Académique Documents

Professionnel Documents

Culture Documents

Fd2dbTraditional & Mordern Formats of Finanancial Statements

Transféré par

Amitesh PandeyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fd2dbTraditional & Mordern Formats of Finanancial Statements

Transféré par

Amitesh PandeyDroits d'auteur :

Formats disponibles

Illustrative example (1) - Traditional Format of Trading A/c & Profit and Loss A/c

Trading Account of Arjun Opening Stock Add: Purchases Less: Purchases Return Drawings NET PURCHASES Add: Other Expenses Duty Cartage Inwards Buying Expenses COST OF GOODS AVAILABLE FOR SALE Less: Closing Stock COST OF GOODS SOLD GROSS PROFIT for the year ended 31 December 2011 5,000 Sales 980,000 500,000 Less: Sales Returns 15,000 10,000 Refunds 5,000 20,000 20,000 470,000 NET SALES 960,000 475,000 2,000 900 500 3,400 478,400 50,000 428,400 531,600 960,000

960,000

Profit and Loss Account of Arjun OPERATING EXPENSES SELLING & DISTRIBUTION Advertising Salesmens Salaries Salesmens commission Motor vehicle expenses Cartage outwards Depreciation - Motor vehicles - Shop Fittings OFFICE & ADMINISTRATIVE Salaries Printing & stationery Electricity Telephone Travelling Entertainment Rent paid Depreciation - Office equipment for the year ended 31 December 2011 Gross profit Add: OPERATING INCOME 75,000 Discount received 60,000 Rent received 20,000 Bad Debts recovered 15,000 Interest received 3,000 Commission received 7,600 3,900 184,500 90,000 5,900 4,800 3,700 400 2,000 12,000 3,700 TOTAL OPERATING INCOME 531,600 2,000 30,000 4,000 10,000 50,000 96,000 627,600

- Buildings - Furniture Postage Legal fees Petty cash expenses Sundry expenses FINANCIAL EXPENSES Bad debts Discount allowed Interest paid Doubtful debts TOTAL OPERATING EXPS NET OPERATING PROFIT

9,700 3,600 2,000 900 500 2,000 141,200 1,600 400 15,000 3,000 20,000 345,700 281,900 627,600 NET OPERATING PROFIT Add: NON-OPERATING INCOME Rent Damages received in court case Gain on sale of fixed assets TOTAL REVENUES 31,000 375,800 406,800

627,600 281,900

Less: NON-OPERATING EXP Loss on Sale of Fixed assets Donation Losses by fire Theft Damage paid in court cases NET PROFIT 5,000 14,000 2,000 10,000

50,000 35,000 39,900 124,900 406,800

406,800

Illustrative example (2) -

Modern Format- Profit and Loss Statement

Profit and Loss Statement of Karan for the year ended 31st December 2011 Sales Less: Sales returns NET SALES LESS COST OF GOODS SOLD Opening stock Add: Purchases Less: Purchases returns Drawings NET PURCHASES Add: Other Expenses Buying expenses Duty Cartage Inwards Wharfage Total Goods available for sale Less: closing stock COST OF GOODS SOLD Gross Profit Add: Operating Income Discount received Interest received Bad debts recovered TOTAL OPERATING INCOME Less: OPERATING EXPENSES Selling & Distribution Expenses Advertising Cartage Outwards Salesmens salaries Salesmens commission Motor vehicle expenses Depreciation - Motor vehicles - Shop fittings Wharehouse houses Office & Administrative Expenses Office salaries Electricity 10,00 0 50,00 0 375,000 2,500 372,500

