Académique Documents

Professionnel Documents

Culture Documents

Datar Case Maps

Transféré par

meherey2kDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Datar Case Maps

Transféré par

meherey2kDroits d'auteur :

Formats disponibles

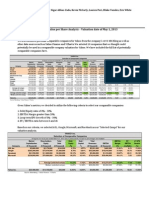

Case Map for Horngren, Foster & Datar: Cost Accounting: A Managerial Emphasis (Prentice Hall)

This map was prepared by an experienced editor at HBS Publishing, not by a teaching professor. Faculty at Harvard Business School were not involved in analyzing the textbook or selecting the cases and articles. Every case map provides only a partial list of relevant items from HBS Publishing. To explore alternatives, or for more information on the cases listed below, visit: hsbp.harvard.edu

Chapter 1: The Accountants Role in the Organization N/A Chapter 2: An Introduction to Cost Terms and Purposes Carver Consulting Co.: William J. Bruns Jr. Product #: 199006 Length: 7p

Abstract

Daniel Dobbins Distillery, Inc.: William J. Bruns Jr. Product #: 189065 Length: 7p Teaching Note: 189172

Abstract The managing partner of a relatively new consulting firm is concerned because training costs at the firm's new training center are higher than expected. Analysis of actual costs compared to those expected is required. In addition, he is considering capitalizing some training costs for later amortization. A management control system for the center is also a priority. Subjects Covered: Accounting policies; Control systems; Cost analysis; Financial analysis; Financial statements; Management accounting; Management controls A distiller increases whiskey production and income declines because of accounting methods in use. Questions are raised regarding the treatment of expenditures, which can be classified as production, inventory, or period costs. The necessary aging process raises added questions about prior period restatements and needed financing. Subjects Covered: Accounting procedures; Cost allocation; Cost analysis; Financing; Inventory management

Chapter 3: Cost-VolumeProfit Analysis Hollydazzle.com: Ratna Sarkar Product #: 100066 Length: 5p

Prestige Telephone Co.: William J. Bruns Jr. Product #: 197097 Length: 4p Teaching Note: 197098

Abstract Describes the underlying economics of a start-up Internet retailing company. Highlights the fact that costs in that setting have a component that varies with volume and thus seriously impacts profitability. Learning Objective: To focus on the unusual cost-volume-profit relationship at an e-tailer. An independent regulated telephone company has established a computer services subsidiary that seems to remain unprofitable. Managers must determine whether it is profitable or not and consider changes in pricing or promotion that might improve profitability. Learning Objective: To introduce concepts of relevant costs,

Mueller-Lehmkuhl GmbH: Robin Cooper, Dagmar Bottenbruch Product #: 187048 Length: 13p Teaching Note: 187049

contribution, and breakeven analysis. Mueller-Lehmkuhl sells apparel fasteners and rents attaching machines. It views these two products as effectively a single item and prices them accordingly, the fasteners at high profit and its attaching machines at a loss. The cost system allocates the cost of the attaching machines to the fasteners. The Japanese have entered the market and found a way to unbundle the two products. As a result they are challenging the European way of doing business. The case asks the student to analyze the true cost and profitability of the products. Subjects Covered: Cost accounting; Cost allocation; Cost analysis; Profitability analysis; Strategic planning; Strategy formulation Abstract A small company in the graphic arts business faces severe price competition. The company has to respond by cutting costs and making process improvements. Learning Objective: To introduce job costing, activity-based costing, cost controls, process improvements, and product pricing concepts in a very simple setting.

Chapter 4: Job Costing Colorscope, Inc.: V.G. Narayanan, Joseph Cha Product #: 197040 Length: 16p Teaching Note: 198110

Chapter 5: Activity-Based Costing and Activity-Based Management Owens & Minor, Inc. (A): V.G. Narayanan, Lisa Brem Product #: 100055 Length: 17p Teaching Note: 100100

Insteel Wire Products: ABM at Andrews: V.G. Narayanan, Ratna Sarkar Product #: 198087 Length: 9p Teaching Note: 198111 Activity-Based Management at Stream International: Robert S. Kaplan, Norman Klein Product #: 196134 Length: 25p Teaching Note: 198079

Abstract Examines the use of activity-based (or menu) pricing at Owens & Minor (O&M). A manager at O&M, a large national medical and surgical distribution company, enlisted the help of both logistics and cost managers to develop an innovative pricing schedule based on the customer's activities instead of product price. The existing cost-plus pricing structure made it impossible for O&M to price services appropriately. However, he encounters customer resistance to his new proposal. Learning Objective: To introduce students to activity-based pricing/menu-pricing in a medical supply distribution company. Insteel implements an ABC system in 1996. It finds pallet nails to be its most profitable product and decides to expand the number of cells making pallet nails from two to four. A repeat of the ABC study in 1997 shows pallet nails have become the least profitable product. Learning Objective: To explore cost allocation in the presence of excess capacity. Describes the design and implementation of an activity-based costing project undertaken by Stream International's Crawfordsville, Indiana, facilities. After analyzing the costs assigned to 161 work activities, Crawfordsville managers present five proposals for change based on ABM results, then meet to decide which to implement. Learning Objective: To provide an example of activity-based costing and to encourage the analysis of change proposals based on activitybased management. A British bank with strong roots in the cooperative movement encounters declining profitability in an increasingly competitive and deregulated financial services industry. It attempts to grow by

The Co-operative Bank: Robert S. Kaplan, Srikant M. Datar Product #: 195196

Length: 17p Teaching Note: 198078

Wilkerson Co.: Robert S. Kaplan Product #: 101092 Length: 4p Teaching Note: 104002

