Académique Documents

Professionnel Documents

Culture Documents

Fort Bonifacio Development Corporation Vs

Transféré par

Pinky De Castro AbarquezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fort Bonifacio Development Corporation Vs

Transféré par

Pinky De Castro AbarquezDroits d'auteur :

Formats disponibles

FORT BONIFACIO DEVELOPMENT CORPORATION vs. CIR GR No. 158885 & GR No. 170680, April 2, 2009 Elements: I.

Parties Petitioner: Fort Bonifacio Development Corporation Respondents: 1. Commissioner of Internal Revenue, Regional Director, Revenue Region No. 8 and Chief, Assessment Division Revenue Region No. 8 (GR 158885) 2. Commissioner of Internal Revenue and Revenue District Officer, Revenue District No. 44, Taguig and Pateros, Bureau of Internal Revenue (GR 170680) Prior Proceedings Fort Bonifacio Development Corporation initiated the proceedings by filing a petition for review before the court. But before the case reached the Supreme Court, it went through the Court of Tax Appeals and Court of Appeals. COURT OF TAX APPEALS The court rendered a decision affirming the assessment made by the respondents. FBDC has to pay an amount of Php 45,188,708.08 representing deficiency tax for the 4th quarter of 1996, including surcharge, interest, and penalty. The CTA sustained the BIRs application of Section 4.105-1 of RR 7-95 that the basis of the transitional tax for real estate dealers shall be the improvements constructed on or after the effectivity of EO 273. Moreover, FBDC is precluded from availing of transitional input tax credit because in 1995, sale of real properties was still exempt from VAT. (first petition) The court denied the FBDCs claim for refund. The government, which is a tax exempt entity, did not pass on any VAT or business tax upon FBDC. To allow FBDC 8% transitional input tax to offset its output VAT liability without having paid any previous taxes has the net effect of granting FBDC an outright bonus equivalent to 10% VAT it may tack on the goods it would sell to its subsequent purchasers. The inventory under Section 105 of the NIRC is limited to improvements. (second petition) COURT OF APPEALS It affirmed the decision of the Court of Tax Appeals, but removing the surcharge, interest, and penalties, thus reducing the amount due to Php 28,413,783. The regulations embodied in RR 7-95 were a valid exercise of the BIRs delegated rulemaking power and were consistent with the letter and spirit of substantive laws establishing the VAT system. A first

II.

time taxpayer who becomes liable for VAT is entitled to a transitional input tax under Section 105 of the NIRC. (first petition) The Court affirmed the CTA decision. It ruled that the grant of transitional input tax presupposes that the VAT taxpayer had previously paid some form of business tax on his inventory of goods. III. Theories of the Parties G. R. No. 158885 Petitioner On September 19, 1996, in order to avail itself of the transitional input tax credit, FBDC submitted to the BIR, Revenue District No. 44, Taguig and Pateros, an inventory of its real properties with a Book Value of Php 71,227,503,200 on which it claims a transitional input tax credit of Php 5,698,200,256. It also registered itself as a VAT taxpayer. On October 14, 1996, two contracts to sell were executed in favor of Metro Pacific Corporation. Sales Output Tax Payable Cash Paid Transitional Input Tax Credit Regular Input Tax Credit on Purchases of goods and services Php 3,498,888,713.60 318,080,792.14 269,340,469.45 28,413,783.00 20,326,539.69

FBDC submitted two letters to BIR informing it of the transaction and computation of its VAT payments and requesting for a ruling on whether its transitional input VAT on the land inventory was in order. The BIR Commissioner sent a letter to the petitioner disallowing the presumptive input tax arising from land inventory on the ground that the basis of the 8% presumptive input tax of the real estate dealer shall be limited to the book value of improvements, in addition to its inventory of supplies and materials for use in its business. FBDC requested for the computation of surcharges, interest and penalties and for the issuance of assessment notice to enable it to pursue its remedy under the NIRC. Respondents: The BIR Commissioner cited RR No. 7-95 and RMC No. 3-96. Specifically, the BIR Commissioner referred to Sec. 4.105-1 and the Transitory Provisions of RR 7-95 issued in implementations of the amendments made by RA 7716, which provides in case of real estate dealers, the basis of the presumptive input tax shall be the improvements. BIR Commissioner directed petitioner to pay VAT equivalent to the disallowed presumptive input tax on land improvements.

Acting Assistant Chief Pascual De Leon sent a letter informing the total amount due and Regional Director Ortega ruled that petitioners request for reconsideration/protest was barred by thte statute of limitations because it was filed more than 30 days.

G. R. No. 170680 Petitioner For the third quarter of 1997: Sales and Lease of Land Output VAT payable Cash paid Regular Input Tax Php 3,591,726,328.11 359,172,623.81 347,741,695.74 19,743,565.73

On May 11, 1999, petitioner filed with the BIR a claim for the tax refund of its output VAT cash payments for the third quarter of 1997 for the reason that it was illegally collected because the BIR didi not take into account its transitional input tax credit. It alleged that its input tax credit was more than enough to offset the VAT paid for the third quarter and as such, it was entitled to a refund.

