Académique Documents

Professionnel Documents

Culture Documents

Banking Laws Notes

Transféré par

Leomar Despi LadongaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Banking Laws Notes

Transféré par

Leomar Despi LadongaDroits d'auteur :

Formats disponibles

BANKING LAWS GOVERNING LAWS Banking Institution are governed by the following laws: A. General banking laws .

General Banking Law (R.A. No. 8791) .New Central Bank Act (R.A. No. 7653) B. Special banking laws .New Rural Banks Act (R.A. No. 7353) .Private Development Banks Act (R.A. No. 4093) .Savings and Loan Association Act (R.A. No. 3779) . Thrift Banks Act (R.A. No. 7906) C. Other laws affecting banks .Secrecy of Bank Deposits Law (R.A. No. 1405) .Unclaimed Balances Law (Act No. 3936) .Philippine Deposit Insurance Corporation Act (R.A. No. 3591) .The general banking laws above mentioned are applicable to government banks like DBP and PNB. .The Al- Amanah Islamic Bank is subject to all banking and pertinent laws. (Bar Review Materials in Commercial Law, Jorge Miravite, 2002 ed.) THREE KINDS OF ENTITIES THAT INTRODUCE FUNDS INTO THE ECONOMY: 1.banks : entities that obtains funds from the public in the form of deposits and re-lend it to the public; 2.quasi-banks : those that obtain funds in the form of deposit substitutes and re-lend the same and not from the public or depositors. 3. Finance companies and other financial intermediaries: those that lend funds from their own assets. FIVE PERSONS PRIMARILY INTERESTED IN THE BUSINESS OF BANKING 1. Government 2. Depositors 3. Investors

4. Creditors 5. Borrowers BAR QUESTION: JOINT ACCOUNT VS. PARTNERSHIP (2000) Distinguish joint account from partnership. (3%) SUGGESTED ANSWER The following are the distinctions between joint account and partnership: 1) A partnership has a firm name while a joint account has none and is conducted in the name of the ostensible partner. 2) WHILE A PARTNERSHIP HAS JURIDICAL PERSONALITY AND MAY SUE OR BE SUED UNDER ITS FIRM NAME, A JOINT ACCOUNT HAS NO JURIDICAL PERSONALITY AND CAN SUE OR BE SUED ONLY IN THE NAME OF THE OSTENSIBLE PARTNER. 3) While a partnership has a common fund, a joint account has none. 4) While in a partnership, all general partners have the right of management, in a joint account, the ostensible partner manages its business operations. 5) While liquidations of a partnership may, by agreement, be entrusted to a partner or partners, in joint account liquidation thereof can only be done by the ostensible partner.

BAR QUESTION: Theory of Cognition vs. Theory of Manifestation (1997) The Civil Code adopts the theory of cognition, while the Code of Commerce generally recognizes the theory of manifestation, in the perfection of contracts. How do these two theories differ? SUGGESTED ANSWER: Under the theory of cognition, the acceptance is considered to effectively bind the offeror only from the time it came to his knowledge. Under the theory of manifestation, the contract is perfected at the moment when the acceptance is declared or made by the offeree. GENERAL BANKING LAW OF 2000 (GBL)

(RA No. 8791) Purpose: To promote and maintain a stable and efficient banking and financial system that is globally competitive, dynamic and responsive to the demands of a developing economy (Sec. 2). Scope of Application: The GBL primarily governs universal banks and commercial banks. It suppletorily governs thrift banks, rural banks and other banking institutions. GENERAL CONCEPTS BANKS . Entities engaged in the lending of funds obtained in the form of deposits (Sec. 2) .Entities duly authorized by the Monetary Board to engage in the business of regularly lending funds obtained regularly from the public through the receipt of deposits of any kind. . An investment company that performs function as such is NOT a bank. Thus an investment company that is engage solely in investing, reinvesting or trading in securities is not engage in banking. (Banas vs. Asia Pacific Finance Corp., Oct. 18, 2000). . However, an investment company which loans out money of its customers, collects interest, and charges a commission to both lender or borrower is engage in banking (Republic vs.Security Credit and Acceptance Corp.) QUASI-BANKS . Entities engaged in the borrowing of funds through the issuance, endorsement or assignment with recourse or acceptance of deposit substitutes(Se c.95) . Entities authorized to perform universal or commercial banking functions may also engage in quasi-banking functions. FINANCIAL INTERMEDIARIES . Persons or entities whose principal functions include the lending, investing or placement of funds on evidences of indebtedness or equity deposited with them, acquired by them or otherwise coursed through them, either for their own account or for the account of others. ORGANIZATION AND OPERATION A. Authority to Register/Incorporate

