Académique Documents

Professionnel Documents

Culture Documents

Infotech Enterprises LTD

Transféré par

Mansukh Investment & Trading SolutionsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Infotech Enterprises LTD

Transféré par

Mansukh Investment & Trading SolutionsDroits d'auteur :

Formats disponibles

Company

16 Mar 2013

Infotech Enterprises Ltd

Target `234 make more, for sure.

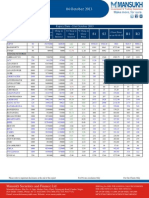

Key Data Matrix as on 15.03.13 (BSE) CMP 52 Week High/Low (Rs) Market Cap (Rs Cr) Share Issued (Cr) Equity Cap (Rs Cr) EPS TTM(Rs) P/E x TTM P/BVx Face Value (Rs) Book Value (Rs) Dividend Yield (%) BSE Code BETA-Sensex Industry PE

170.00 211/140 1,897 11.16 55.71 20.95 8.11 1.61 5 105.28 1.47 532175 0.32 19.75

Infotech Enterprises Ltd provides leading-edge engineering solutions, including product development and life-cycle support, process, network and content engineering to major organizations to a wide range of industries like aerospace, automotive, energy, government, hi-tech consumer and medical devices, marine, rail, retail, telecom and utilities. Infotech has 10,000+ associates and it operates from 36 global locations, including seven development centres and accommodates the largest operations out of India for engineering services, GIS, and IT services. Infotech's cutting edge is its industry specific domain expertise, people and processes, technologies, tools and training. It draws on this strong foundation to create measurable business impact for customers around the world, resulting in long-term relationships with several of the most recognized names in their respective industries.

INVESTMENT RATIONALE Globally in Engineering service, India would gain 40% share by 2020

The growth potential of both Engineering and Network & Content Engineering (N&CE) space have tremendous scope across the world. Engineering outsourcing services have gained prominence amongst leading organizations worldwide and the demand for these services is continuously rising. The recently released NASSCOMs - Booz Global Engineering R&D report shows that globally offshorable revenues of both traditional verticals (Aerospace, Automotive, Telecom, Semiconductors, Consumer Electronics and Construction/Heavy Machinery) and emerging verticals (Computing Systems, Energy, infrastructure, Industrial Automation and Medical Devices) are expected to reach between US$ 90-100 billion. Out of which, India would be able to garner 40% share by year 2020 equivalent to US$ 45-50 billion from the current share of about US$ 9 billion.

Shareholdings 31.12.12

29.7%

22.4% 6.3%

41.7% Promoters Public & Others DIIs FIIs

Significant traction in Engineering Business Segment

In Q3FY13, due to a short rest and recreation of a client in Heavy Equipment segment, the significant part of its engagement has been highly impacted and one of its semiconductor customers announced their exit in two key areas of engagement also resulted in sudden rampdown of our existing engagement. However, despite these shortfalls the remainder of the accounts performed quite well in Q3FY13 and the drop in revenue lowered the operating margin; but further owing to increased of revenue momentum and better utilization, company expects to scale back to earlier levels. Infotech is also envisaging good traction in Rail Transportation & Heavy Equipment business, in Rail Segment company has signed two customers while in Heavy Equipment, it has expanded its existing engagement with a 5-year Technical Publications deal valued at $7M with customers.

Share Price Movement

25,000 22,500 20,000 17,500 15,000 12,500 10,000

Mar-12 Apr-12 May-12 Jun-12 Jul-12 Aug-12 Sep-12 Oct-12 Nov-12 Dec-12 Jan-13 Feb-13 Mar-13

Sensex

Infotech

200 190 180 170 160 150 140

Developing Business centers in tier-II Cities ...

