Académique Documents

Professionnel Documents

Culture Documents

Customs Procedure 20080701

Transféré par

limulsa78Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Customs Procedure 20080701

Transféré par

limulsa78Droits d'auteur :

Formats disponibles

Customes Warehouse And FZ Customs Warehouse Bill of Entry Transactional Processing: 1.

Receive and check documents required for customs declaration processing. 2. Affix stamp of (goods are not allowed to enter local market) on customs declaration. 3. Collect registration fees. 4. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Delivery Order. 2. Commercial invoices. 3. Packing list. 4. Certificate of origin. 5. DFSA declaration (prepared by customs). 6. Copy of the trade license. Ex-customs warehouse import Transactional processing. 1. Receive and check documents required for customs declaration processing. 2. Collect customs duties. Documents required for transactional processing: 1. Import goods declaration form. 2. Permit from competent agencies in event of importing restricted goods. 3. Delivery Order 4. Local invoices issued by customs warehouse companies. 5. Packing list. 6. Certificate of origin. 7. DFSA declaration (prepared by customs). 8. Copy of the trade license. Ex-customs warehouse export Transactional processing: 1. Receive and check documents required for customs declaration processing. 2. Collect registration fees and the deposit amount whether in cash, by cheque or a bank guarantee. 3. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required for transactional processing; 1. DFSA declaration (prepared by customs).

2. Delivery Order. 3. Local invoices issued by customs warehouse companies. 4. Copy of the trade license. Free Zone Transactions Free Zone Bill of Entry In the event of importing goods from outside the country directly into the free zone arriving through a point of entry in Dubai. Transactional processing: 1. Receive and check documents required for customs transactional processing. 2. Collect registration fees. 3. Deliver 3 copies to the client and retain customs copy. Documents required for transactional processing: 1. Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. 2. Original bill of lading (2nd copy). 3. Import permit from the competent agencies in the event of importing restricted goods. 4. Original invoice from the exporter addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item. 5. Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods. 6. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. Ex- Free Zone Import: Sale of goods by a free zone licensee to a licensed importer in UAE. Customs duties on the total value of goods shall be collected for such type of transactions except for duty exemption cases. Transactional processing: 1. Receive and check documents required for customs declaration processing. 2. Exemption approval (if goods are exempted). 3. Collect customs duties and registration fees. 4. Deliver clients own copies and retain customs copy. 5. Import goods declaration form. Documents required for transactional processing: 1. Approved delivery advice in the name of a licensed company by the Free Zone Licensing Management for the goods and approved by the importer in UAE. 2. Import permit from the competent agencies in the event of importing restricted goods. 3. Sale invoice from the free zone licensee addressed to a licensed importer in the country detailing total quantity, goods description, currency and total value for each item.

4. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 5. A form or letter of exemption from customs duties in case the exemption requirements are fulfilled including Local Purchase Order (LPO). Ex-Free Zone import for re-export Sale of goods by a free licensee to an importer outside the country operating under an approved customs system with an approved delivery advice application from the licensee for the purposes of exporting the goods to another country or other customs system. A deposit amount equivalent to the total value of the goods shall be collect for such type of tractions except for duty exemption cases. Transactional processing: 1. Receive and check documents required for customs declaration processing. 2. In case of e-clearance, enter number of e-Mirsal and match data entered in the system with those contained in the declaration. 3. Write data on the banking guarantee if payment through a banking guarantee. 4. Collect registration fees and deposit amount if in cash. 5. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required for transactional processing: 1. Import declaration. 2. Approved delivery advice in the name of a licensed company by the Free Zone Licensing Management for the goods and approved by the importer in UAE. 3. Import permit from the competent agencies in the event of importing restricted goods. 4. Sale invoice from the free zone licensee addressed to a licensed importer in the country detailing total quantity, goods description, currency and total value for each item. 5. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 6. Entry / exit certificate. Ex-Free Zone export Sale of goods by a free licensee to an importer outside the country operating under an approved customs system with an approved delivery advice application by the licensee for the purposes of exporting the goods to another country or other customs system. A deposit amount equivalent to the total value of the goods shall be collected for such type of tractions except for duty exemption cases ship-shore-ship or air to air. Transactional processing: 1. Receive and check documents for customs declaration processing. 2. Write data on the banking guarantee if payment through a banking guarantee. 3. Collect registration fees and deposit amount if in cash. 4. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required fro transactional processing:

