Académique Documents

Professionnel Documents

Culture Documents

NIRI White Paper: Compensation and The IRO

Transféré par

National Investor Relations InstituteTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NIRI White Paper: Compensation and The IRO

Transféré par

National Investor Relations InstituteDroits d'auteur :

Formats disponibles

A NIRI White Paper

225 Reinekers Lane, Suite 560 Alexandria, VA 22314 (703) 562-7700 www.niri.org

Compensation and the Investor Relations Profession

By Ariel Finno, Director-Research (afinno@niri.org) Matt Brusch, Vice President-Communications and Practice Information

2013 National Investor Relations Institute

NIRI White Paper: Compensation and the Investor Relations Profession

NIRI-Korn/Ferry International Corporate IR Profession and Compensation Study Results

Presented here are key findings from NIRIs 2008, 2010 and 2012 NIRI-Korn/Ferry International Corporate IR Compensation and Profession Study research projects.

2008 Key Findings The largest segment (1/3) of respondents earn between $126,000 and $175,000 and over 95% receive a cash bonus, with a typical bonus target of under 50% of base salary. More than half of those surveyed receive stock options and more than half receive restricted stock/units as part of their compensation packages. The largest proportion of respondents (23%) has more than 12 years of experience. IR professionals in our survey most frequently report to the CFO. Over half of respondents have between five and fourteen sell-side analysts covering their companies.64% of NIRI respondents report providing earnings guidance compared to 51% in 2007 survey results and 66% in 2006.

In 2010, NIRI released NIRI-Korn/Ferry International Corporate Investor Relations Compensation Survey Results, which announced the results of its corporate member data on the subject.

2010 Key Findings Despite the dramatic economic downturn and resulting stock market volatility, average base salary ranges of corporate IR practitioners were essentially unchanged from the last survey (published in 2008), with the largest segment reporting a range of $126,000 - $150,000. IR budgets also remain virtually unchanged compared to the prior survey. A new data point in the survey revealed average respondent salary of $168,604 with a median of $156,000. Respondents reported base salaries in ranges from a low of $100,000 and below, to a high of $501,000 to $700,000. The downturn seems to have had its greatest IR compensation impact on cash bonus levels with a majority of respondents (65%) reporting a reduction in amount of bonus received, though other forms of compensation were not reduced for the majority. Eighty-six percent of those who were eligible to receive a bonus report receiving bonuses for 2009 compared to 82% in 2008.

NIRI again studied this subject in 2012 in order to assess the current state of compensation and the IR professional atmosphere and organizational structure, and to review developing trend information. In October 2012, NIRI released 2012 NIRI-Korn/Ferry International Corporate IR Profession and Compensation Study Results.

2012 Key Findings Average base salary ranges of corporate IR practitioners were higher than in the previous two studies (2010 and 2008); the largest segment reported a range of $175,000 - $200,000, an increase of $50,000 from the reported range in both 2010 and 2008. Median salary was $175,000 up from $156,000 in 2010. The percentage receiving a cash bonus increased to 82% from 71% in the 2010 survey.

2013 National Investor Relations Institute

21% of respondents reported a reduction in cash bonus received for the 2012 effort; these findings follow 65% reporting a reduction in the 2010 survey. Bonus target remained unchanged. 46% of respondents had a cash bonus range of 0-25% of their current base salary; for 28% the cash bonus range was 26-50%. 37% of respondents reported an organization total IR budget between $1,000,000 and $2,499,999. These data are in line with 2010 survey results. The majority (70%) of respondents report IR staff sizes remain unchanged for the last two years.

