Académique Documents

Professionnel Documents

Culture Documents

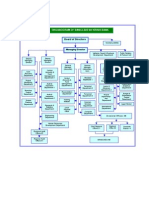

Financial Statement Analysis Methods

Transféré par

Shaheen MahmudDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Statement Analysis Methods

Transféré par

Shaheen MahmudDroits d'auteur :

Formats disponibles

What is Financial Statement Analysis?

Analysis of financial statements is a process of evaluating relationship between component parts of financial statements to obtain better understanding of firms financial position and performance. There are various methods or techniques that are used in analyzing financial statements, such as comparative statements, schedule of changes in working capital, common size percentages, funds analysis, trend analysis, and ratios analysis. Objectives of Financial Statement Analysis: The main objectives of analysis of financial statements are to assess: 1) Present and future earning capacity and profitability of the concern 2) The operational efficiency of the concern as a whole and of its various parts or departments 3) The short-term and long-term solvency of the concern for the benefit of the debenture holders and trade creditors 4) The comparative study in regard to one firm with another firm or one department with another department 5) The possibility of developments in the future by making forecasts and preparing budgets 6) The financial stability of a business concern 7) The real meaning and significance of financial data, and 8) The long-term liquidity of its funds. Types of Financial Statements Analysis: Financial analysis is classified as: A) On the basis of nature of the analyst and the material used by him: i) External analysis: Such type of analysis is made by those persons who are not connected with the enterprise. They dont have access to the enterprise. They do not access to the detail record of the company and have to depend mostly on published statements. Such type of analyst is made by investors, creditors, credit agencies and government agencies and research scholars. This analysis is based on the published reports and statement of the enterprise. ii) Internal analysis: It is made by those persons who have access to books of account. They are member of the organization. Such parties can be designated as accountant or financial analyst. The internal analyst can give more reliable result than the external analyst because every type of information is at his disposal. As such an analysis is based on the factual data recorded in the books of accounts; it provides reliable and dependable information of the enterprise to the users. B) According to the objectives of the analysis: i) Long-term analysis: This analysis is made in order to study the long-term financial stability, solvency and liquidity as well as profitability and earning capacity of a business concern. The purpose of making such type of analysis is to know whether the long-run the concern will be able to earn a minimum amount which will be sufficient to maintain a reasonable rate of return on the investment so as to provide the funds required for modernization, growth and development of the business and to meet its costs of capital. This analysis is made taking various items of long term assets and liabilities with a view to judge long term financial position of the enterprise. It is very much useful for long-term financial planning. ii) Short-term analysis: this is made to determine the short-term solvency, stability and liquidity as well as earning capacity of the business. The purpose of this analysis is to know whether in the short run a business concern will have adequate funds readily available to meet its short-term requirements and sufficient borrowing capacity to meet contingencies in the near future. This analysis is made taking various elements of current assets and current liabilities with a view to judge short-term financial position of the enterprise. It is very much useful for short-term financial planning.