1. Approved delivery advice in the name of a licensed company by the Free Zone Licensing Management for the goods and approved by the importer in UAE. 2. Import permit from the competent agencies in the event of importing restricted goods. 3. Sale invoice from the free zone licensee addressed to a licensed importer in the country detailing total quantity, goods description, currency and total value for each item. 4. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 5. Entry / exit certificate. Free Zone Temporary Admission The entry of goods through customs zones into the country on temporary basis for the purposes of taking part in an exhibition or repairs and maintenance of equipment and machineries. A deposit equivalent to customs tariff on total value of goods shall be collected against suck type of transactions. Transactional processing: 1. Receive and check documents for customs declaration processing. 2. Write data on the banking guarantee if payment through a banking guarantee. 3. Collect registration fees and deposit amount if in cash. 4. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required for transactional processing: 1. Approved delivery advice in the name of a licensed company by the Free Zone Licensing Management for the goods and approved by the importer in UAE. 2. A letter from the free zone licensee showing the purpose of exit of goods, period, total quantity, description and total and detailed value of each item with their serial numbers. 3. Sale invoice from the free zone licensee addressed to a licensed importer in the country detailing total quantity, goods description, currency and total value for each item. 4. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. Free Zone Internal Transfer Sale of goods internally by a free zone licensee to another free zone licensee upon approval and consent of the seller and buyer. Transactional processing: 1. Receive and check documents required for customs declaration processing. 2. Collect registration fees. 3. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Approved delivery advice in the name of a licensed company by the Free Zone Licensing Management for the goods and approved by the importer in UAE 2. Approved letter from two free zone licensees (seller and buyer) showing total quantity

and description of goods. 3. Sale invoice detailing total quantity, goods description, and total value for each item. 4. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. Export of goods from local market through free zone Export of duty paid or locally manufactured goods through free zone outside the country. A delivery advice for entry of local goods into the free zone shall be submitted. Transactional processing: 1. Receive and check documents required fro customs declaration processing. 2. Assign a serial number for IDG application (for airports). 3. Approve IDG application by affixing export stamp. 4. Collect registration fees. 5. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Local Goods Inn/Out Application. 2. IDG application (for airports). 3. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. E-Mirsal Transactional Processing: 1. Copy of E-Mirsal that prepared at the companys premises through e-clearance system 2. Receive and check customs declaration accompanied with documents for transactional processing: Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. Original bill of lading (for seaports). Import permit from the competent agencies in the event of importing restricted goods. Original sale invoice addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item. Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. Customs Clearing Representative Card. 3. Enter the form number into the customs declaration system for checking data entered by the company

4. Print out the customs declaration.

5. Collect customs duties and registration fees. 6. Deliver clients own copies and retain customs. E-Customs Clearance Transactional Processing:

1. Receive customs declaration through e-clearance system. 2. Deliver documents required for transactional processing within 48 hours from the time of their receipt through e-clearance system, which include: Copy of the declaration prepared at the companys premises. Bill of lading.

Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. Import permit from the competent agencies in the event of importing restricted goods. Original sale invoice addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item.

Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 3. Customs Clearing Representative Card.

4. Enter declaration number and check data entered by the company into e-clearance system in terms of (importers code- shipping agent code date of preparing customs declaration 0 delivery order number description of goods). 5. Check customs declaration and enclosures. 6. Send online approval for completing transactional processing. 7. Retain customs` copy. Import and export transactions Any goods being imported through either land, sea or air customs zones shall be subject to the following specific general customs procedures: 1. Submit a detailed customs declaration as per the approved form including all information about the goods and accompanied with all documents required. 2. Declaration of goods and cash for passengers. 3. Register customs declaration with the competent customs officer. 4. Transfer goods to examination, checking and inspection. 5. Evaluate goods for the purposes of payment of customs duties. 6. Release of goods.