The Investor Relations Profession The overwhelming majority of respondents (96%) are currently employed in corporate IR. Of those that are not, about one-half were laid off from work in the field. Based on member interest, NIRI included a few questions to capture data regarding the circumstances for those not currently working in corporate IR. The data clearly reveals that the largest lay-offs occurred in the third quarter of 2009, and the first and fourth quarters of 2010. Most (80%) are actively looking for another IR position, 21% are doing contract IR work, and 15% have accepted another position in a related field. The most common professional title for survey respondents was Vice-President (35%), followed by Director (28%), and Manager (12%). To illustrate the complex nature of the position, 51% of respondents stated they have responsibilities in addition to IR. This data point has remained above the 50% since 2008 findings. Over three-fourths of those stated they had between one and four additional responsibilities, with the most common of these being external communications (52%), followed by financial media relations (49%). The least common additional responsibilities were Corporate Secretary (3%) and audit functions (2%). Seventeen percent of respondents indicated having five or more additional responsibilities separate from their IRO duties. Although salary was not found to be correlated with whether the IRO had Figure 8: Professional Background Field of the IRO by Year additional responsibilities, market cap-size, age, years of work experience, and employment by a Fortune 500 company were all correlated with having additional responsibilities. For example, 92% of micro-cap IROs had additional responsibilities, compared with 16% of their mega-cap counterparts. In terms of age, those reporting additional responsibilities peaked at 61% of respondents in their fifties or above. Thirty percent of IROs with less than one year of IR work experience had additional responsiblities, compared to 70% of those with 21 or more years work experience. Finally, continuing the trend since the 2008 survey, Fortune 500 respondents were less likely to have responsibilities in addition to IR (29%) than their non-Fortune 500 counterparts (67%). Since NIRIs 2008 compensation survey, the number of different industries IRO respondents have reported working in has remained constant, with the majority (80%+) of the populations having worked in two or more. The vast majority has never worked as sell-side or buy-side analysts, and this percentage remains unchanged since the preceding survey. Finally, over one-half plan to make IR their career

2013 National Investor Relations Institute

profession, approximately 25% look at their IR role as transitional, and almost one-quarter are undecided. These data points also remain largely unchanged since the 2008 effort. Concerning type of degree, the MBA continues to be the most common advanced educational attainment for respondent IROs, regardless of survey year. Advanced certifications, associates degrees, Series 7 (and other securities licenses), and other professional credentials are held by approximately 2% of IROs, and this percentage remains unchanged from prior years. IRO Workplace Environment One-half (50%) of participant IROs report to the CFO, and another one-fourth report to the Head (or VP) of IR. For 70% of respondents, IR staff size has remained unchanged since the 2010 effort. Ten percent of respondents are currently in an IR position which is considered rotational within their company. Almost one-fourth have IR staff level positions that are rotational. A new survey question item inquired about the current work environment. The overwhelming majority (92%) reported working full-time in their companys office, while another 6% telecommuted/worked remotely at least part of the week. Conclusion The 2012 NIRI-Korn/Ferry International Corporate IR Profession and Compensation Study sheds light on the behavior of companies emerging from the recent economic downturn, and provides IROs with a reason for optimism. For example, compared with 2010 data, which painted a picture of modest belttightening (most notably seen in cash bonuses), 2012 data reveals that median base salary and cash bonuses received are on the rise. In addition, IRO staff and budget sizes are holding steady, and it appears IROs have weathered the worst of the storm, as IR lay-offs are down in all quarters of 2011 when compared to the previous three years. The IR role continues to grow more complex as todays executives face increasingly varied professional challenges both internally and externally. Over one-half of respondents have responsibilities in addition to their IR duties. The vast majority of the population holds some type of advanced degree, certifications, licenses or other specialized education related to their field. These findings support the idea that the IR position and the IROs that hold them are valued for their expertise among the C-suite. Many variables affect both the base salary of IROs, as well as their equity and benefits compensation packages. To illustrate, for 2012 respondents, the median annual salary of an IRO with 11-15 years of work experience employed at a micro-cap company is $136,500, whereas the annual salary of an IRO with the same amount of experience at a mega-cap company is almost double that amount. Or, depending on geographic location and title, an IRO with the title of VP can have a median salary range between $196,000 and $230,000. More Information For complete survey results, please visit www.niri.org, or contact Ariel Finno, Director of Research, (703) 562-7678, afinno@niri.org. About the National Investor Relations Institute Founded in 1969, the National Investor Relations Institute (NIRI) is the professional association of corporate officers and investor relations consultants responsible for communication among corporate management, shareholders, securities analysts and other financial community constituents. The largest professional investor relations association in the world, NIRIs more than 3,300 members representing over 1,600 publicly held companies and $9 trillion in stock market capitalization.

