Académique Documents

Professionnel Documents

Culture Documents

Goods and Service Tax, Change For Better or Not

Transféré par

Mohd Uzair YahyaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Goods and Service Tax, Change For Better or Not

Transféré par

Mohd Uzair YahyaDroits d'auteur :

Formats disponibles

Goods and service tax, changes for better or worse

Goods and Services tax (GST) is one type of indirect taxes. GST is a broad based consumption tax. Many developing and emerging economies have been transforming their tax revenue bases by progressively moving from direct taxes to consumption taxes such as GST in recent years. GST is known as a consumption tax since it is borne by the end user/consumer and therefore is not intended to add costs to the business. Many countries all around the world have implemented the goods and services tax system and reaped many benefits from it. It is well documented that a GST can be an effective form of indirect tax and Malaysia can most assuredly benefit from it also. The most obvious advantage and the primary reason to move to a GST is to increase the government revenue. Since GST is a multistage tax, businesses along the supply chain would be encourages to be GST registered, thus a larger part of the economy will be brought to the surface for tax contribution. Also GST is based on consumption and hence very broad based it is a more stable source of revenue. Implementing GST on a broader base causes a larger proportion of all activities to be captured in the tax net and thus allowing fewer avenues of escape making administration simpler reducing costs. A broader base means a lower rate which means that the efficiency cost of raising revenue is correspondingly lower; the lowered administrative costs hence contribute to the increase in revenue. Another benefit of implementing GST is that it has built in control mechanisms that help minimize tax evasion by traders, therefore also contributing to an increase in revenue. With GST in place taxpayers are required to have good and proper record keeping, which can lead to improvement in the maintenance of proper accounts and financial records, which will allow for better checks and control by the Royal Malaysian Customs. GST can also for this reason potentially reduces tax leakages such as smuggling as there could be checks before unusual credit claims are processed. Yet given the above advantages there are many critics to the GST system. There comes a trade off when choosing between a single rate and a multiple rate GST. If multiple tax rates are used by lowering the tax rate on necessities and imposing high rate in luxury goods the administration cost may increase and lead to reduced revenue. This system disregards the differences in expenditure pattern and differences between high level and

lower income earners in the country. It is not easy to set the tax rate at a standard rate without affecting equity and social welfare in the country. Furthermore it is important to mention GST is a broad-based tax and exemptions and zero ratings must be scrutinised very carefully. Too many exemptions would result in the erosion of the tax base. There is a need for efficient and effective computerisation of the relevant department which will be administering the tax. The personnel should also be knowledgeable about the GST since in the initial period, the public which does not very familiar with the new tax system will need extra guidance from the administrators. Training costs need to be taken into account. There is a great need to also educate the public on GST operations and provide support during the transition from sales tax to GST especially on treatment of various purchases just before the implementation

Vous aimerez peut-être aussi

- Grammatical Categories of Word N Their InflectionsDocument16 pagesGrammatical Categories of Word N Their InflectionsMohd Uzair YahyaPas encore d'évaluation

- Workplace CounselingDocument5 pagesWorkplace CounselingMohd Uzair Yahya100% (1)

- CMPF112-module3 3Document50 pagesCMPF112-module3 3Mohd Uzair YahyaPas encore d'évaluation

- Counselling ModelsDocument5 pagesCounselling ModelsMohd Uzair Yahya83% (6)

- Counseling in Corporate Industry-WorkplaceDocument16 pagesCounseling in Corporate Industry-WorkplaceMohd Uzair YahyaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Conceptual Framework of TaxDocument9 pagesConceptual Framework of Taxdpak bhusalPas encore d'évaluation

- Capshaw WagesDocument2 pagesCapshaw Wagesapi-583619940Pas encore d'évaluation

- Electric Bill Backup PDFDocument1 pageElectric Bill Backup PDFfahmad_cmsPas encore d'évaluation

- Registration Form ISAR 2023 LatestDocument2 pagesRegistration Form ISAR 2023 LatestNinerMike MysPas encore d'évaluation

- 08 Portillo vs. CIRDocument2 pages08 Portillo vs. CIRBasil MaguigadPas encore d'évaluation

- Essentials of Federal Income Taxation For Individuals and BusinessDocument860 pagesEssentials of Federal Income Taxation For Individuals and BusinessAbhisek chudalPas encore d'évaluation

- State Bank CollectDocument3 pagesState Bank CollectKartik PrajapatiPas encore d'évaluation

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Document11 pagesReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluPas encore d'évaluation

- 1604 CFDocument8 pages1604 CFNette CutinPas encore d'évaluation

- Corporate Taxation & Financial PlanningDocument29 pagesCorporate Taxation & Financial PlanningMonalisa BagdePas encore d'évaluation

- ICAN NoticeDocument1 pageICAN NoticehawaPas encore d'évaluation

- Cfs 9268 MDocument1 pageCfs 9268 Mdavidigoro26Pas encore d'évaluation

- Boat Storm Pro Smartwatch 1.68" Amoled Screen Display With Cloud FacesDocument1 pageBoat Storm Pro Smartwatch 1.68" Amoled Screen Display With Cloud Facesentertainment king0% (2)

- Pas 12 Income Taxes FinalDocument17 pagesPas 12 Income Taxes FinalKeycie Ann ArevaloPas encore d'évaluation

- CIR v. BCDADocument2 pagesCIR v. BCDAChariPas encore d'évaluation

- Capital Gains - An Overview: Ca Ameet PatelDocument51 pagesCapital Gains - An Overview: Ca Ameet PatelPrasun TiwariPas encore d'évaluation

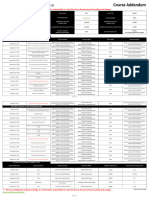

- Fall 2023 ACC400 NKK Course AddendumDocument2 pagesFall 2023 ACC400 NKK Course AddendumGKPas encore d'évaluation

- Zuellig Vs CIRDocument36 pagesZuellig Vs CIRMagenic Manila IncPas encore d'évaluation

- Dispute Transaction FormDocument1 pageDispute Transaction FormAli Naeem SheikhPas encore d'évaluation

- Cgi DD XML MappingDocument3 pagesCgi DD XML MappingRajendra PilludaPas encore d'évaluation

- Payslip of Jun-22Document1 pagePayslip of Jun-22Rohit VenisettyPas encore d'évaluation

- Bob StatementDocument18 pagesBob StatementShreya AgrawalPas encore d'évaluation

- BSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliDocument3 pagesBSNL Wishes All Its Esteemed Customers A Very Happy and Safe DiwaliFiroz ShaikhPas encore d'évaluation

- BIR Ruling 98-97Document1 pageBIR Ruling 98-97Kenneth BuriPas encore d'évaluation

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoPas encore d'évaluation

- System TcodeDocument2 pagesSystem TcodeHridya PrasadPas encore d'évaluation

- OD225544536120314000Document2 pagesOD225544536120314000The AnonymousPas encore d'évaluation

- AAETA0890J - Order Us 80G - 1019180029Document2 pagesAAETA0890J - Order Us 80G - 1019180029Donor CrewPas encore d'évaluation

- Acct Statement - XX9414 - 03102023Document20 pagesAcct Statement - XX9414 - 03102023Saravana RajPas encore d'évaluation

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanPas encore d'évaluation