Académique Documents

Professionnel Documents

Culture Documents

Chart of Accounts - Builder

Transféré par

Peter WestCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chart of Accounts - Builder

Transféré par

Peter WestDroits d'auteur :

Formats disponibles

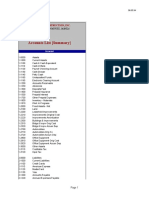

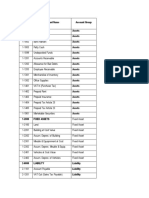

Accounts List Construction Company/Building Contractor

Page 1 Account

1-0000

Assets 1-1000

1-2000

Current Assets 1-1100 Cash On Hand 1-1110 Cheque Account 1-1120 Payroll Cheque Account 1-1130 Cash Drawer 1-1140 Petty Cash 1-1150 Provision Account 1-1160 Investment Account 1-1180 Undeposited Funds 1-1190 Electronic Clearing Account 1-1200 Trade Debtors 1-1210 Less Prov'n for Doubtful Debts 1-1300 Deposits Paid 1-1400 Prepaid Insurance 1-1500 Prepaid Interest 1-1700 Other Prepayments 1-1800 Inventory - Materials 1-1810 Work In Progress 1-1950 Withholding Credits 1-1960 Voluntary Withholding Credits 1-1970 ABN Withholding Credits Fixed Assets 1-2100 Land 1-2200 Leasehold Improvements 1-2210 Improvements at Cost 1-2220 Improvements Amortisation 1-2300 Buildings & Improvements 1-2310 Bldgs & Imprv at Cost 1-2320 Bldgs & Imprv Accum Dep 1-2700 Furniture and Fixtures 1-2710 Furniture & Fixtures Orig Co 1-2720 Furniture & Fixtures Accum Dep 1-2800 Equipment 1-2810 Equipment at Cost 1-2820 Equipment Accum Dep

2-0000

Liabilities 2-1000 Current Liabilities 2-1100 Credit Cards 2-1110 Bankcard 2-1120 Diners Club 2-1130 MasterCard 2-1140 Visa 2-1200 Trade Creditors 2-1210 A/P Accrual - Inventory 2-1300 GST Liabilities 2-1310 GST Collected 2-1330 GST Paid 2-1350 Fuel Tax Credits Accrued 2-1355 WET Payable 2-1360 Import Duty Payable 2-1370 Voluntary Withholdings Payable 2-1380 ABN Withholdings Payable 2-1390 Luxury Car Tax Payable 2-1400 Payroll Liabilities 2-1410 Payroll Accruals Payable 2-1420 PAYG Withholding Payable 2-1600 Customer Deposits 2-2000 Long Term Liabilities 2-2100 Bank Loans 2-2200 Mortgages Payable 2-2300 Other Long Term Liabilities Equity 3-1000

3-0000

3-8000 3-9000

Owner's/Shareholder's Equity 3-1100 Owner's/Sharehldr Capital 3-1200 Owner's/Sharehldr Drawings Retained Earnings Current Year Earnings

Accounts List Construction Company/Building Contractor

Page 2 Account

3-9999 4-0000 Income 4-1000 4-2000 4-3000 4-3500 4-4000 4-5000 4-6000 4-8000 4-9000

Historical Balancing

Contract Revenue Internal Income Commercial Construction Residential Construction Other Income Freight Collected Late Fees Collected Miscellaneous Income Fuel Tax Credits

5-0000

Cost of Sales 5-1000 Direct Job Costs 5-1010 Labour 5-1020 Materials 5-1040 Equipment Rent 5-1050 Permits 5-1060 License 5-1070 Bond 5-1080 Insurance 5-1090 Telephone 5-1100 Electricity 5-1110 Heat 5-1120 Other 5-1130 Water 5-1140 Fuel and Oil 5-1150 Special Tax 5-1160 Photographs 5-1170 Sign 5-1180 Tools and Miscellaneous 5-1190 Plans 5-1200 As Built Drawings 5-1210 Temporary Electricity 5-1220 Surveys 5-1230 Travelling Expenses 5-1240 Postage 5-1250 Office Supplies 5-1260 Ice and Water 5-1270 First Aid Supplies 5-1280 Fire Extinguishers 5-1290 Protective Clothing 5-1300 Interest on Retainage 5-1310 Chemical Toilets 5-1320 Tipping Fees 5-1330 Other 5-1340 Subcontracts 5-3000 Discounts Given Expenses 6-1000 General & Administrative Exp 6-1005 Accounting Fees 6-1010 Legal Fees 6-1020 Bank Charges 6-1030 Depreciation 6-1040 Amortisation 6-1050 Postage 6-1060 Office Supplies 6-1070 Subscriptions 6-1080 Advertising 6-1090 Motor Vehicle Expenses 6-1100 Telephone 6-1200 Other 6-1600 Discounts Taken 6-1700 Freight Paid 6-1800 Late Fees Paid 6-1900 Company Taxes 6-4000 Shrinkage/Spoilage 6-5100 Employment Expenses