Kanthal (A) : Robert S. Kaplan Product #: 190002 Length: 13p Teaching Note: 190115

broadening its customer base and increasing the range of products and services offered. It turns to activity-based costing as part of its reengineering effort to learn more about the process and product costs and customer profitability, and contemplates what actions to take based on this new information. Subjects Covered: Activity-based costing; Cost accounting; Cost analysis; Cost systems; Management accounting The president of Wilkerson, faced with declining profits, is struggling to understand why the company is encountering severe price competition on one product line while able to raise prices without competitive response on another product line. The controller proposes that the company develop an activity-based cost model to understand better the different demands that each product line makes on the organization's indirect and support resources. Learning Objective: Students estimate the new cost model, which provides a radically different perspective on product line profitability. They can suggest actions, based on the new cost model, to improve the company's profitability. Multinational company needs an improved cost system to determine the profitability of individual customer orders. Its strategy is to have significant sales and profitability growth without adding additional administrative and support people. The new cost system assesses a charge to each customer order received and an additional surcharge if the item ordered is not normally stocked. The goal is to direct sales resources to the most profitable customers: those who buy standard products in large predictable quantities with minimal demands on technical resources. Subjects Covered: Cost accounting; Cost allocation; Cost systems; Customer relationship management; Management accounting; Sales strategy

Chapter 6: Master Budget and Responsibility Accounting Cafes Monte Bianco: Building a Profit Plan: Robert L. Simons, Antonio Davila Product #: 198088 Length: 8p Teaching Note: 101044 Walker and Company: Profit Plan Decisions: Robert L. Simons, Ramsey Walker Product #: 197084 Length: 12p Teaching Note: 100005

Abstract Using an income statement, balance sheet, and projected demand and cost schedules, students are required to build a profit plan for a closely-held coffee manufacturer in Italy. Students must estimate cash flow and ROE and use this analysis to evaluate the attractiveness of a new strategy. Subjects Covered: Performance measurement; Planning systems; Profit planning; Profitability analysis; Return on investment Ramsey Walker, a second-year MBA student, must decide how to control a family business as an absentee owner. After providing background details on the publishing industry, the case requires the reader to: 1) make a product segmentation decision; 2) prepare a profit plan; 3) calculate free cash flow effects; 4) determine key accounting performance measures; and 5) assess new control systems and their implementation. Subjects Covered: Control systems; Market segmentation; Profit planning; Profitability analysis; Return on investment

Chapter 7: Flexible Budgets, Direct-Cost Variances, and Management Control Software Associates: Robert S. Kaplan Product #: 101038 Length: 5p Teaching Note: 107088

Abstract The president of a small consulting firm has just seen his secondquarter profit and loss statement, showing an increase in revenues but a substantial decline in profits. He asks his chief financial officer to explain the results in a meeting the next day. The CFO works hard to accumulate information so she can explain the impact of the quantity of billed hours, billing rates, consultant expenses, operating expenses, and the shifting mix of business between the two principal product lines. Learning Objective: To learn the fundamentals of variance analysis and flexible budgeting in the context of a professional service firm, without the complications that arise in manufacturing firms of overhead absorption and fixed-cost volume variances. Describes the cost control system used at an automobile engine plant for labor and overhead costs. The finance staff prepares daily, weekly, and monthly variance reports against budgets. Department supervisors, finance staff, and the plant manager discuss the use and interpretation of these reports. Also describes the company's budgeting procedures, which include a performance improvement factor to motivate annual productivity gains and cost reductions. Allows the class to discuss whether the extensive and detailed variance analysis systems promote valuable managerial objectives such as cost control, learning, and improvement. A big issue is whether an emphasis on meeting short-run budgets inhibits longerterm improvements in quality and productivity. Subjects Covered: Cost control; Cost systems; Management accounting; Plant management; Variance analysis A privately owned German power tool company was dissatisfied with its existing cost system. The system could not produce timely, accurate reports on cost center operations, and newly purchased automated machines were attracting large overhead costs. A new, highly automated system was designed and installed that used 600 cost centers and an appropriate activity base chosen for each center. The case shows the design of a highly accurate cost control system with flexible budgets used in both support and production cost centers. Subjects Covered: Budgeting; Cost control; Cost systems; Management accounting

Peoria Engine Plant (A) (Abridged): Robert S. Kaplan, Amy P. Hutton Product #: 197099 Length: 14p

Metabo GmbH & Co. KG: Robert S. Kaplan, Dagmar Bottenbruch Product #: 189146 Length: 14p Teaching Note: 191098

Chapter 8: Flexible Budgets, Overhead-Cost Variances, and Management Control N/A Chapter 9: Inventory Costing and Capacity Analysis Micro Devices Division: Robin

Abstract

Abstract The company has excess capacity. The case explores the various

Cooper, Christopher D. Ittner Product #: 191073 Length: 13p Teaching Note: 191175 Polysar Ltd.: Robert L. Simons Product #: 187098 Length: 13p Teaching Note: 187198

issues surrounding accounting for the cost of capacity. Several definitions of capacity can be discussed and accounted for. Subjects Covered: Capacity analysis; Cost accounting; Cost allocation; Cost systems Canada's largest chemical company produces and markets butyl rubber in two divisions, each treated as a profit center. The new plant in the North American Division operates below capacity, resulting in a significant volume variance and an operating loss. The European Division is at capacity and is profitable. The actions of the European Division affect the capacity utilization of the North American Division. Includes divisional financial statements and interviews with the vicepresidents of each division. Subjects Covered: Budgeting; Capacity planning; Performance measurement; Profit centers; Variance analysis Abstract A British bank with strong roots in the cooperative movement encounters declining profitability in an increasingly competitive and deregulated financial services industry. It attempts to grow by broadening its customer base and increasing the range of products and services offered. It turns to activity-based costing as part of its reengineering effort to learn more about the process and product costs and customer profitability, and contemplates what actions to take based on this new information. Subjects Covered: Activity-based costing; Cost accounting; Cost analysis; Cost systems; Management accounting The company has committed to major improvements in quality, cost, and on-time delivery performance. Despite strong senior management support, however, the actual rate of improvement was disappointing until a new measurement philosophy was introduced. The new approach specified expected rates of improvement and compared actual improvements to the expected rate. Operational people preferred the new measures to the monthly financial reports they continued to receive. The case explores the conflicts between financial measurements and operating improvements. Subjects Covered: Cost control; Learning curves; Management accounting; Productivity; Quality control The division has recognized the inadequacies of its existing, traditional cost system for estimating product costs. Describes the innovative activity-based system that was developed to more accurately trace overhead costs to individual products. Provides students with the opportunity to critique a standard cost system and to assess the characteristics of the proposed system that traces costs to production activities. Subjects Covered: Activity-based costing; Cost accounting; Cost allocation; Cost systems; Manufacturing Abstract An independent regulated telephone company has established a computer services subsidiary that seems to remain unprofitable. Managers must determine whether it is profitable or not and consider

