Académique Documents

Professionnel Documents

Culture Documents

Tax Credit Information - Foreign

Transféré par

Chad GibsonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Credit Information - Foreign

Transféré par

Chad GibsonDroits d'auteur :

Formats disponibles

Incentives

A World of Looks

TM

Tax Credits Available to Foreign Film and Television Productions

Foreign productions in British Columbia can access a variety of provincial and federal tax credit programs and if eligibility requirements are met, a producer can combine them to access exceptional savings.

Production Services Tax Credit (PSTC)

The Production Services Tax Credit (PSTC) is an economic initiative designed to encourage film, television, digital animation and visual effects production in British Columbia. Eligible applicants are film, television and animation production corporations that have incurred qualifying labour expenses in British Columbia. The PSTC is not subject to any Canadian content requirements and is available to either international or Canadian productions produced in British Columbia.

TAX CREDIT

VALUE

TAX CREDIT CALCULATION BASED ON

Basic PSTC*

33%

The qualified BC labour expenditure of the corporation. The qualified BC labour expenditure of the corporation pro-rated by the number of days of principal photography in BC outside of the designated Vancouver area to the total days of principal photography in BC. This tax credit must be accessed in conjunction with the Basic PSTC. The distant location regional tax credit is added to the regional tax credit for principal photography done outside of the Lower Mainland region, north of Whistler and east of Hope, excluding the Capital Regional District. It is pro-rated by the number of distant location principal photography days to the total BC principal photography days and must be accessed in conjunction with the Regional and Basic PSTC.

Regional PSTC

6%

How the PSTC Works

The PSTC is a refundable corporate income tax credit. When filing tax returns, production corporations may claim a specified percentage of the labour costs incurred in making film, television, digital animation or visual effects productions. The credits are applied to reduce tax payable, and any remaining balance is paid to the corporation. There is no limit on the PSTC that may be claimed on a particular production and there is no limit that a corporation or group of corporations can claim. The production corporation must apply to British Columbia Film + Media to receive an accreditation certificate for the production. In order to claim the PSTC tax credits, the production corporation must file a corporate income tax return, along with the certificates, to the Canada Revenue Agency.

Additional Distant Location PSTC

6%

Digital 17.5% The BC labour expenditures directly attributable to digital animation Animation or or visual effects activities. This Visual Effects tax credit must be accessed in PSTC*

conjunction with the Basic PSTC.

CDN Federal PSTC**

16%

Qualified Canadian labour expenditures of the corporation.

THESE RATES ARE EFFECTIVE FOR PRODUCTIONS THAT BEGIN PRINCIPAL PHOTOGRAPHY AFTER FEBRUARY 28, 2010.

**THE CANADIAN FEDERAL PSTC IS IN ADDITION TO THE PROVINCIAL TAX CREDITS.

Jan 2013 | Page 1 of 2

General Eligibility Rules

Production corporations and their productions must meet the following minimum conditions to qualify for the PSTC: 1. Minimum budget levels: For episodic television, episodes that are less than hour greater than $100,000 per episode For episodic television, episodes that are a half hour or longer greater than $200,000 per episode For episodic television, where episodes are all or substantially all digital animation and are less than hour - greater than $0 per episode In all other cases greater than $1,000,000 2. The corporation claiming the tax credit must own the copyright in the production or be directly contracted with the owner of the copyright in the production. 3. The corporation claiming the tax credit must have a permanent establishment in BC. 4. Some genres are excluded from the PSTC including, but not limited to, pornography, talk shows, news, live sports events, game shows, reality television, and advertising.

Canadian Federal Tax Credits

The Federal Film or Video Production Services Tax Credit (PSTC) is designed to enhance Canada as a location of choice for film and video productions employing talented Canadians, as well as strengthening the industry and securing investment. Federal Film or Video Production Services Tax Credit is primarily for foreign production (although domestic producers can also apply) and is 16% of qualified labour expenditures. This refundable tax credit has no cap on the amount which can be claimed and is available to taxable Canadian corporations or foreign-owned corporations with permanent establishments in Canada. The Canadian Audio-Visual Certification Office (CAVCO) is the entity responsible for issuing certificates on behalf of the Minister of Canadian Heritage. For more information on the Federal Production Services Tax Credit process, eligibility and timelines, contact: Canadian Audio-Visual Certification Office (CAVCO) Department of Canadian Heritage Telephone 1 819 934 9830 Telephone (Toll free): 1 888 433 2200 Fax: 819 934 9828 Email: bcpac-cavco@pch.gc.ca Website: www.pch.gc.ca/cavco NOTE: This document is intended as a general overview. It is not exhaustive and should not be relied upon to determine eligibility or the final amount of an anticipated tax credit. In case of any discrepancies between this document and the legislation and regulations, the regulations and legislation shall prevail.