Import Import of goods from outside the country into local market. Transactional processing: 1. Receive and check the documents required for customs declaration processing. 2. Implement customs tariff and regulations. 3. Collect customs duties and registration fees. 4. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Import goods declaration form. 2. Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. 3. Original bill of lading (for seaports). 4. Import permit from the competent agencies in the event of importing restricted goods. 5. Original invoice from the exporter addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item. 6. Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods. 7. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 8. A form or letter of exemption from customs duties in case the exemption requirements are fulfilled including Local Purchase Order (LPO). 9. Copy of the trade license of buyer and seller. Import of goods from outside the country for re-export Transactional processing: 1. Receive and check the documents required for customs declaration processing. 2. Write all information required on the banking guarantee if payment under banking guarantee. 3. Collect registration fees and deposit amount if in cash. 4. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required for transactional processing: 1. Import goods declaration form. 2. Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. 3. Original bill of lading (for seaports). 4. Import permit from the competent agencies in the event of importing restricted goods. 5. Original invoice from the exporter addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item. 6. Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods.

7. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 8. Copy of the trade license of buyer and seller. Temporary Admission The entry of goods through customs zones into the country on temporary basis for the purposes of taking part in an exhibition or repairs and maintenance of equipment and machineries. A deposit equivalent to customs tariff on total value of goods shall be collected against such type of transactions. Transactional processing: 1. Receive and check the documents required for customs declaration processing. 2. Write all information required on the banking guarantee if payment under banking guarantee. 3. Collect registration fees and deposit amount whether in cash, by cheque or banking guarantee. 4. Deliver clients own copies and retain customs copy and the banking guarantee copy. Documents required for transactional processing: 1. Import goods declaration form. 2. Delivery order from a shipping agent addressed to a licensed company by licensing agencies in UAE. 3. Original bill of lading (for seaports). 4. Import permit from the competent agencies in the event of importing restricted goods. 5. A letter from the licensed company showing the purpose of exit, period, total quantity, description and detailed value of each item showing their serial numbers. 6. Original invoice from the exporter addressed to a licensed importer in the country detailing total quantity, goods description and total value for each item. 7. Original certificate of origin approved by the chamber of commerce at the country of origin detailing the origin of goods. 8. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. 9. Copy of the trade license issued in UAE. Export Export of goods The sale of goods by a licensed company in the country to an importer outside UAE or operating under an approved customs system with an approved delivery advice application from the licensee for the purposes of exporting the goods to another country or other customs system. No customs duties on such goods shall be collected since being exported from the local market or locally manufactured Transactional processing: 1. Receive and check the necessary documents required for customs declaration processing. 2. Approve Instructions of the Declaration of Goods form (IDG) (for airports).

3. Prepare export declaration. 4. Collect registration fees. 5. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Instructions of the Declaration of Goods application (IDG) or an export declaration approved in the name of a licensed company by a licensing agency in the country (for airports). 2. Export permit in event of exporting restricted goods. 3. Sale invoice from a licensed company in the country addressed to a company outside the country or operating under an approved customs system showing total quantity, description and total and detailed value of each item. 4. A detailed packing list as per weight, method of packing and HS code of each type of goods contained in the shipment. Temporary export Transactional processing: 1. Receive and check the documents required for customs declaration processing. 2. Approve Instructions of the Declaration of Goods form (IDG) (for airports). 3. Prepare export declaration. 4. Collect registration fees. 5. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Instructions of the Declaration of Goods application (IDG) or an export declaration approved in the name of a licensed company by a licensing agency in the country (for airports). 2. Export permit in event of exporting restricted goods. 3. Sale invoice from a licensed company in the country addressed to a company outside the country or operating under an approved customs system showing total quantity, description and total and detailed value of each item. 4. A detailed packing list as per weight, method of packing and HS code of each type of goods contained in the shipment. Inter-GCC States Statistical Declaration Such type of declaration is processed for goods intended to be moved between GCC States and regarded as part of a consignment for which customs formalities have been completed at the point of entry. Such goods are called (incomplete consignment), and their final destination shall be one of GCC States. Transactional processing: 1. Receive and check the documents required for customs declaration processing. 2. Prepare and approve the customs declaration. 3. Write import declaration number as a reference for the statistical declaration. 4. Collect registration fees.

