Académique Documents

Professionnel Documents

Culture Documents

City of Syracuse

Transféré par

liz_benjamin6490Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

City of Syracuse

Transféré par

liz_benjamin6490Droits d'auteur :

Formats disponibles

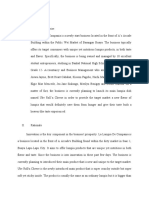

Analysis of Stable Rate Pension Option vs.

Normal Contribution

General Employees Only - ERS - Salary Figures Provided by

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Fiscal Year

2014 -2015

2015 -2016

2016 -2017

2017 -2018

2018 -2019

2019 -2020

2020 -2021

2021 -2022

2022 -2023

2023 -2024

2024 -2025

2025 -2026

2026 -2027

2027 -2028

2028 -2029

2029 -2030

2030 -2031

2031 -2032

2032 -2033

2033 -2034

2034 -2035

2035 -2036

2036 -2037

2037 -2038

2038 -2039

Stable Rate

Pension

Option

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

12.00%

Salaries

Pension Invoice

$35,454,982

$4,254,598

$36,341,357

$4,360,963

$37,249,890

$4,469,987

$38,181,138

$4,581,737

$39,135,666

$4,696,280

$40,114,058

$4,813,687

$41,116,909

$4,934,029

$42,144,832

$5,057,380

$43,198,453

$5,183,814

$44,278,414

$5,313,410

$45,385,374

$5,446,245

$46,520,009

$5,582,401

$47,683,009

$5,721,961

$48,875,084

$5,865,010

$50,096,961

$6,011,635

$51,349,385

$6,161,926

$52,633,120

$6,315,974

$53,948,948

$6,473,874

$55,297,672

$6,635,721

$56,680,114

$6,801,614

$58,097,116

$6,971,654

$59,549,544

$7,145,945

$61,038,283

$7,324,594

$62,564,240

$7,507,709

$64,128,346

$7,695,402

$145,327,549

Normal

Contribution Pension Invoice

21.80%

$7,729,186

17.90%

$6,505,103

15.90%

$5,922,733

14.10%

$5,383,540

12.20%

$4,774,551

12.00%

$4,813,687

10.50%

$4,317,275

9.90%

$4,172,338

9.00%

$3,887,861

8.10%

$3,586,552

7.90%

$3,585,445

7.60%

$3,535,521

7.20%

$3,433,177

6.50%

$3,176,880

6.30%

$3,156,109

6.10%

$3,132,313

6.00%

$3,157,987

6.00%

$3,236,937

6.00%

$3,317,860

6.00%

$3,400,807

6.00%

$3,485,827

6.00%

$3,572,973

6.00%

$3,662,297

6.00%

$3,753,854

6.00%

$3,847,701

$102,548,513

Assumptions

Stable Rate Option = 12% for 25 years per NYS Budget Office (E

Normal Contribution = NYS Executive Bud and Mgmt Plan Pg 24

Assumes an avg. 2.5% Salary Increase

Does not include adjustment allowed for poor performing pensio

a. first review after 5 years may bump rate 2%

b. second review after 10 years may bump rate by 2%

Unanswered questions - what is the minimum time commitment

calculated on repayment for leaving the plan?

calculated on repayment for leaving the plan?

ary Figures Provided by See Through NY

Annual Savings / (Loss)

$3,474,588

$2,144,140

$1,452,746

$801,804

$78,271

Stable Rate Pension Option - 1st period for increase up to 2%

$0

($616,754)

($885,041)

($1,295,954)

($1,726,858)

Stable Rate Pension Option -2nd period for increase up to 2%

($1,860,800)

($2,046,880)

($2,288,784)

($2,688,130)

($2,855,527)

($3,029,614)

($3,157,987)

($3,236,937)

($3,317,860)

($3,400,807)

($3,485,827)

($3,572,973)

($3,662,297)

($3,753,854)

($3,847,701)