. The SEC shall not register the articles of incorporation of any bank or any amendment thereto unless accompanied by a certificate of authority issued by the Monetary Board under its seal (Sec. 14). .The certificate of authority shall not be issued unless the Monetary Board is satisfied: 1. That all requirements of existing laws and regulations to engage in the business for which the applicant is proposed to be incorporated have been complied with; 2. That the public interest and economic conditions, both general and local, justify the authorization; and 3. That the amount of the capital, the financing, organization, direction and administration, as well as the integrity and responsibility of the organizers and administrators, reasonably assure the safety of deposits and the public interest (Sec. 14). Organization of a Bank or Quasi-Bank Requirements: 1. The entity is a stock corporation; 2. Its funds are obtained from the public, i.e. 20 or more persons; and 3. The minimum capital requirements prescribed by the Monetary Board are satisfied (Sec. 8). Note: In Quasi banks, Deposit substitute are alternative forms of obtaining funds for the public, other than deposit, through the issuance, endorsement, or acceptance of debt instrument for the borrowers own account, for the purpose of relending or purchasing of receivables and other obligations.in banking or quasi-banking functions . A person or entity cannot engage in banking or quasi-banking functions without a certificate of authority from the BSP (Sec. 6). . The determination of whether a person or entity is performing banking or quasi-banking functions without BSP authority shall be decided by the Monetary Board. NATURE OF BANKING BUSINESS Impressed with public interest where the trust andconfidence of the public in general is of paramount importance such that:

1. The appropriate standard of diligence must be very high, if not the highest, degree of diligence;highest degree of care (PCI Bank vs. CA, 350SCRA 446, PBCom vs. CA, G.R. No. 121413, 29 Jan. 2001) . This applies only to cases where banks are acting in their fiduciary capacity, that is, as depository of the deposits of their depositors (Reyes vs. CA, G.R. No. 118492, 15 Aug. 2001). 2. Subject to reasonable regulation under the police power of the state. . While an innocent mortgagee is not expected to conduct an exhaustive investigation on the history of the mortgagors title, in case of a institution, it must exercise due diligence before entering into said contract, and cannot rely upon on what is or is not annotated on the title. Reason: Before a loan is approved, representatives are sent to the premises offered as collaterals so as to investigate who the real owners are (DBP vs. CA, 331SCRA 267). . The business of a bank is one affected by public interest for which reason the bank should guard against loss due to negligence and bad faith. It is expected to ascertain and verify the identities of the persons it transacts business with (UCPB vs. Ramos, G.R. No. 147800, November 11, 2003, Callejo, J.). . Due diligence required of banks extend even to persons, or institutions like the GSIS, regularly engaged in the business of lending money secured by real estate mortgages (GSIS vs. Eduardo Santiago, G.R. No. 155206. October 28, 2003). CONSEQUENCES OF NATURE OF BUSINESS: 1. It is subject to heavy and close supervision and/or regulation by the BSP (Central Bank of the Phils. v. CA, 208SCRA 652). 1. It is required to exercise utmost diligence in the handling of deposits (Simex International Manila Inc., 183SCRA 361). 2. Special rules on strikes and lockouts: any strike or lockout involving banks, if unsettled after 7 calendar days shall be reported by the BSP to the Sec. of Labor who has 2 options: a. He may assume jurisdiction over and decide the dispute; or b. certify it to the NLRC for compulsory arbitration

The President may also intervene at any time and assume jurisdiction over such labor dispute in order to settle or terminate the same. CLASSIFICATION OF BANKS (SEC. 3) 1.Universal banks - Primarily governed by the General Banking Law (GBL), can exercise the powers of an investment house and invest in nonallied enterprises and have the highest capitalization requirement. 2.Commercial banks - Ordinary banks governed by the GBL which have a lower capitalization requirement than universal banks and can neither exercise the powers of an investment house nor invest in non-allied enterprises. 3.Thrift banks - These are a) Savings and mortgage banks; b) Stock savings and loan associations; c) Private development banks, which are primarily governed by the Thrift Banks Act (R.A. 7906). 4.Rural banks - Mandated to make needed credit available and readily accessible in the rural areas on reasonable terms and which are primarily governed by the Rural Banks Act of1992( RA7353). 5.Cooperative banks - Those banks organized whose majority shares are owned and controlled by cooperatives primarily to provide financial and credit services to cooperatives. It shall include cooperative rural banks. They are governed primarily by the Cooperative Code (RA 6938). 6.Islamic banks - Banks whose business dealings and activities are subject to the basic principles and rulings of Islamic Shari a, such as the Al Amanah Islamic Investment Bank of the Philippines which was created by RA 6848. 7.Other classification of banks as determined by the Monetary Board of the Bangko Sentral ng Pilipinas.