2013 National Investor Relations Institute

Vous aimerez peut-être aussi

- 2010 Single-Family Compensation StudyD'Everand2010 Single-Family Compensation StudyPas encore d'évaluation

- 2012 Salary ReportDocument26 pages2012 Salary ReportKyle DalyPas encore d'évaluation

- 2013 SalaryreportDocument21 pages2013 SalaryreportgabrielocioPas encore d'évaluation

- How to Recruit, Hire and Retain Great PeopleD'EverandHow to Recruit, Hire and Retain Great PeoplePas encore d'évaluation

- PMO Survey Report2012 AUSDocument32 pagesPMO Survey Report2012 AUSSofia ShimokawaPas encore d'évaluation

- CPO AccentureDocument20 pagesCPO Accenturenilanjan1969100% (1)

- ClearanceJobs' Security Clearance Compensation 2013Document13 pagesClearanceJobs' Security Clearance Compensation 2013Tom BeaulieuPas encore d'évaluation

- CIPR State of The Profession Bench Marking SurveyDocument31 pagesCIPR State of The Profession Bench Marking SurveyShahid AbbasiPas encore d'évaluation

- 18 - Chapter 10 Overview of CSR SurveysDocument25 pages18 - Chapter 10 Overview of CSR SurveysShifali ShettyPas encore d'évaluation

- Revised Chapter 1Document20 pagesRevised Chapter 1Mikie AbrigoPas encore d'évaluation

- Employee Views of Leveraged Buy-Out Transactions - 2021Document65 pagesEmployee Views of Leveraged Buy-Out Transactions - 2021Manal AFconsultingPas encore d'évaluation

- 2011 Cfo Comp SurveyDocument31 pages2011 Cfo Comp SurveysinarahimiPas encore d'évaluation

- Major Findings - United States: 2005 Investment Management Compensation SurveyDocument30 pagesMajor Findings - United States: 2005 Investment Management Compensation SurveyAnuj GuptaPas encore d'évaluation

- Global Report FMCG Sector 2014Document20 pagesGlobal Report FMCG Sector 2014Mabel TanPas encore d'évaluation

- 2012 Industry Profiles and Adviser Opinions: Results From AnDocument7 pages2012 Industry Profiles and Adviser Opinions: Results From Anmbruno8143Pas encore d'évaluation

- New Case StudiesDocument38 pagesNew Case StudiesSammir MalhotraPas encore d'évaluation

- Light Reading Salary Survey 2010Document11 pagesLight Reading Salary Survey 2010Dilip GulatiPas encore d'évaluation

- Executive SummaryDocument26 pagesExecutive SummaryayeshaaqueelPas encore d'évaluation

- 2014 Investment Management Fee Survey: U.S. Institutional Fund Sponsors and Investment ManagersDocument56 pages2014 Investment Management Fee Survey: U.S. Institutional Fund Sponsors and Investment ManagersCallan100% (2)

- Assessing Employee Turnover - FINALDocument5 pagesAssessing Employee Turnover - FINALShida WaniPas encore d'évaluation

- W Mba C M: Highlights Overall Salary DataDocument9 pagesW Mba C M: Highlights Overall Salary DatavinodPas encore d'évaluation

- SR Z Shareholder Activism 2012Document20 pagesSR Z Shareholder Activism 2012BCM PartnersPas encore d'évaluation

- Literature Review On Attrition in BpoDocument7 pagesLiterature Review On Attrition in Bpoc5pgcqzv100% (1)

- European Corporate Security Salary Survey 2008Document2 pagesEuropean Corporate Security Salary Survey 2008AlvinMatabangPas encore d'évaluation

- The Negative Effect and Consequences of Employee Turnover and Retention On The Organization and Its StaffDocument15 pagesThe Negative Effect and Consequences of Employee Turnover and Retention On The Organization and Its StaffAlexander DeckerPas encore d'évaluation

- 2011 It Skills and Salary Report: A Comprehensive Survey From Global Knowledge and TechrepublicDocument22 pages2011 It Skills and Salary Report: A Comprehensive Survey From Global Knowledge and TechrepublicSaileshResumePas encore d'évaluation

- Factors That Determine Dividend Payout. Evidence From The Financial Service Sector in South AfricaDocument9 pagesFactors That Determine Dividend Payout. Evidence From The Financial Service Sector in South AfricaNanditaPas encore d'évaluation

- 2012 Government Management ReportDocument65 pages2012 Government Management ReportFedScoopPas encore d'évaluation

- Forecasting Best Practices For Common ChalengesDocument26 pagesForecasting Best Practices For Common ChalengesacsgonzalesPas encore d'évaluation

