Académique Documents

Professionnel Documents

Culture Documents

Daily Agri Report, March 06

Transféré par

Angel BrokingCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Daily Agri Report, March 06

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

News in brief

Centre likely to allow extra 5 mt wheat exports soon

India could soon allow an extra 5 million tonnes of wheat exports more than doubling volumes this year two government sources said on Tuesday, as the worlds second-biggest wheat producer tries to cut massive government stocks. The move would mean India was exporting a third of the quantities of the United States, the number one exporter, and would almost certainly drag down further global prices that have already hit an eight-month low. The government has already given permission for 4.5 million tonnes of wheat exports in 2012 so the additional 5 million tonnes would take the total to 9.5 million tonnes. The cabinet is expected to allow 5 million tonnes of wheat exports either this week or next week, one source, who is directly involved in the decision making process, said. (Source: Financial Chronicle)

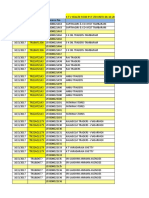

Market Highlights (% change)

Last Prev. day

as on March 5, 2013

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

19143 5784 54.96 90.82 1575

1.40 1.50 -0.01 0.78 0.16

0.67 0.40 1.58 -1.95 -2.51

-3.23 -3.58 3.36 -7.11 -5.68

8.54 7.93 10.96 -14.88 -7.85

.Source: Reuters

Mills advance season closure in some states

Sugar mills in some states have advanced the closure of canecrushing activity by a month for the 2012- 13 season (October to September), stating availability of cane as the reason. With adequate supply, the mills continue operations till April. Last year, mills in Maharashtra and Uttar Pradesh, the two largest producing states, continued operations until May, due to excessive cane output. This year, crushing is unlikely beyond March, says the industry. Fifty mills have already closed crushing operations so far this season, as against 21 last year, due primarily to lower cane availability, said Abinash Verma, director- general, Indian Sugar Mills Association (Isma). The Union ministry of agriculture, in its second advance estimate reported on February 8, said cane output would be 334.54 million tonnes for the 2012- 13 crushing season, compared with its final estimate at 361 mt for the previous season. At the beginning of the season, theyd set it at 352 mt. (Source: Business Standard)

Ineligible farmers rewarded in Rs 52,000 crore debt waiver

The UPA government's Rs 52,516 crore debt waiver for farmers has come under scrutiny by its auditor. The Comptroller and Auditor General (CAG) has pointed to frauds, tampering of records and lack of monitoring the scheme. Overall, the performance audit of the scheme (ADWDRS) has revealed that in 22.32 per cent of cases test checked there were lapses/errors which raised serious concern about the implementation of the scheme, said the CAG report tabled in Parliament on Tuesday. The report deals with implementation of the Agricultural Debt Waiver and Debt Relief Scheme (ADWDRS) 2008 under which 3.69 crore small and marginal farmers and 60 lakh other farmers were given debt relief of Rs 52,516 crore.As per the CAG report, several farmers who had taken loan for non-agricultural purposes or whose loans did not meet eligibility conditions were also given benefits under the scheme. (Source: Financial

Chronicle)

Onion, potato prices fall on higher supplies

After a month of sudden price rises, potato prices have started moderating in the spot market, following a similar trend in onion prices. While onion prices fell up to 40 per cent, prices of potatoes declined up to 20 per cent in the past two weeks. Following delayed rainfall in the sowing season, high moisture due to record low temperatures and unseasonal rainfall during the harvesting period, onion and potato prices surged since January. Owing to higher supplies and the fact that the government said it would levy a minimum export price on the commodity, onion prices fell in the last two months. However, potato prices remained high amid reports of the crop being damaged in major producing centres. But harvesting picked up pace, owing to less moisture in the soil. Consequently, supply increased in the last two weeks (Source:

Business Standard)