5. Affix the set off stamp on the respective transaction 6. Deliver clients own copies and retain customs copy. Documents required for transactional processing: 1. Delivery Order 2. Copy of the import declaration (after payment of customs duties at the point of entry). 3. Original copies of import declaration invoices Goods in transit Imported goods from outside the country for the interest of a foreign importer addressed in his name or the name of a licensed agent carrier by a competent authority on the importers behalf. The goods shall only be registered since transiting the territories of the country to a final destination. A deposit amount equivalent to the total value of goods shall be collected to ensure exit of goods outside the country within 30 days from the transactional processing date. Transactional processing: 1. Receive and check documents for customs declaration processing. 2. Collect registration fees and deposit amount if in cash. 3. Deliver clients own copies and retain customs. Documents required for transactional processing: 1. Delivery order from the shipping agent addressed in the name of the foreign importer or his carrier agent licensed by local authorized licensing agencies in UAE 2. Copy of the sale invoice from the exporter addressed in the name of the foreign importer showing total quantity, description of goods and detailed and total value of each item. 3. Detailed packing list as per weight, method of packing and HS code for each individual article contained in the shipment. Transshipment Imported goods from outside the country for the interest of a foreign importer addressed in his name or the name of a licensed agent carrier by a competent authority on the importers behalf. The goods shall only be registered since transiting the territories of the country or exiting the customs arrival zone to the final destination. Transactional processing: 1. Receive and check documents required for 2. Write customs declaration number on the transshipment order. 3. Deliver clients own copies and retain customs. Documents required for customs declaration processing: 1. Delivery Order . 2. Bill of lading. 3. Mirsal 2 4. Mirsal 2 The future of Customs Declarations Electronic Paperless Declarations

5. Dubai Customs introduces electronic paperless declarations which mean that goods can be cleared without the actual papers being handed in to Customs. However, if special documents are required, or customs inspection is necessary, Mirsal 2 sends a hold clearance to the cargo handler until the necessary steps have been taken. If a permit is required to import restricted goods the importer can apply for the permit before making a declaration and inform Customs of the permit number and Customs will validate the permit with the respective authority. 6. Why is Electronic Paperless Declarations being introduced? 7. Its purpose is to reduce costs to importers, exporters and the freight community by speeding up and streamlining import and export trade. The trade growth in Dubai is increasing at a rate that is not sustainable with current Customs procedures therefore a new simplified way of processing documents to Customs is required. Because Mirsal 2 requires data to be submitted based upon International data standards it allows Customs to focus on the job of inspecting high-risk consignments. 8. Intelligence and Risk Engine 9. In order to apply integrity and consistency of decision making Mirsal 2 has validation rules built into the system with an intelligent Self-learning Risk Assessment Engine at the core of the system. Along with the Profile Management and Profile Creation module the Risk Engine applies selective and random profile matching on declarations. The use of predictive modelling profiling area of the Risk Engine moves Dubai Customs to the forefront of all Customs administrations world-wide in the way that we manage declarations. 10. For more information about Mirsal 2 click the links below to download the file. 11. About Mirsal 2 12. FAQ About Mirsal 2 Declaration Names Descriptions Declaration Types in Mirsal 2 Minimum Set of Requirements for Clients PCs 13. Registration & Declarations Manuals & Processes 14. Declaration Processing User Manual Registration User Manual 15. Etisalat Digital Certificate 16. Digital Certificate Description Digital Certificate Letter of Authorization Digital Certificate Subscriber Agreement Digital User Certificate Application Process Digital Signature Installation Procedure 17. File Upload Templates 18. Declaration Upload Template Description Container Upload Sample Invoice Upload Sample Invoice Upload With Permit Sample Vehicle Upload Sample 19. Policy & Law 20. E-commerce Federal Law Mirsal 2 Terms Conditions

Vous aimerez peut-être aussi

- Irsal: Eclaration RocessingDocument118 pagesIrsal: Eclaration RocessingDanish AzmiPas encore d'évaluation

