Académique Documents

Professionnel Documents

Culture Documents

Annexures

Transféré par

Ashish SharmaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

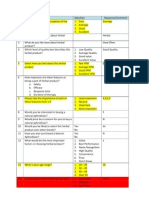

Annexures

Transféré par

Ashish SharmaDroits d'auteur :

Formats disponibles

Sales cover direct and indirect pharmaceutical channel wholesaler and manufacturers The figures above include prescription

and certain over the counter data and represent manufacturer prices

Source: ORG IMS Number of employees/stockist

Others (factors influencing inventory) include: Market demand was main influencer in North, East and west zones while among south zones stockist MR pressure and credit period figured prominently. Respondents from North and East zones also mentioned special discounts other than schemes offered by company as an important factor influenced their purchase/stocking decisions.

Stockist in the north has lowest earning since competition compels them to pass on higher concessions to their customers. Stockists from the west have highest earning whereas East and south are similar

In an industry which has strong double digit growth, the expiry/damages at 3% is a matter of concern and should be maintained ideally at <1% Losses incurred by them reduce their net profit margin which is a serious concern for the distribution industry and highlights the gap in the current norms and policies.

In absolute rupee term north, east and west have an average annual bad debt value of <Rs 1 lakh, this is significantly higher in south zone (>Rs 3 lakhs)probably on account of their higher turnovers.

Services includes delivery timelines, proper order booking, meeting settlement claims on time etc. Others include merchandising gifts i.e. carry bags, umbrella etc to support seasonal demands It is apparent that bonus offers are available to the majority of stockists in south zone while it is preferential in north, east and west zones Stockist said that benefits of these special schemes were to increase sales, improve liquidation, build customer relationships and drive early payments. Discounts offered were highest in North zone followed by east zone- indicating the high fragmentation as well as the resulting competition. Scope of improvements in several areas of operations: Optimization of inventory Improvement in payment cycle Containment of overhead costs Providing value added services to customers and vendors to build loyalty Negotiating with companies to improve settlements Optimum usage of infra

Stockist can do this by embracing new information technology by completely automating the process. Anti-infectives largest therapeutic category Gastrointestinal and cardiac are the second and third largest therapeutic categories, respectively Oral anti-diabetics and anti-peptic ulcerants are the fastest growing segments under alimentary and metabolism therapeutic categories

Reason for decline in acute segment were increase competition and price pressure due to commoditization Decline in chronic segment it is due to macro-economic factors like increase in MR strength and as a result increasing competition. MNC are expanding very aggressively in india and have very high aspiration. They are rapidly expanding their field force to extend their geographical reach. MNC are shifting from acute to chronic therapies due to superior growth rate and high entry barriers. In products which are core to their business they are entering with extremely competitive pricing versus Indian companies. All these factors together with weak macro-economic outlook is adding to slowdown in growth.

MNC s are aggressively investing in branded generics and moving into newer therapies like CVS, CNS and anti-diabetes. .MNCs have aggressively priced their products below their indian counterparts. DRL: India business which contributed 15% grew at lower rate of 6% compared to industry rate of 14 % due to on-going issues of DCGI on the companys top selling pain brand Nise

Weakening macro factors impacting Indian pharma growth

Going ahead we believe all the domestic companies who have strengthen the field force to spurt up the growth will eventually witness a slowdown in domestic growth rates. In order to sustain higher growth rates 15-16%, companies will have to increasingly focus on improving MR productivity by expanding to newer therapies, newer markets and newer launches.

During my visit to some of the general practitioner in Mumbai, I found that for most of the infections and general illness, they was prescribing Mankind medicines. E.g., most of the antiinfective prescribed belonged to penicillins and cephalosporins category. During my interaction, I understood that Mankind gives superior incentives for each prescription written by the doctor. If the patients case is very serious, then higher class of anti-infective i.e. penems were prescribed by the doctors and that too only MNC brands. The reason cited was-MNC brand are original research molecules and so doctors comfort level is usually higher when prescribing these medicines.

