Académique Documents

Professionnel Documents

Culture Documents

The Evolutionary Shift To Mobile

Transféré par

mavolsenDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

The Evolutionary Shift To Mobile

Transféré par

mavolsenDroits d'auteur :

Formats disponibles

The Evolutionary Shift to Mobile

August 2012

The Evolutionary Shift to Mobile

Contents

Introduction .................................................................................................................................................................. 2 Current Mobile Landscape ........................................................................................................................................... 3 6.1 Billion Mobile Subscriptions .............................................................................................................................. 3 Huge Potential in Emerging Markets ........................................................................................................................ 4 The Coming of Age of Smartphones and Tablets ..................................................................................................... 5 Mobile Players.............................................................................................................................................................. 5 Android and Apple Emerge as the Two Powerhouses .............................................................................................. 5 Who Will Hold the Top Spot? .................................................................................................................................. 6 Looking Ahead ......................................................................................................................................................... 7 Migration to Mobile ..................................................................................................................................................... 7 Media and Devices Converging to One .................................................................................................................... 7 Internet Going Mobile .............................................................................................................................................. 8 Mobile Advertising....................................................................................................................................................... 9 Mobile Ad Spend ...................................................................................................................................................... 9 Video and Rich Media Mobile Ads Proving to Be Most Effective ......................................................................... 11 A Shift Away from the Browser ............................................................................................................................. 12 Mobile Ad Targeting .............................................................................................................................................. 12 Picture of the Future ................................................................................................................................................... 13 Digital Capital Advisors ............................................................................................................................................. 14

The Evolutionary Shift to Mobile

Introduction

Digital Capital Advisors inaugural white paper, Serial Cross-Border M&A Excels in the Digital Media Landscape, predicted an increase of cross-border M&A within the digital space over the next few years as acquirers look to expand geographically. DCA anticipates that one of the most active M&A sectors within the digital world will involve mobile-focused companies. This paper aims to uncover the key drivers of the mobile industry and the leading trends that will impact and shape the highly active space. As demonstrated in Exhibit 1, the lifecycle of each technological revolution has four distinct stages: Irruption, Frenzy, Synergy and Maturity. The first two stages (the Installation Period) are separated from the last two (the Deployment Period) by a turning point brought on by a crash. The theory states that new technologies are introduced, become overhyped and then over capitalized, until the market adjusts to determine the eventual winner. After this crash, modifications are made and a refined version of that technology or idea emerges in the Synergy phase or Golden Age. Exhibit 1: Mobile Internet The Golden Age of the Information and Digital Revolution

Source: Carlota Perez

When this theory is applied to the current technological revolution, commonly referred to as the Information or Digital Age, it is evident that this technology is currently entering its Golden Age. The irruption of computing technology during the 1980s, coupled with the over capitalization and investment frenzy of the Internet a decade later, resulted in the crash or dotcom bubble of 2000. Since then, many advancements have been made to these technologies, the result being high-powered mobile Internet-connected devices such as smartphones and tablets. These devices incorporate computing technology that previously existed as stand-alone products and allow users to access the Internet at rapid speeds from almost any corner of the planet without the need for an actual computer.

The Evolutionary Shift to Mobile

Additionally, these technologies are available at a price point that makes them widely accessible to developed and emerging economies, thereby allowing the global population to participate in and shape the current era of computing.

Current Mobile Landscape

6.1 Billion Mobile Subscriptions Currently, over 90% of the world has mobile phone coverage. Consequently, the adoption of mobile phone usage has also expanded to 76% of the global population or 5.3 billion users, with a total of 6.1 billion mobile subscriptions at the end of 2011, as highlighted in Exhibit 2 (where penetration figures exceeding 100% represent multiple devices per person.) This is up from 4.1 billion subscriptions in 2009, as reported by Mocom2020. This unprecedented global growth has been driven by reduced usage friction, higher processing power, improved user interface, lower prices and expanded services of these devices. Exhibit 2: Percent of Mobile Penetration by Country