8,900 290,000

60,000 230,000

3,500 5,900 2,000 4,800

16,200 246,200 45,900 200,300 209,200 163,300 2,000 10,500 4,000

16,500 179,800

12,000 900 20,000 2,000 3,000 500 200 1,000 39,600 30,000 2,900

Telephone Postage & stationery Legal fees Rent paid Petty cash expenses Depreciation - Buildings - Equipment - Furniture Financial Expenses Bad debts Discount allowed Interest paid TOTAL OPERATING EXPENSES Net Operating Profit (Loss) Add: Non- Operating Gains Rent Gain on sale of fixed assets Damages from court case Less: Non-Operating Expenses Damages paid for court case Donations Loss on sale of assets Theft Net Profit (Loss)

1,900 290 900 12,000 450 4,000 2,900 1,800 57,140 200 190 6,000 6390 103,130 76,670

36,000 5,900 12,000

53,900 130,570

6,700 2,800 5,800 500 15,800 114,770

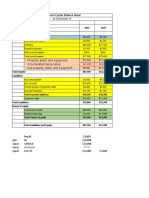

Illustrative example (3) - Traditional Format of Balance Sheet Balance Sheet of Karan as at 31 October 2012

Current Liabilities Creditors Expenses due Income in advance Bank overdraft Non Current Liabilities Debentures Loan Mortgage Proprietorship Capital Add: Net Profit Add: Additional Capital Less: Drawings

35,000 5,900 12,700 70,000 123,600 200,000 100,000 120,000

Current Assets Cash on hand Cash at bank Closing stock Debtors - Bad debts Less: Prov. For D. Debts Prepayments Income due

500 45,900 38,000 60,000 5,800 54,200 590 4,000 143,19 0 80,000 190,000 18,000 172,000 90,000 18,000 72,000 96,000 4,900 91,100 120,000 20,000 100,000 515,100

Non Current Assets 420,000 543,600 Land Buildings (cost) 250,000 Less: Accum. Depn 120,000 370,000 Motor vehicles (cost) 50,000 Less: Accum. Depn 420,000 170,310 Furniture (cost) Less: Accum. Depn 249,690 Equipment (cost) Les: Accum. Depn

Investments Shares in ABC Co. Intangible Assets Goodwill Preliminary expenses

100,000

20,000 15,000 35,000 793,29 0

793,290

Illustrative example (4) - Modern Format- Profit and Loss Statement

Proprietorship

Capital Add: Net Profit Less: Drawings This is represented by Current Assets Cash on hand Cash at bank Closing stock Prepayments Income due Debtors Current Liabilities Creditors Expenses due Income in advance Working Capital Add: Fixed Assets Land Buildings (cost) Less: Accum. Depn Furniture (cost) Less: Accum. Depn Equipment (cost) Less: Accum. Depn

400,000 80,000 480,000 15,000 465,000

500 29,000 12,000 5,900 2,900 12,700 63,000 20,000 3,700 2,800 26,500 36,500

120,000 190,000 10,000 180,000 98,000 3,000 95,000 120,000 40,000 80,000 475,000

Intangible Assets Goodwill Less: Long Term Liabilities Loan

10,000 521,500 56,500 465,000

Vous aimerez peut-être aussi

- Financial Statements - WPIDocument24 pagesFinancial Statements - WPIeuwillaPas encore d'évaluation

- 3 Income StatementDocument14 pages3 Income StatementShienaida Jane ElianPas encore d'évaluation

- Income Statement for NICE SPRING ICEE DELIGHT (CEBUDocument2 pagesIncome Statement for NICE SPRING ICEE DELIGHT (CEBUARISPas encore d'évaluation

- Common Size Income Statements 2Document7 pagesCommon Size Income Statements 2Aniket KedarePas encore d'évaluation

- Amend Interim RSA/RCG Certificate DetailsDocument2 pagesAmend Interim RSA/RCG Certificate Detailsdimuthh7441Pas encore d'évaluation

- Worked Example Financial StatementDocument2 pagesWorked Example Financial StatementNayaz EmamaulleePas encore d'évaluation

- 1.accounts 2012 AcnabinDocument66 pages1.accounts 2012 AcnabinArman Hossain WarsiPas encore d'évaluation