Respondents FBDC is not automatically entitled to 8% transitional input tax allowed under Sec. 105 of the NIRC because it purchased the land at the Global City from the government under a VAT free sale.

IV.

Objectives of the Parties Petitioner 1. To restrain the respondents from collecting the transitional input tax credit due for the 4th Quarter of 1996. 2. To refund the amount it had paid for the 3rd quarter of 1997 in the light of transitional input tax credit entitled to it. Respondents: 1. To sustain their decision to collect and not to give refund to the petitioner in the light of the RRs.

V.

Key Facts

Vous aimerez peut-être aussi

- Macadangdang v. CADocument11 pagesMacadangdang v. CAPinky De Castro AbarquezPas encore d'évaluation

- Tan v. Del RosarioDocument6 pagesTan v. Del RosarioPinky De Castro AbarquezPas encore d'évaluation

- Olfato v. ComelecDocument35 pagesOlfato v. ComelecPinky De Castro AbarquezPas encore d'évaluation

- Social Justice v. AtienzaDocument5 pagesSocial Justice v. AtienzaPinky De Castro AbarquezPas encore d'évaluation

- Castromayor v. ComelecDocument5 pagesCastromayor v. ComelecPinky De Castro AbarquezPas encore d'évaluation

- Motion For Early ResolutionDocument1 pageMotion For Early ResolutionPinky De Castro AbarquezPas encore d'évaluation

- Villaber v. ComelecDocument5 pagesVillaber v. ComelecPinky De Castro AbarquezPas encore d'évaluation

- Go Ong v. CA 154 Scra 270Document5 pagesGo Ong v. CA 154 Scra 270Karla Marie TumulakPas encore d'évaluation

- Rights of Illegitimate Children to Support and SurnameDocument14 pagesRights of Illegitimate Children to Support and SurnamePinky De Castro AbarquezPas encore d'évaluation

- IRR - RA - 9904 HLURB Magna Carta For Homeowners' AssociationDocument35 pagesIRR - RA - 9904 HLURB Magna Carta For Homeowners' AssociationJay100% (9)

- Liluis v. Manila RailroadDocument7 pagesLiluis v. Manila RailroadPinky De Castro AbarquezPas encore d'évaluation

- Nufable v. NufableDocument7 pagesNufable v. NufablePinky De Castro AbarquezPas encore d'évaluation

- IRR - RA - 9904 HLURB Magna Carta For Homeowners' AssociationDocument35 pagesIRR - RA - 9904 HLURB Magna Carta For Homeowners' AssociationJay100% (9)

- Chamber vs. Romulo 614 SCRA 605 2010Document17 pagesChamber vs. Romulo 614 SCRA 605 2010Jacinto Jr JameroPas encore d'évaluation

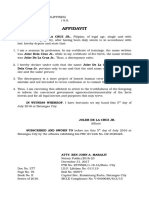

- Affidavit of 1 and The SameDocument2 pagesAffidavit of 1 and The SamePinky De Castro AbarquezPas encore d'évaluation

- Ponzi CasesDocument50 pagesPonzi CasesPinky De Castro AbarquezPas encore d'évaluation

- Sample Affidavit For Red RibbonDocument1 pageSample Affidavit For Red RibbonPinky De Castro AbarquezPas encore d'évaluation

- Salcedo v. MendozaDocument5 pagesSalcedo v. MendozaPinky De Castro AbarquezPas encore d'évaluation

- Republic of The PhilippinesDocument8 pagesRepublic of The PhilippinesPinky De Castro AbarquezPas encore d'évaluation

- Binay Vs DomingoDocument3 pagesBinay Vs DomingoZarah MaglinesPas encore d'évaluation

- City of Manila vs. Judge Laguio Gr. No. 118127Document29 pagesCity of Manila vs. Judge Laguio Gr. No. 118127Hanelizan Ert RoadPas encore d'évaluation

- Rights of The AccusedDocument11 pagesRights of The AccusedThea Pabillore100% (2)

- The Alexandra Condominium Corporation VsDocument3 pagesThe Alexandra Condominium Corporation VsPinky De Castro AbarquezPas encore d'évaluation

- 08-Quinto v. COMELEC G.R. No. 189698 February 22, 2010Document24 pages08-Quinto v. COMELEC G.R. No. 189698 February 22, 2010Jopan SJPas encore d'évaluation

- Articles of Incorporation Ala EhDocument3 pagesArticles of Incorporation Ala EhPinky De Castro AbarquezPas encore d'évaluation

- Page 35-41Document11 pagesPage 35-41Pinky De Castro AbarquezPas encore d'évaluation

- Sales BedaDocument38 pagesSales BedaStephanie AngPas encore d'évaluation

- Digests: Negotiable Instruments LawDocument35 pagesDigests: Negotiable Instruments LawBerne Guerrero93% (15)

