Académique Documents

Professionnel Documents

Culture Documents

Airport Taxi Service

Transféré par

JayeshMulchandaniDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Airport Taxi Service

Transféré par

JayeshMulchandaniDroits d'auteur :

Formats disponibles

Executive Summary

Premier Airport Transportation Service (PATS) is a Cleveland-based airport transportation service. PATS provides limousine like service without the typical high limousine price. Although PATS' cars are not true stretch limousines, they are late model high-end luxury vehicles. Premier Airport Transportation is lead by Sam Brougham, a transportation industry veteran. PATS has forecasted healthy sales by year three. The Market and Services Offered Cleveland currently has four limousine service providers and four taxi services. In addition to these transportation options, Cleveland also has short and long-term airport parking and a rapid transit public train system providing airport service. Premier Airport Transportation Service will span the gap between the mediocre taxi service and the high-priced limousine service. By having a middle price point, PATS will be especially attractive to both families and business travelers. The service will appeal to families as a reasonable and convenient alternative to them driving and parking at the airport. Business travelers who require a more deluxe solution relative to taxis but do not have such a debilitating effect on the company's travel budget will embrace Premier Airport Transportation. These two market segments are growing on average at 8.5% per year and there are over a million potential customers. The Competitive Edge PATS recognizes that their key to success will be providing unmatched customer service. Premier has infused the importance of customer service into the drivers' jobs by offering financial incentives to the drivers for superior service. This will ensure that the best customer service will be offered at every level and interaction with the company. Management Team Premier Airport Transportation Service was founded and is run by Sam Brougham. Sam began his transportation career as a taxi driver, a source of income to put Sam through school. After school, Sam worked at the Yellow Freight Company, initially in the logistics department. Sam then moved on to Yellow's customer service department, ultimately having managerial responsibility over Yellow's customer care call center. Sam's logistics and customer service experience will be essential to the success of PATS. The logistics experience will provide Premier with hyper-efficient operations and the customer service experience will support their competitive edge. Premier Airport Transportation will fulfill Cleveland's unmet need for a reasonably priced, high service level airport transportation service. PATS will achieve break-even status by month eight and will double sales of year one by year three. While PATS will incur a loss for year one, they will generate a tidy net profit for year three.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

1.1 Objectives

The objectives for the first three years of operation include: 1. To create a service-based company whose primary goal is to exceed customer's expectations. 2. To increase customers by 20% per year through superior performance and word-ofmouth referrals. 3. To develop a sustainable transportation company serving the Cleveland Metropolitan Area

1.2 Mission

The Mission of Premier Airport Transportation Service is to provide the customer the finest airport transportation service available. We exist to attract and maintain customers. When we adhere to this maxim, everything else will fall in to place. Our services will exceed the expectations of our customers.

Company Summary

Premier Airport Transportation Service, located in Bedford Hts, OH offers an airport transportation service for the greater Cleveland metropolitan area. PATS will offer their service 24 hours a day to most neighborhoods in Cleveland. PATS will be priced less than a limousine service but more than a group shuttle service. Sam Brougham will be working full time as the dispatcher and back office person. Sam will have four employees.

2.1 Company Ownership

PATS is an Ohio corporation founded and owned by Sam Brougham.

2.2 Start-up Summary

PATS' start-up costs will include all the equipment needed for the home-based office, legal fees, website creation, and start-up advertising. The office equipment will be the largest chunk of the start-up expenses. This equipment includes a computer system, fax machine, office supplies. The computer should have at least a 500 megahertz Celeron/ Pentium processor, 64 megabytes of RAM (preferably 128), 6 gigabyte hard drive, and a rewritable CD- ROM for backing up the system. A DSL line will need to be set up as well. PATS will also need some Nextel phones. The advantage of the Nextel phones is it allows two way communication from the base to the cars over cellular frequencies but at a drastically reduced rate. The office will need some furniture such as a desk, file cabinets. The legal fees are used for the formation of the business as well as for reviewing/generating standard client contracts.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

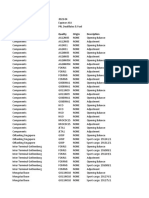

Start-up Requirements Start-up Expenses Legal Stationery etc. Brochures Office equipment Website creation Other Total Start-up Expenses Start-up Assets Cash Required Other Current Assets Long-term Assets Total Assets Total Requirements Need real financials?

$1,000 $125 $400 $500 $500 $0 $2,525 $30,975 $0 $1,500 $32,475 $35,000

We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

Start-up Funding Start-up Expenses to Fund Start-up Assets to Fund Total Funding Required Assets Non-cash Assets from Start-up Cash Requirements from Start-up Additional Cash Raised Cash Balance on Starting Date Total Assets

$2,525 $32,475 $35,000 $1,500 $30,975 $0 $30,975 $32,475

Liabilities and Capital Liabilities Current Borrowing $0 Long-term Liabilities $0 Accounts Payable (Outstanding Bills) $0 Other Current Liabilities (interest-free) $0 Total Liabilities $0 Capital Planned Investment Investor 1 $35,000 Other $0 Additional Investment Requirement $0 Total Planned Investment $35,000 Loss at Start-up (Start-up Expenses) ($2,525) Total Capital $32,475 Total Capital and Liabilities $32,475 Total Funding $35,000

Services

PATS provides an airport transportation solution for the Cleveland metropolitan area. PATS can provide airport travel on short notice if cars are available, but they generally work with a reservation system. A customer would call up in advance and provide PATS with flight information. PATS would schedule the pick up time and then call and send an email to confirm the pickup. For pick up at the airport, PATS would meet the customer outside of baggage claim after the customer has picked up their luggage and would drive them home.