To expand its services in costal areas and company's strategy to grow inclusively by expanding operations in tier-II cities, Infotech Enterprises has inaugurated a new development center having a built up area of 52,000 square feet at SEZ Andhra Pradesh. The center would deliver cutting-edge solutions to customers primarily in the oil and gas, energy and utilities industry. It currently has 650 seats and employs 850 professionals. The company plans to ramp up this facility to 1500 seats and employ 2000 professionals by 2014. The new development center is Infotech's seventh in India and second at Kakinada in Andhra Pradesh.

Vikram Singh +91-11-30211872 vikram_research@moneysukh.com

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@moneysukh.com, Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Company

Infotech Enterprises Ltd make more, for sure.

Expanding Global presence with strategic partnerships

Infotech Enterprises has entered into a strategic partnership with a leading software solution provider Viryanet that optimize planning, execution and monitoring of service processes for mobile networking. The partnership will offer a flexible framework so that the JV may evolve in a variety of ways in response to customer demands and market conditions, particularly within the utilities and telecommunication sectors. This relationship not only ensures a combined global presence but also expands Infotech's capabilities to include the ability to deliver purpose-built mobile workforce management applications for strategic planning, optimized scheduling, exception-based dispatch and online/offline mobile work execution by integrating the best-of-breed mobile workforce management solutions from ViryaNet.

Geographical Revenue Spread

11% 57% 32%

Adding Business centers in USA to enhance Aerospace's revenue

Asia Pacific & Others North America Europe

Infotech Enterprises has recently started new service offering in Operations/manufacturing software and company is getting encouraging response from its existing customer base. However, Infotech has added a new customer first time from Israel and added two more new customers in Europe. Infotech has been awarded with Highest Productivity Supplier for initiatives in productivity savings that contributed to more than 50% of total savings received from all its engineering suppliers in year 2012. In Aerospace segment, In spite of fewer working days in Q3, revenue of the company is improving and further to increase the revenue contribution from this segment company has opened a 200 people new delivery center in USA to support one of their Aerospace customers. Company has also good pipeline for Q4 and expect to see growth coming from existing/new customers.

Valuations & Recommendations

Business Segment Revenue 1% 65% 34%

Infotech Enterprises is trading at PE of 8.7x of its estimated earning per share of Rs 19.65 for FY14. Further, globally a wider scope of engineering service and having a good traction in the engineering business segment, Infotech is expanding its business across globe. Apart from developing business centers particularly in tier-II cities India, Infotech is also expanding its global presence with strategic partnerships and joint ventures with global partners. Company is also increasing business from its major contributing segment aerospace, especially from USA. Hence with the impressive financial growth and better future prospects we recommend for the investors having medium to long-term view, to keep buy on dips strategy for the stock with the target price of Rs 234.

Utilities/Telecom & Content Engineering Others

Financials - Standalone

In the preceding five years (FY07-FY12) the Top Line of Infotech grew at extraordinary CAGR of 20%, Operating Profit and PAT of the company for the same period also grew at encouraging CAGR between 18.50-19.50%. In FY12, the Net Sales of Infotech grew by 33.40% to Rs 863.76 crore over FY11, while owing to efficient operational cost the Operating Profit of the company surged 54% to Rs 210.98 crore and despite a jump of over 3.5 folds in tax outgo over the previous year, the PAT of the company jumped by 34.5% to Rs 158.6 crore for the same period.

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@moneysukh.com, Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Company

Infotech Enterprises Ltd make more, for sure.

In Q3FY13, The Net Sales of the company surged 15% to Rs 269.53 crore from Rs 234.35 crore in Q2FY12, Operating Profit grew 7.35% to Rs 72.99 crore from Rs 67.99 crore. However, the PAT abnormally jumped 141% to Rs 52.38 crore from Rs 21.72 crore, the unusual gain in PAT has been highly reflected due to foreign exchange loss in same quarter of previous year. OPM of the company for the same period turned down 193bps to 27.08% while PAT of the company for the same period stood at 19.43%, which is 1017bps higher than Q2FY12 PAT margin.

