Académique Documents

Professionnel Documents

Culture Documents

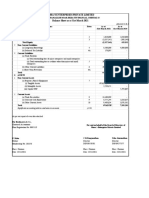

Associate Bearings Company Limited

Transféré par

Knt Nallasamy GounderCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Associate Bearings Company Limited

Transféré par

Knt Nallasamy GounderDroits d'auteur :

Formats disponibles

Associate Bearings Company Limited

Q1. What is ABCLs cost of debt? Would you include the current liabilities in debt, why, why not? ABCLs cost of debt can be calculated by finding the interest paid as a percentage of the total debt, the total debt will include both short term and long term debt. The tax rate is assumed to be 35 % as from the PAT values, the tax rate comes to be different for each year which is not possible. The cost of debt is calculated for each year and then averaged to find the mean cost of debt. Hence ABCLs cost of debt is found to be 6.89% (Refer Excel Sheet) Current liability is not included in debt because it is deployed only to finance the working capital of the firm, where as debt is raised by a firm to undertake capital expenditure.

Q2. ABCL has not raised any equity capital in the last five years and used its retained earnings for financing, since it has no obligation to pay dividends on retained earnings, do you agree that they are cost free source of funds? No, since, retained earnings are a part of the shareholders equity and a part of the profit that should be paid to the shareholders, so when ABCL is paying a dividend from its retained earnings; it is incurring a cost of equity. Hence, these are not cost free source of funds. Q3 Calculate Cost of Equity based on DGM and CAPM? Which is better? With reference to the excel sheet Cost of Equity based on DGM: 17.2% Cost of Equity based on CAPM: 9.5% The Cost of Equity based on the CAPM model gives a more accurate value of the cost of equity since it takes into account the historical data and the markets rate of return. Thus it represents a more real picture of the cost of equity. Q4 What is ABCLs Weighted Average cost of capital (WAAC) ? Refer the Excel sheet The Weighted Average Cost of Capital (WACC) of ABCL based on the historical cost of debt and cost of equity calculated using the Dividend Growth Model was found to be 12.78%.

Q5 Would you agree that all the companies in ball bearing industry have approximate same cost of capital? The costs of capital of the various companies in the ball bearing industry were calculated based on the Dividend Growth Model. Following are the Weighted Average Cost of Capital values: (With reference to the excel sheet) ABCL: 12.78% BIMETAL: 11.14% ANTIFRICTION: 10.55% FAG PRECISION: 10.21% Thus the companies have different costs of capital.

----------------------------------------------------------------------------------------------------------------

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Golden KeyDocument18 pagesGolden KeyDemetrius New El100% (6)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- UCC Lien Perfection and Priority Scott HelbingDocument35 pagesUCC Lien Perfection and Priority Scott Helbingtrustkonan100% (19)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Mid MarketDocument234 pagesMid Marketfarafin100% (1)

- Freakonomics SummaryDocument2 pagesFreakonomics SummaryKnt Nallasamy GounderPas encore d'évaluation

- Tom Gayner Value Investor Conference TranscriptDocument9 pagesTom Gayner Value Investor Conference TranscriptCanadianValue100% (1)

- WWTDocument13 pagesWWTKnt Nallasamy GounderPas encore d'évaluation

- Horizontal IntegrationDocument1 pageHorizontal IntegrationAshish PerePas encore d'évaluation

- Acc 210 - Principles of Accounting - pdf-1Document415 pagesAcc 210 - Principles of Accounting - pdf-1adekoya eniolaPas encore d'évaluation

- Market ShareDocument2 pagesMarket ShareKnt Nallasamy Gounder100% (1)

- Regulatory Framework For Investment Banking in IndiaDocument2 pagesRegulatory Framework For Investment Banking in IndiaDevanshee Kothari0% (1)

- RFBT Drill 2 (Partnership, Corpo, and Nego)Document13 pagesRFBT Drill 2 (Partnership, Corpo, and Nego)ROMAR A. PIGA100% (1)

- Operations Management TQMDocument16 pagesOperations Management TQMKnt Nallasamy Gounder100% (2)

- Ambit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Document54 pagesAmbit - CDSL - Initiation - Best Play On Equitisation - 05sept2023Naushil Shah100% (1)

- Strategic Cost ManagementDocument27 pagesStrategic Cost ManagementKnt Nallasamy GounderPas encore d'évaluation

- Negotiable Instruments Law - Philippine Law ReviewersDocument49 pagesNegotiable Instruments Law - Philippine Law ReviewersRenalyn DarioPas encore d'évaluation

- HEPL Financials v1.9 FinalDocument15 pagesHEPL Financials v1.9 FinalA YoungPas encore d'évaluation

- Ansoff MatrixDocument2 pagesAnsoff MatrixblnPas encore d'évaluation

- SPM Project ReportDocument18 pagesSPM Project ReportKnt Nallasamy GounderPas encore d'évaluation

- PEST AnalysisDocument2 pagesPEST AnalysisKnt Nallasamy GounderPas encore d'évaluation

- Business Law IPR in IndiaDocument22 pagesBusiness Law IPR in IndiaKnt Nallasamy GounderPas encore d'évaluation