Commodities worth over Rs 229 cr confiscated in 2012: KV Thomas

The government today said essential commodities worth over Rs 229 crore-worth in 2012 for violating norms under the law that seeks to check hoarding and price rise. The Essential Commodities Act (ECA), 1955 enables state governments to impose stock-holding limit on traders of essential items like pulses and edible oils, and to take effective action for undertaking de-hoarding operations. In a written reply to the Lok Sabha, Food and Consumer Affairs Minister K V Thomas said over Rs 229 croreworth of commodities was confiscated in 2012, much higher than Rs 71.64 crore in 2011. As many as 1,28,852 raids were conducted, 4,022 persons were arrested, 3,256 were prosecuted and 423 were convicted during last year, according to the data provided by the Minister. To a separate query on inspection of godowns of state-run Food Corporation of India in Allahabad, Thomas said disciplinary action has been taken against 15 officials in the current fiscal for shortages and damages to foodgrains, including unsafe storage. (Source: Economic Times)

Textile body asks govt to release cotton stock

The Confederation of Indian Textile Industry (CITI) has asked the government to offload cotton stocks piled up by state-run agencies through procurement operations. In a letter to textile and commerce minister Anand Sharma, CITI chairman SV Arumugam said cotton prices in the domestic market had increased steeply because of an artificial shortage of cotton in the market, which is created partly by hoarding of cotton by traders, and partly by non-release of procured cotton by the Cotton Corporation of India (CCI) and other procurement agencies.

(Source: Financial Express)

UCX to commence trading in April

Indias sixth nationwide commodity futures trading platform, Universal Commodity Exchange ( UCX), is set to go live in April this year with at least 10 agri and nonagri commodities in its kitty. The exchange has enrolled alittle 200 members for trading on its platform, which is awaiting the issuance of a unique trading code by the regulator, Forward Markets Comm- ission (FMC). We are in the process of getting a unique trading code for each of our registered members. Once that process gets completed, we would be ready for launch, said Ketan Sheth, managing director of Commex Technologies, the promoter of UCX. The exchange got a nod from the ministry of consumer affairs in August last year. Since then, UCX has been steadily getting approvals for contracts. Generally, traders interest reduces towards the end of the financial year. Hence, we are waiting for this period to end to commence futures trading in at least 10 commodities, Sheth added (Source: Business Standard)

Coffee exports up 5% at 59,288 tonne in Jan-Feb

Farmers are preparing to plant a record rice crop that will boost inventories held by the worlds biggest exporters to the highest ever. Harvests will climb 1.2 percent to 472 million metric tons as the five largest shippers hoard 38 million tons, or a year of global imports, International Grains Council data show. Thailand may run out of warehouse space as reserves jump 40 percent to a record 18.2 million tons, according to the United Nations. Prices in Vietnam, an Asian benchmark, will drop 6.6 percent by December to $377.50 a ton, the lowest level since 2010, based on the median of 10 trader estimates compiled by Bloomberg. (Source: Financial Express)

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Chana

Chana April futures continued to decline yesterday and hit a fresh contract low of Rs 3286 but recovered towards the end on account of short coverings. Higher supplies in the domestic markets amidst ongoing harvesting coupled along with bumper output expectations have pressurized chana prices. Sharp downside was however, cushioned on the back of demand from the stockists at lower price levels. The Spot settled 1.63% while the Futures settled 0.33% higher on Tuesday. In the union budget 2013-14, although no direct move was considered for Pulses, still The Finance Minister expressed concern about the supplydemand mismatch in pulses. He said that the aggregate demand is a concern. Stating that food inflation is worrying, he said the government would take all steps to augment the supply side.

Market Highlights

Unit Rs/qtl Rs/qtl Last 3400 3319 Prev day -1.63 0.33

as on March 5, 2013 % change WoW MoM -2.86 -4.91 -0.84 -3.71 YoY -4.54 -7.29

Chana Spot - NCDEX (Delhi) Chana- NCDEX Apr'13 Futures

Source: Reuters

Technical Chart - Chana

NCDEX April contract

Pulses Sowing 2012-13

According to the final figures from ministry of agriculture dated 22 February 2012, Chana sowing is 3.6% higher at 95.15 lakh ha compared to previous year. Acreage is up in Rajasthan, Maharashtra, MP and AP at 15.7 lakh ha, 12.53 lakh ha, 32.99 lakh ha and 7.33 lakh ha respectively.

nd

Higher returns earned in 2012, coupled with a hike in minimum support prices (MSP), have helped expand overall acreage in 2012-13 season. The Centre has hiked the MSP by 14 per cent to Rs 3,200 a quintal for chana and as part of its strategy to encourage farmers to grow more pulses to reduce import dependence.