Chapter 10: Determining How Costs Behave The Co-operative Bank: Robert S. Kaplan, Srikant M. Datar Product #: 195196 Length: 17p Teaching Note: 198078

Analog Devices, Inc.: The HalfLife System: Robert S. Kaplan Product #: 190061 Length: 26p Teaching Note: 191103

John Deere Components Works (A): Robert S. Kaplan, Artemis March Product #: 187107 Length: 19p Teaching Note: 188049

Chapter 11: Decision Making and Relevant Information Prestige Telephone Co.: William J. Bruns Jr. Product #: 197097

Length: 4p Teaching Note: 197098 Catawba Industrial Co.: Francis J. Aguilar Product #: 191053 Length: 4p Teaching Note: 894058

Bridgeton Industries: Automotive Component & Fabrication Plant: Robin Cooper, Patricia J. Bost Product #: 190085 Length: 7p Teaching Note: 191168

changes in pricing or promotion that might improve profitability. Learning Objective: To introduce concepts of relevant costs, contribution, and breakeven analysis. A department general manager has to decide whether or not to add a lightweight compressor to the line, what price to charge, and what volume to produce. The analysis requires maximizing contribution in a situation where one factor is constrained. As such, it takes into account opportunity costs and shadow prices as well as fixed and variable costs, demand curve analysis, and sunk costs. Also invites discussion about the proper measurement, offering departmental profits and return on sales as candidates. Subjects Covered: Capacity analysis; Cost analysis; Demand analysis; Machinery; Pricing; Quantitative analysis Bridgeton Industries was experiencing reduced sales. To become more competitive it introduced a classification procedure for products based upon their productivity and other factors. Products were classified into three groups: world class, potentially world class, and non-world class. The firm outsources the non-world class products. This outsourcing causes the costs on the remaining products to increase because some costs associated with the outsourced products dont go away. These residual costs caused more products to become non-world class and hence candidates for outsourcing. The firm has entered the death spiral. Subjects Covered: Budgeting; Corporate strategy; Cost accounting; Cost allocation Abstract Examines the use of activity-based (or menu) pricing at Owens & Minor (O&M). A manager at O&M, a large national medical and surgical distribution company, enlisted the help of both logistics and cost managers to develop an innovative pricing schedule based on the customer's activities instead of product price. The existing cost-plus pricing structure made it impossible for O&M to price services appropriately. However, he encounters customer resistance to his new proposal. Learning Objective: To introduce students to activity-based pricing/menu-pricing in a medical supply distribution company. Explores Toyota's target costing system, considered to be the most advanced such system of any major Japanese manufacturer. Specifically, describes Toyota's process of setting rigorous costreduction goals and the steps taken to achieve them. Subjects Covered: Cost accounting; Cost control; Design; Product development Explores Olympus Optical's strategic response to major losses in its camera business. Key to Olympus's recovery were its extensive product planning process, a quality improvement program, and an aggressive cost-reduction program. In particular, the case details Olympus's target costing system, which enabled the firm to design high-quality products at low cost. Subjects Covered: Cost control; Cost systems; Product development Describes the various value engineering techniques used by Isuzu.

Chapter 12: Pricing Decisions and Cost Management Owens & Minor, Inc. (A): V.G. Narayanan, Lisa Brem Product #: 100055 Length: 17p Teaching Note: 100100

Toyota Motor Corp.: Target Costing System: Robin Cooper, Takao Tanaka Product #: 197031 Length: 10p Olympus Optical Co. Ltd. (A): Cost Management for Short Life Cycle Products: Robin Cooper Product #: 195072 Length: 12p Teaching Note: 195074 Isuzu Motors Ltd.: Cost

Creation Program: Robin Cooper, Takeo Yoshikawa Product #: 195054 Length: 15p Teaching Note: 195055 Nissan Motor Co. Ltd.: Target Costing System: Robin Cooper Product #: 194040 Length: 20p Teaching Note: 195063

Shows how Isuzu reduces the cost of its products while increasing their functionality within the constraints of a target cost. Subjects Covered: Cost control; Product development

Describes Nissan's sophisticated target costing system in the context of new product introduction. On the basis of consumer analysis and a life cycle contribution study, Nissan conducts an exhaustive analysis of component costs to determine whether a new model can be profitably manufactured. Cost reduction measures are then pursued both internally and with suppliers to ensure that the model can be produced to the target cost. The target costing system is central to Nissan's continued competitiveness in the fiercely contested Japanese automobile market. Subjects Covered: Cost accounting; Cost control; Design; Product development; Product introduction

Chapter 13: Strategy, Balanced Scorecard, and Strategic Profitability Analysis Boston Lyric Opera: Robert S. Kaplan, Dennis Campbell Product #: 101111 Length: 21p

Pillsbury: Customer-Driven Reengineering: Robert S. Kaplan Product #: 195144 Length: 28p Teaching Note: 199021

Abstract The Boston Lyric Opera was the fastest growing opera company in North America during the 1990s. Having successfully completed a move to a larger facility in 1999, the board and general director recognize the need to develop a formal strategic planning and governance process to guide the company into the future. Board members, senior managers, and artistic leaders use the Balanced Scorecard as the focus of a strategic planning process that develops a strategy map and objectives in the four BSC perspectives for three core strategic themes. This case describes the high-level scorecard development, its cascading down to departments and individuals, and the directors' interactions, using the Balanced Scorecard, with the artistic leaders and board of directors. Learning Objective: To demonstrate to students how the Balanced Scorecard is used for strategic planning and performance management in a performing arts organization. To serve as an introductory class on the Balanced Scorecard or as a follow-up session after the scorecard has been introduced in a traditional forprofit setting. Pillsbury is transforming itself from an integrated producer of flour and bakery products to a value-added supplier of premium branded products. After initial successes applying activity-based costing to manufacturing operations, two senior executives decide to collaborate to propose a major reengineering project across the company's entire value chain. The case describes the project's definition and scope to yield projected annual cost savings and margin improvement between $100 and $300 million. Subjects Covered: Activity-based costing; Business process reengineering; Cost analysis; Customer relationship management; Management accounting

