Académique Documents

Professionnel Documents

Culture Documents

Nalco, 1st February 2013

Transféré par

Angel BrokingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nalco, 1st February 2013

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

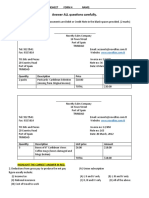

3QFY2013 Result Update | Base Metals

January 31, 2013

National Aluminium

Performance Highlights

Quarterly highlights (Standalone) Particulars (` cr) Net sales EBITDA EBITDA margin (%) Net profit

Source: Company, Angel Research

REDUCE

CMP Target Price

Investment Period

`49 `46

12 months

2QFY13 1,670 182 10.9 119

2QFY12 1,430 68 4.8 51

yoy % 16.8 166.6 614bp 132.0

1QFY13 1,586 (2) (0.1) 5

qoq % 5.3 1,104bp 2,384.1

Stock Info Sector Market Cap (` cr) Net debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Base Metals 12,732 (4,600) 0.9 68/44 71,102 5 19,895 6,035 NALU.BO NACL@IN

For 3QFY2013, Nalco reported a better-than-expected PAT performance, although the top-line was in line with our estimates. We recommend Reduce rating on the stock due to its expensive valuation. Muted top-line performance: Nalcos net sales grew by 16.8% yoy to `1,670cr (in line our estimate of `1,657cr). Its aluminium sales volumes grew 4.1% yoy to 102,000 tonne while alumina production increased by 35.0% yoy to 220,000 tonne. Higher input and energy costs hit margins: Nalcos power costs as a percentage of net sales stood at 35.0%, ie above our estimate, due to higher-than-expected proportion of linkage coal from Mahanadi Coalfields (80%). Hence, Nalcos profitability was above our estimates. Nalco reported an EBITDA and PAT growth of 166.6% and 132.0% yoy, respectively. Update on Utkal coal block: Currently, there is no clarity on land acquisition for the coal block. While Nalco expects to commence production from this mine by the end of CY2013, our recent experience suggests that it could take a much longer time to acquire land and sign the mining lease with the state government. Outlook and valuation: Although Nalco has captive bauxite mines, the cost of aluminium production remains very high on account of high power costs. Further, there is lack of clarity over the companys future expansion plans. At the CMP, Nalco is trading at valuations of 10.7x FY2013E and 7.3x FY2014E EV/EBITDA, ie at a significant premium to its peers. Hence, valuing the stock at 6.5x FY2014E EV/EBITDA, we derive a target price of `46 and recommend Reduce on the stock. Key financials (Standalone)

(` cr) Net sales % change Adj. PAT % change EPS (`) OPM (%) PE (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 87.2 5.2 3.9 3.7

Abs. (%) Sensex Nalco

3m 7.5 5.6

1yr 15.7 (13.6)

3yr 21.6 (48.2)

FY11 5,959 17.9 1,069 31.3 4.1 26.7 11.9 1.1 9.9 10.2 1.3 4.8

FY12 6,500 9.1 871 (18.5) 3.4 17.5 14.6 1.1 7.4 5.5 1.2 6.9

FY13E 6,630 2.0 548 (37.1) 2.1 11.4 23.2 1.1 4.6 2.0 1.2 10.7

FY14E 8,357 26.0 840 53.3 3.3 14.5 15.2 1.0 6.9 5.0 1.0 7.3

Bhavesh Chauhan

Tel: 022- 39357600 Ext: 6821 bhaveshu.chauhan@angelbroking.com

Vinay Rachh

Tel: 022- 39357600 Ext: 6841 vinay.rachh@angelbroking.com

Please refer to important disclosures at the end of this report

National Aluminium | 3QFY2013 Result Update

Exhibit 1: 3QFY2013 performance (Standalone)