Market Analysis Summary

PATS will be focusing on families as well as business travelers. Both groups will likely demand PATS services. The families will utilize our service because it is convenient and less expensive than if they drove themselves and paid for long-term parking of their car. Business travelers will use our service because it offers a limousine-like service (other than the fact that PATS does not use limousines) where the traveler has a ride waiting for them when their planes comes in, but the service is less expensive than normal limousine services. Since the service is fairly comparable to a louisine service, companies will encourage their workers to utilize PATS as a

cost saving measure, particularly in this economic downturn. Currently there are four limousine services in Cleveland and four taxi-type service providers.

4.1 Market Segmentation

Our customers can be divided into two groups: families/individuals on pleasure trips, and business travelers. The first group is taking a trip for pleasure and will either be an individual or a family. Their choices are to either drive and park in long term parking, take a taxi, or use a limousine service. This group does not typically mind paying a bit more for a solution that takes care of their transportation to and from the airport. Since they are are on vacation, they appreciate having a service that gets them to the airport in a seamless way so they do not have to worry about anything. All they have to do is make the reservation and show up at the arranged pickup point. The second group is the business traveler. In the past a company would typically hire a limousine service to pick up their worker. The company would always pay for the service. With PATS as an alternative, there is a transportation service that functions like a limousine (you can preschedule pickup dates and be taken directly home or to the airport) but without the overly fancy car and the associated high price. As companies are always looking at ways to cut costs, PATS offers a very reasonable solution in terms of comfort and cost. The business traveler will not notice anything different with PATS versus a limo service other than the vehicle they are traveling won't be a limo, but will still be a sufficiently large and comfortable car.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan.

Create your own business plan

Market Analysis Year 1 Potential Customers Individual/families Business travelers Total Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan Year 2 Year 3 Year 4 Year 5 Growth CAGR 9% 578,000 630,020 686,722 748,527 815,894 9.00% 8% 425,000 459,000 495,720 535,378 578,208 8.00% 8.58% 1,003,000 1,089,020 1,182,442 1,283,905 1,394,102 8.58%

4.2 Target Market Segment Strategy

PATS will be targeting these two groups because they consistently travel, and PATS solution makes traveling easy for them. While a slow economy has some effect on travel. In general Americans tend to travel more each year, this trend beginning in the early 1980s. These groups are particularly attractive to PATS because they will always need to get to the airport and they are willing to pay a bit extra for the luxury of having someone take them there instead of being required to get themselves there. Please note, however, PATS is only slightly more expensive for trips under four days; over four days it is more cost effective to use PATS. Compared to driving a personal vehicle and paying for long-term parking. In regard to the business customers, it is generally accepted practice for the company to provide the transportation for their employees. For trips over four days, there is no question that PATS is more cost effective. Under four days PATS service is slightly more expensive than driving oneself and parking, however, companies are more than willing to pay a bit extra as their employee is giving up a decent amount of their free time to go on the trip for work and the business recognizes and appreciates this. Of course for the companies already willing to pay limousine prices, PATS will appear as a way of reducing travel costs with no appreciable loss in service quality.

4.3 Competition and Buying Patterns

Currently in Cleveland there are several competing airport transportation systems: 1. Public transportation: RTA provides rapid transit service to the airport. While this is an inexpensive alternative there are several disadvantages. The service does not run all hours of the night. RTA also forces travelers to change trains downtown to pick up the airport line. The rapid transit also requires travelers to manage all of their luggage which can be

quite chore from some that are not skilled in the art of packing or are traveling for a real long time. 2. Taxi service: Taxis do provide service to and from the airport, however, travelers cannot book the trip in advance, forcing them to call right before they want to travel. The level of service is inconsistent from taxi service to taxi service as well as from occasion to occasion. Taxis can also be quite expensive if city dwellers are going out to the suburbs. 3. Airport parking: Airport parking can be cost effective if it is for fewer than four days. Driving oneself has the advantage of not having to deal with anyone else, the flip side to this however is they must do everything for themselves. Lastly, there is always the risk of damage to their car when it is parked and all airport parking facilities have drivers sign a waiver absolving the lot from responsibility if anything happens to the car. 4. Shuttle service: This option packs a few different people into a van and takes them to the airport. This is a less expensive option, however, it takes longer to make the commute due to the other customers that are traveling Additionally, travelers lose out on the personalized service relative to PATS or a limousine service. The buying patterns of these services vary based on the length of the trip, who is paying for it, and if it is a last minute or planned in advance trip. The longer the trip, the more economical a transportation option is relative to airport parking. A large percentage of business travelers use an upscale airport transportation solution like PATS or a limousine service for their employees. People who are just scraping by to go on vacation are likely to choose the least costly option, public transportation. Lastly, if the trip is planned at the last minute, taxi service might be the only option however, PATS will offer last minute rides if cars are available.

Strategy and Implementation Summary

PATS' marketing/sales strategy will be two pronged, one to address each of our two segmented targeted groups: 1. Families/individuals: In addition to some advertising, we will be working with associations such as AAA and other community groups to try to build up a network of users. PATS believes that working with these groups will provide us with steady flow of customers. Additionally, since a lot of these groups have close knit among member referrals will be quite powerful when they are coming from a member who already has established a trust bond with other organizational members. 2. Business travelers: PATS will be contacting the travel department of many of the different companies in Cleveland that have a lot of employees traveling and informing them about our service and offering them an introductory discount. This will be an important segment to win over as companies routinely have employees traveling throughout the year. Businesses are also valuable because once the initial contact is made, the relationship can be turned into a steady stream of business.

5.1 Competitive Edge

PATS' competitive advantage will be based on an incentive system that rewards the driver economically when they achieve good service, develop repeat customers and act in a team fashion instead of competing against other company drivers. This incentive system will reward drivers when: 1. The company receives positive feedback about the driver (a feedback system will be set up). 2. The customer is turned into a repeat customer. 3. The driver develops new customers. 4. The driver acts in manners that are team based instead of for individual gain. Through this complicated but purposeful system, PATS is incentivizing behavior that they believe will help the company succeed, while not rewarding behavior that is destructive to the company. Additionally, PATS will be having the drivers lease the cars through PATS for several reasons: 1. With PATS leasing the cars, they are able to get a volume discount for the leases. PATS will actually be passing on the costs to the drivers. 2. Leasing through PATS encourages a long term employee as there are fees to break a lease and PATS includes provisions in the lease that do not allow drivers to use the cars for more than two months beyond termination of employment. 3. By having the drivers lease the cars, they have an economic incentive to maintain the cars as they are financial responsible for damage beyond reasonable wear and tear.