- Financial StatementDocument21 pagesFinancial StatementBiancaDoloPas encore d'évaluation

- Projected income statement for Chamerz Internet CaféDocument2 pagesProjected income statement for Chamerz Internet CaféK. CustodioPas encore d'évaluation

- Financial Statement 2020 - Corporation of Hamilton 2Document27 pagesFinancial Statement 2020 - Corporation of Hamilton 2Anonymous UpWci5Pas encore d'évaluation

- San Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)Document1 pageSan Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)SanJoaquinIloiloPas encore d'évaluation

- 2012 Consolidated Financial StatementsDocument32 pages2012 Consolidated Financial StatementstessavanderhartPas encore d'évaluation

- BL SheetDocument3 pagesBL Sheetroselle oronganPas encore d'évaluation

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document52 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)jeaniePas encore d'évaluation

- 1.PaySlip Jan15Document1 page1.PaySlip Jan15Dilip DineshPas encore d'évaluation

- QatarDocument2 pagesQatarKelz YouknowmynamePas encore d'évaluation

- Single Business Permit: County Government of Uasin Gishu 2021Document1 pageSingle Business Permit: County Government of Uasin Gishu 2021T-NAY Classic100% (1)

- Business Tax Guide: VAT, Percentage Tax, ExemptionsDocument44 pagesBusiness Tax Guide: VAT, Percentage Tax, ExemptionsZhaneah Rhej SaradPas encore d'évaluation

- Date of Issue Mon July 13 2020 Your Reference: 3200237: Property No: 5257806 Payment No: 52578060007Document6 pagesDate of Issue Mon July 13 2020 Your Reference: 3200237: Property No: 5257806 Payment No: 52578060007Nir AlonPas encore d'évaluation

- Muhasebe Terimleri Sözlüğü (İngilizce-Türkçe) Kısa ÖzetiDocument58 pagesMuhasebe Terimleri Sözlüğü (İngilizce-Türkçe) Kısa ÖzetiCenk KurterPas encore d'évaluation

- VERIFY INDIAN INCOME TAX RETURNDocument1 pageVERIFY INDIAN INCOME TAX RETURNRajesh KumarPas encore d'évaluation

- Chart of Accounts: Account Type Income Tax LineDocument4 pagesChart of Accounts: Account Type Income Tax LineNak VanPas encore d'évaluation

- ACCT212 WorkingPapers E12-20ADocument3 pagesACCT212 WorkingPapers E12-20AlowluderPas encore d'évaluation

- QwertyDocument1 pageQwertyqwew1ePas encore d'évaluation

- MOCK EXAM TAX QUESTIONSDocument17 pagesMOCK EXAM TAX QUESTIONSVannak2015Pas encore d'évaluation

- 2020 02 01 0030300175734 PDFDocument1 page2020 02 01 0030300175734 PDFShavina Say Miguel ArnaizPas encore d'évaluation

- Profit & Loss StatementDocument1 pageProfit & Loss StatementNabila Ayuningtias100% (1)

- Comparative Income Statement for Reliance Industries LtdDocument23 pagesComparative Income Statement for Reliance Industries LtdManan Suchak100% (1)

- PayStub - California ExampleDocument1 pagePayStub - California ExampleanthonyzallerPas encore d'évaluation

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilPas encore d'évaluation

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Document686 pagesXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiPas encore d'évaluation

- Payslip 2018 2019 MalaysiaDocument1 pagePayslip 2018 2019 MalaysiaMT Mukhtar MisranPas encore d'évaluation

- UAE VAT Tax Invoice TemplateDocument1 pageUAE VAT Tax Invoice TemplateQuincy Joy Bartolome PasaholPas encore d'évaluation

- Jules Verne's income and balance sheetDocument3 pagesJules Verne's income and balance sheetTahira HassenPas encore d'évaluation

