Académique Documents

Professionnel Documents

Culture Documents

Case 30 The WM Wrigley J Company Questions

Transféré par

odie990 évaluation0% ont trouvé ce document utile (0 vote)

1K vues1 pageWrigley J Company Case

Titre original

Case 30 the Wm Wrigley J Company Questions

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentWrigley J Company Case

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

1K vues1 pageCase 30 The WM Wrigley J Company Questions

Transféré par

odie99Wrigley J Company Case

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

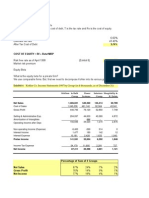

THE WM. WRIGLEY JR.

COMPANY: CAPITAL STRUCTURE, VALUATION, AND COST OF CAPITAL

Questions 1. In the abstract, what is Blanka Dobrynin hoping to accomplish through her active-investor strategy? 2. What will be the effects of issuing $3 billion of new debt and using the proceeds either to pay a dividend or to repurchase shares on: a. Wrigleys outstanding shares? b. Wrigleys book value of equity? c. The price per share of Wrigley stock? d. Earnings per share? e. Debt interest coverage ratios and financial flexibility? f. Voting control by the Wrigley family? 3. What is Wrigleys current (prerecapitalization) weighted-average cost of capital (WACC)? 4. What would you expect to happen to Wrigleys WACC if it issued $3 billion in debt and used the proceeds to pay a dividend or to repurchase shares? 5. Should Blanka Dobrynin try to convince Wrigleys directors to undertake the recapitalization?

Vous aimerez peut-être aussi

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument4 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalAditya Mukherjee100% (1)

- Wrigley CaseDocument15 pagesWrigley CaseDwayne100% (4)

- Paper Wrigley gr.4Document9 pagesPaper Wrigley gr.4shaherikhkhanPas encore d'évaluation

- William WrigleyDocument8 pagesWilliam WrigleyRajaram Iyengar100% (2)

- TN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalDocument108 pagesTN 34 The WM Wrigley JR Company Capital Structure Valuation and Cost of CapitalStanisla Lee0% (2)

- Submitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Document3 pagesSubmitted To: Submitted By: Dr. Kulbir Singh Vinay Singh 201922106 Aurva Bhardwaj 201922066 Deepanshu Gupta 201922069 Sameer Kumbhalwar 201922097Aurva BhardwajPas encore d'évaluation

- Case Report Grading Rubric: Case: Zorbas Cohort: FIN6425 (F1/F2) Team: 5Document2 pagesCase Report Grading Rubric: Case: Zorbas Cohort: FIN6425 (F1/F2) Team: 5Ha shtPas encore d'évaluation

- Group7 AnadarkoDocument16 pagesGroup7 AnadarkoHimanshu BohraPas encore d'évaluation

- Kohler CompanyDocument3 pagesKohler CompanyDuncan BakerPas encore d'évaluation

- KKTiwari - 18214263 - Worldwide Paper Company-2016Document5 pagesKKTiwari - 18214263 - Worldwide Paper Company-2016KritikaPandeyPas encore d'évaluation

- Full Ans - StudentsDocument8 pagesFull Ans - StudentsHussain AhmedPas encore d'évaluation

- Wrigley Case AnswerDocument4 pagesWrigley Case AnswerYehan MatuilanaPas encore d'évaluation

- Wrigley CalculationDocument13 pagesWrigley CalculationAnindito W WicaksonoPas encore d'évaluation

- Worldwide Paper CompanyDocument1 pageWorldwide Paper CompanyendiaoPas encore d'évaluation

- Mars - Wrigley Case Study - SolutionDocument8 pagesMars - Wrigley Case Study - SolutionSidhartha ModiPas encore d'évaluation

- Finance Simulation: M&A in Wine Country Valuation ExerciseDocument7 pagesFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- Case 5 Midland Energy Case ProjectDocument7 pagesCase 5 Midland Energy Case ProjectCourse HeroPas encore d'évaluation

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmunePas encore d'évaluation

- WrigleyDocument5 pagesWrigleywaldek87Pas encore d'évaluation

- Wrigley CaseDocument12 pagesWrigley Caseresat gürPas encore d'évaluation

- WrigleyDocument14 pagesWrigleysotki4100% (1)

- BNYC and Mellons Merger, Grp-11, MACR-BDocument2 pagesBNYC and Mellons Merger, Grp-11, MACR-Balok_samal_250% (2)

- Kohler DCF Control Prem and DiscDocument6 pagesKohler DCF Control Prem and Discapi-239586293Pas encore d'évaluation

- KohlerDocument10 pagesKohleragarhemant100% (1)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- CASE6Document7 pagesCASE6Yến NhiPas encore d'évaluation