6-0000

Accounts List Construction Company/Building Contractor

Page 3 Account

6-6000

6-5105 Fringe Benefits Tax 6-5110 Staff Amenities 6-5120 Superannuation 6-5130 Wages & Salaries 6-5140 Workers' Compensation 6-5150 Other Employer Expenses Occupancy Costs 6-6010 Rent 6-6020 Property Insurance 6-6030 Property Taxes 6-6060 Rates 6-6090 Electricity

8-0000

Other Income 8-1000 Interest Income 8-2000 Purchase Discount Other Expenses 9-1000 Interest Expense 9-2000 Income Tax Expense

9-0000

Vous aimerez peut-être aussi

- Accounts List Summary for CC Puno Jr ConstructionDocument4 pagesAccounts List Summary for CC Puno Jr ConstructionAndrew CatamaPas encore d'évaluation

- Chart of Accounts - BakeryDocument2 pagesChart of Accounts - BakeryPeter West75% (16)

- Chart of Account Pertamina Standart For SampleDocument19 pagesChart of Account Pertamina Standart For SampleRescomsolution Pieter AuPas encore d'évaluation

- Chart of AccountsDocument14 pagesChart of AccountsEmir Ademovic100% (1)

- Chart of AccountsDocument21 pagesChart of AccountsJayRellvic Guy-ab100% (1)

- Standard Chart of Accounts For Manufacturing OperationsDocument31 pagesStandard Chart of Accounts For Manufacturing Operationswpentinio67% (15)

- Unique Share Management LTD.: Chart of AccountsDocument34 pagesUnique Share Management LTD.: Chart of AccountsFarida YesminPas encore d'évaluation

- Sample Manufacturing Business Chart of Accounts PDFDocument3 pagesSample Manufacturing Business Chart of Accounts PDFMamun Kabir73% (15)

- Schedule of Accounts Receivables - TobesDocument1 pageSchedule of Accounts Receivables - TobesClarisse30100% (1)

- REVISED CHART OF ACCOUNTS AND PHILIPPINE PUBLIC SECTOR STANDARDSDocument99 pagesREVISED CHART OF ACCOUNTS AND PHILIPPINE PUBLIC SECTOR STANDARDSWilliam Kano100% (1)

- Chart of Accounts SamplesDocument9 pagesChart of Accounts Samplesredro50% (2)

- Problems in Chart of Accounts DesignDocument5 pagesProblems in Chart of Accounts Designbarber bobPas encore d'évaluation

- Chartofaccounts ExampleDocument3 pagesChartofaccounts ExampleherawandonoPas encore d'évaluation

- Charts of AccountsDocument7 pagesCharts of Accountszindabhaag100% (1)

- Accounting Worksheet V 1.0Document6 pagesAccounting Worksheet V 1.0Adil IqbalPas encore d'évaluation

- Revenue Memorandum Order 26-2010Document2 pagesRevenue Memorandum Order 26-2010Jayvee OlayresPas encore d'évaluation

- 4 Chart of AccountsDocument115 pages4 Chart of Accountsresti rahmawatiPas encore d'évaluation

- Chart of AccountsDocument61 pagesChart of AccountsSoehermanto Dody80% (5)

- Balance Sheet Assets and LiabilitiesDocument168 pagesBalance Sheet Assets and LiabilitiesPrivilege Mudzinge50% (4)

- Chart of Accounts With DescriptionsDocument8 pagesChart of Accounts With DescriptionsKhan Mohammad100% (2)

- Chart of Accounts For Small Business Template V 1.1Document3 pagesChart of Accounts For Small Business Template V 1.1Zubair Alam100% (1)

- Hospital Chart of AccountsDocument14 pagesHospital Chart of AccountsEphraim Boadu100% (1)