(` cr.) 3QFY13 1,670 299 17.9 585 35.0 289 17.3 336 20.1 1,510 90.4 23 182 10.9 0 123 113 0 172 10.3 53 30.9 119 3QFY12 1,430 240 16.7 568 39.7 296 20.7 278 19.4 1,382 96.7 21 68 4.8 (0) 123 126 0 71 5.0 20 27.9 51 132.0 168.4 142.1 (0.3) (10.5) 9.3 166.6 9.3 20.9 (2.4) 3.0 yoy % 16.8 25.0 2QFY13 1,586 253 16.0 753 47.5 296 18.6 308 19.4 1,610 101.5 22 (2) (0.1) 4 124 139 0 9 0.6 5 49.5 5 2,384.1 1,032.0 1,714.5 (0.6) (19.0) 1.6 (6.2) 9.2 (2.0) (22.3) qoq % 5.3 18.3 9MFY13 4,974 798 16.1 1,943 39.1 869 17.5 954 19.2 4,564 91.8 75 485 9.7 7 369 392 0 500 10.1 154 30.7 347 9MFY12 4,747 713 15.0 1,688 35.6 874 18.4 802 16.9 4,076 85.9 80 751 15.8 (0) 343 385 0 792 16.7 225 28.4 567 (38.9) (31.6) (36.8) 7.5 2.0 (6.9) (35.4) 12.0 18.9 (0.6) 15.1 yoy % 4.8 12.0

Net Sales Raw Material % of Net sales Power and Fuel % of Net sales Staff Cost % of Net sales Other Expenses % of Net sales Total Expenditure % of Net sales Operating Income EBIDTA % of Net sales Interest Depreciation Other Income Exceptional Items Profit before Tax % of Net sales Provision for tax % of PBT Profit after tax

Source: Company, Angel Research

Exhibit 2: 3QFY2013 Actual vs. Angel estimates

(` cr) Net sales EBITDA EBITDA margin (%) PAT

Source: Company, Angel Research

Actual 1,670 182 10.9 119

Estimates 1,657 46 2.8 63

Variation (%) 0.8 293.3 813bp 88.5

Result highlights

Net sales up 16.8% yoy

Nalcos net sales grew by 16.8% yoy to `1,670cr (in line our estimate of `1,657cr). Its aluminium sales volumes grew 4.1% yoy to 102,000 tonne while alumina production increased by 35.0% yoy to 220,000 tonne.

January 31, 2013

National Aluminium | 3QFY2013 Result Update

Exhibit 3: Quarterly revenue trend

2,000 1,800 1,600 1,400 1,200 1,733 1,584 1,430 1,753 40 1,718 1,586 1,670 35 30 25 15 10 5 0 (5) 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 Net revenue (LHS)

Source: Company, Angel Research

(`cr)

800 600 400 200 0 yoy chg (RHS)

Higher mix of linkage coal results in EBITDA improvement

The companys aluminium segment reported a lower EBIT loss of `22cr for the quarter compared to a loss of ~`150cr in 3QFY2012, which helped in improvement in the performance. Power costs as a percentage of net sales stood at 35.0%, compared to 39.7% in 3QFY2012 as there was significant improvement in supply of linkage coal from Mahanadi Coalfields (80% of the coal mix). Further, staff costs (surprisingly) decreased 2.4% yoy to `289cr. Hence, Nalco reported an EBITDA growth of 166.6% yoy to `182cr. Nalcos aluminium EBIT continues to make losses on account of lower realizations coupled with higher costs.

Exhibit 4: Quarterly EBITDA trend

600 500 400 307 304 530 35 30 25

Exhibit 5: Aluminium EBIT continues to make losses

300 250 200 150 100 50 0 (50) (100) (150) (200) (89) (153) 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 Aluminium EBIT (16) (19) (53) (22) 193 242

(` cr)

200 100 0 (100)

153 68 (2)

182

15 10 5 0 (5)

1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 EBITDA (LHS) EBITDA margin (RHS)

Source: Company, Angel Research

(%)

300

Source: Company, Angel Research

January 31, 2013

(` cr)

20

(%)

