Académique Documents

Professionnel Documents

Culture Documents

725 PDF

Transféré par

Oscar BasilTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

725 PDF

Transféré par

Oscar BasilDroits d'auteur :

Formats disponibles

ISSN No-2231-5063

Vol.1,Issue.X/April 2012pp.1-4

Research Paper

Reverse Mortgage

Prof. Sachin Napate Asst. Professor (Finance) 89/2-A, New Pune Mumbai Highway, Tathwade, Pune 4110336

ABSTRACT

This paper explores the prospects for reverse mortgage (RM) products in India. Developed countries are faced with severe budgetary constraints in sustaining their current universal and liberal Old Age Social and Income Security (OASIS) programmes. Developing countries are slated to face acute problems in meeting the OASIS needs of their projected population of the elderly.

These budgetary constraints and increasing expectations on quality of life amongst the elderly would fuel a massive demand for financial products tailored to the elderly for safe investment avenues, systematic liquidation of assets to finance consumption, managing longevity and inflation risks and imparting liquidity to illiquid assets. Since bulk of the savings at retirement is typically locked in home equity, reverse mortgage is a powerful device to increase the incomes of the elderly. However, its complexity exposes a lender to several risks: mortality, interest rates and real estate markets. It is an unusual product for a typical elderly borrower, creating fears of debt burden, eviction and inability to bequeath property. Demographic projections indicate that reverse mortgage could have reasonable prospects in India, which includes mortality amongst the elderly, current home ownership amongst the elderly, trends in appreciation in home value and long term interest rates. For designing of reverse mortgage products suited to Indian conditions further reverse mortgage specific research is needed such as location specific assessment of market potential, documentation of legal and regulatory issues and real estate markets. Keywords: longevity, home equity, market potential, reverse mortgage, legal and regulatory issues. Introduction: Reverse mortgage is a financial instrument that allows a homeowner to consume some of his housing equity by converting it into an income stream, yet maintain ownership and residence in the home. The government formally introduced the Reverse Mortgage Scheme in India in its budget 2007-08. The National Housing Board has been given the task of drawing up the regulatory mechanism to enable the use of reverse mortgage in the country. A type of mortgage in which a homeowner can borrow money against the value of his or her home. No repayment of the mortgage (principal or interest) is required until the borrower

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

dies or the home is sold. After accounting for the initial mortgage amount, the rate at which interest accrues, the length of the loan and rate of home price appreciation, the transaction is structured so that the loan amount will not exceed the value of the home over the life of the loan. Reverse mortgage is the opposite of a normal forward mortgage. In a forward mortgage loan, the borrower uses his house as collateral and receives a one-time lump sum payment, which he then utilizes to purchase the house. Subsequently, the borrower pays his regular mortgage installments, gradually reducing his outstanding loan amount and increasing his proportion of the equity of the house. On the other hand, the reverse mortgage mechanism enables a borrower who owns a house without encumbrance to sell his house to a lender and avail of a steady cash stream based on the valuation of his house. The unique aspect of this model is that the borrower continues to occupy the house until his demise, or until he sells the house to another party, or moves out of the house permanently. One of the positive features of reverse mortgage is that it is a non-recourse loan and therefore protects assets other than the house of the borrower from being used as collateral. In India, most of the home owners lifetime savings are used to buy or build a house, making reverse mortgage a welcome instrument that helps them convert some or all of their rising but locked home equity into a cash stream that can comfortably sustain them in their old age. The borrower can enter into a loan disbursement mode that involves a lump sum at the beginning of the loan term, monthly payments for a fixed term or for a lifetime annuity, or a line of credit with or without the accrual of interest on credit balance. Since the borrower need not make any payment to the lender, the loan and interest accrued accumulate till maturity (which is subject to a maximum of 15 years in India). Further, since there is no loan servicing requirement from the borrower, consequently there is no credit worthiness or minimum income level hurdles to be crossed to avail of this loan. A safety feature that protects the borrower's heirs from the market risk exposure to the lender is that even if the accumulated loan and interest exceed the realizable value of the house at the time of disposal, the repayment liability of the borrower remains pegged to the market value of the house at the time of loan recovery. Reverse mortgage as a concept is not a recent one. There is evidence that as far back as 400 years in Europe, investors purchased homes from elderly homeowners and allowed them to continue living in the house for the rest of their lives, without them being liable for any rent payments. Cash flow constraints and increasing expectations on quality of life amongst the elderly would fuel a massive demand for financial products tailored to monetize the locked equity of the asset rich but cash poor elderly homeowners in India. This unlocked equity could be utilized by the elderly for reinvesting into other safe investment avenues, systematic liquidation of assets to finance consumption and managing increased life expectancy and inflation risks. Opportunities and Threats: The Reverse Mortgage Scheme offers multiple opportunities of advantages to the borrowers. These opportunities are clubbed with some associated threats as well; most of them are related to the misuse of this novice concept.