Source: Jana Research 2011

The Evolutionary Shift to Mobile

Huge Potential in Emerging Markets Of the 5.3 billion phone users, the majority of those users Exhibit 3: Global Smartphones vs. Feature Phones 3.8 billion or 73% of the group lives in emerging 800 economies and utilizes feature phones. A region by region Smartphones 145 breakdown of smartphone vs. feature phone usage is shown Feature Phones 600 in Exhibit 3. Smartphones, in this case, are defined as having the ability to access the Internet from a mobile 400 browser whereas feature phones do not. As technology 603 improves, smartphones and tablets will continue to grow 153 37 more advanced and affordable, providing for extreme 200 28 109 172 149 growth into these regions. The low penetration of fixed-line 139 63 0 telephones and the vast infrastructure in place and being Asia-Pacific Europe Afica Noth Latin further developed for mobile data transmission is resulting Middle East America America Source: VisionMobile 2011 in the Internet being a solely mobile phenomenon in emerging economies. As a result, many emerging countries are skipping the step of desktops and laptops and going straight to smartphones and tablets, as seen in Exhibit 4. Various geographies are already exhibiting this trend as demonstrated by a selection of countries where 70% of Internet users in Egypt, 59% in India, 57% in South Africa, 55% in Ghana and 54% in Kenya get online exclusively via mobile phones. Exhibit 4: Top Global Percentage Breakdown of Mobile-Only Internet Users

Source: WebHostingBuzz 2012

The Evolutionary Shift to Mobile

The Coming of Age of Smartphones and Tablets Global penetration of smartphones and tablets has skyrocketed as seen in Exhibit 5. Smartphone shipments are expected to grow exponentially with an estimated 1 billion+ units shipped in 2015, a 123% increase from 2011, while tablet shipments are expected to reach 249 million units shipped by 2015. Tablets have penetrated faster than any other technology product in history, reaching 10% market penetration in only 2.5 years, as demonstrated in Exhibit 6. This rate is 3 times faster than smartphone adoption and 10 times faster than the standard telephone. As 3G and 4G capable smartphones and tablets continue to experience unprecedented growth, global Internet traffic from wireless devices is expected to exceed traffic from wired devices by the end of 2013. Exhibit 5: Global Smartphone and Tablet Shipments

1,400 1,200 1,000 800 600 400 200 (Figures in $USD millions)

Exhibit 6: 10% Market Penetration by Technology

Telephone Electricity Radio Television 25 30

1,048

7

11 9 11 9 8 2.5 0 5 10 15

Years

Computer

470 282 18 2010

Tablets

Mobile 249 Internet Smartphone Tablet 2015

SmartPhones

67 2011

20

25

30

35

Source: Transparency Market Research 2012

Source: Ovum Estimates, Morgan Stanley 2010

Mobile Players

Android and Apple Emerge as the Two Powerhouses An examination of the US mobile market shows that Android (Google) and iOS (Apple) operating systems are the dominant influencers, as seen in Exhibit 7. Android has grown its market share from 15% to 45% over the past 2 years and Apple from 25% to 30% in the same time frame. These trends remain true in the tablet space where Apple and Android hold significant shares as well, as seen in Exhibit 8.

The Evolutionary Shift to Mobile

Exhibit 7: US Smartphone Market Share by OS

100%

Exhibit 8: Tablet Market Share by OS

iPad 2

iPad 22% 8% 31%

75%

iPad 3

50%

Kindle Fire Sansung Galaxy

28% 13%

10% 9% 8% 8%

Source:OPA 2012

25%

Other Android Nook

0%

HP Touchpad RIM Playbook

Android iOS Windows Mobile Blackberry

Source:ComScore 2011

Who Will Hold the Top Spot? Android maintains a commanding market share lead over iOS and continues to acquire new users at a faster rate, yet market share does not tell the whole story. While Android controls the most market share, Apple still reigns supreme for developers and revenue, as seen in Exhibit 9. Recent statistics show that 69% of developers prefer iOS for new projects due to the drastic revenue differences between these platforms. For every dollar that a developer earns on iOS, they can only expect to earn about 24 cents from Android. This differential is due largely to the fragmentation of the Android platform and Androids limited financial tools. iOS limits developers to half a dozen uniform i devices that help drive enhanced revenue streams, while Android developers need to support dozens of devices, OS versions and OS implementations. Further increasing the gap in developer revenue opportunities, Google does not control a mature payment product like Apple and only has a fraction of the detailed customer database that Apple has acquired through its iTunes store.

