Académique Documents

Professionnel Documents

Culture Documents

The Cadbury Report

Transféré par

life15Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Cadbury Report

Transféré par

life15Droits d'auteur :

Formats disponibles

Introduction

The Adrian Cadbury Report, titled Financial Aspects of Corporate Governance, is a report of a committee chaired by Adrian Cadbury that sets out recommendations on the arrangement of company boards and accounting systems to mitigate corporate governance risks and failures. The committee was formed in May, 1991 by the Financial Reporting Council, the London Stock Exchange & the group of accountancy professionals & its role was to consider the UKs corporate governance system The Report and Code of Best Practice published by this committee in December 1992 have ever since been known as the Cadbury Report and the Cadbury Code. The report's recommendations have been adopted in varying degree by the European Union, the United States, the World Bank, and others. The encourage for the Committee's creation was an increasing lack of investor confidence in the honesty and accountability of listed companies, occasioned in particular by the sudden financial collapses of two companies, wallpaper group Chloral and Asil Nadir's Polly Peck consortium: neither of these sudden failures was at all foreshadowed in their apparently healthy published accounts. Even as the Committee was getting down to business, two further scandals shook the financial world: the collapse of the Bank of Credit and Commerce International and exposure of its widespread criminal practices, and the posthumous discovery of Robert Maxwell's appropriation of 440m from his companies' pension funds as the Maxwell Group filed for bankruptcy in 1992. The shockwaves from these two incidents only heightened the sense of urgency behind the Committee's work, and ensured that all eyes would be on its eventual report. The effect of these multiple blows to the perceived probity and integrity of UK financial institutions was such that many feared an overly heavy-handed response, perhaps even legislation mandating certain boardroom practices. This was not the strategy the Committee ultimately suggested, but even so the publication of their draft report in May 1992 met with a degree of criticism and hostility by institution which believed themselves to be under attack. Peter Morgan, Director General of the Institute of Directors, described their proposals as divisive', particularly language favoring a two-tier board structure, of executive directors on the one hand and of mom-executives on the other.

The suggestions which met with such disfavor were considerably toned down come the publication of the final Report in December 1992, as were proposals that shareholders have the right to directly question the Chairs of audit and remuneration committees at AGMs, and that there be a Senior Non-Executive Director to represent shareholders interests in the event that the positions of CEO and Chairman are combined. Nevertheless the broad substance of the Report remained intact, principally its belief that an approach 'based on compliance with a voluntary code coupled with disclosure, will prove more effective than a statutory code.

Impact on todays Management style

Companies are now complying with Adrian Cadbury Code and enjoyed widespread of acceptance.

Due to Adrian Cadbury Report, the business practice became more

transparent, flexible & proves more effectiveness.

Inspired trust in the mind of shareholders about the companies.

The quality of financial report increased due to Adrian Cadbury Committee.

There is a lot of faith in the scrutinizing powers of non-executive

directors.

There is increasing the compensation to shareholders out of profit or success of the companies.

The Cadbury Report resulting Code of Best Practice may succeeded in

their aims of providing a model for effective corporate governance.

Now the board meets regularly, retaining full and effective control over the company and monitoring the executive management.

Reasons for setting up Adrian Cadbury Committee

The Committee was set up in May 1991 by the Financial Reporting Council, the London Stock Exchange and the accountancy profession to address the financial aspects of corporate governance. Its sponsors were concerned at the perceived low level of confidence both in financial reporting and in the ability of auditors to provide the safeguards which the users of company reports sought and expected. The underlying factors were seen as the looseness of accounting standards, the absence of a clear framework for ensuring that directors kept under review the controls in their business, and competitive pressures both on companies and on auditors which made it difficult for auditors to stand up to demanding boards. These concerns about the working of the corporate system were heightened by some unexpected failures of major companies and by criticisms of the lack of effective board accountability for such matters as directors pay. Further evidence of the breadth of feeling that action had to be taken to

clarify responsibilities and to raise standards came from a number of reports on different aspects of corporate governance which had either been published or were in preparation at that time. The committee draft report which was issued for public on 27th May, 1992.Since then the Committee has received over 200 written responses to its proposals, the great majority of which positively support the committees approach. The committees have helped to shape companies final report and in addition, they are a valuable reference source for companys successors. The role of the auditors is to provide the shareholders with an external and objective check on the directors financial statements which form the basis of that reporting system. Although the reports of the directors are addressed to the shareholders, they are important to a wider audience, not least to employees whose interests boards have a statutory duty to take into account.