- 2011 Global State of Information Security Survey-ReportDocument58 pages2011 Global State of Information Security Survey-ReportDan SoraPas encore d'évaluation

- Us Cons Total Rewards SurveyDocument54 pagesUs Cons Total Rewards SurveysugandhaPas encore d'évaluation

- How Do CFOs mak-WPS OfficeDocument12 pagesHow Do CFOs mak-WPS OfficeLaiqaPas encore d'évaluation

- Capital StructureDocument16 pagesCapital StructureankitakumPas encore d'évaluation

- Literature Review For Impact of Mergers & Acquisitions On: Human Resource Practices in IT IndustryDocument15 pagesLiterature Review For Impact of Mergers & Acquisitions On: Human Resource Practices in IT Industryasmita_matrix1983Pas encore d'évaluation

- Summary of Findings, Suggestions and ConclusionsDocument28 pagesSummary of Findings, Suggestions and ConclusionsSinghania AbhishekPas encore d'évaluation

- Financial Analysis Dissertation PDFDocument8 pagesFinancial Analysis Dissertation PDFProfessionalCollegePaperWritersUK100% (1)

- Startup OutlookDocument16 pagesStartup Outlookapi-26305678Pas encore d'évaluation

- 2022人才市场分析报告 2022 State of Staffing - 20220727194855Document59 pages2022人才市场分析报告 2022 State of Staffing - 20220727194855ryanPas encore d'évaluation

- Chandler Macleod Technology IT Industry Insights 2011Document11 pagesChandler Macleod Technology IT Industry Insights 2011cbruneton1Pas encore d'évaluation

- Survey On Corporate Investment Practices in NepalDocument12 pagesSurvey On Corporate Investment Practices in NepalkapildebPas encore d'évaluation

- UAE - PQ Salary Survey 2010Document12 pagesUAE - PQ Salary Survey 2010Mohamed Zahid محمد زاهدPas encore d'évaluation

- Finance Dissertation Report PDFDocument5 pagesFinance Dissertation Report PDFOrderCustomPaperUK100% (1)

- ATA - Translation and Interpreting Compensation Survey 2006 (Summary)Document4 pagesATA - Translation and Interpreting Compensation Survey 2006 (Summary)SebasthosPas encore d'évaluation

- IAOP Outsourcing 2010 ReportDocument7 pagesIAOP Outsourcing 2010 Reportskn_scribdPas encore d'évaluation

- Hemanth - Aviva Insurance - Covid 19 StrategiesDocument78 pagesHemanth - Aviva Insurance - Covid 19 Strategiesmadhu.j644313Pas encore d'évaluation

- 10 2014 MCF Rewards and Recognition Trends ReportDocument7 pages10 2014 MCF Rewards and Recognition Trends ReportgenerationpoetPas encore d'évaluation

- Mid-Market Perspectives America's Economic Engine - Competing in Uncertain TimesDocument40 pagesMid-Market Perspectives America's Economic Engine - Competing in Uncertain TimesDeloitte Analytics100% (1)

- The Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsDocument15 pagesThe Relationship Between Dividend Payout and Financial Performance: Evidence From Top40 JSE FirmsLouise Barik- بريطانية مغربيةPas encore d'évaluation

- Is Hybrid Working?Document36 pagesIs Hybrid Working?FDAunion100% (1)

- India HR and Recruiting Issues Update - : Labor Market OverviewDocument37 pagesIndia HR and Recruiting Issues Update - : Labor Market OverviewKiran ChavanPas encore d'évaluation

- Comparative Analysis On The Factors Affecting Employee Turnover Between Supervisors and Frontline Employees in The Bpo IndustryDocument6 pagesComparative Analysis On The Factors Affecting Employee Turnover Between Supervisors and Frontline Employees in The Bpo IndustryIJARP PublicationsPas encore d'évaluation

- BpoDocument10 pagesBpodeepikab_21Pas encore d'évaluation

- SG Market Trends Report 2013Document24 pagesSG Market Trends Report 2013Puteri Nora DanishPas encore d'évaluation

- Retention BpoDocument22 pagesRetention BpoJomarie Emiliano100% (1)

- Attrition in InfosysDocument3 pagesAttrition in InfosysANIMESH SABHARWALPas encore d'évaluation