The Evolutionary Shift to Mobile

Exhibit 9: Developer Projects, iOS vs. Android

20 18 16 14 12 27% 25% Android iOS 31%

10

8 6 4 2 63% 37%

27%

75% 73%

73%

69%

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Source: Flurry Analytics 2012

Looking Ahead As Android and Apple continue to battle for dominance, RIM and Microsoft are making plays to claw back some market share. Microsoft recently announced the release of the Windows Phone 8 to bundle with their new tablet, the Surface. This new tablet is being positioned as a mobile work device with a removable keyboard, the ability to run Microsoft Office and a variety of ports including USB. RIM is also expected to come out with a new OS, Blackberry 10, and a new enhanced line of phones; however, after multiple delays there is growing skepticism around whether this release will actually happen. It will continue be an uphill battle for both RIM and Microsoft, but the potential value in the space is driving both companies to allocate vast resources to mobile Internet projects.

Migration to Mobile

Media and Devices Converging to One Smart mobile devices have revolutionized the way people consume media and interact with the world. Not only are multiple devices such as the digital camera, GPS and MP3 players converging into one device, but many forms of media are migrating to these devices as well. Movies, television, radio, newspapers, magazines and books are all increasingly being consumed on tablets and smartphones. Exhibit 10 illustrates how much consumption of each media or device has migrated to and is being enjoyed by consumers on tablets and/or smartphones. As these trends continue, mobile devices will become the dominant portal for our media experiences.

The Evolutionary Shift to Mobile

Exhibit 10: Percentage of US Mobile Absorption by Device & Media

61.1% 34.2%

20.1%

24.2%

27.5% 44.3% 41.6%

14.1%

28.2% 20.8% 37.6% 40.3%

52.3%

19.5%

Source: Prosper Mobile Insights Mobile Survey 2011

Internet Going Mobile Not only have mobile devices revolutionized the way we consume media and interact with the world, but they have also revolutionized how we interact with the Internet. The Internet is no longer solely experienced from a desktop with a mouse and keyboard; it is increasingly a mobile experience. As previously noted, many emerging markets will skip the wired desktop stage entirely and the only Internet these markets will experience, en masse, will be exclusively via mobile connections. Due to this, Internet traffic from mobile devices is expected to overtake traffic

The Evolutionary Shift to Mobile

from non-mobile devices in 2013. For the time being, the traditional PC and notebook are mainly used for workrelated tasks and content creation that involves heavy use of the mouse/touchpad and keyboard, while the percentage of users using tablets is now larger for pure consumption-related tasks, as seen in Exhibit 11 (which shows the percentage of respondents who reported which device they used for certain tasks). As keyboards and mice are integrated into tablets, as Microsoft is doing with the Surface, there will be little reason for the desktop or notebook as they exist today. Exhibit 11: Consumption vs. Creation

Source: AlphaWise and Morgan Stanley Research 2011

Mobile Advertising

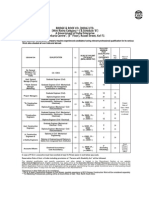

With users and content migrating to mobile platforms, monetization strategies will have to quickly adapt. As mobile devices are quickly becoming the primary portal for accessing the Internet, the mobile advertising landscape will follow on the same explosive trajectory. Mobile Ad Spend While the shift toward mobile is well underway, the migration of advertising dollars has lagged until now. As seen in Exhibit 12, advertising dollars have not yet caught up to the time spent with new devices. However, as advertising spend begins to catch up and as mobile penetration continues to ramp, this will lead to tremendous growth in the mobile advertising sector. The mobile advertising sector experienced nearly 45% growth in 2011, with revenue breaking $2 billion. This trend is projected to continue, with an estimated 27.9% CAGR through 2021 when total US mobile advertising revenue is expected to surpass $25 billion, as illustrated in Exhibit 13.