- The Uniform Chart of AccountsDocument137 pagesThe Uniform Chart of AccountsElzein Amir ElzeinPas encore d'évaluation

- Chart of AccountsDocument3 pagesChart of AccountsOzioma Ihekwoaba0% (1)

- Basic Journal Entries for Sole ProprietorshipsDocument2 pagesBasic Journal Entries for Sole ProprietorshipsNafis HasanPas encore d'évaluation

- Chart of Accounts for Dilley & CompanyDocument9 pagesChart of Accounts for Dilley & CompanyCharitycharityPas encore d'évaluation

- Sample Bookkeeping Engagement Letter PDFDocument3 pagesSample Bookkeeping Engagement Letter PDFGayathri JagadeeshPas encore d'évaluation

- FINANCIAL STATEMENT For PCABDocument5 pagesFINANCIAL STATEMENT For PCABRodel Ryan YanaPas encore d'évaluation

- Accounting For Construction ContractsDocument8 pagesAccounting For Construction ContractsSantu DuttaPas encore d'évaluation

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Sample Real Estate Agent Chart of AccountDocument6 pagesSample Real Estate Agent Chart of AccountJohn Abebrese50% (2)

- Construction AccountingDocument12 pagesConstruction AccountingtezgajPas encore d'évaluation

- PHC-BOA UpdatesDocument67 pagesPHC-BOA UpdatesMaynard Mirano100% (1)

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangPas encore d'évaluation

- PICPA Audit Guide For Small and Medium-Sized Practitioners: List of ExhibitsDocument51 pagesPICPA Audit Guide For Small and Medium-Sized Practitioners: List of ExhibitsShyrine Ejem100% (2)

- Audit Engagement LetterDocument3 pagesAudit Engagement Lettertmir_1100% (1)

- Audit of Sole ProprietorDocument9 pagesAudit of Sole ProprietorPrincess Bhavika100% (1)

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Accounting in ConstructionDocument85 pagesAccounting in ConstructionYihun abrahamPas encore d'évaluation

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene baderePas encore d'évaluation

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Descriptive Chart of Accounts Model TemplateDocument17 pagesDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीPas encore d'évaluation

- Chart of AccountsDocument4 pagesChart of AccountsAsad MuhammadPas encore d'évaluation

- Monitoring of Cash Advances 2018 FormatDocument8 pagesMonitoring of Cash Advances 2018 FormatMarivic Soriano50% (2)

- BKKG&TAX ServicesDocument3 pagesBKKG&TAX ServicesJean Fajardo Badillo100% (1)

- ABC Basics of Construction Accounting Webinar April 2013Document77 pagesABC Basics of Construction Accounting Webinar April 2013Gaby Pertubal100% (2)

- Charts of AccountsDocument112 pagesCharts of AccountsTodorán Laci100% (1)

- Accounting Proposal TemplateDocument6 pagesAccounting Proposal TemplateTracy LawtonPas encore d'évaluation

- Accounting Services ProposalDocument8 pagesAccounting Services ProposalMoireeG100% (1)

- Chart of Accounts: Current AssetsDocument8 pagesChart of Accounts: Current Assetsgalatid4u100% (1)

- Esales (TP) Annex CDocument27 pagesEsales (TP) Annex CPriMa Ricel Arthur83% (6)

- CPA's Notes to Financial StatementsDocument17 pagesCPA's Notes to Financial Statementsbadette Paningbatan100% (1)

- AL-QAIRAWAN Chart of AccountsDocument4 pagesAL-QAIRAWAN Chart of AccountsMohammed Aslam100% (2)

- NCCC Business PlanDocument60 pagesNCCC Business PlanLuvsansharav Naranbaatar50% (2)

- MSDocument1 pageMSWarren Junior M. GloryPas encore d'évaluation

- Revised Revenue Code of Cainta Rizal 2001Document113 pagesRevised Revenue Code of Cainta Rizal 2001Shannen Buen PondocPas encore d'évaluation

- CPA - Accounting ProposalDocument11 pagesCPA - Accounting ProposalAnnor AmapolleyPas encore d'évaluation

- Bookeeper Proposal Letter SampleDocument3 pagesBookeeper Proposal Letter SampleEdmarkPas encore d'évaluation

- Data Akun - PebriyantiDocument4 pagesData Akun - PebriyantiHabibah AzzahraPas encore d'évaluation