Vous aimerez peut-être aussi

- Use of Non-Financial Measures in Performance EvaluationDocument12 pagesUse of Non-Financial Measures in Performance EvaluationVasile MihaelaPas encore d'évaluation

- Admixtures For Concrete, Mortar and Grout ÐDocument12 pagesAdmixtures For Concrete, Mortar and Grout Ðhz135874Pas encore d'évaluation

- Explain The Advantage of Non Financial PerfomanceDocument5 pagesExplain The Advantage of Non Financial PerfomanceIchiehara YukeidoPas encore d'évaluation

- Reform in Justice System of PakistanDocument5 pagesReform in Justice System of PakistanInstitute of Policy Studies100% (1)

- Company Research ChecklistDocument4 pagesCompany Research ChecklistthanhPas encore d'évaluation

- Making Money On Autopilot V3 PDFDocument6 pagesMaking Money On Autopilot V3 PDFGatis IvanansPas encore d'évaluation

- Researh & Analysis Project: An Evaluation of Business and Financial Performance of British Airways (BA)Document31 pagesResearh & Analysis Project: An Evaluation of Business and Financial Performance of British Airways (BA)Hammad SaeedPas encore d'évaluation

- OBU Project Pass NotesDocument2 pagesOBU Project Pass NotesWaqas Siddique SammaPas encore d'évaluation

- RAP PresentationDocument16 pagesRAP PresentationHammad SaeedPas encore d'évaluation

- British Airways Strategic ManagementDocument29 pagesBritish Airways Strategic ManagementcebucpatriciaPas encore d'évaluation

- An Analysis and Evaluation of Financial and Business Performance of Apollo Tyres LimitedDocument26 pagesAn Analysis and Evaluation of Financial and Business Performance of Apollo Tyres LimitedAditya KanabarPas encore d'évaluation

- RAPDocument42 pagesRAPJozua Oshea PungPas encore d'évaluation

- BCI4001 Cyber Forensics and Investigation: LTPJC 3 0 0 4 4Document4 pagesBCI4001 Cyber Forensics and Investigation: LTPJC 3 0 0 4 4raj anaPas encore d'évaluation

- Rap Checklist 1Document1 pageRap Checklist 1Asim SaleemPas encore d'évaluation

- Receivable Financing IllustrationDocument3 pagesReceivable Financing IllustrationVatchdemonPas encore d'évaluation

- LT Bill Dec16Document2 pagesLT Bill Dec16nahkbcePas encore d'évaluation

- RAP MARYAM - R02 (Old)Document34 pagesRAP MARYAM - R02 (Old)Asad MuhammadPas encore d'évaluation

- The Micronesia Institute Twenty-Year ReportDocument39 pagesThe Micronesia Institute Twenty-Year ReportherondellePas encore d'évaluation

- Management By Objectives A Complete Guide - 2021 EditionD'EverandManagement By Objectives A Complete Guide - 2021 EditionPas encore d'évaluation

- Sls Ukessays - Com-Skills - and - Learning - Statement - Education - Essay PDFDocument4 pagesSls Ukessays - Com-Skills - and - Learning - Statement - Education - Essay PDFKit YuenPas encore d'évaluation

- Proposals For ResearchDocument6 pagesProposals For ResearchJayman Tamang0% (1)

- RAPDocument48 pagesRAPRohail Amjad100% (1)

- OBU Topic 8 Lucky CementDocument25 pagesOBU Topic 8 Lucky CementHassanPas encore d'évaluation

- SLS (Period 36 - Draft)Document5 pagesSLS (Period 36 - Draft)M.KazimSadiqPas encore d'évaluation

- Financial Analysis On British American Tobacco Bangladesh (BAT)Document12 pagesFinancial Analysis On British American Tobacco Bangladesh (BAT)Shoyeb MahmudPas encore d'évaluation

- Adrian Cadbury ReportDocument11 pagesAdrian Cadbury ReportKunal NikalePas encore d'évaluation

- SLS GuideDocument4 pagesSLS GuideYuvraj VermaPas encore d'évaluation

- OBU BSC RAP-Business ModelsDocument4 pagesOBU BSC RAP-Business ModelsTanim Misbahul MPas encore d'évaluation

- Auditing Mobile Money Electronic Transactions by Mr. Moses KangetheDocument19 pagesAuditing Mobile Money Electronic Transactions by Mr. Moses KangetheOnche AbrahamPas encore d'évaluation

- RAP StyleDocument1 pageRAP StyleThansal Abdul BasheerPas encore d'évaluation

- Sample Reasearch ProjectDocument40 pagesSample Reasearch ProjectRabiaasadPas encore d'évaluation