1,000

20

National Aluminium | 3QFY2013 Result Update

Exhibit 6: 3QFY2013 segmental performance

(` cr.) Revenue Chemicals Aluminium Electricity Total Revenue Less intersegment Net Revenue EBIT Chemicals Aluminium Electricity Total Unallocated income PBT EBIT margin (%) Chemicals Aluminium Electricity

Source: Company, Angel Research

3QFY13 648 1,247 464 2,359 (773) 1,586 40 (53) (57) (70) 84 9 0.6 6.2 (4.3) (12.3)

3QFY12 621 1,218 523 2,362 (778) 1,584 121 (89) 50 82 84 167 10.5 19.5 (7.3) 9.5

% yoy 4.4 2.4 (11.3) (0.1) (0.7) 0.1 (67.2) (40.1) (214.0) (185.1) (0.8) -

2QFY13 760 1,248 515 2,523 (804) 1,718 191 (19) 73 244 78 319 18.6 25.1 (1.5) 14.1

% qoq (14.7) (0.1) (9.9) (6.5) (3.9) (7.7) (79.1) 178.0 (178.3) 7.0 -

9MFY13 2,656 4,968 1,977 9,600 3,101 12,701 590 (16) 287 861 338 523 4.1 22.2 (0.3) 14.5

9MFY12 2,069 2,828 1,766 6,662 2,703 9,366 450 593 322 1,365 159 1,206 12.9 21.7 21.0 18.3

yoy % 28.4 75.7 11.9 44.1 14.7 35.6 31.2 (102.7) (11.0) (36.9) 112.4 (56.6) -

Higher EBITDA lifts PAT

Other income declined by 10.5% yoy to `113cr and tax rate also increased to 30.9% compared to 27.9% in 3QFY2012. The company reported a net profit growth of 132.0% yoy to `119cr (significantly above our estimate of `63cr).

Exhibit 7: Quarterly net profit trend

400 350 300 250 282 223 139 51 5 0 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 3QFY13 Net profit (LHS)

Source: Company, Angel Research

377

25 20 15 10 5

(` cr)

200 150 100 50 0 Net profit margin (RHS) 119

January 31, 2013

(%)

National Aluminium | 3QFY2013 Result Update

Investment rationale

Coal supply issues to continue

Nalco has been facing coal supply issues, which has disrupted operations in the past few quarters. The company sources its annual coal requirement from Mahanadi Coalfields Ltd, but the supply is not evenly distributed. In our view, any disturbance in coal supply would increase the companys dependence on imported or external coal (which is very expensive compared to linkage coal), thereby negatively affecting its margins.

Limited growth visibility

There is little clarity on Nalcos proposed expansion plans, as they are in various stages of financial closure and significant progress is yet to be made.

Outlook and valuation

At the current price of aluminium of US$2,000-2,100, we expect Nalco to make losses on its Aluminium business. Moreover, prices of key inputs such as coal, caustic soda, CP coke, aluminium fluoride etc continue to remain high. Hence, we expect Nalco to operate its aluminium smelters at lower utilization levels during FY2013-14. Although Nalco has captive bauxite mines, the cost of aluminium production remains very high on account of high power costs. Further, there is lack of clarity over the companys future expansion plans. At the CMP, Nalco is trading at valuations of 10.7x FY2013E and 7.3x FY2014E EV/EBITDA, ie at a significant premium to its peers. Hence, valuing the stock at 6.5x FY2014E EV/EBITDA, we derive a target price of `46 and recommend Reduce on the stock.

