Académique Documents

Professionnel Documents

Culture Documents

Instructions For Schedule B (Form 941) : (Rev. June 2011)

Transféré par

sakkioDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Instructions For Schedule B (Form 941) : (Rev. June 2011)

Transféré par

sakkioDroits d'auteur :

Formats disponibles

Instructions for Schedule B (Form 941)

(Rev. June 2011)

Report of Tax Liability for Semiweekly Schedule Depositors

Section references are to the Internal Revenue Code unless otherwise noted.

Department of the Treasury Internal Revenue Service

Who Must File?

File Schedule B (Form 941) if you are a semiweekly schedule depositor. You are a semiweekly depositor if you reported more than $50,000 of employment taxes in the lookback period or accumulated a tax liability of $100,000 or more on any given day in the current or prior calendar year. See section 11 of Pub. 15 (Circular E) for more information.

Reminders

Reporting prior period adjustments. Prior period adjustments are reported on Form 941-X, Amended Employers QUARTERLY Federal Tax Return or Claim for Refund, and are not taken into account when figuring the tax liability for the current quarter. When you file Schedule B (Form 941) with your Form 941 (or Form 941-SS), do not change your tax liability by adjustments reported on any Form 941-X. Amended Schedule B. If you have been assessed a failure-to-deposit (FTD) penalty, you may be able to file an amended Schedule B (Form 941). See Amending a Previously Filed Schedule B (Form 941) on page 2.

CAUTION

Do not complete Schedule B (Form 941) if you have a tax liability that is less than $2,500 during the quarter.

When Must You File?

Schedule B (Form 941) is filed with Form 941, Employers QUARTERLY Federal Tax Return, or Form 941-SS, Employers QUARTERLY Federal Tax Return (American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands). File Schedule B (Form 941) with your Form 941 or Form 941-SS every quarter when Form 941 or Form 941-SS is due. Do not file Schedule B (Form 941) as an attachment to Form 944, Employers ANNUAL Federal Tax Return, or Form 944-SS, Employers ANNUAL Federal Tax Return (American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands). Instead, if required to file a report of tax liability with either of these forms, use Form 945-A, Annual Record of Federal Tax Liability.

General Instructions

Purpose of Schedule B (Form 941)

These instructions tell you about Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors. To determine if you are a semiweekly depositor, visit IRS.gov and type semiweekly depositor in the search box. Also see Pub. 15 (Circular E), Employers Tax Guide, or Pub. 80 (Circular SS), Federal Tax Guide for Employers in the U.S. Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands. Federal law requires you, as an employer, to withhold taxes from your employees paychecks. Each time you pay wages, you must withhold or take out of your employees paychecks certain amounts for federal income tax, social security tax, and Medicare tax (payroll taxes). Under the withholding system, taxes withheld from your employees are credited to your employees in payment of their tax liabilities. Federal law also requires employers to pay any liability for the employers portion of social security and Medicare taxes. This portion of social security and Medicare taxes is not withheld from employees. On Schedule B (Form 941), list your tax liability for each day. Your liability includes: The federal income tax you withheld from your employees paychecks, and Both employee and employer social security and Medicare taxes. Do not use the Schedule B (Form 941) to show federal tax deposits. The IRS gets deposit data from electronic funds transfers. The IRS uses Schedule B (Form 941) to determine if you have deposited your federal employment tax CAUTION liabilities on time. If you do not properly complete and file your Schedule B (Form 941) with Form 941 or Form 941-SS, the IRS may propose an averaged failure-to-deposit penalty. See Deposit Penalties in section 11 of Pub. 15 (Circular E) for more information.

Specific Instructions

Completing Schedule B (Form 941)

Enter Your Business Information

Carefully enter your employer identification number (EIN) and name at the top of the schedule. Make sure that they exactly match the name of your business and the EIN that the IRS assigned to your business and also agree with the name and EIN shown on the attached Form 941 or Form 941-SS.

Calendar Year

Enter the calendar year that applies to the quarter checked.

Check the Box for the Quarter

Under Report for this Quarter at the top of Schedule B (Form 941), check the appropriate box of the quarter for which you are filing this schedule. Make sure the quarter checked on the top of the Schedule B (Form 941) matches the quarter checked on your Form 941 or Form 941-SS.