- Oxford Brookes University: Research and Analysis ProjectDocument46 pagesOxford Brookes University: Research and Analysis ProjectjawadPas encore d'évaluation

- An Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011Document32 pagesAn Analysis of Financial and Business Performance of Gul Ahmed Textile Mills Limited Between FY2009 To FY2011techyaccountantPas encore d'évaluation

- Skills and Learning StatementDocument7 pagesSkills and Learning StatementBlessing UmorenPas encore d'évaluation

- Skills and Learning Statement Oxford Brookes University Nishat Mills Limited (NML)Document6 pagesSkills and Learning Statement Oxford Brookes University Nishat Mills Limited (NML)Flutter BugPas encore d'évaluation

- Agha Steel Human Resources 2017 PDFDocument12 pagesAgha Steel Human Resources 2017 PDFDarlene HarrisPas encore d'évaluation

- Pepsi CoDocument3 pagesPepsi CoabcPas encore d'évaluation

- Vision Industry Internship ReportDocument64 pagesVision Industry Internship Reportbbaahmad89Pas encore d'évaluation

- GENERAL QUESTIONS Prudential RegulationsDocument2 pagesGENERAL QUESTIONS Prudential RegulationsFaran AliPas encore d'évaluation

- Acca Thesis For BSC Applied AccountancyDocument32 pagesAcca Thesis For BSC Applied AccountancyJehanzeb KhanPas encore d'évaluation

- SBL MJ23 Examiner's ReportDocument21 pagesSBL MJ23 Examiner's ReportAmmar ArifPas encore d'évaluation

- F9FM-RQB-As - d08jk N LKJDocument152 pagesF9FM-RQB-As - d08jk N LKJErclanPas encore d'évaluation

- Intership Reports Azgard Nine Limited Muzaffar GardDocument44 pagesIntership Reports Azgard Nine Limited Muzaffar GardAsad AliPas encore d'évaluation

- Ayodele Olatiregun ObuDocument32 pagesAyodele Olatiregun ObuAyodele Samuel OlatiregunPas encore d'évaluation

- Case Study OB Dominos Pizza Job SatisfactionDocument32 pagesCase Study OB Dominos Pizza Job SatisfactionBhavika Jain100% (2)

- Sui Northern Gas Pipe Lines LimitedDocument38 pagesSui Northern Gas Pipe Lines LimitedRayesha80% (5)

- Esearch Roject: A. Files To Be UploadedDocument4 pagesEsearch Roject: A. Files To Be Uploadedasfandkamal12345Pas encore d'évaluation

- Sls Ukessays - Com-Personal - Skills - and - Learning - Statement - Personal - Development - Essay PDFDocument4 pagesSls Ukessays - Com-Personal - Skills - and - Learning - Statement - Personal - Development - Essay PDFKit YuenPas encore d'évaluation

- BSC Oxford BrookesDocument8 pagesBSC Oxford Brookesrizwan99pkPas encore d'évaluation

- Under Armour Vs NikeDocument1 pageUnder Armour Vs NikeNazibul IslamPas encore d'évaluation

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)WasifPas encore d'évaluation

- Accounting Textbook Solutions - 53Document19 pagesAccounting Textbook Solutions - 53acc-expertPas encore d'évaluation

- FCCL Internship ReportDocument17 pagesFCCL Internship ReportMaham WasimPas encore d'évaluation

- An Overview of OBU RAP PDFDocument4 pagesAn Overview of OBU RAP PDFAbdul BariPas encore d'évaluation

- BSC Degree Oxford Brookes - How To Get StartedDocument7 pagesBSC Degree Oxford Brookes - How To Get StartedMamunur Rashid RedoyPas encore d'évaluation

- Sls Ukessays - Com-Research - and - Analysis - Project PDFDocument4 pagesSls Ukessays - Com-Research - and - Analysis - Project PDFKit YuenPas encore d'évaluation

- Tour Report - KDSDocument26 pagesTour Report - KDSJoshua SmithPas encore d'évaluation

- Final Project FertilizersDocument44 pagesFinal Project FertilizersFatmahmlkPas encore d'évaluation

- C CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCDocument26 pagesC CC C CC C C C CC CC CCC C: CCCC C CCC C C C C C C C C C C C C C C C C C CCAhmed FarazPas encore d'évaluation

- CORPORATE GOVERNANCE REPORT On ONGCDocument11 pagesCORPORATE GOVERNANCE REPORT On ONGCKunal AsraniPas encore d'évaluation