Quarterly Growth Net Sales Other operating income Total Operating Income Total Expenditure Operating Profit OPM% (YoY chg in bps) Other Income PBIDT Interest Exceptional Items PBDT Depreciation PBT Tax Profit After Tax PATM% (YoY chg in bps) EPS (Rs) EPS Annualised (Rs)

Annual Growth Net Sales Other operating income Total Operating Income Total Expenditure Operating Profit OPM% Other Income PBIDT Interest Exceptional Items PBDT Depreciation PBT Tax Provisions & Contingencies Profit After Tax PATM% EPS (Rs)

Source: ACE Equity

Quarterly Revenue Growth

300 250 200 150 100 50 0

Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13

Net Sales (Rs cr) PAT (Rs cr) Operating Profit (Rs cr)

Q3FY12 Q4FY12 Q1FY13 Q2FY13 Q3FY13 YoY Chg 234.35 231.13 258.74 260.06 269.53 15.0% 0.00 0.04 0.00 0.00 0.00 0.0% 234.35 231.17 258.74 260.06 269.53 15.0% 166.36 170.40 183.13 192.24 196.54 18.1% 67.99 60.77 75.61 67.82 72.99 7.4% 29.01 26.29 29.22 26.08 27.08 -193 12.53 75.66 16.14 -3.08 14.48 0.0% 80.52 136.43 91.75 64.74 87.47 8.6% 0.11 0.34 0.00 0.01 0.02 -81.8% -37.51 0.00 -1.81 0.00 0.00 0.0% 42.90 136.09 89.94 64.73 87.45 103.8% 10.55 10.80 11.89 13.07 13.79 30.7% 32.35 125.29 78.05 51.66 73.66 127.7% 10.63 32.68 24.51 16.39 21.28 100.2% 21.72 92.61 53.54 35.27 52.38 141.2% 9.27 40.07 20.69 13.56 19.43 1017 1.95 8.31 4.81 3.16 4.69 140.5% 7.80 33.25 19.22 12.66 18.77 140.6%

FY09 566.57 0 566.57 431.48 135.09 23.84 -22.76 112.33 3.51 0 108.82 42.66 66.16 -4.71 0 70.87 12.51 6.42 FY10 561.80 0.00 561.80 411.95 149.85 26.67 46.15 196.00 0.47 0.00 195.53 40.71 154.82 28.06 0.00 126.76 22.56 11.42 FY11 647.67 0.00 647.67 510.65 137.02 21.16 29.76 166.78 0.08 2.29 168.99 37.55 131.44 13.56 0.00 117.88 18.20 10.59 FY12 863.76 0.04 863.80 652.82 210.98 24.43 53.58 264.56 0.56 0.00 264.00 41.16 222.84 64.24 0.00 158.60 18.36 14.23 FY13E 1050.1 0.00 1050.1 767.62 282.5 26.90 41.20 323.7 0.05 0.00 323.63 52.10 271.53 81.73 0.00 189.80 18.07 17.01 FY14E 1280.2 0.00 1280.2 940.95 339.3 26.50 35.00 374.3 0.10 0.00 374.15 55.40 318.75 99.45 0.00 219.30 17.13 19.65

` Crore

Yearly Revenue Growth

1400 1200 1000 800 600 400 200 0

FY13E FY14E FY09 FY10 FY11 FY12

Net Sales (Rs cr) Operating P ro fit (Rs cr) P A T (Rs cr)

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@moneysukh.com, Website: www.moneysukh.com

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Company

Infotech Enterprises Ltd make more, for sure.