- Consumer Lifestyles in The United Arab EmiratesDocument65 pagesConsumer Lifestyles in The United Arab Emiratesu76ngPas encore d'évaluation

- Dubai Islamic FinanceDocument5 pagesDubai Islamic FinanceKhuzaima ShafiqPas encore d'évaluation

- Booking Holdings Inc.: Submitted byDocument58 pagesBooking Holdings Inc.: Submitted byNancy JainPas encore d'évaluation

- RizzDocument5 pagesRizzRizwan Jaffer SultanPas encore d'évaluation

- Re Export From UAEDocument7 pagesRe Export From UAERaghu VenkataPas encore d'évaluation

- PPLounge DirectoryDocument236 pagesPPLounge DirectorybujjiusaPas encore d'évaluation

- Report On Dubai Islami BankDocument44 pagesReport On Dubai Islami BankUMARUSMANPas encore d'évaluation

- Dubai BankDocument43 pagesDubai BankArslanMehmoodPas encore d'évaluation

- Avari ReportDocument10 pagesAvari ReportMahnoor AmjadPas encore d'évaluation

- Export Documentation and ProceduresDocument29 pagesExport Documentation and ProceduresVetri M KonarPas encore d'évaluation

- Dubai 1962Document17 pagesDubai 1962usman zafarPas encore d'évaluation

- Strategic Alliance of AccorDocument3 pagesStrategic Alliance of AccorLee BK100% (1)

- Exporting To The UAE - The DHL Fact SheetDocument3 pagesExporting To The UAE - The DHL Fact SheetDHL Express UKPas encore d'évaluation

- Audit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationDocument12 pagesAudit Firms in Dubai, Audit Firm, Bookkeeping, Business Setup, LiquidationImtiaz JavedPas encore d'évaluation

- SP J Printer DubaiDocument12 pagesSP J Printer DubaiAdhaar AgarwalPas encore d'évaluation

- Analysis of ICT Usage PatternsDocument16 pagesAnalysis of ICT Usage PatternsFajri FebrianPas encore d'évaluation

- AgthiaDocument13 pagesAgthiakhulood100% (1)

- Pro-Poor Analysis of The Rwandan Tourism Value ChainDocument53 pagesPro-Poor Analysis of The Rwandan Tourism Value ChainAdina ConstantinescuPas encore d'évaluation

- Dubai Food SectorDocument17 pagesDubai Food SectorprisharPas encore d'évaluation

- 2018 - OASIS General Company ProfileDocument8 pages2018 - OASIS General Company ProfileOasis Holidays (India) Pvt.Ltd. ,Pas encore d'évaluation

- Internship Practical ReportDocument60 pagesInternship Practical ReportAmin Emengto100% (1)

- Christophe Kati: International Business Development SpecialistDocument5 pagesChristophe Kati: International Business Development SpecialistTheophilus MuyiwaPas encore d'évaluation

- Aujan Industries: Dubai, UAE May 2011Document12 pagesAujan Industries: Dubai, UAE May 2011Originalo VersionaPas encore d'évaluation

- Starting A Business in DubaiDocument8 pagesStarting A Business in DubaiMazen KhamisPas encore d'évaluation

- 20101005045642Document92 pages20101005045642binrePas encore d'évaluation

- Gitex 2009 Exhibitors Manual - FormsDocument36 pagesGitex 2009 Exhibitors Manual - FormsVaishaliduaPas encore d'évaluation

- Unit V: Export IncentivesDocument37 pagesUnit V: Export IncentivesthensureshPas encore d'évaluation

- Skynet Courier Tracking Dubai PDFDocument7 pagesSkynet Courier Tracking Dubai PDFRODEWAY INN ERIEPas encore d'évaluation

- EMBA ClassDirectory 2014Document12 pagesEMBA ClassDirectory 2014sisqokcPas encore d'évaluation

- Moncy ResumeDocument5 pagesMoncy ResumeMoncy Palliathu Varughese100% (6)

- UAEDocument13 pagesUAErishifiib08100% (1)