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

Opportunities: The beneficiaries in this scheme may enjoy the following advantages 1.The borrower or his spouse will never have to repay the loans as the same becomes due after his or his spouse's death whichever is later. 2.The borrower will never be asked to vacate his house. Hence he can enjoy living in his dream house which he would have built in his youth. Hence his house, not only provides a shelter to him, but also becomes a source for his livelihood. 3.A substantial amount (up to 90%) of his hard earned money gets unlocked from his residential property which otherwise was illiquid. More importantly this happens when he needs this money the most i.e. to take care of his health etc. which obviously deteriorates with age. 4.His bequest desire can still be fulfilled even when he has availed of reverse mortgage loan because as and when the loan becomes due, his heirs will be given the first choice to repay the loan amount and stake a claim over his house. 5.There is no penalty on early repayment of loan. 6.There is a Non Recourse Guarantee clause in reverse mortgage loans. Hence at no point of time the lender can trouble the borrower for repayment even if the total loan amount has exceeded the value of the house. 7.He has flexibility of managing his cash inflows from this loan i.e. he can choose bullet point, monthly, quarterly, half yearly, yearly or revolving credit options. Hence he can plan olden days as per his wishes. 8.He has flexibility of using these funds for various purposes like home improvement, medical expenses, repayment of an existing loan taken or meeting any other genuine need. 9.The loan amount gets revised with every valuation of his property. If the value of the property increases, which may generally be expected, the installments received by him increases. Threats: Current Indian demographic and socio-economic can breed potential financial scams related to Reverse Mortgage Loan. Sound mechanisms will have to be devised to tackle them. 1.Forgery: This has been a bane of many areas including finance. Since property documents are involved in Reverse Mortgage Loan, the scope of forgery is highly pronounced as the land and buildings records are still manually maintained in India. Land scams are common because of poor record keeping. The ongoing automation of these records and e-governance measure might help tackle this threat. 2.Misuse of Funds: It is possible that the children of a potential Reverse Mortgage borrower are forcing him/her to avail of the facility even when it is really not genuinely needed. This way the funds through Reverse Mortgage Loan may be used by the children in the pretext of the senior citizens. This might defeat the very purpose of the scheme. Strict monitoring of the use of funds through Reverse Mortgage Loan is extremely important from the point of view of protecting the borrowers from the coercion and brutality of their own kith and kin. 3.Under-pricing by the lenders at the time of disposal: One way of recovering the loan amount is