Chemical Bank: Implementing the Balanced Scorecard: Robert S. Kaplan, Norman Klein Product #: 195210 Length: 19p Teaching Note: 198090

The retail bank division of Chemical Bank faces declining margins and increased competition in its credit and deposit gathering and processing business. It wishes to implement a new strategy to become a preferred financial service provider to target customer groups. The division adapts the Balanced Scorecard to clarify and communicate the new strategy and to identify the key drivers for strategic success. The case describes the development of strategic objectives and measures for four perspectives: financial, customer, internal, and learning growth, and the process for implementing the new measurement and management system. Subjects Covered: Implementing strategy; Management accounting; Performance measurement

Chapter 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis Insteel Wire Products: ABM at Andrews: V.G. Narayanan, Ratna Sarkar Product #: 198087 Length: 9p Teaching Note: 198111 Cambridge Hospital Community Health Network: The Primary Care Unit: V.G. Narayanan, Ryan Moore, Lisa Brem Product #: 100054 Length: 19p Teaching Note: 101007

Wilkerson Co.: Robert S. Kaplan Product #: 101092 Length: 4p Teaching Note: 104002

Abstract Insteel implements an ABC system in 1996. It finds pallet nails to be its most profitable product and decides to expand the number of cells making pallet nails from two to four. A repeat of the ABC study in 1997 shows pallet nails have become the least profitable product. Learning Objective: To explores cost allocation in the presence of excess capacity. Examines a pilot activity-based costing program at the Primary Care Unit (PCU) of the Cambridge Hospital Community Health Network. The network needed to gain a better understanding of its unit-ofservice costs, which had been rising at a rate of 10% per year. The network's current step-down costing system gave only aggregate costing information, and there was some concern that it was inaccurately representing the true cost of the intern/resident program, the interpretive services department, and the use of nurse practitioners. Provides detailed exhibits on the methods of allocating costs using activity-based drivers. Students are encouraged to examine both the data and methodology of the pilot study. Learning Objective: To help students gain an understanding of how activity-based costing models are designed in the health care industry and to examine both the data and the methodology of the pilot study in the case. The president of Wilkerson, faced with declining profits, is struggling to understand why the company is encountering severe price competition on one product line while able to raise prices without competitive response on another product line. The controller proposes that the company develop an activity-based cost model to understand better the different demands that each product line makes on the organization's indirect and support resources. Learning Objective: Illustrates motivation and design for an activitybased cost system. Students estimate the new cost model, which provides a radically different perspective on product line profitability. They can suggest actions, based on the new cost model, to improve the company's profitability.

Chapter 15 Allocation of Support Department Costs, Common Costs and Revenues Chapter 16: Cost Allocation: Joint Products and Byproducts N/A Chapter 17: Process Costing N/A Chapter 18: Spoilage, Rework and Scrap N/A Chapter 19: Balanced Scorecard: Quality, Time, and the Theory of Constraints Lehigh Steel: V.G. Narayanan, Laura E. Donohue Product #: 198085 Length: 15p Teaching Note: 198112

Abstract

Abstract Abstract

Abstract

Abstract Lehigh Steel is a specialty steel manufacturer that plummeted from record profits to record losses in less than three years, driven by an inability to distinguish between profitable and unprofitable business. The scale and growth of service activities and overhead costs in an increasingly customized product line suggests that ABC could unlock the secrets of profitability. However, the high fixed-cost structure suggests that the theory of constraints (TOC) could also be relevant. How should Lehigh measure profitability to rationalize its products? Learning objective: To demonstrate to students that Accounting methods must reflect the economics of the business, the time horizon, and the nature of the decision. To assess the relevance of various costs and the structure (fixed or variable) to calculate profitability relevant to a product mix decision over a certain time horizon. The company has committed to major improvements in quality, cost, and on-time delivery performance. Despite strong senior management support, however, the actual rate of improvement was disappointing until a new measurement philosophy was introduced. The new approach specified expected rates of improvement and compared actual improvements to the expected rate. Operational people preferred the new measures to the monthly financial reports they continued to receive. The case explores the conflicts between financial measurements and operating improvements. Subjects Covered: Cost control; Learning curves; Management accounting; Productivity; Quality control Texas Instruments implements a Cost of Quality (COQ) system as part of a company-wide "Total Quality Thrust." After several years of operation, group management questions whether or not the COQ system should be updated to make it more useful in identifying areas for quality improvement. The case documents the current system and asks students to analyze the role it played in the quality control process and areas in which it could be improved. Subjects Covered: Cost accounting; Cost systems; Manufacturing; Quality control; Systems design; Total quality

Analog Devices, Inc.: The HalfLife System: Robert S. Kaplan Product #: 190061 Length: 26p Teaching Note: 191103

Texas Instruments: Cost of Quality (A): Robert S. Kaplan, Christopher D. Ittner Product #: 189029 Length: 16p Teaching Note: 189112

Chapter 20: Inventory Management, Just-in-Time, and Simplified Costing Methods Supply Chain Management at World Co. Ltd.: Ananth Raman, Anna McClelland, Marshall L. Fisher Product #: 601072 Length: 21p Teaching Note: 601147 Raychem Corp.: Interconnection Systems Division: Clayton M. Christensen Product #: 694063 Length: 17p Teaching Note: 695012

