Académique Documents

Professionnel Documents

Culture Documents

Currency Trading

Transféré par

servicemanuals1Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Currency Trading

Transféré par

servicemanuals1Droits d'auteur :

Formats disponibles

Currency Trading

What's Currency Trading?

In a Currency trading, you buy one currency while simultaneously selling another.

Currency trading is an inter-bank market that took shape in 1971 when global trade shifted from fixed exchange rates to floating ones. During exchange, the exchange rate of one currency to another currency is determined simply: by supply and demand exchange to which both parties agree. Currencies trade in pairs, like the Euro-US Dollar (EUR/USD) or US Dollar / Japanese Yen (USD/JPY). Currency Trading is used to speculate on the relative strength of one currency against another. The currency market is an over-the-counter market, which means that it is a decentralized market with no central exchange.

Advantages

Liquidity: the market operates the enormous money supply and gives absolute freedom in opening or closing a position in the current market quotation. High liquidity is a powerful magnet for any investor, because it gives him or her the freedom to open or to close a position of any size whatever. With average daily turnover of US$3.2 trillion,currency trading is the most traded market in the world. A true 24-hour market from Sunday 10 PM GMT to Friday 10 PM GMT, Currency trading begins in Sydney, and moves around the globe as the business day begins, first to Tokyo, London, and New York. Unlike other financial markets, investors can respond immediately to currency fluctuations, whenever they occur - day or night. Advantage of this business is that you make deals using computer from any part of the world 24 hours per day 5 days per week.

What Moves Currency ?

Currency is affected by various economic and political factors. The largest fluctuations in currency prices usually occur during Central Bank intervention, when government trade in huge amounts in an attempt to either raise or lower the value of their own currency. This, as well as many other factors such as interest rate changes, economic figures, political instability and large lot transactions by hedge funds can move the market.

Participants

Commercial Banks Central Banks Currency Exchanges

Investment Funds Brokerage Houses Participants of this market are, first of all, large commercial banks through which the basic operations under the instruction of exporters and importers, investment institutes are carried out, insurance and pension funds, hedge and individual investors. Also these banks operations and in the interests due to own means, thus at large banks volumes of daily operations reach billions dollars, and at some banks even the basic part of the profit is formed only due to speculative operations with currency. Most traders focus on the biggest, most liquid currency pairs. "The Majors" include US Dollar, Japanese Yen, Euro, British Pound, Swiss Franc, Canadian Dollar and Australian Dollar. In fact, more than 85% of daily Forex trading happens in the major currency pairs.

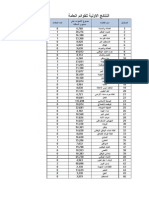

Currency Trading Specifications

Symbol AUD/USD Winter: Monday : 05:00 Saturday :04:30 Summer : Monday : 05:00 Saturday :03:30 Spot EUR/USD Winter: Monday : 05:00 Saturday :04:30 Summer : Monday : 05:00 Saturday : 03:30 Spot GBP/USD Winter: Monday : 05:00 Saturday :04:30 Summer : Monday : 05:00 Saturday : 03:30 Spot USD/JPY Winter: Monday : 05:00 Saturday :04:30 Summer : Monday : 05:00 Saturday : 03:30 Spot USD/CHF Winter: Monday : 05:00 Saturday : 04:30 Summer : Monday : 05:00 Saturday : 03:30 Spot

Trading Hours(GMT +7)

Trading Month Contract Size Leverage

AUD 100,000 EUR 100,000 GBP 100,000 USD 100,000 USD 100,000 1:100 1:100 USD 10,000 0.0001 3 points USD 50 1:100 USD 10,000 0.0001 3 points USD 50 1:100 USD 10,000 0.01 3 points USD 50 1:100 USD 10,000 0.0001 3 points USD 50

Initial Margin USD 10,000 Tick Size Spread 0.0001 3 points

Commission USD 50 /Lot Limit Order Minimum Maximum Volume

10 points 10 points 10 points 10 points 10 points from Running from Running from Running from Running from Running Price Price Price Price Price 20 Lots 20 Lots 20 Lots 20 Lots 20 Lots

Margin Requirement / USD 1,000 Lot Hedging / Lot USD 200 Force Liquidation

If Client Equity is equal or smaller than 10% Margin Requirement

USD 1,000 USD 200

If Client Equity is equal or smaller than 10% Margin Requirement

USD 1,000 USD 200

If Client Equity is equal or smaller than 10% Margin Requirement

USD 1,000 USD 200

If Client Equity is equal or smaller than 10% Margin Requirement

USD 1,000 USD 200

If Client Equity is equal or smaller than 10% Margin Requirement

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Withdraw PayPal Money in Malaysia SolutionDocument16 pagesWithdraw PayPal Money in Malaysia Solutionafarz2604Pas encore d'évaluation

- 57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCDocument85 pages57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCAravamudhan Srinivasan100% (4)

- Mill On Liberty Views of Freedom of SpeechDocument2 pagesMill On Liberty Views of Freedom of Speechservicemanuals1100% (1)

- Chapter 2: Relational Data Model & SQL: Basics: Ref. Chapter 3 in The TextDocument30 pagesChapter 2: Relational Data Model & SQL: Basics: Ref. Chapter 3 in The Textservicemanuals1Pas encore d'évaluation

- Hazardous Enviro TransmitterDocument2 pagesHazardous Enviro Transmitterservicemanuals1Pas encore d'évaluation

- Scott Cunningham - Cunningham's Creating Magickal Entities PDFDocument82 pagesScott Cunningham - Cunningham's Creating Magickal Entities PDFwhitecreamcoffee86% (7)

