Académique Documents

Professionnel Documents

Culture Documents

USDA Edge Fixed Product

Transféré par

AccessLendingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

USDA Edge Fixed Product

Transféré par

AccessLendingDroits d'auteur :

Formats disponibles

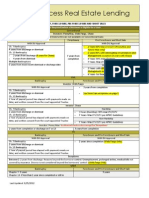

USDA EDGE FIXED PRODUCT

Effective Date: Description: January 28, 2013 & February 25, 2013 Fixed Rate Mortgage insured by the United States Department of Agriculture USDA Fixed Rate Fully Amortizing Mortgage 30 Year Term No Money Down No Mortgage Insurance - See Guarantee and Annual fee below No First-Time Homebuyer Requirement

Up-Front Guarantee Fee

Transaction Type Purchase Up-front Guarantee Fee Prior Up-front Guarantee Fee On/ to 10/01/2012 After 10/01/2012 2% 1.5% 2% 2%

Guarantee fee and Annual Fee:

Refinance

Annual Fee (Paid Monthly)

Transaction Type Purchase Refinance Up-front Guarantee Fee Prior Up-front Guarantee Fee On/ to 10/01/2012 After 10/01/2012 30% 30% 40% 40%

Maximum Loan Amounts The maximum loan amount is limited to the appraised value of the property plus the on Purchases: Guarantee fee and can include closing cost when the appraised value exceeds the sales price. For Refinances, see Refinance Limitations and Maximum Loan Amounts. Assumability: PrePayment Penalty: Escrow Waiver: Underwriting Method: Not Permitted None Not Permitted May follow GUS AUS decision and documentation requirements or manual underwrite. Not Permitted

Temporary Buydown:

Page 1 of 7

USDA EDGE FIXED PRODUCT

Continued

Qualifying Rate and Ratios: Qualify at note rate. Note: The maximum interest rate for the Rural Development Guaranteed Rural Housing Program is defined as the FNMA 90-day actual-actual yield requirements plus 60 basis points, rounded up to the nearest quarter percent. MAX 29/41% DTI - Exceptions encouraged with compensating factors and RD concurrence. Purchase Rate and Term Refinance of existing USDA loan Streamline Refinance Rural Refinance Pilot streamline Property must be located in rural area as designated by RHS - refer to htt://eligibility.sc.egov.usda.gov Allowed: Acreage, Attached, Condos, Condos - Low Rise (< 4 stories), Detached Single Family, Leashold, Mixed Use, Modular, Panelized Homes, Pre-Fab Homes, PUD, PUD-Attached, Rural, Townhomes Acreage: > 30% site value: case by case basis Condos: Complex must be FHA Approved Leasehold: must be common to area Mixed Use: 1 unit only PUDS-Attached: FNMA/FHLMC Warrantable Rural: must be residential in nature; income producing not allowed; additional restrictions may apply - contact u/w for details Note: Properties listed for sale: Refi = currently listed not available Full Doc Manual underwrite Primary Residence First-time homebuyers allowed Non-occupant coborrower not allowed Non-permanent resident alien not allowed Trailing wage earner income not allowed In order to be eligible for a Rural Development guaranteed loan, the Borrwers' adjusted household income cannot exceed the maximum allowable income limit set forth in Rural Development Instruction 1980-D 1980.348 Exhibit C (use moderate income limits). http://eligibility.sc.egov.usda.gov The borrower must not have sufficient assets to obtain other traditional conventional financing. The borrower may, however, to qualify for an FHA or VA loan. In other words, applicants may have liquid assets and be eligible to participate in the GRH Program. Those assets, however, should not be sufficient to meet the down payment and closing cost requirements associated with a conventional uninsured mortgage product (LTV 80%). This means applicants do have a choice of USDA-Guaranteed Rural Housing, FHA, VA, or a conventional mortgage product with private Page 2 of 7 mortgage insurance.