- Revisi COA (Chart of Account)Document3 pagesRevisi COA (Chart of Account)Simarfian jaya abadiPas encore d'évaluation

- Hume Doors & Timber - CatalogueDocument40 pagesHume Doors & Timber - CataloguePeter WestPas encore d'évaluation

- Digital Theodolite Dt-101Document46 pagesDigital Theodolite Dt-101Peter WestPas encore d'évaluation

- Guides Theguide AusDocument72 pagesGuides Theguide AusSyamil DzulfidaPas encore d'évaluation

- Wood #236 2015Document92 pagesWood #236 2015Peter West100% (2)

- Ultimate Creating Parts in Eagle TutorialDocument87 pagesUltimate Creating Parts in Eagle TutorialPeter WestPas encore d'évaluation

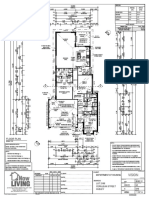

- A3 FLOOR PLAN - Layout - 2105Document8 pagesA3 FLOOR PLAN - Layout - 2105Peter WestPas encore d'évaluation

- GUIDE Res Floors - 2003Document47 pagesGUIDE Res Floors - 2003Peter WestPas encore d'évaluation

- INDUSTRY GUIDE T38 Reinforced Concrete Design in Accordance With AS3600Document225 pagesINDUSTRY GUIDE T38 Reinforced Concrete Design in Accordance With AS3600Peter WestPas encore d'évaluation

- Digital Theodolite Dt-101Document46 pagesDigital Theodolite Dt-101Peter WestPas encore d'évaluation

- PART 5 of 25 - Properties of Concrete - 2020Document25 pagesPART 5 of 25 - Properties of Concrete - 2020Peter WestPas encore d'évaluation

- INDUSTRY GUIDE T38 Reinforced Concrete Design in Accordance With AS3600Document225 pagesINDUSTRY GUIDE T38 Reinforced Concrete Design in Accordance With AS3600Peter WestPas encore d'évaluation

- Chisel CaseDocument4 pagesChisel CasePeter WestPas encore d'évaluation

- AB110-6 Essential Project Template TechniquesDocument16 pagesAB110-6 Essential Project Template TechniquesPeter WestPas encore d'évaluation

- Strongbow Plans Complete 111 PDFDocument64 pagesStrongbow Plans Complete 111 PDFPeter WestPas encore d'évaluation

- Electronic Experimenters Handbook 1959Document166 pagesElectronic Experimenters Handbook 1959Peter West100% (1)

- Draw SprocketDocument15 pagesDraw Sprocketfernandop_77Pas encore d'évaluation

- The Complete Book of Nothing - A Guide to EmptinessDocument7 pagesThe Complete Book of Nothing - A Guide to EmptinessPeter WestPas encore d'évaluation

- Diy Kart Plans - Electric CarDocument8 pagesDiy Kart Plans - Electric CarzaoioazPas encore d'évaluation

- Universal Bolt Bevel 1.0Document8 pagesUniversal Bolt Bevel 1.0Peter WestPas encore d'évaluation

- Es230 350 3511 NetworkAdminGuide Ver.00Document208 pagesEs230 350 3511 NetworkAdminGuide Ver.00Nadeesha NishaniPas encore d'évaluation

- Digital Theodolite ManualDocument46 pagesDigital Theodolite ManualPeter WestPas encore d'évaluation

- Clayton Steam Truck-Ocr PDFDocument76 pagesClayton Steam Truck-Ocr PDFbackyardcncPas encore d'évaluation

- Guide To Standards and Tolerances 2015 PDFDocument70 pagesGuide To Standards and Tolerances 2015 PDFSathishPas encore d'évaluation

- Design Draw Sprocket by HardiDocument15 pagesDesign Draw Sprocket by HardiPeter West100% (1)

- Individually Constructed VehiclesDocument23 pagesIndividually Constructed VehiclesPeter WestPas encore d'évaluation

- Holden LS1Document113 pagesHolden LS1jteeg100% (1)

- Catalogue - EasySteel - Steel Book 2012 PDFDocument112 pagesCatalogue - EasySteel - Steel Book 2012 PDFIvan BuhiinzaPas encore d'évaluation

- Building A BillycartDocument1 pageBuilding A BillycartPeter WestPas encore d'évaluation