5.2 Sales Strategy

As stated earlier, we will be going after both families/individuals as well as business travelers. PATS will have a different strategy for each group. For the individuals, PATS will use contacts through membership associations and clubs to build customers. Customers that are a part of an association tend to put more trust in a service provider when the service provider is aligned with the association. PATS will offer a discount for the association members to try to build up a following. Our selling spiel will be total convenience at a cost that is competitive with the price that they currently pay when they leave their car in the parking lot. Offering the ability to schedule in advance pick up from home and then pick up from airport should be a big selling point. People like convenience, and people are willing to pay for conveniences. One phone call to arrange all of your transport needs to the airport is quite a convenience. Our strategy of wooing the business travelers will be a campaign to introduce PATS to the different travel departments of the larger companies in the area. The initial contact will be a letter/brochure describing our services along with a pricing guide. PATS will then follow that up with a phone call to try to receive a commitment from the company. By including the pricing information within the brochure, PATS believes that this will catch the eyes of the companies' travel departments as they are acutely aware of the costs that they are paying now and PATS believes that they can convert the lead into a customer by offering essentially the same service of a limo company at a reduced rate.

5.2.1 Sales Forecast

The first month will be spent setting up the business. It is unlikely that everything will be ready to go so that we could begin to take fares. By month two the business office will be in order, brochures will have been sent out and PATS will have been working with associations to create visibility for the company. PATS will have two drivers and will be paying a base monthly wage on the assumption that PATS wants to have the drivers ready when fares come up but there is not likely to be enough fares to support the wages of the two drivers. Month three will see an increase in fares and things will be getting busy. Business will continue to grow and by month five a third driver will be brought on board. It will not be until month 11 that a fourth and final driver will be brought on board.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Sales Forecast Year 1 Year 2 Year 3 Sales Individuals/families $94,061 $145,885 $169,874 Business travelers $74,763 $136,874 $149,874 Total Sales $168,824 $282,759 $319,748 Direct Cost of Sales Year 1 Year 2 Year 3 Individuals/families $18,812 $29,177 $33,975 Business travelers $14,953 $27,375 $29,975 Subtotal Direct Cost of Sales $33,765 $56,552 $63,950 Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

5.3 Milestones

PATS will have several milestones to aim for: 1. Business plan completion. This will be done as a road map for the organization. While we do not need a business plan to raise capital, it will be an indispensable tool for the ongoing performance and improvement of the company. 2. Set up office. 3. Profitability. 4. Bringing on board the fourth driver.

Milestones Milestone Business plan completion Set up office Profitability Fourth drive hired Totals

Start Date 1/1/2001 1/1/2001 1/1/2001 1/1/2001

End Date 1/1/2001 1/1/2001 8/30/2001 11/1/2001 $0 $0 $0 $0 $0

Budget

Manager Department ABC ABC ABC ABC Sam Sam everyone everyone

Management Summary

Premier Airport Transportation Service is owned and operated by Sam Brougham. Sam will be incorporating in Ohio. Sam has a degree in business and mathematics from Case Western Reserve University. While at Case, Sam worked as a taxi driver to cover expenses for his education. Upon graduation, Sam went to work for Yellow Freight Company as a manager for the Logistics Department. In this position, Sam was responsible for devising systems that utilized Yellow's truck fleet to its maximum capacity. After developing systems for the efficient use of the equipment, Sam applied and was accepted to transfer over to the customer service department. Same felt that he did not have sufficient "people" skills and was determined to develop these skills. For three years Sam worked in the department, eventually being promoted to leader of a call center group. Once Sam had developed the skills that he deemed necessary to run his own business, he left Yellow and decided to open up his own transportation business. The logistic skills coupled with an outstanding ability to communicate with others provides Sam with the necessary foundation to run PATS.

6.1 Personnel Plan

The staff will consist of Sam working full time in the back office. Sam will be responsible for setting up the appointments as well as the marketing to develop customers. By month two, Sam

will be bringing on board a part-time employee to help him out in answering the phones and setting up appointments for fares. Month two will also bring two drivers to PATS. The head count will remain the same until month five when a third driver will be brought on board. Lastly, month 11 will see a fourth driver brought on board.

Personnel Plan Sam Part-time employee Driver Driver Driver Driver Total People Total Payroll Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan Year 1 Year 2 Year 3 $36,000 $36,000 $36,000 $16,500 $16,500 $16,500 $20,600 $21,600 $21,600 $20,600 $21,600 $21,600 $14,400 $21,600 $21,600 $3,600 $21,600 $21,600 6 6 6 $111,700 $138,900 $138,900

Financial Plan

The following sections will detail important financial information.

7.1 Important Assumptions

The following table highlights some of the important financial assumptions for PATS.

General Assumptions Year 1 Year 2 Year 3 Plan Month 1 2 3 Current Interest Rate 10.00% 10.00% 10.00% Long-term Interest Rate 10.00% 10.00% 10.00% Tax Rate 25.42% 25.00% 25.42% Other 0 0 0

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

7.2 Break-even Analysis

The Break-even Analysis indicates what PATS must have in averaged monthly revenue to break even.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Break-even Analysis Monthly Revenue Break-even $15,131 Assumptions: Average Percent Variable Cost 20% Estimated Monthly Fixed Cost $12,105

7.3 Projected Profit and Loss

The following table presents the projected profit and loss.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts?