($42,779,036)

udget Office (ERS)

gmt Plan Pg 24 - years after 2030 kept flat

orming pensions

ate by 2%

e commitment and what are the compound interest rates

Analysis of Stable Rate Pension Option vs. Normal Contribution

General Employees Only - ERS

Year

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

Fiscal Year

2014 -2015

2015 -2016

2016 -2017

2017 -2018

2018 -2019

2019 -2020

2020 -2021

2021 -2022

2022 -2023

2023 -2024

2024 -2025

2025 -2026

2026 -2027

2027 -2028

2028 -2029

2029 -2030

2030 -2031

2031 -2032

2032 -2033

2033 -2034

2034 -2035

2035 -2036

2036 -2037

2037 -2038

2038 -2039

Stable

Rate

Pension

Option

12.00%

12.00%

12.00%

12.00%

14.00%

14.00%

14.00%

14.00%

14.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

16.00%

Salaries

Pension Invoice

$35,454,982

$4,254,598

$36,341,357

$4,360,963

$37,249,890

$4,469,987

$38,181,138

$4,581,737

$39,135,666 $5,478,993

$40,114,058

$5,615,968

$41,116,909

$5,756,367

$42,144,832

$5,900,276

$43,198,453

$6,047,783

$44,278,414 $7,084,546

$45,385,374

$7,261,660

$46,520,009

$7,443,201

$47,683,009

$7,629,281

$48,875,084

$7,820,013

$50,096,961

$8,015,514

$51,349,385

$8,215,902

$52,633,120

$8,421,299

$53,948,948

$8,631,832

$55,297,672

$8,847,627

$56,680,114

$9,068,818

$58,097,116

$9,295,539

$59,549,544

$9,527,927

$61,038,283

$9,766,125

$62,564,240 $10,010,278

$64,128,346 $10,260,535

$183,766,772

Normal

Contribution Pension Invoice

21.80%

$7,729,186

17.90%

$6,505,103

15.90%

$5,922,733

14.10%

$5,383,540

12.20%

$4,774,551

12.00%

$4,813,687

10.50%

$4,317,275

9.90%

$4,172,338

9.00%

$3,887,861

8.10%

$3,586,552

7.90%

$3,585,445

7.60%

$3,535,521

7.20%

$3,433,177

6.50%

$3,176,880

6.30%

$3,156,109

6.10%

$3,132,313

6.00%

$3,157,987

6.00%

$3,236,937

6.00%

$3,317,860

6.00%

$3,400,807

6.00%

$3,485,827

6.00%

$3,572,973

6.00%

$3,662,297

6.00%

$3,753,854

6.00%

$3,847,701

$102,548,513

Assumptions

Stable Rate Option = 12% for 25 years per NYS Budget Office (E

Normal Contribution = NYS Executive Bud and Mgmt Plan Pg 24

Assumes an avg. 2.5% Salary Increase

Adjustments Included a. first review after 5 years may bump rate 2%

b. second review after 10 years may bump rate by 2%

Unanswered questions - what is the minimum time commitment

calculated on repayment for leaving the plan?

Annual Savings / (Loss)

$3,474,588

$2,144,140

$1,452,746

$801,804

($704,442)

($802,281)

($1,439,092)

($1,727,938)

($2,159,923)

($3,497,995)

($3,676,215)

($3,907,681)

($4,196,105)

($4,643,133)

($4,859,405)

($5,083,589)

($5,263,312)

($5,394,895)

($5,529,767)

($5,668,011)

($5,809,712)

($5,954,954)

($6,103,828)

($6,256,424)

($6,412,835)

Stable Rate Pension Option - 1st period for increase up to 2%

Stable Rate Pension Option -2nd period for increase up to 2%

181

250

431

($81,218,259)

Budget Office (ERS)

Mgmt Plan Pg 24 - years after 2030 kept flat

rate by 2%

e commitment and what are the compound interest rates

ase up to 2%

ase up to 2%

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Court Ruling On Legislative Compensation Commission.Document19 pagesCourt Ruling On Legislative Compensation Commission.liz_benjamin6490Pas encore d'évaluation

- John Cahill's New Job.Document1 pageJohn Cahill's New Job.liz_benjamin6490Pas encore d'évaluation

- U.S. v. Christopher Collins Et Al Indictment 18 CR 567Document30 pagesU.S. v. Christopher Collins Et Al Indictment 18 CR 567WGRZ-TVPas encore d'évaluation

- Onondaga Co Comptroller Bob Antonacci To Run For State SenateDocument2 pagesOnondaga Co Comptroller Bob Antonacci To Run For State Senateliz_benjamin6490Pas encore d'évaluation