C) According to the modus operandi of the analysis: i) Horizontal or Dynamic Analysis: When an analyst compares financial information for two or more years for a single company, the process is referred to as horizontal analysis. Such an analysis is done to examine Financial Statements of a number of years of an enterprise. Therefore, this analysis is based on financial data of several accounting years and it is for this reason that it is also called Dynamic Analysis. It is a time series analysis of the data contained in Financial Statements. It indicates the growth of the enterprise over a number of years by a comparative time series analysis. Comparative Financial Statements and Trend Percentage Analysis are two tools that are commonly used for this analysis. ii) Vertical or Static Analysis: Vertical analysis reports each amount on a financial statement as a percentage of another item. Such an analysis is done to examine Financial Statements of only particular year of an enterprise. Therefore, this analysis is based on financial data of only one accounting year and it is for this reason that it is also called Static Analysis. It presents the structural relationship of different items contained in Financial Statements. Accounting ratios and Common-size Statements are two tools that are generally used for this analysis. Techniques or Tools of Financial Statements Analysis: i) Comparative financial statement analysis: Comparative Financial Statement Analysis is a form of horizontal analysis where Financial Statements of two or more years or of two or more different companies or of a company and its industry are compared, analyzed and interpreted. Advantages of this analysis are that changes in components of Assets and Liabilities can easily be known at a glance through Comparative Balance Sheet. Comparative Income statements identify trend of changes in sales, gross profit, operating profit, net profit, etc. It helps to determine long-term and short-term solvency position of the firm. Disadvantage of Comparative Analysis is that it might express misleading disclosure if certain external factors like market conditions, business risk, etc. are not taken into consideration. ii) Common size analysis: Common size analysis allows us to compare one companys Financial Statements to another companys or to the industry average. It exhibits the absolute figures of the items appearing in Financial Statements of two or more years or two or more firms. It also exhibits the percentage figure of every item in Financial Statements as a percentage of the pre-selected base item. In common-size income statement, all items are converted in percentage terms of sales. Such conversion helps the firm to ascertain how much portion of its sales is used up in cost of sales, operating expenses, interest, tax, etc. It helps to know short-term and long-term financial position of an enterprise. Disadvantages of this analysis are that no comparative study is done between the years and it does not consider the time value of money. iii) Trend analysis: Trend analysis is a form of Horizontal Analysis of Financial Statements between two or more years. It indicates the trend of individual item of FSs over a period of time. It helps to analyze the trend of each such item and, thus, helps the management in the process of present and future policy-making. It is a useful tool for inter-firm comparison. It helps in analyzing growth in financial activities of the firm at a glance. One of the disadvantages of trend analysis is that changes in market conditions are not considered in trend analysis. Trend ratios become incomparable if the same accounting practices are not followed. It do not take into consideration the price level changes.

iv) Funds Flow Statement (or analysis): This statement is prepared in order to reveal clearly the various sources where from the funds are procured to finance the activities of a business concern during the accounting period and also brings to highlight the uses to which these funds are put during the said period. v) Cash Flow Statements (or analysis): This statement is prepared to know clearly the various items of inflow and outflow of cash. It is an essential tool for short-term financial analysis and is very helpful in the evaluation of current liquidity of a business concern. It helps the business in the efficient cash management and internal financial management. vi) Statement of changes in working capital: This statement is prepared to know the net change in working capital of the business between two specified dates. It is prepared from current assets and current liabilities of the said dates to show the net increase or decrease in working capital. vii) Ratio Analysis: It is done to develop meaningful relationship between individual items or group of items usually shown in the periodical financial statements published by the concern. An accounting ratio shows the relationship between the two inter-related accounting figures as gross profit to sales, current assets to current liabilities, loaned capital to owned capital etc. Trend percentage Analysis: Trend analysis calculates the percentage change for one account over a period of time of several years. Trend percentage states several years' financial data in terms of a base year. The base year equals 100%, with all other years stated in some percentage of this base. Steps in computing Trend Percentages: i) A year is chosen as the base year and the figures as appearing in Financial Statements of that year are assigned as 100. ii) Necessary adjustments for price level should be made in the figures of other years compared to the base year.iii) Now, trend percentages are to be computed in the following manner:Trend Percentage = (Current years figure/Base years figure)100 iv) Conclusion is then to be drawn studying the trend patterns of various items and also taking into account absolute values of the concerned items.

Limitations of trend ratios: 1) Trend ratios become incomparable if the same accounting practices are not followed. 2) Trend ratios do not take into consideration the price level changes. 3) Trend ratios must always be read with absolute data on which they are based; otherwise the conclusion may be misleading. 4) Trend ratio have to be interpretated in the light of certain nonfinancial factors like economic conditions, government policies, changes in income and its distribution etc.