For more information

Copies of the tax credit guidelines, legislation, regulations and application forms may be obtained from British Columbia Film + Medias website www.bcfm.ca. For more information on British Columbias Production Service Tax Credit process, eligibility and timelines, contact: British Columbia Film + Media Robert Wong Tel: 604 736 7997 Fax: 604 736 7290 Email: bwong@bcfm.ca Website: www.bcfm.ca

201 865 HORNBY STREET VANCOUVER, BC CANADA V6Z 2G3

TEL 604 660 2732 BCFILMCOMMISSION.COM Jan 2013 | Page 2 of 2

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Supreme Court Decisions PDFDocument378 pagesSupreme Court Decisions PDFJeffrey L. OntangcoPas encore d'évaluation

- United States v. Aaron Gomes, 387 F.3d 157, 2d Cir. (2004)Document8 pagesUnited States v. Aaron Gomes, 387 F.3d 157, 2d Cir. (2004)Scribd Government DocsPas encore d'évaluation

- 20.03.2020 Order of NCLAT Regarding Appointment of IRP For Two UP ProjectsDocument3 pages20.03.2020 Order of NCLAT Regarding Appointment of IRP For Two UP Projectspraveensingh77Pas encore d'évaluation

- FATCADocument1 pageFATCAmuslimnswPas encore d'évaluation

- Plaintiffs' Letter Regarding Scope of Discovery and Putative Discovery RequestsDocument68 pagesPlaintiffs' Letter Regarding Scope of Discovery and Putative Discovery RequestspipolygmPas encore d'évaluation

- Legal Aptitude: Contracts - 1Document6 pagesLegal Aptitude: Contracts - 1Vishal JainPas encore d'évaluation

- Scholarship GrantsDocument1 pageScholarship GrantsPipoy AmyPas encore d'évaluation

- Davao Smoking LawDocument4 pagesDavao Smoking LawJohn Remy HerbitoPas encore d'évaluation

- Dangerous Drugs Board Regulation No. 3Document9 pagesDangerous Drugs Board Regulation No. 3Junyvil TumbagaPas encore d'évaluation

- Calalang V WilliamsDocument1 pageCalalang V WilliamsErca Gecel BuquingPas encore d'évaluation

- Huling Defensa Kuya TimbalDocument97 pagesHuling Defensa Kuya TimbalShanice Del RosarioPas encore d'évaluation

- BNI Membership Application FormDocument2 pagesBNI Membership Application FormSatya PrakashPas encore d'évaluation

- PEOPLE OF THE PHLIPPINES vs. TANESDocument2 pagesPEOPLE OF THE PHLIPPINES vs. TANESlinlin_17100% (2)

- (Digest) Philippine Airlines Inc. vs. NLRC Et Al. G.R. No. 85985 August 13, 1993 - CanedoDocument3 pages(Digest) Philippine Airlines Inc. vs. NLRC Et Al. G.R. No. 85985 August 13, 1993 - CanedoPhulagyn CañedoPas encore d'évaluation

- US Supreme Court Writ For CertiorariDocument58 pagesUS Supreme Court Writ For CertiorariNausheen ZainulabeddinPas encore d'évaluation

- Chapter 1 Audit Under TaxDocument15 pagesChapter 1 Audit Under TaxSaurabh GogawalePas encore d'évaluation

- Introduction To Air LawDocument22 pagesIntroduction To Air LawJaycee Quiambao0% (1)

- Section 6. - Right To Choose Abode & Right To Travel at Home & Out of CountryDocument19 pagesSection 6. - Right To Choose Abode & Right To Travel at Home & Out of CountryANDREA JOSES TANPas encore d'évaluation

- Republic of Kenya. Ministry of State For Immigration and Registration of Persons. Nyayo House. 2006Document29 pagesRepublic of Kenya. Ministry of State For Immigration and Registration of Persons. Nyayo House. 2006Lucas Daniel Smith100% (1)

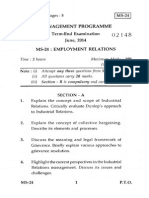

- Time: 3 Hours Maximum Marks: 100 (Weightage 70%)Document5 pagesTime: 3 Hours Maximum Marks: 100 (Weightage 70%)2912manishaPas encore d'évaluation

- Contemporary World. Institutions (Global)Document22 pagesContemporary World. Institutions (Global)joy sooyoungPas encore d'évaluation

- ALTI Minutes of The Meeting 04Document3 pagesALTI Minutes of The Meeting 04Dave Jasm MatusalemPas encore d'évaluation

- National, Regional, and Global GovernanceDocument25 pagesNational, Regional, and Global GovernanceAbhiPas encore d'évaluation

- Rule 7 PDFDocument31 pagesRule 7 PDFJanila BajuyoPas encore d'évaluation

- Interregnum My Rump, Or, Stop Being Stupid Part 26Document2 pagesInterregnum My Rump, Or, Stop Being Stupid Part 26mrelfePas encore d'évaluation

- Evidence ProjectDocument162 pagesEvidence ProjectMohammad Tabrez SiddiquiPas encore d'évaluation

- Exclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andDocument19 pagesExclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andPOOJA AGARWALPas encore d'évaluation

- 14 .Labor Et Al Vs NLRC and Gold City Commercial Complex, Inc., GR 110388, Sept 14, 1995Document10 pages14 .Labor Et Al Vs NLRC and Gold City Commercial Complex, Inc., GR 110388, Sept 14, 1995Perry YapPas encore d'évaluation

- Jurisprudence-II Project VIDocument18 pagesJurisprudence-II Project VISoumya JhaPas encore d'évaluation

- ACI PHILIPPINES, INC. V COQUIADocument1 pageACI PHILIPPINES, INC. V COQUIAChilzia RojasPas encore d'évaluation