Demand supply fundamentals

According to second advance Estimates released on 8 Feb 2013, Total pulses output for 2012-13 season has been pegged at 17.58 mn tn, down 3.3% compared to previous year. The target for 2012-13 pulses crop output was set at 18.24 million tonne during the year. However, drought conditions have hampered kharif pulses output, which has been only partially offset by Rabi pulses output, especially chana. Out of the total pulses output, kharif output is estimated at 23% lower at 5.48 mn tn while rabi pulses output is pegged 8.72% higher at 12.09 mn tn compared with the final estimates of 2011-12. There has been a sharp increase in the chana output estimates on the back of higher acreage and good yield. Chana output is expected to breach its 2010-11 record of 8.2 mn tn and is estimated at 8.57 mn tn for 2012-13. In its first advance estimates chana output was pegged at 7.9 mn tn. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch).

th

Source: Telequote

Technical Outlook

Contract Chana Apr Futures Unit Rs./qtl Support

valid for Mar 6, 2013 Resistance 3330-3350

3270-3290

Trade Scenario

India imports Chana mainly from Australia and Canada and higher availability in these countries at comparatively cheaper rates is seen boosting imports of Chana to meet the domestic shortfall. In Australia, total chickpea production in 201213 is estimated to have increased to a record 713000 tones as compared with 485000 tons in 2011-12. In Canada chickpea output is estimated at 1.58 lakh tonnes compared with 86000 tn in 2011-12.

Outlook

Chana is expected to continue to trade lower tracking increasing arrivals of the new crop coupled with higher imports. However, sharp downside may be capped as demand will emerge at lower levels. Also, prices may not sustain below Rs 3200 as farmers will not liquidate their produce below these levels.

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Sugar

Sugar April futures traded on a positive note on account of short coverings. Also reports that the government may partially decontrol sugar next week supported prices at lower levels. Prices have declined sharply over the last couple of days on account of rising supplies in the physical markets and delay in lifting curbs on the controlled sector by the government. March futures hit a fresh contract low of Rs. 2986 earlier this week on account of higher supplies coupled with sluggish demand in the domestic markets.

The government has decided not to increase import duty on sugar though industry bodies and manufacturers had demanded a hike in the duty to 60% from the current 10% to curb shipment of the sweetener. Indias Agriculture Minister Sharad Pawar said that they are favoring Food Ministrys proposal to increase the production tax on Sugar from the current Rs. 0.71/kg by Rs. 1.5/kg if mills were freed from an obligation to sell the sweetener at lower prices for public distribution. India's sugar production in the 2013/14 season is set to fall below consumption for the first time in four years as a water shortage trims acreage in three key states.

Market Highlights

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX Mar'13 Futures Rs/qtl Last 3162

as on March 5, 2013 % Change Prev. day WoW -0.07 -0.80 MoM -2.04 YoY 8.72

Rs/qtl

2996

0.03

-2.35

-2.31

5.53

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMay'13 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 516.7 404.22

as on March 5, 2013 % Change Prev day WoW 0.21 0.61 1.55 2.25 MoM 2.83 -3.71 YoY -18.17 -24.37

.Source: Reuters

Technical Chart - Sugar

NCDEX April contract

Domestic Production and Exports

Out of the estimated 24 mn tn sugar output for the season 2012-13, India produced 13.7 mn tn in the first four months of the season beginning October 2012, up 3 percent a year ago period. With the opening stocks of 6.5 mn tn, domestic Sugar supplies are estimated at 30.5 mn tn against the domestic consumption of around 22. 5mln tn for 2012-13. Exports are not viable as international prices have also declined significantly.