- BTTM 704 Outbound TourismDocument66 pagesBTTM 704 Outbound TourismSaurabh ShahiPas encore d'évaluation

- Best Resume Format For GCC RegionDocument3 pagesBest Resume Format For GCC Regionneo190Pas encore d'évaluation

- Muslim Friendly Tourism MFT Regulating Accommodation Establishments in The OIC Member CountriesDocument125 pagesMuslim Friendly Tourism MFT Regulating Accommodation Establishments in The OIC Member CountriesLarasitaPas encore d'évaluation

- Export BooksDocument3 pagesExport BooksKamlesh PrajapatiPas encore d'évaluation

- Internship HandbookDocument24 pagesInternship Handbookapi-282642719Pas encore d'évaluation

- $ CCS Directory 2017Document232 pages$ CCS Directory 2017K S Rao100% (1)

- School Report On StrategyDocument36 pagesSchool Report On StrategyNicholas Seetoh Yifeng100% (1)

- Final Presentation For Transport (Combined)Document160 pagesFinal Presentation For Transport (Combined)Sharif HafifyPas encore d'évaluation

- UAE Procedures To Satrt BusinessDocument2 pagesUAE Procedures To Satrt BusinessRamalingam ChandrasekharanPas encore d'évaluation

- Final Report IPM WOP DUBAI EnglishDocument4 pagesFinal Report IPM WOP DUBAI EnglishUmair GardeziPas encore d'évaluation

- Gul Ahmed Business Plan For DubaiDocument25 pagesGul Ahmed Business Plan For DubaiZain ImranPas encore d'évaluation

- Luxury The Dubai Way: Fast Growing Luxury Online Marketplace Eyes International MarketsDocument3 pagesLuxury The Dubai Way: Fast Growing Luxury Online Marketplace Eyes International MarketsPR.comPas encore d'évaluation

- Vietnam Agriculture Food Market 2018 ReportDocument45 pagesVietnam Agriculture Food Market 2018 ReportLuan RobertPas encore d'évaluation

- Doing Business in UAE PresentationDocument10 pagesDoing Business in UAE PresentationAmira Feriel MehailiaPas encore d'évaluation

- Benefits of Being A Travel AgentDocument4 pagesBenefits of Being A Travel AgentClaritySSOPas encore d'évaluation

- LiveDocument31 pagesLivebkaaljdaelvPas encore d'évaluation

- Ate Dec 2013Document7 pagesAte Dec 2013Asim JavedPas encore d'évaluation

- Indian Export Import GuideDocument101 pagesIndian Export Import GuideMEGHANALOKSHA100% (1)

- DubaiCustoms AboutMirsal2Document14 pagesDubaiCustoms AboutMirsal2Hassan Eleyyan100% (1)

- Assignment On ComputerDocument6 pagesAssignment On ComputerOsprissho HridoyPas encore d'évaluation

- City Tech Dubai Company ProfileDocument16 pagesCity Tech Dubai Company ProfileSalahuddin MughalPas encore d'évaluation

- Business Setup Abu Dhabi Global MarketDocument5 pagesBusiness Setup Abu Dhabi Global MarketKpiDubaiPas encore d'évaluation

- Dubai PRJDocument29 pagesDubai PRJNitesh R ShahaniPas encore d'évaluation

- External Trade: Team ADocument11 pagesExternal Trade: Team AKhan ShahRukhPas encore d'évaluation

- Topic 4 - Export Marketing 2Document10 pagesTopic 4 - Export Marketing 2arrowphoto10943438andrewPas encore d'évaluation

- Warehousing of GoodsDocument6 pagesWarehousing of GoodsNGANJANI WALTERPas encore d'évaluation

- L 10 External TradeDocument5 pagesL 10 External TradeDeveshi TewariPas encore d'évaluation

- 1.A. Distinguish Between Export Order, Agreement & ContractDocument43 pages1.A. Distinguish Between Export Order, Agreement & Contractchanfa3851Pas encore d'évaluation

- Overview of Standard WeightsDocument16 pagesOverview of Standard WeightsAnonymous 1gbsuaafddPas encore d'évaluation