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Knt Nallasamy Gounder100% (1)

- 2.2 IkeaDocument1 page2.2 IkeaVeronaDVPas encore d'évaluation

- Strategies Air IndiaDocument6 pagesStrategies Air IndiaKnt Nallasamy GounderPas encore d'évaluation

- ONGC DocumentDocument4 pagesONGC DocumentKnt Nallasamy GounderPas encore d'évaluation

- 2.2 IkeaDocument1 page2.2 IkeaVeronaDVPas encore d'évaluation

- Doha Development Round - Issues and BenefitsDocument8 pagesDoha Development Round - Issues and BenefitsKnt Nallasamy GounderPas encore d'évaluation

- Marketing Warfare StrategyDocument8 pagesMarketing Warfare StrategyKnt Nallasamy GounderPas encore d'évaluation

- Twitter-Express Yourself in 140 CharactersDocument4 pagesTwitter-Express Yourself in 140 CharactersKnt Nallasamy GounderPas encore d'évaluation

- Exploratory and Formal StudiesDocument3 pagesExploratory and Formal StudiesKnt Nallasamy Gounder100% (2)

- E-Business Model of CitiBankDocument1 pageE-Business Model of CitiBankKnt Nallasamy GounderPas encore d'évaluation

- SPM Reverse Engineering GoogleDocument3 pagesSPM Reverse Engineering GoogleKnt Nallasamy GounderPas encore d'évaluation

- Negotiation As A Tool For Project Management PracticeDocument5 pagesNegotiation As A Tool For Project Management PracticeKnt Nallasamy GounderPas encore d'évaluation

- The Tata Way83492343Document12 pagesThe Tata Way83492343Knt Nallasamy GounderPas encore d'évaluation

- IT Driven Offshoring Development OpportunityDocument27 pagesIT Driven Offshoring Development OpportunityKnt Nallasamy GounderPas encore d'évaluation

- 6 Additional Q in 5th Edition Book PDFDocument28 pages6 Additional Q in 5th Edition Book PDFBikash KandelPas encore d'évaluation

- Option Pit'S 4 Day Boot CampDocument2 pagesOption Pit'S 4 Day Boot CampVineet Vidyavilas PathakPas encore d'évaluation

- FA TestDocument13 pagesFA TestJed Riel BalatanPas encore d'évaluation

- VLIS SelectionOpinion021916Document12 pagesVLIS SelectionOpinion021916Abdullah18Pas encore d'évaluation

- Soybeans (OZS - ZS) OZSU2 Vs 1463.25 - Open Interest ChangeDocument1 pageSoybeans (OZS - ZS) OZSU2 Vs 1463.25 - Open Interest ChangeIndranil BanerjeePas encore d'évaluation

- 9 14 2015 Canaccord UADocument6 pages9 14 2015 Canaccord UAWilliam HarrisPas encore d'évaluation

- SPAN ExplanationDocument18 pagesSPAN Explanationjigsan5Pas encore d'évaluation

- Funds Flow Statement Meaning HowDocument8 pagesFunds Flow Statement Meaning HowAshrafPas encore d'évaluation

- Tutorial 3 Sol Sem21920Document8 pagesTutorial 3 Sol Sem21920Zhenjie YuePas encore d'évaluation

- Live Case Study - Lssues For AnalysisDocument4 pagesLive Case Study - Lssues For AnalysisNhan PhPas encore d'évaluation

- ("The Corporation"), A Domestic Corporation Duly Organized and Existing Under Philippine Laws, WithDocument6 pages("The Corporation"), A Domestic Corporation Duly Organized and Existing Under Philippine Laws, WithRaysunArellanoPas encore d'évaluation

- IDX Annually 2013Document141 pagesIDX Annually 2013Sheren reginaPas encore d'évaluation

- PF (B) - Compound, Notes, Debt Restruct, LeasesDocument4 pagesPF (B) - Compound, Notes, Debt Restruct, LeasesVencint LaranPas encore d'évaluation

- Assignment 9 (DionDocument36 pagesAssignment 9 (DionMaxPas encore d'évaluation

- Table of SEBI Violations by NDTVDocument4 pagesTable of SEBI Violations by NDTVPGurusPas encore d'évaluation

- FRMJorion 14 Hedging Linear RiskDocument51 pagesFRMJorion 14 Hedging Linear RiskZishan KhanPas encore d'évaluation

- Investor Profile QuestionnaireDocument4 pagesInvestor Profile QuestionnaireammanairsofterPas encore d'évaluation

- Managing Your Innovation Portfolio Puneet Agarwal (EPGP Roll No: 1914002) Individual AssignmentDocument1 pageManaging Your Innovation Portfolio Puneet Agarwal (EPGP Roll No: 1914002) Individual AssignmentPuneet AgarwalPas encore d'évaluation

- Ppfin PDFDocument9 pagesPpfin PDFAhmed HussainPas encore d'évaluation

- Chap 1 Tóm TắtDocument13 pagesChap 1 Tóm TắtLinh Thai ThuyPas encore d'évaluation