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@moneysukh.com, Website: www.moneysukh.com

SEBI Regn No. BSE: BSE: INB010985834 / NSE: INB230781431 SEBI Reg.No: INB 010985834, F&O: INF 010985834

PMSINF Regn No. INP000002387 NSE: INB 230781431, F&O: 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- International Travel Agency Business PlanDocument38 pagesInternational Travel Agency Business PlanShiva100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Profit and LosslDocument18 pagesProfit and LosslMayjuneJulyPas encore d'évaluation

- Goals of Financial ManagementDocument22 pagesGoals of Financial ManagementBhuvanPas encore d'évaluation

- IMM Assignment Group 2 (L'Oreal)Document21 pagesIMM Assignment Group 2 (L'Oreal)gurgurgurgur100% (2)

- Wilkerson ABC Costing Case StudyDocument8 pagesWilkerson ABC Costing Case StudyParamjit Singh100% (4)

- ICS-Merbatty Boat Case Report ExampleDocument22 pagesICS-Merbatty Boat Case Report Examplehaliza amirahPas encore d'évaluation

- Chapter 13 - Cost planning for product life cycleDocument51 pagesChapter 13 - Cost planning for product life cycleRenard100% (1)

- Full Report Enterpreneur - Docx UTHMDocument55 pagesFull Report Enterpreneur - Docx UTHMAshraf Jamaludin0% (1)

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsPas encore d'évaluation

- Assignment Guidelines - BAPDocument4 pagesAssignment Guidelines - BAPTilottamaPatilPas encore d'évaluation

- Brands and Brand Management - Lecture 1Document49 pagesBrands and Brand Management - Lecture 1Fawad AfzalPas encore d'évaluation

- Cost Control Techniques PDFDocument3 pagesCost Control Techniques PDFHosamMohamedPas encore d'évaluation

- ChapterDocument28 pagesChapterSanDe ValPas encore d'évaluation

- Chapter 1Document27 pagesChapter 1cherryyllPas encore d'évaluation

- Building and Sustaining Strategy For SonyDocument18 pagesBuilding and Sustaining Strategy For SonyRay KiariePas encore d'évaluation

- Term Paper FinalDocument16 pagesTerm Paper FinalItisha JainPas encore d'évaluation

- 2010 F2Document63 pages2010 F2Rehman MuzaffarPas encore d'évaluation

- Akmen Chapter 7Document4 pagesAkmen Chapter 7Choi MinriPas encore d'évaluation

- 1) Dec 2002 - QDocument5 pages1) Dec 2002 - QNgo Sy VinhPas encore d'évaluation

- Case Study Salem TelephoneDocument3 pagesCase Study Salem TelephoneahbahkPas encore d'évaluation

- Consulting Basics: Frameworks for Guesstimates and Market EntryDocument39 pagesConsulting Basics: Frameworks for Guesstimates and Market EntryRiya GuptaPas encore d'évaluation

- SM PFA 2e CH 1 Accounting in Business PDFDocument63 pagesSM PFA 2e CH 1 Accounting in Business PDFellewinaPas encore d'évaluation

- Profit and Shareholder MaximizationDocument23 pagesProfit and Shareholder MaximizationDaodu Ladi BusuyiPas encore d'évaluation

- A Study On Customer Relationship Management Practices in Banking Sector in IndiaDocument5 pagesA Study On Customer Relationship Management Practices in Banking Sector in Indiaakshay shirkePas encore d'évaluation

- SCM Fishing IndustryDocument17 pagesSCM Fishing IndustryNaji hamidPas encore d'évaluation

- Jaiib MarketingDocument51 pagesJaiib Marketing17585Pas encore d'évaluation

- Senate Bill 365Document5 pagesSenate Bill 365samtlevinPas encore d'évaluation

- Hindustan Lever (A) : Leaping A MillenniumDocument5 pagesHindustan Lever (A) : Leaping A MillenniumjitinchandelPas encore d'évaluation

- Sustainable Finance As A Connection Between CSR & Social Responsible InvestingDocument23 pagesSustainable Finance As A Connection Between CSR & Social Responsible Investingrusriyanto08Pas encore d'évaluation

- Statement of Comprehensive IncomeDocument29 pagesStatement of Comprehensive IncomeMarjorie TacordaPas encore d'évaluation