Difference between Horizontal and Vertical analysis: 1) When an analyst compares financial information for two or more years for a single company, the process is referred to as horizontal analysis/ Vertical analysis reports each amount on a financial statement as a percentage of another item.2) In addition to comparing dollar amounts, the analyst computes percentage changes from year to year for all financial statement balances/ When using vertical analysis, the analyst calculates each item on a single financial statement as a percentage of a total. 3) Horizontal analysis can help a financial

statement user to see relative changes over time and identify positive or perhaps troubling trends/ Vertical analysis allows one to see the composition of each of the financial statements and determine if significant changes have occurred.4) It shows comparison of financial data for several years against a chosen base year/ Under this method each entry is represented as a percentage of the total account.5) It is called dynamic analysis of the financial statements/ Vertical analysis is done to review and analysis the financial statements for a year only and therefore it is also called static analysis. Difference between Comparative and Common-size analysis: 1) Comparative analysis is statement which compares financial data from different periods of time. On the other hand, common size ratios are used to compare financial statements of different-size companies or of the same company over different periods.2) It is a form of horizontal analysis/ It is a form of vertical analysis.3)It is a comparison of different elements of Financial Statements between two or more years/ It is a comparison of different of elements of Financial Statements with one chosen base item in the same year. 4) Changes in values of different items in two different years are shown both in absolute as well as percentage terms/ Changes in values of different items are shown as percentage of a base item.5) It fails to exhibit relative importance of individual component in total/ It shows relative importance of each item of such statement in whole.6) It facilitates both intra- and inter-firm comparison/ It mainly facilitates inter-firm comparison.7) It is very popular technique of Financial Statement Analysis/ It is not so popular as compared to Comparative Statement. Limitations of Financial Statement Analysis: Analysis of Financial Statements is a very important device but the person using this device must keep in mind its limitations. The following are the main limitations of the analysis:i) Historical nature of financial statements: The basic nature of these statements is historical, i.e., relating to the past period. Past can never be a precise and infallible index of the future and can never be hundred percent helpful for the future forecast and planning.ii) No substitute for judgment: Analysis of financial Statements is a tool which can be used profitably by an expert analyst but may lead to faulty conclusions if used by unskilled analyst. The result of analysis, thus, should not be taken as judgments or conclusions.iii) Reliability of figures: The reliability of analysis depends on reliability of the figures of the FSs under scrutiny. The entire working of analysis will be vitiated by manipulations in the income statement, window dressing in the balance sheet, questionable procedures adopted by the accountant for the valuation of fixed assets and such other factors.iv) Single year analysis is not much valuable and useful: The analysis of these statements relating to single year only will have limited use and value.v) Results may have different interpretation: The results or indications derived from the analysis of these statements may be differently interpreted by different users.vi) Change in accounting methods: Analysis will be effective if the figure derived from the FSs are comparable. Due to change in accounting methods the figures of the current period may have no comparable base, and then the whole exercise of analysis will become futile and will be of little value.vii) Pitfalls in inter-firm comparison: When different firms are adopting different procedures, records, objectives, policies and different items under similar headings, comparison will become more difficult.viii) Price level changes reduce the validity of the analysis: The continuous and rapid changes in the

value of money, in the present day economy, also reduce the validity of the analysis.ix) Shortcoming of the tool of analysis: There are different tools of analysis available to the analyst. If a wrong tool is used, it may give misleading results and may lead to wrong conclusions which may be harmful to the interest of business. Difference between Financial Statement Analysis and Interpretation: 1) Analyzing financial statements is a process of evaluating relationship between component parts of financial statements to obtain a better understanding of firms position and performance. On the other hand, Interpretation of financial statements refers to evaluating the performance of the business.It may be defined as critical examination of financial statements for a given period.2) The term analysis is used in narrow sense whereas the term interpretation is used in a broad sense to include analysis.3) Analysis is the first step whereas interpretation follows analysis.4) Analysis implies classification of facts or data in a logical order. It involves splitting the complex data into various simple elements. Whereas interpretation implies explaining the meaning and significance of the facts or data so classified.However, it can be concluded that analysis and interpretation are complementary to each other. Analysis without interpretation is useless and interpretation becomes difficult without analysis. What will be the effect on return when a company uses debt? Companies often use debt when constructing their capital structure, which helps lower total financing cost. In addition to the relatively lower cost of debt financing, using debt has other advantages compared to equity financing, despite potential issues that using debt may cause, such as ongoing financial liabilities and potential bankruptcy risk. In general, using debt helps keep profits within a company and increases returns on equity for current company owners and helps secure tax savings. Sources of Information for Financial Statement Analysis: The main sources of information about publicly held corporations are company published reports, such as annual reports and interim financial statements, SEC reports, business periodicals, and credit and investment advisory services.