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

that the lenders sell the property and recover their loan from the sale proceeds. It is the responsibility of the lenders to transfer the balance amount to the heirs of the borrower. Since the lenders interest is only to the extent of Reverse Mortgage Loan amount, they may not make enough attempts to get the best price at the time of disposing of the property. This is a common observation in many foreclosed housing loans, where the lenders have sold the property due to default. Hence a suitable mechanism like appointment of a receiver etc. has to be worked out to curb this menace. Risk inherent in the Reverse Mortgage Product: Any financial product involves some risk and reverse mortgage is no exception. The lender faces many type of risk for this product. Some of these risks are: 1.Longevity Risk: The lender has to provide the payment upfront either lump sum or installments as the case may be but gets his money back only when the borrowers dies or move into another residence. As we are aware that the life expectancy of people is increasing, the risk of late recovery of loans is a big risk for the lenders. 2.Interest Rate Risk: The payments to the borrower in case of a reverse mortgage are fixed, either for a term or lifetime but the cash flows for the lender may not be fixed and are dependent on the interest rate market. Thus the lender runs the risk that the interest rates in the market may move in the opposite direction of that the lender anticipated. 3.Market Risk (Property Value Risk): The lender in a reverse mortgage can claim back his loan only from the property on which the loan has been granted. He does not have recourse to any other asset of the borrower. If the sales proceeds of the home are not sufficient, the lender cannot claim the balance from the heirs of the borrower. This gives rise to the risk of adverse movement in property market which affects the profitability of the product. 4.Early Redemption Risk: Some of the reverse mortgages loans may give the borrower an option of repay the loan at any point of time. This leads to another risk for the lender of early redemption as the borrower will pay back the loan when it is most beneficial to him which in most cases does not coincide with the interests of the lender. 5.Adverse Selection and Moral Hazard Risk: As with insurance products, reverse mortgage products also have the scope of adverse selection i.e. only people with expected higher longevity may go for such products. Also as the borrower has really no incentive for keeping the house in proper condition as the risk is borne by the lender, it may lead to depreciation of value of the property. 6.Condemnation/ Sovereign Takeover of the Property by Government Agency: The asset available to the lender is the house and if there are changes like takeover of property by the government for development purposes etc., the lender is the looser. Risk Mitigation: Risk mitigation is the key for the success of any financial product including reverse mortgage. Some of the risk mitigation techniques which the providers can apply to reduce the risk are: 1.Proper Eligibility Criterions: The first mitigation of risk can be done at the time of providing loans. This can be done through proper verification of the title of the property, age of the borrower; his/her credit analysis etc. This reduces the risk of default by the borrower. 2.Variable Interest Rates Loan as compared to Fixed Interest Rate Loan: To avoid interest rate risk, the lender can go for variable interest rates based on some market benchmark like MIBOR. This will also reduce the risk of pre-payment as the borrower will not have interest arbitrage on prepayment of the loan.

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

3.Proper Analysis of Mortality Trends: As the product has significant longevity risk, the lender can do a detailed mortality trend analysis on a macro level and also in the market where it is operating. 4.Geographical Diversification: The lender can look at spreading the business across the country by promoting the product in secondary and tertiary cities also so that the law of large numbers may work properly and if the provider has a bad experience in one market, it can compensated with good experience in other cities. 5.Develop the Product for Lower Age Groups: The lender can develop home equity conversion mortgages for all households and not just for elderly. This will significantly reduce loan to value ratio and that will take care of many of the risks inherent in the product. 6.Securitization: One of the most effective ways of mitigation risk is securitization. USA has a history of eight years of securitization of its reverse mortgage and had a good response from the market. Reverse Mortgage in India: Getting into old age without proper financial support can be a very bad experience. The rising cost of living, healthcare, other amenities compound the problem significantly. No regular incomes, a dwindling capacity to work and earn livelihood at this age can make life miserable. A constant inflow of income without any work would be an ideal solution, which can put an end to all such sufferings. The reverse mortgage scheme offered by some of the leading banks in India could bring the required answers to the suffering senior citizens. Most of the people in the senior age groups, either by inheritance or by virtue of building assets have properties in names, but they were not able to convert it into instant and regular income stream due to its illiquid nature. Through the reverse mortgage scheme, a senior citizen who holds a house or property, but lacks a regular source of income can put mortgage his property with a bank or housing finance company (HFC) and the bank or HFC pays the person a regular payment. The good thing is that the person who reverse mortgages his property can stay in the house for his life and continue to receive the much needed regular payments. The draft guidelines of reverse mortgage in India prepared by RBI have the following salient features: 1.Any house owner over 60 years of age is eligible for a reverse mortgage. 2.The maximum loan is up to 60% of the value of residential property. 3.The maximum period of property mortgage is 15 years with a bank of HFC. 4.The borrower can opt for a monthly, quarterly, annual or lump sum payments at any point, as per his discretion. 5.The revaluation of the property has to be undertaken by the bank or HFC once every 5 years. 6.The amount received through reverse mortgage is considered as loan and not income; hence the same will not attract any tax liability. 7.Reverse mortgage rates can be fixed or floating and hence will vary according to market