- Designing Layout For Manual Order Picking in WarehousesDocument34 pagesDesigning Layout For Manual Order Picking in WarehousesAnonymous 1gbsuaafddPas encore d'évaluation

- Articles On Order Picking and Warehouse ManagementDocument52 pagesArticles On Order Picking and Warehouse ManagementAnonymous 1gbsuaafddPas encore d'évaluation

- AbcanalysisDocument298 pagesAbcanalysisAnonymous 1gbsuaafddPas encore d'évaluation

- Thing To DoDocument1 pageThing To DoAnonymous 1gbsuaafddPas encore d'évaluation

- Ganapathipura Building Cost: Date Particulars Sub Amount Total Amount Cumulative AmountDocument1 pageGanapathipura Building Cost: Date Particulars Sub Amount Total Amount Cumulative AmountAnonymous 1gbsuaafddPas encore d'évaluation

- Industry I Table of Key Performance IndicatorsDocument26 pagesIndustry I Table of Key Performance IndicatorsAnonymous 1gbsuaafddPas encore d'évaluation

- Logistics Technology Final 02.16.10Document32 pagesLogistics Technology Final 02.16.10Anonymous 1gbsuaafddPas encore d'évaluation

- Warehousing DesignDocument34 pagesWarehousing DesignRamneek Singh KhalsaPas encore d'évaluation

- Supply Chain Management in International Logistics - RFID ApplicationsDocument25 pagesSupply Chain Management in International Logistics - RFID ApplicationsAnonymous 1gbsuaafddPas encore d'évaluation

- Motorola RFID Transportation Logistics White PaperDocument8 pagesMotorola RFID Transportation Logistics White PaperAnonymous 1gbsuaafddPas encore d'évaluation

- Refrigeration Heat Load EstimatingDocument17 pagesRefrigeration Heat Load EstimatingAnonymous 1gbsuaafddPas encore d'évaluation

- Warehouse Staff Performance AppraisalDocument3 pagesWarehouse Staff Performance AppraisalAnonymous 1gbsuaafdd50% (2)

- Flow Chart SymbolsDocument3 pagesFlow Chart SymbolsAnonymous 1gbsuaafddPas encore d'évaluation

- Thirteen Aesthetic Tie KnotsDocument51 pagesThirteen Aesthetic Tie KnotsAnonymous 1gbsuaafddPas encore d'évaluation

- List of Jewelleries With Tamil Selvi: Purchase Date Item Grams ValueDocument2 pagesList of Jewelleries With Tamil Selvi: Purchase Date Item Grams ValueAnonymous 1gbsuaafddPas encore d'évaluation

- Pallet Racking GuideDocument33 pagesPallet Racking GuideAnonymous 1gbsuaafddPas encore d'évaluation

- EstimateDocument5 pagesEstimateAnonymous 1gbsuaafddPas encore d'évaluation

- Nestle Refusal Analysis by Customer: PERIOD: JanuaryDocument7 pagesNestle Refusal Analysis by Customer: PERIOD: JanuaryAnonymous 1gbsuaafddPas encore d'évaluation

- Cheat Code Excel 2010Document2 pagesCheat Code Excel 2010Hasan ShahariarPas encore d'évaluation

- Chapter 2 SVDocument43 pagesChapter 2 SVTM PhụngPas encore d'évaluation

- Ang Vs American SS AgenciesDocument3 pagesAng Vs American SS AgenciesteepeePas encore d'évaluation

- Cargo ClaimsDocument20 pagesCargo ClaimsAdi SinghPas encore d'évaluation

- UK P&I Legal Briefing e Bill of Lading 2017 06Document8 pagesUK P&I Legal Briefing e Bill of Lading 2017 06Toheid AsadiPas encore d'évaluation

- Ship Brokering and Chartering SyllabusDocument2 pagesShip Brokering and Chartering SyllabusAzlan Khan100% (1)

- Sealand v. CADocument2 pagesSealand v. CAd2015memberPas encore d'évaluation

- Taligaman CaseDocument11 pagesTaligaman CaseTeacherEliPas encore d'évaluation

- What Are Hague-Visby Rules - Marine InsightDocument3 pagesWhat Are Hague-Visby Rules - Marine Insightanand raoPas encore d'évaluation