Vous aimerez peut-être aussi

- Cash Receipt Template 03Document1 pageCash Receipt Template 03B. GundayaoPas encore d'évaluation

- Pob Scheme of Work Form 4 - September To December 2021Document8 pagesPob Scheme of Work Form 4 - September To December 2021pratibha jaggan martinPas encore d'évaluation

- Modules 1Document4 pagesModules 1JT GalPas encore d'évaluation

- Secure - Docs - The Amazing Formula For Creating WealthDocument288 pagesSecure - Docs - The Amazing Formula For Creating Wealthinstantdownloader100% (1)

- Long-Term FinancingDocument30 pagesLong-Term Financingmarkwillbalbas100% (1)

- Chapter 3 AccountingDocument11 pagesChapter 3 AccountingĐỗ ĐăngPas encore d'évaluation

- Debt Reduction CalculatorDocument6 pagesDebt Reduction CalculatorAnonymous fE2l3DzlPas encore d'évaluation

- Credit Administration, MeasurementDocument11 pagesCredit Administration, Measurementmentor_muhaxheriPas encore d'évaluation

- Responsibility AccountingDocument39 pagesResponsibility AccountingShaheen MahmudPas encore d'évaluation

- Operations ManagementDocument175 pagesOperations ManagementAnurag Saikia100% (2)

- Fundamentals of Accounting Business and Management 1Document140 pagesFundamentals of Accounting Business and Management 1Marie FePas encore d'évaluation

- Short-Term Financial PlanningDocument64 pagesShort-Term Financial PlanningSheila Mae LaputPas encore d'évaluation

- Chapter 2Document5 pagesChapter 2Sundaramani SaranPas encore d'évaluation

- Quiz Working Cap-StudentsDocument4 pagesQuiz Working Cap-StudentsJennifer RasonabePas encore d'évaluation

- Business FinanceDocument18 pagesBusiness FinanceFriedrich Mariveles100% (1)

- Business Finance Summative Test 3Document3 pagesBusiness Finance Summative Test 3Juanito II Balingsat100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMarielle Mae BurbosPas encore d'évaluation

- MKT, INST & INSTRUMENTSDocument58 pagesMKT, INST & INSTRUMENTSDaniela MercadoPas encore d'évaluation

- Fundamentals of ABMDocument161 pagesFundamentals of ABMPavi Antoni Villaceran100% (1)

- Building Your Financial Future: A Practical Guide For Young AdultsD'EverandBuilding Your Financial Future: A Practical Guide For Young AdultsPas encore d'évaluation

- FM-Fin. Statements Analysis - Session-2 (12.1.2015 & 13.1.2015)Document18 pagesFM-Fin. Statements Analysis - Session-2 (12.1.2015 & 13.1.2015)PratikPas encore d'évaluation

- FABM1 Lesson8-1 Five Major Accounts-LIABILITIESDocument13 pagesFABM1 Lesson8-1 Five Major Accounts-LIABILITIESWalter MataPas encore d'évaluation

- Exam 1 LXTDocument31 pagesExam 1 LXTphongtrandangphongPas encore d'évaluation

- Business Finance - ACC501 Handouts PDFDocument194 pagesBusiness Finance - ACC501 Handouts PDFHamid Mahmood100% (1)

- A122 Exercises QDocument30 pagesA122 Exercises QBryan Jackson100% (1)

- Trial BalanceDocument12 pagesTrial BalanceAshish ToppoPas encore d'évaluation

- Fundamentals of Abm 1: First QuarterDocument8 pagesFundamentals of Abm 1: First QuarterIvan NuescaPas encore d'évaluation

- Scope of Public Finance and its Key ConceptsDocument12 pagesScope of Public Finance and its Key ConceptsshivaniPas encore d'évaluation