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

conditions depending on the interest rate regime chosen by the borrower. The lender will recover the loan along with the accumulated interest by selling the house after the death of the borrower or earlier, if the borrower leaves the mortgaged residential property permanently. Any excess amount will be remitted back to the borrower or his heirs. Thus, reverse mortgage is very beneficial for senior citizens who want a regular income to meet their everyday needs, without leaving their houses. Existing Products: 1)Saksham: Dewan Housing Finance Limited (DHFL) was the first company to launch a product in the category of Reverse Mortgage Loans in India. DHFL's product is known as Saksham (DHFL, 2007). The urge to introduce these products was so much than even before the comprehensive guidelines by the NHB were announced, this product became operational. This reflects about the perception of the lenders about the potential of Reverse Mortgage Loan. 2)Baghban: The first public sector bank to launch a similar product is Punjab National Bank, when it launched the product Baghban (PNB, 2007). 3)State Bank of India and Others: There had been a number of lenders including State Bank of India (SBI, 2009), Bank of Baroda (BOB), Central Bank of India, LIC Housing Finance (LICHF, 2009), Allahabad Bank, Union Bank of India (UBI, 2009), Indian Bank (IB, 2009) etc., who have started offering this product in the broad category of Personal Finance. The following table lists some features of a few of these products (As on January, 2009)

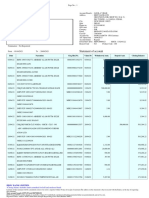

Comparison of Some Existing Products Lender DHFL PNB SBI Indian Bank RM-for seniors 11% (5 years) LIC HF Union BI

RML Product Annual Interest Rate (Reset Period) Processing Fee

Saksham

Baghban

SBI RML

RM Loan

Union RM

12% (linked to PLR)

11% (5 years)

10.75% (5 years)

Fixed 11% (5 years)

10% fixed pa (5 years)

NA

month amount Rs. 15,000/10-20 years

0.5% of Loan amount Max 15 years

NA

1% of loan amount

0.5% maximum Rs. 10 Lacs Max 15 years

Tenure

NA

NA

Max 15 years

Current Positions: 1)Young India is ageing: Currently India is young but ageing. As per 1961 census, the people with more than 60 years of age were 5.62% of the total population of 434 millions (CMIE Database, 2009). This proportion has maintained its upwards move and the same had been at 5.96% in 1971, 6.49% in 1981, 6.76% in 1991 and 7.44% in 2001. The total population has also grown to about 1140 million in 2008. It has been depicted in the following chart, as the upward movement continues.