Growth in anti-infective category is mainly coming from volume growth and new product launches. Industry growth is mainly driven by unlisted players like Mankind.

Mankind has been pricing its product at relatively lower rates as compared to other pharma companies in India. Mankind is particularly strong in commoditized therapies such as antiinvectives, gynaecology, and gastro which together contribute more than 50% of domestic revenues.

In acute category, increase in competition and pricing pressures are affecting the anti-infective therapy and to some extent pain management. However, other therapies in acute category like ophthalmology, gynaecology, hormones, and vaccines which are speciality in nature are not affected by competition. Hence another way to dissect Indian pharma industry is how drugs are being prescribed or sold in the market i.e. addressed to GP, specialist and OTCs. This will be more relevant because competitive companies target drugs that have huge revenue potential and can be sold easily through existing relationship with doctors. Specialist categories have high-entry barriers due to requirement of specialized sales personnels, lower competition, good growth prospects and hence lower price pressures compared to GP category. Therefore, better growth and margins in speciality segments.

Speciality category contributes ~45% of total Indian pharma market. This includes chronic therapies and also some of the acute therapies like opthal, hormones, derma, gynaec, and vaccines. GP category includes Anti-infective, pain, gastro, vitamins and others. Pricing pressures and competition is intense in this category mainly from unlisted players like Mankind. Hence

relationship with doctors is of utmost important for the companies, so that it becomes easier to push newer products into the market. 4 step stress-test on the profile of pharma companies Step1: companies having strong presence in the speciality therapies-less prone to competition

Step 2: companies having fewer top products in the GP category-lower pricing pressure

It is well known that the top brands in GP category face the maximum competition making it difficult for them to grow above the market. Companies having more than top 4 brands falling into the GP category, will be highly susceptible to competition and price pressures

Step 3: Companies having lower dependence on a single therapy- lower concentration risk

Such high dependence on a single therapy is detrimental for the companys long term growth prospects. Step 4: Domestic companies having tied-up with MNCs for launching products in the speciality category-competitive advantage In this step, I have identified domestic companies having tie-ups with MNCs and have access to their expertise & blockbuster drugs. I believe these companies will always have an edge vis--vis competition because of their alliance with the MNCs, which helps them club their distribution strength with a superior product portfolio. Based on the 4 step stress test:

In IPCA labs cut in growth estimates for domestic business stands highest at 7 %. This is mainly led by companys high dependence on the antimalarial and anti-infective therapies. These two therapies contribute 31% of the total revenue and five of the top brands come from these therapies. In case of Dr. Reddy we have cut the domestic growth estimates by 5%. This is mainly led by controversy related to one of its top brand Nice in pain therapy due to which there was a decline in this therapy which brought down the overall growth. The estimate also have been changed for its limited competition product i.e. Fondaparinux due to which earnings downgrade is steeper than cut in domestic growth estimates. Conclusions: Companies like IPCA which are mainly focused on Indian markets are already feeling the heat of competition. The growth are of the company in domestic market are already come down to single digit. In case of Dr. Reddy domestic growth is coming down due to high exposure to the anti-infective category but strong growth will come from US market due to strong para IV pipeline DRL: DRL to witness modest growth of 12% CAGR (FY11-13)in domestic market, due to issues in pain management and anti-infective therapy. New launches, gain in market share in existing products & limited competition opportunities to drove the growth in US

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Messi HistoryDocument16 pagesMessi HistoryAshish SharmaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- E 2 LiteratureDocument12 pagesE 2 LiteratureAshish SharmaPas encore d'évaluation

- Tag LinesDocument9 pagesTag LinesAshish SharmaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- AdvertisingDocument2 pagesAdvertisingdhiru12883Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Synopsis of Advertising IndustryDocument10 pagesSynopsis of Advertising IndustryAshish SharmaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Scenario of Indian Credit Card IndustryDocument11 pagesScenario of Indian Credit Card IndustryAshish SharmaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- QuestionnaireDocument2 pagesQuestionnaireAshish SharmaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- STP and NPD-SBIDocument4 pagesSTP and NPD-SBIAshish SharmaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- ECO FinalDocument3 pagesECO FinalAshish SharmaPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- CasesDocument4 pagesCasesNaveen Stephen LoyolaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Carelink Connect: User GuideDocument41 pagesCarelink Connect: User GuideMiha SoicaPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Sem 4 - Minor 2Document6 pagesSem 4 - Minor 2Shashank Mani TripathiPas encore d'évaluation