- Case 5Document15 pagesCase 5Qiao LengPas encore d'évaluation

- Ugcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCoDocument6 pagesUgcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCotimbulmanaluPas encore d'évaluation

- The WM Wringley JR CompanyDocument3 pagesThe WM Wringley JR Companyavnish kumarPas encore d'évaluation

- Team 14 - William WrigleyDocument7 pagesTeam 14 - William WrigleySyed Ahmedullah Hashmi100% (1)

- Wrigley Case FinalDocument8 pagesWrigley Case FinalNicholas Reyner Tjoegito100% (4)

- Wrigley Gum 21Document18 pagesWrigley Gum 21Fidelity RoadPas encore d'évaluation

- SFM Wrigley JR Case Solution HBRDocument17 pagesSFM Wrigley JR Case Solution HBRHayat Omer Malik100% (1)

- Wrigley Case GRP 5Document13 pagesWrigley Case GRP 5Kobi Garbrah0% (1)

- WrigleyDocument28 pagesWrigleyKaran Rana100% (1)

- The Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalDocument19 pagesThe Wm. Wrigley Jr. Company: Capital Structure, Valuation and Cost of CapitalMai Pham100% (1)

- The Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalDocument10 pagesThe Wm. Wrigley Jr. Company:: Capital Structure, Valuation, and Cost of CapitalSalil Kuwelkar100% (1)

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccPas encore d'évaluation

- Continental CarriersDocument10 pagesContinental Carriersnipun9143Pas encore d'évaluation

- Case Background: Kaustav Dey B18088Document9 pagesCase Background: Kaustav Dey B18088Kaustav DeyPas encore d'évaluation

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoPas encore d'évaluation

- Jetblue Airways Ipo ValuationDocument6 pagesJetblue Airways Ipo ValuationXing Liang HuangPas encore d'évaluation

- American Home Products CorporationDocument7 pagesAmerican Home Products Corporationpancaspe100% (2)

- Americanhomeproductscorporation Copy 120509004239 Phpapp02Document6 pagesAmericanhomeproductscorporation Copy 120509004239 Phpapp02Tanmay Mehta100% (1)

- Landmark Facility Solutions - QuestionsDocument1 pageLandmark Facility Solutions - QuestionsFaig0% (1)

- Ocean Carriers Executive SummaryDocument2 pagesOcean Carriers Executive SummaryAniket KaushikPas encore d'évaluation

- LinearDocument6 pagesLinearjackedup211Pas encore d'évaluation

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyPas encore d'évaluation

- Lex Service PLC - Cost of Capital1Document4 pagesLex Service PLC - Cost of Capital1Ravi VatsaPas encore d'évaluation

- Marriott Corporation Case SolutionDocument6 pagesMarriott Corporation Case Solutionanon_671448363Pas encore d'évaluation

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Blaine Kitchenware IncDocument4 pagesBlaine Kitchenware IncUmair ahmedPas encore d'évaluation

- California Pizza Kitchen Rev2Document7 pagesCalifornia Pizza Kitchen Rev2ahmed mahmoud100% (1)

- 34 Suggested Questions For The WM Wrigley JR CompanyDocument1 page34 Suggested Questions For The WM Wrigley JR CompanyStephanie ReginaPas encore d'évaluation

- WrigleyDocument1 pageWrigleyStephanie WidjayaPas encore d'évaluation

- The Wm. Wrigley Jr. Company Case Study - Kimesha Clarke - 412002313Document6 pagesThe Wm. Wrigley Jr. Company Case Study - Kimesha Clarke - 412002313Kym LatoyPas encore d'évaluation

- Suggested Questions For Wrigley and TimkenDocument1 pageSuggested Questions For Wrigley and TimkenfiqhifauzanPas encore d'évaluation

- AuroraDocument6 pagesAuroraNathan LimPas encore d'évaluation

- Famba6e Quiz Mod08 032014Document5 pagesFamba6e Quiz Mod08 032014aparna jethaniPas encore d'évaluation

- The Effect of The Present Value of Debt Tax Shields: It Shows That Adding $3 Billion in Debt ToDocument5 pagesThe Effect of The Present Value of Debt Tax Shields: It Shows That Adding $3 Billion in Debt ToJuris PasionPas encore d'évaluation

- OWASP IoT Top 10 2018 FinalDocument3 pagesOWASP IoT Top 10 2018 FinalLuke SkywalkerPas encore d'évaluation

- Cyber Safety Insights Report Global Results: Prepared byDocument44 pagesCyber Safety Insights Report Global Results: Prepared byodie99Pas encore d'évaluation