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

It is expected that the number of senior citizens would be 140 million by 2016and 220 million by 2030 (Kasbekar, 2008). Their share in the total population is projected to be 9% by 2016 and 13% by 2026 (Rajgopalan, 2006). Life expectancy at age of 60 years will increase to around by 20% by 2020 (IIPS, 2000 and Irudayarajan, 1999). 1)Current Sources of Income: A 1995-96 National Sample Survey of the senior citizen reported that about 5% of them lived alone, another 10% lived with their spouses only and another 5% lived with relative/non-relatives, other than their own children. The remaining (80%) lived with their children (Rajgopalan, 2006). In other words, co-residence with children and other relatives is predominant. Reverse Mortgage is a bankable scheme that takes away the sting from the existing definedcontribution pension plans. Reverse Mortgage Loan takes care of two simultaneous risks associated with these plans for the savers, first is insufficient returns earned and the second is unpredictable longevity of beneficiaries. Criticism: Reverse mortgages have been criticized for three major shortcomings: 1)Being expensive. Reverse mortgages can cost more to enter into, as compared with other types of loans which often cost less. 2)Being confusing to those entering into them. Many seniors entering into reverse mortgages don't fully understand the terms and conditions associated with the loans and it has been suggested that some lenders have sought to take advantage of this. 3)Compound interest. Since no monthly payments are made by the borrower on a reverse mortgage, the interest that accrues is treated as a loan advance. Each month, interest is calculated not only on the principal amount received by the borrower but on the interest previously assessed to the loan. Because of this compound interest, the longer a senior has a reverse mortgage, the more likely it is that all of the home equity will be depleted when the loan becomes due. Can India become a global destination for reverse mortgage? As we had seen in above reverse mortgage is a new source for cash income. It means it is an emerging formula to unlock revenue potential, by turning an immovable property to a liquid asset that generates a return while it is used by the real owner. The reverse mortgage money may be used by the senior home owner as he or she sees fit. The money can be obtained as a fixed monthly income or as a one-time payment which can be invested also. Reverse Mortgages will serve to inject some funds into the economy and increase jobs, which helps to strengthen the nation's economy. And right now, India is the best destination to go for Reverse Mortgage, not only for Indians but even also for NRIs, as this important financial tool is the key to get all the facts to make

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Reverse Mortgage

Vol.1,Issue.X/April; 2012

an educated decision. Supporting to this, buying a home has so many advantages to the buyer. Apart from giving you the opportunity to house yourself and your family, the house you buy today depending on market development and your own ability to add value to what you have purchased, can be a huge income earner for you in future when you decide to sell. Conclusion: India has the potential for a significant market for reverse mortgage if its economy continues at its current pace of growth, leading to increase in prosperity, real estate prices, disposable incomes, life expectancy and decrease in fertility rates in the population. Reverse mortgage will be a useful tool for the house-rich, cash-poor elderly in India, as it will help them unlock all or part of their working-age savings for their old age needs without any debt or relocation burden. The senior citizens will definitely find reverse mortgage a solution for their financial needs after retirement and help them in regaining their feeling of independence. With the changing social milieu in India and the collapse of the joint family system, introduction of reverse mortgage products could be a worthwhile experiment. Instead of being dependent on their children for monetary support, this would be a good option for the elderly to continue with a graceful lifestyle. It can be concluded that the concept of reverse mortgage still in infancy stage in India. If designed properly and offered by an empathetic lender, reverse mortgage might turn out to be the vanguard product to build up brand equity for the lender in this niche segment. References: 1)www.charteredclub.com 2)Reverse Mortgage in India: Social Implications by Dr. V. Chandrashekhar 3)Reverse Mortgage Products for the Indian Market by R. Rajagopalan 4)Reverse Mortgage: Growing Market in India by Singhal, Saket & Jain, Amit 5)Reverse Mortgage in India: Your property pays you a regular income by Joseph Samson 6)Assessment of Reverse Mortgage Products in Indian Market by Gireesh Chandra Tripathi, IMT, Ghaziabad.