Types of Financing:

Eligible Property Types:

Documentation Type: Occupancy: Borrower Eligibility:

USDA EDGE FIXED PRODUCT

Continued

Borrower Eligibility Con't: The Appraisal determines the maximum loan amount. The applicant may borrow up to 100% of the appraised value plus the Guarantee Fee Primary Income - Two year history required Two Years of tax returns will only be required for o Self-employed borrowers (In addition to P&L) o Commissioned borrowers Alimony - 12 month history, with proof of 3 years continuance Part-time, Overtime & Bonus - 12 month history Disability - Benefits letter, 3 years continuance and gross up 125% SSI benefits - Awards Letter Salary Increases - With 30 day of the first payment due date are accepted. Non-Occupant Co-Borrowers: Credit: Not Permitted

USDA Credit Standards Apply. Rural Development Guaranteed Rural Housing loans are typically underwritten to Rural Development Instruction 1980.345(d) USDA Credit Standards Apply. Rural Development Guaranteed Rural Housing loans are typically underwritten to Rural Development Instruction 1980.345(d) Credit Score: o 620 minimum FICO o No Fico - allowed with non-Traditional credit - Will have a 3 point add to pricing Late Payments: o 1x30 Permitted in last 12 months with explanations - Exceptions may be granted if your borrowers have 620 or greater middle credit scores Bankruptcy/Foreclosure: o Chapter 7 and 13 must be discharged for 3 years - Foreclosures must be completed 3 years ago Collections: o Accounts cannot have been placed in collection status within the last 12 months o Exceptions may be granted if your borrowers have 620 or greater middle credit scores Judgments: o Must be paid off for at least 12 months - Exceptions may be granted if borrowers have 620 or greater middle credit scores

Credit Score :

Page 3 of 7

USDA EDGE FIXED PRODUCT

Continued

Credit Con't: Debt Ratio: o The Total Debt Ratio should include revolving debt regardless of when the debt will be retired. Installment loans will only be considered if the debt will be retired in more than six months. However, if the monthly payment on the debt is substantial, the payment will also be included in long term debt. o If the borrower has co-signed a loan for another party, an acceptable 12 month history validating that the borrower is not making the payment must be provided in order to exclude the payment from the total debt. Liabilities solely in the applicant's name must always be considered in the debt ratio, regardless of who is making the monthly payment as the legal obligation resides with the applicant. o When a borrower has a delinquent student loan obligation, a satisfactory six-month repayment history must be provided. Regardless of deferment status, all student loans must have the monthly payment included in the debt ratio calculation. Verification of Rent is required with a Refer or manual underwrite: o A 24-month history of residence is required (previous housing payments is not necessarily required). Additionally, a 12-month verification of rent or mortgage with a payment rating is also required on all files when the primary wage earner has a credit score of less than 640 or a GUS Accept is not received. This may be done using a Request for Verification of Rent or Mortgage Account, or information contained on the credit report, or cancelled checks. All lates grater than 30 days must be documented with an explanation from the applicant Non-Traditional Credit: Acceptable if no credit is available and borrowers has no derogatory credit history. If no Fico score, there will be a 3 point add to fee. Requirements are as follows. Four nontraditional sources are required for applicants with no current rent or housing history. Only three nontraditional sources are required if applicants currently pay rent or housing expenses which can be documented for 12 months. All tradeline sources must be open and have a recent 12 month history. Documentation maybe canceled Checks or written verifications that include the creditors name, date the account was opened, account balance, monthly payment due, and history reported in 0x30, 0x60, 0x90 format. Subjective statements such as satisfactory or acceptable are NOT an acceptable format. Applicants may only have one 30 day late in the 12 months Payments made to relatives for credit sources are ineligible Minimum Borrower's Investment No minimum borrower investment is required

Page 4 of 7

Assets:

USDA EDGE FIXED PRODUCT

Continued

Seller Contributions: Seller can pay 100% of discount points and borrower's non-recurring closing costs. Seller can provide an additional amount not to exceed 6% of the estimated reasonable value to assist the borrower's payment of buydown points, prepaid expenses and funding fee. Borrowing of Unsecured funds allowed with 660 credit score Gifts (or Grants) - A borrower can use funds obtained as a gift (or grant) to satisy part of the cash requirement for closing only if the donor is a relative, charitable organization, municipality, or nonprofit organization. A gift must be evidenced by a letter that is signed by the donor. The letter must: Specify the dollar amount of the gift and the date the funds were transferred Indicate the donor's name, address, telephone number, and relationship to the borrower, and include the donor's statement that no repayment is expected. The lender must verify that funds have been transferred to the borrower's account and show documentation of the transfer of the fit funds from the donor's account; for example, by obtaining a copy of the donor's withdrawal slip or canceled check and the borrower's deposit slip ect. When the funds are not transferred prior to settlement, the donor may give the closing agent a certified check for the amount of the gift. A couple of that check or a settlement statement showing receipt of that check will be sufficient documentation for the lender's records provided the donor is listed as the remitter. A gift or grant from a charitable organization, municipality, or nonprofit organization must be evidenced by either a copy of the letter awarding the gift or grant to the borrower or a copy of the legal agreement that specifies the terms and conditions of the gift or grant. This supporting document must include language indicating that no repayment of the gift or grant is expected and an indication of how the funds will be transferred (to the borrower, the lender, or the closing agent). The lender must include in the individual mortgage file evidence of the transfer of the funds - such as a copy of the donor's cancelled check or a settlement statement showing receipt of the check. Reserves: Limitations on other Real Estate Owned: Mortgage Insurance: Per the AU Borrower may not have any ownership in any other residential properties at time of closing unless other property is beyond a reasonable commute of current job See Guarantee and Annual fee

Gift Funds:

Properties Listed for Sale: Refinances are currently listed not allowed

Page 5 of 7

USDA EDGE FIXED PRODUCT

Continued

Appraiser Requirements: Must be completed by certified residential/general FHA Roster appraiser No Transferred appraisals Appraisal Requirements: One full appraisal required - Must meet HUD handbook Guidelines Rate and Term Refinance: Appraisal not required if Refi to pay off existing balance & guarantee fee Any conditions noted on an appraisal that are related to the safety or livability of the subject property must be addressed and rectified prior to loan closing. Expenses related to property inspecitions and property repairs may not be financed into the new GRH refinance loan, or escrowed for prior to closing. Termite Inspection - required in all areas Well/Septic Inspections - 100% required - Well test must be completed by state certified lab. EPA hotline 800-426-4791 Refinance Limitations and Only refinanced of prior USDA loans are allowed Maximum Loan Amounts: Cash out loans are not permitted Rate and Term Refinance: Appraisal not required if Refi to pay off existing balance and guarantee fee Income and ratios must be verified on standard USDA Streamline loans unless it qualifies for the Pilot Refinance Program below: Components of the USDA Rural Refinance Pilot Program Include: A new appraisal and additional inspections are not required Ratios are not calculated, but income verification for all adult household members is required for income eligibility determination. Household income is necessary for determining program eligibility only, not for determining repayment ability. Therefore, ratio waivers are not required. Must be in one of the following Pilot States: o AL, AZ, CA, FL, GA, IL, IN, KY, MI, MS, NV, NJ, NM, NC, OH, OR, RI, SC, & TN o Pilot States Added & Effective 2/25/2013: AK, AR, CO, ID, KS, MO, MT, ND, OK, SD, TX, UT, WA, WV, WI Borrowers must have made timely mortgage payments for the 12 month period prior to the refinance The interest rate on the new loan must be a minimum of 1.000% lower than the existing USDA loan Max new loan term is 30 years All Rural Refinance Pilot loans must be manually underwritten. GUS is not available for the Rural Refinance Pilot loans The new term of the refinance loan must be 30 years The upfront USDA guarantee fee wil be 1.50% (Will be going to 2.0% on 10/01/2012) The applicable Annual Fee will be 0.30% (will be going to 0.40% on 10/01/2012)