Global Sugar Updates

Liffe white sugar as well as Raw Sugar futures on ICE settled higher by 0.21% and 0.61% respectively on Tuesday on account of short coverings. A global surplus situation coupled with ample supplies has led the prices to a sharp decline. Currently the prices are trading around their 2 year lows. Prices also declined as ISO forecasted higher global sugar surplus. Brazil exported 1.21 mt of raw sugar in February, vs 1.73 mt in January. The ISO last week had forecasted a global sugar surplus of 8.526 mn tn in 2012/13, up from 6.479 mn tn in 2011-12. It forecast that the sugar stocks-to-consumption ratio would rise to 40.56 percent in 2012/13 from 38.21 percent in 2011/12. Sugar traders are the most bullish since October on speculation that the slump in prices to the lowest in 2 1/2 years will spur Brazilian millers to make more biofuel and less of the raw sweetener from cane. Brazil plans to reduce taxes on ethanol to boost production and use of the biofuel. If brazil cuts tax the ethanol parity to sugar may rise and thus the share of cane directed to sugar production in the 2013-14 season may be 44 -45%, down from 49.6 % in the current period.

Source: Telequote

Technical Outlook

Contract Sugar Apr NCDEX Futures Unit Rs./qtl Support

valid for Mar 6, 2013 Resistance 3080-3095

3035-3050

Outlook

Sugar prices are expected to continue to decline further on account of huge supplies of sugar in both domestic and international markets. The market needs strong signals to bring an upside rebound in the prices. It may be in the form of sugar decontrol or yield concerns over next years output. Also, demand from the bulk manufacturers ahead of the summer season may support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Oilseeds

Soybean: Soybean April futures traded on a bullish note yesterday

on account of lower domestic supplies. Good export demand for US Soy also supported prices in the international markets. The spot as well as the futures settled 0.0.56% and 3.2% higher on Tuesday. Oil meal exports rose by almost 40 per cent to 7.68 lakh tonnes in January this year, industry body Solvent Extractors Association of India said. The export of oil meals, however declined by 18 per cent to 36.79 lakh tonnes in the first 10 months of this fiscal compared to 44.85 lakh tonnes in the year-ago period. The country exported 25.36 lakh tn soybean meal in first 10 months compared to 30.82 lakh tn in the same period last year which showing a decline of 17.72%. According to the second advance estimates, 2012-13 oilseed output is pegged at 29.4 mn tn, down by 1.1%, while soybean output is pegged higher at 12.9 mn tn, up 3.2%.

Market Highlights

% Change Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Mar '13 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Mar '13 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3425 3368 684.6 684.9 Prev day 0.56 1.88 -0.08 1.11

as on March 5, 2013

WoW 1.15 2.23 -2.55 -0.71

MoM 1.54 1.14 -9.45 -7.78

YoY 27.09 24.22 -3.29 -3.43

Source: Reuters

as on March 5, 2013 International Prices Soybean- CBOTMar'13 Futures Soybean Oil - CBOTMar'13 Futures Unit USc/ Bushel USc/lbs Last 1497 49.92 Prev day 0.42 -0.26 WoW 3.37 1.84 MoM 1.51 -5.79

Source: Reuters

International Markets

Soybean Futures on CBOT traded on a positive and settled 0.42% higher on Tuesday on account of strong export demand. Also tight supplies of the old crop supported the prices. Informa Economics raised its estimate of Brazil's soybean harvest to 84.5 mn tn from its earlier estimates of 84 mn tn. German oilseeds analyst Oil World cut its forecast of the 2013 soybean harvest in Argentina by 2 mn tn to 50 mn tn from its Jan estimates because of dry weather, but has raised its forecast of Brazil's soybean crop by 0.5 mn tn. Rainfall in Argentina's top soy-producing province revived wilting crops as many entered important growth stages, but others were still in urgent need of rain. Argentina soybean acreage is estimated at 19.35 mn ha. U.S. farmers will harvest record soybean crops in 2013, ending three years of falling production and rebuilding nearly depleted stockpiles. U.S. soybean processors say they have been pleasantly surprised by the high oil content of the latest U.S. soybean harvest, a factor that has contributed to strong profit margins and should pad year-end soy oil inventories.