Enter Your Tax Liability by Month

Schedule B (Form 941) is divided into the 3 months that make up a quarter of a year. Each month has 31 numbered spaces that correspond to the dates of a typical month. Enter your tax liabilities in the spaces that correspond to the dates you paid wages to your employees, not the date payroll deposits were made. For example, if your payroll period ended on December 31, 2010, and you paid the wages for that period on January 6, 2011, you would: Go to Month 1 (because January is the first month of the quarter), and

Jul 08, 2011

Cat. No. 38683X

Enter your tax liability on line 6 (because line 6 represents

the sixth day of the month). Make sure you have checked the appropriate box in TIP Part 2 of Form 941 or Form 941-SS to show that you are a semiweekly schedule depositor.

Total Liability for the Quarter

To find your total liability for the quarter, add your monthly tax liabilities.

Tax Liability for Month 1 +Tax Liability for Month 2 +Tax Liability for Month 3 Total Liability for the Quarter Your total liability for the quarter must equal line 10 on Form 941 or Form 941-SS.

$3,000 liability on day 1 of month 3. Also, you must enter the liabilities previously reported for the quarter that did not change. Write Amended at the top of Schedule B (Form 941). The IRS will refigure the penalty and notify you of any change in the penalty. Monthly schedule depositors. You can also file an amended Schedule B (Form 941) if you have been assessed an FTD penalty for a quarter and you made an error on the monthly tax liability section of Form 941. When completing Schedule B (Form 941), only enter the monthly totals. The daily entries are not required. Where to file. File your amended Schedule B at the address provided in the penalty notice you received. You do not have to submit your original Schedule B (Form 941).

Form 941-X

Tax decrease. If you are filing Form 941-X for a quarter, you can file an amended Schedule B (Form 941) with Form 941-X if both of the following apply. 1. You have a tax decrease. 2. You were assessed an FTD penalty. File your amended Schedule B (Form 941) with Form 941-X. The total liability for the quarter reported on your corrected Schedule B (Form 941) must equal the corrected amount of tax reported on Form 941-X. If your penalty is decreased, the IRS will include the penalty decrease with your tax decrease. Tax increase Form 941-X filed timely. If you are filing a timely Form 941-X, do not file an amended Schedule B (Form 941), unless you were assessed an FTD penalty caused by an incorrect, incomplete, or missing Schedule B (Form 941). If you are filing an amended Schedule B (Form 941), do not include the tax increase reported on Form 941-X. Tax increase Form 941-X filed late. If you owe tax and are filing a late Form 941-X, that is, after the due date of the return for the filing period of the Form 941 in which you discovered the error, you must file an amended Schedule B (Form 941) with Form 941-X. Otherwise, the IRS may assess an averaged FTD penalty. The total tax reported on the Total liability for the quarter line of the amended Schedule B (Form 941) must match the corrected tax (line 10 of Form 941 combined with any correction reported on line 21 of Form 941-X for the quarter), less any previous abatements and interest-free adjustments. Paperwork Reduction Act Notice. We ask for the information on Schedule B (Form 941) to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The time needed to complete and file Schedule B (Form 941) will vary depending on individual circumstances. The estimated average time is 2 hours, 53 minutes. If you have comments concerning the accuracy of this time estimate or suggestions for making Schedule B (Form 941) simpler, we would be happy to hear from you. You can email us at: taxforms@irs.gov. Enter Schedule B (Form 941) on the subject line. Or write to: Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send Schedule B (Form 941) to this address. Instead, see Where Should You File? in the Form 941 or Form 941-SS instructions.

Example 1. Employer A is a semiweekly schedule depositor who pays wages for each month on the last day of the month. On December 22, 2010, Employer A also paid its employees year-end bonuses (subject to employment taxes). Employer A must report employment tax liabilities on Schedule B (Form 941) for the 4th quarter (October, November, December), as follows.

Month 1 (October) 2 (November) 3 (December) 3 (December) Lines for dates wages were paid line 31 (pay day, last day of the month) line 30 (pay day, last day of the month) line 22 (bonus paid December 22, 2010) line 31 (pay day, last day of the month)

Example 2. Employer B is a semiweekly schedule depositor who pays employees every other Friday. Employer B accumulated a $20,000 employment tax liability on each of these pay dates: 1/14/11, 1/28/11, 2/11/11, 2/25/11, 3/11/11, and 3/25/11. Employer B must report employment tax liabilities on Schedule B (Form 941) as follows.

