Académique Documents

Professionnel Documents

Culture Documents

AmeraTex Energy On Unconventional Oil

Transféré par

AmeraTex EnergyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AmeraTex Energy On Unconventional Oil

Transféré par

AmeraTex EnergyDroits d'auteur :

Formats disponibles

AmeraTex Energy On Unconventional Oil & Gas Plays

AmeraTex Energy lists the top shale plays in the U.S.

Dallas based oil exploration and production firm AmeraTex Energy has curated a significant amount of industry content that paints a vibrant picture for the effects of unconventional oil and gas on the U.S. economy based on the top shale plays currently leading in resources. In 2012, there were several major shale plays in the US, that required huge amounts of investments and accounted for the majority of unconventional oil & gas exporation and production. AmeraTex Energy lists the plays as originially presented in 2012 by Dan Warlick of Warlick Energy. - Anadarko-Woodford Also called the Cana Woodford, the Anadarko-Woodford is a growing crude and liquids play in West-Central Oklahoma running up within the Anadarko basin. Devon Energy is the unchallenged leader here, accounting for more than 40% of all drilling activity. Four other companies follow with another 40% or so of new wells including Cimarex Energy, Continental Resources, Marathon, and ExxonMobil. It's a relatively deep horizontal play with depths ranging from 11,500 to 14,500 feet. Average drilling and completion costs/well can be ~ $8.5 million. - Bakken The Bakken shale play is one of the biggest oil discoveries in recent history. Long known since the early days of drilling in the Williston basin, the Bakken shale was largely ignored until technology came along to make it economic to develop. Since then, it has become a huge success. Seven E&P companies will account for about 65% of Bakken drilling this year. In rank order they are: Continental Resources, Hess, Whiting Petroleum, Statoil/Brigham, Oasis Petroleum, Marathon, and EOG Resources. At present, Continental and Hess are together running ~ 40 rigs. Each is developing ways to become more efficient and reduce drilling days/well to somewhere in the mid-20s. These wells will be around 10,000-foot TVD and cost over $9 million each. - Eagle Ford About 400 miles in length and stretching from Southwest Texas into East Texas, the Eagle Ford shale is a very interesting play with oil, liquids, and dry gas windows with 60% to 70% carbonate content and a more brittle geology that's good for fracturing. Four companies account for around 45% of all drilling here: Chesapeake Energy, EOG, Conoco Phillips, and Marathon. But there are other very aggressive players including Pioneer, Anadarko, Talisman/Statoil, and BHP (which paid $12 billion for Petrohawk and gained significant Eagle Ford holdings). Most are drilling $6.5 million to $7 million wells with focus on the Eagle Ford's oil and liquids windows. - Granite Wash A collection of several "wash plays" in the Texas-Oklahoma Panhandle are alluvial placers formed by mineral particles and deposits set down by ancient streams, involving a number of stacked oil and gas formations at depths of 11,000-15,000 feet. Chesapeake, Apache, and Linn Energy lead all players in the Granite Wash, drilling more than six of 10 wells here while Devon and Forest follow. These wells can have up to 15 frac stages (at least at this time) and cost $7.5 million to $8 million each.

- Marcellus Most Marcellus shale wells are in Pennsylvania, with about 8 of 10 wells focused on natural gas. Range Resources and a few others are leading wet play development in the southwestern corner of the state. TVDs are around 6,300 feet with horizontals costing around $5.3 million. Busy players include Anadarko (with their Mitsui JV), Chesapeake and their associated JV with Statoil, then comes Range, Shell (which bought into the Marcellus by paying KKR $4.7 billion for East Resources), and then Chevron via their $4.3 billion acquisition of Atlas Energy. A plus for the Marcellus is its location adjacent to the biggest gas-consuming region in the country. - Niobrara The Niobrara formation is located in a corner of the Rockies involving Colorado, Wyoming, Kansas, and Nebraska. Most activity today is in the northeastern corner of Colorado within the DenverJulesburg basin. Noble Energy is the hands-down leader with more than 440,000 net acres in leasehold, drilling almost one in three wells here. Growing independent Bonanza Creek and Anadarko follow, both with aggressive development programs. TVDs are in the neighborhood of 6,200 feet with well costs that range from $4.5 million to ~ $5 million/well. - Permian Several exciting shales now overlay an historic conventional oil basin where drilling began in the 1920s. They include the Avalon, Leonard, Wolfcamp, Bone Spring Field, Spraberry Field, and Yeso Oil Play. Also included is the Wolfberry Trend which refers to the Wolfcamp Shale and the Spraberry Field. There are plenty of operators of record here, but just eight account for around 70% of shale drilling today in the Permian. The top three: Pioneer Natural Resources, Concho Resources (which just spent over $1 billion to acquire Three Rivers Operating), and Apache. Oxy follows close behind, then comes Energen, Sandridge, Cimarex, and EOG.