- GSIS eBilling Collection SummaryDocument2 pagesGSIS eBilling Collection SummaryDom Minix del RosarioPas encore d'évaluation

- VAT FormDocument2 pagesVAT FormGbenga Ogunsakin67% (3)

- So A 900920160610Document1 pageSo A 900920160610Francisco Oringo Sr ESPas encore d'évaluation

- Self Assessment Payment LetterDocument1 pageSelf Assessment Payment LetterSardarified Charanpreet SinghPas encore d'évaluation

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9Pas encore d'évaluation

- Statement of Taxes DueDocument1 pageStatement of Taxes DueCynthia McCoyPas encore d'évaluation

- Income Statement of Mercantile Bank Limited and NRB Commercial BankDocument4 pagesIncome Statement of Mercantile Bank Limited and NRB Commercial BankmahadiparvezPas encore d'évaluation

- Fiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATDocument2 pagesFiscalised Tax Invoice: Description Invoice Amount Ex. Vat Inc. VATtony roxPas encore d'évaluation

- Power Notes: Statement of Cash FlowsDocument63 pagesPower Notes: Statement of Cash FlowsRon ManPas encore d'évaluation

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- NYS - 45 Fill inDocument2 pagesNYS - 45 Fill inSalameh LauriePas encore d'évaluation

- O-180326093328 - Mersal Express SystemDocument1 pageO-180326093328 - Mersal Express SystemAnonymous cPRjYSXvwDPas encore d'évaluation

- 2022 Financial StatementsDocument19 pages2022 Financial StatementsThe King's UniversityPas encore d'évaluation

- Audited FS 2010 PfrsDocument46 pagesAudited FS 2010 Pfrsracs_ann110% (1)

- Print PDFDocument2 pagesPrint PDFLany GepegaPas encore d'évaluation

- Intermediate Accounting - Chapter 4 Spreadsheet Answer - KiesoDocument55 pagesIntermediate Accounting - Chapter 4 Spreadsheet Answer - KiesodPas encore d'évaluation

- IRDDocument6 pagesIRDKKPas encore d'évaluation

- SIDS Health Care Pvt. LTD.: Payslip For January-2019Document1 pageSIDS Health Care Pvt. LTD.: Payslip For January-2019hitesh gandhiPas encore d'évaluation

- Salary Statement SmitDocument1 pageSalary Statement SmitSmit PatoliyaPas encore d'évaluation

- Government of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormDocument11 pagesGovernment of The People'S Republic of Bangladesh: National Board of Revenue Mushak-9.1 Value Added Tax Return FormMd. Abu NaserPas encore d'évaluation

- COMP-YOUTH-HERS chart accountsDocument2 pagesCOMP-YOUTH-HERS chart accountsAveryl Lei Sta.AnaPas encore d'évaluation

- Purchases-Adlaw (Month of February 2019)Document121 pagesPurchases-Adlaw (Month of February 2019)Giann Fritz AlvarezPas encore d'évaluation

- Apollo Shoes Trial BalanceDocument1 pageApollo Shoes Trial Balancebabar zahoorPas encore d'évaluation

- CIM InvoiceDocument6 pagesCIM InvoiceTony Peterz KurewaPas encore d'évaluation

- Chaper 1 - FS AuditDocument12 pagesChaper 1 - FS AuditLouie De La Torre60% (5)

- Principles of Accounting Simulation - Student's Answer - Excel FileDocument55 pagesPrinciples of Accounting Simulation - Student's Answer - Excel FilekoopamonsterPas encore d'évaluation

- A Project Report On Custmer Satisfaction Regarding HDFC BANKDocument66 pagesA Project Report On Custmer Satisfaction Regarding HDFC BANKvarun_bawa25191585% (94)

- Exam Time TableDocument1 pageExam Time TableAmitesh PandeyPas encore d'évaluation