Page 6 of 7

USDA EDGE FIXED PRODUCT

Continued

Refinance Limitations and The new loan may only include the principal balance of the existing loan plus the Maximum Loan Amounts: upfront guarantee fee (accrued interest, prepaid interest, closing costs, and funds required to establish an escrow account may be financed into the new loan) No cash out is permitted Reasonable and customary closing costs and other fees may be collected from the borrower by the originating lender. However, the origination fee charged to the borrower may not exceed one percent of the total loan amount A fully executed RD Form 1980-21 Request for Single Family Housing Loan Guarantee is required Access Real Estate Lending will require all borrowers to be employed at the time of the closing on the refinance transaction or have alternate sources of income, such as: retirement income, social security income, disability income, alimony or child support 4506-T: A completed, signed, and dated IRS form 4506-T must be completed for all borrowers whose income is used to qualify for the mortgage The 4506-T must be processed and tax transcripts obtained (for each year requested) to validate against the borrower's tax returns and/or W-2 forms

Intended as a quick reference quide only and may not capture all program features or changes that may have occured. Call Access Today if you have any questions or would like to get approved for a USDA home loan - 530.897.4090

Access Real Estate Lending | 1051 Mangrove Avenue | Chico CA 95926 Office: 530.897.4090 | Fax: 530.892.2090 | www.accessloans.net

CA DRE#: 01215943 | NMLS#: 1850 | Licensed by the Department of Corporations under the California Residential Mortgage Lending Act. An Equal Housing Lender. *Info Subject to Change. Page 7 of 7

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Firearm Laws in PennsylvaniaDocument2 pagesFirearm Laws in PennsylvaniaJesse WhitePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Plant Management TafskillsDocument4 pagesPlant Management TafskillsTHEOPHILUS ATO FLETCHERPas encore d'évaluation

- Shell Answer Book 07 The Driving Emergency BookDocument8 pagesShell Answer Book 07 The Driving Emergency BookKenneth100% (2)

- 007 G.R. No. 162523 November 25, 2009 Norton Vs All Asia BankDocument5 pages007 G.R. No. 162523 November 25, 2009 Norton Vs All Asia BankrodolfoverdidajrPas encore d'évaluation

- Zeb OSARSInstallDocument128 pagesZeb OSARSInstallThien TranPas encore d'évaluation

- Case Studies Public LibraryDocument4 pagesCase Studies Public LibraryHimalya Kaim83% (6)

- HARP 2.0 Freddie Open Access Relief UnlimitedDocument4 pagesHARP 2.0 Freddie Open Access Relief UnlimitedAccessLendingPas encore d'évaluation

- Important Bulletin Regarding Termite Reports On FHA LoansDocument3 pagesImportant Bulletin Regarding Termite Reports On FHA LoansAccessLendingPas encore d'évaluation

- The 3 8% TaxDocument11 pagesThe 3 8% Taxsanwest60Pas encore d'évaluation

- Elite HARP Open Access ReliefDocument4 pagesElite HARP Open Access ReliefAccessLendingPas encore d'évaluation

- HUD Announcement: Single Family Mortgage Insurance: Annual and Up-Front Mortgage Insurance Premium - ChangesDocument5 pagesHUD Announcement: Single Family Mortgage Insurance: Annual and Up-Front Mortgage Insurance Premium - ChangesAccessLendingPas encore d'évaluation

- Bankruptcy, Foreclosure, Pre-Foreclosure, and Shorts Sales GuideDocument2 pagesBankruptcy, Foreclosure, Pre-Foreclosure, and Shorts Sales GuideAccessLendingPas encore d'évaluation

- CAPITAL MARKETS Fannie and Freddie Pricing ChangesDocument1 pageCAPITAL MARKETS Fannie and Freddie Pricing ChangesAccessLendingPas encore d'évaluation

- Fannie Mae Desktop Originator/Underwriter Release Notes UpdateDocument3 pagesFannie Mae Desktop Originator/Underwriter Release Notes UpdateAccessLendingPas encore d'évaluation

- FEDERAL HOUSING FINANCE AGENCY News Release: 10/24/11Document8 pagesFEDERAL HOUSING FINANCE AGENCY News Release: 10/24/11AccessLendingPas encore d'évaluation

- 2012 VA County Loan LimitsDocument4 pages2012 VA County Loan LimitsAccessLendingPas encore d'évaluation