- Draw SprocketDocument15 pagesDraw Sprocketfernandop_77Pas encore d'évaluation

- Autodesk Robot Structural Analysis Professional 2010 - Training Manual (Metric Version)Document178 pagesAutodesk Robot Structural Analysis Professional 2010 - Training Manual (Metric Version)ericfgPas encore d'évaluation

- Zambeef 2008 Annual ReportDocument91 pagesZambeef 2008 Annual ReportafricaniscoolPas encore d'évaluation

- Australian Sharemarket: TablesDocument21 pagesAustralian Sharemarket: TablesallegrePas encore d'évaluation

- Estimating Cash Flows with Aswath DamodaranDocument15 pagesEstimating Cash Flows with Aswath Damodaranthomas94josephPas encore d'évaluation

- Adjusting Journal EntriesDocument11 pagesAdjusting Journal EntriesKatrina RomasantaPas encore d'évaluation

- Presentations - DeWatering With ESPDocument31 pagesPresentations - DeWatering With ESPBambang Hadinugroho100% (1)

- Company Law NotesDocument125 pagesCompany Law NotesSaaksshi SinghPas encore d'évaluation

- International Financial ManagementDocument20 pagesInternational Financial ManagementKnt Nallasamy GounderPas encore d'évaluation

- TCS India Process - Separation KitDocument25 pagesTCS India Process - Separation KitT HawkPas encore d'évaluation

- Financial AccountingDocument340 pagesFinancial AccountingTinasha Farrier100% (6)

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiPas encore d'évaluation

- Executive SummaryDocument3 pagesExecutive SummaryChetan Narendra Dhande100% (1)

- Boğaziçi University EC 344 Financial Markets and Institutions L.YıldıranDocument4 pagesBoğaziçi University EC 344 Financial Markets and Institutions L.YıldıranAlp SanPas encore d'évaluation

- EnglishDocument171 pagesEnglishSrimathi RajamaniPas encore d'évaluation

- Documents - Ienergizer Admission Document 27 8 101 PDFDocument120 pagesDocuments - Ienergizer Admission Document 27 8 101 PDFShubham ChahalPas encore d'évaluation

- Chapter 8 - Receivables Lecture Notes - StudentsDocument43 pagesChapter 8 - Receivables Lecture Notes - StudentsKy Anh NguyễnPas encore d'évaluation

- How Traditional Firms Must Compete in The Sharing EconomyDocument4 pagesHow Traditional Firms Must Compete in The Sharing EconomyJorgePas encore d'évaluation

- How Age and Income Impact Savings and Investment HabitsDocument22 pagesHow Age and Income Impact Savings and Investment HabitsManas MhatrePas encore d'évaluation

- FIN TestDocument7 pagesFIN Testisidro3791Pas encore d'évaluation

- 4 - Sensitivity AnalysisDocument6 pages4 - Sensitivity AnalysismarcusfortePas encore d'évaluation

- Green Banking in IndiaDocument4 pagesGreen Banking in Indiamuralib4u5Pas encore d'évaluation

- 1213 PDFDocument23 pages1213 PDFnamasralPas encore d'évaluation

- Financial Aid Application GuideDocument7 pagesFinancial Aid Application GuideAqib AnjumPas encore d'évaluation

- Ch 7: Financial Markets OverviewDocument9 pagesCh 7: Financial Markets OverviewArly Kurt TorresPas encore d'évaluation

- 0452 s07 Ms 3 PDFDocument10 pages0452 s07 Ms 3 PDFAbirHudaPas encore d'évaluation

- Britannia Industries: PrintDocument1 pageBritannia Industries: PrintTejaswiniPas encore d'évaluation

- CD - Lim Tanhu Vs RamoleteDocument2 pagesCD - Lim Tanhu Vs RamoleteAbbot ReyesPas encore d'évaluation

- Shinhan Bank Circular Dated 22 June 2009Document348 pagesShinhan Bank Circular Dated 22 June 2009eureka8Pas encore d'évaluation

- Bitcoin As A Monetary System: Examining Attention and AttendanceDocument115 pagesBitcoin As A Monetary System: Examining Attention and AttendanceJuan Paulo Moreno CrisostomoPas encore d'évaluation

- Whats Your OTB Purchase Planning Made Easy.17143105Document2 pagesWhats Your OTB Purchase Planning Made Easy.17143105ramjee prasad jaiswalPas encore d'évaluation

- Agatha ReportDocument12 pagesAgatha ReportDianne ChanPas encore d'évaluation