- Katalog Closing SaleDocument17 pagesKatalog Closing SaleMarspilloow Nanda RahmaniaPas encore d'évaluation

- Security Standards White PaperDocument60 pagesSecurity Standards White Paperodie99Pas encore d'évaluation

- Katalog Closing SaleDocument17 pagesKatalog Closing SaleMarspilloow Nanda RahmaniaPas encore d'évaluation

- OWASP SCP Quick Reference Guide v2Document17 pagesOWASP SCP Quick Reference Guide v2Lika ostPas encore d'évaluation

- The Development of Knowledge Management in The OilDocument36 pagesThe Development of Knowledge Management in The Oilodie99Pas encore d'évaluation

- Aukey - Ep-B48 User ManualDocument1 pageAukey - Ep-B48 User Manualodie99Pas encore d'évaluation

- DAMA International DAMA International: The DAMA-DMBOK Guide: A Concise OverviewDocument32 pagesDAMA International DAMA International: The DAMA-DMBOK Guide: A Concise OverviewT BonePas encore d'évaluation

- Defense in Depth 2016 S508C PDFDocument58 pagesDefense in Depth 2016 S508C PDFodie99Pas encore d'évaluation

- Aukey - Ep-B48 User ManualDocument1 pageAukey - Ep-B48 User Manualodie99Pas encore d'évaluation

- Security by Design As An Efficient, Cost-Effective Methodology For Reducing Cyber Security Risk in Electrical Monitoring and Control SystemsDocument5 pagesSecurity by Design As An Efficient, Cost-Effective Methodology For Reducing Cyber Security Risk in Electrical Monitoring and Control Systemsodie99Pas encore d'évaluation

- Adhering To NIST Cybersecurity Framework With Indegy Security SuiteDocument9 pagesAdhering To NIST Cybersecurity Framework With Indegy Security Suiteodie99Pas encore d'évaluation

- 10 Basic Cybersecurity Measures-WaterISAC June2015 S508C PDFDocument9 pages10 Basic Cybersecurity Measures-WaterISAC June2015 S508C PDFodie99Pas encore d'évaluation

- Cyber Security - Industrial Control Systems: April 2015Document7 pagesCyber Security - Industrial Control Systems: April 2015odie99Pas encore d'évaluation

- Cisco CleanAir TechnologyDocument4 pagesCisco CleanAir TechnologyDarit_ScribdPas encore d'évaluation

- Ascent Whitepaper The Convergence of It and Operational TechnologyDocument16 pagesAscent Whitepaper The Convergence of It and Operational Technologyodie99Pas encore d'évaluation

- Waterfall Top 20 Attacks Article d2 Article S508NCDocument3 pagesWaterfall Top 20 Attacks Article d2 Article S508NCodie99Pas encore d'évaluation

- Using ANSI ISA 99 Standards WP May 2012 PDFDocument11 pagesUsing ANSI ISA 99 Standards WP May 2012 PDFodie99Pas encore d'évaluation

- WP 7 Steps To ICS SecurityDocument16 pagesWP 7 Steps To ICS SecurityDong TranPas encore d'évaluation

- Gea32435a Iec Whitepaper r1Document8 pagesGea32435a Iec Whitepaper r1krakraoPas encore d'évaluation

- IMECS2017 pp484-489 PDFDocument6 pagesIMECS2017 pp484-489 PDFodie99Pas encore d'évaluation

- Cyber Securityof Industrial Control Systems GCCS2015Document61 pagesCyber Securityof Industrial Control Systems GCCS2015odie99Pas encore d'évaluation

- IMECS2017 pp484-489 PDFDocument6 pagesIMECS2017 pp484-489 PDFodie99Pas encore d'évaluation

- The Mediation of External VariablesDocument37 pagesThe Mediation of External Variablesodie99Pas encore d'évaluation

- Correlation Matrix Output SPSSDocument2 pagesCorrelation Matrix Output SPSSodie99Pas encore d'évaluation

- Asia Pacific Customer Education Conference 2013 - : The Fairmont Resort Blue Mountains, New South Wales, AustraliaDocument7 pagesAsia Pacific Customer Education Conference 2013 - : The Fairmont Resort Blue Mountains, New South Wales, Australiaodie99Pas encore d'évaluation

- 07the Use of Wireless Technology in Hazardous AreasDocument6 pages07the Use of Wireless Technology in Hazardous Areasodie99Pas encore d'évaluation

- Mediating Effect of PEOUDocument8 pagesMediating Effect of PEOUodie99Pas encore d'évaluation

- Tut Suhr PDFDocument19 pagesTut Suhr PDFnugroho suryoputroPas encore d'évaluation