- 62 - Opinion 2.4.19, Grant Hoyt MTDDocument24 pages62 - Opinion 2.4.19, Grant Hoyt MTDliz_benjamin6490Pas encore d'évaluation

- NYC DSS Letter To Broome Co.Document4 pagesNYC DSS Letter To Broome Co.liz_benjamin6490Pas encore d'évaluation

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490Pas encore d'évaluation

- Gov Cuomo Approves Prosecutorial Misconduct Commission Bill....Document1 pageGov Cuomo Approves Prosecutorial Misconduct Commission Bill....liz_benjamin6490Pas encore d'évaluation

- 340 Local Elected Officials Write in Support of Fusion Voting in NYDocument10 pages340 Local Elected Officials Write in Support of Fusion Voting in NYliz_benjamin6490Pas encore d'évaluation

- 2019StateoftheStateBook 2Document356 pages2019StateoftheStateBook 2liz_benjamin6490Pas encore d'évaluation

- U.S. v. Kevin Schuler Plea AgreementDocument5 pagesU.S. v. Kevin Schuler Plea Agreementliz_benjamin6490Pas encore d'évaluation

- Sen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.Document3 pagesSen. Brad Hoylman Asks Gov. Andrew Cuomo To Veto Hymn Bill.liz_benjamin6490Pas encore d'évaluation

- IDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.Document1 pageIDC Leader Jeff Klein Requests JCOPE Investigation Into Forcible Kissing Claim.liz_benjamin6490Pas encore d'évaluation

- Letter 5-9-18Document2 pagesLetter 5-9-18Nick ReismanPas encore d'évaluation

- GOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.Document2 pagesGOP 37th SD Candidate Samard Khojasteh Letter To Committee Members.liz_benjamin6490Pas encore d'évaluation

- Mailer For Democratic 37th SD Candidate Shelley MayerDocument2 pagesMailer For Democratic 37th SD Candidate Shelley Mayerliz_benjamin6490Pas encore d'évaluation

- Letter of Resignation From The Senate - Andrea Stewart CousinsDocument1 pageLetter of Resignation From The Senate - Andrea Stewart CousinsNick ReismanPas encore d'évaluation

- IDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.Document3 pagesIDC Leader Jeff Klein Legal Memo Re: Sexual Harassment Allegation.liz_benjamin6490Pas encore d'évaluation

- McLaughlin Responds To Assembly Action Against Him.Document2 pagesMcLaughlin Responds To Assembly Action Against Him.liz_benjamin6490Pas encore d'évaluation

- Nassau County Tracking Memo F10.30.17Document1 pageNassau County Tracking Memo F10.30.17liz_benjamin6490Pas encore d'évaluation

- Skelos Corruption Decision Overturned.Document12 pagesSkelos Corruption Decision Overturned.liz_benjamin6490Pas encore d'évaluation

- NY - Nassau County Survey Polling Memorandum 10-27-2017-2Document3 pagesNY - Nassau County Survey Polling Memorandum 10-27-2017-2liz_benjamin6490Pas encore d'évaluation

- Albany Money Machine June 2017Document5 pagesAlbany Money Machine June 2017liz_benjamin6490Pas encore d'évaluation

- Vetoes Issued by Gov. Andrew Cuomo, October 2017Document18 pagesVetoes Issued by Gov. Andrew Cuomo, October 2017liz_benjamin6490Pas encore d'évaluation

- NYPIRG's 2017 Session Review.Document5 pagesNYPIRG's 2017 Session Review.liz_benjamin6490Pas encore d'évaluation

- March Fundraising Invite For Assemblyman Lavine's Nassau Co Exec RunDocument2 pagesMarch Fundraising Invite For Assemblyman Lavine's Nassau Co Exec Runliz_benjamin6490Pas encore d'évaluation

- Martins Backer Calls For B of E Probe of Curran Campaign.Document1 pageMartins Backer Calls For B of E Probe of Curran Campaign.liz_benjamin6490Pas encore d'évaluation

- Official Denny Farrell Resignation Letter.Document1 pageOfficial Denny Farrell Resignation Letter.liz_benjamin6490Pas encore d'évaluation