We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Pro Forma Profit and Loss Year 1 Sales $168,824 Direct Cost of Sales $33,765 Other $0 Total Cost of Sales $33,765 Gross Margin $135,059 Gross Margin % 80.00% Expenses Payroll $111,700 Sales and Marketing and Other Expenses $3,100 Depreciation $504 Web site maintenance $600 Utilities $1,200 Insurance $5,400 Rent $6,000 Payroll Taxes $16,755 Other $0 Total Operating Expenses $145,259 Profit Before Interest and Taxes ($10,200) EBITDA ($9,696) Interest Expense $0 Taxes Incurred $0 Net Profit ($10,200) Net Profit/Sales -6.04% $282,759 $56,552 $0 $56,552 $226,207 80.00% $138,900 $3,600 $498 $600 $1,200 $5,400 $0 $20,835 $0 $171,033 $55,174 $55,672 $0 $13,794 $41,381 14.63% Year 2 $319,748 $63,950 $0 $63,950 $255,798 80.00% $138,900 $3,600 $498 $600 $1,200 $5,400 $0 $20,835 $0 $171,033 $84,765 $85,263 $0 $21,545 $63,221 19.77% Year 3

7.4 Projected Cash Flow

The following chart and table display the projected cash flow.

Need actual charts? We recommend using LivePlan as the easiest way to create graphs for your own business plan. Create your own business plan

Pro Forma Cash Flow Year 1 Cash Received Cash from Operations Cash Sales Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Year 2 Year 3

$168,824 $168,824

$282,759 $282,759

$319,748 $319,748

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $168,824 $282,759 $319,748 Year 1 Year 2 Year 3 $111,700 $138,900 $138,900

Bill Payments $57,893 Subtotal Spent on Operations $169,593 Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out $0 Principal Repayment of Current Borrowing $0 Other Liabilities Principal Repayment $0 Long-term Liabilities Principal Repayment $0 Purchase Other Current Assets $0 Purchase Long-term Assets $0 Dividends $0 Subtotal Cash Spent $169,593 Net Cash Flow ($769) Cash Balance $30,206

$102,525 $241,425 $0 $0 $0 $0 $0 $0 $0 $241,425 $41,334 $71,540

$115,884 $254,784 $0 $0 $0 $0 $0 $0 $0 $254,784 $64,964 $136,504

7.5 Projected Balance Sheet

The following table details the projected balance sheet.

Pro Forma Balance Sheet Year 1 Assets Current Assets Cash Other Current Assets Total Current Assets Long-term Assets Long-term Assets Accumulated Depreciation Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Subtotal Current Liabilities Long-term Liabilities Total Liabilities Year 2 Year 3

$30,206 $0 $30,206

$71,540 $0 $71,540

$136,504 $0 $136,504

$1,500 $1,500 $1,500 $504 $1,002 $1,500 $996 $498 $0 $31,202 $72,038 $136,504 Year 1 Year 2 Year 3 $8,927 $0 $0 $8,927 $0 $8,927 $8,382 $0 $0 $8,382 $0 $8,382 $9,627 $0 $0 $9,627 $0 $9,627

Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth Need real financials?

$35,000 ($2,525) ($10,200) $22,275 $31,202 $22,275

$35,000 ($12,725) $41,381 $63,656 $72,038 $63,656

$35,000 $28,656 $63,221 $126,877 $136,504 $126,877

We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

7.6 Business Ratios

The business ratios table below is generated by the planning software using the interconnected tables. Standard industry ratios, based upon Standard Industrial Classification Code (SIC) 4111, Local and Suburban Transit, are shown for comparison.

Ratio Analysis Year 1 Sales Growth Percent of Total Assets Other Current Assets Total Current Assets Long-term Assets Total Assets Current Liabilities Long-term Liabilities Total Liabilities Net Worth Percent of Sales Sales Gross Margin Selling, General & Administrative Expenses Advertising Expenses Profit Before Interest and Taxes 0.00% 0.00% 96.81% 3.19% 100.00% 28.61% 0.00% 28.61% 71.39% 100.00% 80.00% 86.04% 0.36% -6.04% Year 2 67.49% 0.00% 99.31% 0.69% 100.00% 11.64% 0.00% 11.64% 88.36% 100.00% 80.00% 65.37% 0.21% 19.51% Year 3 13.08% 0.00% 100.00% 0.00% 100.00% 7.05% 0.00% 7.05% 92.95% 100.00% 80.00% 60.12% 0.19% 26.51% 3.70% 45.30% 64.40% 35.60% 100.00% 31.20% 25.20% 56.40% 43.60% 100.00% 66.70% 46.50% 0.50% 2.90% Industry Profile

Main Ratios Current Quick Total Debt to Total Assets Pre-tax Return on Net Worth Pre-tax Return on Assets Additional Ratios Net Profit Margin Return on Equity Activity Ratios Accounts Payable Turnover Payment Days Total Asset Turnover Debt Ratios Debt to Net Worth Current Liab. to Liab. Liquidity Ratios Net Working Capital Interest Coverage Additional Ratios Assets to Sales Current Debt/Total Assets Acid Test Sales/Net Worth Dividend Payout

3.38 8.53 14.18 1.61 3.38 8.53 14.18 1.17 28.61% 11.64% 7.05% 56.40% -45.79% 86.68% 66.81% 4.60% -32.69% 76.59% 62.10% 10.50% Year 1 Year 2 Year 3 -6.04% 14.63% 19.77% -45.79% 65.01% 49.83% 7.49 27 5.41 0.40 1.00 $21,279 0.00 0.18 29% 3.38 7.58 0.00 12.17 31 3.93 0.13 1.00 $63,158 0.00 0.25 12% 8.53 4.44 0.00 12.17 28 2.34 0.08 1.00 $126,877 0.00 0.43 7% 14.18 2.52 0.00

n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a n.a

Appendix

Sales Forecast Month 1 Sales Individuals/families Business travelers Total Sales Direct Cost of Sales Individuals/families 0% 0% $0 $0 $0 Month 1 $0 $1,578 $1,874 $3,958 $6,645 $7,345 $8,287 $9,258 $9,985 $12,455 $14,822 $17,854 $1,114 $1,358 $3,225 $4,754 $5,514 $6,958 $8,125 $9,125 $10,458 $11,587 $12,545 $2,692 $3,232 $7,183 $11,399 $12,859 $15,245 $17,383 $19,110 $22,913 $26,409 $30,399 Month 2 $316 Month 3 $375 Month 4 $792 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