The Evolutionary Shift to Mobile

Exhibit 12: 2011 US Consumption vs. Ad Spending

A B 50% 40% 30% 20% 10%

7% 25% 15% 11% 26% 22% 43%42%

Exhibit 13: US Mobile Advertising Revenue

30,000 25,000 20,000

25,767 22,406 19,315 16,369 13,417

C D

E F

G H

~$20B+

Opportunity

15,000 10,000

10,734 8,386 6,212 4,405 3,124

10%

5,000

528 807 1,531 2,200

0% Print Radio Media Consumption

Source: KPCB 2012

TV Ad Spend

Internet Mobile Potential Opportunity

Source: SNL Kagan 2012

As shown in Exhibit 14 on the following page, the market is dominated by Google, which commanded 48% of the total 2011 mobile advertising revenue and grew 40% in 2011 to $1 billion. Apple and its advertising network Quattro only accounted for 6% of the total market with Yahoo! and Twitter following with 5% and 4% respectively. The biggest growth story was Pandora which reportedly saw half its gross revenues from mobile ad placements and experienced a 476% increase in mobile ad revenue from $15 million in 2010 to $86.6 million in 2011, ranking 5th. Search and display formats accounted for 45.0% and 30.7% of total US mobile advertising spending in 2011, respectively. Other ad formats, such as video, are projected to see significant growth over the next 5 years while SMS/MMS based advertising quickly diminishes as a contributing medium, depicted in Exhibit 15.

10

The Evolutionary Shift to Mobile

Exhibit 14: 2011 US Mobile Ad Revenue Market Share

Exhibit 15: US Mobile Ad Spending by Format

100%

75% 30% 48% 50%

3% 4% 4% 5% Google/AdMob Twitter

Source: SNL Kagan 2012

25%

6% Apple/Quattro Pandora Yahoo! Jumptap

0% 2011 Search 2012 2013 2014 SMS/MMS 2015 2016 Display Video

Source: SNL Kagan 2012

Video and Rich Media Mobile Ads Proving to Be Most Effective With mobile devices rapidly becoming the primary Exhibit 16: Global Mobile Display Breakout portal for accessing the Internet and mobile networks 100% becoming more robust, rich-media advertising is quickly 15.0% 31.0% becoming a preferred advertising format, skipping the 13.0% 75% long evolution traditional online advertising 6.0% 21.0% experienced. Static mobile banner advertisements have 50% been rapidly replaced with rich media units that are 35.0% capable of delivering powerful and engaging 51.0% impressions through high-resolution, interactive content 25% such as video, full-screen takeovers and social 28.0% networking integration. In 2011, mobile video ads 0% Jan-12 Jun-12 accounted for just 4.7% or $103 million of the $2.2 HTML5 Rich Media Standard billion spent on mobile advertising in the US This Video Expandable Banner format is expected to grow to 10% of the total ad Source: Opera 2012 spending in 2016, or $1.1 billion out of a total $10.7 billion spent on mobile ads. Even though DCA anticipates video to gain significant market share, display will see the largest growth from 30.7% of all mobile ad formats in 2011 to 37% in 2016. This growth will be due in large part to the increasing usage of rich media, which has proven to have significantly better engagement than non-rich media ads. As seen in Exhibit 16, during the first six months

11

The Evolutionary Shift to Mobile

of 2012, HTML5 rich media ads jumped from 28% of all display ads to 51%. This is a sign that advertisers and agencies are becoming more comfortable with mobile as a medium due to double-digit engagement rates, in-ad features driving time spent up, and click-through rates averaging higher than its online counterpart. Srini Dharmaji, CEO of GoldSpot Media, a mobile rich media and video advertising platform, noted the pros of mobile rich media, including higher CPMs, but pointed out some limiting factors as well. One of the biggest barriers to adoption of rich media is the need for the time and skills to create the ads. He pointed out that the lead time for creating one iAd campaign is currently about 8-10 weeks due to Apples tight control of the process. Media planners do not have the time to sit down and create a lot of these ads, he said frankly. A big company like Apple can do that because they have the budget and clout, but smaller businesses have neither the time nor the money. A Shift Away from the Browser As the devices we use to access the web change, so Exhibit 18: Desktop Browsing vs. Mobile App Usage too will the ways we access and experience the web. While the desktop browser web experience Web browsing was still dominant (it was overtaken by mobile use Mobile app usage in the first half of last year), companies tried to recreate this same browser experience on the mobile phone; however, they quickly realized this 94 was the wrong approach. Mobile devices have 81 74 72 70 66 64 become heavily app based and many advertisers 43 are now realizing the mobile experience a user has with their company should be through app form, as seen in Exhibit 18. Many companies, even ones Jun-10 Dec-10 Jun-11 Dec-11 with mobile-optimized websites, have now created Source: Flurry Analytics 2011 apps giving their users a much more native feeling and streamlined experience. As this trend continues, agencies and brands will look to mobile advertising companies to reach their targeted audiences. Celtras CEO, Mihael Mikek states, Rich media advertising proved to be the most effective form of advertising on mobile devices. It drives incredibly high engagement rates as well as desired conversions. Our efforts in mobile rich media advertising have been focused on providing the best possible engagement experience and users appreciate and reward that. Mobile Ad Targeting Targeting remains the number one attribute advertisers are looking for across mobile, according to a September Jumptap/Digiday survey. Initially, this was a problem on mobile devices due to carrier imposed security restrictions