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490Pas encore d'évaluation

- Rauh vs. de Blasio DecisionDocument13 pagesRauh vs. de Blasio Decisionliz_benjamin6490Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Lambo v. NLRCDocument17 pagesLambo v. NLRCPatrisha AlmasaPas encore d'évaluation

- COHR321 Module Guide S2 2019Document14 pagesCOHR321 Module Guide S2 2019Tsakane SibuyiPas encore d'évaluation

- Math and Logic Problems with Multiple Choice AnswersDocument4 pagesMath and Logic Problems with Multiple Choice AnswersTamara Gutierrez100% (3)

- Construction Kickoff Meeting AgendaDocument3 pagesConstruction Kickoff Meeting AgendaBernardus Epintanta GintingPas encore d'évaluation

- Finance Class 04 - New With TestDocument23 pagesFinance Class 04 - New With TestMM Fakhrul IslamPas encore d'évaluation

- Business ProposalDocument4 pagesBusiness ProposalCatherine Avila IIPas encore d'évaluation

- Incoterms QuestionsDocument6 pagesIncoterms Questionsndungutse innocent100% (1)

- Ciad-Ret-2022-04-01 - Annex 1Document11 pagesCiad-Ret-2022-04-01 - Annex 1Edmond Jayson PeregilPas encore d'évaluation

- All About Msmed Act 2006: CA. Manish ChowdhuryDocument4 pagesAll About Msmed Act 2006: CA. Manish ChowdhurySUNIL PUJARIPas encore d'évaluation

- India's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargDocument2 pagesIndia's Central Bank Reserve Bank of India Regional Office, Delhi, Foreign Remittance Department. New Delhi: 110 001, India, 6, Sansad MargvnkatPas encore d'évaluation

- Ensuring E/CTRM Implementation SuccessDocument10 pagesEnsuring E/CTRM Implementation SuccessCTRM CenterPas encore d'évaluation

- Ripple CryptocurrencyDocument5 pagesRipple CryptocurrencyRipple Coin NewsPas encore d'évaluation

- Accounting Edexcel FINALDocument6 pagesAccounting Edexcel FINALClifford PeraltaPas encore d'évaluation

- Marketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseDocument2 pagesMarketing Manager Coordinator Programs in Dallas FT Worth TX Resume KeJaun DuBoseKeJuanDuBosePas encore d'évaluation

- PPE PPT - Ch10Document81 pagesPPE PPT - Ch10ssreya80Pas encore d'évaluation

- Starbucks PDFDocument14 pagesStarbucks PDFanimegod100% (1)

- Summary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Document28 pagesSummary of BRC Global Food Safety Standard Issue 6 Changes Landscape 110111Poulami DePas encore d'évaluation

- Cleansheet Target CostingDocument4 pagesCleansheet Target CostingrindergalPas encore d'évaluation

- Adrian MittermayrDocument2 pagesAdrian Mittermayrapi-258981850Pas encore d'évaluation

- Account Payable Tables in R12Document8 pagesAccount Payable Tables in R12anchauhanPas encore d'évaluation

- Oranjolt - Rasn-WPS OfficeDocument3 pagesOranjolt - Rasn-WPS OfficeKaviya SkPas encore d'évaluation

- Program Management StudyDocument19 pagesProgram Management Studynavinchopra1986Pas encore d'évaluation

- SAE1Document555 pagesSAE1Aditya100% (1)

- Costco - Supplier Code of ConductDocument6 pagesCostco - Supplier Code of ConductalmariveraPas encore d'évaluation

- Kevin Kato Fischer Swot AnalysisDocument17 pagesKevin Kato Fischer Swot AnalysisKevin Kato Fischer100% (2)

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaPas encore d'évaluation

- FINAL ASEAN Handbook 01 - Engineering ServicesDocument92 pagesFINAL ASEAN Handbook 01 - Engineering ServicesGerry GsrPas encore d'évaluation

- CRM of HardeesDocument6 pagesCRM of Hardeeshamza_butt88Pas encore d'évaluation

- Eligibility of Claiming Input Tax Credit on Imported Stock under GSTDocument5 pagesEligibility of Claiming Input Tax Credit on Imported Stock under GSTUtkarsh KhandelwalPas encore d'évaluation

- NFJPIA Mock Board 2016 - AuditingDocument8 pagesNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)