$1,329 $1,469 $1,657 $1,852 $1,997 $2,491 $2,964 $3,571

Business travelers Subtotal Direct Cost of Sales

$0 $0

$223 $538

$272 $646

$645

$951

$1,103 $1,392 $1,625 $1,825 $2,092 $2,317 $2,509

$1,437 $2,280 $2,572 $3,049 $3,477 $3,822 $4,583 $5,282 $6,080

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

Personnel Plan Month 1 $3,000 $0 $0 $0 $0 $0 1 $3,000 Month 2 $3,000 $1,500 $2,200 $2,200 $0 $0 4 $8,900 Month 3 $3,000 $1,500 $2,200 $2,200 $0 $0 4 $8,900 Month 4 $3,000 $1,500 $1,800 $1,800 $0 $0 4 $8,100 Month 5 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 6 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 7 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 8 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 9 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 10 $3,000 $1,500 $1,800 $1,800 $1,800 $0 5 $9,900 Month 11 $3,000 $1,500 $1,800 $1,800 $1,800 $1,800 6 $11,700 Month 12 $3,000 $1,500 $1,800 $1,800 $1,800 $1,800 6 $11,700

Sam Part-time employee Driver Driver Driver Driver Total People Total Payroll General Assumptions

0% 0% 0% 0% 0% 0%

Plan Month Current Interest Rate Long-term Interest Rate Tax Rate Other

Pro Forma Profit and Loss

Month Month Month Month Month Month Month Month Month Month Month Month 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 30.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 25.00% 0 0 0 0 0 0 0 0 0 0 0 0

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Sales Direct Cost of Sales Other Total Cost of Sales Gross Margin Gross Margin % Expenses Payroll Sales and Marketing and Other Expenses Depreciation $3,000 $150 $42 $8,900 $175 $42 $8,900 $200 $42 $8,100 $225 $42 $9,900 $250 $42 $9,900 $300 $42 $9,900 $300 $42 $9,900 $300 $42 $9,900 $300 $42 $0 $0 $0 $0 $0 0.00% $2,692 $538 $0 $538 $2,154 $3,232 $646 $0 $646 $2,586 $7,183 $1,437 $0 $1,437 $5,746

Month 10

Month Month 11 12

$11,399 $12,859 $15,245 $17,383 $19,110 $22,913 $26,409 $30,399 $2,280 $0 $2,280 $9,119 $2,572 $0 $2,572 $3,049 $0 $3,049 $3,477 $0 $3,477 $3,822 $0 $3,822 $4,583 $0 $4,583 $5,282 $0 $5,282 $6,080 $0 $6,080

$10,287 $12,196 $13,906 $15,288 $18,330 $21,127 $24,319

80.00% 80.00% 80.00% 80.00% 80.00% 80.00% 80.00% 80.00% 80.00% 80.00% 80.00% $9,900 $300 $42 $11,700 $11,700 $300 $42 $300 $42

Web site maintenance Utilities Insurance Rent Payroll Taxes Other Total Operating Expenses Profit Before Interest and Taxes EBITDA Interest Expense Taxes Incurred Net Profit Net Profit/Sales 15%

$50 $100 $450 $500 $450 $0 $4,742

$50 $100 $450 $500 $1,335 $0

$50 $100 $450 $500 $1,335 $0

$50 $100 $450 $500 $1,215 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,485 $0

$50 $100 $450 $500 $1,755 $0

$50 $100 $450 $500 $1,755 $0

$11,552 $11,577 $10,682 $12,777 $12,827 $12,827 $12,827 $12,827 $12,827 $14,897 $14,897 $1,079 $1,121 $0 $0 $1,079 $2,461 $2,503 $0 $0 $2,461 $5,503 $5,545 $0 $0 $5,503 $6,230 $6,272 $0 $0 $6,230 $9,422 $9,464 $0 $0 $9,422

($4,742) ($9,398) ($8,991) ($4,936) ($3,658) ($2,540) ($631) ($4,700) ($9,356) ($8,949) ($4,894) ($3,616) ($2,498) ($589) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

($4,742) ($9,398) ($8,991) ($4,936) ($3,658) ($2,540) ($631) 0.00%

-68.71% -32.09% -19.75% -4.14% 6.21% 349.12% 278.20%

12.88% 24.02% 23.59% 31.00%

Pro Forma Cash Flow Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 Cash Received Cash from Operations Cash Sales Subtotal Cash from Operations Additional Cash Received Sales Tax, VAT, HST/GST Received New Current Borrowing New Other Liabilities (interest-free) New Long-term Liabilities Sales of Other Current Assets Sales of Long-term Assets New Investment Received Subtotal Cash Received Expenditures Expenditures from Operations Cash Spending Bill Payments Subtotal Spent on Operations Additional Cash Spent Sales Tax, VAT, HST/GST Paid Out Principal Repayment of Current Borrowing Other Liabilities Principal Repayment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $3,000 $57 $3,057 $8,900 $1,748 $8,900 $3,153 $8,100 $3,305 $9,900 $4,015 $9,900 $5,126 $9,900 $9,900 $9,900 $9,900 $11,700 $11,700 $5,473 $5,948 $6,373 $6,732 $7,500 $8,463 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2,692 $0 $0 $0 $0 $0 $0 $0 $3,232 $0 $0 $0 $0 $0 $0 $0 $7,183 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2,692 $2,692 $3,232 $3,232 $7,183 $7,183 $11,399 $12,859 $15,245 $17,383 $19,110 $22,913 $26,409 $30,399 $11,399 $12,859 $15,245 $17,383 $19,110 $22,913 $26,409 $30,399 Month Month Month Month Month Month 7 8 9 10 11 12