- Vylto Seed DeckDocument17 pagesVylto Seed DeckBear MatthewsPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Pharmaceutical Microbiology NewsletterDocument12 pagesPharmaceutical Microbiology NewsletterTim SandlePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Bell WorkDocument26 pagesBell WorkChuột Cao CấpPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Starrett 3812Document18 pagesStarrett 3812cdokepPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Supply Chain Risk Management: Resilience and Business ContinuityDocument27 pagesSupply Chain Risk Management: Resilience and Business ContinuityHope VillonPas encore d'évaluation

- Part A Plan: Simple Calculater Using Switch CaseDocument7 pagesPart A Plan: Simple Calculater Using Switch CaseRahul B. FerePas encore d'évaluation

- DevelopersDocument88 pagesDevelopersdiegoesPas encore d'évaluation

- Colibri - DEMSU P01 PDFDocument15 pagesColibri - DEMSU P01 PDFRahul Solanki100% (4)

- For Email Daily Thermetrics TSTC Product BrochureDocument5 pagesFor Email Daily Thermetrics TSTC Product BrochureIlkuPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- RFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonDocument8 pagesRFM How To Automatically Segment Customers Using Purchase Data and A Few Lines of PythonSteven MoietPas encore d'évaluation

- Ril Competitive AdvantageDocument7 pagesRil Competitive AdvantageMohitPas encore d'évaluation

- TRX Documentation20130403 PDFDocument49 pagesTRX Documentation20130403 PDFakasamePas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- How Can You Achieve Safety and Profitability ?Document32 pagesHow Can You Achieve Safety and Profitability ?Mohamed OmarPas encore d'évaluation

- VRIODocument3 pagesVRIOJane Apple BulanadiPas encore d'évaluation

- Pet Care in VietnamFull Market ReportDocument51 pagesPet Care in VietnamFull Market ReportTrâm Bảo100% (1)

- Consultancy Services For The Feasibility Study of A Second Runway at SSR International AirportDocument6 pagesConsultancy Services For The Feasibility Study of A Second Runway at SSR International AirportNitish RamdaworPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Frito Lay AssignmentDocument14 pagesFrito Lay AssignmentSamarth Anand100% (1)

- Chapter 1.4Document11 pagesChapter 1.4Gie AndalPas encore d'évaluation

- Volvo B13R Data SheetDocument2 pagesVolvo B13R Data Sheetarunkdevassy100% (1)

- Corporation Law Review Test Midterms 2019Document4 pagesCorporation Law Review Test Midterms 2019Van NessaPas encore d'évaluation

- EP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4Document5 pagesEP2120 Internetworking/Internetteknik IK2218 Internets Protokoll Och Principer Homework Assignment 4doyaPas encore d'évaluation

- Software Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToDocument30 pagesSoftware Testing Notes Prepared by Mrs. R. Swetha M.E Unit I - Introduction at The End of This Unit, The Student Will Be Able ToKabilan NarashimhanPas encore d'évaluation

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Document6 pagesMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezPas encore d'évaluation

- 6mm Superlite 70 40t Clear +16as+6mm ClearDocument1 page6mm Superlite 70 40t Clear +16as+6mm ClearNav JavPas encore d'évaluation

- Kuper ManualDocument335 pagesKuper Manualdonkey slap100% (1)

- Chapter 11 Walter Nicholson Microcenomic TheoryDocument15 pagesChapter 11 Walter Nicholson Microcenomic TheoryUmair QaziPas encore d'évaluation

- SPIE Oil & Gas Services: Pressure VesselsDocument56 pagesSPIE Oil & Gas Services: Pressure VesselsSadashiw PatilPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)