Exhibit 8: Angel EPS forecast vs. consensus

Angel forecast FY2013E FY2014E

Source: Company, Angel Research

Bloomberg consensus 2.4 3.4

Variation (%) (12.9) (5.3)

2.1 3.3

January 31, 2013

National Aluminium | 3QFY2013 Result Update

Exhibit 9: EV/EBITDA band

60,000 50,000 40,000

(` cr)

30,000 20,000 10,000 0

Nov-07

Sep-08

Feb-09

Oct-10

May-10

2x

5x

8x

11x

14x

Source: Bloomberg, Angel Research

Exhibit 10: P/E band

200 180 160 140 120 100 80 60 40 20 0

Oct-07 Oct-08 Oct-09 Oct-10 Oct-11 Oct-12 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11 Apr-12 Jan-13 Jul-07 Jul-08 Jul-09 Jul-10 Jul-11 Jul-12

(`)

5x

10x

15x

20x

Source: Bloomberg, Angel Research

Exhibit 11: P/BV band

250 200 150

(`)

100 50 0

Dec-06

Dec-07

Dec-08

Dec-09

Dec-10

Dec-11

1x

2x

3x

4x

Source: Bloomberg, Angel Research

January 31, 2013

Dec-12

Jun-06

Jun-07

Jun-08

Jun-09

Jun-10

Jun-11

Jun-12

Nov-12

Dec-09

Apr-08

Mar-11

Aug-11

Jan-12

Jun-12

Jun-07

Jul-09

National Aluminium | 3QFY2013 Result Update

Exhibit 12: Recommendation summary

Company CMP Target Reco. M.cap Upside/ P/E (x) P/BV (x) EV/EBITDA (x) RoE (%) RoCE (%) (downside) (` cr) (%) FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E (7)

-

(`) Price (`)

Hindalco

Nalco

116 49

114

- Neutral 22,160 46 Reduce 12,732

- Neutral 38,284

7.7 23.2

7.0

7.4 15.2

6.4

0.7 1.1

0.8 1.7

0.6 1.0

0.7 1.4

7.1 10.7

3.4 5.2

6.4 7.3

2.9 3.8

8.8 4.6

11.3 21.1

8.4 6.9

11.2 19.8

5.8 2.0

9.5 17.7

5.6 5.0

9.6 17.7

Sterlite Hind. Zinc

129

149

Buy 54,338

16

8.7

7.9

Source: Company, Angel Research

Company background

Nalco, a Navratna company, is Indias third largest aluminium producer. The company has Asia's largest integrated aluminium complex. The company engages into alumina refining (capacity 2.1mn tonne), aluminium smelting (capacity 0.7mn tonne) and power generation (capacity - 1,200MW). The company has a captive bauxite mine at Panchpatmalli with a mining capacity of 6.3mn tonne per annum. The company also sells excess power. Nalco exports its products to South East Asia, Far East, Indian subcontinent, Gulf, China and the US.

January 31, 2013

National Aluminium | 3QFY2013 Result Update

Profit & loss statement (Standalone)

Y/E March (` cr) Net Sales Other operating income Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation& Amortisation EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Inc/(Expense) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of asso. Less: Minority interest (MI) Extraordinary Expense/(Inc.) PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 5,095 5,095 2.1 3,401 585 1,562 771 483 1,694 (23.7) 33.2 272 1,421 (26.7) 27.9 4 496 25.9 1,913 (23.2) 14 1,927 655 34.0 1,272 1,272 1,258 (24.0) 24.7 5,055 119 5,174 1.6 4,071 808 2,124 813 326 1,102 (34.9) 21.8 319 783 (44.9) 15.5 2 374 32.4 1,155 (39.6) 1,155 341 29.5 814 814 814 (35.3) 16.1 5,959 98 6,057 17.1 4,464 704 1,765 961 1,033 1,592 44.4 26.7 422 1,170 49.5 19.6 0 353 23.2 1,524 31.9 1,524 455 29.8 1,069 1,069 1,069 31.3 17.9 6,500 111 6,612 9.2 5,473 1,034 2,197 1,035 1,208 1,139 (28.5) 17.5 467 673 (42.5) 10.3 1 542 44.7 1,214 (20.3) (22) 1,192 342 28.7 850 850 871 (18.5) 13.4 6,630 136 6,766 2.3 6,013 1,094 3,070 1,153 696 753 (33.9) 11.4 500 253 (62.4) 3.8 6 548 68.9 794 (34.6) 794 246 31.0 548 548 548 (37.1) 8.3 8,357 149 8,506 25.7 7,298 1,254 3,802 1,239 1,003 1,208 60.4 14.5 557 651 157.4 7.8 2 586 47.4 1,235 55.5 1,235 395 32.0 840 840 840 53.3 10.1