$11,399 $12,859 $15,245 $17,383 $19,110 $22,913 $26,409 $30,399 Month Month Month Month Month Month 7 8 9 10 11 12

Month 1 Month 2 Month 3 Month 4 Month 5 Month 6

$10,648 $12,053 $11,405 $13,915 $15,026 $15,373 $15,848 $16,273 $16,632 $19,200 $20,163

Long-term Liabilities Principal Repayment Purchase Other Current Assets Purchase Long-term Assets Dividends Subtotal Cash Spent Net Cash Flow Cash Balance

$0 $0 $0 $0 $3,057

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$0 $0 $0 $0

$10,648 $12,053 $11,405 $13,915 $15,026 $15,373 $15,848 $16,273 $16,632 $19,200 $20,163 $4,404 $2,237 $2,109 $3,644 $6,481 $12,761 $19,971 $30,206

($3,057) ($7,956) ($8,821) ($4,222) ($2,516) ($2,167) ($128) $1,535 $2,837 $6,281 $7,209 $10,236 $27,918 $19,962 $11,141 $6,920

Need real financials? We recommend using LivePlan as the easiest way to create automatic financials for your own business plan. Create your own business plan

Pro Forma Balance Sheet Month 1 Assets Current Assets Cash Other Current Assets Total Current Assets Long-term Assets Long-term Assets Total Long-term Assets Total Assets Liabilities and Capital Current Liabilities Accounts Payable Current Borrowing Other Current Liabilities Long-term Liabilities Total Liabilities Paid-in Capital Retained Earnings Earnings Total Capital Total Liabilities and Capital Net Worth $0 $0 $0 $0 $0 $35,000 ($2,525) $0 $32,475 $32,475 $32,475 $1,643 $0 $0 $1,643 $0 $1,643 $35,000 ($2,525) ($4,742) $27,733 $29,376 $27,733 $3,043 $0 $0 $3,043 $0 $3,043 $35,000 ($2,525) $18,335 $21,378 $18,335 $3,172 $0 $0 $3,172 $0 $3,172 $35,000 ($2,525) $9,343 $12,515 $9,343 $3,844 $0 $0 $3,844 $0 $3,844 $35,000 ($2,525) $4,408 $8,252 $4,408 $4,944 $0 $0 $4,944 $0 $4,944 $35,000 ($2,525) $750 $5,694 $750 $5,275 $0 $0 $5,275 $0 $5,275 $35,000 ($2,525) ($1,790) $3,485 ($1,790) $5,736 $0 $0 $5,736 $0 $5,736 $35,000 ($2,525) ($2,421) $3,315 ($2,421) $6,150 $0 $0 $6,150 $0 $6,150 $35,000 ($2,525) ($1,342) $4,808 ($1,342) $6,483 $0 $0 $6,483 $0 $6,483 $35,000 ($2,525) $1,119 $7,603 $1,119 $7,219 $0 $0 $7,219 $0 $7,219 $35,000 ($2,525) $6,623 $13,841 $6,623 $8,156 $0 $0 $8,156 $0 $8,156 $35,000 ($2,525) $12,853 $21,009 $12,853 $8,927 $0 $0 $8,927 $0 $8,927 $35,000 ($2,525) $22,275 $31,202 $22,275 $1,500 $1,500 $32,475 $1,500 $42 $1,458 $29,376 Month 1 $1,500 $84 $1,416 $21,378 Month 2 $1,500 $126 $1,374 $12,515 Month 3 $1,500 $168 $1,332 $8,252 Month 4 $1,500 $210 $1,290 $5,694 Month 5 $1,500 $252 $1,248 $3,485 Month 6 $1,500 $294 $1,206 $3,315 Month 7 $1,500 $336 $1,164 $4,808 Month 8 $1,500 $378 $1,122 $7,603 $1,500 $420 $1,080 $13,841 $1,500 $462 $1,038 $21,009 $1,500 $504 $996 $31,202 Accumulated Depreciation $0 $30,975 $0 $30,975 $27,918 $0 $27,918 $19,962 $0 $19,962 $11,141 $0 $11,141 $6,920 $0 $6,920 $4,404 $0 $4,404 $2,237 $0 $2,237 $2,109 $0 $2,109 $3,644 $0 $3,644 $6,481 $0 $6,481 $12,761 $0 $12,761 $19,971 $0 $19,971 $30,206 $0 $30,206 Starting Balances Month 2 Month 3 Month 4 Month 5 Month 6 Month 7 Month 8 Month 9 Month 10 Month 11 Month 12

Month 9 Month 10 Month 11 Month 12

Subtotal Current Liabilities $0

($14,140) ($23,132) ($28,067) ($31,725) ($34,265) ($34,896) ($33,817) ($31,356) ($25,852) ($19,622) ($10,200)

Vous aimerez peut-être aussi

- CASO Pantry ShopperDocument2 pagesCASO Pantry ShopperDiana0% (1)

- Bird X Oklahoma State University RFPDocument75 pagesBird X Oklahoma State University RFPasherdemontrealPas encore d'évaluation

- A Complete Tire Shop Business Plan: A Key Part Of How To Start A Tire Shop BusinessD'EverandA Complete Tire Shop Business Plan: A Key Part Of How To Start A Tire Shop BusinessPas encore d'évaluation

- Santa Monica Bike Share RFP Response From CycleHop RedactedDocument232 pagesSanta Monica Bike Share RFP Response From CycleHop RedactedSocial BicyclesPas encore d'évaluation