Please cite this Article as : Prof. Sachin Napate , Reverse Mortgage : Golden Research Thoughts (April ; 2012)

Vous aimerez peut-être aussi

- Mba CoursesDocument2 pagesMba CoursesOscar BasilPas encore d'évaluation

- 13-1007311919 Asif Chowdhury Bank SlipDocument1 page13-1007311919 Asif Chowdhury Bank SlipArthur SandersPas encore d'évaluation

- SAVAARI CAR RENTALS PVT LTD-Car Rentals Across IndiaDocument2 pagesSAVAARI CAR RENTALS PVT LTD-Car Rentals Across IndiaOscar BasilPas encore d'évaluation

- Oscar MBA Finance Main AssignmentDocument1 pageOscar MBA Finance Main AssignmentOscar BasilPas encore d'évaluation

- Excel Navigation, Functions, Pivot Tables, VBA & MacrosDocument3 pagesExcel Navigation, Functions, Pivot Tables, VBA & MacrosOscar BasilPas encore d'évaluation

- Devterra Careers Business AnalystDocument3 pagesDevterra Careers Business AnalystAnil SinghPas encore d'évaluation

- TransiitioDocument1 pageTransiitioOscar BasilPas encore d'évaluation

- CdoDocument2 pagesCdoOscar BasilPas encore d'évaluation

- 28 11Document1 page28 11Oscar BasilPas encore d'évaluation

- PrinciplesDocument1 pagePrinciplesOscar BasilPas encore d'évaluation

- Business Analyst in Banking Domain ResumeDocument6 pagesBusiness Analyst in Banking Domain ResumeOscar BasilPas encore d'évaluation

- What Is Organisational DiagnosisDocument4 pagesWhat Is Organisational DiagnosisAnu Bumra100% (1)

- CertificationsDocument1 pageCertificationsOscar BasilPas encore d'évaluation

- SDLC Is Software Development Life CycleDocument1 pageSDLC Is Software Development Life CycleOscar BasilPas encore d'évaluation

- SSC CGL 2013 Notification Downloaded FromDocument39 pagesSSC CGL 2013 Notification Downloaded FromSushant PatilPas encore d'évaluation

- Schools in CBEDocument10 pagesSchools in CBEOscar BasilPas encore d'évaluation

- Prince 2Document4 pagesPrince 2Oscar BasilPas encore d'évaluation

- Power Electronics Lab ManualDocument49 pagesPower Electronics Lab ManualNeelakanth BenakalPas encore d'évaluation

- Oscar - Deposit and Credit InsuranceDocument8 pagesOscar - Deposit and Credit InsuranceOscar BasilPas encore d'évaluation

- Abstract For Tech Xplore - Eric, Maharaja Engg CollegeDocument1 pageAbstract For Tech Xplore - Eric, Maharaja Engg CollegeOscar BasilPas encore d'évaluation

- E-Banking Application Form: Account DetailsDocument3 pagesE-Banking Application Form: Account DetailsOscar BasilPas encore d'évaluation

- BankerDocument1 pageBankerOscar BasilPas encore d'évaluation

- SSC CGL 2013 Notification Downloaded FromDocument39 pagesSSC CGL 2013 Notification Downloaded FromSushant PatilPas encore d'évaluation

- Birla Sun Life Insurance Co LTDDocument1 pageBirla Sun Life Insurance Co LTDOscar BasilPas encore d'évaluation

- Schools in CBEDocument10 pagesSchools in CBEOscar BasilPas encore d'évaluation

- Marketing CommunicationsDocument3 pagesMarketing CommunicationsOscar BasilPas encore d'évaluation

- Schools in CBEDocument10 pagesSchools in CBEOscar BasilPas encore d'évaluation

- SENSEX - 8000 Scrips: Company NameDocument5 pagesSENSEX - 8000 Scrips: Company NameOscar BasilPas encore d'évaluation

- AlbumDocument1 pageAlbumOscar BasilPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Krishna Grmeena BankDocument38 pagesKrishna Grmeena BankpawartejaPas encore d'évaluation

- BFN3164 Assignment1 ReportDocument16 pagesBFN3164 Assignment1 ReportIBNAT AKILA IBNAT AKILAPas encore d'évaluation

- LT BILL 49124180005 Jul14Document2 pagesLT BILL 49124180005 Jul14Suchismita SenPas encore d'évaluation