January 31, 2013

National Aluminium | 3QFY2013 Result Update

Balance sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Reserves & Surplus Shareholders Funds Total Loans Other long-term liabilities Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Othe long-term assets Mis. Exp. not written off Total Assets

FY2009 644 9,126 9,770 621 10,391 9,900 5,868 4,032 2,868 896 4,529 2,869 616 1,044 1,933 2,596 10,391

FY2010 644 9,751 10,396 661 11,056 11,018 6,182 4,836 2,243 987 5,210 3,152 786 1,272 2,220 2,990 11,056

FY2011 1,289 9,876 11,165 270 693 12,128 12,076 6,583 5,494 1,707 1,332 5,589 3,795 612 1,183 2,821 2,768 827 12,128

FY2012 1,289 10,426 11,715 280 849 12,844 13,659 7,046 6,612 684 754 6,269 4,168 750 1,351 2,677 3,592 1,201 12,844

FY2013E FY2014E 1,289 10,613 11,902 280 849 13,030 14,709 7,546 7,162 584 754 6,006 3,952 750 1,303 2,677 3,329 1,201 13,030 1,289 11,061 12,350 280 849 13,479 16,409 8,103 8,306 284 754 5,611 3,218 750 1,643 2,677 2,934 1,201 13,479

January 31, 2013

National Aluminium | 3QFY2013 Result Update

Cash flow statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments (Inc.)/ Dec. in loans and adv. Other income Cash Flow from Investing Inc./(Dec.) in loans Dividend paid Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances 388 (388) (647) 3,516 2,869 303.8 (304) 275 2,878 3,152 219 (219) 642 3,152 3,794 FY2009 FY2010 FY2011 FY2012 1,927 273 361 60 682 1,938 (2,211) 13 (2,198) 1,155 319 (20) 9 292 1,172 (678) 84 (593) 1,524 422 288 (56) 548 1,630 (833) 65 (768) 1,197 467 (397) (77) 304 886 (181) (181) 416 15 (430) 275 3,794 4,168 FY2013E 794 500 47 246 1,095 (950) (950) 361 (361) (216) 4,168 3,952 FY2014E 1,235 557 (339) 395 1,057 (1,400) (1,400) 392 (392) (734) 3,952 3,218

January 31, 2013

10

National Aluminium | 3QFY2013 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV/Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio (%) Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA (0.4) (2.2) (0.4) (3.8) (0.5) (3.2) (0.4) (4.3) (0.4) (6.2) (0.3) (3.3) 0.5 55 2 717 (5) 0.5 65 13 718 (27) 0.5 62 7 0 22 0.5 64 8 0 71 0.5 64 8 0 73 0.5 64 8 0 64 14.3 39.1 13.6 7.3 18.6 8.1 10.2 24.1 9.9 5.5 11.2 7.4 2.0 3.5 4.6 5.0 7.9 6.9 27.9 66.0 1.4 25.8 25.8 15.5 70.5 1.2 13.4 13.4 19.6 70.2 1.2 17.2 17.2 10.3 71.3 1.1 8.1 8.1 3.8 69.0 0.9 2.5 2.5 7.8 68.0 1.0 5.5 5.5 4.9 4.9 6.0 1.3 37.9 3.2 3.2 4.4 0.6 40.3 4.1 4.1 5.8 0.9 43.3 3.4 3.4 5.1 1.0 45.5 2.1 2.1 4.1 1.2 46.2 3.3 3.3 5.4 1.3 47.9 10.1 8.2 1.3 2.5 1.8 5.3 0.9 15.6 11.2 1.2 1.3 1.7 7.8 0.8 11.9 8.5 1.1 1.8 1.3 4.8 0.6 14.6 9.7 1.1 2.0 1.2 6.9 0.6 23.2 12.1 1.1 2.4 1.2 10.7 0.6 15.2 9.1 1.0 2.6 1.0 7.3 0.6 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