Abstract Describes a supply chain with very quick (i.e., two week) response times and allows students to explore how such short response times are achieved. Allows students to explore why other supply chains, with much longer response times, might not be able to replicate this performance. Learning Objective: To illustrate the need and value of response times to short-lifecycle product supply chains and how response times can be reduced through process and organizational changes. Describes the highly successful efforts of a management team to turn around the performance of a $30 million Raychem division that manufactures electronic connectors. The original manufacturing system was a batch operation, with a broad product line, high inventories, and slow throughput time. Describes the process of converting the operation to a low-inventory, just-in-time plant, organized by manufacturing cells. Shows how it was done, and the impact it had on different categories of overhead cost. Learning Objective: Can be used for two purposes: 1) explains how to manage the transition of an organization to one based upon just-intime manufacturing, and 2) can be used to show in detail the cost structure of a manufacturing organization, describing how costs change when just-in-time principles are adopted. Describes a comprehensive manufacturing strategy designed to reduce substantially the cycle time of orders (the time between the placement of an order by a customer and its delivery to the customer). To launch the strategy, Digital has adopted manufacturing resource planning (MRP II). The case allows students to assess the pros and cons of the strategy, which requires rapid information flows and tight manufacturing discipline; the usefulness of MRP II, which integrates manufacturing with overall business plans; and the implementation process to date. Subjects Covered: Implementing strategy; Inventory management; Manufacturing strategy; Operations management; Plant management Abstract Phuket Beach Hotel has an opportunity to lease its underutilized space to a karaoke pub and earn a rental income. Alternatively, the hotel could develop the unused space and create its own pub. The general manager of the hotel must decide which of the two capital projects to recommend to the hotel owners. This case presents sufficient information to build cash flow forecasts for each project and to rank the mutually exclusive projects using various evaluation criteria. Subjects Covered: Capital budgeting An individual is considering the development of a new restaurant. To make the decision, she uses NPV analysis to determine whether she should undertake the investment, and if so, the optimal size of the investment.

Digital Equipment Corp.: The Endpoint Model (A): David A. Garvin, Janet Simpson Product #: 688059 Length: 14p Teaching Note: 691047

Chapter 21: Capital Budgeting and Cost Analysis Phuket Beach Hotel: Valuing Mutually Exclusive Capital Projects: Su Han Chan, Ko Wang, Mary Ho Product #: HKU145 Length: 4p Teaching Note: HKU146

Ginnys Restaurant: Mark Mitchell Product #: 201099 Length: 2p

Teaching Note: 202013 Dixon Corp.: The Collinsville Plant (Abridged): Peter Tufano, Ronald W. Moore Product #: 201097 Length: 14p Reto S.A.: William J. Bruns Jr. Product #: 197102 Length: 2p Teaching Note: 197109

Learning Objective: To introduce net present value analysis. Specialty chemical company Dixon must decide whether to acquire Collinsville, a business in a new segment, and how much to pay. Learning Objective: To practice in applying free cash flow valuation methods. The company must decide whether to acquire new equipment to offer a new product line. The question is whether equipment will meet return on investment targets considering depreciation and taxation of profits. The equipment is acquired, but one year later, better equipment becomes available. Learning Objective: To review all major issues to be considered in analyzing new equipment proposals. Disequilibrium in the $350 million TiO2 market has prompted Du Pont's Pigments Department to develop two strategies for competing in this market in the future. The growth strategy has a smaller internal rate of return than the alternative strategy due to large capital outlays in early years and positive cash flows arising only in later years. However, it is the more valuable project on a net present value basis for all discount rates less than 21%. Students must convert strategic plans and objectives into free cash flow projections and determine a breakeven discount rate between these mutually exclusive projects. They must then decide which strategy to pursue. Subjects Covered: Capital budgeting; Financial management; Present value; Return on investment; Strategic planning

E.I. du Pont de Nemours & Co.: Titanium Dioxide: W. Carl Kester, Robert R. Glauber, David W. Mullins Jr., Stacy S. Dick Product #: 284066 Length: 7p Teaching Note: 289005

Chapter 22: Management Control Systems, Transfer Pricing, and Multinational Considerations Airtex Aviation: Brian J. Hall, Carleen Madigan Product #: 800269 Length: 16p

Abstract Two young and inexperienced MBAs buy a virtually bankrupt company. They design a decentralized control system organized around profit centers. As a case in control systems, there is ample detail for discussion of design issues, control of independent profit centers, and details about decentralized control. Subjects Covered: Control systems; Decentralization; Entrepreneurship; Information systems; Management accounting; Profit centers A self-contained exercise that takes students through five stages of growth in an entrepreneurial start-up in the medical devices industry: 1) founding, 2) growth, 3) push to profitability, 4) refocus on process, and 5) takeover by new management. At each stage, students must confront tensions in balancing profit, growth, and control. Difficulties encountered in the business are due to management's attempts to design and use formal control systems to achieve profit and performance goals. Learning Objective: Longitudinal study of company attempting to balance innovation and control. Describes Kyocera's unusual approach to profit centers. The firm's

ATH Technologies, Inc.: Making the Numbers: Robert L. Simons Product #: 108092 Length: 14p Teaching Note: 108097

Kyocera Corp.: The Amoeba

Management System: Robin Cooper Product #: 195064 Length: 12p Teaching Note: 195065

J Boats: Robert L. Simons Product #: 197015 Length: 18p Teaching Note: 199042

basic units of operation are profit centers called "amoebas," which are sales or manufacturing units with full responsibility for their planning, decision making, and administration. Amoebas are expected to find ways to improve production and lower costs, reflecting the belief of Kyocera's founder that profits are generated during the manufacturing process. Subjects Covered: Cost accounting; Organizational design; Profit centers; Transfer pricing Traces the 20-year evolution of a family-owned, entrepreneurial sailboat company. Illustrates how two founders leveraged their design and marketing skills to build one of the most recognized brands in the recreational boating industry. Ends as the founder considers management succession and the need to improve financial planning and control systems to capitalize on brand value. Illustrates how entrepreneurs successfully utilize the levers of control by focusing on core values, risks to be avoided, critical performance variables, and strategic uncertainties in a small, family-run business. Learning Objective: To illustrate how entrepreneurs successfully manage a small, family-run business by focusing on core values, risks to be avoided, critical performance variables, and strategic uncertainties

Chapter 23: Performance Measurement, Compensation, and Multinational Considerations Vyaderm Pharmaceuticals: Robert L. Simons, Indra A. Reinbergs Product #: 101019 Length: 15p Teaching Note: 101043