- Sample IB Economics Internal Assessment Commentary - MacroDocument3 pagesSample IB Economics Internal Assessment Commentary - MacroUday SethiPas encore d'évaluation

- Online Car Renting System (SPM - Project) Bussiness CaseDocument14 pagesOnline Car Renting System (SPM - Project) Bussiness CaseJameel MemonPas encore d'évaluation

- Taxi Business PlanDocument25 pagesTaxi Business PlanGhenadie Martinov100% (1)

- Competitor AnalysisDocument6 pagesCompetitor AnalysisOh ChungPas encore d'évaluation

- Business Plan SampleDocument7 pagesBusiness Plan SampleAimee DenostaPas encore d'évaluation

- MSVI - InDrive - Final Report1Document17 pagesMSVI - InDrive - Final Report1Hassan MahmoodPas encore d'évaluation

- Scope Statement - Tutorial 2 (Activity 4) : Project Title: Date: Prepared By: Project JustificationDocument8 pagesScope Statement - Tutorial 2 (Activity 4) : Project Title: Date: Prepared By: Project JustificationSanhita KotipalliPas encore d'évaluation

- Investor Presentation 20th Oct 2021Document61 pagesInvestor Presentation 20th Oct 2021Juma HassanPas encore d'évaluation

- 2016-Uber Case StudyDocument2 pages2016-Uber Case Studyqa diiPas encore d'évaluation

- Coworking Space: Shared Workspaces in Metro ManilaDocument23 pagesCoworking Space: Shared Workspaces in Metro ManilaKenneth VirtudesPas encore d'évaluation

- How to Start a Valet Service Business: Step by Step Business PlanD'EverandHow to Start a Valet Service Business: Step by Step Business PlanPas encore d'évaluation

- City Bus Service KGFDocument20 pagesCity Bus Service KGFsaileshPas encore d'évaluation

- How To Improve Car Rental Business: To Improve Top-Line To Improve Bottom-Line Enhance Customer Service Better WebsiteDocument5 pagesHow To Improve Car Rental Business: To Improve Top-Line To Improve Bottom-Line Enhance Customer Service Better WebsitenytynshettyPas encore d'évaluation

- An Indian Startup Acquiring The WorldDocument13 pagesAn Indian Startup Acquiring The WorldashuPas encore d'évaluation

- CHAPTER 1 Bike Rental Business PlanDocument3 pagesCHAPTER 1 Bike Rental Business PlanLishaEli100% (1)

- Bike Share CompleteDocument142 pagesBike Share CompleteOsman ErcinPas encore d'évaluation

- Automart Com Profile-Eng 2018Document4 pagesAutomart Com Profile-Eng 2018ZabidiPas encore d'évaluation

- Diezel® Taxi Services: Business PlanDocument30 pagesDiezel® Taxi Services: Business PlanBabila JosephPas encore d'évaluation

- Marketing StrategyDocument14 pagesMarketing StrategyMamunurRashidTuragPas encore d'évaluation

- Numericals On - Demand Analysis PDFDocument7 pagesNumericals On - Demand Analysis PDFKiran maruPas encore d'évaluation

- Business Plan For CompanyDocument14 pagesBusiness Plan For Companyanon_874869443Pas encore d'évaluation

- Sample Marketing Plan (For 508 Remediation) PDFDocument3 pagesSample Marketing Plan (For 508 Remediation) PDFKaren R. RoyoPas encore d'évaluation

- Liquid CultureDocument16 pagesLiquid CultureDolly BadlaniPas encore d'évaluation

- Basic Consulting Company Profile in PDFDocument5 pagesBasic Consulting Company Profile in PDFAmir RamadanPas encore d'évaluation

- M/S Salasar Carz Spa Services: Project ReportDocument10 pagesM/S Salasar Carz Spa Services: Project ReportLegal ExpertPas encore d'évaluation

- Market AnalaysiDocument14 pagesMarket AnalaysiHizkiel mulatu Aselet100% (1)

- Camping Facility: Profile No.: 09 NIC Code: 55200Document9 pagesCamping Facility: Profile No.: 09 NIC Code: 55200AmitPas encore d'évaluation

- On The Spot Courier Services Business ReportDocument7 pagesOn The Spot Courier Services Business Reportapi-253540656Pas encore d'évaluation

- Business PlanDocument8 pagesBusiness PlanRahul SavaliaPas encore d'évaluation

- Pankhuri - Competitor Analysis PDFDocument29 pagesPankhuri - Competitor Analysis PDFpankhuri89Pas encore d'évaluation

- The Car Rental SystemDocument4 pagesThe Car Rental SystemVipul Singh40% (5)

- Soapy Rides Is A Prominent Hand Car Wash Serving The East MeadowDocument36 pagesSoapy Rides Is A Prominent Hand Car Wash Serving The East MeadowCharles MarongaPas encore d'évaluation

- LinkedIn Pitch DeckDocument11 pagesLinkedIn Pitch DeckAMBER RAJESH BORSE IMS21019Pas encore d'évaluation

- Business ProposalDocument16 pagesBusiness ProposalCaila Dominique AlmeidaPas encore d'évaluation

- Opportunity Evaluation - DoormintDocument7 pagesOpportunity Evaluation - DoormintamitcmsPas encore d'évaluation

- Business PlanDocument10 pagesBusiness PlanBhea Antonette Alcones BarberoPas encore d'évaluation

- Business Plan Car SprayDocument3 pagesBusiness Plan Car SpraySamatechPas encore d'évaluation

- Toyota D 4d Suction Control Valve ReplacementDocument2 pagesToyota D 4d Suction Control Valve ReplacementJosePas encore d'évaluation

- Uber Vs GrabDocument10 pagesUber Vs GrabZijian ZhuangPas encore d'évaluation

- Marketing Plan - Beva AutoDocument10 pagesMarketing Plan - Beva AutonoeryatiPas encore d'évaluation