Vous aimerez peut-être aussi

- Commonwealth Act No. 63Document4 pagesCommonwealth Act No. 63Sherill Padua GapasinPas encore d'évaluation

- Art. 333 - 346 - Crimes Against ChastityDocument6 pagesArt. 333 - 346 - Crimes Against ChastityLeomar Despi LadongaPas encore d'évaluation

- Aznar Vs GarciaDocument1 pageAznar Vs GarciaLeomar Despi LadongaPas encore d'évaluation

- Art. 171 - 184Document8 pagesArt. 171 - 184Leomar Despi LadongaPas encore d'évaluation

- ObligationDocument2 pagesObligationLeomar Despi LadongaPas encore d'évaluation

- Gregorio Araneta Vs RodasDocument2 pagesGregorio Araneta Vs RodasLeomar Despi LadongaPas encore d'évaluation

- CRIMES AGAINST CIVIL STATUSDocument4 pagesCRIMES AGAINST CIVIL STATUSLeomar Despi LadongaPas encore d'évaluation

- Phil Bank Vs EchiverriDocument1 pagePhil Bank Vs EchiverriLeomar Despi LadongaPas encore d'évaluation

- Conflict CasesDocument28 pagesConflict CasesLeomar Despi LadongaPas encore d'évaluation

- Phil Bank Vs EchiverriDocument1 pagePhil Bank Vs EchiverriLeomar Despi LadongaPas encore d'évaluation

- NEGLIGENT ACTS UNDER PHILIPPINE LAWDocument3 pagesNEGLIGENT ACTS UNDER PHILIPPINE LAWLeomar Despi Ladonga100% (3)

- Full CasesDocument70 pagesFull CasesLeomar Despi LadongaPas encore d'évaluation

- Aznar Vs GarciaDocument1 pageAznar Vs GarciaLeomar Despi LadongaPas encore d'évaluation

- Art. 353 - 364 - Crimes Against HonorDocument13 pagesArt. 353 - 364 - Crimes Against HonorLeomar Despi Ladonga88% (8)

- Crimes Against State LawsDocument4 pagesCrimes Against State LawsLeomar Despi LadongaPas encore d'évaluation

- Book VDocument19 pagesBook VLeomar Despi LadongaPas encore d'évaluation

- January 11-20 2013 Civil CasesDocument1 pageJanuary 11-20 2013 Civil CasesLeomar Despi LadongaPas encore d'évaluation

- Mercantile Law 2013 October Bar ExamsDocument17 pagesMercantile Law 2013 October Bar ExamsNeil RiveraPas encore d'évaluation

- Bar Exams QuestionsDocument43 pagesBar Exams QuestionsLeomar Despi LadongaPas encore d'évaluation

- FActsDocument2 pagesFActsLeomar Despi LadongaPas encore d'évaluation

- MANPOWER SUPPLY AGREEMENTDocument3 pagesMANPOWER SUPPLY AGREEMENTLeomar Despi LadongaPas encore d'évaluation

- Complaint: X IncorporatedDocument6 pagesComplaint: X IncorporatedLeomar Despi LadongaPas encore d'évaluation

- Monte de Piedad Earthquake Relief Funds DisputeDocument11 pagesMonte de Piedad Earthquake Relief Funds DisputeLeomar Despi LadongaPas encore d'évaluation

- Spouses Yap vs. International Exchange BankDocument1 pageSpouses Yap vs. International Exchange BankLeomar Despi LadongaPas encore d'évaluation

- Bildner V IlusorioDocument8 pagesBildner V IlusorioLeomar Despi LadongaPas encore d'évaluation

- Basco V PagcorDocument1 pageBasco V PagcorLeomar Despi LadongaPas encore d'évaluation

- Chan Robles Virtual Law LibraryDocument7 pagesChan Robles Virtual Law LibraryLeomar Despi LadongaPas encore d'évaluation

- Simple Tenses and Perfect Tenses ExplainedDocument3 pagesSimple Tenses and Perfect Tenses ExplainedLeomar Despi LadongaPas encore d'évaluation

- BDO Bank Account Authorization CertificateDocument3 pagesBDO Bank Account Authorization CertificateLeomar Despi LadongaPas encore d'évaluation

- RTC Hilongos Leyte People Philippines vs AB arson informationDocument1 pageRTC Hilongos Leyte People Philippines vs AB arson informationLeomar Despi LadongaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Lecture 4 Corp Personality 130917-4 PDFDocument23 pagesLecture 4 Corp Personality 130917-4 PDF靳雪娇Pas encore d'évaluation

- PB-OBLIGATIONS-SET B Q&A - AnswersDocument28 pagesPB-OBLIGATIONS-SET B Q&A - AnswersKenneth John TomasPas encore d'évaluation