Abstract In 1999, the new CEO of Vyaderm Pharmaceuticals introduces an Economic Value Added (EVA) program to focus the company on long-term shareholder value. The EVA program consists of three elements: EVA centers (business units), EVA drivers (operational practices that improve EVA results), and an EVA-based incentive program for bonus-eligible managers. Over the next two years, the implementation of the program runs into several stumbling blocks, including resistance from regional managers, who push for "line of sight" EVA drivers; the difficulty of managing a large number of EVA centers; and unexpected bonus adjustments due to poor EVA performance. The decision point focuses on the competitive situation in a business unit where the sudden exit of a competitor produces an unexpected one-time "windfall" in earnings. Vyaderm's top managers struggle with the question of whether to adjust the EVA results to prevent demoralizing managers in future years when EVA results are likely to decline. Learning Objective: To allow students to calculate EVA bonus payouts using a pharmaceutical company example. Guidant is a successful IPO start-up selling pacemakers and defibrillators. The case describes how managers install systems to balance innovation and control. Three parts of a shareholder value strategy are described. Controls include incentive systems, beliefs systems, and risk-management systems. Subjects Covered: Control systems; Implementing strategy; Incentives; Planning systems; Risk management

Guidant Corp.: Shaping Culture Through Systems: Robert L. Simons, Antonio Davila Product #: 198076 Length: 17p Teaching Note: 199056

Citibank: Performance Evaluation: Robert L. Simons, Antonio Davila Product #: 198048 Length: 9p Teaching Note: 199047

Mobil USM&R (A): Linking the Balanced Scorecard: Robert S. Kaplan Product #: 197025 Length: 19p Teaching Note: 198044

Citibank has introduced a new, comprehensive performancescorecard system. A regional president struggles with a tough decision: how to evaluate an outstanding branch manager who has scored poorly on an important customer satisfaction measure. This case provides a scoring sheet to be completed by the reader and an explanation of the ramifications of the decision for the business's strategy. Subjects Covered: Control systems; Implementing strategy; Incentives; Performance appraisals; Performance measurement The CEO of the marketing and refining division of a major oil company is in the midst of implementing a profit turnaround. He transforms the strongly centralized, functionally-organized division into 17 independent business units and 14 internal service companies. The division also launches a new, market-segmented strategy aimed at high-end buyers. The CEO recognizes, however, that the new organization and strategy require a new measurement system. He turns to the Balanced Scorecard (BSC) because of its ability to link measurement to strategy, and to help the new profitcenter managers develop customized strategies for their local responsibilities. The case describes the development of the initial divisional BSC, the linkage of the divisional BSC to independent business unit and internal service company BSCs, and linkage of the BSC to managers' compensation. Concludes with the senior executives reflecting on how they are using the BSC in their management processes. Subjects Covered: Cost accounting; Executive committees; Implementing strategy; Incentives; Performance measurement

Vous aimerez peut-être aussi

- MarkNtel - Middle East Specialty Chemicals Market Analysis 2020 - Sample PDFDocument50 pagesMarkNtel - Middle East Specialty Chemicals Market Analysis 2020 - Sample PDFManojPas encore d'évaluation

- Harvard - CV Packet 2014Document83 pagesHarvard - CV Packet 2014my009.tkPas encore d'évaluation

- Marketing Strategy of Tommy HilfigerDocument27 pagesMarketing Strategy of Tommy HilfigerKamal King40% (5)

- FIN4414 SyllabusDocument31 pagesFIN4414 SyllabusQQQQQQPas encore d'évaluation

- Business Plan and Business ModelDocument23 pagesBusiness Plan and Business ModelFarrukhPas encore d'évaluation

- The Phuket Beach CaseDocument4 pagesThe Phuket Beach Casepeilin tongPas encore d'évaluation

- Marketing Plan For A High-Tech Product: Alexandra BerestovaDocument88 pagesMarketing Plan For A High-Tech Product: Alexandra Berestovavikas joshiPas encore d'évaluation

- Global Hydrogen Peroxide Market - Growth, Trends and Forecasts 2018 - 2023Document187 pagesGlobal Hydrogen Peroxide Market - Growth, Trends and Forecasts 2018 - 2023Khiết NguyênPas encore d'évaluation

- Case Map For Foundations of Finance, 7/eDocument2 pagesCase Map For Foundations of Finance, 7/eJoseph SchizmoPas encore d'évaluation

- SM - A00570 - Global Footwear Market, 2020-2027 - V1.2Document89 pagesSM - A00570 - Global Footwear Market, 2020-2027 - V1.2Simran SinghPas encore d'évaluation

- TRIAL Coffee Shop Financial Model Excel Template v1.4.122020Document88 pagesTRIAL Coffee Shop Financial Model Excel Template v1.4.122020fvfvfsPas encore d'évaluation

- Brochure - Food Flavors Market - Global Trends & Forecast To 2018Document27 pagesBrochure - Food Flavors Market - Global Trends & Forecast To 2018shishirchemPas encore d'évaluation

- Atek PCDocument2 pagesAtek PCLiontiniPas encore d'évaluation

- Wenban MonitorDocument21 pagesWenban Monitoralex.nogueira396Pas encore d'évaluation

- Security Valuation PriciplesDocument69 pagesSecurity Valuation PriciplesvacinadPas encore d'évaluation

- CBS Case Competition 2007Document20 pagesCBS Case Competition 2007thanhPas encore d'évaluation

- BPM-Financial Modelling Fundamentals-Practical ExerciseDocument24 pagesBPM-Financial Modelling Fundamentals-Practical ExerciseSiddharth GuptaPas encore d'évaluation

- Amazon Case Study Model Data File - FinalDocument42 pagesAmazon Case Study Model Data File - FinalBishoy SamirPas encore d'évaluation

- Sample - Ghana Automobile Market (2022 - 2027) - Mordor Intelligence1646740554907Document26 pagesSample - Ghana Automobile Market (2022 - 2027) - Mordor Intelligence1646740554907Mpact LanePas encore d'évaluation

- IA SAP Security Meeting Agenda VF 20151104 - PresentationDocument29 pagesIA SAP Security Meeting Agenda VF 20151104 - PresentationspicychaituPas encore d'évaluation

- Market Research On PEPSI BLUEDocument22 pagesMarket Research On PEPSI BLUEpankaj627450% (4)

- VP Strategy Marketing Operations in Austin TX Raleigh Durham NC Resume Joseph CarsanaroDocument2 pagesVP Strategy Marketing Operations in Austin TX Raleigh Durham NC Resume Joseph CarsanaroJosephCarsanaroPas encore d'évaluation

