Académique Documents

Professionnel Documents

Culture Documents

Incometaxform 2012-13

Transféré par

Jayaprakash Vayakkoth MadhamTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Incometaxform 2012-13

Transféré par

Jayaprakash Vayakkoth MadhamDroits d'auteur :

Formats disponibles

2012-2013

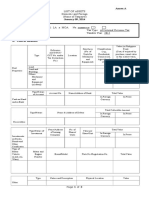

Income Tax Declaration for the Financial Year 2012-13

Assessment Year 2013-2014

./PAN NO. (COMPULSORY)

/NAME IN BLOCK LETTERS __________________________________________________/DESIGNATION :

/RESIDENTIAL ADDRESS :________________________________________________________________________________

_________________________________________________________________________________

Station

1. Gross Salary (includes Basic, DA, HRA, OTA, Honorarium,Emplo.cont.to New pension.

leave encashment on LTC)-------------------------------------------------------------------------------------------Less: TRA, Hill Compensatory Allow,Washing allowance etc. Under Section 10(14)

TOTAL SALARY_______________________________________________________________________.

a) Employers contribution to New pension Fund Fund--------------------------------------------Rs

b) Bonus ------------------------------------------------------------------------------------------------------------- Rs

c) DA Arrears I------------------------------------------------------------------------------------------------------ Rs

d) DA Arrears I------------------------------------------------------------------------------------------------------Rs

e) Pay Arrears ( like increment promotion)-------------------------------------------------------------Rs

f) Medical reimbursement (if it exceeds Rs15000/-)----------------------------------------------Rs.

g) Tution fees reimbursement-----------------------------------------------------------------------------------Rs.

h) Other Income if any------------------------------------------------------------------------------------------- Rs.

Total ----------------------------------- a to h-------------------------------------------------------------------------Rs.

2 GROSS INCOME _____________________________________________________________________

3. Less : Deduction (those who are staying in a rented house/flat.)

Exemption of HRA, least of the following

a. The actual amount of HRA received (HRA x 12)----------------------------------------------------Rs.

b. The excess of (rent paid -10% of basic salary & DP)x12---------------------------------------Rs.

c 50% or 40% of the basic 12 months salary as per class of city.

Rs.

(50% if house is situated in Mumbai, Calcutta, Delhi & Chennai

and 40% if house is situated in any other place)

4 Professional Tax ________________________________________________________________________________________

5 TOTAL INCOME __________

________________

6 Less : Interest on house property (deduction of interest on capital

borrowed from Housing boards, Banks, etc.) max. upto Rs.1,50,000/- -----------------------------------------------7. Less : Deduction under Chapter VIA

(a) Any premium paid by cheque for medical insurance subject to a maximum of ----------------Rs.15,000 under any scheme sponsored by the GIC or any other insurer U/s. 80D

including deduction of Rs 5000/-(Max)for preventive health chek-up

(b) Donation U/s. 80G

______________________________________________ _____________________________________

(c) Deduction if any,.-----------------_________________________________________________________________________________

8. NET INCOME _______________________________________________________________________

9 Less : Deduction

U/s 80C

a) GPF/EPF -----------------------------------------------------------------------------------------------------b) GSLI (Office)---------------------------------------------------------------------------------------------------c) HBA recovery (Office)----------------------------------------------------------------------------------------d) LIC (Office)---------------------------------------------------------------------------------------------------e) LIC ( Directly)--------------------------------------------------------------------------------------------------f) NSC/ULIP---------------------------------------------------------------------------------------------------g) PPF----------------------------------------------------------------------------------------------------------h) Any instalement of principle amount paid to ------------------------------------------------------Housing Boards, LIC, Banks, Finanancial

Institutions etc.( includes stamp duty, registration fee

& other expenses for the purpose of transfer

of such property.

i ) Tution fees paid limited to two Children------------------------------------------------------------------- Rs.

thereafter.

continue to page 2

j) Subscription to units of any Mutual Fund----------------------------------------------------------------k) Any other savings -------------------------------------------------------------------------------------------10)Total Deduction under section 80-C____________________

(a to K)

11) Contribution up to one lakh rupees per annum to the new

pension fund introduced by the LIC or any other insurer notified by

the Central Govt. under Section 80-CCC (Prudential).

Rs.

12) Contribution to the New Pension scheme limited 10% of salary

(Employees contribution ) under section 80 CCD

13) The aggregate amount of deductions under Sections 80-C, 80-CCC,80CCD

and should not exceed Rs.1,00,000/-. (10+11+12)_______________________________

14) Deduction under section 80-CCE

a) Cont. to the New Pension Scheme, upto 10% of salary.------------------------------------(Government'S Contribution to New Pension Scheme)

* From 2012-13 Contribution made by the Government to the New Pension Scheme will be excluded from the limit

of one lakh under section 80 CCE

15 50% of invested amount max.Rs 25000/- up to gross income Rs 10.00 lakhs notified by govt.________________________

16) TOTAL DEDUCTION _______________________________

17) TAXABLE INCOME ________________________________

Taxable Income

Upto Rs 2,00,000

Rs 2,00,001To 5,00,000

Rs 5,00,001 To 10,00,000

Rs 10,00,01 and above

INCOMETAX

Rate of Income Tax

NIL

10% of income

Rs 30,000+20%of income

Rs1,30,000+30% of income

exceeding Rs. 2,00,000

exceeding Rs 5,00,000

exceeding Rs 10,00,000

Add : Education Cess (3% on income tax)________________

Rs.