Month 1 (January) 2 (February) 3 (March) Lines for dates wages were paid lines 14 and 28 lines 11 and 25 lines 11 and 25

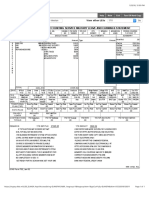

Example 3. Employer C is a new business and monthly schedule depositor for 2011. Employer C pays wages every Friday and has accumulated a $2,000 employment tax liability on 1/14/11 and a $110,000 employment tax liability on 1/21/11 and on every subsequent Friday during 2011. Under the deposit rules, employers become semiweekly schedule depositors on the day after any day they accumulate $100,000 or more of employment tax liability in a deposit period. Employer C became a semiweekly schedule depositor on 1/22/11, because Employer C had a total accumulated employment tax liability of $112,000 on 1/21/11. For more information, see section 11 of Pub. 15 (Circular E) or section 8 of Pub. 80 (Circular SS). Employer C must complete Schedule B (Form 941) as shown below and file it with Form 941 or 941-SS.

Month 1 (January) 1 (January) 2 (February) 3 (March) Lines for dates wages were paid line 14 lines 21, 28 lines 4, 11, 18, 25 lines 4, 11, 18, 25 Amount to report $2,000 $110,000 $110,000 $110,000

Amending a Previously Filed Schedule B (Form 941)

Semiweekly schedule depositors. If you have been assessed a failure-to-deposit (FTD) penalty for a quarter and you made an error on Schedule B (Form 941) and the correction will not change the total liability for the quarter you reported on Schedule B (Form 941), you may be able to reduce your penalty by filing a corrected Schedule B (Form 941). Example. You reported a liability of $3,000 on day 1 of month 1. However, the liability was actually for month 3. Prepare an amended Schedule B (Form 941) showing the

-2-

Vous aimerez peut-être aussi

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterTony MillerPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyPas encore d'évaluation

- F 941 SsDocument4 pagesF 941 SsBilboDBagginsPas encore d'évaluation

- ACC 105 Lesson 4 Assignment 1 3-11bDocument4 pagesACC 105 Lesson 4 Assignment 1 3-11bJennifer BaileyPas encore d'évaluation

- Annual Record of Federal Tax Liability: January Tax Liability February Tax Liability March Tax LiabilityDocument3 pagesAnnual Record of Federal Tax Liability: January Tax Liability February Tax Liability March Tax LiabilityFrancis Wolfgang UrbanPas encore d'évaluation

- Payroll Accounting 2014 Form1040 Ch4Document4 pagesPayroll Accounting 2014 Form1040 Ch4DanCoppePas encore d'évaluation

- US Internal Revenue Service: I941 - 2000Document4 pagesUS Internal Revenue Service: I941 - 2000IRSPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterDocument4 pagesEmployer's QUARTERLY Federal Tax Return: Part 1: Answer These Questions For This QuarterFrancis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: I941 - 2002Document4 pagesUS Internal Revenue Service: I941 - 2002IRSPas encore d'évaluation

- 941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnDocument4 pages941-SS For 2010:: Employer's QUARTERLY Federal Tax ReturnFrancis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: I941ss - 2005Document6 pagesUS Internal Revenue Service: I941ss - 2005IRSPas encore d'évaluation

- Annual Record of Federal Tax Liability: January Tax Liability February Tax Liability March Tax LiabilityDocument4 pagesAnnual Record of Federal Tax Liability: January Tax Liability February Tax Liability March Tax LiabilityBilboDBagginsPas encore d'évaluation

- US Internal Revenue Service: I941 - 2003Document4 pagesUS Internal Revenue Service: I941 - 2003IRSPas encore d'évaluation

- Schedule R (Form 941)Document3 pagesSchedule R (Form 941)Francis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: I941 - 2004Document4 pagesUS Internal Revenue Service: I941 - 2004IRSPas encore d'évaluation

- US Internal Revenue Service: I941Document8 pagesUS Internal Revenue Service: I941IRSPas encore d'évaluation

- Schedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsDocument2 pagesSchedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsFrancis Wolfgang UrbanPas encore d'évaluation

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelPas encore d'évaluation

- Schedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsDocument2 pagesSchedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsBilboDBagginsPas encore d'évaluation

- Instructions For Form 941: (Rev. January 2011)Document9 pagesInstructions For Form 941: (Rev. January 2011)Ten TendulkarPas encore d'évaluation

- US Internal Revenue Service: I941mDocument4 pagesUS Internal Revenue Service: I941mIRSPas encore d'évaluation