YoY 12.54 -5.67

Crude Palm Oil

% Change Prev day WoW -0.67 -0.09 -0.13 1.26

as on March 5, 2013

Unit

CPO-Bursa Malaysia Mar '13 Contract CPO-MCX- Mar '13 Futures

Last 2384 458.6

MoM -0.75 1.42

YoY -25.96 -16.25

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Apr'13 Futures Rs/100 kgs Rs/100 kgs Last 3529 3409 Prev day -1.26 1.34 WoW -3.49 0.24

as on March 5, 2013 MoM -11.24 -1.33

Source: Reuters

YoY 2.02 -5.17

Refined Soy Oil: Ref soy oil traded on a positive note yesterday

tracking positive edible oil pack. CPO witnessed thin trades as traders are adopting a wait and watch policy tracking the ongoing palm oil conference and settled marginally lower by 0.09%. Higher global production estimates of palm oil by oil world have pressurized prices at higher levels. Global palm oil output is estimated at 55.3 mn tn in 2012-13, up by 3.4 mn tn. India's vegetable oil imports soared 27 percent from a month ago to an all-time high in January on purchases of cheap palm oil. To curb imports, the tariff value of crude palm oil, the edible oil India imports most, has been raised from $ 815 a tonne to $ 848 a tonne, a rise of 4.04%. Rape/mustard Seed: Mustard Futures recovered on account of short coverings and settled 1.34% higher prices have declined on account of higher output expectations. Arrivals have commenced in Rajasthan and thus prices may decline further. Mustard seed sowing is now up by 2.2% at 67.23 lakh ha. Agriculture ministry in its third advance estimates, pegged mustard output at 7.36 mn tn, up by 11.5%. MSP of mustard seed is fixed at Rs 3000 per qtl.

Technical Chart Soybean

NCDEX April contract

Source: Telequote

Technical Outlook

Contract Soy Oil Apr NCDEX Futures Soybean NCDEX Apr Futures RM Seed NCDEX Apr Futures CPO MCX Mar Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Mar 6, 2013 Support 670-675 3320-3355 3340-3375 455457 Resistance 688-692 3420-3450 3430-3450 461-463

Outlook

Soybean may trade higher tracking positive international markets as well as lower supplies in the domestic. Mustard seed may recover from lower levels tracking higher edible oil pack. CPO may trade on a mixed note as traders are watching the palm oil conference and may take cues from any announcements over there. also decline as higher production estimates may pressurize prices.

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities h

Black Pepper

Pepper Futures declined yesterday on account of increasing arrivals of the new crop from Karnataka. Prices have gained over the last couple of days due to low stocks, thin supplies and delayed harvesting on back of to lack of skilled laborers. Harvesting of the fresh crop is going in and is expected to gain momentum in the coming days. Food Safety and Standards Authority of India sealed the entire quantity of pepper stored in six warehouses in Kerala of about 8,000 tonnes. Exports demand for Indian pepper in the international markets is also weak due to price parity. The Spot as well as the April Futures settled 0.78% and 1.35% lower on Tuesday. According to a circular issued by NCDEX on 09/02/2013, launch of June 2013 expiry contract in Pepper which is scheduled on February 11, 2013, has been postponed till further notice. The revised launch date will be announced in due course. Spices Board has announced plans to import high yielding Madagascar variety that was behind the record productivity in Vietnam. It could raise productivity of Indian pepper from 2,000 kg/ha to 7,000 kg/ha. Pepper prices in the international market are being quoted at $7,100/tn. Vietnams Asta is quoted at $6,925-6,975/tn, Indonesia GM-1 is quoted at $6,900/tn and Brazil Asta is quoted at $6,600/tn.

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Mar'13 Futures Rs/qtl Rs/qtl Last 37928 36265 % Change Prev day -0.78 -1.35 WoW -4.57 -2.17

as on March 5, 2013 MoM -6.58 -6.57 YoY -4.07 -9.79

Source: Reuters

Technical Chart Black Pepper

NCDEX April contract

Exports and Imports

Indias pepper exports in 2012 have been reported at just 12,000 tonnes while imports reported at 15,000 tonnes making India a net importer. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of pepper in 2012 stood at 116,962 mt, Vietnam shipped 12000 mt of pepper in January 2013. Pepper imports by U.S. the largest consumer of the spice declined 9% in 2012 period to 62,458 tn as compared to 68,489 tn in 2011. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. Brazil exported 25,900 tn pepper during Jan-Nov 2012, around 20% lower compared with 32,650 tn in the same period last year. Exports from Malaysia 8,300 tn pepper during Jan-Oct 2012, lower by 30% last year while exports in October stood at 1,077 mt in.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Apr Futures Unit Rs/qtl