- Disclosure and Employee WagesDocument43 pagesDisclosure and Employee WagesRyanPas encore d'évaluation

- Group Report CRSEDocument9 pagesGroup Report CRSEaashish acharyaPas encore d'évaluation

- AttritionDocument43 pagesAttritionswarnasharma100% (1)

- Measuring Road Roughness by Static Level Method: Standard Test Method ForDocument6 pagesMeasuring Road Roughness by Static Level Method: Standard Test Method ForDannyChaconPas encore d'évaluation

- Dynamic Study of Parabolic Cylindrical Shell A Parametric StudyDocument4 pagesDynamic Study of Parabolic Cylindrical Shell A Parametric StudyEditor IJTSRDPas encore d'évaluation

- BSNL BillDocument3 pagesBSNL BillKaushik GurunathanPas encore d'évaluation

- Lecture 19 Code Standards and ReviewDocument27 pagesLecture 19 Code Standards and ReviewAdhil Ashik vPas encore d'évaluation

- Not CE 2015 Version R Series 1t-3.5t Operating Manua 2015-08Document151 pagesNot CE 2015 Version R Series 1t-3.5t Operating Manua 2015-08hocine gherbiPas encore d'évaluation

- Unit 1 Bearer PlantsDocument2 pagesUnit 1 Bearer PlantsEmzPas encore d'évaluation

- E Voting PPT - 1Document11 pagesE Voting PPT - 1madhu100% (2)

- Intro To MavenDocument18 pagesIntro To MavenDaniel ReckerthPas encore d'évaluation

- Stratum CorneumDocument4 pagesStratum CorneumMuh Firdaus Ar-RappanyPas encore d'évaluation

- Microsoft Powerpoint BasicsDocument20 pagesMicrosoft Powerpoint BasicsJonathan LocsinPas encore d'évaluation

- Documentos de ExportaçãoDocument17 pagesDocumentos de ExportaçãoZinePas encore d'évaluation

- Sage TutorialDocument115 pagesSage TutorialChhakuli GiriPas encore d'évaluation

- PCM Cables: What Is PCM Cable? Why PCM Cables? Application?Document14 pagesPCM Cables: What Is PCM Cable? Why PCM Cables? Application?sidd_mgrPas encore d'évaluation

- Acceptable Use Policy 08 19 13 Tia HadleyDocument2 pagesAcceptable Use Policy 08 19 13 Tia Hadleyapi-238178689Pas encore d'évaluation

- A. Computed Only For A 2x2 Table B. 0 Cells (,0%) Have Expected Count Less Than 5. The Minimum Expected Count Is 3,40Document1 pageA. Computed Only For A 2x2 Table B. 0 Cells (,0%) Have Expected Count Less Than 5. The Minimum Expected Count Is 3,40harvey777Pas encore d'évaluation

- Power System Protection (Vol 3 - Application) PDFDocument479 pagesPower System Protection (Vol 3 - Application) PDFAdetunji TaiwoPas encore d'évaluation

- Unit-Ii Syllabus: Basic Elements in Solid Waste ManagementDocument14 pagesUnit-Ii Syllabus: Basic Elements in Solid Waste ManagementChaitanya KadambalaPas encore d'évaluation

- QAU TTS Form Annual AssessmentDocument6 pagesQAU TTS Form Annual AssessmentsohaibtarikPas encore d'évaluation

- Springs: All India Distributer of NienhuisDocument35 pagesSprings: All India Distributer of NienhuisIrina DroliaPas encore d'évaluation

- Req Equip Material Devlopment Power SectorDocument57 pagesReq Equip Material Devlopment Power Sectorayadav_196953Pas encore d'évaluation

- Corelink Mmu600ae TRM 101412 0100 00 enDocument194 pagesCorelink Mmu600ae TRM 101412 0100 00 enLv DanielPas encore d'évaluation

- DHA - Jebel Ali Emergency Centre + RevisedDocument5 pagesDHA - Jebel Ali Emergency Centre + RevisedJam EsPas encore d'évaluation

- Kortz Center GTA Wiki FandomDocument1 pageKortz Center GTA Wiki FandomsamPas encore d'évaluation

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- Chapter1 Intro To Basic FinanceDocument28 pagesChapter1 Intro To Basic FinanceRazel GopezPas encore d'évaluation