- Instructions For Schedule D (Form 941) : (Rev. June 2011)Document4 pagesInstructions For Schedule D (Form 941) : (Rev. June 2011)Josh JasperPas encore d'évaluation

- Schedule R (Form 940) : Allocation Schedule For Aggregate Form 940 FilersDocument3 pagesSchedule R (Form 940) : Allocation Schedule For Aggregate Form 940 FilerspdizypdizyPas encore d'évaluation

- Tax ReturnDocument18 pagesTax ReturnJoachim NosikPas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamPas encore d'évaluation

- Form 941X-745287Document7 pagesForm 941X-745287Catori-Dakoda Eil100% (1)

- Instructions For Form 941: (Rev. July 2020)Document20 pagesInstructions For Form 941: (Rev. July 2020)Kugilan BalakrishnanPas encore d'évaluation

- Adjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundDocument4 pagesAdjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundFrancis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: I941ss - 2006Document6 pagesUS Internal Revenue Service: I941ss - 2006IRSPas encore d'évaluation

- Schedule B (Form 941) :: Report of Tax Liability For Semiweekly Schedule DepositorsDocument1 pageSchedule B (Form 941) :: Report of Tax Liability For Semiweekly Schedule DepositorsTihui SorianoPas encore d'évaluation

- Instructions For Schedule R (Form 941) : (Rev. June 2021)Document3 pagesInstructions For Schedule R (Form 941) : (Rev. June 2021)Josh JasperPas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiPas encore d'évaluation

- Instructions For Form 940: Internal Revenue ServiceDocument4 pagesInstructions For Form 940: Internal Revenue ServiceIRSPas encore d'évaluation

- Adjusted Annual Return of Withheld Federal Income Tax or Claim For RefundDocument2 pagesAdjusted Annual Return of Withheld Federal Income Tax or Claim For RefundBilboDBagginsPas encore d'évaluation

- E211 Income Taxes - Provision To Return PolicyDocument4 pagesE211 Income Taxes - Provision To Return PolicyRY NaPas encore d'évaluation

- Instructions For Form 940: Internal Revenue ServiceDocument4 pagesInstructions For Form 940: Internal Revenue ServiceIRSPas encore d'évaluation

- Notice To Employee Instructions For Employee: (Continued From The Back of Copy B.)Document1 pageNotice To Employee Instructions For Employee: (Continued From The Back of Copy B.)redditor1276Pas encore d'évaluation

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSPas encore d'évaluation

- Employer's Annual Federal Tax Return For Agricultural EmployeesDocument2 pagesEmployer's Annual Federal Tax Return For Agricultural EmployeespdizypdizyPas encore d'évaluation

- Fuel Charge Return For Fuel Held in A Listed Province On Adjustment DayDocument4 pagesFuel Charge Return For Fuel Held in A Listed Province On Adjustment DayBryan WilleyPas encore d'évaluation

- (Circular E), Employer's Tax Guide: Pager/SgmlDocument73 pages(Circular E), Employer's Tax Guide: Pager/SgmlthecodekingPas encore d'évaluation

- Adjusted Annual Return of Withheld Federal Income Tax or Claim For RefundDocument2 pagesAdjusted Annual Return of Withheld Federal Income Tax or Claim For RefundFrancis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: F1040es - 1997Document7 pagesUS Internal Revenue Service: F1040es - 1997IRSPas encore d'évaluation

- W2 InstructionsDocument3 pagesW2 Instructionswarriorsinrecoveryalex.rPas encore d'évaluation

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- F 843Document1 pageF 843Manjula.bsPas encore d'évaluation

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrancis Wolfgang UrbanPas encore d'évaluation

- US Internal Revenue Service: F1040esn - 1995Document4 pagesUS Internal Revenue Service: F1040esn - 1995IRSPas encore d'évaluation

- 1040 Exam Prep: Module II - Basic Tax ConceptsD'Everand1040 Exam Prep: Module II - Basic Tax ConceptsÉvaluation : 1.5 sur 5 étoiles1.5/5 (2)

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyPas encore d'évaluation

- Notice To Employee Instructions For Employee: WWW - SSA.govDocument1 pageNotice To Employee Instructions For Employee: WWW - SSA.govPiyush AgrawalPas encore d'évaluation

- Directorate of Income Tax 20 SepDocument4 pagesDirectorate of Income Tax 20 SepOmkar KhanapurePas encore d'évaluation