valid for Mar 6, 2013 Support 33900-34300 Resistance 35300-35870

Production and Arrivals

The arrivals in the spot market were reported at 22 tonnes while off takes were reported at 25 tonnes on Tuesday. As per IPC, Global pepper production in 2012 is projected at 3.27 lk tn, up compared with 3.18 lk tn in 2011. Production for 2013 is projected at 316832 tn. Indonesian pepper output is expected to rise by 24% and in Vietnam by 10%. According to estimates, pepper output in Vietnam is estimated to be 1.05 lakh tonne in 2012 as compared to 1.1 lakh tonne in 2011. Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) Pepper production in 2012-13 is expected around 60,000-63,000 tonnes. Currently, pepper is in the fruit formation stage in Kerala.

Outlook

Pepper is expected to trade lower as improvement in arrivals may pressurize prices further. However, low stocks coupled with good demand from the upcountry markets may support prices. Reports that farmers are holding back stocks may also support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Jeera

Jeera Futures declined yesterday as increasing arrivals of the new crop has pressurized prices. Demand of the new crop is low due to high moisture content. The arrivals of new crop are averaging around 20,000 bags/ day and are expected to improve in the coming days. Higher sowing as well as conducive weather in Gujarat, the main jeera growing region has increased output expectations. According to Gujarat State Agri Dept. sowing in Gujarat is reported at 3.352 lakh ha in 2013 compared with 3.719 lakh ha last year. In Rajasthan, sowing is expected to increase by 10-15%. The spot settled higher by 1.34% while the Arpil Futures settled 0.93% lower on Tuesday. According to markets sources the exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,975-$3,000 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 5-6 lakh bags.

Market Highlights

Unit Jeera Spot- NCDEX (Unjha) Jeera- NCDEX Mar '13 Futures Rs/qtl Rs/qtl Last 13486 12883 Prev day 1.34 -1.11

as on March 5, 2013 % Change WoW 0.50 -0.02 MoM -4.29 -6.26 YoY -2.69 -3.81

Source: Reuters

Technical Chart Jeera

NCDEX April contract

Production, Arrivals and Exports

Arrivals in Unjha were reported at 22,000 tn on Tuesday. Production of Jeera in 2012-13 is expected around 38-40 lakh bags (55 kgs each), same as last year. According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.42 -0.68

as on March 5, 2013 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Apr '13 Futures Rs/qtl Rs/qtl

Last 5438 6132

WoW -0.08 -1.51

MoM 0.14 -4.40

YoY 24.40 31.59

Outlook

Jeera Futures is expected to decline today. Increasing arrivals as well as low demand will pressurize prices. However, demand at lower levels may support prices. In the medium term, prices are likely to stay firm as Syria and Turkey have stopped shipments.

Turmeric

Turmeric Futures declined by 0.68% on Tuesday on account of higher supplies of the new crop coupled with higher carryover stocks. However, lower output expectations supported prices in the spot. Unseasonal rains in Andhra Pradesh have damaged about 9240 tonnes. The Spot settled 0.42% higher while the Futures settled 0.68% lower on Tuesday.

Technical Chart Turmeric

NCDEX April contract

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 5,000 bags and 10,000 bags respectively on Tuesday. Expectations are that production may be lower by 40-50%. There are reports of some crop damage in Erode region. Turmeric production in 2012-13 is expected around 50 lakh bags. Production in Nizamabad is expected around 12 lakh bags. Production in 2011-12 is projected at historical high of 10.62 lakh tn. It is estimated that next years carryover stocks would be around 10 lakh bags. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric may recover from lower levels as demand for the new crop is low due to high moisture content. Reports of some damage to the crop coupled with lower output concerns and demand from stockists may also support prices. Demand from stockists at lower levels may also support prices. However, higher carryover stocks and weak overseas demand are expected to pressurize prices from higher levels.

