Académique Documents

Professionnel Documents

Culture Documents

Example of Problem To Be Used in Financial Management PBL

Transféré par

Adi AliTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Example of Problem To Be Used in Financial Management PBL

Transféré par

Adi AliDroits d'auteur :

Formats disponibles

Faculty of Management and Economics Accounting and Finance Department

FIN3103 Corporate Finance Problem One Mr Hassan and his family have recently moved into their new house in Taman Golf Tok Jembal. He has thought of renting out his old house in Mengabang Telipot to students of UMT. His wife on the other hand, does not like the thought of having to repair and maintain the house since damages done by students are common. So, she prefers to turn the house into a lodging property, carrying the name Akmas Homestay, wherein people can rent it out based on number of nights. Mr Hassan believes that a consistent rental income from students can be expected to be around RM700 a month. Over a period of five years, the income received from the property can accumulate to a comfortable amount that can be used to support his eldest son, Arif who is now in form 3 to enter a university. Driven by the same motive, his wife believes that they can charge up to RM200 a night to lodgers even though rental from families or travelers are irregular. She asserted that the income can be considerably more at around RM2000 during peak season such as in school holidays and wedding seasons. Having discussed further, they have both estimated the following cash flows:

Monthly Rental to students Daily Rental to lodgers Annual Income RM8,400 RM6,200 Annual Maintenance Cost RM1,000 RM300

To reach a final agreement, they have asked Arifs opinion, after all the money received from the rental property will be deposited into his SSPN account earning an interest of 4.5% p.a. Being respectful to his parents, Arif does not mind which alternative they will decide on, but he has raised a concern that the money saved in five years time may not accumulate to RM40,000 to allow a comfort tertiary education financing. His teacher always reminds that money received in the future may not be in an equivalent todays value due to inflation and decreased purchasing power. He further suggested that they should ask for advice from his uncle, Dr Hussein, a finance lecturer at UMT. Mr Hassan then went to seek advices from Dr Hussein at FPE, UMT. Dr Hussein agreed with Arif that for an investment decision to be a success, they should consider the expected return and its associated risk. For instance, he worried that carrying a name with a homestay terminology on the house can have a legal implication as the government is encouraging the actual homestay industry, while this illegal homestay properties have mushroomed over the past five years. However, he completely agrees with the idea of depositing the money into Arifs SSPN account as risk-free rate has

been around 4% annually, while the inflation rate has been fluctuated within a range between 2% and 3.5%. After a lengthy discussion, Dr Hussein came up with a new proposal of selling the house instead of renting it out. He said that the house can easily be valued at RM300,000. In fact, he himself is interested to buy the house, but currently lacks of fund. He suggested that he would like to have an option to buy the house after 8 months for RM310,000 with an option premium of RM18,000. Mr Hassan queried how he got the premium figure. Dr Hussein explained that by using the Black-Scholes model, the premium is about a correct amount as prices in the area have been increasing at a rate of 10% p.a., with an annual standard deviation of 20%. Dr Hussein then advised his brother to tell his decision after a week. Compelled by the suggestions made by his brother, Mr Hassan did a further research on discounted cash flow, time value of money and option pricing. Although not entirely convinced by the offer of his brother, Mr Hassan and his wife decided to sell the house to Dr Hussein, rather than to someone else beside their kith and kin. The decision was fuelled by the news that a highly growing local company producing seafood products is planning to expand their businesses to Middle East market; thus, Mr Hassan has planned to purchase the companys shares and bonds. The premium and principal received from Dr Hussein can be used to purchase these securities, which earning more return than a mere 4.5% SSPN interest. The seafood company is expected to pay a dividend of RM0.60 at the end of 2013, and Mr Hassan has planned to purchase the shares on the first day of the New Year. The company stresses that the current growth rate of increasing the dividend from RM0.55 in 2012 is expected to continue indefinitely. The current price of the companys shares is RM21.00 per share. The company is also issuing RM1,000,000 corporate bond with a par value of RM1,000, paying a coupon interest of 8% and will mature in five years. The bond is currently priced at RM910.00 and promises a satisfactory yield to maturity. Mr Hassan went again to tell Dr Hussein that he agrees to sell the house and tell his intention to buy the securities. Dr Hussein was delighted with the decision but stressed that his brother should calculate the intrinsic value of the securities properly before buying them. He added that using a discount rate of 12% would be appropriate. What would you do if you were in Mr Hassans shoes?