- Import ProcedureDocument46 pagesImport Procedureskedar89Pas encore d'évaluation

- Cebu United Enterprises Vs Gallofin, 106 Phil 491 Case Digest (Administrative Law)Document1 pageCebu United Enterprises Vs Gallofin, 106 Phil 491 Case Digest (Administrative Law)AizaFerrerEbinaPas encore d'évaluation

- UnclosDocument58 pagesUnclospushpendra mishraPas encore d'évaluation

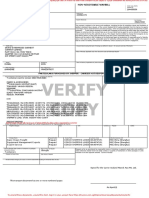

- Verify Copy: Particulars Furnished by Shipper - Carrier Not ResponsibleDocument2 pagesVerify Copy: Particulars Furnished by Shipper - Carrier Not ResponsibleThant ZinPas encore d'évaluation

- International Business Transactions Outline Professor Ramsey, Spring 2015Document77 pagesInternational Business Transactions Outline Professor Ramsey, Spring 2015Chen HakaniPas encore d'évaluation

- Force Majeure Clauses in ICC Rules 1559904833 PDFDocument27 pagesForce Majeure Clauses in ICC Rules 1559904833 PDFReena TahirPas encore d'évaluation

- QRHW23050034 FletadoDocument2 pagesQRHW23050034 FletadoAnthony CollantesPas encore d'évaluation

- Magellan Manufacturing Marketing Corporation VsDocument2 pagesMagellan Manufacturing Marketing Corporation VsAndrea GerongaPas encore d'évaluation

- Export DocumentsDocument8 pagesExport DocumentsBassma EL GHALBZOURIPas encore d'évaluation

- Domestic LC Front and Back Pages PDFDocument2 pagesDomestic LC Front and Back Pages PDFAnasor GoPas encore d'évaluation

- Documents Required For Import Customs Clearance in IndiaDocument7 pagesDocuments Required For Import Customs Clearance in IndiaHuzaifaPas encore d'évaluation

- GEORGE CHINGORE MATARUKA Bill of LadingDocument1 pageGEORGE CHINGORE MATARUKA Bill of LadingVictor TimirePas encore d'évaluation

- Home Insurance Company vs. American Steamship and Luzon Stevedoring G.R. No. L-25599 April 4, 1968Document7 pagesHome Insurance Company vs. American Steamship and Luzon Stevedoring G.R. No. L-25599 April 4, 1968MJ DecolongonPas encore d'évaluation

- Conline BillDocument1 pageConline BillDuong Quoc Truong100% (1)

- The Indian Bills of Lading Act, 1856Document2 pagesThe Indian Bills of Lading Act, 1856Parimal KashyapPas encore d'évaluation

- Freight Forwarders Michael SilvaDocument9 pagesFreight Forwarders Michael SilvaAftab AhmadPas encore d'évaluation

- Seller's LOI FORMAT - LNG - LGP - Via WFPetroleumDocument2 pagesSeller's LOI FORMAT - LNG - LGP - Via WFPetroleumJuan AgueroPas encore d'évaluation

- Tax Invoice - Spkg1604022862 - C - Hombespkg (29-Apr-16)Document2 pagesTax Invoice - Spkg1604022862 - C - Hombespkg (29-Apr-16)WANSPas encore d'évaluation

- ADS & Export DocumentsDocument102 pagesADS & Export Documentsamit1002001Pas encore d'évaluation

- Anec 42Document5 pagesAnec 42carloPas encore d'évaluation

- Keng Hua Products Vs CA 286 SCRA 257 (1998)Document2 pagesKeng Hua Products Vs CA 286 SCRA 257 (1998)Benitez Gherold100% (1)

- Valpy and Others, Assignees of The Estate and Effects of Edward Brown, A Bankrupt, V Gibson and Another (1847) 136 ER 737Document13 pagesValpy and Others, Assignees of The Estate and Effects of Edward Brown, A Bankrupt, V Gibson and Another (1847) 136 ER 737Jahnavi GopaluniPas encore d'évaluation