- The Mortgage Guide BookDocument39 pagesThe Mortgage Guide BookAccessLending100% (1)

- Hud FHADocument12 pagesHud FHAAccessLendingPas encore d'évaluation

- Comparison of FHA Expiring and New County LimitsDocument11 pagesComparison of FHA Expiring and New County LimitsAccessLendingPas encore d'évaluation

- Krishna Yadav Cell#+91-9540308010: BjectiveDocument6 pagesKrishna Yadav Cell#+91-9540308010: BjectiveIssac JohnPas encore d'évaluation

- DSU ManualDocument204 pagesDSU ManualCarlos Alberto Rueda100% (1)

- 2-FedEx Vs American Home AssDocument8 pages2-FedEx Vs American Home AssJoan Dela CruzPas encore d'évaluation

- Power GREPDocument392 pagesPower GREPCeles NubesPas encore d'évaluation

- City of London SWM Guidelines 2Document22 pagesCity of London SWM Guidelines 2Dotan NutodPas encore d'évaluation

- HboDocument126 pagesHboKunal ChaudhryPas encore d'évaluation

- Assessment Task 1: Written Questions 1. Identify and Describe Five Common Components of A Business PlanDocument6 pagesAssessment Task 1: Written Questions 1. Identify and Describe Five Common Components of A Business PlanJoanne Navarro AlmeriaPas encore d'évaluation

- Dahua Network Speed Dome & PTZ Camera Web3.0 Operation ManualDocument164 pagesDahua Network Speed Dome & PTZ Camera Web3.0 Operation ManualNiksayPas encore d'évaluation

- Optimizing The Office.: Transforming Business ProcessesDocument10 pagesOptimizing The Office.: Transforming Business ProcessesNOSHEEN MEHFOOZPas encore d'évaluation

- 95 IDocument17 pages95 IsvishvenPas encore d'évaluation

- PD Download Fs 1608075814173252Document1 pagePD Download Fs 1608075814173252straullePas encore d'évaluation

- Optical Current TransformerDocument22 pagesOptical Current TransformerchallaramcharanreddyPas encore d'évaluation

- Case Study: PointDocument1 pageCase Study: PointprasadzinjurdePas encore d'évaluation

- Test Your Skills For Computer Basics: November 2013Document24 pagesTest Your Skills For Computer Basics: November 2013Charie C. OrbocPas encore d'évaluation

- Rules and Regulations Governing Private Schools in Basic Education - Part 2Document103 pagesRules and Regulations Governing Private Schools in Basic Education - Part 2Jessah SuarezPas encore d'évaluation

- Railway CircularsDocument263 pagesRailway CircularsDrPvss Gangadhar80% (5)

- GX Deloitte 2017 TMT PredictionsDocument60 pagesGX Deloitte 2017 TMT PredictionsMontevideo PortalPas encore d'évaluation

- March 2023 Complete Month Dawn Opinion With Urdu TranslationDocument361 pagesMarch 2023 Complete Month Dawn Opinion With Urdu Translationsidra shabbirPas encore d'évaluation

- Supplier Relationship Management As A Macro Business ProcessDocument17 pagesSupplier Relationship Management As A Macro Business ProcessABCPas encore d'évaluation

- Strategic Role of Operations ManagementDocument2 pagesStrategic Role of Operations ManagementEashan JindalPas encore d'évaluation

- Class 10 - Organizational Structure and CultureDocument11 pagesClass 10 - Organizational Structure and CultureTrịnh ThanhPas encore d'évaluation

- Economics: PAPER 1 Multiple ChoiceDocument12 pagesEconomics: PAPER 1 Multiple ChoiceigcsepapersPas encore d'évaluation

- ECEN 160 Final Project Logisim Instrs and DecoderDocument2 pagesECEN 160 Final Project Logisim Instrs and DecoderEvandro Fernandes LedemaPas encore d'évaluation

- Corporation Law Syllabus With Assignment of CasesDocument4 pagesCorporation Law Syllabus With Assignment of CasesMarilou AgustinPas encore d'évaluation