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Yardi Commercial SuiteDocument52 pagesYardi Commercial SuiteSpicyPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- On capital structure, dividend policy and bankruptcy costsDocument3 pagesOn capital structure, dividend policy and bankruptcy costsAdi AliPas encore d'évaluation

- Pharma Pathway SopDocument350 pagesPharma Pathway SopDinesh Senathipathi100% (1)

- Shell Omala S2 G150 DatasheetDocument3 pagesShell Omala S2 G150 Datasheetphankhoa83-1Pas encore d'évaluation

- Pathways-Childrens Ministry LeaderDocument16 pagesPathways-Childrens Ministry LeaderNeil AtwoodPas encore d'évaluation

- 14 - Hydraulic Design of Urban Drainage Systems PDFDocument45 pages14 - Hydraulic Design of Urban Drainage Systems PDFDeprizon SyamsunurPas encore d'évaluation

- Solution of Introduction To Many-Body Quantum Theory in Condensed Matter Physics (H.Bruus & K. Flensberg)Document54 pagesSolution of Introduction To Many-Body Quantum Theory in Condensed Matter Physics (H.Bruus & K. Flensberg)Calamanciuc Mihai MadalinPas encore d'évaluation

- Continuance Intention in Using Homestay TerminologyDocument19 pagesContinuance Intention in Using Homestay TerminologyAdi AliPas encore d'évaluation

- Accounting Students Problem Based Learning AcceptanceDocument7 pagesAccounting Students Problem Based Learning AcceptanceAdi AliPas encore d'évaluation

- Tax Knowledge and Compliance Among Youth in MalaysiaDocument19 pagesTax Knowledge and Compliance Among Youth in MalaysiaAdi Ali50% (2)

- Attitudes and IR WebsitesDocument11 pagesAttitudes and IR WebsitesAdi AliPas encore d'évaluation

- ROM Magazine V1i6Document64 pagesROM Magazine V1i6Mao AriasPas encore d'évaluation

- Purp Com Lesson 1.2Document2 pagesPurp Com Lesson 1.2bualjuldeeangelPas encore d'évaluation

- Veolia Moray Outfalls Repair WorksDocument8 pagesVeolia Moray Outfalls Repair WorksGalih PutraPas encore d'évaluation

- Farm mechanization subsidy applications invitedDocument2 pagesFarm mechanization subsidy applications inviteddraqbhattiPas encore d'évaluation

- APTARE IT Analytics: Presenter NameDocument16 pagesAPTARE IT Analytics: Presenter NameCCIE DetectPas encore d'évaluation

- Lending Tree PDFDocument14 pagesLending Tree PDFAlex OanonoPas encore d'évaluation

- Past Paper Booklet - QPDocument506 pagesPast Paper Booklet - QPMukeshPas encore d'évaluation

- Conservation of Kuttichira SettlementDocument145 pagesConservation of Kuttichira SettlementSumayya Kareem100% (1)

- Experimental Investigation On The Properties of Compressed Earth Blocks Stabilised With A Liquid ChemicalDocument7 pagesExperimental Investigation On The Properties of Compressed Earth Blocks Stabilised With A Liquid ChemicalDeb Dulal TripuraPas encore d'évaluation

- Minimum Fees To Be Taken by CADocument8 pagesMinimum Fees To Be Taken by CACA Sanjay BhatiaPas encore d'évaluation

- MP & MC Module-4Document72 pagesMP & MC Module-4jeezPas encore d'évaluation

- AIIMS Mental Health Nursing Exam ReviewDocument28 pagesAIIMS Mental Health Nursing Exam ReviewImraan KhanPas encore d'évaluation

- Nysc Editorial ManifestoDocument2 pagesNysc Editorial ManifestoSolomon Samuel AdetokunboPas encore d'évaluation

- FRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksDocument3 pagesFRABA - Absolute - Encoder / PLC - 1 (CPU 314C-2 PN/DP) / Program BlocksAhmed YacoubPas encore d'évaluation

- Performance of a Pelton WheelDocument17 pagesPerformance of a Pelton Wheellimakupang_matPas encore d'évaluation

- Goes 300 S Service ManualDocument188 pagesGoes 300 S Service ManualШурик КамушкинPas encore d'évaluation

- Diferencias Gas LP y Gas Natural: Adminigas, S.A. de C.VDocument2 pagesDiferencias Gas LP y Gas Natural: Adminigas, S.A. de C.VMarco Antonio Zelada HurtadoPas encore d'évaluation

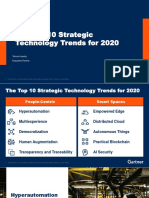

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocument31 pagesThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloPas encore d'évaluation

- Introduction To Global Positioning System: Anil Rai I.A.S.R.I., New Delhi - 110012Document19 pagesIntroduction To Global Positioning System: Anil Rai I.A.S.R.I., New Delhi - 110012vinothrathinamPas encore d'évaluation

- Case Acron PharmaDocument23 pagesCase Acron PharmanishanthPas encore d'évaluation

- Capex Vs RescoDocument1 pageCapex Vs Rescosingla.nishant1245Pas encore d'évaluation

- Chapter 1Document2 pagesChapter 1Nor-man KusainPas encore d'évaluation

- Ejemplo FFT Con ArduinoDocument2 pagesEjemplo FFT Con ArduinoAns Shel Cardenas YllanesPas encore d'évaluation

- UTC awarded contracts with low competitionDocument2 pagesUTC awarded contracts with low competitioncefuneslpezPas encore d'évaluation