- Chapter 1 - Introduction To InvestmentDocument30 pagesChapter 1 - Introduction To InvestmentAnh ĐỗPas encore d'évaluation

- 2.0 The Recording ProcessDocument14 pages2.0 The Recording ProcessSarah Jane Dulnuan NipahoyPas encore d'évaluation

- Accounting Concepts and PrinciplesDocument26 pagesAccounting Concepts and PrinciplesWindelyn Iligan100% (2)

- Szabist Ibf Spring08 Lec1Document38 pagesSzabist Ibf Spring08 Lec1api-3712641100% (1)

- Fabm 1 Quiz TheoriesDocument4 pagesFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- Unit 1 Role of Financial Institutions and MarketsDocument11 pagesUnit 1 Role of Financial Institutions and MarketsGalijang ShampangPas encore d'évaluation

- Epler Consulting ServicesDocument3 pagesEpler Consulting ServicesAmmad Ud Din SabirPas encore d'évaluation

- Acc406 Topic 5 Trial BalanceDocument5 pagesAcc406 Topic 5 Trial BalanceSafiah KamalPas encore d'évaluation

- Central Bank Functions and ResponsibilitiesDocument16 pagesCentral Bank Functions and ResponsibilitiesAyesha Parvin RubyPas encore d'évaluation

- Managing Finance Functions and Financial HealthDocument17 pagesManaging Finance Functions and Financial HealthMa-marts OfilandaPas encore d'évaluation

- SHS Business Finance Chapter 3Document17 pagesSHS Business Finance Chapter 3Ji BaltazarPas encore d'évaluation

- JPIA Financial Accounting 1 (Prelims)Document20 pagesJPIA Financial Accounting 1 (Prelims)Kristienalyn De AsisPas encore d'évaluation

- Chapter 7Document53 pagesChapter 7api-358995037100% (1)

- Accounting I Test: Questions 1-30: True/FalseDocument10 pagesAccounting I Test: Questions 1-30: True/FalseDayton 66Pas encore d'évaluation

- Creative Accounting: A Literature ReviewDocument13 pagesCreative Accounting: A Literature ReviewthesijPas encore d'évaluation

- CED Pricing - Costing PresentationDocument63 pagesCED Pricing - Costing Presentationmarlynrich3652Pas encore d'évaluation

- The Definition of FinanceDocument9 pagesThe Definition of FinanceJan Mae EstaresPas encore d'évaluation

- Completing The Accounting Cycle: © The Mcgraw-Hill Companies, Inc., 2005 Mcgraw-Hill/IrwinDocument44 pagesCompleting The Accounting Cycle: © The Mcgraw-Hill Companies, Inc., 2005 Mcgraw-Hill/Irwiniminent11888Pas encore d'évaluation

- Contra AccountsDocument6 pagesContra AccountsRaviSankarPas encore d'évaluation

- Accounting adjustments and financial statementsDocument12 pagesAccounting adjustments and financial statementsKwaku DanielPas encore d'évaluation

- Chapter 6: Business Financing: Internal Sources (Equity Capital)Document6 pagesChapter 6: Business Financing: Internal Sources (Equity Capital)betsega shiferaPas encore d'évaluation

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoPas encore d'évaluation

- FINANCE FOR MANAGER TERM PAPERxxxDocument12 pagesFINANCE FOR MANAGER TERM PAPERxxxFrank100% (1)

- ANNEX C On Site Monitoring FormDocument3 pagesANNEX C On Site Monitoring FormJohnRayFloresArquisolaPas encore d'évaluation

- Lesson 1 Statement of Financial PositionDocument22 pagesLesson 1 Statement of Financial PositionMylene SantiagoPas encore d'évaluation

- Understanding Financial StatementsDocument103 pagesUnderstanding Financial StatementsLawa LopezPas encore d'évaluation

- Econ 102 - Essay ProblemsDocument4 pagesEcon 102 - Essay ProblemsCruxzelle BajoPas encore d'évaluation