- 1-Outline of PowersDocument2 pages1-Outline of PowersPinky De Castro AbarquezPas encore d'évaluation

- Banat+v +comelecDocument2 pagesBanat+v +comelecJohnlery O. PugaoPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Will Probate Case Reversed for Failure to Allow Documentary Stamp AffixingDocument2 pagesWill Probate Case Reversed for Failure to Allow Documentary Stamp AffixingIvan Montealegre ConchasPas encore d'évaluation

- United States v. Peter Sgro, 816 F.2d 30, 1st Cir. (1987)Document7 pagesUnited States v. Peter Sgro, 816 F.2d 30, 1st Cir. (1987)Scribd Government DocsPas encore d'évaluation

- Tonog vs. CADocument5 pagesTonog vs. CACarla AbiogPas encore d'évaluation

- Terry Vs OhioDocument4 pagesTerry Vs OhioJeliza ManaligodPas encore d'évaluation

- G.R. No. 191525 Iame Vs Litton and Company Inc. December 13, 2017Document16 pagesG.R. No. 191525 Iame Vs Litton and Company Inc. December 13, 2017Paul ToguayPas encore d'évaluation

- SP5309AcaraJenayah EVIDENCE2Document14 pagesSP5309AcaraJenayah EVIDENCE2dkhana243Pas encore d'évaluation

- 5) Zenith Insurance Corporation vs. Court of Appeals, 185 SCRA 398, G.R. No. 85296 May 14, 1990Document6 pages5) Zenith Insurance Corporation vs. Court of Appeals, 185 SCRA 398, G.R. No. 85296 May 14, 1990Alexiss Mace JuradoPas encore d'évaluation

- Court upholds dismissal of original charges and filing of new charges against petitionersDocument2 pagesCourt upholds dismissal of original charges and filing of new charges against petitionersRyannCabañeroPas encore d'évaluation

- Failure To Lend AssistanceDocument3 pagesFailure To Lend AssistanceNoelle Therese Gotidoc VedadPas encore d'évaluation

- LRTA Vs NAVIDADDocument2 pagesLRTA Vs NAVIDADmaccy adalidPas encore d'évaluation

- ADMINISTRATIVE LAW SYLLABUS ATENEO COLLEGE OF LAWDocument3 pagesADMINISTRATIVE LAW SYLLABUS ATENEO COLLEGE OF LAWBenBulacPas encore d'évaluation

- People Vs AgustinDocument2 pagesPeople Vs AgustinKristine GarciaPas encore d'évaluation

- Sample AffidavitDocument1 pageSample AffidavitpuffymindPas encore d'évaluation

- Arson Law Explained and Applied to CaseDocument11 pagesArson Law Explained and Applied to CaseJanelle Leano MarianoPas encore d'évaluation

- Anti Dummy Law12 01Document4 pagesAnti Dummy Law12 01jonbelzaPas encore d'évaluation

- Cajayon Vs Spouses BatuyongDocument4 pagesCajayon Vs Spouses BatuyongDi ko alamPas encore d'évaluation

- Procedures For Zoom Bench TrialsDocument2 pagesProcedures For Zoom Bench TrialsHR100% (1)

- Ag Memo Election Year SensitivitiesDocument2 pagesAg Memo Election Year SensitivitiesThinkProgressPas encore d'évaluation

- Laput vs. RemotigueDocument2 pagesLaput vs. RemotigueHuehuehuePas encore d'évaluation

- USA vs. Roger StoneDocument38 pagesUSA vs. Roger StoneAndy BeltPas encore d'évaluation

- Republic Vs Sereno With DissentingDocument5 pagesRepublic Vs Sereno With DissentingChaoSison100% (1)

- Legal MemorandumDocument4 pagesLegal MemorandumWinly SupnetPas encore d'évaluation

- 02 Kuizon V Desierto PeraltaDocument2 pages02 Kuizon V Desierto PeraltaTrixie PeraltaPas encore d'évaluation

- Pinga v. Heirs of German SantiagoDocument1 pagePinga v. Heirs of German SantiagoRudejane TanPas encore d'évaluation

- (HIGHLIGHTED) G.R. No. 83589 - Farolan v. Solmac Marketing CorporationDocument9 pages(HIGHLIGHTED) G.R. No. 83589 - Farolan v. Solmac Marketing CorporationThe FlipPas encore d'évaluation

- Chavez vs. ViolaDocument2 pagesChavez vs. ViolaJeacell100% (1)

- Jugement Pravind JugnauthDocument21 pagesJugement Pravind JugnauthL'express MauricePas encore d'évaluation

- People Vs ValerioDocument15 pagesPeople Vs ValerioKristine DyPas encore d'évaluation

- Privilege A Defence in Defamatiom"Document25 pagesPrivilege A Defence in Defamatiom"SHASHI BHUSHANPas encore d'évaluation

- Gallon Moore InformationDocument4 pagesGallon Moore InformationChris GothnerPas encore d'évaluation