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns Onlinepdizypdizy0% (1)

- Tax Com Review Program - Expanded Withholding Tax Program.v.2018 082018Document7 pagesTax Com Review Program - Expanded Withholding Tax Program.v.2018 082018bulasa.jefferson16Pas encore d'évaluation

- Processing 1099 in PayablesDocument15 pagesProcessing 1099 in PayablesKotesh Kumar100% (2)

- Instructions For Form 944-SS: Pager/SgmlDocument7 pagesInstructions For Form 944-SS: Pager/SgmlIRSPas encore d'évaluation

- US Internal Revenue Service: F1040esn - 1996Document5 pagesUS Internal Revenue Service: F1040esn - 1996IRSPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsD'Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsPas encore d'évaluation

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507Pas encore d'évaluation

- IRS Publication 5187Document21 pagesIRS Publication 5187Zenger NewsPas encore d'évaluation

- 2008 Tax Table Form 1040NR H1B F1 J1 Visa TaxesDocument12 pages2008 Tax Table Form 1040NR H1B F1 J1 Visa TaxesNon Resident Tax Expert100% (2)

- Patricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Document16 pagesPatricia Gonzalez Naranjo XXX XX 9179 2021 01-15-091525Maria Valentina Neira GonzalezPas encore d'évaluation

- Blank 4506TDocument2 pagesBlank 4506TRoger PeiPas encore d'évaluation

- Steve Jackson Age 51 Is A Single Taxpayer Living at PDFDocument1 pageSteve Jackson Age 51 Is A Single Taxpayer Living at PDFLet's Talk With HassanPas encore d'évaluation

- Sa Lesson13Document1 pageSa Lesson13api-263754616Pas encore d'évaluation

- IVES Request For Transcript of Tax Return: First)Document2 pagesIVES Request For Transcript of Tax Return: First)GlendaPas encore d'évaluation

- Responsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 11/15/13Document71 pagesResponsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 11/15/13CREWPas encore d'évaluation

- No Loan May Be Sanctioned On The Basis of This Salary Slip Without Obtaining NOC From Competent Authority in NDMCDocument1 pageNo Loan May Be Sanctioned On The Basis of This Salary Slip Without Obtaining NOC From Competent Authority in NDMCParasPas encore d'évaluation

- CORRECTED (If Checked) : Nonemployee CompensationDocument2 pagesCORRECTED (If Checked) : Nonemployee CompensationNathalin De IsoldiPas encore d'évaluation

- Manuel Medel Paystubs PDFDocument7 pagesManuel Medel Paystubs PDFSantiago ManuelPas encore d'évaluation

- Instructions For Completing Form 4506-C (Individial Taxpayer)Document1 pageInstructions For Completing Form 4506-C (Individial Taxpayer)GlendaPas encore d'évaluation

- w2 Efile 2023Document10 pagesw2 Efile 2023latrellPas encore d'évaluation

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument6 pagesNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comPas encore d'évaluation

- Certificate of Business Name Registration: MGTV Sari Sari StoreDocument2 pagesCertificate of Business Name Registration: MGTV Sari Sari StoreMaria MalangPas encore d'évaluation

- 2001 TasDocument279 pages2001 TasIRSPas encore d'évaluation

- IRS Publication 15 - 2009Document70 pagesIRS Publication 15 - 2009Wayne Schulz100% (11)

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerPas encore d'évaluation

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaPas encore d'évaluation

- 1040es Estimated Tax 2014 For IndividualsDocument12 pages1040es Estimated Tax 2014 For IndividualsClaudia MaldonadoPas encore d'évaluation

- Routing CODEDocument1 pageRouting CODEzaw khaingPas encore d'évaluation

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Document10 pagesPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorPas encore d'évaluation

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- Capital Gains and LossesDocument1 pageCapital Gains and Losseskushaal subramonyPas encore d'évaluation

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumPas encore d'évaluation

- California TaxesDocument2 pagesCalifornia Taxesloverlover125Pas encore d'évaluation

- Annual Pay SlipDocument2 pagesAnnual Pay SlipPraveen SharmaPas encore d'évaluation

- Adjusted Gross Income ExplainedDocument4 pagesAdjusted Gross Income ExplainedMarko Zero FourPas encore d'évaluation

- ADP Earnings StatementDocument1 pageADP Earnings StatementNikhil Almeida50% (4)