- Nielsen KAEC Qualitative Proposal 280919Document48 pagesNielsen KAEC Qualitative Proposal 280919Mohammad Al-khatibPas encore d'évaluation

- How To Breathe New Life Into Strategy - Bain & CompanyDocument8 pagesHow To Breathe New Life Into Strategy - Bain & Companymasterjugasan6974Pas encore d'évaluation

- Practical Enterprise Risk Management (ERM) : Casualty Loss Reserve Seminar, Fall 2013Document14 pagesPractical Enterprise Risk Management (ERM) : Casualty Loss Reserve Seminar, Fall 2013Saife GeePas encore d'évaluation

- Interview Preparation Series - Session 6 - New Product Launch - Competitive ResponseDocument29 pagesInterview Preparation Series - Session 6 - New Product Launch - Competitive ResponsedanielPas encore d'évaluation

- Unilever S&P Analysis Report - S1Document16 pagesUnilever S&P Analysis Report - S1sarika sugurPas encore d'évaluation

- Strategic Management: Levels StrategyDocument10 pagesStrategic Management: Levels Strategysagar09Pas encore d'évaluation

- Financial Projections Model v6.8.3Document28 pagesFinancial Projections Model v6.8.3Hitesh ShahPas encore d'évaluation

- Gep JD PDFDocument2 pagesGep JD PDFAdarsh BansalPas encore d'évaluation

- Five Formal Organization StructuresDocument5 pagesFive Formal Organization StructuresMeghna JaiswalPas encore d'évaluation

- Strategy FormulationDocument9 pagesStrategy Formulationapi-3774614100% (1)

- Comparison of Strategic Planning Models and FrameworksDocument14 pagesComparison of Strategic Planning Models and FrameworksRiz DeenPas encore d'évaluation

- ABB Strategy 2011: Zurich, Switzerland September 5, 2007Document69 pagesABB Strategy 2011: Zurich, Switzerland September 5, 2007Namdev NayakPas encore d'évaluation

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- Mekko Graphics Sample ChartsDocument47 pagesMekko Graphics Sample ChartsluizacoditaPas encore d'évaluation

- Accenture Annual ReportDocument6 pagesAccenture Annual ReportstudentbusyPas encore d'évaluation

- An Assessment of The Post-Reform Competitive Performance ofState-Owned Enterprises in IndiaDocument25 pagesAn Assessment of The Post-Reform Competitive Performance ofState-Owned Enterprises in IndiaChantich CharmtongPas encore d'évaluation

- Fairness Opinion or A Valuation Opinion FINAL E 2014-08-27Document3 pagesFairness Opinion or A Valuation Opinion FINAL E 2014-08-27glogma9693Pas encore d'évaluation

- Marketing OverviewDocument9 pagesMarketing OverviewGourav SihariyaPas encore d'évaluation

- Valuation Q&A McKinseyDocument4 pagesValuation Q&A McKinseyZi Sheng NeohPas encore d'évaluation

- The Benefit Cost of VDT Highlighting PDFDocument9 pagesThe Benefit Cost of VDT Highlighting PDFinitiative1972Pas encore d'évaluation

- Operations Due Diligence: An M&A Guide for Investors and BusinessD'EverandOperations Due Diligence: An M&A Guide for Investors and BusinessPas encore d'évaluation

- BCG Retail What The Data Tells Us About Digital Transformation by IndustryDocument17 pagesBCG Retail What The Data Tells Us About Digital Transformation by IndustryBerchtesgaden ranPas encore d'évaluation

- Deloitte - 2022 Global Automotive Consumer StudyDocument34 pagesDeloitte - 2022 Global Automotive Consumer StudyAakash MalhotraPas encore d'évaluation

- Chris Hartz CV - May 2023Document4 pagesChris Hartz CV - May 2023PAUL LEDGERPas encore d'évaluation

- Promotions in The Retail Industry - ConsumerDocument13 pagesPromotions in The Retail Industry - ConsumerSoumit GhoshPas encore d'évaluation

- Business Plan Template InteractiveDocument18 pagesBusiness Plan Template InteractiveAlex GranderPas encore d'évaluation

- 04 - Convert Symbols To Editable ShapesDocument6 pages04 - Convert Symbols To Editable ShapesSANJITPas encore d'évaluation

- Uneecops Technologies LTDDocument12 pagesUneecops Technologies LTDRajan KumarPas encore d'évaluation

- BBVA Roadmap and Benefits Case Development V7 - FinalDocument47 pagesBBVA Roadmap and Benefits Case Development V7 - FinalchrisystemsPas encore d'évaluation

- Growth Strategy Process Flow A Complete Guide - 2020 EditionD'EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionPas encore d'évaluation

- CM MKT Anderson NarusDocument8 pagesCM MKT Anderson Narusmeherey2kPas encore d'évaluation

- Financial Projection Analysis Report For StudentsDocument6 pagesFinancial Projection Analysis Report For StudentsArchie TonogPas encore d'évaluation

- Management Accounting Techniques 1Document15 pagesManagement Accounting Techniques 1Ekin BaharinPas encore d'évaluation

- Week 2 Workshop SolutionsDocument6 pagesWeek 2 Workshop SolutionsJenDNg50% (2)

- Financial Analysis Thesis SampleDocument4 pagesFinancial Analysis Thesis Samplecrfzqkvcf100% (1)

- Cooper, Slagmulder - 1998 - The Scope of Strategic Cost ManagementDocument2 pagesCooper, Slagmulder - 1998 - The Scope of Strategic Cost ManagementEric FerreiraPas encore d'évaluation

- Reimagining India A Conversation With Yasheng HuangDocument2 pagesReimagining India A Conversation With Yasheng Huangmeherey2kPas encore d'évaluation

- Internet Trends 2014Document164 pagesInternet Trends 2014harlock01Pas encore d'évaluation

- CM MKT Anderson NarusDocument8 pagesCM MKT Anderson Narusmeherey2kPas encore d'évaluation

- Thank You For The MusicDocument1 pageThank You For The Musicmeherey2kPas encore d'évaluation

- Aftershock Global Financial Meltdown-02 062610Document10 pagesAftershock Global Financial Meltdown-02 062610meherey2kPas encore d'évaluation