Contact Ameratex Energy for more industry news and events. News Source: http://pressdoc.com/p/000sv6 Social: https://twitter.com/ameratex LinkedIn: http://www.linkedin.com/company/ameratex-energy-inc Website: http://www.ameratexenergy.us

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 10 1016@j Rser 2015 02 052Document9 pages10 1016@j Rser 2015 02 052salah hamdyPas encore d'évaluation

- Chap01 BiogasteDocument19 pagesChap01 BiogasteKamal Kumar Kamal KumarPas encore d'évaluation

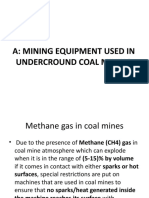

- Mining Equipment Used in Undercround Coal MiningDocument55 pagesMining Equipment Used in Undercround Coal MiningIrene lemaPas encore d'évaluation

- Golar LNG Limited PDFDocument2 pagesGolar LNG Limited PDFjulio0021Pas encore d'évaluation

- Saudi Arabia nc3 22 Dec 2016Document298 pagesSaudi Arabia nc3 22 Dec 2016Adil SyedPas encore d'évaluation

- HydrocarbonDocument25 pagesHydrocarbonSoham NagPas encore d'évaluation

- Propulsion Trends in LNG CarriersDocument20 pagesPropulsion Trends in LNG CarriersFuchsbauPas encore d'évaluation

- 03 - Zarroug CDM in Libya (REAoL)Document35 pages03 - Zarroug CDM in Libya (REAoL)FaisalPas encore d'évaluation

- CNG ppt-124121Document19 pagesCNG ppt-124121Sumit Pareek100% (1)

- TRKDocument3 pagesTRKPutri Sekar AyuPas encore d'évaluation

- LNGDocument92 pagesLNGIndra Mochtar100% (1)

- Exercise GasesDocument4 pagesExercise GasesAri AdiantariPas encore d'évaluation

- Biogas Upgrading AND Utilisation: IEA BioenergyDocument20 pagesBiogas Upgrading AND Utilisation: IEA BioenergyDan PascaruPas encore d'évaluation

- CHE211 Problem Set 5Document3 pagesCHE211 Problem Set 5AlexPas encore d'évaluation

- Al-Khor Community: 8th Oil & Gas Cricket Tournament 2011Document9 pagesAl-Khor Community: 8th Oil & Gas Cricket Tournament 2011swa.deepakPas encore d'évaluation

- 5 Underground Coal GasificationDocument11 pages5 Underground Coal GasificationAhilesh100% (1)

- Perhitungan Panas Dari Pelepas Panas Reaksi:: Reaksi 2 C2H6 + 3.5 O2 M: 0 0 RX: 0 0 S: 0 0Document10 pagesPerhitungan Panas Dari Pelepas Panas Reaksi:: Reaksi 2 C2H6 + 3.5 O2 M: 0 0 RX: 0 0 S: 0 0Evi diah phitalokAPas encore d'évaluation

- RWGS Catalysis Review Daza, YolandaDocument17 pagesRWGS Catalysis Review Daza, YolandaDanielPas encore d'évaluation

- Moore GSLDocument39 pagesMoore GSLاحمد حمید کارسول عزیزPas encore d'évaluation

- REPORTDocument10 pagesREPORTSudip ShresthaPas encore d'évaluation

- Ahotu JDocument82 pagesAhotu JyemiPas encore d'évaluation

- Module 1 2 - EcoRel-S General Presentation BraytonDocument37 pagesModule 1 2 - EcoRel-S General Presentation Braytonvlcktor100% (2)

- Grade 10 Science Unit3Document196 pagesGrade 10 Science Unit3BuddyPas encore d'évaluation

- FloatingDocument33 pagesFloatingJORDAN FREEPas encore d'évaluation

- Nitric Acid Production ProcessDocument36 pagesNitric Acid Production Processmaha20100% (4)

- Che1211 Module 5 PDFDocument5 pagesChe1211 Module 5 PDFMaries San PedroPas encore d'évaluation

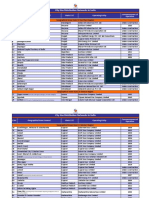

- CGD Data For Website 7.10.2016Document3 pagesCGD Data For Website 7.10.2016arbaz khanPas encore d'évaluation

- (ME - 514A: Alternative Energy Resources) : Natural GasDocument11 pages(ME - 514A: Alternative Energy Resources) : Natural GasMarvin ArnaizPas encore d'évaluation

- 571 Study Guide - 1000+ QADocument112 pages571 Study Guide - 1000+ QABilal Ghazanfar100% (15)

- Gas To LiquidDocument15 pagesGas To LiquidIshag HaroonPas encore d'évaluation