Total Income Tax & Cess payable._______________________

Rs.

Tax recovered from salary_____________________________________________________________________

Rs.

Tax to be recovered ____________________________________________________________________

Rs.

The documentary evidence in relation to concessions sought by me will be produced herewith as per guidelines adopted

in the meeting of the Vigilance Officers on circular dated 22.06.2006.

I here by declare that I will produce Investment proof as mentioned in declaration form by 31.3.2012

If shortfall in investment as per mentioned in declaration form, I am liable to pay required Income tax

to Income tax department directly.

PLACE :

DATE

Signaure

Name:--

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- List of AssetsDocument3 pagesList of AssetsArjam B. Bonsucan80% (5)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

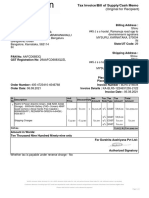

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shiva Kumar0% (1)

- Your Bofa Core Checking: Account SummaryDocument4 pagesYour Bofa Core Checking: Account SummaryAnonymous pDXH2Z100% (1)

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorPas encore d'évaluation

- Commissioner Thiruvananthapuram.: A.T. l.A.S.) RDDDocument3 pagesCommissioner Thiruvananthapuram.: A.T. l.A.S.) RDDJayaprakash Vayakkoth MadhamPas encore d'évaluation

- 28 A Option FormDocument1 page28 A Option FormJayaprakash Vayakkoth MadhamPas encore d'évaluation

- Last Pay CertificateDocument2 pagesLast Pay CertificateJayaprakash Vayakkoth Madham100% (3)

- Weekly OffDocument1 pageWeekly OffJayaprakash Vayakkoth MadhamPas encore d'évaluation

- 1000 Rupee CoinDocument2 pages1000 Rupee CoinJayaprakash Vayakkoth MadhamPas encore d'évaluation

- MSCDocument9 pagesMSCJayaprakash Vayakkoth MadhamPas encore d'évaluation

- Tax Invoice TS1222303 BO89592Document1 pageTax Invoice TS1222303 BO89592MOHIT SHARMAPas encore d'évaluation

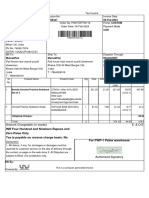

- Default Invoice ReportDocument3 pagesDefault Invoice ReportRahul FularePas encore d'évaluation

- Invoice: TO MR Sahil Bhandari #1403, Sector 9, Urban EstateDocument1 pageInvoice: TO MR Sahil Bhandari #1403, Sector 9, Urban EstateVarun SinglaPas encore d'évaluation

- Secured CC Deed of AssignmentDocument1 pageSecured CC Deed of AssignmentAlnie DemoralPas encore d'évaluation

- Sample Commercial InvoiceDocument1 pageSample Commercial Invoiceserdar khanPas encore d'évaluation

- CE22 - 14 - After Tax Economic AnalysisDocument50 pagesCE22 - 14 - After Tax Economic AnalysisNina MabantaPas encore d'évaluation

- Monthly Bank StatementDocument1 pageMonthly Bank StatementRudy AlconcherPas encore d'évaluation

- SwiftDocument61 pagesSwiftdebarghya.official2021Pas encore d'évaluation

- 3 - Realization TestDocument15 pages3 - Realization TestPaula BitorPas encore d'évaluation

- Sip On Income TaxDocument75 pagesSip On Income TaxGaurav Jain0% (1)

- SoC Non ComfortDocument3 pagesSoC Non ComfortShanmugam ThiyagarajanPas encore d'évaluation

- InvoiceDocument1 pageInvoicemainakpati03Pas encore d'évaluation

- Complete GST NotesDocument102 pagesComplete GST Noteslawsaba6Pas encore d'évaluation

- Balibago WaterDocument9 pagesBalibago WaterJeffrey MacalinoPas encore d'évaluation

- PaymentMethodsRevised PDFDocument2 pagesPaymentMethodsRevised PDFMohd AzamPas encore d'évaluation

- Factory Ledger and General Ledger-1Document9 pagesFactory Ledger and General Ledger-1gull skPas encore d'évaluation

- Practice Reading GraphsDocument4 pagesPractice Reading GraphsSharon TaylorPas encore d'évaluation

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyPas encore d'évaluation

- Prelim ExamDocument2 pagesPrelim Examfitz garlitos100% (1)

- Taxation Homework 1 PDFDocument4 pagesTaxation Homework 1 PDFKNVS Siva KumarPas encore d'évaluation

- Return On Assets and Return On EquityDocument2 pagesReturn On Assets and Return On EquitycapsfastPas encore d'évaluation

- Loan Statetement BalajiDocument2 pagesLoan Statetement BalajiSubramanyam JonnaPas encore d'évaluation

- Tax Book Part PDFDocument128 pagesTax Book Part PDFTimothy WilliamsPas encore d'évaluation

- Student Information: Check Centre Lot S.NO. Student NameDocument232 pagesStudent Information: Check Centre Lot S.NO. Student NameVijayant GautamPas encore d'évaluation

- Kina Bank Fees Charges ScheduleDocument15 pagesKina Bank Fees Charges SchedulemarcialitovivaresPas encore d'évaluation

- Set Off and Carry Forward of Losses, Indian Income TaxDocument4 pagesSet Off and Carry Forward of Losses, Indian Income TaxAbhishek Sharma100% (1)