Jeera NCDEX Apr Futures Turmeric NCDEX April Futures

Source: Telequote

Technical Outlook

Unit Rs/qtl Rs/qtl

Valid for Mar 6, 2013

Support 12830-12930 6034-6088 Resistance 13180-13330 6200-6260

www.angelcommodities.com

Commodities Daily Report

Wednesday| March 06, 2013

Agricultural Commodities

Kapas

NCDEX Kapas and MCX Cotton recovered sharply and settled 1.14% and 1.1% higher on Tuesday tracking positive international markets. There is some buying interest seen from China which has raised expectations of export demand. Removal of duties from cotton led he prices to decline in the last few sessions. However, sharp downside was capped as government decided to continue with current cotton exports policy. Traders expect exports to cross governments estimates of 8 mn bales. Finance Minister announced various incentives and policies in the Union Budget to support the ailing textile industry. Cotton supplies since the beginning of the year in October 2012 until February 10, 2013 were down at 183.4 lakh bales, down from 189.27 lakh bales a year earlier.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 972.5 18410

as on March 5, 2013 % Change Prev. day WoW MoM 1.14 -2.06 10.14 1.10 3.14 3.14 YoY #N/A 11.78

NCDEX Kapas Apr Futures MCX Cotton Mar Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit USc/Lbs Last 85.97 81.35

as on March 5, 2013 % Change Prev day WoW 1.25 7.02 0.00 0.00 MoM 3.60 0.00 YoY -6.93 -29.20

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) estimates (23 Jan 2013) for 2012-13 season that commenced in October, domestic cotton production is pegged 330 lakh bales, down from the previous years estimates of 353 lakh bales. However, higher exports and domestic consumption can be met through revised higher opening stocks of 40 lakh bales and higher imports. After witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 80 lakh bales this season, compared with 128.8 lakh bales last year.

th

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

Cotton traded higher and settled 1.25% on Tuesday higher as mills st buying lifted prices. Prices reported its 1 weekly gains after declining for the last 3 weeks after touching a 9 month high due to lower world demand. However, mills buying and expectations of good demand from China have supported prices at lower levels. U.S. growers will harvest the smallest cotton crop in four years and notch the smallest exports in 12 years as world demand for the fiber drops, especially in China.

0

Source: Telequote

Technical Chart - Cotton

MCX March contract

At its annual Outlook Forum, USDA projected a crop of 14 million bales from planted acreage of 10 million acres. Plantings would be the smallest in four years and down 19 percent from last year. The crop, projected to be down 18 percent from 2012, would be the smallest since 2009. China is planning to issue more cotton import quotas to exportdependent textile mills that are struggling to protect margins as domestic prices soar due to a state stockpiling plan. However, according to USDA, the world's largest cotton grower and user, will import the smallest amount of cotton, 8 million bales, in five years in 2013/14 as it copes with huge domestic reserves.

Source: Telequote

Outlook

Cotton prices are expected trade higher on expectations of good export demand. Various policy announcements to support the textile industry may support prices. Also the prices may take cues from firmness in the international markets. Expectations that China may release higher import quota which might boost imports also supported an upside in the cotton prices. Also, expected lower US cotton acreage and output in 2013-14 may also support prices at lower levels.

Technical Outlook

Contract Kapas NCDEX April Futures Cotton MCX March Futures Unit Rs/20 kgs Rs/bale

valid for Mar 6, 2013 Support 950-962 18120-18270 Resistance 980-990 18510-18590

www.angelcommodities.com

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingPas encore d'évaluation

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingPas encore d'évaluation

- Objectives of Study Scope of Study Research Methodology Limitation of Study - 7Document76 pagesObjectives of Study Scope of Study Research Methodology Limitation of Study - 7Anand SagarPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- 32098-Article Text-132415-1-10-20210409Document9 pages32098-Article Text-132415-1-10-20210409Kunto Anjono PriyambodoPas encore d'évaluation

- DespatchDocument42 pagesDespatchjagadeesan leninPas encore d'évaluation

- Savitribai Phule Pune UniversityDocument55 pagesSavitribai Phule Pune UniversityRushabh MeherPas encore d'évaluation