- Analysis AssignmentDocument3 pagesAnalysis AssignmentmadyanoshiePas encore d'évaluation

- ApexDocument24 pagesApexreaz uddinPas encore d'évaluation

- Risk Based Internal Audit A Complete Guide - 2020 EditionD'EverandRisk Based Internal Audit A Complete Guide - 2020 EditionPas encore d'évaluation

- A Good Service RequiresDocument19 pagesA Good Service Requireslife15Pas encore d'évaluation

- Business Plan - Bakery, Biscuit and FoodDocument10 pagesBusiness Plan - Bakery, Biscuit and Foodlife15Pas encore d'évaluation

- HDFC Word FileDocument36 pagesHDFC Word Filelife15Pas encore d'évaluation

- HDFC Word FileDocument36 pagesHDFC Word Filelife15Pas encore d'évaluation

- Affidavit of UndertakingDocument3 pagesAffidavit of UndertakingPingotMagangaPas encore d'évaluation

- Business Plan V.3.1: Chiken & Beef BBQ RestaurantDocument32 pagesBusiness Plan V.3.1: Chiken & Beef BBQ RestaurantMohd FirdausPas encore d'évaluation

- "A Stone's Throw" by Elma Mitchell Class NotesDocument6 pages"A Stone's Throw" by Elma Mitchell Class Noteszaijah taylor4APas encore d'évaluation

- Consent To TreatmentDocument37 pagesConsent To TreatmentinriantoPas encore d'évaluation

- 01 Manual's WorksheetsDocument39 pages01 Manual's WorksheetsMaria KhanPas encore d'évaluation

- Solved Acme Realty A Real Estate Development Company Is A Limited PDFDocument1 pageSolved Acme Realty A Real Estate Development Company Is A Limited PDFAnbu jaromiaPas encore d'évaluation

- Peshawar PresentationDocument21 pagesPeshawar PresentationsamPas encore d'évaluation

- EssayDocument3 pagesEssayapi-358785865100% (3)

- Arvind Fashions Limited Annual Report For FY-2020 2021 CompressedDocument257 pagesArvind Fashions Limited Annual Report For FY-2020 2021 CompressedUDIT GUPTAPas encore d'évaluation

- Mrunal Updates - Money - Banking - Mrunal PDFDocument39 pagesMrunal Updates - Money - Banking - Mrunal PDFShivangi ChoudharyPas encore d'évaluation

- Memorial On Behalf of AppellentDocument16 pagesMemorial On Behalf of Appellenttopperslibrary001Pas encore d'évaluation

- Analysis Condominium RulesDocument12 pagesAnalysis Condominium RulesMingalar JLSPas encore d'évaluation

- 01 - First Law of ThermodynamicsDocument20 pages01 - First Law of ThermodynamicsFabio BosioPas encore d'évaluation

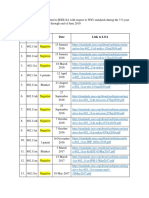

- WiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019Document3 pagesWiFi LoAs Submitted 1-1-2016 To 6 - 30 - 2019abdPas encore d'évaluation

- Setting Up Ansys Discovery and SpaceClaimDocument2 pagesSetting Up Ansys Discovery and SpaceClaimLeopoldo Rojas RochaPas encore d'évaluation

- 1 Types of Life Insurance Plans & ULIPSDocument40 pages1 Types of Life Insurance Plans & ULIPSJaswanth Singh RajpurohitPas encore d'évaluation

- AMCTender DocumentDocument135 pagesAMCTender DocumentsdattaPas encore d'évaluation

- Pre-Commencement Meeting and Start-Up ArrangementsDocument1 pagePre-Commencement Meeting and Start-Up ArrangementsGie SiegePas encore d'évaluation

- Tecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Document2 pagesTecno Spark Power 2 Misty Grey, 64 GB: Grand Total 9999.00Lucky KumarPas encore d'évaluation

- On Rural America - Understanding Isn't The ProblemDocument8 pagesOn Rural America - Understanding Isn't The ProblemReaperXIXPas encore d'évaluation

- Guide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassDocument62 pagesGuide 7000 - Application For Permanent Residence - Federal Skilled Worker ClassIgor GoesPas encore d'évaluation

- Cibse Lighting LevelsDocument3 pagesCibse Lighting LevelsmdeenkPas encore d'évaluation

- Ecm Type 5 - 23G00019Document1 pageEcm Type 5 - 23G00019Jezreel FlotildePas encore d'évaluation