January 31, 2013

11

National Aluminium | 3QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

National Aluminium No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

January 31, 2013

12

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- International Financial QuestionnaireDocument4 pagesInternational Financial QuestionnaireHenrypat Uche Ogbudu100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Ogden Theatre Apartments - Project Summary (Final)Document16 pagesOgden Theatre Apartments - Project Summary (Final)Kevin DayPas encore d'évaluation

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOePas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- TaxationnnnDocument12 pagesTaxationnnnRenji kleinPas encore d'évaluation

- CLS 12Document27 pagesCLS 12aarchi goyalPas encore d'évaluation

- Quiz 2Document9 pagesQuiz 2yuvita prasadPas encore d'évaluation

- 31.economic Contributions of Indian Film IndustryDocument3 pages31.economic Contributions of Indian Film IndustrymercatuzPas encore d'évaluation

- Fundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualDocument44 pagesFundamentals of Advanced Accounting Hoyle Doupnik 4th Edition Solutions ManualCarolineAndersoneacmg100% (35)

- TVM Stocks and BondsDocument40 pagesTVM Stocks and Bondseshkhan100% (1)

- Accounting 2 Week 1 4 LPDocument33 pagesAccounting 2 Week 1 4 LPMewifell100% (1)

- FIN 315 Spring 2017 SyllabusDocument5 pagesFIN 315 Spring 2017 SyllabusMaxx Maxx SumnerPas encore d'évaluation

- McDonalds RoyaltyfeesDocument2 pagesMcDonalds RoyaltyfeesNidhi BengaliPas encore d'évaluation

- Petition For Issuance of Letter of AdministrationDocument4 pagesPetition For Issuance of Letter of AdministrationMa. Danice Angela Balde-BarcomaPas encore d'évaluation

- Affidavit of Loss - Lavina AksakjsDocument1 pageAffidavit of Loss - Lavina AksakjsAnjo AlbaPas encore d'évaluation

- Dvs Minutes - September 19 2013Document3 pagesDvs Minutes - September 19 2013api-124277777Pas encore d'évaluation

- Etf PDFDocument14 pagesEtf PDFYash MeelPas encore d'évaluation

- References DI MICELI ErmannoDocument1 pageReferences DI MICELI ErmannoIronmanoPas encore d'évaluation

- Wikborg Global Offshore Projects DEC15Document13 pagesWikborg Global Offshore Projects DEC15sam ignarskiPas encore d'évaluation

- Aids To TradeDocument14 pagesAids To TradeDeepak Jarariya67% (3)

- Job Sheet Od Buku BesarDocument13 pagesJob Sheet Od Buku Besarjuandry andryPas encore d'évaluation

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaPas encore d'évaluation

- Nature of Banking and Functions of A BankerDocument22 pagesNature of Banking and Functions of A BankerYashitha CaverammaPas encore d'évaluation

- Sample Quiz KEY1Document6 pagesSample Quiz KEY1ElaineJrV-IgotPas encore d'évaluation

- Case#14 Analysis Group10Document7 pagesCase#14 Analysis Group10Mohammad Aamir100% (1)

- Marginal Costing and Cost Volume Profit AnalysisDocument5 pagesMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanPas encore d'évaluation

- Quiz 9Document3 pagesQuiz 9朱潇妤100% (1)

- Real Estate Principles Legal Equitable "Exclusive Equity"Document92 pagesReal Estate Principles Legal Equitable "Exclusive Equity"Ven Geancia100% (1)

- IMF Reformation of BangladeshDocument125 pagesIMF Reformation of BangladeshSajjad HossainPas encore d'évaluation

- Project Proposal by Nigah-E-Nazar FatimiDocument8 pagesProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Financial DistressDocument5 pagesFinancial DistresspalkeePas encore d'évaluation