- Process of Recruitment 0990Document40 pagesProcess of Recruitment 0990Amitesh PandeyPas encore d'évaluation

- 73rd & 74th Ammendment ActDocument11 pages73rd & 74th Ammendment ActAmitesh Pandey100% (2)

- Questionnaire MassComm 2013Document14 pagesQuestionnaire MassComm 2013Amitesh PandeyPas encore d'évaluation

- 03-Ces Moa Aoa FinalDocument26 pages03-Ces Moa Aoa FinalAmitesh PandeyPas encore d'évaluation

- Term Paper Course Code: BCH 330 Credit Units: 03 MethodologyDocument4 pagesTerm Paper Course Code: BCH 330 Credit Units: 03 MethodologyAmitesh PandeyPas encore d'évaluation

- Debate On Models of Development in IndiaDocument523 pagesDebate On Models of Development in IndiaAmitesh PandeyPas encore d'évaluation

- Finance Commission of IndiaDocument15 pagesFinance Commission of IndiaAmitesh PandeyPas encore d'évaluation

- EmotionsDocument33 pagesEmotionsNikhil RaiPas encore d'évaluation

- Growth of Indian Retail SectorDocument21 pagesGrowth of Indian Retail SectorAmitesh PandeyPas encore d'évaluation

- Indian Retail1Document52 pagesIndian Retail1Amitesh PandeyPas encore d'évaluation

- Edc76Financial Accounting I - An Introductory PerspectiveDocument21 pagesEdc76Financial Accounting I - An Introductory PerspectiveAmitesh PandeyPas encore d'évaluation

- Features of Indian Constitution of IndiaDocument17 pagesFeatures of Indian Constitution of IndiaAmitesh PandeyPas encore d'évaluation

- PROJECT REPORT On Retail Sector in India by SatishpgoyalDocument77 pagesPROJECT REPORT On Retail Sector in India by SatishpgoyalSatish P.Goyal96% (24)

- SkitDocument6 pagesSkitAmitesh PandeyPas encore d'évaluation

- GAAP Differences SummaryDocument7 pagesGAAP Differences SummaryAmitesh PandeyPas encore d'évaluation

- Indian Retail Sector March 2011Document86 pagesIndian Retail Sector March 2011Apurve PatilPas encore d'évaluation

- 9a7e9BCH102 - Additional Trial Exam QuestionsDocument2 pages9a7e9BCH102 - Additional Trial Exam QuestionsAmitesh PandeyPas encore d'évaluation

- 1804cself EsteemDocument21 pages1804cself EsteemAmitesh PandeyPas encore d'évaluation

- Indian Partnership Act 1932Document8 pagesIndian Partnership Act 1932Amitesh PandeyPas encore d'évaluation

- Indian Partnership Act 1932Document6 pagesIndian Partnership Act 1932Prashant Raj PandeyPas encore d'évaluation

- 9a7e9BCH102 - Additional Trial Exam QuestionsDocument2 pages9a7e9BCH102 - Additional Trial Exam QuestionsAmitesh PandeyPas encore d'évaluation

- 9a7e9BCH102 - Additional Trial Exam QuestionsDocument2 pages9a7e9BCH102 - Additional Trial Exam QuestionsAmitesh PandeyPas encore d'évaluation

- 73rd & 74th Ammendment ActDocument11 pages73rd & 74th Ammendment ActAmitesh Pandey100% (2)

- S-Corp 1120S Tax Filing Checklist - 2014Document3 pagesS-Corp 1120S Tax Filing Checklist - 2014Anonymous ruUxJt7lxPas encore d'évaluation

- L1 March 2014Document22 pagesL1 March 2014Metick MicaiahPas encore d'évaluation

- Fae3e SM ch03Document19 pagesFae3e SM ch03JarkeePas encore d'évaluation

- SM Chap 7Document70 pagesSM Chap 7Debora BongPas encore d'évaluation

- Flinder Valves and Controls Inc. - WorksheetsDocument22 pagesFlinder Valves and Controls Inc. - WorksheetsBach Cao50% (4)