- Basics of Financial Accounting - 1Document40 pagesBasics of Financial Accounting - 1Dr.Ashok Kumar PanigrahiPas encore d'évaluation

- Principles of Strategic and Tactical Marketing PlanningDocument24 pagesPrinciples of Strategic and Tactical Marketing PlanningSabel Cimafranca RegalaPas encore d'évaluation

- Robert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Document13 pagesRobert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Parki jiminsPas encore d'évaluation

- My Presentation About PayRoll SystemDocument3 pagesMy Presentation About PayRoll SystemAzeem Asim MughalPas encore d'évaluation

- BetaDocument16 pagesBetaAkshita Saxena100% (2)

- Combining Liability Structure and Current Asset DecisionDocument13 pagesCombining Liability Structure and Current Asset DecisionAsjad BashirPas encore d'évaluation

- FABM2 Module - 1Document3 pagesFABM2 Module - 1Jennifer NayvePas encore d'évaluation

- Ae11 Module-Managerial EconomicsDocument65 pagesAe11 Module-Managerial EconomicsJynilou Pinote100% (1)

- Critical Analysis of Nigeria's BVN Project and RecommendationsDocument13 pagesCritical Analysis of Nigeria's BVN Project and RecommendationsOwolabi PetersPas encore d'évaluation

- Value Chain Management Capability A Complete Guide - 2020 EditionD'EverandValue Chain Management Capability A Complete Guide - 2020 EditionPas encore d'évaluation

- Group 7 Section BDocument25 pagesGroup 7 Section BShaheen MahmudPas encore d'évaluation

- Statistical InformationDocument1 pageStatistical InformationShaheen MahmudPas encore d'évaluation

- Succession Planning Ensures Optimum ProductivityDocument12 pagesSuccession Planning Ensures Optimum ProductivityShaheen MahmudPas encore d'évaluation

- DocDocument1 pageDocShaheen MahmudPas encore d'évaluation

- Guide EngDocument219 pagesGuide EngShaheen MahmudPas encore d'évaluation

- Report For SirDocument57 pagesReport For SirMostafizur RahmanPas encore d'évaluation

- AssumptionsDocument3 pagesAssumptionsShaheen MahmudPas encore d'évaluation

- Accrual PrincipleDocument3 pagesAccrual PrincipleShaheen MahmudPas encore d'évaluation

- HRMDocument57 pagesHRMShaheen MahmudPas encore d'évaluation

- Bank Credit Trends in BangladeshDocument259 pagesBank Credit Trends in BangladeshShaheen MahmudPas encore d'évaluation

- Final ReportDocument210 pagesFinal ReportShaheen MahmudPas encore d'évaluation

- CSR in Bangladesh BankingDocument3 pagesCSR in Bangladesh BankingShaheen MahmudPas encore d'évaluation

- Report For SirDocument57 pagesReport For SirMostafizur RahmanPas encore d'évaluation

- Last Four Years Activities of BKBDocument4 pagesLast Four Years Activities of BKBShaheen MahmudPas encore d'évaluation

- Android Tutorial PDFDocument34 pagesAndroid Tutorial PDFThế AnhPas encore d'évaluation

- OrganogramDocument1 pageOrganogramShaheen MahmudPas encore d'évaluation

- College LevelDocument42 pagesCollege LevelShaheen MahmudPas encore d'évaluation

- Phrase and IdiomsDocument14 pagesPhrase and IdiomsShaheen MahmudPas encore d'évaluation

- Slide of ProductivityDocument15 pagesSlide of ProductivityShaheen MahmudPas encore d'évaluation

- OMDocument8 pagesOMShaheen MahmudPas encore d'évaluation

- Job Circular of Different OrganizationDocument1 pageJob Circular of Different OrganizationShaheen MahmudPas encore d'évaluation

- Managerial AssaignmentDocument20 pagesManagerial AssaignmentShaheen MahmudPas encore d'évaluation

- Bank Head Office AddressesDocument6 pagesBank Head Office AddressesShaheen MahmudPas encore d'évaluation

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudPas encore d'évaluation

- Transfer PricingDocument17 pagesTransfer PricingShaheen MahmudPas encore d'évaluation