- Studyof Conflict in Family Businesses PDFDocument19 pagesStudyof Conflict in Family Businesses PDFmeherey2kPas encore d'évaluation

- CM STRAT Hitt Ireland HoskissonDocument19 pagesCM STRAT Hitt Ireland Hoskissonmeherey2k0% (1)

- CM Strat YipDocument9 pagesCM Strat Yipmeherey2kPas encore d'évaluation

- STRAT Wheelen HungerDocument20 pagesSTRAT Wheelen Hungermbilal1985Pas encore d'évaluation

- CM STRAT-Saloner-Shepard-Podolny PDFDocument13 pagesCM STRAT-Saloner-Shepard-Podolny PDFmeherey2kPas encore d'évaluation

- Case Maps of StrategyDocument15 pagesCase Maps of Strategymeherey2k100% (1)

- Datar Case MapsDocument13 pagesDatar Case Mapsmeherey2kPas encore d'évaluation

- Datar Case MapsDocument13 pagesDatar Case Mapsmeherey2kPas encore d'évaluation

- Datar Case MapsDocument13 pagesDatar Case Mapsmeherey2kPas encore d'évaluation

- Case Map For Babin and Harris CB, 4th Edition (Cengage, ©2013)Document14 pagesCase Map For Babin and Harris CB, 4th Edition (Cengage, ©2013)meherey2kPas encore d'évaluation

- Post - AF3313 - Sem 1 Midterm 2015-16Document9 pagesPost - AF3313 - Sem 1 Midterm 2015-16siuyinxddPas encore d'évaluation

- Mgac 1Document7 pagesMgac 1Yah yah yahhhhhPas encore d'évaluation

- IMC Unit2 v11Document20 pagesIMC Unit2 v11Munyaradzi Pasinawako0% (1)

- American Chemical CorporationDocument5 pagesAmerican Chemical Corporationjlvaldesm100% (1)

- Indian River Citrus Company Is A Leading Producer of FreshDocument9 pagesIndian River Citrus Company Is A Leading Producer of FreshKiran FarooqPas encore d'évaluation

- Chapter 16 DCF With Inflation and Taxation: 1. ObjectivesDocument7 pagesChapter 16 DCF With Inflation and Taxation: 1. ObjectivesShir Aboks HughesPas encore d'évaluation

- Chapter 2 - Organizational Strategy & Project SelectionDocument27 pagesChapter 2 - Organizational Strategy & Project SelectionAliImranPas encore d'évaluation

- Yahoo! Inc. Valuation ProjectDocument8 pagesYahoo! Inc. Valuation ProjectNigar_AbbasPas encore d'évaluation

- What Is The Cost-Benefit Analysis Formula?: ExplanationDocument2 pagesWhat Is The Cost-Benefit Analysis Formula?: Explanationmuna moonoPas encore d'évaluation

- Advanced Financial Management R. KitDocument247 pagesAdvanced Financial Management R. KitMhasibu Mhasibu97% (35)

- Formula SheetDocument3 pagesFormula SheetTaVuKieuNhiPas encore d'évaluation

- Net Present ValueDocument23 pagesNet Present ValueJune JunePas encore d'évaluation

- Finanacial Management E-BookDocument455 pagesFinanacial Management E-BookArnold Quachin TanayPas encore d'évaluation

- Absorbent CottonDocument27 pagesAbsorbent CottonTrầnChíTrungPas encore d'évaluation

- Pc-I (Infrastructure-Proforma For Development Projects)Document12 pagesPc-I (Infrastructure-Proforma For Development Projects)Haider IqbalPas encore d'évaluation

- 7408 gcd1105 Asm1 Pham Thi Thanh Thien gcd210520Document28 pages7408 gcd1105 Asm1 Pham Thi Thanh Thien gcd210520Ton That Quan (FPI DN)Pas encore d'évaluation

- 10 Fs Discount Rate in Project AnalysisDocument6 pages10 Fs Discount Rate in Project AnalysisMohammed HeshamPas encore d'évaluation

- Financial Management: 61FIN2FIMDocument6 pagesFinancial Management: 61FIN2FIMNguyễn HuyềnPas encore d'évaluation

- Two Years Ago, A Company Purchased A Machine. Curr... PDFDocument3 pagesTwo Years Ago, A Company Purchased A Machine. Curr... PDFkamran0% (1)

- Financial Maths II TUTORIALSDocument18 pagesFinancial Maths II TUTORIALSPelah Wowen DanielPas encore d'évaluation

- November 2021 Professional Examination Financial Management (Paper 2.4) Chief Examiner'S Report, Questions & Marking SchemeDocument19 pagesNovember 2021 Professional Examination Financial Management (Paper 2.4) Chief Examiner'S Report, Questions & Marking SchemeAsaamah John AsumyusiaPas encore d'évaluation

- Financing of Project: DR Anurag AgnihotriDocument79 pagesFinancing of Project: DR Anurag AgnihotriAnvesha TyagiPas encore d'évaluation

- Project: Selection & Organization StructureDocument10 pagesProject: Selection & Organization StructureTravis BanPas encore d'évaluation

- Lesson 2: Fundamental and Technical Analysis For Investing in StockDocument13 pagesLesson 2: Fundamental and Technical Analysis For Investing in StockNica BastiPas encore d'évaluation

- Pgdba - Fin - Sem III - Project FinanceDocument31 pagesPgdba - Fin - Sem III - Project Financeapi-3762419100% (6)

- 33 Comm 308 Final Exam (Summer 1 2018)Document16 pages33 Comm 308 Final Exam (Summer 1 2018)Carl-Henry FrancoisPas encore d'évaluation

- Alternative Investments Angus Cartwright, JR Case AnalysisDocument9 pagesAlternative Investments Angus Cartwright, JR Case Analysissharanya86Pas encore d'évaluation

- CSE 405N System Analysis and DesignDocument19 pagesCSE 405N System Analysis and DesignAsfikRahmanPas encore d'évaluation

- ACC501 - Final Term Papers 01Document16 pagesACC501 - Final Term Papers 01Devyansh GuptaPas encore d'évaluation

- A Cross-Border Cap BudgetingDocument18 pagesA Cross-Border Cap BudgetingGaurav VermaPas encore d'évaluation