Académique Documents

Professionnel Documents

Culture Documents

Risk Assessment For Inspections

Transféré par

migraneTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Risk Assessment For Inspections

Transféré par

migraneDroits d'auteur :

Formats disponibles

GRENADA AUTHORITY FOR THE REGULATION OF FINANCIAL INSTITUTIONS RISK ASSESSMENTS FOR CREDIT UNIONS .

CO-OPERATIVE CREDIT UNION LIMITED. Risks Financial Risk Assessments

[ ] Does credit union have negative capital? [ ] Can the credit union meet its financial obligations? [ ] Credit union has liquidity problems? [ ] Credit union has a sound capital base? [ ] Credit union operates in lots of foreign currencies? [ ] Rate of the currencies change on a regular basis? [ ] Credit union has investments that are held in foreign currencies. [ ] Credit union has liabilities to collect that are in foreign currencies. [ ] Directors take decisions that can be bad for the future of the organization. [ ] The credit union does not have a Strategic Plan [ ] The credit union does not have an Action Plan [ ] The credit union does not have a Budget [ ] The credit union does not have a Marketing Plan. [ ] Directors are not aware of the risks faced by the institution [ ] Credit union does not have a Risk Policy [ ] Credit union does not have a Disaster Recovery Policy [ ] Staff members do not have job descriptions [ ] The credit union has poor lines of reporting [ ] Trial Balances are not done [ ] Variances of the budget are not monitored and investigated [ ] Delinquency is not follow up and monitored properly [ ] Staff members are not properly trained [ ] Most of the work are done manually [ ] Work done by one staff member is not checked for accuracy by another [ ] The credit union des not have an Internal Control Policy [ ] The credit union does not have a Procedures Manual [ ] Many persons have keys to the office and vaults without control mechanisms [ ] Credit union has litigations to be settled in the court [ ] The Regulator has taken legal action against the credit union [ ] The credit union is in violation of the Co-operative Societies Act [ ] The credit union is in violation of Regulation and its own by-laws [ ] The economy of the country posses a risk to the credit union [ ] The financial services sector is unstable [ ] The credit union has investments that are impaired and are unlikely to be received [ ] The economy of the country has an effect on the delinquency of the credit union [ ] The credit union has a high rate of delinquency [ ] The economic situation is causing members not to pay their loans [ ] The credit analysis of the credit union is poor and could result in high delinquency [ ] The credit committee and Loans Officers are not properly trained in credit analysis [ ] The credit union does not meet the liquidity ratio as required by PEARLS. [ ] The credit union has difficulties meeting its financial obligations [ ] The non-earnings assets ratio of the credit union is high. [ ] There is a long period before disbursements after loans are approved

Ratings [ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4) [ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4)

Currency Risk

Strategic Risk

[ ] High (6-8/8) [ ] Medium (4-5/8) [ ] Low (0-3/8)

Operational Risk

[ ] High (8-11/11) [ ] Medium (5-7/11) [ ] Low (0-4/11)

Legal Risk

[ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4) [ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4)

Economic Risk

Credit Risk

[ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4) [ ] High (3-4/4) [ ] Medium (2/4) [ ] Low (0-1/4)

Liquidity Risk

Technological Risk Investment Risk

[ ] The computers are in areas where they can be affected by floods [ ] The computer information are not backed up on a daily basis [ ] The backed up information are stored at the credit unions office [ ] Computers do not have passwords for each user to log into [ ] All computers do not have anti-virus software installed on them [ ] The credit union does not have an Investment Policy []

[ ] High (4-5/5) [ ] Medium (2-3/5) [ ] Low (0-1/5)

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Knee JointDocument28 pagesKnee JointRaj Shekhar Singh100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- P5 Advanced Performance ManagementDocument12 pagesP5 Advanced Performance ManagementmigranePas encore d'évaluation

- P5 Advanced Performance ManagementDocument12 pagesP5 Advanced Performance ManagementmigranePas encore d'évaluation

- Biblical DispensationsDocument28 pagesBiblical DispensationsmigranePas encore d'évaluation

- SyncopeDocument105 pagesSyncopeJohn DasPas encore d'évaluation

- Financial ManagementDocument265 pagesFinancial ManagementPaul Mwangi Makau100% (5)

- African Gospel SongsDocument2 pagesAfrican Gospel Songsmigrane50% (2)

- A Hybrid Genetic-Neural Architecture For Stock Indexes ForecastingDocument31 pagesA Hybrid Genetic-Neural Architecture For Stock Indexes ForecastingMaurizio IdiniPas encore d'évaluation

- Account Statement 250820 240920 PDFDocument2 pagesAccount Statement 250820 240920 PDFUnknown100% (1)

- EdisDocument227 pagesEdisThong Chan100% (1)

- Final N & S Business PlanDocument20 pagesFinal N & S Business PlanmigranePas encore d'évaluation

- T5 B11 Victor Manuel Lopez-Flores FDR - FBI 302s Re VA ID Cards For Hanjour and Almihdhar 195Document11 pagesT5 B11 Victor Manuel Lopez-Flores FDR - FBI 302s Re VA ID Cards For Hanjour and Almihdhar 1959/11 Document Archive100% (2)

- Assemblies of The Glorious Church Adult Sunday School ClassDocument2 pagesAssemblies of The Glorious Church Adult Sunday School Classmigrane100% (1)