- Slide MR Mansor MatradeDocument18 pagesSlide MR Mansor MatradeThe MaverickPas encore d'évaluation

- Thesis Oil PalmDocument5 pagesThesis Oil Palmmariapolitepalmdale100% (2)

- Business Plan For Palm Oil ProductionDocument16 pagesBusiness Plan For Palm Oil ProductionAsan Godwin Jnr100% (2)

- Oleochemicals: Optimized For The Highest Quality OutputDocument16 pagesOleochemicals: Optimized For The Highest Quality OutputGloria Elena PerezPas encore d'évaluation

- Process Lines For Crude Palm Oil Production - tcm11 55437 PDFDocument24 pagesProcess Lines For Crude Palm Oil Production - tcm11 55437 PDFLim Zamora Gemota100% (1)

- RBD Palm Olein: Technical Data Sheet PL10Document1 pageRBD Palm Olein: Technical Data Sheet PL10Thao BichPas encore d'évaluation

- ProjectDocument12 pagesProjectkusumaguturuPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Biofuels Scenario in Asia MarlonDocument5 pagesBiofuels Scenario in Asia MarlonrscordovaPas encore d'évaluation

- Refinery of Palm OilDocument14 pagesRefinery of Palm OilEvantono Balin Christianto100% (1)

- H2 Economics Tutorial Package Topics 2, 3 and 4: Price Mechanism and Its ApplicationsDocument27 pagesH2 Economics Tutorial Package Topics 2, 3 and 4: Price Mechanism and Its ApplicationsThaddeus TungPas encore d'évaluation

- Palm Kernel & Coconut Oils - Analytical Characteristics - JAOCS - 1983Document6 pagesPalm Kernel & Coconut Oils - Analytical Characteristics - JAOCS - 1983EtsABD100% (1)

- Biodiesel From Palm Oil in Comparison With Other Renewable FuelsDocument18 pagesBiodiesel From Palm Oil in Comparison With Other Renewable FuelsJessicalba LouPas encore d'évaluation

- Estimating Nutrient Content - UAV Derived Oil PalmDocument10 pagesEstimating Nutrient Content - UAV Derived Oil PalmFitri AudiaPas encore d'évaluation

- Oil and Fat Technology Lectures IDocument27 pagesOil and Fat Technology Lectures Iaulger100% (4)

- Kilang UnileverDocument23 pagesKilang UnileverCynthiaPas encore d'évaluation

- 116929-Article Text-324490-1-10-20150514Document11 pages116929-Article Text-324490-1-10-20150514Nofiu Moshood OlaidePas encore d'évaluation

- Castellanos Navarrete 2015Document27 pagesCastellanos Navarrete 2015Lazarus SolusPas encore d'évaluation

- jppdf-14013233 - Coconut PHDocument7 pagesjppdf-14013233 - Coconut PHAndry YusufPas encore d'évaluation

- Product Biodiversity Footprint - 2020Document11 pagesProduct Biodiversity Footprint - 2020Markel MartínPas encore d'évaluation

- GEMCO Pellet Plant in Malaysia - Malaysian Oil Palm Biomass StudyDocument3 pagesGEMCO Pellet Plant in Malaysia - Malaysian Oil Palm Biomass StudyKelly ObrienPas encore d'évaluation

- WebDocument313 pagesWebYemi FajingbesiPas encore d'évaluation

- Monthly Palm Product MalaysiaDocument1 pageMonthly Palm Product MalaysiaDian PalupiPas encore d'évaluation

- Swot AnalysisDocument2 pagesSwot AnalysisYee 八婆100% (1)

- Devolopment of Alternative Energy in Thailand-FinalDocument76 pagesDevolopment of Alternative Energy in Thailand-FinalsomkiatsutiratanaPas encore d'évaluation

- The Banking Environment Initiative Sustainable Shipment Letter of Credit - 1Document25 pagesThe Banking Environment Initiative Sustainable Shipment Letter of Credit - 1ShirleyPas encore d'évaluation

- Company Brief - 2018v2-EmailDocument26 pagesCompany Brief - 2018v2-EmailMatsuda HagiwaraPas encore d'évaluation