Minutes per day

12

The Evolutionary Shift to Mobile

over cookies and tagging on mobile browsers. While major mobile ad networks have gained access to large advertising budgets, they currently lack the transparency and rich analytics to prove that the media buy was effective for advertisers and brands. Alex Rahaman, CEO of StrikeAd, a global mobile demand side platform, pointed out: As advertisers and agencies seek to access an effective mobile audience, they are looking to move away from blind buying to highly targeted media buys. However, the shift toward mobile apps has allowed for better ad targeting because of the workaround provided by direct usage of a closed system app. After logging in, perhaps via Facebook connect, a publisher now has the ability to pull a users demographic information directly from their social networking profile. Additionally, the mobile device allows for real-time geo-locational targeting without the need for complex cookies or profiles because the app can simply use the phones GPS location. Mobile search engines and social-location networks such as Foursquare have made early use of this, providing ads based on the users current location. As these geo-targeting models and device identification approaches are combined with other techniques such as behavioral and audience targeting, mobile advertising will reach a level of sophistication that few other platforms have attained.

Picture of the Future

The shift to mobile continues at a rapid pace, with mobile devices quickly becoming the central portal for accessing media, facilitating communication and connecting the world. Having the ability to target and serve individuals across such a diverse and global user base will be critical for advertisers as well as publishers who are looking to monetize content. As mobile advertising continues to develop and mature, DCA believes that the greatest market activity will be in targeting and other mobile advertising products such as reporting and analytics. With major mobile ad networks such as Millennial Media already publicly traded, and its rival Jumptap preparing for a 2013 IPO, we believe we are only months away from a significant ramp up in M&A activity as private capital seeks return on investment. Already, larger players such as Opera have made their bets acquiring mobile advertising companies 4th Screen Advertising and Mobile Theory, while others such as InMobi sought strategic investment, locking up a $200 million capital injection from SOFTBANK. As the mobile advertising landscape continues to evolve, DCA anticipates that the established networks in the space will mimic earlier expansion tactics of DoubleClick and others by acquiring competitors in other countries while complementing their networks with highly technical acquisitions that will enhance targeting, audience selection and most importantly increasing margins. These acquisitions will allow companies to move from blind and channel buying to highly focused audience buys that target a consumer with the most advanced optimization witnessed to date. ***

13

The Evolutionary Shift to Mobile

Digital Capital Advisors

Digital Capital Advisors is the premier global investment banking boutique dedicated to serving innovative media companies for whom digital is core to their DNA as well as those who would like it to be. Founded and run by longtime media investment bankers and former CEO's, these entrepreneurs / financiers / investors / advisors have been fully immersed in and have helped shape the media landscape for the past 20 years, both offline and online. Such invaluable experience, well-honed insights and extensive relationships throughout the industry with both strategic operators and financial sponsors are of immense value to DCA's clients as it helps them navigate the fast-changing media landscape and create superior value. DCA provides advisory services in the form of sell-side and buy-side M&A, as well as the private placement of equity and debt, for digital media companies throughout their evolution. A key differentiator of the firm is its focus on seamlessly executing cross-border transactions, just as the digital world has knocked down those boundaries. The firm's unique capabilities are enhanced by the recently launched venture capital fund, Entrepreneur's Investment Fund in the US, and by its strategic alliance with eValue Group AG, a prolific and highly successful European venture capital fund, as well as other global alliances that have been formed over the years. From its headquarters in New York City, DCA's principals span the globe uniting and building digital leaders of today and tomorrow. They regard their client relationships as partnerships in the true meaning of the word unified with one another in a sphere of common interest as they help entrepreneurs and other business owners transfer various forms of capital into tangible and significant wealth.