- ABBindustrialdrives Modules en RevBDocument2 pagesABBindustrialdrives Modules en RevBMaitry ShahPas encore d'évaluation

- Writ Petition 21992 of 2019 FinalDocument22 pagesWrit Petition 21992 of 2019 FinalNANDANI kumariPas encore d'évaluation

- Tax Havens IMF PDFDocument59 pagesTax Havens IMF PDFClassic PhyXPas encore d'évaluation

- Ty Baf TaxationDocument4 pagesTy Baf TaxationAkki GalaPas encore d'évaluation

- Linux ProgramDocument131 pagesLinux ProgramsivashaPas encore d'évaluation

- The Tragic Mind: Fear, Fate, and the Burden of PowerD'EverandThe Tragic Mind: Fear, Fate, and the Burden of PowerÉvaluation : 4 sur 5 étoiles4/5 (14)

- From Cold War To Hot Peace: An American Ambassador in Putin's RussiaD'EverandFrom Cold War To Hot Peace: An American Ambassador in Putin's RussiaÉvaluation : 4 sur 5 étoiles4/5 (23)

- How States Think: The Rationality of Foreign PolicyD'EverandHow States Think: The Rationality of Foreign PolicyÉvaluation : 5 sur 5 étoiles5/5 (7)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Cry from the Deep: The Sinking of the KurskD'EverandCry from the Deep: The Sinking of the KurskÉvaluation : 3.5 sur 5 étoiles3.5/5 (6)

- Reagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarD'EverandReagan at Reykjavik: Forty-Eight Hours That Ended the Cold WarÉvaluation : 4 sur 5 étoiles4/5 (4)

- The Economic Weapon: The Rise of Sanctions as a Tool of Modern WarD'EverandThe Economic Weapon: The Rise of Sanctions as a Tool of Modern WarÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- The Prize: The Epic Quest for Oil, Money, and PowerD'EverandThe Prize: The Epic Quest for Oil, Money, and PowerÉvaluation : 4 sur 5 étoiles4/5 (47)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- International Relations: A Very Short IntroductionD'EverandInternational Relations: A Very Short IntroductionÉvaluation : 5 sur 5 étoiles5/5 (5)

- New Cold Wars: China’s rise, Russia’s invasion, and America’s struggle to defend the WestD'EverandNew Cold Wars: China’s rise, Russia’s invasion, and America’s struggle to defend the WestPas encore d'évaluation

- Never Give an Inch: Fighting for the America I LoveD'EverandNever Give an Inch: Fighting for the America I LoveÉvaluation : 4 sur 5 étoiles4/5 (10)

- Human Intelligence Collector OperationsD'EverandHuman Intelligence Collector OperationsPas encore d'évaluation

- The Bomb: Presidents, Generals, and the Secret History of Nuclear WarD'EverandThe Bomb: Presidents, Generals, and the Secret History of Nuclear WarÉvaluation : 4.5 sur 5 étoiles4.5/5 (41)

- Summary: The End of the World Is Just the Beginning: Mapping the Collapse of Globalization By Peter Zeihan: Key Takeaways, Summary & AnalysisD'EverandSummary: The End of the World Is Just the Beginning: Mapping the Collapse of Globalization By Peter Zeihan: Key Takeaways, Summary & AnalysisÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- The Israel Lobby and U.S. Foreign PolicyD'EverandThe Israel Lobby and U.S. Foreign PolicyÉvaluation : 4 sur 5 étoiles4/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Can We Talk About Israel?: A Guide for the Curious, Confused, and ConflictedD'EverandCan We Talk About Israel?: A Guide for the Curious, Confused, and ConflictedÉvaluation : 5 sur 5 étoiles5/5 (5)

- The Generals Have No Clothes: The Untold Story of Our Endless WarsD'EverandThe Generals Have No Clothes: The Untold Story of Our Endless WarsÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Conflict: The Evolution of Warfare from 1945 to UkraineD'EverandConflict: The Evolution of Warfare from 1945 to UkraineÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

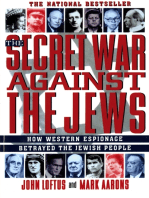

- The Secret War Against the Jews: How Western Espionage Betrayed The Jewish PeopleD'EverandThe Secret War Against the Jews: How Western Espionage Betrayed The Jewish PeopleÉvaluation : 2.5 sur 5 étoiles2.5/5 (8)