Académique Documents

Professionnel Documents

Culture Documents

参考2

Transféré par

zhangweihelenDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

参考2

Transféré par

zhangweihelenDroits d'auteur :

Formats disponibles

Henry, a real estate developer, had acquired expertise in the selection of lucrative sites to build residential apartment dwellings.

He had little significant knowledge of financing the development. In 2006 he wanted to finance a new project. He went to see Kerry the branch manager of the Sydney Bank (the Bank) to ask for a loan. Henry was concerned about the high level of interest that was payable on the loan. Kerry told him that a loan could be obtained in a foreign currency at a lower rate of interest and arranged for Henry to meet wade, the Banks international business officer. Wade told Henry of the advantage of foreign currency loans. Wade said that the main benefit to Henry of borrowing in a foreign currency was the significantly lower interest rates offered on such overseas loans compared with higher prevailing interest rates in Australia. Wade also told Henry that it was good business for Henry to borrow offshore and that there was no substantial risk in an offshore loan. He mentioned that some borrowers took out insurance to protect themselves, but in his view it was not necessary and probably. 2006 Henry agreed to borrow the equivalent of AUD49000, 000 in an overseas currency from the Bank. Although the interest rate was considerably lower than the rate chargeable in Australia on an equivalent loan in Australian dollars, the severe depreciation of the Australian dollar against the overseas currency during the period of the loan has resulted in Henry now being required to repay in dollar terms almost one third than the original loan. He wishes to commence legal proceedings against the Bank to recover his loss.

AUD49000,000 ,, ,

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Financial Planning & Forecasting GuideDocument15 pagesFinancial Planning & Forecasting GuideChanet SetiadiPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Transaction List B SUADocument5 pagesTransaction List B SUAPhuong Tran100% (24)

- AFAR TestbankDocument56 pagesAFAR TestbankDrama SubsPas encore d'évaluation

- Capital Budgetting Multiple ChoiceDocument24 pagesCapital Budgetting Multiple ChoiceMaryane Angela67% (3)

- Bir Submitted - EmailedDocument8 pagesBir Submitted - EmailedATRIYO ENTERPRISESPas encore d'évaluation

- Altman Z-ScoreDocument30 pagesAltman Z-Scoreshikhakalani_19100% (1)

- Z. Kolundzic - Street Smart Forex PDFDocument131 pagesZ. Kolundzic - Street Smart Forex PDFj2daaa50% (2)

- Bulkowski's Day Trading Setup - Reader ViewDocument3 pagesBulkowski's Day Trading Setup - Reader ViewPaulo AzevedoPas encore d'évaluation

- Lai Final PT Bk-2016 Final OkDocument75 pagesLai Final PT Bk-2016 Final Okdeborah rumatePas encore d'évaluation

- Meaning of Corporate Finance ExplainedDocument24 pagesMeaning of Corporate Finance ExplainedNidhi Kulkarni100% (2)

- Amk 1Document4 pagesAmk 1rykaPas encore d'évaluation

- Fabm ReviewerDocument25 pagesFabm Reviewerdnicolecarreon11Pas encore d'évaluation

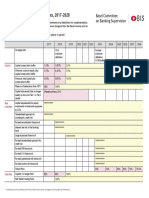

- Basel III transitional arrangements 2017-2028 summaryDocument1 pageBasel III transitional arrangements 2017-2028 summarygoonPas encore d'évaluation

- ReviewDocument6 pagesReviewgabrenillaPas encore d'évaluation

- Financial Globalisation Opportunity and CrisisDocument4 pagesFinancial Globalisation Opportunity and Crisismafeiraheta27Pas encore d'évaluation

- Top 100 Finance and Accounting QuestionsDocument7 pagesTop 100 Finance and Accounting QuestionsArun KC0% (1)

- Garp MarchDocument5 pagesGarp MarchZerohedgePas encore d'évaluation

- TB 15Document82 pagesTB 15Hasan100% (2)

- Tutorial 5 - Money Market - QuestionDocument4 pagesTutorial 5 - Money Market - QuestionSHU WAN TEHPas encore d'évaluation

- Unit 1 ProductDocument41 pagesUnit 1 Productvishalbembde71Pas encore d'évaluation

- Yawyaw Ka SisDocument8 pagesYawyaw Ka SisMary Rose PontejosPas encore d'évaluation

- About Hantec MarketsDocument12 pagesAbout Hantec MarketsSrini VasanPas encore d'évaluation

- 4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsDocument2 pages4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsSiraj MohiuddinPas encore d'évaluation

- Chapter-1: Introduction of Merchant BankingDocument47 pagesChapter-1: Introduction of Merchant BankingKritika IyerPas encore d'évaluation

- Lums Cases Bibliography FinalDocument165 pagesLums Cases Bibliography FinalFahid JavadPas encore d'évaluation

- High-Frequency Trading, Order Types, and The Evolution of The Securities Market StructureDocument31 pagesHigh-Frequency Trading, Order Types, and The Evolution of The Securities Market StructuretabbforumPas encore d'évaluation

- Beneish's M-Score: The Detection ofDocument23 pagesBeneish's M-Score: The Detection ofraghavendra_20835414Pas encore d'évaluation

- FN2191 Commentary 2022Document27 pagesFN2191 Commentary 2022slimshadyPas encore d'évaluation

- Acc 223 PointersDocument2 pagesAcc 223 PointersAngel FlordelizaPas encore d'évaluation

- IAS 21 Foreign CurrencyDocument17 pagesIAS 21 Foreign CurrencyTanvir HossainPas encore d'évaluation