- PollutionDocument1 pagePollutionservicemanuals1Pas encore d'évaluation

- 3ds ArcardDocument1 page3ds Arcardservicemanuals1Pas encore d'évaluation

- Nonverbal CommunicationDocument2 pagesNonverbal Communicationservicemanuals1Pas encore d'évaluation

- مرشحو الإنتخابات البرلمانية الأردنDocument2 pagesمرشحو الإنتخابات البرلمانية الأردنservicemanuals1Pas encore d'évaluation

- Stiffness Attracts MomentsDocument25 pagesStiffness Attracts Momentsservicemanuals1Pas encore d'évaluation

- TCP TutorialDocument28 pagesTCP Tutorialphuongtuan1803Pas encore d'évaluation

- Brute Forcing Wi-Fi Protected Setup: When Poor Design Meets Poor ImplementationDocument9 pagesBrute Forcing Wi-Fi Protected Setup: When Poor Design Meets Poor ImplementationMind AngerPas encore d'évaluation

- Act 1 Doll's House NotesDocument7 pagesAct 1 Doll's House Notesservicemanuals1100% (2)

- Ottoman Grammar KeyDocument202 pagesOttoman Grammar Keyservicemanuals167% (3)

- B Spline 2Document24 pagesB Spline 2Kasturika BorahPas encore d'évaluation

- Summary of Hindi MoviesDocument3 pagesSummary of Hindi Moviesservicemanuals1Pas encore d'évaluation

- Jivan Rekha Research and Marketing LimitedDocument1 pageJivan Rekha Research and Marketing Limitedservicemanuals1Pas encore d'évaluation

- Area Between ParabolaDocument1 pageArea Between Parabolaservicemanuals1Pas encore d'évaluation

- Gpro From HtfedDocument1 pageGpro From Htfedservicemanuals1Pas encore d'évaluation

- MFC 9840 Parts ManualDocument40 pagesMFC 9840 Parts Manualservicemanuals1Pas encore d'évaluation

- Answer For T3 FMRDocument4 pagesAnswer For T3 FMRYehHunTeePas encore d'évaluation

- Gold LoanDocument22 pagesGold LoanJinal Vasa0% (1)

- WGU C 213 Accounting Terms - Most RecentDocument13 pagesWGU C 213 Accounting Terms - Most Recentsdwew0% (1)

- Financial Accounting and Reporting Fundamentals ReviewDocument1 pageFinancial Accounting and Reporting Fundamentals ReviewRyan PelitoPas encore d'évaluation

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDocument4 pagesInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayPas encore d'évaluation

- Finalised Interest Rate Swaps ConfirmationDocument18 pagesFinalised Interest Rate Swaps ConfirmationSurbhi GuptaPas encore d'évaluation

- Uladzislau KharashkevichDocument7 pagesUladzislau KharashkevichHarry BurgePas encore d'évaluation

- NTS - Candidate (Portal)Document3 pagesNTS - Candidate (Portal)MUHAMMAD FAIZAANPas encore d'évaluation

- Final Presentation On Accounting FraudDocument15 pagesFinal Presentation On Accounting FraudDisha JugatPas encore d'évaluation

- BA CH3 會計算式 (GP - NP)Document2 pagesBA CH3 會計算式 (GP - NP)Chun Kit LauPas encore d'évaluation

- Empoly EmplerDocument20 pagesEmpoly EmplerAlapati Sridhar Nag100% (2)

- Portfolio Risk AnalysisDocument4 pagesPortfolio Risk AnalysisHarneet ChughPas encore d'évaluation

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENEROPas encore d'évaluation

- Mesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Document58 pagesMesleki Yabancı Dil (Borsa Ve Finansman-İngilizce) 1Özgur ÇPas encore d'évaluation

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiPas encore d'évaluation

- Sabeetha Final ProjectDocument52 pagesSabeetha Final ProjectPriyesh KumarPas encore d'évaluation

- Amity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "Document60 pagesAmity Global Business School, Mumbai: "A Study On The Mutual Fund Industry in India "ryotsuPas encore d'évaluation

- Fin Aw7Document84 pagesFin Aw7Rameesh DePas encore d'évaluation

- Easy Pinjaman Ekspres PDSDocument4 pagesEasy Pinjaman Ekspres PDSFizz FirdausPas encore d'évaluation

- Assign 4Document3 pagesAssign 4Guangjun OuPas encore d'évaluation

- Syllabus BUSS416 Fall2015Document3 pagesSyllabus BUSS416 Fall2015Stephen KimPas encore d'évaluation

- Insurance Fraud: Atty. Dennis B. FunaDocument47 pagesInsurance Fraud: Atty. Dennis B. FunaShie La Ma RiePas encore d'évaluation

- Substantive Procedures For InvestmentsDocument2 pagesSubstantive Procedures For InvestmentsChristian PerezPas encore d'évaluation

- JPM - Emerging - Markets - Equ - 2021-01-13 - Dividend Plays 2021Document18 pagesJPM - Emerging - Markets - Equ - 2021-01-13 - Dividend Plays 2021Joyce Dick Lam PoonPas encore d'évaluation

- Current Liabilities, Contingencies, and Time Value of Money Chapter ExercisesDocument44 pagesCurrent Liabilities, Contingencies, and Time Value of Money Chapter ExercisesAarti J0% (2)

- FFBL's Financial Management and OperationsDocument20 pagesFFBL's Financial Management and OperationsSunny KhanPas encore d'évaluation

- Pristine's Cardinal Rules of TradingDocument44 pagesPristine's Cardinal Rules of Tradingsk77*100% (11)

- Corporate Finance Chapter 3 ProblemsDocument1 pageCorporate Finance Chapter 3 ProblemsRidho Muhammad RamadhanPas encore d'évaluation