- The CleanDocument41 pagesThe CleanPoonam KatariaPas encore d'évaluation

- Courier Network DesignDocument5 pagesCourier Network DesignPraveen BandiPas encore d'évaluation

- Digital Marketing Boon or Bane For Indian BusinessesDocument16 pagesDigital Marketing Boon or Bane For Indian BusinessesDhirajShirodePas encore d'évaluation

- 6th InternshipDocument28 pages6th InternshipSmarts SPas encore d'évaluation

- Proposal Paul Okello Rev 2Document40 pagesProposal Paul Okello Rev 2Okello PaulPas encore d'évaluation

- Uber Leading The Sharing Economy: Syndicate 3Document6 pagesUber Leading The Sharing Economy: Syndicate 3meidianizaPas encore d'évaluation

- The E-Marketing Plan: Erina Widianti Florine Berlian Hasriani Puspitasari Maurent Chandra Yola ArtameviaDocument15 pagesThe E-Marketing Plan: Erina Widianti Florine Berlian Hasriani Puspitasari Maurent Chandra Yola ArtameviaVallen Chandra100% (1)

- Acknowledgment: Altaf Who Worked Day and Night With Us For This Project. HeDocument60 pagesAcknowledgment: Altaf Who Worked Day and Night With Us For This Project. HeZainKazmiPas encore d'évaluation

- E-Commerce Business ModelsDocument3 pagesE-Commerce Business Modelsrocker_9xPas encore d'évaluation

- MarketingDocument57 pagesMarketingvivekroyfpmPas encore d'évaluation

- Careem Uber Research PDFDocument45 pagesCareem Uber Research PDFkandy khan khanPas encore d'évaluation

- Transporation RFP FinalDocument121 pagesTransporation RFP FinalEmily100% (1)

- TSF GRIP Tasks Jan'2021 OnwardsDocument42 pagesTSF GRIP Tasks Jan'2021 OnwardsSalim AssalamPas encore d'évaluation

- Pitchdeck 2022Document38 pagesPitchdeck 2022Andrei DizonPas encore d'évaluation

- Car Wash Business Plan 2Document17 pagesCar Wash Business Plan 2Yhennie ICee Cristobal50% (2)

- Shoe and Bag Business PlanDocument5 pagesShoe and Bag Business PlanMAVERICK MONROEPas encore d'évaluation

- Build your empire: learning to lead the life of a leaderD'EverandBuild your empire: learning to lead the life of a leaderPas encore d'évaluation

- ESPSDocument2 pagesESPSNitin DevPas encore d'évaluation

- Ci17 5Document11 pagesCi17 5robmeijerPas encore d'évaluation

- Teens and Credit Card Debt Passage and WKSHTDocument2 pagesTeens and Credit Card Debt Passage and WKSHTmillboarPas encore d'évaluation

- Chaprer III PFS PreparationDocument63 pagesChaprer III PFS PreparationFrancis Dave Peralta BitongPas encore d'évaluation

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013Pas encore d'évaluation

- Quiz 9Document3 pagesQuiz 9朱潇妤100% (1)

- APC 2017 English Information On The DayDocument17 pagesAPC 2017 English Information On The DaySafwaan DanielsPas encore d'évaluation

- 2023-04 Valuation Report - PRL Destillates & FuelDocument6 pages2023-04 Valuation Report - PRL Destillates & FuelJianyun ZhouPas encore d'évaluation

- Exchange RateDocument5 pagesExchange Ratekim juhwiPas encore d'évaluation

- High Conviction BreakoutsDocument4 pagesHigh Conviction BreakoutsRajeshPas encore d'évaluation

- Runaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinDocument2 pagesRunaway Corporations: Political Band-Aids vs. Long-Term Solutions, Cato Tax & Budget BulletinCato InstitutePas encore d'évaluation

- Response Letter - LOA - VAT 2021 - RAWDocument2 pagesResponse Letter - LOA - VAT 2021 - RAWGeralyn BulanPas encore d'évaluation

- Investment Project (Mock Trading)Document9 pagesInvestment Project (Mock Trading)sanaPas encore d'évaluation

- NCDDP AF Sub-Manual - Program Finance, Aug2021Document73 pagesNCDDP AF Sub-Manual - Program Finance, Aug2021Michelle ValledorPas encore d'évaluation

- DO - 163 - S2015 - DupaDocument12 pagesDO - 163 - S2015 - DupaRay Ramilo100% (1)

- Vat Ec Fr-EnDocument27 pagesVat Ec Fr-EnDjema AntohiPas encore d'évaluation

- Project Finance EMBA - NandakumarDocument63 pagesProject Finance EMBA - NandakumarKrishna SinghPas encore d'évaluation

- Financial DistressDocument5 pagesFinancial DistresspalkeePas encore d'évaluation

- PDFDocument5 pagesPDFranvir ranaPas encore d'évaluation

- Investment and VC Funds Acting in SEE RegionDocument72 pagesInvestment and VC Funds Acting in SEE Regionpaul_costasPas encore d'évaluation

- Ronda 2 ResultadosDocument3 pagesRonda 2 ResultadosCristian MiunsipPas encore d'évaluation

- Garuda Indonesia Case AnalysisDocument8 pagesGaruda Indonesia Case AnalysisPatDabz67% (3)

- Peabody BankruptcyDocument30 pagesPeabody BankruptcyZerohedgePas encore d'évaluation

- #5 PFRS 5Document3 pages#5 PFRS 5jaysonPas encore d'évaluation

- Architect Colleges ComparisonDocument4 pagesArchitect Colleges ComparisonMathew YoyakkyPas encore d'évaluation

- Services, Training, Delivery Equipment Right To Trade NameDocument6 pagesServices, Training, Delivery Equipment Right To Trade Namecram colasitoPas encore d'évaluation

- DRM-CLASSWORK - 16th JuneDocument3 pagesDRM-CLASSWORK - 16th JuneSaransh MishraPas encore d'évaluation