- Target Market Segmentation and Positioning StrategiesDocument5 pagesTarget Market Segmentation and Positioning StrategiesShaheen MahmudPas encore d'évaluation

- Annual Report ComparisonDocument7 pagesAnnual Report ComparisonShaheen MahmudPas encore d'évaluation

- DocumentDocument1 pageDocumentShaheen MahmudPas encore d'évaluation

- Chetna AdhiyaDocument8 pagesChetna AdhiyaVikash MauryaPas encore d'évaluation

- TVM Chapter 4 Time Value of MoneyDocument19 pagesTVM Chapter 4 Time Value of MoneySomera Abdul Qadir100% (1)

- Accounts Specimen QP Class XiDocument7 pagesAccounts Specimen QP Class XiAnju TomarPas encore d'évaluation

- Acct Statement - XX5332 - 11052022Document2 pagesAcct Statement - XX5332 - 11052022Debendra SathyPas encore d'évaluation

- Risk of Money Laundering Version 2 Completo PDFDocument244 pagesRisk of Money Laundering Version 2 Completo PDFRian HidayatPas encore d'évaluation

- OFB TECH FINANCIALSDocument2 pagesOFB TECH FINANCIALSamitsundarPas encore d'évaluation

- Distance Education Program Accounting AssignmentDocument2 pagesDistance Education Program Accounting AssignmentArafo BilicsanPas encore d'évaluation

- Vandell Acquisition ValuationDocument19 pagesVandell Acquisition ValuationashibhallauPas encore d'évaluation

- Pay Slip For August 2023: Entero Healthcare Solutions LimitedDocument1 pagePay Slip For August 2023: Entero Healthcare Solutions Limitedkadamaniket7894Pas encore d'évaluation

- Impact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaDocument8 pagesImpact of Dividend Announcements On Stock Prices With Special Reference To Banking Companies in IndiaThejo Jose100% (1)

- Inflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoDocument31 pagesInflation, Activity, and Nominal Money Growth: Prepared By: Fernando Quijano and Yvonn QuijanoRizki Praba NugrahaPas encore d'évaluation

- Rangkuman Soal Mid Test SolusiDocument2 pagesRangkuman Soal Mid Test SolusiViona AnggraeniPas encore d'évaluation

- Evolution of Financial EconomicsDocument38 pagesEvolution of Financial EconomicsSoledad PerezPas encore d'évaluation

- e-StatementBRImo 107101000260307 Aug2023 20230905 004028Document12 pagese-StatementBRImo 107101000260307 Aug2023 20230905 004028Fedy HermawanPas encore d'évaluation

- ACCA F3-FFA Revision Mock - Answers D15Document12 pagesACCA F3-FFA Revision Mock - Answers D15Kiri chrisPas encore d'évaluation

- Brief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inDocument5 pagesBrief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inPrakhar MaheshwariPas encore d'évaluation

- Deposits in Transit and Outstanding Checks PDFDocument1 pageDeposits in Transit and Outstanding Checks PDFAaliyah Joize LegaspiPas encore d'évaluation

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Document10 pagesACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- 1234 Statement of Cash FlowDocument9 pages1234 Statement of Cash Flowahmie banez100% (1)

- Solution Problem of Financial DerivativeDocument16 pagesSolution Problem of Financial DerivativeKhalid Mishczsuski LimuPas encore d'évaluation

- CFA Level 1 - Test 2 - AMDocument35 pagesCFA Level 1 - Test 2 - AMHongMinhNguyenPas encore d'évaluation

- OpTransactionHistoryUX522 02 2024Document7 pagesOpTransactionHistoryUX522 02 2024piyush882676Pas encore d'évaluation

- Mary Hager Resume For Ba3500Document1 pageMary Hager Resume For Ba3500api-501111716Pas encore d'évaluation

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongPas encore d'évaluation

- GSLC Shares, Treasury Shares, DividensDocument2 pagesGSLC Shares, Treasury Shares, DividensGeordy SusantoPas encore d'évaluation