All inquiries and requests for further information should be directed to:

112 West 34th Street 18th Floor New York, NY 10120 +1.212.877.7100

Jay C. MacDonald CEO / Managing Partner jay@digitalcapitaladvisors.com Marti J. Frucci Managing Director marti@digitalcapitaladvisors.com

14

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Discovery MR750w 3.0T GEMDocument52 pagesDiscovery MR750w 3.0T GEMJasmina Cabukovska100% (1)

- Kerberos TutorialDocument137 pagesKerberos Tutorialjinish.K.GPas encore d'évaluation

- 1947 5048 1 PBDocument8 pages1947 5048 1 PBpkm2023 smkn40jakartaPas encore d'évaluation

- AI Research ReportDocument13 pagesAI Research ReportVanshika SharmaPas encore d'évaluation

- Unit 8Document14 pagesUnit 8samer achkarPas encore d'évaluation

- Barudan TESDocument42 pagesBarudan TESMartinandKimberly RayPas encore d'évaluation

- PUFF-CONSTRUCTION ESTIMATE USER MANUALDocument5 pagesPUFF-CONSTRUCTION ESTIMATE USER MANUALjoanPas encore d'évaluation

- Essailec® Test BlocksDocument68 pagesEssailec® Test BlocksPhong DuongPas encore d'évaluation

- Disk2vhd tool captures physical disks as VHD filesDocument4 pagesDisk2vhd tool captures physical disks as VHD filesjupiterPas encore d'évaluation

- bbs145 PDFDocument2 pagesbbs145 PDFnageshwariPas encore d'évaluation

- Order Confirmation for 5 Passengers from Geneva to ParisDocument6 pagesOrder Confirmation for 5 Passengers from Geneva to ParisDiego Campos EspinozaPas encore d'évaluation

- B&R Construction Company Job OpeningsDocument9 pagesB&R Construction Company Job OpeningsroopavijaykumarPas encore d'évaluation

- AP2610-20 - Install 9034544-01Document2 pagesAP2610-20 - Install 9034544-01CartoonXPas encore d'évaluation

- SUP-01-Document ControlDocument2 pagesSUP-01-Document ControlSALAH HELLARAPas encore d'évaluation

- Sony CDX-656/656X Service ManualDocument42 pagesSony CDX-656/656X Service ManualtudorpopescuPas encore d'évaluation

- Master Coursework UmpDocument6 pagesMaster Coursework Umpf67m6abx100% (2)

- Check Point 5000 Appliances: Getting Started GuideDocument47 pagesCheck Point 5000 Appliances: Getting Started Guidevuabai racPas encore d'évaluation

- Hellas Sat 4Document1 pageHellas Sat 4Paolo LobbaPas encore d'évaluation

- Tripwire Enterprise 8.3.8 Platform Support DatasheetDocument6 pagesTripwire Enterprise 8.3.8 Platform Support DatasheetFrancoisPas encore d'évaluation

- Smart School Roadmap 020506Document60 pagesSmart School Roadmap 020506Nancy NgPas encore d'évaluation

- Silnik A490 XinchaiDocument40 pagesSilnik A490 XinchaiTomaszPas encore d'évaluation

- Metashape ComparisonDocument5 pagesMetashape ComparisonRyo Lordan GeorgePas encore d'évaluation

- Dr. Mahalingam College of Engineering and Technology Mandatory DisclosureDocument149 pagesDr. Mahalingam College of Engineering and Technology Mandatory Disclosureleninkumar_2007@yahoo.co.inPas encore d'évaluation

- Script FontDocument76 pagesScript FontJulio Gomez SilvermanPas encore d'évaluation

- 05 DistanceProt-7SA8 Principles V02 PDFDocument23 pages05 DistanceProt-7SA8 Principles V02 PDFOliver RisteskiPas encore d'évaluation

- Modules English Industrial EngineeringDocument16 pagesModules English Industrial EngineeringMikel Vega GodoyPas encore d'évaluation

- IP5407 InjoinicDocument13 pagesIP5407 InjoinicWillyPVPas encore d'évaluation

- Validation Based ProtocolDocument7 pagesValidation Based ProtocolTerimaaPas encore d'évaluation

- Enforcer Implementation Guide SNAC11.0.5Document422 pagesEnforcer Implementation Guide SNAC11.0.5Mohammed SemmourPas encore d'évaluation

- Fisher 846 Current To Pressure Transducers PDFDocument60 pagesFisher 846 Current To Pressure Transducers PDFJamesPas encore d'évaluation