- Account2 BDocument20 pagesAccount2 BamitpriyashankarPas encore d'évaluation

- Full Sets For One Type of Harp / According To One String ChartDocument1 pageFull Sets For One Type of Harp / According To One String ChartklausPas encore d'évaluation

- 1695715127564J6rJ9PpG 646Document12 pages1695715127564J6rJ9PpG 646Ayush KumarPas encore d'évaluation

- DEPOSIT INSURANCE Handout PDFDocument13 pagesDEPOSIT INSURANCE Handout PDFAleric MondanoPas encore d'évaluation

- Metrobank Liable for Full Value of Check with Missing IndorsementDocument1 pageMetrobank Liable for Full Value of Check with Missing IndorsementJENNY BUTACANPas encore d'évaluation

- Axis Bank: India's 3rd Largest Private BankDocument5 pagesAxis Bank: India's 3rd Largest Private BankakshathPas encore d'évaluation

- Filed Visa Plaid Complaint 0Document23 pagesFiled Visa Plaid Complaint 0ForkLogPas encore d'évaluation

- Non Deposits Week 10 PDFDocument24 pagesNon Deposits Week 10 PDFCynthia KesumaPas encore d'évaluation

- Definiton.: V. Interest Rate Risk (IRR) of VietinbankDocument2 pagesDefiniton.: V. Interest Rate Risk (IRR) of VietinbankQuynh Ngoc DangPas encore d'évaluation

- Merged DocumentDocument93 pagesMerged DocumentsurekhaPas encore d'évaluation

- Composition of cash and petty cash fundsDocument7 pagesComposition of cash and petty cash fundsRyou ShinodaPas encore d'évaluation

- Article AssgnmentDocument27 pagesArticle AssgnmentNurul NadiaPas encore d'évaluation

- EEFCDocument8 pagesEEFCkalik goyalPas encore d'évaluation

- Intership ReportttttttDocument29 pagesIntership Reportttttttsehrish MalikPas encore d'évaluation

- Midxix Prestige Savings FormDocument2 pagesMidxix Prestige Savings FormKartik ShuklaPas encore d'évaluation

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoPas encore d'évaluation

- 03 Bank Reconcilation Answer KeyDocument6 pages03 Bank Reconcilation Answer Keywheein aegiPas encore d'évaluation

- Banco Filipino v. Navarro (Escalation Clause De-Escalation Clause Is Also NECESSARY)Document3 pagesBanco Filipino v. Navarro (Escalation Clause De-Escalation Clause Is Also NECESSARY)kjhenyo218502Pas encore d'évaluation

- Financial Markets and Institutions 6Th Edition: Powerpoint Slides ForDocument33 pagesFinancial Markets and Institutions 6Th Edition: Powerpoint Slides ForPratik PatelPas encore d'évaluation

- The 7 Cryptos That Will Reset The Financial System: Special ReportsDocument34 pagesThe 7 Cryptos That Will Reset The Financial System: Special ReportsJefferson Martins100% (1)

- Prepaid CreditDocument8 pagesPrepaid CreditJavier RojasPas encore d'évaluation

- HDFC Bank statement for Javed AliDocument3 pagesHDFC Bank statement for Javed AliNew NewPas encore d'évaluation

- AAMI Car Renewal Account MPA006039747Document2 pagesAAMI Car Renewal Account MPA006039747RichiePas encore d'évaluation

- HDFC Bank's Financial Performance During CovidDocument21 pagesHDFC Bank's Financial Performance During CovidSasi Samhitha KPas encore d'évaluation

- Companies Swap Rates to Match NeedsDocument4 pagesCompanies Swap Rates to Match NeedsHana LeePas encore d'évaluation

- CLD - BAO3404-Group Assignment 2021Document4 pagesCLD - BAO3404-Group Assignment 2021Shi MingPas encore d'évaluation

- New Microsoft Office Word DocumentDocument15 pagesNew Microsoft Office Word Documentabdulkhaderjeelani14Pas encore d'évaluation