- Evangelism 2012Document28 pagesEvangelism 2012migranePas encore d'évaluation

- Christian Budgeting & FinanceDocument20 pagesChristian Budgeting & FinancemigranePas encore d'évaluation

- Process Servicing RulesDocument32 pagesProcess Servicing RulesmigranePas encore d'évaluation

- 5th Annual AML CFT Conference Brochure 2013 AntiguaDocument1 page5th Annual AML CFT Conference Brochure 2013 AntiguamigranePas encore d'évaluation

- Budgeting & FinanceDocument16 pagesBudgeting & FinancemigranePas encore d'évaluation

- SongsDocument1 pageSongsmigranePas encore d'évaluation

- What Is A Risk-Based Audit Approach?Document4 pagesWhat Is A Risk-Based Audit Approach?migranePas encore d'évaluation

- The Power of Worship #2Document3 pagesThe Power of Worship #2migranePas encore d'évaluation

- Auditing TechniquesDocument31 pagesAuditing TechniquesmigranePas encore d'évaluation

- The Qualities of A Godly MotherDocument5 pagesThe Qualities of A Godly MothermigranePas encore d'évaluation

- Assemblies of The Glorious Church Christian Education Department Adult ClassDocument2 pagesAssemblies of The Glorious Church Christian Education Department Adult ClassmigranePas encore d'évaluation

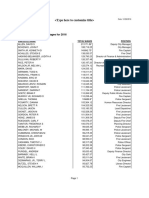

- 2016 W-2 Gross Wages CityDocument16 pages2016 W-2 Gross Wages CityportsmouthheraldPas encore d'évaluation

- Instructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Document4 pagesInstructions For Preparing Manuscript For Ulunnuha (2019 Template Version) Title (English and Arabic Version)Lailatur RahmiPas encore d'évaluation

- All Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaDocument7 pagesAll Day Breakfast: .Served With Cappuccino or Espresso or Lime Juice or TeaBryan KuoKyPas encore d'évaluation

- Production of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmDocument26 pagesProduction of Bioethanol From Empty Fruit Bunch (Efb) of Oil PalmcelestavionaPas encore d'évaluation

- Feed-Pump Hydraulic Performance and Design Improvement, Phase I: J2esearch Program DesignDocument201 pagesFeed-Pump Hydraulic Performance and Design Improvement, Phase I: J2esearch Program DesignJonasPas encore d'évaluation

- MSC-MEPC.2-Circ.17 - 2019 Guidelines For The Carriage of Blends OfBiofuels and Marpol Annex I Cargoes (Secretariat)Document4 pagesMSC-MEPC.2-Circ.17 - 2019 Guidelines For The Carriage of Blends OfBiofuels and Marpol Annex I Cargoes (Secretariat)DeepakPas encore d'évaluation

- TESTDocument27 pagesTESTLegal CheekPas encore d'évaluation

- CORP2165D Lecture 04Document26 pagesCORP2165D Lecture 04kinzi chesterPas encore d'évaluation

- Guardcam InstructionsDocument12 pagesGuardcam InstructionsCompuFix RepairsPas encore d'évaluation

- Types of Water Pump and Applications in Power Plant.Document6 pagesTypes of Water Pump and Applications in Power Plant.abbas bilalPas encore d'évaluation

- Gaming Ports MikrotikDocument6 pagesGaming Ports MikrotikRay OhmsPas encore d'évaluation

- Ecs h61h2-m12 Motherboard ManualDocument70 pagesEcs h61h2-m12 Motherboard ManualsarokihPas encore d'évaluation

- CS8CHP EletricalDocument52 pagesCS8CHP EletricalCristian ricardo russoPas encore d'évaluation

- Iphone and Ipad Development TU GrazDocument2 pagesIphone and Ipad Development TU GrazMartinPas encore d'évaluation

- Decision Trees For Management of An Avulsed Permanent ToothDocument2 pagesDecision Trees For Management of An Avulsed Permanent ToothAbhi ThakkarPas encore d'évaluation

- List of Some Common Surgical TermsDocument5 pagesList of Some Common Surgical TermsShakil MahmodPas encore d'évaluation

- Question Answers of Chapter 13 Class 5Document6 pagesQuestion Answers of Chapter 13 Class 5SuvashreePradhanPas encore d'évaluation

- BARUDocument53 pagesBARUhueuaPas encore d'évaluation

- UM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Document154 pagesUM-140-D00221-07 SeaTrac Developer Guide (Firmware v2.4)Antony Jacob AshishPas encore d'évaluation

- Ajmera - Treon - FF - R4 - 13-11-17 FinalDocument45 pagesAjmera - Treon - FF - R4 - 13-11-17 FinalNikita KadamPas encore d'évaluation

- Manual For Tacho Universal Edition 2006: Legal DisclaimerDocument9 pagesManual For Tacho Universal Edition 2006: Legal DisclaimerboirxPas encore d'évaluation

- Cam 18 Test 3 ListeningDocument6 pagesCam 18 Test 3 ListeningKhắc Trung NguyễnPas encore d'évaluation

- GE 7 ReportDocument31 pagesGE 7 ReportMark Anthony FergusonPas encore d'évaluation

- Water Pump 250 Hrs Service No Unit: Date: HM: ShiftDocument8 pagesWater Pump 250 Hrs Service No Unit: Date: HM: ShiftTLK ChannelPas encore d'évaluation