- BADM741 Chapter 4Document29 pagesBADM741 Chapter 4eyob yohannesPas encore d'évaluation

- Superior Co Manufactures Automobile Parts For Sale To The MajorDocument1 pageSuperior Co Manufactures Automobile Parts For Sale To The MajorAmit PandeyPas encore d'évaluation

- Financial Statements of A CompanyDocument34 pagesFinancial Statements of A CompanykingPas encore d'évaluation

- Test Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesDocument22 pagesTest Bank For Introduction To Government and Non-For-Profit Accounting 7E - IvesIven ChienPas encore d'évaluation

- Class 11 Accountancy Chapter-10 Revision NotesDocument7 pagesClass 11 Accountancy Chapter-10 Revision NotesBadal singh ThakurPas encore d'évaluation

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramPas encore d'évaluation

- Chapter 3 - The Adjusting ProcessDocument7 pagesChapter 3 - The Adjusting ProcessHa Phuoc HauPas encore d'évaluation

- BS (4 Years) Course Details for Subject COMMDocument75 pagesBS (4 Years) Course Details for Subject COMMRana AwaisPas encore d'évaluation

- Ribs and WingsDocument27 pagesRibs and WingsKristeen Shane AtaligPas encore d'évaluation

- Topic 2,5,4 - IAS 16,38,40 (28.2.23) .SVDocument15 pagesTopic 2,5,4 - IAS 16,38,40 (28.2.23) .SVHuyền TrầnPas encore d'évaluation

- Final Project ReportDocument88 pagesFinal Project ReportPrathmesh KadamPas encore d'évaluation

- Annual Examinations for Secondary Schools 2018 Accounting - Year 11Document8 pagesAnnual Examinations for Secondary Schools 2018 Accounting - Year 11waheeda17Pas encore d'évaluation

- CB SimexDocument14 pagesCB SimexRob De CastroPas encore d'évaluation

- Chapter 10 - Government Grant Defraying Safety Problem 1: Answer KeyDocument5 pagesChapter 10 - Government Grant Defraying Safety Problem 1: Answer KeyMark IlanoPas encore d'évaluation

- Bisiness Plan For Porrige Flour-Victoria Grain Millers LTDDocument15 pagesBisiness Plan For Porrige Flour-Victoria Grain Millers LTDJohn McOdeyoPas encore d'évaluation

- Accounting cycle stepsDocument36 pagesAccounting cycle stepsRodolfo CorpuzPas encore d'évaluation

- Financial Modeling Case - Premium Bus ServiceDocument1 pageFinancial Modeling Case - Premium Bus Servicericha krishnaPas encore d'évaluation

- Dec 2005 - Qns Mod ADocument14 pagesDec 2005 - Qns Mod AHubbak KhanPas encore d'évaluation

- Integrated Review May 2020 Batch Second Monthly Exams AfarDocument94 pagesIntegrated Review May 2020 Batch Second Monthly Exams AfarKriztle Kate Gelogo100% (5)

- Understanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyDocument58 pagesUnderstanding Income Statements: Presenter's Name Presenter's Title DD Month YyyyAbdulelah AlhamayaniPas encore d'évaluation

- CostingDocument24 pagesCostingminalsk100% (2)

- Ahrend Sen 2012Document12 pagesAhrend Sen 2012sajid bhattiPas encore d'évaluation

- IE 2311 Test 4 PracticeDocument11 pagesIE 2311 Test 4 PracticeZoloft Zithromax ProzacPas encore d'évaluation

- Syllabus For Sap Fico TrainingDocument8 pagesSyllabus For Sap Fico TrainingManoj KumarPas encore d'évaluation

- CPT Accounts Question PaperDocument11 pagesCPT Accounts Question PaperNikhil Boggarapu100% (1)