- Company Regulation SampleDocument13 pagesCompany Regulation SampleJames Oludele Etu67% (3)

- Home Loan Process at Dena BankDocument57 pagesHome Loan Process at Dena BankDeshrajsingh SengarPas encore d'évaluation

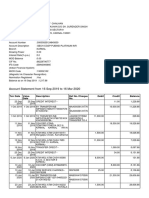

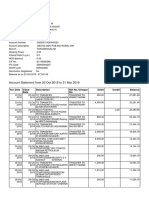

- Account Statement From 16 Sep 2019 To 16 Mar 2020Document2 pagesAccount Statement From 16 Sep 2019 To 16 Mar 2020SUNYYRPas encore d'évaluation

- SEBI ICDR Chapter V Preferential Issue ExemptionsDocument2 pagesSEBI ICDR Chapter V Preferential Issue Exemptionskpved92Pas encore d'évaluation

- How To Take Money From ATM: Procedure TextDocument1 pageHow To Take Money From ATM: Procedure TextOctavinaPas encore d'évaluation

- Law 204: Easy Way To Read Section 17 of The Registration Act 1908Document6 pagesLaw 204: Easy Way To Read Section 17 of The Registration Act 1908Efaz Mahamud AzadPas encore d'évaluation

- SPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, Respondent. FACTS: Spouses Eduardo and Lydia Silos (Petitioners) Have Been inDocument4 pagesSPOUSES EDUARDO and LYDIA SILOS, Petitioners, Philippine National Bank, Respondent. FACTS: Spouses Eduardo and Lydia Silos (Petitioners) Have Been indaryllPas encore d'évaluation

- Handouts For Credit TransactionsDocument15 pagesHandouts For Credit TransactionsIrene Sheeran100% (1)

- Corpus Christi Town Club Order Authorizing Auction SaleDocument1 pageCorpus Christi Town Club Order Authorizing Auction SalecallertimesPas encore d'évaluation

- Quick Reference To Base 24 Error CodesDocument2 pagesQuick Reference To Base 24 Error Codesthangella_nagendra0% (1)

- Income From House PropertyDocument12 pagesIncome From House PropertydipxxxPas encore d'évaluation

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Debt Collection in India Why Is It So DifficultDocument2 pagesDebt Collection in India Why Is It So DifficultSoumiki GhoshPas encore d'évaluation

- Adjustments To Financial Statements - Students - ACCA Global - ACCA GlobalDocument4 pagesAdjustments To Financial Statements - Students - ACCA Global - ACCA Globalacca_kaplan100% (1)

- TATA Card - PaynetmarchDocument2 pagesTATA Card - PaynetmarchabhilashaupadhyayaPas encore d'évaluation

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorPas encore d'évaluation

- Max Gardner's Top 200 Signs You've Got A False Document As Published by The Florida Bar in 2008Document18 pagesMax Gardner's Top 200 Signs You've Got A False Document As Published by The Florida Bar in 2008lizinsarasota100% (2)

- 2003 Hbos RaDocument124 pages2003 Hbos RasaxobobPas encore d'évaluation

- Deed of Antichresis ExplainedDocument2 pagesDeed of Antichresis Explainedjoshboracay100% (8)

- Transcribe 2nd MeetingDocument4 pagesTranscribe 2nd MeetingGian Paula MonghitPas encore d'évaluation

- Plaintiff-Appellee Vs Vs Defendant-Appellant Araneta & Zaragosa Ross, Lawrence & Selph Andres NicolasDocument7 pagesPlaintiff-Appellee Vs Vs Defendant-Appellant Araneta & Zaragosa Ross, Lawrence & Selph Andres NicolasCams Tres ReyesPas encore d'évaluation

- Paper8 Solution PDFDocument22 pagesPaper8 Solution PDFbinuPas encore d'évaluation

- Keshavlal Khemchand and Sons Private Ltd. v. Union of India PDFDocument52 pagesKeshavlal Khemchand and Sons Private Ltd. v. Union of India PDFBar & BenchPas encore d'évaluation

- Philippine Financial System StructureDocument28 pagesPhilippine Financial System StructureJenielyn Delamata83% (6)

- Klkiulm QDQ PK 4 SXDocument8 pagesKlkiulm QDQ PK 4 SXkarthickPas encore d'évaluation

- Araneta V PaternoDocument5 pagesAraneta V PaternopurplebasketPas encore d'évaluation

- Topic 2 Guide - Due Diligence and Takeover LawDocument5 pagesTopic 2 Guide - Due Diligence and Takeover LawHubibPas encore d'évaluation

- Balus Vs Balus Case DigestDocument3 pagesBalus Vs Balus Case DigestHanna TevesPas encore d'évaluation