

- Joining OrderDocument1 pageJoining OrderD M Shafiqul Islam0% (1)

- Bank EssayDocument3 pagesBank EssayD M Shafiqul Islam0% (3)

- The Complex Effects of Low Interest Rates On Consumption and InvestmentDocument3 pagesThe Complex Effects of Low Interest Rates On Consumption and InvestmentD M Shafiqul IslamPas encore d'évaluation

- CVDocument3 pagesCVD M Shafiqul Islam100% (2)

- English (30 Marks) Read The Following Passage and Answer (Questions 01 - 05)Document5 pagesEnglish (30 Marks) Read The Following Passage and Answer (Questions 01 - 05)D M Shafiqul IslamPas encore d'évaluation

- IdiomDocument8 pagesIdiomMikita JainPas encore d'évaluation

- Brac Cover Letter & CVDocument4 pagesBrac Cover Letter & CVD M Shafiqul Islam84% (25)

- CVDocument3 pagesCVD M Shafiqul IslamPas encore d'évaluation

- CV of ToufiqDocument2 pagesCV of ToufiqD M Shafiqul IslamPas encore d'évaluation

- CV Tanzil Moch Sofyan PDFDocument9 pagesCV Tanzil Moch Sofyan PDFTanzil Mochamad SofyanPas encore d'évaluation

- LanguageCert PP1 A1 B1 Enpro LsDocument9 pagesLanguageCert PP1 A1 B1 Enpro LsBelen GCFPas encore d'évaluation

- Estafa and Criminal Negligence Under RA 10951Document5 pagesEstafa and Criminal Negligence Under RA 10951Jai HoPas encore d'évaluation

- Unit I IntroductionDocument19 pagesUnit I IntroductionArunagiri Senthil KumarPas encore d'évaluation

- Lesson 1 - Mock Test - HandoutDocument3 pagesLesson 1 - Mock Test - HandoutHUYỀN NGUYỄN THỊ NGỌCPas encore d'évaluation

- 10-Schedule 5,6,7&10Document113 pages10-Schedule 5,6,7&10zamsiranPas encore d'évaluation

- Notes Dalton Case StudyDocument1 pageNotes Dalton Case StudyAMPas encore d'évaluation

- 5 Star Hotels Name Location Facilities Provided Contact DetailsDocument6 pages5 Star Hotels Name Location Facilities Provided Contact DetailsArijit Banerjee100% (1)

- Alissha All in Package Apr2021 Compressed H16kWXewODocument16 pagesAlissha All in Package Apr2021 Compressed H16kWXewOOlivia OktavianiPas encore d'évaluation

- Planning Cox's BazarDocument17 pagesPlanning Cox's BazarAhsan Zaman100% (1)

- Guide of Rural England - Isle of ManDocument21 pagesGuide of Rural England - Isle of ManTravel Publishing100% (1)

- SreeakilandeshwariDocument2 pagesSreeakilandeshwariShivaani ThemuduPas encore d'évaluation

- Maldives CRED FAQsDocument3 pagesMaldives CRED FAQsYaskPas encore d'évaluation

- Flo2-Lodging SegmentDocument58 pagesFlo2-Lodging Segmentraul m partozaPas encore d'évaluation

- Marina City, ChicagoDocument21 pagesMarina City, ChicagoRemya R. KumarPas encore d'évaluation

- Case DigestDocument7 pagesCase DigestVanessa Yvonne GurtizaPas encore d'évaluation

- Sdrawkcab: Brave It Backwards Introducing The Swarm at Thorpe ParkDocument3 pagesSdrawkcab: Brave It Backwards Introducing The Swarm at Thorpe ParkJoe KleimanPas encore d'évaluation

- User Research Report: Presented by Jake Allen, UX ResearcherDocument21 pagesUser Research Report: Presented by Jake Allen, UX ResearcherGarrick BasseyPas encore d'évaluation

- Answer Key Lookahead XDocument48 pagesAnswer Key Lookahead XValentino Vavayosa95% (20)

- Fire Fighting Facilities Checklist PDFDocument8 pagesFire Fighting Facilities Checklist PDFMarcio BritoPas encore d'évaluation

- Tourism AttractionDocument67 pagesTourism AttractionTem YuPas encore d'évaluation

- WWW Affordablecebu Com Free PNP Entrance Exam Reviewer I 20Document39 pagesWWW Affordablecebu Com Free PNP Entrance Exam Reviewer I 20christopherPas encore d'évaluation

- Visiitors Illinois Mufon Journal 1Document4 pagesVisiitors Illinois Mufon Journal 1Frank CoffmanPas encore d'évaluation

- Industrial and Manufacturing Process QuestionnaireDocument4 pagesIndustrial and Manufacturing Process QuestionnaireDaveRaphaelDumanatPas encore d'évaluation

- Diamond Rating Guidelines LodgingDocument45 pagesDiamond Rating Guidelines LodgingDung Phuong LePas encore d'évaluation

- Soal Bahasa Inggris STR GENAP X - IPADocument5 pagesSoal Bahasa Inggris STR GENAP X - IPAniningPas encore d'évaluation

- 24 NovemberDocument3 pages24 NovemberAMH_DocsPas encore d'évaluation

- CFHMP 2018 PDFDocument88 pagesCFHMP 2018 PDFKristen NicolePas encore d'évaluation

- Types of Reservation System Front Office Accounting FolioDocument23 pagesTypes of Reservation System Front Office Accounting FolioDinah Mae AlagaoPas encore d'évaluation

- The Receptionists' Standard Operating Procedure When The Guests Are Checking-In and Checking-Out in Amarelo Hotel SoloDocument11 pagesThe Receptionists' Standard Operating Procedure When The Guests Are Checking-In and Checking-Out in Amarelo Hotel Solominhcongnguyen1604Pas encore d'évaluation